The Behavioral Biometrics Market size was valued at US 2552.7 Mn in 2023 and market revenue is growing at a CAGR of 23.7 % from 2024 to 2030, reaching nearly USD 11313.26 Mn by 2030. Global Behavioral Biometrics Market Behavioral biometrics is an innovative authentication technology that utilizes human behavioral patterns captured through accelerometers and gyroscopes in mobile devices. This data is then analyzed using advanced software, including artificial intelligence, to verify and authenticate users. Its application is particularly prevalent in the banking, financial services, and insurance sectors, where securing online payment services is of utmost importance. The increasing demand for a multi-layered security approach, especially in financial institutions, is driving the growth of the behavioral biometrics market.To know about the Research Methodology:- Request Free Sample Report The expanding Internet of Things (IoT) landscape and the growing need for STRONG security systems are also contributing to this upward trend. With the widespread use of smartphones for various purposes such as entertainment, socializing, and work, there is a corresponding increase in mobile applications. This increased usage also raises concerns about security and privacy. Traditional authentication methods like passwords and unlock patterns not be sufficient against evolving threats, which is why there is a growing adoption of more advanced techniques like continuous authentication based on behavioral biometrics. The rise in online services such as webmail, e-banks, and e-commerce, which heavily rely on username and password verification, has become a target for identity thieves. By integrating additional security layers, such as user verification through mouse activities and keystroke dynamics, potential identity theft attempts are thwarted. These factors collectively contribute to the projected growth of the behavioral biometrics market in the foreseeable future.

Global Behavioral Biometrics Market Dynamics:

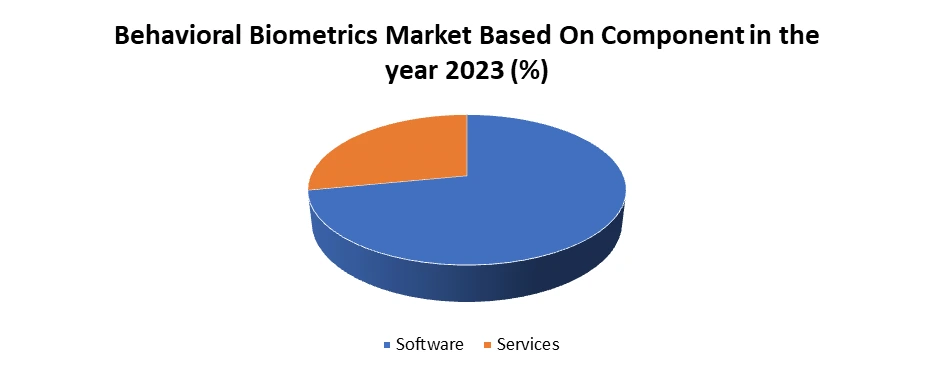

Driver Rising Security Concerns Boost the Market Growth The dominance of the software segment in the growing Behavioral Biometrics Market is primarily due to its crucial role in harnessing and interpreting behavioral data for authentication and security purposes. Software solutions in this market consist of advanced algorithms, machine learning models, and analytical tools that analyze and interpret various behavioral patterns exhibited by users. These patterns include keystroke dynamics, mouse movements, voice modulation, gait analysis, and more.The software segment offers versatile and adaptable solutions that are seamlessly integrated into existing systems across different platforms and industries. This integration ensures a smooth user experience while maintaining strong security measures. Continuous advancements in artificial intelligence and data analytics empower software solutions to evolve and adapt to emerging threats, making them indispensable in today's rapidly evolving cybersecurity landscape. The software segment often includes features such as real-time monitoring, anomaly detection, and adaptive authentication, which enhance its effectiveness in identifying and mitigating potential security breaches. This versatility and effectiveness establish software solutions as the foundation of behavioral biometrics implementations, leading to their dominance over other components in the Behavioral Biometrics Market. Restrain High Implementation Challenges limit the Behavioral Biometrics Market growth Implementing behavioral biometrics poses several challenges for organizations. Integrating these systems with existing IT infrastructure is complex due to compatibility issues and the need for custom integration. Technical expertise in machine learning algorithms and data analytics is essential for developing and maintaining robust solutions, which organizations lack. Ensuring data security and privacy compliance adds another layer of complexity, requiring robust security measures and adherence to regulations such as GDPR and CCPA. Educating users about the technology and addressing their concerns is also crucial for successful adoption. The upfront and ongoing costs associated with technology acquisition, customization, and maintenance must be carefully considered. Overcoming these challenges demands careful planning, collaboration, and investment in resources and expertise. Partnering with experienced vendors and consultants and adopting a phased approach to deployment help mitigate risks and ensure a smooth transition to behavioral biometrics authentication. These factors hamper the Behavioral Biometrics Market growth Opportunity Advancements in AI and Machine Learning create lucrative growth opportunities for the Behavioral Biometrics Market. The convergence of AI and machine learning has propelled the Behavioral Biometrics Market into a realm of unprecedented growth and innovation. Behavioral biometrics, a cutting-edge technology, scrutinizes patterns in human actions like typing rhythms, mouse movements, and voice characteristics to authenticate users and bolster security measures. Thanks to AI advancements, these systems now boast unparalleled accuracy in discerning subtle behavioral nuances, elevating authentication standards to unprecedented levels of reliability. Industries requiring stringent security protocols, such as finance, healthcare, and e-commerce, are particularly drawn to the potential of behavioral biometrics. The ability to accurately identify users based on their unique behavioral traits offers a robust defense against identity theft, fraud, and unauthorized access. The world has become increasingly interconnected through IoT devices, and the demand for seamless and dependable authentication methods has surged, further fueling the growth of the behavioral biometrics market. Businesses operating in this domain stand to reap substantial rewards from this burgeoning market, with projections indicating exponential expansion in the foreseeable future. The combination of AI-driven advancements and the growing necessity for secure authentication solutions underscores the lucrative opportunities awaiting those at the forefront of behavioral biometrics innovation. As the market continues to evolve, it promises to revolutionize the landscape of authentication and security across diverse sectors, driving unprecedented growth and prosperity.Behavioral Biometrics Market Segment Analysis:

Based On Component, the software segment dominated the Component segment of the Behavioral Biometrics Market in the year 2023. Due to its crucial role in harnessing and interpreting behavioral data for authentication and security purposes. Software solutions in this market consist of advanced algorithms, machine learning models, and analytical tools that analyze and interpret various behavioral patterns exhibited by users. These patterns include keystroke dynamics, mouse movements, voice modulation, gait analysis, and more. The software segment offers versatile and adaptable solutions that are seamlessly integrated into existing systems across different platforms and industries. This integration ensures a smooth user experience while maintaining robust security measures. The continuous advancements in artificial intelligence and data analytics empower software solutions to evolve and adapt to emerging threats, making them indispensable in today's rapidly evolving cybersecurity landscape. The software segment often includes features such as real-time monitoring, anomaly detection, and adaptive authentication, which enhance its effectiveness in identifying and mitigating potential security breaches. This versatility and effectiveness establish software solutions as the foundation of behavioral biometrics implementations, leading to their dominance over other components in the Behavioral Biometrics Market.

Behavioral Biometrics Market Regional Analysis:

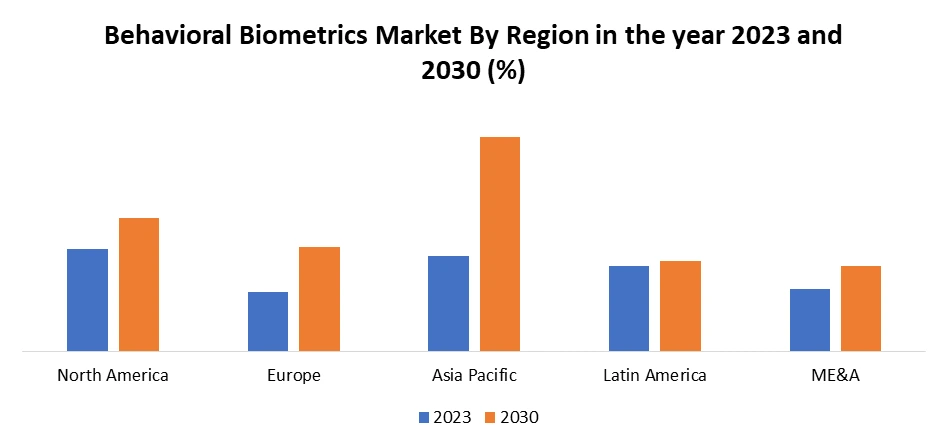

North America dominated the Behavioral Biometrics Market in the year 2022. North America's dominance in the Behavioral Biometrics Market is attributable to several key factors that have collectively propelled the region to the forefront of this burgeoning industry. North America houses a dense concentration of tech-savvy enterprises and financial institutions that prioritize cutting-edge security measures, creating a fertile ground for the adoption of behavioral biometrics solutions. The region benefits from a robust ecosystem of research and development, with numerous institutions and companies driving innovation in biometric technologies. North America boasts a large population of digitally active consumers, fueling the demand for advanced security solutions to safeguard personal and financial data. This high level of awareness and demand for cybersecurity measures further accelerates the adoption of behavioral biometrics solutions. Regulatory initiatives in North America, such as GDPR in the United States and Canada's Personal Information Protection and Electronic Documents Act (PIPEDA), incentivize organizations to invest in robust authentication and fraud prevention technologies to ensure compliance and mitigate risks. North America's leadership in the Behavioral Biometrics Market is a result of its conducive business environment, technological prowess, consumer awareness, and regulatory frameworks that collectively drive innovation and adoption in this rapidly evolving field. Behavioral Biometrics Market Competitive Landscape The Behavioral Biometrics Market boasts a competitive landscape characterized by strategic expansions, innovative partnerships, and significant acquisitions among key players. BioCatch, a prominent provider of behavioral biometric intelligence and fraud prevention technology, solidified its global presence with the establishment of Australian headquarters and entry into the Asia-Pacific region, bolstering its market position. BioCatch's recognition as a "Company to Watch in 2023" by Liminal underscores its exceptional standing and potential for significant achievements. Collaborating with industry giant Microsoft to integrate its solutions into the FSI Cloud further strengthens BioCatch's offerings, enabling financial institutions to enhance security and mitigate fraudulent activities effectively. Meanwhile, LexisNexis Risk Solutions' acquisition of BehavioSec amplifies its portfolio in device and digital identity solutions, complementing the capabilities of LexisNexis ThreatMetrix. This strategic move reinforces LexisNexis' commitment to providing comprehensive security solutions to its clientele. ValidSoft's launch of a new voice authentication solution geared towards enterprise remote access applications reflects ongoing innovation within the market. By leveraging digit-based voice authentication, ValidSoft offers enhanced security measures, catering to the growing demand for trusted identity assurance in remote access scenarios within enterprise environments. These developments underscore the dynamic nature of the Behavioral Biometrics Market, with key players continually innovating and expanding their offerings to meet evolving security needs and solidify their market positions.

Behavioral Biometrics Market Scope: Inquire before buying

Behavioral Biometrics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2552.7 Mn. Forecast Period 2024 to 2030 CAGR: 23.7 % Market Size in 2030: US $ 11313.26 Mn. Segments Covered: by Component Software Services by Deployment Cloud On-Premises by Organization Size Large Enterprises Small and Medium Enterprises by Application Identity Proofing Continuous Authentication Risk & Compliance Management Fraud Detection & Prevention by End-User BFSI IT & Telecom Energy & Utilities Retail & E-Commerce Healthcare Manufacturing Government Education Public Sector Others Behavioral Biometrics Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Behavioral Biometrics Market key players

Major Players of Behavioral Biometrics in North America 1. BioSig-ID - Dallas, Texas, United States 2. Plurilock - Victoria, British Columbia, Canada 3. UnifyID - Redwood City, California, United States 4. TypingDNA - New York, United States 5. OneSpan - Chicago, Illinois, United States 6. SecureAuth - Irvine, California, United States 7. IBM Corporation - Armonk, New York, United States 8. Mastercard - Purchase, New York, United States 9. SAS Institute Inc. - Cary, North Carolina, United States 10. SecuGen Corporation - Santa Clara, California, United States 11. Aware, Inc. - Bedford, Massachusetts, United States Leading Companies of Behavioral Biometrics in Europe 1. BehavioSec - Stockholm, Sweden 2. AimBrain - London, United Kingdom 3. XTN Cognitive Security - Milan, Italy 4. Callsign - London, United Kingdom Asia Pacific 1. BioCatch - Tel Aviv, Israel 2. SecuredTouch - Tel Aviv, Israel 3. NEC Corporation - Minato, Tokyo, Japan Frequently Asked Question: 1] What segments are covered in the Global Behavioral Biometrics Market report? Ans. The segments covered in the Behavioral Biometrics Market report are based on, Component, Deployment, organization size, Application, End User, and Regions. 2] Which region is expected to hold the highest share of the Global Behavioral Biometrics Market? Ans. The North American region is expected to hold the highest share of the Behavioral Biometrics Market. 3] What is the market size of the Global Behavioral Biometrics Market by 2030? Ans. The market size of the Behavioral Biometrics Market by 2030 is expected to reach US$ 11313.26 Mn. 4] What was the market size of the Global Behavioral Biometrics Market in 2023? Ans. The market size of the Behavioral Biometrics Market in 2023 was valued at US$ 2552.7Mn. 5] Key players in the Behavioral Biometrics Market. Ans. BioSig-ID, Plurilock , UnifyID , TypingDNA and OneSpan

1. Behavioral Biometrics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Behavioral Biometrics Market: Dynamics 2.1. Behavioral Biometrics Market Trends by Region 2.1.1. North America Behavioral Biometrics Market Trends 2.1.2. Europe Behavioral Biometrics Market Trends 2.1.3. Asia Pacific Behavioral Biometrics Market Trends 2.1.4. Middle East and Africa Behavioral Biometrics Market Trends 2.1.5. South America Behavioral Biometrics Market Trends 2.2. Behavioral Biometrics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Behavioral Biometrics Market Drivers 2.2.1.2. North America Behavioral Biometrics Market Restraints 2.2.1.3. North America Behavioral Biometrics Market Opportunities 2.2.1.4. North America Behavioral Biometrics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Behavioral Biometrics Market Drivers 2.2.2.2. Europe Behavioral Biometrics Market Restraints 2.2.2.3. Europe Behavioral Biometrics Market Opportunities 2.2.2.4. Europe Behavioral Biometrics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Behavioral Biometrics Market Drivers 2.2.3.2. Asia Pacific Behavioral Biometrics Market Restraints 2.2.3.3. Asia Pacific Behavioral Biometrics Market Opportunities 2.2.3.4. Asia Pacific Behavioral Biometrics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Behavioral Biometrics Market Drivers 2.2.4.2. Middle East and Africa Behavioral Biometrics Market Restraints 2.2.4.3. Middle East and Africa Behavioral Biometrics Market Opportunities 2.2.4.4. Middle East and Africa Behavioral Biometrics Market Challenges 2.2.5. South America 2.2.5.1. South America Behavioral Biometrics Market Drivers 2.2.5.2. South America Behavioral Biometrics Market Restraints 2.2.5.3. South America Behavioral Biometrics Market Opportunities 2.2.5.4. South America Behavioral Biometrics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Behavioral Biometrics Industry 2.8. Analysis of Government Schemes and Initiatives For Behavioral Biometrics Industry 2.9. Behavioral Biometrics Market Trade Analysis 2.10. The Global Pandemic Impact on Behavioral Biometrics Market 3. Behavioral Biometrics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 3.1.1. Software 3.1.2. Services 3.2. Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 3.2.1. Cloud 3.2.2. On-Premises 3.3. Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 3.3.1. Large Enterprises 3.3.2. Small and Medium Enterprises 3.4. Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 3.4.1. Identity Proofing 3.4.2. Continuous Authentication 3.4.3. Risk & Compliance Management 3.4.4. Fraud Detection & Prevention 3.5. Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 3.5.1. BFSI 3.5.2. IT & Telecom 3.5.3. Energy & Utilities 3.5.4. Retail & E-Commerce 3.5.5. Healthcare 3.5.6. Manufacturing 3.5.7. Government 3.5.8. Education 3.5.9. Public Sector 3.5.10. Others 3.6. Behavioral Biometrics Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Behavioral Biometrics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 4.1.1. Software 4.1.2. Services 4.2. North America Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 4.2.1. Cloud 4.2.2. On-Premises 4.3. North America Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 4.3.1. Large Enterprises 4.3.2. Small and Medium Enterprises 4.4. North America Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 4.4.1. Identity Proofing 4.4.2. Continuous Authentication 4.4.3. Risk & Compliance Management 4.4.4. Fraud Detection & Prevention 4.5. North America Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 4.5.1. BFSI 4.5.2. IT & Telecom 4.5.3. Energy & Utilities 4.5.4. Retail & E-Commerce 4.5.5. Healthcare 4.5.6. Manufacturing 4.5.7. Government 4.5.8. Education 4.5.9. Public Sector 4.5.10. Others 4.6. North America Behavioral Biometrics Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 4.6.1.1.1. Software 4.6.1.1.2. Services 4.6.1.2. United States Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 4.6.1.2.1. Cloud 4.6.1.2.2. On-Premises 4.6.1.3. United States Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 4.6.1.3.1. Large Enterprises 4.6.1.3.2. Small and Medium Enterprises 4.6.1.4. United States Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 4.6.1.4.1. Identity Proofing 4.6.1.4.2. Continuous Authentication 4.6.1.4.3. Risk & Compliance Management 4.6.1.4.4. Fraud Detection & Prevention 4.6.1.5. United States Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 4.6.1.5.1. BFSI 4.6.1.5.2. IT & Telecom 4.6.1.5.3. Energy & Utilities 4.6.1.5.4. Retail & E-Commerce 4.6.1.5.5. Healthcare 4.6.1.5.6. Manufacturing 4.6.1.5.7. Government 4.6.1.5.8. Education 4.6.1.5.9. Public Sector 4.6.1.5.10. Others 4.6.2. Canada 4.6.2.1. Canada Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 4.6.2.1.1. Software 4.6.2.1.2. Services 4.6.2.2. Canada Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 4.6.2.2.1. Cloud 4.6.2.2.2. On-Premises 4.6.2.3. Canada Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 4.6.2.3.1. Large Enterprises 4.6.2.3.2. Small and Medium Enterprises 4.6.2.4. Canada Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 4.6.2.4.1. Identity Proofing 4.6.2.4.2. Continuous Authentication 4.6.2.4.3. Risk & Compliance Management 4.6.2.4.4. Fraud Detection & Prevention 4.6.2.5. Canada Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 4.6.2.5.1. BFSI 4.6.2.5.2. IT & Telecom 4.6.2.5.3. Energy & Utilities 4.6.2.5.4. Retail & E-Commerce 4.6.2.5.5. Healthcare 4.6.2.5.6. Manufacturing 4.6.2.5.7. Government 4.6.2.5.8. Education 4.6.2.5.9. Public Sector 4.6.2.5.10. Others 4.6.3. Mexico 4.6.3.1. Mexico Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 4.6.3.1.1. Software 4.6.3.1.2. Services 4.6.3.2. Mexico Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 4.6.3.2.1. Cloud 4.6.3.2.2. On-Premises 4.6.3.3. Mexico Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 4.6.3.3.1. Large Enterprises 4.6.3.3.2. Small and Medium Enterprises 4.6.3.4. Mexico Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 4.6.3.4.1. Identity Proofing 4.6.3.4.2. Continuous Authentication 4.6.3.4.3. Risk & Compliance Management 4.6.3.4.4. Fraud Detection & Prevention 4.6.3.5. Mexico Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 4.6.3.5.1. BFSI 4.6.3.5.2. IT & Telecom 4.6.3.5.3. Energy & Utilities 4.6.3.5.4. Retail & E-Commerce 4.6.3.5.5. Healthcare 4.6.3.5.6. Manufacturing 4.6.3.5.7. Government 4.6.3.5.8. Education 4.6.3.5.9. Public Sector 4.6.3.5.10. Others 5. Europe Behavioral Biometrics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 5.2. Europe Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 5.3. Europe Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 5.4. Europe Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 5.5. Europe Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 5.6. Europe Behavioral Biometrics Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 5.6.1.2. United Kingdom Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 5.6.1.3. United Kingdom Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 5.6.1.4. United Kingdom Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 5.6.1.5. United Kingdom Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 5.6.2. France 5.6.2.1. France Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 5.6.2.2. France Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 5.6.2.3. France Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 5.6.2.4. France Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 5.6.2.5. France Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 5.6.3.2. Germany Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 5.6.3.3. Germany Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 5.6.3.4. Germany Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 5.6.3.5. Germany Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 5.6.4.2. Italy Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 5.6.4.3. Italy Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 5.6.4.4. Italy Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 5.6.4.5. Italy Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 5.6.5.2. Spain Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 5.6.5.3. Spain Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 5.6.5.4. Spain Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 5.6.5.5. Spain Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 5.6.6.2. Sweden Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 5.6.6.3. Sweden Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 5.6.6.4. Sweden Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 5.6.6.5. Sweden Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 5.6.7.2. Austria Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 5.6.7.3. Austria Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 5.6.7.4. Austria Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 5.6.7.5. Austria Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 5.6.8.2. Rest of Europe Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 5.6.8.3. Rest of Europe Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 5.6.8.4. Rest of Europe Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 5.6.8.5. Rest of Europe Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6. Asia Pacific Behavioral Biometrics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.3. Asia Pacific Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.4. Asia Pacific Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.5. Asia Pacific Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6.6. Asia Pacific Behavioral Biometrics Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.6.1.2. China Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.6.1.3. China Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.6.1.4. China Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.6.1.5. China Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.6.2.2. S Korea Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.6.2.3. S Korea Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.6.2.4. S Korea Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.6.2.5. S Korea Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.6.3.2. Japan Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.6.3.3. Japan Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.6.3.4. Japan Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.6.3.5. Japan Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6.6.4. India 6.6.4.1. India Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.6.4.2. India Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.6.4.3. India Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.6.4.4. India Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.6.4.5. India Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.6.5.2. Australia Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.6.5.3. Australia Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.6.5.4. Australia Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.6.5.5. Australia Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.6.6.2. Indonesia Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.6.6.3. Indonesia Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.6.6.4. Indonesia Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.6.6.5. Indonesia Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.6.7.2. Malaysia Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.6.7.3. Malaysia Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.6.7.4. Malaysia Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.6.7.5. Malaysia Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.6.8.2. Vietnam Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.6.8.3. Vietnam Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.6.8.4. Vietnam Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.6.8.5. Vietnam Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.6.9.2. Taiwan Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.6.9.3. Taiwan Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.6.9.4. Taiwan Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.6.9.5. Taiwan Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 6.6.10.2. Rest of Asia Pacific Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 6.6.10.3. Rest of Asia Pacific Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 6.6.10.4. Rest of Asia Pacific Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 6.6.10.5. Rest of Asia Pacific Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 7. Middle East and Africa Behavioral Biometrics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 7.3. Middle East and Africa Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 7.4. Middle East and Africa Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 7.5. Middle East and Africa Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 7.6. Middle East and Africa Behavioral Biometrics Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 7.6.1.2. South Africa Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 7.6.1.3. South Africa Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 7.6.1.4. South Africa Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 7.6.1.5. South Africa Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 7.6.2.2. GCC Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 7.6.2.3. GCC Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 7.6.2.4. GCC Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 7.6.2.5. GCC Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 7.6.3.2. Nigeria Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 7.6.3.3. Nigeria Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 7.6.3.4. Nigeria Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 7.6.3.5. Nigeria Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 7.6.4.2. Rest of ME&A Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 7.6.4.3. Rest of ME&A Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 7.6.4.4. Rest of ME&A Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 7.6.4.5. Rest of ME&A Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 8. South America Behavioral Biometrics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 8.2. South America Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 8.3. South America Behavioral Biometrics Market Size and Forecast, by Organisation Type(2023-2030) 8.4. South America Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 8.5. South America Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 8.6. South America Behavioral Biometrics Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 8.6.1.2. Brazil Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 8.6.1.3. Brazil Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 8.6.1.4. Brazil Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 8.6.1.5. Brazil Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 8.6.2.2. Argentina Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 8.6.2.3. Argentina Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 8.6.2.4. Argentina Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 8.6.2.5. Argentina Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Behavioral Biometrics Market Size and Forecast, by Component (2023-2030) 8.6.3.2. Rest Of South America Behavioral Biometrics Market Size and Forecast, by Deployment (2023-2030) 8.6.3.3. Rest Of South America Behavioral Biometrics Market Size and Forecast, by Organisation Type (2023-2030) 8.6.3.4. Rest Of South America Behavioral Biometrics Market Size and Forecast, by Application (2023-2030) 8.6.3.5. Rest Of South America Behavioral Biometrics Market Size and Forecast, by End Use (2023-2030) 9. Global Behavioral Biometrics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Behavioral Biometrics Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. BioSig-ID - Dallas, Texas, United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Plurilock - Victoria, British Columbia, Canada 10.3. UnifyID - Redwood City, California, United States 10.4. TypingDNA - New York, United States 10.5. OneSpan - Chicago, Illinois, United States 10.6. SecureAuth - Irvine, California, United States 10.7. IBM Corporation - Armonk, New York, United States 10.8. Mastercard - Purchase, New York, United States 10.9. SAS Institute Inc. - Cary, North Carolina, United States 10.10. SecuGen Corporation - Santa Clara, California, United States 10.11. Aware, Inc. - Bedford, Massachusetts, United States 10.12. BehavioSec - Stockholm, Sweden 10.13. AimBrain - London, United Kingdom 10.14. XTN Cognitive Security - Milan, Italy 10.15. Callsign - London, United Kingdom 10.16. BioCatch - Tel Aviv, Israel 10.17. SecuredTouch - Tel Aviv, Israel 10.18. NEC Corporation - Minato, Tokyo, Japan 11. Key Findings 12. Industry Recommendations 13. Behavioral Biometrics Market: Research Methodology 14. Terms and Glossary