Global Beta-Glucan Market size was valued at USD 542.3 Million in 2024, and the total Beta-Glucan Market is expected to grow by 8.2% from 2025 to 2032, reaching nearly USD 1018.73 Million.Beta-Glucan Market Overview

Beta-glucans are found in bacteria, fungi, yeast, algae, and plants such as barley and are found in cell walls. These compounds are known for their immunomodulatory properties and have been studied for their possible health benefits. Beta-glucans stimulate the immune system, promoting a strong response to infections and diseases. In the market, beta-glucans have attracted attention to their applications in various industries, including pharmaceuticals, food and beverages, cosmetics, and animal fodder. Beta-glucans are often used as functional materials in the food and beverage industry. They are usually added to products such as oat-based foods, grains, bread, and beverages so that they increase their nutrition profiles and provide possible health benefits. Beta- Glucan market contributes to heart health by helping reduce cholesterol levels. Beta-glucans are available as dietary supplements, often derived from sources such as yeast, mushrooms, or oats.To know about the Research Methodology:-Request Free Sample Report Europe and North America currently organize the largest market stocks due to strong consumer support (eg, EFSA and FDA approval) and strong consumer interest in natural health solutions. However, Asia-Pacific is experiencing rapid growth, rising health care awareness, diet infection, and investing in local nutraceutical manufacturing-especially in countries such as China, Japan, South Korea, and India. Leading players, such as Tate and Lyl, Carry Group, Lesfrey, DSM, and Biothera pharmaceuticals, clinical, cosmetic, and food-grade applications are shaping the market through innovations, strategic partnerships, and product-specific beta-glucan yogas. Their focus on stability, supply chain traceability, and analog health benefits is important in separating the offerings and building consumer trust.

Beta-Glucan Market Dynamics:

Increasing Consumer Awareness of the Health Benefits Associated with Beta-Glucan Drive the Beta-Glucan Market Growth The increasing consumer awareness of the health benefits associated with beta-glucan, such as immune system support and cholesterol reduction, contributed to the beta-glucan market growth. This heightened awareness has led to a substantial increase in the beta-glucan market share of products containing beta-glucan, showcasing its potential to capture a significant portion of the broader health and wellness market. Also, rising health concerns, including the prevalence of lifestyle diseases and the growing focus on preventive healthcare, boosted the beta-glucan market's penetration into the dietary supplements and functional foods segment. The market's penetration into these sectors indicated a promising opportunity for beta-glucan to become a staple in the daily health routines of consumers, further enhancing its market share and industry influence. Beta-glucan's functional properties positioned it as a key player in the food and beverage industry, leading to increased market share within this sector. The industry's recognition of beta-glucan as an ingredient with potential health benefits contributed to the innovation in industry practices, with companies exploring novel ways to incorporate beta-glucan market into various food and beverage products. This innovation, coupled with the market's growth potential, indicated a positive outlook for the beta-glucan industry. The incorporation of beta-glucan into nutraceutical products emerged as a significant driver for the market, highlighting the industry's response to consumer demands for health-focused products. The growth in demand for nutraceuticals and functional foods showcased the industry's ability to capitalize on the increasing market opportunities. Additionally, ongoing research and development activities demonstrated the industry's commitment to exploring new applications for beta-glucan in pharmaceuticals, cosmetics, and other emerging trends, further solidifying its position in the market. High production costs to restrain the Beta-Glucan Market The Beta-Glucan market is significantly restrained by high production costs due to the complex extraction and manufacturing processes. Obtaining beta-glucan from sources like oats, barley, mushrooms, and yeast requires advanced technology and capital-intensive machinery to ensure purity and quality, which drives up expenses. These higher costs increase product prices, limiting accessibility in price-sensitive and emerging markets and narrowing the consumer base. Small and medium enterprises (SMEs) face barriers entering or scaling in the market because of expensive setup and operational costs, leading to market dominance by larger companies with greater resources. Additionally, raw material prices fluctuate with agricultural conditions, adding further cost pressures. To manage these challenges, key players such as Kerry Group and DSM Tate are expanding production capacity, adopting innovative processing methods, and optimizing supply chains by locating manufacturing closer to growth regions. Some are also using AI and digital tools to improve procurement and reduce costs. Besides production costs, the market contends with limited raw material availability, regulatory hurdles across regions, allergen concerns, and competition from alternative ingredients. Growing Popularity of Plant-Based and Natural Products creates lucrative growth opportunities for the Beta-Glucan Market growth The increasing consumer demand for plant-based and natural products is unlocking significant growth opportunities in the Beta-Glucan market. Heightened health awareness globally, particularly after the pandemic, has led consumers to seek immune-boosting, natural, and sustainable ingredients in their diets and personal care routines. Beta-glucan, a natural dietary fiber derived from sources like oats, barley, yeast, mushrooms, and algae, perfectly fits this trend. Producers are responding with innovative offerings such as non-GMO, gluten-free, and organic-certified beta-glucan products to meet consumer preferences. For instance, Kemin Industries introduced water-dispersible beta-glucan sourced from algae in 2023, targeting immune support in convenient formats like drink mixes and sachets. Similarly, Kerry Group launched gluten-free, fruit-flavored beta-glucan candies catering to health-conscious, plant-based consumers. Beta-glucan’s applications are expanding beyond foods and supplements into pharmaceuticals and natural cosmetics, offering benefits like cholesterol management, gut health improvement, and skin anti-aging effects. Leading players such as Kerry Group, DSM Tate, and Lyle are expanding production capacities and establishing regional manufacturing hubs in growth markets. This strategy optimizes supply chains by leveraging local raw materials and reducing operational costs.Beta-Glucan Market Segment Analysis

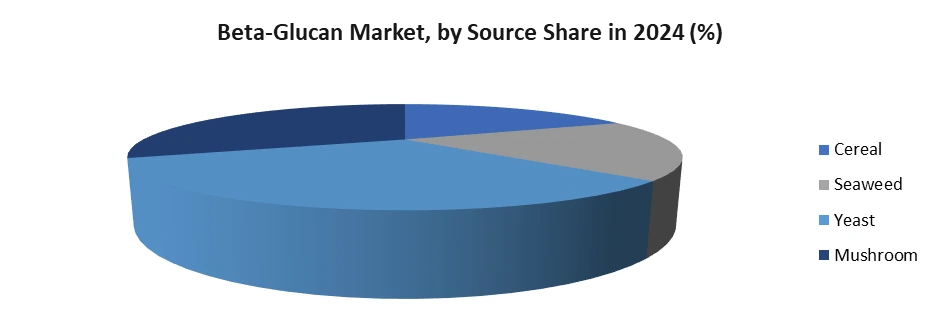

Based on Source, Beta-Glucan Market is segmented into Cereal, Seaweed, Yeast and Mushroom. The Cereal segment dominated the Beta-Glucan Market in 2024. Its widespread availability, high beta-glucan content, and strong consumer preference for cereal-based health products. Cereals such as oats and barley are naturally rich sources of beta-glucan, a soluble dietary fiber known for its cholesterol-lowering and immune-boosting properties. This has driven demand in both the functional food and dietary supplements sectors. Additionally, cereals are versatile and widely consumed globally, making beta-glucan derived from these sources more accessible and cost-effective compared to other segments such as yeast or mushrooms. Growing health awareness and the rising incidence of lifestyle-related diseases have encouraged consumers to choose natural, plant-based ingredients. Beta-glucan from cereals fits well into this trend, as it is recognized for promoting heart health and improving digestion. Food manufacturers have also innovated by incorporating cereal-based beta-glucan into various products such as breakfast cereals, bakery items, and beverages, increasing its market penetration. These combined factors contributed to the cereal segment’s dominance in the beta-glucan market in 2024.

Beta-Glucan Market Regional Insights

Asia Pacific dominates the Beta-Glucan market in 2024. Due to a combination of rising health awareness, strong government backing, evolving consumer preferences, and robust industry growth. Increasing health consciousness in countries such as China and India has boosted demand for beta-glucan, which is valued for its immune-boosting and cholesterol-lowering benefits. The region’s high prevalence of chronic diseases, such as diabetes and cardiovascular disorders, further drives consumers toward functional foods and supplements containing beta-glucan as preventive health measures. Government initiatives and regulatory support have played a crucial role, particularly in China, where authorities have expanded approvals for beta-glucan use in infant formulas and other products. National health programs encourage the consumption of natural, functional ingredients, fostering market acceptance and growth. Additionally, Asia Pacific’s rapidly growing pharmaceutical and nutraceutical sectors are increasingly adopting beta-glucan in products targeting immunity, diabetes, and heart health. Product innovation and diversification also contribute significantly. Companies are developing beta-glucan-based foods, beverages, supplements, and personal care items from various sources like cereals, yeast, and mushrooms to meet diverse consumer needs. Countries such as Japan and Australia stand out with advanced product development and sustainable extraction technologies, enhancing both domestic consumption and export capabilities. Economic factors such as rising disposable incomes, urbanization, and expanding retail and e-commerce networks have improved accessibility and affordability of beta-glucan products. Prominent global and regional players actively invest in research and production capacity within the region. Together, these factors create a dynamic environment positioning Asia Pacific as the leading market for beta-glucan, with sustained growth driven by health trends, regulatory encouragement, and innovation.Beta-Glucan Industry Ecosystem

Beta-Glucan Market Competitive Landscape: The beta-glucon market has been marked by intensifying competition between global component manufacturers, nutraceutical innovators, and clinical wellness brands, with major players such as Tate and Lile PLC and Kerry Group PLC emerging as market leaders. Tate and Lyl maintains a strong impact in North America and Europe through its high-purity ot-ritual beta-glukens, which is integrated into corrective strategies for heart health, glycemic control and functional food items through its Promoter and health and well-being platforms. Its competitive advantage lies in scalable processing, regulatory compliance (FDA/EFSA claims), and alignment support support with clean-labeled and stability trends. Meanwhile, the Kerry Group displays a significant appearance in Asia-Pacific and Europe through its patent velimune yeast beta-glucon line, supported by clinical trials and widely used in sports nutrition, pediatric products and immune health supplements. Carry's edge is reinforced by its vertical integrated manufacturing, consumer-friendly delivery formats and strategic investments in probiotics and personal welfare. The players such as lesfrey focus on intestine and immune health with a luxury care yeast-rich glucus, DSM provides beta-glukeens within a wide nutritional portfolio for cardiovascular wellness, bioothera pharmaceuticals in clinical and pharmaceutical-grad-knit on clinical and pharmaceutical-manuals. Eastern medicinal market. These companies are investing rapidly in patent extraction technologies, scientific cooperation and market-specific distribution systems to remain competitive as the demand for natural, immune-growth and functional ingredients. Beta-Glucan Market Key Developments: In June 2023, Kemin Industries obtained approval from the Thai Food and Drug Administration (TFDA) for its immune support ingredient, BetaVia Complete, classifying it as a Novel Food in Thailand. Derived from Kemin’s proprietary algae strain, Euglena gracilis, BetaVia Complete is rich in beta-1,3-glucan, protein, and essential fatty acids. The TFDA authorized its use in food supplements at a dosage of 375 milligrams per day following a thorough safety evaluation. In January 2022, DSM launched an integrated Food & Beverage division that merges three segments of its nutrition business: Food Specialties, Hydrocolloids, and part of the Nutritional Products Group. This new division focuses on helping consumers make balanced choices regarding taste, texture, and health. This strategic initiative supports DSM’s goal to become a fully dedicated company in Health, Nutrition, and Bioscience, building upon an announcement from September 2021. In December 2022, Kemin Industries expanded its production facility in Cavriago, underscoring the company’s commitment to innovation and sustainability in animal nutrition and health. The expansion aims to address growing demand for premium beta-glucan products and drive further innovation in this important sector. In December 2021, Angel Yeast began a major expansion of its yeast product line, targeting an annual production capacity of 20,000 tons. The project, managed by China National Chemical Engineering NO.16 Construction Co., Ltd., is expected to be completed by May 2024 and is designed to significantly increase the company’s overall production capabilities. In June 2020, Lesaffre acquired a majority stake in Biohymn Biotechnology, a Chinese company specializing in yeast and yeast extracts. This acquisition supports Lesaffre’s strategy to strengthen its presence in China and enhance customer proximity. It also aligns with Lesaffre Human Care’s plans for expansion in the Chinese market.

Beta-Glucan Market Key Trends:

Extreme position optimization Beta-glucon products are developed to serve remote, off-grid, and high-stress environments, stability, encapsulation, and innovations in delivery formats, along with innovations in behavior energy manufacturing trends in the infrastructure. Data-operated personalization Integration of AI and wearable-based monitoring is enabling real-time health tracking and individual doses, aligning beta-glucon supplements with comprehensive digital health and future-storing wellness solutions.Beta-glucan Market Scope: Inquire before buying

Global Beta-glucan Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 542.3 Mn. Forecast Period 2025 to 2032 CAGR: 8.2% Market Size in 2032: USD 1018.73 Mn. Segments Covered: by Category Soluble Insoluble by Type (1,3) Beta Glucan (1,4) Beta Glucan (1,6) Beta Glucan by Source Cereal Seaweed Yeast Mushroom by Application Food & beverages Personal care Pharmaceuticals Animal feed Others Beta-Glucan Market, by Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Beta-Glucan Market, Key Players

North America 1. Merck (US) – United States 2. Specialty Biotech Co. Ltd. (US) – United States 3. NutriScience Innovations LLC – United States 4. Tate & Lyle PLC – United Kingdom (formerly headquartered in the U.S.) 5. Kemin Industries – United States 6. Lallemand Inc. – Canada 7. Alltech – United States 8. Super Beta Glucan – United States 9. Garuda International Inc. – United States 10. Ceapro Inc. – Canada Europe 1. Kerry Group PLC – Ireland 2. Lesaffre – France 3. Associated British Foods Plc (ABF) – United Kingdom 4. Van Wankum Ingredients (VW-Ingredients) – Netherlands 5. BENEO – Germany 6. Leiber – Germany 7. DSM Firmenich – Switzerland 8. ABAC R&D – Switzerland 9. Algafl Iceland hf. – Iceland 10. GlycaNova AS – Norway Asia-Pacific & Latin America 1. Angel Yeast Co. Ltd – China 2. L&P Food Ingredient Co. Ltd. – China 3. Beta Bio Technology sp. z o.o – Poland 4. Natural Biologics – New Zealand Latin America 1. Biorigin – BrazilFAQ’S

1. What is Beta-Glucan? Ans: Beta-Glucan is a natural polysaccharide found in various sources like oats, barley, mushrooms, and yeast, known for its immune-boosting and cholesterol-lowering properties. 2. What drives the growth of the Beta-Glucan market? Ans: The market is primarily driven by factors such as increasing consumer awareness of health benefits, rising demand for functional foods, and the growth of the food and beverage industry. 3. What are the challenges faced by the Beta-Glucan market? Ans: Challenges include high production costs, limited source availability, regulatory complexities, allergen concerns, and competition with alternative functional ingredients. 4. How is Beta-Glucan used in different industries? Ans: Beta-Glucan is utilized across various sectors, including finance, healthcare, manufacturing, retail, telecommunications, and more, for purposes such as risk management, personalized services, predictive maintenance, and optimization. 5. Beta-Glucan market forecast Period? Ans: Beta-Glucan market forecast Period is 2025 to 2032.

1. Beta-Glucan Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Beta-Glucan Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Beta-Glucan Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Beta-Glucan Market: Dynamics 3.1. Beta-Glucan Market Trends by Region 3.1.1. North America Beta-Glucan Market Trends 3.1.2. Europe Beta-Glucan Market Trends 3.1.3. Asia Pacific Beta-Glucan Market Trends 3.1.4. Middle East and Africa Beta-Glucan Market Trends 3.1.5. South America Beta-Glucan Market Trends 3.2. Beta-Glucan Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Beta-Glucan Market Drivers 3.2.1.2. North America Beta-Glucan Market Restraints 3.2.1.3. North America Beta-Glucan Market Opportunities 3.2.1.4. North America Beta-Glucan Market Challenges 3.2.2. Europe 3.2.2.1. Europe Beta-Glucan Market Drivers 3.2.2.2. Europe Beta-Glucan Market Restraints 3.2.2.3. Europe Beta-Glucan Market Opportunities 3.2.2.4. Europe Beta-Glucan Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Beta-Glucan Market Drivers 3.2.3.2. Asia Pacific Beta-Glucan Market Restraints 3.2.3.3. Asia Pacific Beta-Glucan Market Opportunities 3.2.3.4. Asia Pacific Beta-Glucan Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Beta-Glucan Market Drivers 3.2.4.2. Middle East and Africa Beta-Glucan Market Restraints 3.2.4.3. Middle East and Africa Beta-Glucan Market Opportunities 3.2.4.4. Middle East and Africa Beta-Glucan Market Challenges 3.2.5. South America 3.2.5.1. South America Beta-Glucan Market Drivers 3.2.5.2. South America Beta-Glucan Market Restraints 3.2.5.3. South America Beta-Glucan Market Opportunities 3.2.5.4. South America Beta-Glucan Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Beta-Glucan Industry 3.8. Analysis of Government Schemes and Initiatives For Beta-Glucan Industry 3.9. Beta-Glucan Market Trade Analysis 3.10. The Global Pandemic Impact on Beta-Glucan Market 4. Beta-Glucan Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Beta-Glucan Market Size and Forecast, by Category (2024-2032) 4.1.1. Soluble 4.1.2. Insoluble 4.2. Beta-Glucan Market Size and Forecast, by Type (2024-2032) 4.2.1. (1,3) Beta Glucan 4.2.2. (1,4) Beta Glucan 4.2.3. (1,6) Beta Glucan 4.3. Beta-Glucan Market Size and Forecast, by Source (2024-2032) 4.3.1. Cereal 4.3.2. Seaweed 4.3.3. Yeast 4.3.4. Mushroom 4.4. Beta-Glucan Market Size and Forecast, by Application (2024-2032) 4.4.1. Food & beverages 4.4.2. Personal care 4.4.3. Pharmaceuticals 4.4.4. Animal feed 4.4.5. Others 4.5. Beta-Glucan Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Beta-Glucan Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Beta-Glucan Market Size and Forecast, by Category (2024-2032) 5.1.1. Soluble 5.1.2. Insoluble 5.2. North America Beta-Glucan Market Size and Forecast, by Type (2024-2032) 5.2.1. (1,3) Beta Glucan 5.2.2. (1,4) Beta Glucan 5.2.3. (1,6) Beta Glucan 5.3. North America Beta-Glucan Market Size and Forecast, by Source (2024-2032) 5.3.1. Cereal 5.3.2. Seaweed 5.3.3. Yeast 5.3.4. Mushroom 5.4. North America Beta-Glucan Market Size and Forecast, by Application (2024-2032) 5.4.1. Food & beverages 5.4.2. Personal care 5.4.3. Pharmaceuticals 5.4.4. Animal feed 5.4.5. Others 5.5. North America Beta-Glucan Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Beta-Glucan Market Size and Forecast, by Category (2024-2032) 5.5.1.1.1. Soluble 5.5.1.1.2. Insoluble 5.5.1.2. United States Beta-Glucan Market Size and Forecast, by Type (2024-2032) 5.5.1.2.1. (1,3) Beta Glucan 5.5.1.2.2. (1,4) Beta Glucan 5.5.1.2.3. (1,6) Beta Glucan 5.5.1.3. United States Beta-Glucan Market Size and Forecast, by Source (2024-2032) 5.5.1.3.1. Cereal 5.5.1.3.2. Seaweed 5.5.1.3.3. Yeast 5.5.1.3.4. Mushroom 5.5.1.4. United States Beta-Glucan Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Food & beverages 5.5.1.4.2. Personal care 5.5.1.4.3. Pharmaceuticals 5.5.1.4.4. Animal feed 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Beta-Glucan Market Size and Forecast, by Category (2024-2032) 5.5.2.1.1. Soluble 5.5.2.1.2. Insoluble 5.5.2.2. Canada Beta-Glucan Market Size and Forecast, by Type (2024-2032) 5.5.2.2.1. (1,3) Beta Glucan 5.5.2.2.2. (1,4) Beta Glucan 5.5.2.2.3. (1,6) Beta Glucan 5.5.2.3. Canada Beta-Glucan Market Size and Forecast, by Source (2024-2032) 5.5.2.3.1. Cereal 5.5.2.3.2. Seaweed 5.5.2.3.3. Yeast 5.5.2.3.4. Mushroom 5.5.2.4. Canada Beta-Glucan Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Food & beverages 5.5.2.4.2. Personal care 5.5.2.4.3. Pharmaceuticals 5.5.2.4.4. Animal feed 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Beta-Glucan Market Size and Forecast, by Category (2024-2032) 5.5.3.1.1. Soluble 5.5.3.1.2. Insoluble 5.5.3.2. Mexico Beta-Glucan Market Size and Forecast, by Type (2024-2032) 5.5.3.2.1. (1,3) Beta Glucan 5.5.3.2.2. (1,4) Beta Glucan 5.5.3.2.3. (1,6) Beta Glucan 5.5.3.3. Mexico Beta-Glucan Market Size and Forecast, by Source (2024-2032) 5.5.3.3.1. Cereal 5.5.3.3.2. Seaweed 5.5.3.3.3. Yeast 5.5.3.3.4. Mushroom 5.5.3.4. Mexico Beta-Glucan Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Food & beverages 5.5.3.4.2. Personal care 5.5.3.4.3. Pharmaceuticals 5.5.3.4.4. Animal feed 5.5.3.4.5. Others 6. Europe Beta-Glucan Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Beta-Glucan Market Size and Forecast, by Category (2024-2032) 6.2. Europe Beta-Glucan Market Size and Forecast, by Type (2024-2032) 6.3. Europe Beta-Glucan Market Size and Forecast, by Source (2024-2032) 6.4. Europe Beta-Glucan Market Size and Forecast, by Application (2024-2032) 6.5. Europe Beta-Glucan Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Beta-Glucan Market Size and Forecast, by Category (2024-2032) 6.5.1.2. United Kingdom Beta-Glucan Market Size and Forecast, by Type (2024-2032) 6.5.1.3. United Kingdom Beta-Glucan Market Size and Forecast, by Source (2024-2032) 6.5.1.4. United Kingdom Beta-Glucan Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Beta-Glucan Market Size and Forecast, by Category (2024-2032) 6.5.2.2. France Beta-Glucan Market Size and Forecast, by Type (2024-2032) 6.5.2.3. France Beta-Glucan Market Size and Forecast, by Source (2024-2032) 6.5.2.4. France Beta-Glucan Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Beta-Glucan Market Size and Forecast, by Category (2024-2032) 6.5.3.2. Germany Beta-Glucan Market Size and Forecast, by Type (2024-2032) 6.5.3.3. Germany Beta-Glucan Market Size and Forecast, by Source (2024-2032) 6.5.3.4. Germany Beta-Glucan Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Beta-Glucan Market Size and Forecast, by Category (2024-2032) 6.5.4.2. Italy Beta-Glucan Market Size and Forecast, by Type (2024-2032) 6.5.4.3. Italy Beta-Glucan Market Size and Forecast, by Source (2024-2032) 6.5.4.4. Italy Beta-Glucan Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Beta-Glucan Market Size and Forecast, by Category (2024-2032) 6.5.5.2. Spain Beta-Glucan Market Size and Forecast, by Type (2024-2032) 6.5.5.3. Spain Beta-Glucan Market Size and Forecast, by Source (2024-2032) 6.5.5.4. Spain Beta-Glucan Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Beta-Glucan Market Size and Forecast, by Category (2024-2032) 6.5.6.2. Sweden Beta-Glucan Market Size and Forecast, by Type (2024-2032) 6.5.6.3. Sweden Beta-Glucan Market Size and Forecast, by Source (2024-2032) 6.5.6.4. Sweden Beta-Glucan Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Beta-Glucan Market Size and Forecast, by Category (2024-2032) 6.5.7.2. Austria Beta-Glucan Market Size and Forecast, by Type (2024-2032) 6.5.7.3. Austria Beta-Glucan Market Size and Forecast, by Source (2024-2032) 6.5.7.4. Austria Beta-Glucan Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Beta-Glucan Market Size and Forecast, by Category (2024-2032) 6.5.8.2. Rest of Europe Beta-Glucan Market Size and Forecast, by Type (2024-2032) 6.5.8.3. Rest of Europe Beta-Glucan Market Size and Forecast, by Source (2024-2032) 6.5.8.4. Rest of Europe Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Beta-Glucan Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.2. Asia Pacific Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.3. Asia Pacific Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.4. Asia Pacific Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Beta-Glucan Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.5.1.2. China Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.5.1.3. China Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.5.1.4. China Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.5.2.2. S Korea Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.5.2.3. S Korea Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.5.2.4. S Korea Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.5.3.2. Japan Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.5.3.3. Japan Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.5.3.4. Japan Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.5.4.2. India Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.5.4.3. India Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.5.4.4. India Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.5.5.2. Australia Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.5.5.3. Australia Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.5.5.4. Australia Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.5.6.2. Indonesia Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.5.6.3. Indonesia Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.5.6.4. Indonesia Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.5.7.2. Malaysia Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.5.7.3. Malaysia Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.5.7.4. Malaysia Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.5.8.2. Vietnam Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.5.8.3. Vietnam Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.5.8.4. Vietnam Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.5.9.2. Taiwan Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.5.9.3. Taiwan Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.5.9.4. Taiwan Beta-Glucan Market Size and Forecast, by Application (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Beta-Glucan Market Size and Forecast, by Category (2024-2032) 7.5.10.2. Rest of Asia Pacific Beta-Glucan Market Size and Forecast, by Type (2024-2032) 7.5.10.3. Rest of Asia Pacific Beta-Glucan Market Size and Forecast, by Source (2024-2032) 7.5.10.4. Rest of Asia Pacific Beta-Glucan Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Beta-Glucan Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Beta-Glucan Market Size and Forecast, by Category (2024-2032) 8.2. Middle East and Africa Beta-Glucan Market Size and Forecast, by Type (2024-2032) 8.3. Middle East and Africa Beta-Glucan Market Size and Forecast, by Source (2024-2032) 8.4. Middle East and Africa Beta-Glucan Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Beta-Glucan Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Beta-Glucan Market Size and Forecast, by Category (2024-2032) 8.5.1.2. South Africa Beta-Glucan Market Size and Forecast, by Type (2024-2032) 8.5.1.3. South Africa Beta-Glucan Market Size and Forecast, by Source (2024-2032) 8.5.1.4. South Africa Beta-Glucan Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Beta-Glucan Market Size and Forecast, by Category (2024-2032) 8.5.2.2. GCC Beta-Glucan Market Size and Forecast, by Type (2024-2032) 8.5.2.3. GCC Beta-Glucan Market Size and Forecast, by Source (2024-2032) 8.5.2.4. GCC Beta-Glucan Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Beta-Glucan Market Size and Forecast, by Category (2024-2032) 8.5.3.2. Nigeria Beta-Glucan Market Size and Forecast, by Type (2024-2032) 8.5.3.3. Nigeria Beta-Glucan Market Size and Forecast, by Source (2024-2032) 8.5.3.4. Nigeria Beta-Glucan Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Beta-Glucan Market Size and Forecast, by Category (2024-2032) 8.5.4.2. Rest of ME&A Beta-Glucan Market Size and Forecast, by Type (2024-2032) 8.5.4.3. Rest of ME&A Beta-Glucan Market Size and Forecast, by Source (2024-2032) 8.5.4.4. Rest of ME&A Beta-Glucan Market Size and Forecast, by Application (2024-2032) 9. South America Beta-Glucan Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Beta-Glucan Market Size and Forecast, by Category (2024-2032) 9.2. South America Beta-Glucan Market Size and Forecast, by Type (2024-2032) 9.3. South America Beta-Glucan Market Size and Forecast, by Source(2024-2032) 9.4. South America Beta-Glucan Market Size and Forecast, by Application (2024-2032) 9.5. South America Beta-Glucan Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Beta-Glucan Market Size and Forecast, by Category (2024-2032) 9.5.1.2. Brazil Beta-Glucan Market Size and Forecast, by Type (2024-2032) 9.5.1.3. Brazil Beta-Glucan Market Size and Forecast, by Source (2024-2032) 9.5.1.4. Brazil Beta-Glucan Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Beta-Glucan Market Size and Forecast, by Category (2024-2032) 9.5.2.2. Argentina Beta-Glucan Market Size and Forecast, by Type (2024-2032) 9.5.2.3. Argentina Beta-Glucan Market Size and Forecast, by Source (2024-2032) 9.5.2.4. Argentina Beta-Glucan Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Beta-Glucan Market Size and Forecast, by Category (2024-2032) 9.5.3.2. Rest Of South America Beta-Glucan Market Size and Forecast, by Type (2024-2032) 9.5.3.3. Rest Of South America Beta-Glucan Market Size and Forecast, by Source (2024-2032) 9.5.3.4. Rest Of South America Beta-Glucan Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Merck (US) – United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Specialty Biotech Co. Ltd. (US) – United States 10.3. NutriScience Innovations LLC – United States 10.4. Tate & Lyle PLC – United Kingdom (formerly headquartered in the U.S.) 10.5. Kemin Industries – United States 10.6. Lallemand Inc. – Canada 10.7. Alltech – United States 10.8. Super Beta Glucan – United States 10.9. Garuda International Inc. – United States 10.10. Ceapro Inc. – Canada 10.11. Kerry Group PLC – Ireland 10.12. Lesaffre – France 10.13. Associated British Foods Plc (ABF) – United Kingdom 10.14. Van Wankum Ingredients (VW-Ingredients) – Netherlands 10.15. BENEO – Germany 10.16. Leiber – Germany 10.17. DSM Firmenich – Switzerland 10.18. ABAC R&D – Switzerland 10.19. Algafl Iceland hf. – Iceland 10.20. GlycaNova AS – Norway 10.21. Angel Yeast Co. Ltd – China 10.22. L&P Food Ingredient Co. Ltd. – China 10.23. Beta Bio Technology sp. z o.o – Poland 10.24. Natural Biologics – New Zealand 10.25. Biorigin – Brazil 11. Key Findings 12. Industry Recommendations 13. Beta-Glucan Market: Research Methodology 14. Terms and Glossary