Consumer Electronic Biometrics Market was worth US$ 2.86 Bn. in 2022 and overall revenue is anticipated to rise at a rate of 16.8% from 2023 to 2029, reaching almost US$ 8.49 Bn. in 2029.Consumer Electronic Biometrics Market Overview:

Customer interactions with devices and services have increased as a result of increased connectivity and digitization, requiring identity authentication for access. The market is expected to grow as the scope of biometrics Authentication Functionality’s in consumer electronics grows in order to improve customer experiences. Consumers are willing to forget their passwords, according to the results of a VISA-commissioned survey. The 70% of consumer are always more comfortable in Biometric system because they do not require remembering passwords. Biometrics is now familiar to more than 65 %, and 86 % want to use them to authenticate their identity or make payments.To know about the Research Methodology :- Request Free Sample Report

Consumer Electronic Biometrics Market Dynamics:

Biometric Authentication is being increasingly used in businesses to ensure more convenience, secure identity management, and superior human resource management. When compared to traditional security systems based on passwords, PINs, or smart cards, biometric systems are considered to be more efficient, convenient, and secure. International terrorism, criminal gangs, and illegal migration linked to identity theft and document fraud have all been facilitated by these systems. Furthermore, biometric systems are simple to set up and operate, and they do not necessitate a high level of expertise. All of these factors are driving the biometric market for consumer electronics. When choosing and implementing a biometric system, cost is an important factor. Multi-factor authentication is required for high-security functionalities, while single-factor biometric solutions are required for low-security functionalities. The type of sensor used in the device may affect the cost of implementing multi-factor biometric functionalities. The high cost of biometric solution Offerings, as well as the high cost of installation, restricts the demand for biometric authentication among private and public companies. In recent years, biometric solutions have seen tremendous technological advancements. Advances in sensing Authentication, as well as the widespread use of devices like computers and cellphones, have created new possibilities for capturing physiological and behavioral aspects of humans and analyzing the data for biometric authentication. Machine learning and artificial intelligence technologies are introducing new opportunities for identifying any odd behavior intelligently and automatically, as well as providing an additional layer of authentication if necessary, to increase behavioral biometrics. Many people are hesitant to use biometrics technologies because to concerns about hygiene and a lack of understanding of the system. Insufficient awareness of how biometric systems work, as well as the risk of data leak, causes anxiety among users, influencing their acceptance and adoption of biometric systems. The accuracy of a biometrics system and its subsequent adoption can be harmed by a lack of communication or even opposition to using these technologies. The lack of technologically and public awareness are seen as major challenges to the implementation of biometric systems.Consumer Electronic Biometrics Market Segment Analysis:

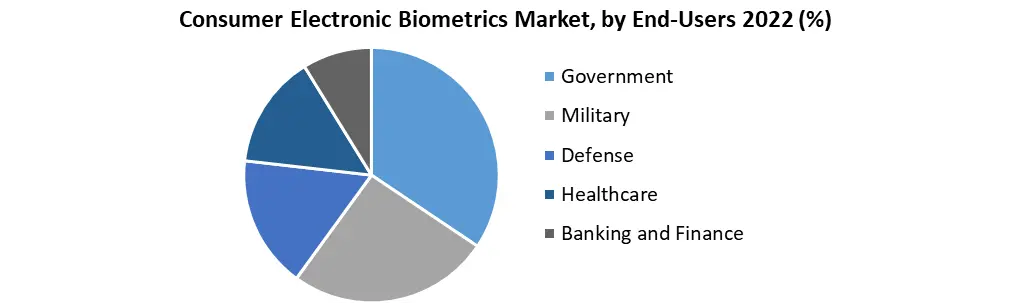

Based Authentication, the market is segmented into single factor authentication and multi factor authentication. In single factor authentication the market is sub segmented into face recognition, fingerprint recognition, palm print recognition, signature recognition and voice recognition. During the forecast period, the single factor segment is expected to grow at a higher CAGR of xx%. Fingerprint recognition is the most widely used biometric solution in a variety of industries, including banking and finance, healthcare, and others. Moreover, the need for fingerprint solutions in the government and travel & immigration industries is expanding for e-passports and e-visas, as well as the issuance of driving licenses. The low cost and ease of installation of fingerprint biometric solutions is driving market growth. Based on Offering, the market is segmented into Software and Software. The software segment is expected to grow at a faster CAGR of xx% during the forecast period, owing to the growing adoption of cloud-based solutions and services, as well as Artificial Intelligence (AI) for Biometrics, which is propelling the growth of the software because it provides compatibility between devices and operating systems for various functionalities. By updating the software to users, the software also enables the functionality to incorporate add-on capabilities in existing equipment. Based on Functionality, the market is segmented in contact functionality, non-contact functionality and combined functionality. Over the forecast period, contact functionality is expected to grow at a faster rate of xx%. Palm, fingerprint, and signature recognition systems are included. The market for contact functionality is growing because to the growing popularity of fingerprint solutions across industries. Signature recognition is also gaining popularity as a result of the low cost of acquisition and deployment.Based on End User, the market is segmented into government, military, defense, healthcare, banking and finance. Because of the increased initiative to protect public safety, the government segment is likely to grow at a faster CAGR of xx%. Biometrics is used in the healthcare industry to improve diagnosis, treatment, and clinical process efficiency. Because of its ease of usage, biometrics is employed in banking and finance. Biometrics is used in travel and immigration as a result of rising security concerns in numerous countries.

Consumer Electronic Biometrics Market Regional Insights:

Asia-Pacific has the most population of any of the continents. Asia-Pacific is expected to be one of the largest and fastest expanding markets for consumer biometrics, because to rising urban populations and rising spending power. Huawei, Apple, Samsung, Xiaomi, and Lenovo are among the major smartphone manufacturers with factories in China. The demand for fingerprint sensors to be included in smartphones is likely to rise in the country as smartphone sales continue to rise. The economies of the United States and Canada are robust, allowing them to invest in a variety of public safety initiatives. The fast digitalization and increasing usage of smart technologies have boosted the growth of the biometric industry in this area. Many end-users are choosing Biometric because of the growing number of government initiatives in North American countries such as the United States, Canada, and Mexico for large-scale financed programmers like as e-passports and e-visas. The US Departments of Defense and Homeland Security have been using fingerprint biometrics to improve physical and digital access while also addressing security concerns. The objective of the report is to present a comprehensive analysis of the global Analog and mixed signal device market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Analog and mixed signal device market dynamics, structure by analyzing the market segments and project the global Analog and mixed signal device market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Analog and mixed signal device market make the report investor’s guide.Consumer Electronic Biometrics Market Scope: Inquire before buying

Consumer Electronic Biometrics Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 2.86 Bn. Forecast Period 2023 to 2029 CAGR: 16.8% Market Size in 2029: US $ 8.49 Bn. Segments Covered: by Authentication • Single factor authentication • Multi factor authentication by Offering • Software • Hardware by Functionality • Contact functionality • Non-contact functionality • Combined functionality by End-Users • Government • Military • Defense • Healthcare • Banking and Finance Consumer Electronic Biometrics Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Consumer Electronic Biometrics Market key player:

• Thales Group • NEC Corporation • Fujitsu Ltd. • Suprema Inc. • Iris ID • Idemia • Crossmatch Technologies • Ultinous • IDEX Biometrics • Synaptics • Aware Inc. • ASSA ABLOY AB • Apple • Assa AbloyFrequently Asked Questions:

1) What was the market size of Consumer Electronic Biometrics Markets in 2022? Ans - Global Consumer Electronic BiometricsMarket was worth US$ 2.86 Bn in 2022. 2) What is the market segment of Consumer Electronic Biometrics Markets? Ans -The market segments are based on Authentication, Offering, Functionality and End user. 3) What is forecast period consider for Consumer Electronic Biometrics Markets market? Ans -The forecast period for Consumer Electronic Biometrics Market is 2023 to 2029. 4) Which are the worldwide major key players covered for Consumer Electronic Biometrics Markets market report? Ans - Thales Group, NEC Corporation, Fujitsu Ltd., Suprema Inc., Iris ID, Idemia, Crossmatch Technologies, Ultinous, IDEX Biometrics, Synaptics, Aware Inc., ASSA ABLOY AB, Apple, Assa Abloy 5) Which region is dominated in Consumer Electronic Biometrics Markets Market? Ans -In 2022, Asia Pacific region dominated the Consumer Electronic Biometrics Markets Market

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Consumer Electronic Biometrics Market Size, by Market Value (US$ Bn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Consumer Electronic Biometrics Market 3.4. Geographical Snapshot of the Consumer Electronic Biometrics Market, By Manufacturer share 4. Consumer Electronic Biometrics Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Consumer Electronic Biometrics Market 5. Supply Side and Demand Side Indicators 6. Consumer Electronic Biometrics Market Analysis and Forecast, 2022-2029 6.1. Consumer Electronic Biometrics Market Size & Y-o-Y Growth Analysis. 7. Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 7.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 7.1.1. Single factor authentication 7.1.2. Multi factor authentication 7.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 7.2.1. Software 7.2.2. Hardware 7.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 7.3.1. Contact functionality 7.3.2. Non-contact functionality 7.3.3. Combined functionality 7.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 7.4.1. Government 7.4.2. Military 7.4.3. Defense 7.4.4. Healthcare 7.4.5. Banking and Finance 8. Consumer Electronic Biometrics Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 9.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 9.1.1. Single factor authentication 9.1.2. Multi factor authentication 9.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 9.2.1. Software 9.2.2. Hardware 9.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 9.3.1. Contact functionality 9.3.2. Non-contact functionality 9.3.3. Combined functionality 9.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 9.4.1. Government 9.4.2. Military 9.4.3. Defense 9.4.4. Healthcare 9.4.5. Banking and Finance 10. North America Consumer Electronic Biometrics Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 11.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 11.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 11.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 11.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 12. Canada Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 12.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 12.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 12.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 12.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 13. Mexico Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 13.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 13.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 13.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 13.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 14. Europe Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 14.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 14.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 14.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 14.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 15. Europe Consumer Electronic Biometrics Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 16.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 16.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 16.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 16.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 17. France Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 17.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 17.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 17.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 17.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 18. Germany Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 18.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 18.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 18.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 18.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 19. Italy Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 19.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 19.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 19.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 19.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 20. Spain Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 20.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 20.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 20.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 20.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 21. Sweden Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 21.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 21.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 21.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 21.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 22. CIS Countries Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 22.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 22.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 22.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 22.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 23. Rest of Europe Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 23.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 23.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 23.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 23.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 24. Asia Pacific Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 24.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 24.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 24.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 24.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 25. Asia Pacific Consumer Electronic Biometrics Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 26.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 26.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 26.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 26.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 27. India Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 27.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 27.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 27.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 27.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 28. Japan Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 28.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 28.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 28.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 28.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 29. South Korea Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 29.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 29.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 29.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 29.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 30. Australia Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 30.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 30.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 30.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 30.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 31. ASEAN Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 31.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 31.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 31.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 31.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 32. Rest of Asia Pacific Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 32.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 32.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 32.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 32.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 33. Middle East Africa Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 33.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 33.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 33.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 33.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 34. Middle East Africa Consumer Electronic Biometrics Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 35.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 35.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 35.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 35.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 36. GCC Countries Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 36.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 36.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 36.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 36.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 37. Egypt Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 37.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 37.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 37.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 37.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 38. Nigeria Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 38.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 38.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 38.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 38.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 39. Rest of ME&A Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 39.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 39.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 39.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 39.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 40. South America Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 40.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 40.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 40.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 40.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 41. South America Consumer Electronic Biometrics Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 42.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 42.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 42.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 42.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 43. Argentina Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 43.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 43.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 43.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 43.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 44. Rest of South America Consumer Electronic Biometrics Market Analysis and Forecasts, 2022-2029 44.1. Market Size (Value) Estimates & Forecast By Authentication, 2022-2029 44.2. Market Size (Value) Estimates & Forecast By Offering, 2022-2029 44.3. Market Size (Value) Estimates & Forecast By Functionality, 2022-2029 44.4. Market Size (Value) Estimates & Forecast By End users, 2022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Consumer Electronic Biometrics Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Functionalities and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1. Thales Group 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. NEC Corporation 45.3.3. Fujitsu 45.3.4. Suprema inc 45.3.5. Iris ID 45.3.6. Idemia 45.3.7. Crossmatch Technologies 45.3.8. Ultinous 45.3.9. IDEX Biometrics 45.3.10. Synaptics 45.3.11. Aware Inc 45.3.12. Assa Abloy 45.3.13. Apple 45.3.14. Others 46. Primary Key Insights