The Bicycle Market size was valued at USD 70.49 Bn in 2023 and market revenue is growing at a CAGR of 9.8% from 2023 to 2030, reaching nearly USD 135.63 Bn by 2030.Bicycle Market Overview

The global bicycle market is booming with energy and innovation. Shifting preferences are steering individuals towards sustainable and health-conscious modes of travel, sparking a remarkable growth in bicycle demand. Growing environmental consciousness has prompted many to opt for bicycles as a cleaner alternative to conventional vehicles, a trend further accelerated by the COVID-19 pandemic's emphasis on safety and social distancing. Bicycles offer an accessible, eco-friendly, and enjoyable means of transportation, increasingly appealing to both city residents and fitness enthusiasts. Government initiatives across the world are driving momentum, offering incentives, and developing cycling infrastructure to encourage more widespread adoption of bicycles. In essence, the bicycle market embodies more than mere transportation—it embodies a dynamic ecosystem of innovation, sustainability, and well-being. As more individuals embrace the joys of cycling, the future of mobility shines brighter than ever. The bicycle market is the rising demand for electric bicycles (e-bikes). E-bikes offer the benefits of traditional bicycles, such as zero emissions and improved health, while also providing electric assistance for easier and longer rides. This segment has seen rapid growth due to advancements in battery technology, making e-bikes more affordable and accessible to a wider range of consumers.To know about the Research Methodology :- Request Free Sample Report

Bicycle Market Trends

AI Revolutionizes Cycling: Safety and Performance Take Center Stage AI is increasingly permeating the realm of cycling, accompanied in significant advancements in safety and performance. The 'Coalition for Cyclist Safety,' formed in 2023 by leading brands such as BMC, Bosch, Shimano, and Trek, is leveraging V2X technology to enhance road safety for cyclists. V2X enables communication among vehicles, infrastructure, and now bikes, facilitating the transmission of crucial information like traffic conditions and hazards. Canyon has disclosed plans to implement this technology into select e-bikes by 2026, with features such as warning systems for nearby cyclists and potential interventions to prevent accidents, such as stopping motorists from opening doors when a cyclist is passing. AI has found its way into professional cycling, notably aiding in the formulation of dietary plans for teams like Jumbo-Visma during events like the Tour de France. This integration of AI promises to revolutionize performance optimization strategies, potentially becoming a cornerstone in teams' pursuit of incremental advantages. As AI continues to evolve, its impact on cycling is set to expand, reshaping both safety measures and performance enhancement techniques across the industry.Bicycle Market: Dynamics

Increasing Government focus on building a cycling Infrastructure to boost the growth of the Bicycle Market Governments are increasingly prioritizing the development of cycling infrastructure to foster growth in the bicycle market due to several interconnected reasons. Promoting cycling aligns with broader environmental goals by reducing carbon emissions and combating air pollution, thereby addressing climate change concerns. Investing in cycling infrastructure promotes public health by encouraging physical activity and reducing sedentary lifestyles, leading to potential savings in healthcare costs associated with diseases like obesity and cardiovascular issues. Therefore, cycling infrastructure enhances urban mobility, reducing traffic congestion and dependence on fossil fuels, while also offering cost-effective transportation options, especially in densely populated areas. Fostering a bicycle-friendly environment stimulates economic growth by boosting tourism related to cycling, supporting local businesses catering to cyclists, and creating jobs in infrastructure development and bicycle manufacturing sectors. The focus on building cycling infrastructure serves as a multifaceted approach addressing environmental, public health, urban mobility, and economic development goals, thereby driving the growth of the bicycle market while promoting sustainable and healthy living.

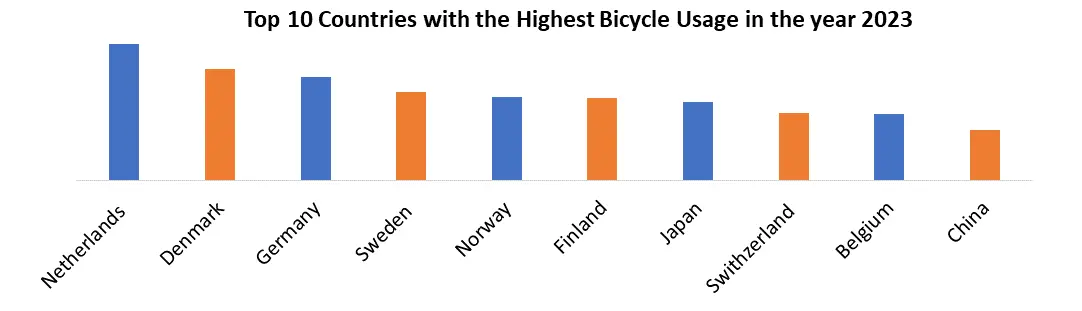

Region Description Denmark Copenhagen, the capital city of Denmark, is renowned for its cycling infrastructure. The City of Copenhagen, through its Roads and Parks Department, has allocated a significant budget for the development of cycling infrastructure, with one-third of the road construction budget earmarked for improving cycling conditions. The city has also established the Bicycle Account, a biennial document that focuses solely on bicycle use and provides statistics on cycling in the city. The Cycling Embassy of Denmark and the Danish Cyclists' Federation assist in formulating, implementing, and monitoring the policy, serving as advocacy groups for the city's and country's cyclists. Global Cities The Bloomberg Initiative for Cycling Infrastructure has received applications from cities worldwide advocating for cycling as a central mode of transit, not just a greener alternative. Cities are now including cycling infrastructure in their policy and planning processes, to establish it as a preferred mode of transit. The initiative has also highlighted the importance of creating new benefits and efficiencies for residents, linking historically disconnected communities, increasing road safety for young people, and delivering infrastructure that meets local needs. Australia and New Zealand A survey of local governments in Australia and New Zealand revealed that the most significant barriers to providing adequate infrastructure and delivering safe cycling environments are related to the lack of funding and resources for cycling infrastructure and facilities and competition for road space. State, regional, and national governing organizations are considered important partners and enablers for the planning and delivery of cycling infrastructure, especially in their capacity as funding bodies. Netherlands The Netherlands is known for its extensive cycling infrastructure, with examples such as the Melkwegbridge in Purmerend, which separates cyclists and pedestrians while allowing easy passage for boats, and the Hovenring in Eindhoven, a circular cycle bridge over a busy road intersection Bicycle Market Growth Restraints

The Availability of alternative transport solutions limits the bicycle Market growth The availability of alternative transport solutions limits the growth of the bicycle market. The wide range of alternative travel choices, such as buses, trains, autos, and others, compete with bicycles for commuters' preferences. These alternatives offer advantages such as faster travel times, greater comfort, and all-weather usability, making them more appealing to some users. The rising concerns regarding safety and comfort play a significant role. Many people perceive cycling as less safe compared to other modes of transport, particularly in areas with heavy traffic or inadequate cycling lanes. Adverse weather conditions deter individuals from choosing bicycles as their primary mode of transportation. Another factor is the trade restrictions related to the bike/cycle components and accessories within different countries across the globe. These restrictions hinder the supply chain and increase the cost of bicycles, making them less competitive with other modes of transport. E-bicycles, while growing in popularity, also face limitations due to their higher cost compared to scooters or motorbikes. The expense of the battery and technology in e-bicycles make them more expensive, leading some consumers to consider traditional scooters and motorbikes as superior in performance while costing the same or less. The higher cost and lack of charging facilities also restrain the market growth for e-bicycles. However, some factors drive the growth of the bicycle market. For instance, the rising urban road congestion leads to increased demand for bicycles as a more efficient and environmentally friendly mode of transportation. Additionally, the growing popularity of cycling-related adventure sports boosts the demand for specific types of bicycles, such as mountain or road bikes.Bicycle Market Growth Opportunity

Growing Health Consciousness creates lucrative Growth opportunities for market growth Growing health consciousness creates lucrative growth opportunities for the wellness market by driving increased demand for products and services that provide to consumers' well-being. As more individuals prioritize their health, there is a significant shift towards wellness-related offerings, such as fitness apps, mental wellness services, personalized nutrition, and beauty products. This heightened awareness of health benefits and preventive care not only boosts consumer spending on wellness but also encourages innovation and development within the industry. Bicycle companies that tap into this trend by providing clinically proven, personalized, and holistic wellness solutions stand to benefit the most. By addressing the unmet needs of health-conscious consumers through thoughtful, differentiated, and tailored offerings, businesses capitalize on the growing market demand and consumer preferences. The emphasis on health and wellness is reshaping consumer behavior, creating a fertile ground for companies to thrive by meeting the evolving needs of an increasingly health-conscious population.

Bicycle Market Segment Analysis

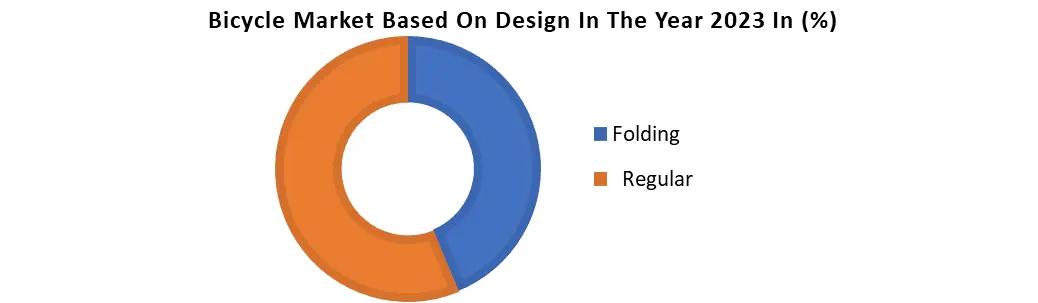

Based on Product, road bicycles dominated the product segment of the bicycle Market in the year 2023. Road bicycles have come to dominate the bicycle market primarily due to their versatility, efficiency, and popularity among cyclists of all levels. These bikes are specifically designed for speed and efficiency on paved surfaces, making them ideal for commuting, fitness, racing, and long-distance rides. The advancements in technology have led to the development of lightweight materials and aerodynamic designs, enhancing speed and agility. Also, the rise of cycling as a recreational and competitive sport has boosted demand for high-performance road bikes. The increasing emphasis on health and fitness has encouraged more people to take up cycling as a form of exercise, further driving the demand for road bikes. The accessibility of road cycling events and the production of cycling communities have also contributed to their popularity. The combination of technological innovation, increased interest in cycling, and the versatile nature of road bicycles has solidified its position as the dominant product segment in the Bicycle Market.Based on Design The Regular sub-segment dominated the design segment of the Bicycle Market in the year 2023 Due to its versatility, simplicity, and widespread appeal. This category encompasses traditional bicycle designs, favored for their familiarity and functionality. They provide a broad audience, from casual riders to commuters and enthusiasts, providing a reliable means of transportation and recreation. Advancements in material technology and manufacturing processes have enhanced the performance and comfort of regular bicycles, further solidifying their Bicycle market dominance. Their enduring popularity stems from their ability to meet the diverse needs of consumers without the complexity or niche focus of specialized designs, making them a staple in the cycling industry.

Bicycle Market Regional Analysis :

Asia Pacific Region Dominated the Global Bicycle Market The Asia Pacific Region Dominated the Bicycle Market in the Year 2023. The region's large population, particularly in countries like China and India, creates a vast consumer base for bicycles. According to an MMR Study report Asia and the Pacific region is home to 60 percent of the world’s population – some 4.3 billion people – and includes the world’s most populous countries, China and India. The Asia Pacific region has become a manufacturing hub for bicycles, benefitting from lower production costs and established supply chains. This enables manufacturers to produce bicycles at competitive prices, provided to both domestic and international markets. Also, cultural factors play a significant role in the popularity of bicycles in the region. In many Asian countries, cycling is deeply ingrained in the culture as a primary mode of transportation for daily commuting and errands. This cultural acceptance fosters a strong demand for bicycles across various demographics. The positive government initiatives promoting cycling infrastructure and initiatives to combat pollution and congestion have spurred further growth in the bicycle market in the Asia Pacific region. Therefore, the combination of population size, manufacturing capabilities, cultural affinity, and government support has boosted the Asia Pacific region to dominance in the global bicycle market.Bicycle Market Scope: Inquiry Before Buying

Bicycle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 70.49 Bn. Forecast Period 2024 to 2030 CAGR: 9.8% Market Size in 2030: US $ 135.63 Bn. Segments Covered: by Product Mountain Bikes Hybrid Bikes Road Bikes Cargo Bikes Others by Design Folding Regular by Technology Electric Conventional by End-User Men Women Kids by Distribution Channel Online Offline Bicycle Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bicycle Market Key players are

North America 1. Trek Bicycle Corporation (USA) 2. Felt Bicycles (USA) 3. Kona Bikes (USA) 4. Specialized Bicycle Components, Inc. (USA) 5. Cannondale Bicycle Corporation (USA) 6. Santa Cruz Bicycles (USA) 7. Fuji Bikes (USA) Europe 1. BMC Switzerland AG (Switzerland) 2. Cube Bikes (Germany) 3. Accell Group (Netherlands) 4. Scott Sports SA( Switzerland) 5. Focus Bikes (Germany) 6. Canyon Bicycles GmbH (Germany) 7. Cube Bikes ( Germany) 8. Orbea (Spain) 9. Bianchi (Italy) Asia Pacific 1. Merida Industry Co., Ltd.(Taiwan) 2. Giant Manufacturing Co., Ltd. (Taiwan) 3. Shimano Inc (Japan)Frequently Asked Questions

1] What segments are covered in the Global Bicycle Market report? Ans. The segments covered in the Bicycle Market report are based on, Product, Design, Technology, End-user, Distribution Channel, and Regions. 2] Which region is expected to hold the highest Global Bicycle Market share? Ans. The Asia Pacific region is expected to hold the highest Bicycle Market share. 3] What is the market size of the Global Bicycle Market by 2030? Ans. The market size of the Bicycle Market by 2030 is expected to reach US$ 135.63 Bn. 4] What was the market size of the Global Bicycle Market in 2023? Ans. The market size of the Bicycle Market in 2023 was valued at US$ 70.49 Bn. 5] Key players in the Bicycle Market. Ans. Trek Bicycle Corporation (USA), Felt Bicycles (USA), Kona Bikes (USA), Specialized Bicycle Components, Inc. (USA), and Cannondale Bicycle Corporation (USA)

1. Bicycle Market: Research Methodology 2. Bicycle Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Bicycle Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Product Segment 3.3.3. End User Segment 3.3.4. Revenue (2023) 3.3.5. Headquarter 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Mergers and Acquisitions Details 4. Bicycle Market: Dynamics 4.1. Bicycle Market Trends by Region 4.1.1. North America Bicycle Market Trends 4.1.2. Europe Bicycle Market Trends 4.1.3. Asia Pacific Bicycle Market Trends 4.1.4. Middle East and Africa Bicycle Market Trends 4.1.5. South America Bicycle Market Trends 4.2. Bicycle Market Dynamics by Region 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Technology Roadmap 4.6. Regulatory Landscape by Region 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 4.7. Key Opinion Leader Analysis for Bicycle Industry 4.8. Analysis of Government Schemes and Initiatives for the Bicycle Industry 5. Bicycle Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Bicycle Market Size and Forecast, by Product (2023-2030) 5.1.1. Mountain Bikes 5.1.2. Hybrid Bikes 5.1.3. Road Bikes 5.1.4. Cargo Bikes 5.1.5. Others 5.2. Bicycle Market Size and Forecast, by Design (2023-2030) 5.2.1. Folding 5.2.2. Regular 5.3. Bicycle Market Size and Forecast, by Technology (2023-2030) 5.3.1. Electric 5.3.2. Conventional 5.4. Bicycle Market Size and Forecast, by End-User (2023-2030) 5.4.1. Men 5.4.2. Women 5.4.3. Kids 5.5. Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.1. Online 5.5.2. Offline 5.6. Bicycle Market Size and Forecast, by Region (2023-2030) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Bicycle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. North America Bicycle Market Size and Forecast, by Product (2023-2030) 6.1.1. Mountain Bikes 6.1.2. Hybrid Bikes 6.1.3. Road Bikes 6.1.4. Cargo Bikes 6.1.5. Others 6.2. North America Bicycle Market Size and Forecast, by Design (2023-2030) 6.2.1. Folding 6.2.2. Regular 6.3. North America Bicycle Market Size and Forecast, by Technology (2023-2030) 6.3.1. Electric 6.3.2. Conventional 6.4. North America Bicycle Market Size and Forecast, by End-User (2023-2030) 6.4.1. Men 6.4.2. Women 6.4.3. Kids 6.5. North America Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.1. Online 6.5.2. Offline 6.6. Bicycle Market Size and Forecast, by Country (2023-2030) 6.6.1. United States 6.6.1.1. United States Bicycle Market Size and Forecast, by Product (2023-2030) 6.6.1.1.1. Mountain Bikes 6.6.1.1.2. Hybrid Bikes 6.6.1.1.3. Road Bikes 6.6.1.1.4. Cargo Bikes 6.6.1.1.5. Others 6.6.1.2. United States Bicycle Market Size and Forecast, by Design (2023-2030) 6.6.1.2.1. Folding 6.6.1.2.2. Regular 6.6.1.3. United States Bicycle Market Size and Forecast, by Technology (2023-2030) 6.6.1.3.1. Electric 6.6.1.3.2. Conventional 6.6.1.4. United States Bicycle Market Size and Forecast, by End-User (2023-2030) 6.6.1.4.1. Men 6.6.1.4.2. Women 6.6.1.4.3. Kids 6.6.1.5. United States Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.1.5.1. Online 6.6.1.5.2. Offline 6.6.2. Canada 6.6.2.1. Canada Bicycle Market Size and Forecast, by Product (2023-2030) 6.6.2.1.1. Mountain Bikes 6.6.2.1.2. Hybrid Bikes 6.6.2.1.3. Road Bikes 6.6.2.1.4. Cargo Bikes 6.6.2.1.5. Others 6.6.2.2. Canada Bicycle Market Size and Forecast, by Design (2023-2030) 6.6.2.2.1. Folding 6.6.2.2.2. Regular 6.6.2.3. Canada Bicycle Market Size and Forecast, by Technology (2023-2030) 6.6.2.3.1. Electric 6.6.2.3.2. Conventional 6.6.2.4. Canada Bicycle Market Size and Forecast, by End-User (2023-2030) 6.6.2.4.1. Men 6.6.2.4.2. Women 6.6.2.4.3. Kids 6.6.2.5. Canada Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.2.5.1. Online 6.6.2.5.2. Offline 6.6.3. Mexico 6.6.3.1. Mexico Bicycle Market Size and Forecast, by Product (2023-2030) 6.6.3.1.1. Mountain Bikes 6.6.3.1.2. Hybrid Bikes 6.6.3.1.3. Road Bikes 6.6.3.1.4. Cargo Bikes 6.6.3.1.5. Others 6.6.3.2. Mexico Bicycle Market Size and Forecast, by Design (2023-2030) 6.6.3.2.1. Folding 6.6.3.2.2. Regular 6.6.3.3. Mexico Bicycle Market Size and Forecast, by Technology (2023-2030) 6.6.3.3.1. Electric 6.6.3.3.2. Conventional 6.6.3.4. Mexico Bicycle Market Size and Forecast, by End-User (2023-2030) 6.6.3.4.1. Men 6.6.3.4.2. Women 6.6.3.4.3. Kids 6.6.3.5. Mexico Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.3.5.1. Online 6.6.3.5.2. Offline 7. Europe Bicycle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Europe Bicycle Market Size and Forecast, by Product (2023-2030) 7.2. Europe Bicycle Market Size and Forecast, by Design (2023-2030) 7.3. Europe Bicycle Market Size and Forecast, by Technology (2023-2030) 7.4. Europe Bicycle Market Size and Forecast, by End-User (2023-2030) 7.5. Europe Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 7.6. Europe Bicycle Market Size and Forecast, by Country (2023-2030) 7.6.1. United Kingdom 7.6.1.1. United Kingdom Bicycle Market Size and Forecast, by Product (2023-2030) 7.6.1.2. United Kingdom Bicycle Market Size and Forecast, by Design (2023-2030) 7.6.1.3. United Kingdom Bicycle Market Size and Forecast, by Technology (2023-2030) 7.6.1.4. United Kingdom Bicycle Market Size and Forecast, by End-User (2023-2030) 7.6.1.5. United Kingdom Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.2. France 7.6.2.1. France Bicycle Market Size and Forecast, by Product (2023-2030) 7.6.2.2. France Bicycle Market Size and Forecast, by Design (2023-2030) 7.6.2.3. France Bicycle Market Size and Forecast, by Technology (2023-2030) 7.6.2.4. France Bicycle Market Size and Forecast, by End-User (2023-2030) 7.6.2.5. France Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.3. Germany 7.6.3.1. Germany Bicycle Market Size and Forecast, by Product (2023-2030) 7.6.3.2. Germany Bicycle Market Size and Forecast, by Design (2023-2030) 7.6.3.3. Germany Bicycle Market Size and Forecast, by Technology (2023-2030) 7.6.3.4. Germany Bicycle Market Size and Forecast, by End-User (2023-2030) 7.6.3.5. Germany Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.4. Italy 7.6.4.1. Italy Bicycle Market Size and Forecast, by Product (2023-2030) 7.6.4.2. Italy Bicycle Market Size and Forecast, by Design (2023-2030) 7.6.4.3. Italy Bicycle Market Size and Forecast, by Technology (2023-2030) 7.6.4.4. Italy Bicycle Market Size and Forecast, by End-User (2023-2030) 7.6.4.5. Italy Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.5. Spain 7.6.5.1. Spain Bicycle Market Size and Forecast, by Product (2023-2030) 7.6.5.2. Spain Bicycle Market Size and Forecast, by Design (2023-2030) 7.6.5.3. Spain Bicycle Market Size and Forecast, by Technology (2023-2030) 7.6.5.4. Spain Bicycle Market Size and Forecast, by End-User (2023-2030) 7.6.5.5. Spain Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.6. Sweden 7.6.6.1. Sweden Bicycle Market Size and Forecast, by Product (2023-2030) 7.6.6.2. Sweden Bicycle Market Size and Forecast, by Design (2023-2030) 7.6.6.3. Sweden Bicycle Market Size and Forecast, by Technology (2023-2030) 7.6.6.4. Sweden Bicycle Market Size and Forecast, by End-User (2023-2030) 7.6.6.5. Sweden Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.7. Austria 7.6.7.1. Austria Bicycle Market Size and Forecast, by Product (2023-2030) 7.6.7.2. Austria Bicycle Market Size and Forecast, by Design (2023-2030) 7.6.7.3. Austria Bicycle Market Size and Forecast, by Technology (2023-2030) 7.6.7.4. Austria Bicycle Market Size and Forecast, by End-User (2023-2030) 7.6.7.5. Austria Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.8. Rest of Europe 7.6.8.1. Rest of Europe Bicycle Market Size and Forecast, by Product (2023-2030) 7.6.8.2. Rest of Europe Bicycle Market Size and Forecast, by Design (2023-2030) 7.6.8.3. Rest of Europe Bicycle Market Size and Forecast, by Technology (2023-2030) 7.6.8.4. Rest of Europe Bicycle Market Size and Forecast, by End-User (2023-2030) 7.6.8.5. Rest of Europe Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8. Asia Pacific Bicycle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Asia Pacific Bicycle Market Size and Forecast, by Product (2023-2030) 8.2. Asia Pacific Bicycle Market Size and Forecast, by Design (2023-2030) 8.3. Asia Pacific Bicycle Market Size and Forecast, by Technology (2023-2030) 8.4. Asia Pacific Bicycle Market Size and Forecast, by End-User (2023-2030) 8.5. Asia Pacific Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8.6. Asia Pacific Bicycle Market Size and Forecast, by Country (2023-2030) 8.6.1. China 8.6.1.1. China Bicycle Market Size and Forecast, by Product (2023-2030) 8.6.1.2. China Bicycle Market Size and Forecast, by Design (2023-2030) 8.6.1.3. China Bicycle Market Size and Forecast, by Technology (2023-2030) 8.6.1.4. China Bicycle Market Size and Forecast, by End-User (2023-2030) 8.6.1.5. China Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.2. S Korea 8.6.2.1. S Korea Bicycle Market Size and Forecast, by Product (2023-2030) 8.6.2.2. S Korea Bicycle Market Size and Forecast, by Design (2023-2030) 8.6.2.3. S Korea Bicycle Market Size and Forecast, by Technology (2023-2030) 8.6.2.4. S Korea Bicycle Market Size and Forecast, by End-User (2023-2030) 8.6.2.5. S Korea Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.3. Japan 8.6.3.1. Japan Bicycle Market Size and Forecast, by Product (2023-2030) 8.6.3.2. Japan Bicycle Market Size and Forecast, by Design (2023-2030) 8.6.3.3. Japan Bicycle Market Size and Forecast, by Technology (2023-2030) 8.6.3.4. Japan Bicycle Market Size and Forecast, by End-User (2023-2030) 8.6.3.5. Japan Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.4. India 8.6.4.1. India Bicycle Market Size and Forecast, by Product (2023-2030) 8.6.4.2. India Bicycle Market Size and Forecast, by Design (2023-2030) 8.6.4.3. India Bicycle Market Size and Forecast, by Technology (2023-2030) 8.6.4.4. India Bicycle Market Size and Forecast, by End-User (2023-2030) 8.6.4.5. India Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.5. Australia 8.6.5.1. Australia Bicycle Market Size and Forecast, by Product (2023-2030) 8.6.5.2. Australia Bicycle Market Size and Forecast, by Design (2023-2030) 8.6.5.3. Australia Bicycle Market Size and Forecast, by Technology (2023-2030) 8.6.5.4. Australia Bicycle Market Size and Forecast, by End-User (2023-2030) 8.6.5.5. Australia Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.6. Indonesia 8.6.6.1. Indonesia Bicycle Market Size and Forecast, by Product (2023-2030) 8.6.6.2. Indonesia Bicycle Market Size and Forecast, by Design (2023-2030) 8.6.6.3. Indonesia Bicycle Market Size and Forecast, by Technology (2023-2030) 8.6.6.4. Indonesia Bicycle Market Size and Forecast, by End-User (2023-2030) 8.6.6.5. Indonesia Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.7. Malaysia 8.6.7.1. Malaysia Bicycle Market Size and Forecast, by Product (2023-2030) 8.6.7.2. Malaysia Bicycle Market Size and Forecast, by Design (2023-2030) 8.6.7.3. Malaysia Bicycle Market Size and Forecast, by Technology (2023-2030) 8.6.7.4. Malaysia Bicycle Market Size and Forecast, by End-User (2023-2030) 8.6.7.5. Malaysia Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.8. Vietnam 8.6.8.1. Vietnam Bicycle Market Size and Forecast, by Product (2023-2030) 8.6.8.2. Vietnam Bicycle Market Size and Forecast, by Design (2023-2030) 8.6.8.3. Vietnam Bicycle Market Size and Forecast, by Technology (2023-2030) 8.6.8.4. Vietnam Bicycle Market Size and Forecast, by End-User (2023-2030) 8.6.8.5. Vietnam Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.9. Taiwan 8.6.9.1. Taiwan Bicycle Market Size and Forecast, by Product (2023-2030) 8.6.9.2. Taiwan Bicycle Market Size and Forecast, by Design (2023-2030) 8.6.9.3. Taiwan Bicycle Market Size and Forecast, by Technology (2023-2030) 8.6.9.4. Taiwan Bicycle Market Size and Forecast, by End-User (2023-2030) 8.6.9.5. Taiwan Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.10. Rest of Asia Pacific 8.6.10.1. Rest of Asia Pacific Bicycle Market Size and Forecast, by Product (2023-2030) 8.6.10.2. Rest of Asia Pacific Bicycle Market Size and Forecast, by Design (2023-2030) 8.6.10.3. Rest of Asia Pacific Bicycle Market Size and Forecast, by Technology (2023-2030) 8.6.10.4. Rest of Asia Pacific Bicycle Market Size and Forecast, by End-User (2023-2030) 8.6.10.5. Rest of Asia Pacific Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 9. Middle East and Africa Bicycle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. Middle East and Africa Bicycle Market Size and Forecast, by Product (2023-2030) 9.2. Middle East and Africa Bicycle Market Size and Forecast, by Design (2023-2030) 9.3. Middle East and Africa Bicycle Market Size and Forecast, by Technology (2023-2030) 9.4. Middle East and Africa Bicycle Market Size and Forecast, by End-User (2023-2030) 9.5. Middle East and Africa Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 9.6. Middle East and Africa Bicycle Market Size and Forecast, by Country (2023-2030) 9.6.1. South Africa 9.6.1.1. South Africa Bicycle Market Size and Forecast, by Product (2023-2030) 9.6.1.2. South Africa Bicycle Market Size and Forecast, by Design (2023-2030) 9.6.1.3. South Africa Bicycle Market Size and Forecast, by Technology (2023-2030) 9.6.1.4. South Africa Bicycle Market Size and Forecast, by End-User (2023-2030) 9.6.1.5. South Africa Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 9.6.2. GCC 9.6.2.1. GCC Bicycle Market Size and Forecast, by Product (2023-2030) 9.6.2.2. GCC Bicycle Market Size and Forecast, by Design (2023-2030) 9.6.2.3. GCC Bicycle Market Size and Forecast, by Technology (2023-2030) 9.6.2.4. GCC Bicycle Market Size and Forecast, by End-User (2023-2030) 9.6.2.5. GCC Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 9.6.3. Nigeria 9.6.3.1. Nigeria Bicycle Market Size and Forecast, by Product (2023-2030) 9.6.3.2. Nigeria Bicycle Market Size and Forecast, by Design (2023-2030) 9.6.3.3. Nigeria Bicycle Market Size and Forecast, by Technology (2023-2030) 9.6.3.4. Nigeria Bicycle Market Size and Forecast, by End-User (2023-2030) 9.6.3.5. Nigeria Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 9.6.4. Rest of ME&A 9.6.4.1. Rest of ME&A Bicycle Market Size and Forecast, by Product (2023-2030) 9.6.4.2. Rest of ME&A Bicycle Market Size and Forecast, by Design (2023-2030) 9.6.4.3. Rest of ME&A Bicycle Market Size and Forecast, by Technology (2023-2030) 9.6.4.4. Rest of ME&A Bicycle Market Size and Forecast, by End-User (2023-2030) 9.6.4.5. Rest of ME&A Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 10. South America Bicycle Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 10.1. South America Bicycle Market Size and Forecast, by Product (2023-2030) 10.2. South America Bicycle Market Size and Forecast, by Design (2023-2030) 10.3. South America Bicycle Market Size and Forecast, by Technology (2023-2030) 10.4. South America Bicycle Market Size and Forecast, by End-User (2023-2030) 10.5. South America Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 10.6. South America Bicycle Market Size and Forecast, by Country (2023-2030) 10.6.1. Brazil 10.6.1.1. Brazil Bicycle Market Size and Forecast, by Product (2023-2030) 10.6.1.2. Brazil Bicycle Market Size and Forecast, by Design (2023-2030) 10.6.1.3. Brazil Bicycle Market Size and Forecast, by Technology (2023-2030) 10.6.1.4. Brazil Bicycle Market Size and Forecast, by End-User (2023-2030) 10.6.1.5. Brazil Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 10.6.2. Argentina 10.6.2.1. Argentina Bicycle Market Size and Forecast, by Product (2023-2030) 10.6.2.2. Argentina Bicycle Market Size and Forecast, by Design (2023-2030) 10.6.2.3. Argentina Bicycle Market Size and Forecast, by Technology (2023-2030) 10.6.2.4. Argentina Bicycle Market Size and Forecast, by End-User (2023-2030) 10.6.2.5. Argentina Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 10.6.3. Rest Of South America 10.6.3.1. Rest Of South America Bicycle Market Size and Forecast, by Product (2023-2030) 10.6.3.2. Rest Of South America Bicycle Market Size and Forecast, by Design (2023-2030) 10.6.3.3. Rest Of South America Bicycle Market Size and Forecast, by Technology (2023-2030) 10.6.3.4. Rest Of South America Bicycle Market Size and Forecast, by End-User (2023-2030) 10.6.3.5. Rest Of South America Bicycle Market Size and Forecast, by Distribution Channel (2023-2030) 11. Company Profile: Key Players 11.1. Trek Bicycle Corporation - Waterloo, Wisconsin, USA 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Felt Bicycles - Irvine, California, USA 11.3. Kona Bikes - Ferndale, Washington, USA 11.4. Specialized Bicycle Components, Inc. - Morgan Hill, California, USA 11.5. Cannondale Bicycle Corporation - Wilton, Connecticut, USA 11.6. Santa Cruz Bicycles - Santa Cruz, California, USA 11.7. Fuji Bikes - Philadelphia, Pennsylvania, USA 11.8. BMC Switzerland AG - Grenchen, Switzerland 11.9. Cube Bikes - Waldershof, Germany 11.10. Accell Group - Heerenveen, Netherlands 11.11. Scott Sports SA - Givisiez, Switzerland 11.12. Focus Bikes - Cloppenburg, Germany 11.13. Canyon Bicycles GmbH - Koblenz, Germany 11.14. Cube Bikes - Waldershof, Germany 11.15. Orbea - Mallabia, Spain 11.16. Bianchi - Treviglio, Italy 11.17. Merida Industry Co., Ltd. - Yuanlin, Taiwan 11.18. Giant Manufacturing Co., Ltd. - Taichung City, Taiwan 11.19. Shimano Inc. - Sakai, Japan 12. Key Findings 13. Distribution Channel Recommendations