The Battery Materials Market size was valued at USD 77.49 Billion in 2024 and the total Battery Materials revenue is expected to grow at a CAGR of 15.8% from 2025 to 2032, reaching nearly USD 250.58 Billion. Batteries have the potential to store electrical energy for decentralised fixed or mobile applications, which is one of the most pressing social, economic, and scientific issues of the twenty-first century. Because of the emergence of new end-user markets, such as electric vehicles and energy storage systems (ESS), for both commercial and residential applications, as well as increased demand from already established markets, such as automotive, UPS, telecom, and consumer electronics, there are potential opportunities for batteries all over the world. A mixture of components such as manganese (cathode), potassium, and zinc make up around 60% of the battery (anode). Secondary batteries are rechargeable and made of nickel-hydrogen, lithium-ion, or nickelcadmium. Demand for Lithium-ion batteries is expected to increase significantly due to the falling price of lithium. Sales of lithium-ion batteries are expected to increase by the end of 2025-2032 compared to other battery technologies, principally driven by energy storage systems and electric cars. These estimations are susceptible to change, since new battery chemistries may lower the amount of lithium-ion battery sales. India is one of the fastest developing economies in the Asia-Pacific region, with the world's second biggest population, which translates into high energy consumption and a high need for energy storage solutions. Lead-acid batteries are one of the oldest and most established battery technologies in the country, with respectable life and moderate costs compared to other battery kinds. They are used in a variety of applications, including autos, backup power, telephony, and grid-scale storage systems. However, because of their poor energy density, they are inappropriate for some applications, such as hybrid or electric cars.To know about the Research Methodology:- Request Free Sample Report

Battery Materials Market Dynamics

Increasing Adoption of Electric Vehicles The consumer electronics industry was the primary end-user of lithium-ion batteries in the early years of the market's growth. However, as EV sales have increased, electric vehicle (EV) makers have become one of the largest consumers of lithium-ion batteries. EVs release no CO2, NOX, or other greenhouse gases and hence have a lower environmental effect than traditional internal combustion engine (ICE) vehicles. Because of this benefit, governments are pushing the adoption of EVs through subsidies and government initiatives. To meet the growing demand for EVs, EV and battery manufacturers are pursuing expansion options such as collaborations and partnerships. In over 29,000 electric cars were sold in Japan, an increase from approximately 12,600 EVs sold a decade prior. The COVID-19 pandemic, along with lower consumer purchasing power, caused a drop in sales in . An estimated 14,700 PHEVs and 14,600 BEVs will be marketed in . Japan aspires to implement a "Well-to-Wheel Zero Emission" strategy by 2050, in line with worldwide efforts to reduce emissions, with an emphasis on energy supply and vehicle innovation. Replacing all cars with EVs may save greenhouse gas emissions by up to 80% per vehicle, with a further 90% decrease per passenger vehicle. Such government initiatives are likely to increase the demand for electric vehicles, which, in turn, is likely to act as a driver for the battery materials market in Japan during the forecast period. Increasing Demand for Telecommunication and Datacenter Application Stationary batteries are utilised in a variety of applications where electricity is required on an ongoing or emergency basis. Because of their short lifespan, these batteries are not regularly drained, thus they do not require a large storage capacity. As a result, lead-acid batteries offer a feasible answer to the telecom sector. Expanding population, digitization, and the launch of 4G services were major drivers in the world's growing subscriber base over the previous decade, and it is expected to rise further with the future launch of 5G services. With more users, corporations must increase the number of telecom towers in the nation, creating a significant need for lead-acid batteries for backup purposes. With 1.17 billion users, India's telecommunications sector is the world's second biggest. According to the GSM Association (GSMA), India's mobile economy is fast expanding and will contribute considerably to the country's GDP (GDP). In terms of app downloads, India surpassed the United States to become the second-largest market in . Lead acid battery producers are poised to increase their market share across the country as the e-commerce sector and digitalization grow. The percentage of rural users increased significantly, accounting for 44.5% of all subscribers in August , up from 37.8% in December 2012. Lack of Domestic Li-Ion Battery Manufacturing Facilities Australia is a major source of raw materials including lithium, cobalt, and nickel. However, domestic demand for batteries in Australia is fast increasing, particularly in the residential and utility-scale battery storage sectors. To fulfil expanding demand, Australia imports the majority of its Li-ion battery needs from elsewhere. Because Australia lacks indigenous battery manufacturing capabilities, it is fully reliant on other nations for Li-ion battery supplies. As a result, the country is extremely vulnerable to supply chain interruptions caused by geopolitical or environmental factors. Because of the increased usage of renewable energy, these batteries are becoming an increasingly important aspect of the country's energy security; any incident that disrupts the supply chain affects the country's energy security. Furthermore, despite supplying the majority of the raw materials required in battery production, these minerals are exported to other nations with battery manufacturing facilities and then imported back to Australia, raising the price of Li-ion batteries. These comparatively higher prices are expected to impede the implementation of lithium-ion batteries in energy storage systems, electric vehicles (EV), and consumer electronics, limiting Battery materials market development during the forecast period. Safety Concerns Regarding Li-Ion Battery Fires According to researchers, there have been 38 significant lithium-ion battery fires worldwide since 2018, resulting in fatalities. Water simply slows the progress of flames caused by lithium-ion batteries, which make their own oxygen as they degrade, and the fire cannot be stopped unless the batteries are cooled. These flames also generate dangerous gases that can cause major physical issues in living things and need massive amounts of water to extinguish. As a result, there has been some debate concerning the widespread use of Li-ion battery packs. Even in household applications, Li-ion batteries have been a source of worry.

Battery Materials Market Segment Analysis

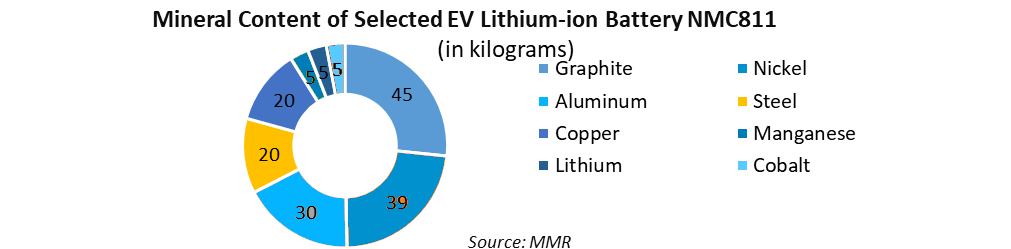

Based on the Battery Type, the Battery materials market is segmented into lithium-ion, lead-acid, and others. The lithium-ion segment is expected to dominate the market during the forecast period thanks to the increased demand for electric vehicles. Because of its colour memory effect, low self-discharge, and high energy density, it is employed in portable electronic devices. It has several uses in consumer electronics, automotive, and industrial settings, among others. As government organisations in numerous countries have taken measures toward a green environment and minimising carbon emissions, most automotive manufacturers are focused on the creation of electric cars. The increased demand for lead-acid batteries is driven by factors such as their dependability, convenience of purchase, tolerance to abuse, tolerance to overcharging, and capacity to produce large currents, among others. During the forecast period, the lead-acid sector is likely to generate considerable market revenue. The expansion of automobile manufacturing centres, primarily in Germany, the United Kingdom, Brazil, the United States, China, India, and Japan, will fuel market growth. Lead-acid batteries are made up of a cathode, an anode, a separator, and an electrolyte. High disposable income, along with an increase in overall passenger car sales in China and India, will benefit the whole market. Lead batteries are environmentally friendly since they are recyclable, and according to the Battery Council International (BCI), 99% of all lead batteries made are recycled. Based on Material, the Battery materials market is segmented into cathode, anode, electrolyte, separator, and others. Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Manganese Oxide, Lithium Nickel Cobalt Aluminium Oxide, and Lithium Nickel Manganese Oxide constitute the cathode segment. Artificial graphite, natural graphite, and other materials are used as anode materials. During the forecast period, cathode material may account for the majority of market share. Cobalt, manganese, and nickel are the principal active components of cathode materials. Cobalt is now largely supplanted by nickel, namely Lithium Nickel Manganese Oxide (NMC) and Nickel Cobalt Aluminium Oxide (NCAO) (NCA).Cathode materials must be exceedingly pure and devoid of undesirable metal impurities, primarily sulphur, vanadium, and iron. The battery family contains several devices that respond to diverse user demands for high energy density or high load capacity. Lead-acid is classified by material into cathode, anode, electrolyte, separator, and others. Cathode material led the market in 2024 and is expected to do so again in 2030. The anode of a lead-acid battery is metallic lead, while the cathode is lead dioxide. The efficiency of lead-acid batteries varies based on parameters such as temperature and duty cycle, which are generally between 75% and 85% for DC to DC cycling. Based on Application, the battery materials market is segmented into consumer electronics, automotive, industrial, and others. The growing use of lithium-ion batteries in consumer electronics applications is expected to boost market expansion. The increased need for smart electronic gadgets as a result of rising population and buying power parity, as well as changes in lifestyle preferences, will boost industry demand. Furthermore, governments throughout the world are concentrating more on digitalization, and encouraging people to use electronic gadgets properly is a crucial factor in market growth. The need for battery power for wireless devices is expanding at an exponential rate, creating a substantial market potential for battery makers. Lead-acid is classified as automotive, industrial, and other. During the forecast period, automotive applications account for a significant market share. A boom in global automotive sales and production has resulted in more vehicle electrification, which is driving the industry. Lead-acid batteries are preferred by purchasers and the automobile industry because to their high efficiency, low cost, excellent performance, tolerance to overcharging, longevity, and dependability.

Battery Materials Market Regional Insights

Asia Pacific, dominated by India, Japan, China, and South Korea, is likely to reach USD 21.45 billion. Rapid urbanisation, as well as rising consumer expenditure on electric cars, are predicted to boost regional growth. The Indian market is predicted to expand significantly over the forecast period, with a CAGR of 14.3%. Factors such as rising telecommunications and data centre demand, as well as increased applications in industries like as railroads, are projected to boost the market throughout the forecast period. However, other technologies, especially lithium-ion, are expected to disrupt market development, given to their lower costs and technological benefits. Most Indian companies are developing alliances with foreign firms and introducing new manufacturing plants to create an EV battery plant utilising indigenous battery materials, which would push the region's global battery materials market growth. The Japan market is predicted to develop significantly throughout the forecast period, with a CAGR of 12.7% between 2025 and 2032. Growing demand from the industrial, consumer electronics, and automotive industries is likely to boost market expansion. Increasing renewable energy penetration is likely to drive demand for battery energy storage systems, thereby boosting the market over the forecast period. North America is expected to develop significantly as a result of the fast adoption of electric cars and rising consumer electronics sales. The United States government is encouraging investment in the renewable and electric vehicle industries, leading in increased demand for battery-based energy storage devices, notably lithium-ion batteries, which will predominantly aid growth in the region through 2030. During the projection period, the European market is predicted to increase significantly. Over one million plug-in electric passenger vehicles were registered in Europe in June 2018, making it the world's second-largest automobile seller. Furthermore, Germany's expanding electronics and automotive sectors may generate profitable development prospects in the global battery materials market.Battery Materials Market Scope: Inquire before buying

Battery Materials Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 77.49 Bn. Forecast Period 2025 to 2032 CAGR: 15.8% Market Size in 2032: USD 250.58 Bn. Segments Covered: by Battery Type Lead-Acid Lithium Ion Others by Material Cathode Anode Electrolyte Separator Others by Application Consumer Electronics Automotive Industrial Others by End use Industry Automobile Industry Household Appliances Electronics Industry Others Battery Materials Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Battery Materials Market, Key Players are:

1. NEI Corporation (US) 2. Livent Corporation(US) 3. Albemarle(US) 4. TCI Chemicals Pvt. Ltd.(India) 5. Mitsubishi Chemical Holdings(Japan) 6. Hitachi Chemical Co., Ltd.(Japan) 7. NICHIA CORPORATION (Japan) 8. TORAY INDUSTRIES, INC.(Japan) 9. Kureha Corporation(Japan) 10.Asahi Kasei(Japan) 11.BASE SE (Germany) 12.Umicore Cobalt & Specialty Materials (CSM)(Netherlands) 13.Norlisk Nickel(Russia) 14.Glencore PLC(Canada) 15.Sheritt International Corporation(Canada) 16.SQM(Canada ) 17.Targray Technology International Inc.(Canada) 18.Targray Technology International(Canada) 19.Teck Resources(Canada) 20.Tianqi Lithium(China) 21.China Molybdenum Co. Ltd.(China) 22.Gan feng Lithium Co., Ltd.(China) 23.Shanghai Shanshan Tech Co., Ltd.(China) 24.Vale S.A.(Brazil) Frequently Asked Questions: 1] What segments are covered in the Global Battery Materials Market report? Ans. The segments covered in the Battery Materials Market report are based on Battery Type, Material, Application. 2] Which region is expected to hold the highest share in the Global Battery Materials Market? Ans. The Asia Pacific region is expected to hold the highest share in the Battery Materials Market. 3] What is the market size of the Global Battery Materials Market by 2032? Ans. The market size of the Battery Materials Market by 2032 is expected to reach USD 250.58 Bn. 4] What is the forecast period for the Global Battery Materials Market? Ans. The forecast period for the Battery Materials Market is 2025-2032. 5] What was the Global Battery Materials Market size in 2024? Ans: The Global Battery Materials Market size was USD 77.49 Billion in 2024.

1. Global Battery Materials Market: Research Methodology 2. Global Battery Materials Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Battery Materials Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Battery Materials Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Battery Materials Market Segmentation 4.1 Global Battery Materials Market, by Battery Type (2024-2032) • Lead-Acid • Lithium Ion • Others 4.2 Global Battery Materials Market, by Material (2024-2032) • Cathode • Anode • Electrolyte • Separator • Others 4.3 Global Battery Materials Market, by Application (2024-2032) • Consumer Electronics • Automotive • Industrial • Others 4.4 Global Battery Materials Market, by End use Industry (2024-2032) • Automobile Industry • Household Appliances • Electronics Industry • Others 5. North America Battery Materials Market(2024-2032) 5.1 North America Battery Materials Market, by Battery Type (2024-2032) • Lead-Acid • Lithium Ion • Others • Cathode • Anode • Electrolyte • Separator • Others 5.3 North America Battery Materials Market, by Application (2024-2032) • Consumer Electronics • Automotive • Industrial • Others 5.4 North America Battery Materials Market, by End use Industry (2024-2032) • Automobile Industry • Household Appliances • Electronics Industry • Others 5.5 North America Battery Materials Market, by Country (2024-2032) • United States • Canada • Mexico 6. Europe Battery Materials Market (2024-2032) 6.1. European Battery Materials Market, by Battery Type (2024-2032) 6.2. European Battery Materials Market, by Material (2024-2032) 6.3. European Battery Materials Market, by Application (2024-2032) 6.4. European Battery Materials Market, by End use Industry (2024-2032) 6.5. European Battery Materials Market, by Country (2024-2032) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Battery Materials Market (2024-2032) 7.1. Asia Pacific Battery Materials Market, by Battery Type (2024-2032) 7.2. Asia Pacific Battery Materials Market, by Material (2024-2032) 7.3. Asia Pacific Battery Materials Market, by Application (2024-2032) 7.4. Asia Pacific Battery Materials Market, by End use Industry (2024-2032) 7.5. Asia Pacific Battery Materials Market, by Country (2024-2032) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Battery Materials Market (2024-2032) 8.1 Middle East and Africa Battery Materials Market, by Battery Type (2024-2032) 8.2. Middle East and Africa Battery Materials Market, by Material (2024-2032) 8.3. Middle East and Africa Battery Materials Market, by Application (2024-2032) 8.4. Middle East and Africa Battery Materials Market, by End use Industry (2024-2032) 8.5. Middle East and Africa Battery Materials Market, by Country (2024-2032) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Battery Materials Market (2024-2032) 9.1. South America Battery Materials Market, by Battery Type (2024-2032) 9.2. South America Battery Materials Market, by Material (2024-2032) 9.3. South America Battery Materials Market, by Application (2024-2032) 9.4. South America Battery Materials Market, by End use Industry (2024-2032) 9.5. South America Battery Materials Market, by Country (2024-2032) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 NEI Corporation (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Livent Corporation(US) 10.3 Albemarle(US) 10.4 TCI Chemicals Pvt. Ltd.(India) 10.5 Mitsubishi Chemical Holdings(Japan) 10.6 Hitachi Chemical Co., Ltd.(Japan) 10.7 NICHIA CORPORATION (Japan) 10.8 TORAY INDUSTRIES, INC.(Japan) 10.9 Kureha Corporation(Japan) 10.10 Asahi Kasei(Japan) 10.11 BASE SE (Germany) 10.12 Umicore Cobalt & Specialty Materials (CSM)(Netherlands) 10.13 Norlisk Nickel(Russia) 10.14 Glencore PLC(Canada) 10.15 Sheritt International Corporation(Canada) 10.16 SQM(Canada ) 10.17 Targray Technology International Inc.(Canada) 10.18 Targray Technology International(Canada) 10.19 Teck Resources(Canada) 10.20 Tianqi Lithium(China) 10.21 China Molybdenum Co. Ltd.(China) 10.22 Gan feng Lithium Co., Ltd.(China) 10.23 Shanghai Shanshan Tech Co., Ltd.(China) 10.24 Vale S.A.(Brazil)