The Biocides Market size was valued at USD 12.77 Billion in 2024 and the total Biocides revenue is expected to grow at a CAGR of 3.9% from 2025 to 2032, reaching nearly USD 17.34 Billion.Biocides Market introduction:

Biocides are chemicals are used to kill pests or microbes. Mold, bacteria, algae, insects, and rodents are commonly utilized to manage and kill hazardous and undesired species. Rodenticides, wood preservatives, disinfectants, in-can preservatives, antifouling agents (on boats), and other biocides are used in households and public locations such as hospitals and industries. Biocide preservation applications are at the forefront of the industry, consuming the most specialist biocides in terms of both volume and value. Apart from regulatory pressures to reduce the number of biocides used in end products based on their concentrations, blends of carefully selected biocides active substances in optimal ratios, combined with new technological advancements, can provide enhanced preservation solutions without the need for cautionary labeling.To know about the Research Methodology :- Request Free Sample Report

Biocides Market Dynamics:

Increasing Adoption of Powder Coatings: The paints and coatings sector, which has been in turmoil due to the presence of lead in paints, has increased its capabilities with the introduction of powder coatings. With a growing novel front, the scope of biocide's application in the paints and coatings sector has been expanded even further. Powder Coatings Market is a major growth driver for biocides market demand, with a global CAGR of 6.10 percent projected through 2025. This category is a big trend that is positively impacting the market, with automotive OEMs shifting to powder form of coatings due to economic and labour efficiency. Abundant Adhesives and Sealants in Modern Infrastructures and Lightweight Automotive: Because of their flexibility and lightweight qualities, moulded glass and polymers are used in modern constructions with complicated designs. In intricately built infrastructures fitted out with glass and polymers, this has increased the need of adhesives and sealants that are more susceptible to microbial attack. Thus, the construction industry's growing need for adhesives and sealants is pushing the use of along preservatives and dry film fungicides, favourably impacting the biocides market size. Likewise, the lightweight automobile trend has led automakers to use polymers in the production of vehicles. Adhesives and sealants are widely used by companies in the electric vehicle (EV) market, as glass and plastic add aesthetic feasibility and flexibility to automobile design.Biocides Market Segmentation:

Based on the Type: The Biocides market is further segmented into Metallic Compounds, Halogen-Based Biocides, Organic Acids, Sulphones, Phenol-Based Biocides, and Others. The halogen compounds segment held the largest market share of around 26% of the global market in . The halogen compounds segment is expected to rise by 3.6 percent Y-o-Y in . Halogen compound biocides are the most popular choice among end-users, as the disinfectants. The halogen compounds are utilized in a variety of sectors, including paints & coatings, pulp & paper, and water treatment. The biocides market is growing because of significant growth in water treatment and surface cleaning applications around the globe. Because halogen-based compounds are commonly utilized to inhibit the growth of bacteria and pathogens in fresh water, they are increasingly used in industrial, institutional, and commercial cleaning. Following halogen compounds, metallic compounds and organosulfur emerged as important type segment. Copper and silver, as well as other heavy metals, are frequently used. Due to the high toxicity to bacteria and other microbes, copper is thought to be more efficient. In water treatment plants, copper sulfate-based biocide formulations are commonly active to inhibit algae development. In terms of End-use Industry: The Biocides market is further segmented into Food & Beverages, Construction, Agriculture, Pharmaceutical, Personal Care, Water Treatment, Paints & Coatings, Home Care, and Others. In , the paints and coatings application segment had the highest market share of 27.5 percent, and this is expected to continue during the forecast period (2025-2032). Along with their exposure to bulk handling and storage systems, paints and coatings are especially sensitive to aqueous and airborne microbiological contamination. Dry-film preservation, microbiological growth inhibition, as well as in preservation are all advantages of using biocides in paints and coatings. It also aids in the prevention of fungus growth after the film has developed and the paint has dried. Thus, using the substance in paints and varnishes to prevent deterioration has become a necessary for producers. Biocides are used in a variety of applications, including cooling water systems, pulp and paper mills, pools and spas, municipal drinking water systems, and industrial water treatment systems, to prevent antifouling and bacterial or algal contamination in water systems. Because of its high organic content, which promotes bacterial/algal growth, wastewater is extremely vulnerable to bacterial growth and contamination. So, the use of these plants has become a critical component in producing clean and pure water. Because of the mass manufacture of products like sanitizers, surface disinfectants, and sterilants to combat the coronavirus and meet their increased demand, the cleaning products application category is expected to grow significantly in the coming years. For example, Clorox, one of the biggest disinfectant producers in the United States, produced 40 million more items in the Q1 of than it did in the Q1 of . In addition, Dow Inc. switched output in five of its sites to produce 200 tonnes of sanitizers weekly. This indicates that the product has a lot of potential in cleaning applications. In the future, demand for bio-based or natural biocides is expected to rise.Biocides Market Regional Insights:

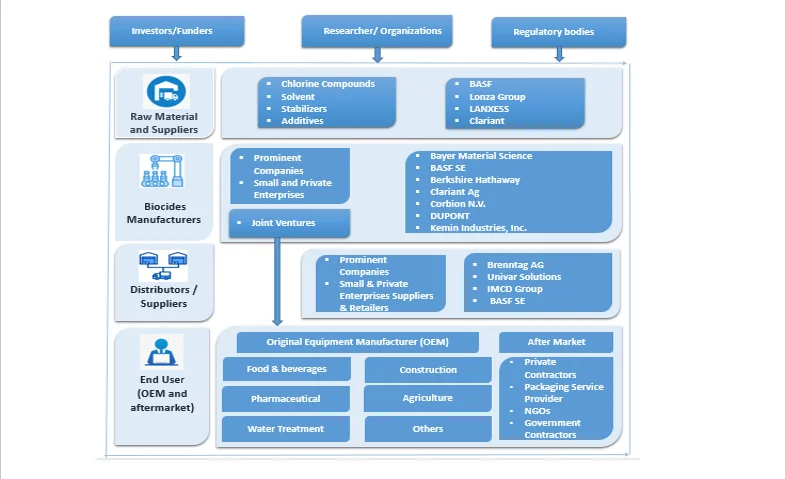

The biocides market in the US expanded by 3.7 percent Y-o-Y in , reached a market worth of US$ 2.89 billion in . The rising use of halogen compounds in paints and coatings, as well as the pulp and paper sectors, is attributed to the country's growth. According to MMR research, the demand for halogen compounds in North America would reach US$ 4 billion by the end of . Thus, biocides' use in paints and coatings, wood preservatives, oil & gas, and paper and pulp industries is boost market growth in the U.S. China is considered to be a major producer and consumer of biocides in , accounting for 73 percent of the East Asian biocides market. The need for biocides in the country has increased due to the country's strong industrial expansion. In addition, the presence of important end consumers in the country aids market expansion. The usage of biocides is expanding due to significant advancements in end-use sectors such as water treatment, paints and coatings, paper and pulp, disinfection, agrochemicals, and others. During the forecast period, China is expected to grow at a stable 4.3 percent CAGR. The objective of the report is to present a comprehensive analysis of the global Biocides market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Biocides dynamics, structure by analyzing the market segments and projecting the Biocides size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Biocides market make the report investor’s guide.Biocides Industry Ecosystem

Biocides Market Scope: Inquiry Before Buying

Biocides Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 12.77 Bn. Forecast Period 2025 to 2032 CAGR: 3.9% Market Size in 2032: USD 17.34 Bn. Segments Covered: by Grade Food Grade Pharmaceutical Grade Industrial/ Technical Grade by Type Metallic Compounds Halogen-Based Biocides Organic Acids Sulphones Phenol-Based Biocides Others by End User Food & Beverages Construction Agriculture Pharmaceutical Personal Care Water Treatment Paints & Coatings Home Care Others Biocides Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Biocides Market, Key Players are:

1. Bayer Material Science 2. BASF SE 3. Berkshire Hathaway 4. Clariant Ag 5. Corbion N.V. 6. DUPONT 7. Kemin Industries, Inc. 8. Kerry 9. Lanxess Ag 10.Lonza Group Ag 11.Nouryon 12.Solvay Sa 13.Thor Group Limited 14.Ecolab Inc. 15.Solenis 16.Veolia 17.Sigura Water 18.Italmatch chemicals 19.Albemarle Corporation 20.ICL Group 21.Accepta Water Treatment 22.Buckman Laboratories Interanational Inc. 23.B&V Chemicals 24.Kimberlite Chemicals 25.Kurita Water Industries 26.Melzer Chemicals Pvt. Ltd. 27.Momar Inc. 28.Ozone Tech Systems 29.Chemicrea Inc Frequently Asked Questions: 1. Which region has the largest share in Biocides Market? Ans: The Asia Pacific held the largest share in 2024. 2. What is the growth rate of the Biocides Market? Ans: The Biocides Market is growing at a CAGR of 3.9% during the forecasting period 2025-2032 3. What segments are covered in the Biocides market? Ans: Biocides Market is segmented into Type, End-use Industry, and Region. 4. Who are the key players in the Biocides market? Ans: The important key players in the Biocides Market are – Bayer Material Science, BASF SE, Berkshire Hathaway, Clariant Ag, Corbion N.V., DUPONT, Kemin Industries, Inc., Kerry, Lanxess Ag, Lonza Group Ag, Nouryon, Solvay Sa, Thor Group Limited, Ecolab Inc., Solenis, Veolia, Sigura Water, Italmatch chemicals, Albemarle Corporation, ICL Group, Accepta Water Treatment, Buckman Laboratories Interanational Inc., B&V Chemicals, Kimberlite Chemicals, Kurita Water Industries, Pelzer Chemicals Pvt. Ltd., Momar Inc., Ozone Tech Systems, and Chemicrea Inc. 5. What is the study period of this market? Ans: The Biocides Market is studied from 2024 to 2032

1. Global Biocides Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Biocides Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Company Location 2.5.3. Product Segment 2.5.4. End-user Segment 2.5.5. Revenue (2024) 2.5.6. Growth Rate (Y-O-Y in %) 2.5.7. Key Development 2.5.8. Market Share 2.6. Industry Ecosystem Analysis 2.7. Market Structure 2.7.1. Market Leaders 2.7.2. Market Followers 2.7.3. Emerging Players 2.8. Consolidation of the Market 2.8.1. Strategic Initiatives and Developments 2.8.2. Mergers and Acquisitions 2.8.3. Collaborations and Partnerships 2.8.4. Product Launches and Innovations 3. Global Biocides Market: Dynamics 3.1. Biocides Market Trends 3.2. Biocides Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.3.1. Threat of New Entrants 3.3.2. Threat of Substitutes 3.3.3. Bargaining Power of Suppliers 3.3.4. Bargaining Power of Buyers 3.3.5. Intensity of Competitive Rivalry 3.4. PESTLE Analysis 3.5. Value Chain Analysis 3.5.1. Raw Material 3.5.2. Manufacturing 3.5.3. Distribution Network 3.5.4. Application 3.6. Technology Analysis 3.6.1. Key Technology 3.6.1.1. Aqueous Process 3.6.1.2. Kemira KemConnect DEX technology 3.6.1.3. Thor AMME (Advanced Micro Matrix Embedding) technology 3.7. Regulatory Landscape 3.7.1. Regulations by Region 3.7.2. Regulatory Bodies, Government Agencies, and Other Organizations 3.8. Trade Analysis 3.8.1. Import Scenario of Biocides 3.8.2. Export scenario of Biocides 3.9. Pricing Analysis 3.9.1. Average Selling Price Trend by Key Players 3.10. Patent Analysis 3.11. Supply Chain Analysis 3.11.1. Raw Material Procurement 3.11.2. Manufacturing Process 3.11.3. Distribution and Logistics 3.11.4. Conversion and Processing 4. Global Biocides Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 4.1. Global Biocides Market Size and Forecast, by Grade (2024-2032) 4.1.1. Food Grade 4.1.2. Pharmaceutical Grade 4.1.3. Industrial/ Technical Grade 4.2. Global Biocides Market Size and Forecast, by Type (2024-2032) 4.2.1. Metallic Compounds 4.2.2. Halogen-Based Biocides 4.2.3. Organic Acids 4.2.4. Sulphones 4.2.5. Phenol-Based Biocides 4.2.6. Others 4.3. Global Biocides Market Size and Forecast, by End-Use (2024-2032) 4.3.1. Food & Beverages 4.3.2. Construction 4.3.3. Agriculture 4.3.4. Pharmaceutical 4.3.5. Personal Care 4.3.6. Water Treatment 4.3.7. Paints & Coatings 4.3.8. Home Care 4.3.9. Others 4.4. Global Biocides Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Biocides Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Biocides Market Size and Forecast, by Grade (2024-2032) 5.1.1. Food Grade 5.1.2. Pharmaceutical Grade 5.1.3. Industrial/ Technical Grade 5.2. North America Biocides Market Size and Forecast, by Type (2024-2032) 5.2.1. Metallic Compounds 5.2.2. Halogen-Based Biocides 5.2.3. Organic Acids 5.2.4. Sulphones 5.2.5. Phenol-Based Biocides 5.2.6. Others 5.3. North America Biocides Market Size and Forecast, by End-Use (2024-2032) 5.3.1. Food & Beverages 5.3.2. Construction 5.3.3. Agriculture 5.3.4. Pharmaceutical 5.3.5. Personal Care 5.3.6. Water Treatment 5.3.7. Paints & Coatings 5.3.8. Home Care 5.3.9. Others 5.4. North America Biocides Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Biocides Market Size and Forecast, by Grade (2024-2032) 5.4.1.1.1. Food Grade 5.4.1.1.2. Pharmaceutical Grade 5.4.1.1.3. Industrial/ Technical Grade 5.4.1.2. United States Biocides Market Size and Forecast, by Type (2024-2032) 5.4.1.2.1. Metallic Compounds 5.4.1.2.2. Halogen-Based Biocides 5.4.1.2.3. Organic Acids 5.4.1.2.4. Sulphones 5.4.1.2.5. Phenol-Based Biocides 5.4.1.2.6. Others 5.4.1.3. United States Biocides Market Size and Forecast, by End-Use (2024-2032) 5.4.1.3.1. Food & Beverages 5.4.1.3.2. Construction 5.4.1.3.3. Agriculture 5.4.1.3.4. Pharmaceutical 5.4.1.3.5. Personal Care 5.4.1.3.6. Water Treatment 5.4.1.3.7. Paints & Coatings 5.4.1.3.8. Home Care 5.4.1.3.9. Others 5.4.2. Canada 5.4.2.1. Canada Biocides Market Size and Forecast, by Grade (2024-2032) 5.4.2.1.1. Food Grade 5.4.2.1.2. Pharmaceutical Grade 5.4.2.1.3. Industrial/ Technical Grade 5.4.2.2. Canada Biocides Market Size and Forecast, by Type (2024-2032) 5.4.2.2.1. Metallic Compounds 5.4.2.2.2. Halogen-Based Biocides 5.4.2.2.3. Organic Acids 5.4.2.2.4. Sulphones 5.4.2.2.5. Phenol-Based Biocides 5.4.2.2.6. Others 5.4.2.3. Canada Biocides Market Size and Forecast, by End-Use (2024-2032) 5.4.2.3.1. Food & Beverages 5.4.2.3.2. Construction 5.4.2.3.3. Agriculture 5.4.2.3.4. Pharmaceutical 5.4.2.3.5. Personal Care 5.4.2.3.6. Water Treatment 5.4.2.3.7. Paints & Coatings 5.4.2.3.8. Home Care 5.4.2.3.9. Others 5.4.3. Mexico 5.4.3.1. Mexico Biocides Market Size and Forecast, by Grade (2024-2032) 5.4.3.1.1. Food Grade 5.4.3.1.2. Pharmaceutical Grade 5.4.3.1.3. Industrial/ Technical Grade 5.4.3.2. Mexico Biocides Market Size and Forecast, by Type (2024-2032) 5.4.3.2.1. Metallic Compounds 5.4.3.2.2. Halogen-Based Biocides 5.4.3.2.3. Organic Acids 5.4.3.2.4. Sulphones 5.4.3.2.5. Phenol-Based Biocides 5.4.3.2.6. Others 5.4.3.3. Mexico Biocides Market Size and Forecast, by End-Use (2024-2032) 5.4.3.3.1. Food & Beverages 5.4.3.3.2. Construction 5.4.3.3.3. Agriculture 5.4.3.3.4. Pharmaceutical 5.4.3.3.5. Personal Care 5.4.3.3.6. Water Treatment 5.4.3.3.7. Paints & Coatings 5.4.3.3.8. Home Care 5.4.3.3.9. Others 6. Europe Biocides Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Europe Biocides Market Size and Forecast, by Grade (2024-2032) 6.2. Europe Biocides Market Size and Forecast, by Type (2024-2032) 6.3. Europe Biocides Market Size and Forecast, by End-Use (2024-2032) 6.4. Europe Biocides Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Biocides Market Size and Forecast, by Grade (2024-2032) 6.4.1.2. United Kingdom Biocides Market Size and Forecast, by Type (2024-2032) 6.4.1.3. United Kingdom Biocides Market Size and Forecast, by End-Use (2024-2032) 6.4.2. France 6.4.2.1. France Biocides Market Size and Forecast, by Grade (2024-2032) 6.4.2.2. France Biocides Market Size and Forecast, by Type (2024-2032) 6.4.2.3. France Biocides Market Size and Forecast, by End-Use (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Biocides Market Size and Forecast, by Grade (2024-2032) 6.4.3.2. Germany Biocides Market Size and Forecast, by Type (2024-2032) 6.4.3.3. Germany Biocides Market Size and Forecast, by End-Use (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Biocides Market Size and Forecast, by Grade (2024-2032) 6.4.4.2. Italy Biocides Market Size and Forecast, by Type (2024-2032) 6.4.4.3. Italy Biocides Market Size and Forecast, by End-Use (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Biocides Market Size and Forecast, by Grade (2024-2032) 6.4.5.2. Spain Biocides Market Size and Forecast, by Type (2024-2032) 6.4.5.3. Spain Biocides Market Size and Forecast, by End-Use (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Biocides Market Size and Forecast, by Grade (2024-2032) 6.4.6.2. Sweden Biocides Market Size and Forecast, by Type (2024-2032) 6.4.6.3. Sweden Biocides Market Size and Forecast, by End-Use (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Biocides Market Size and Forecast, by Grade (2024-2032) 6.4.7.2. Russia Biocides Market Size and Forecast, by Type (2024-2032) 6.4.7.3. Russia Biocides Market Size and Forecast, by End-Use (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Biocides Market Size and Forecast, by Grade (2024-2032) 6.4.8.2. Rest of Europe Biocides Market Size and Forecast, by Type (2024-2032) 6.4.8.3. Rest of Europe Biocides Market Size and Forecast, by End-Use (2024-2032) 7. Asia Pacific Biocides Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Biocides Market Size and Forecast, by Grade (2024-2032) 7.2. Asia Pacific Biocides Market Size and Forecast, by Type (2024-2032) 7.3. Asia Pacific Biocides Market Size and Forecast, by End-Use (2024-2032) 7.4. Asia Pacific Biocides Market Size and Forecast, by Industry (2024-2032) 7.5. Asia Pacific Biocides Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Biocides Market Size and Forecast, by Grade (2024-2032) 7.5.1.2. China Biocides Market Size and Forecast, by Type (2024-2032) 7.5.1.3. China Biocides Market Size and Forecast, by End-Use (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Biocides Market Size and Forecast, by Grade (2024-2032) 7.5.2.2. S Korea Biocides Market Size and Forecast, by Type (2024-2032) 7.5.2.3. S Korea Biocides Market Size and Forecast, by End-Use (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Biocides Market Size and Forecast, by Grade (2024-2032) 7.5.3.2. Japan Biocides Market Size and Forecast, by Type (2024-2032) 7.5.3.3. Japan Biocides Market Size and Forecast, by End-Use (2024-2032) 7.5.4. India 7.5.4.1. India Biocides Market Size and Forecast, by Grade (2024-2032) 7.5.4.2. India Biocides Market Size and Forecast, by Type (2024-2032) 7.5.4.3. India Biocides Market Size and Forecast, by End-Use (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Biocides Market Size and Forecast, by Grade (2024-2032) 7.5.5.2. Australia Biocides Market Size and Forecast, by Type (2024-2032) 7.5.5.3. Australia Biocides Market Size and Forecast, by End-Use (2024-2032) 7.5.6. ASEAN 7.5.6.1. ASEAN Biocides Market Size and Forecast, by Grade (2024-2032) 7.5.6.2. ASEAN Biocides Market Size and Forecast, by Type (2024-2032) 7.5.6.3. ASEAN Biocides Market Size and Forecast, by End-Use (2024-2032) 7.5.7. Rest of Asia Pacific 7.5.7.1. Rest of Asia Pacific Biocides Market Size and Forecast, by Grade (2024-2032) 7.5.7.2. Rest of Asia Pacific Biocides Market Size and Forecast, by Type (2024-2032) 7.5.7.3. Rest of Asia Pacific Biocides Market Size and Forecast, by End-Use (2024-2032) 8. Middle East and Africa Biocides Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Middle East and Africa Biocides Market Size and Forecast, by Grade (2024-2032) 8.2. Middle East and Africa Biocides Market Size and Forecast, by Type (2024-2032) 8.3. Middle East and Africa Biocides Market Size and Forecast, by End-Use (2024-2032) 8.4. Middle East and Africa Biocides Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Biocides Market Size and Forecast, by Grade (2024-2032) 8.4.1.2. South Africa Biocides Market Size and Forecast, by Type (2024-2032) 8.4.1.3. South Africa Biocides Market Size and Forecast, by End-Use (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Biocides Market Size and Forecast, by Grade (2024-2032) 8.4.2.2. GCC Biocides Market Size and Forecast, by Type (2024-2032) 8.4.2.3. GCC Biocides Market Size and Forecast, by End-Use (2024-2032) 8.4.3. Rest of ME&A 8.4.3.1. Rest of ME&A Biocides Market Size and Forecast, by Grade (2024-2032) 8.4.3.2. Rest of ME&A Biocides Market Size and Forecast, by Type (2024-2032) 8.4.3.3. Rest of ME&A Biocides Market Size and Forecast, by End-Use (2024-2032) 9. South America Biocides Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 9.1. South America Biocides Market Size and Forecast, by Grade (2024-2032) 9.2. South America Biocides Market Size and Forecast, by Type (2024-2032) 9.3. South America Biocides Market Size and Forecast, by End-Use (2024-2032) 9.4. South America Biocides Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Biocides Market Size and Forecast, by Grade (2024-2032) 9.4.1.2. Brazil Biocides Market Size and Forecast, by Type (2024-2032) 9.4.1.3. Brazil Biocides Market Size and Forecast, by End-Use (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Biocides Market Size and Forecast, by Grade (2024-2032) 9.4.2.2. Argentina Biocides Market Size and Forecast, by Type (2024-2032) 9.4.2.3. Argentina Biocides Market Size and Forecast, by End-Use (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Biocides Market Size and Forecast, by Grade (2024-2032) 9.4.3.2. Rest of South America Biocides Market Size and Forecast, by Type (2024-2032) 9.4.3.3. Rest of South America Biocides Market Size and Forecast, by End-Use (2024-2032) 10. Company Profile: Key Players 10.1. Bayer Material Science 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. BASF SE 10.3. Berkshire Hathaway 10.4. Clariant Ag 10.5. Corbion N.V. 10.6. DUPONT 10.7. Kemin Industries, Inc. 10.8. Kerry 10.9. Lanxess Ag 10.10. Lonza Group Ag 10.11. Nouryon 10.12. Solvay Sa 10.13. Thor Group Limited 10.14. Ecolab Inc. 10.15. Solenis 10.16. Veolia 10.17. Sigura Water 10.18. Italmatch chemicals 10.19. Albemarle Corporation 10.20. ICL Group 10.21. Accepta Water Treatment 10.22. Buckman Laboratories Interanational Inc. 10.23. B&V Chemicals 10.24. Kimberlite Chemicals 10.25. Kurita Water Industries 10.26. Melzer Chemicals Pvt. Ltd. 10.27. Momar Inc. 10.28. Ozone Tech Systems 10.29. Chemicrea Inc 11. Key Findings & Analyst Recommendations 12. Biocides Market: Research Methodology 12.1. Top-Down Approach 12.2. Bottom-up Approach 12.3. Market Breakdown and Data Triangulation 12.4. Research Assumption