Global Baking Enzymes Market size was valued at USD 814.3 Mn. in 2022 and the total Baking Enzymes revenue is expected to grow by 5.25 % from 2023 to 2029, reaching nearly USD 1165.08 Mn.Baking Enzymes Market Overview:

Enzymes are nothing but the natural proteins that act as catalysts for biochemical reactions and helps to improve the life of shelf and texture of baked foods. Baking enzymes are widely used in sweet items like cookies, pastries, cakes, and are considered as the important ingredient in the preparation of these items which improves the texture and appearance of the product. Enzyme additives for baking Fungal Alpha Amylase are food grade alpha amylase from a fungal origin which is used specifically in the baking industry. The chemical based dough improvers can be replaced by the Lipase enzymes for the baking industry. There are different Bakery Enzymes for various applications.To know about the Research Methodology :- Request Free Sample Report

Baking Enzymes Market Dynamics:

Growing popularity of Western-style baked goods and Health Awareness Drive the Baking Enzymes Market Some of the vital uses of baking enzymes include dough fermentation and relaxation, dough stability, long crumb softness, and improved flour, volume, texture, and color. At present, enzymes are considered a natural and advanced solution for the bakery business thanks to their ability to improve the quality of the product. Baking enzymes are ingredient solutions and preservation systems that allow baked goods producers to answer quickly to consumer demand for gluten-free salt, acrylamide, additives, emulsifiers, and bread. Advanced consumers are constantly looking for baked goods that are tastier, healthier, more valuable, and versatile. The baking enzyme industry is providing better solutions and ingredients to help baked goods producers meet consumer needs. Due to the busy lifestyle of consumers the adoption of ready-to-eat and confectionery products is increasing that are convenient to consume. The demand for baking enzymes in the food industry is growing especially in bakery products. Western-style baked goods such as bread, cakes, and cookies, are becoming popular in developing countries. These baked goods frequently contain baking enzymes, to improve the taste, texture, and look of the bread, cakes, cookies, etc. Developments in the biotechnology sector have reduced the cost of enzyme production, which is expected to drive demand for baking enzymes. The awareness among consumers related to the health benefits of several baked goods is increasing, such as gluten-free bread and whole-wheat bread. Hence, theses are the factors that helps to drive the demand for the baking enzymes market. Restraints Lack of Awareness and Regulatory restrictions can hamper the growth of the market The excessive proportions in baking enzymes when consumed, can cause allergies, headaches, and ulcers, which are the key factors affecting the growth of the global baking enzyme market. Also, fluctuations in temperature and pH levels affect the ability of enzymes to bake, and severe government rules and regulations on the use of proteins for Baking enzyme solutions in countries like the UK and Canada are interfering with the growth of the global market for baking enzymes during the forecast period. There are certain regulatory restrictions in some countries for the use of baking enzymes. There is a lack of awareness of baking enzymes, some bakeries do not know the advantages of using baking enzymes, or else they may not be aware of how to use them effectively. The adoption of baking enzymes can be limited by small and medium-sized bakeries because they can be expensive to produce. Market Growth Opportunity Growing demand for organic baked goods and the Development of new baking enzymes create opportunities Organic and gluten-free bread uses bakery enzymes like transglutaminase, glutathione, protease, etc. So, as the demand for natural and gluten-free bread increases, the need for enzymatic baking is presumed to increase in the forecast period. The demand for organic baked goods is growing, as consumers are becoming more interested in healthy and sustainable food products. Baking enzymes can be used to improve the quality and taste of organic baked goods. Fast urbanization, increased consumption of convenience foods, and retail outlets like Pizza Hut, Domino’s, McDonald's, and the subway are expected to lead the global baking enzyme market in the future. Also, as the use of emulsifiers decreased, enzyme-enhanced baking and has increased the demand and the growth of the global baking enzymes market. The new baking enzymes are being developed that are more well-organized and effective than traditional baking enzymes. This is creating new opportunities for new entrants and businesses in the baking enzymes market.Baking Enzymes Market Segment Analysis

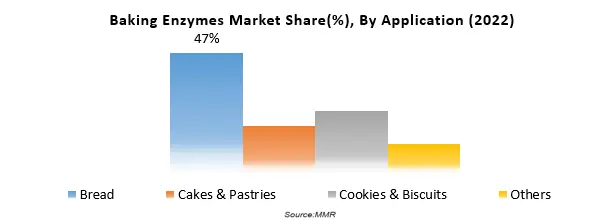

Based on the Product, The carbohydrase segment has dominated the market and is expected to hold the largest market share of the baking enzymes market during the forecast period, because of its wide-ranging application in many products as it is used in the production of baked products over other products. As well as this, carbohydrase enzymes have high thermal stability and can potentially improve the texture and extend the shelf-life of food products. Supportive regulatory standards led by the FDA regarding GRAS approval of carbohydrase and amylase in food products should have a positive impact on baking enzyme demand. Carbohydrases is a class of enzymes that break down carbohydrates, such as sugar and starch. It is used to make the Bread, Cake, and Other types of baking enzymes. The demand for baked goods is increasing, because of the factors such as rising disposable incomes, urbanization, and population growth.Based on the Applications, The bread segment held the largest share of the market in baking enzyme applications in terms of revenue in the year 2022 and is expected to dominate the market during the forecast period. Amongst the highly consumable products in developed and developing economies from the wide range of applications. Bread is used as a major ingredient in widely consumed food products in pizza, burgers, hotdogs, and others hence is expected to witness a continuous rise during the forecast period (2023-2029). Cakes and pastries of baking enzymes are believed to rise effectively as demands from regions are expected to grow with the launch of new products with better taste and flavor by numerous market players is expected to further grow the consumption rate in the future.

Baking Enzymes Market Regional Insights:

North America dominated the market in the year 2022 and is expected to hold the largest market share in the global baking enzymes market in terms of revenue by 2029, the increasing demand for baking enzymes in food & beverage and confectionery industries in countries in the region. The United States and Canada are countries that dominated the market in this region. The market in Europe is expected to account for the second-largest revenue share contribution to the global baking enzymes market followed by markets in the Asia Pacific. The Asia Pacific market is expected to witness the fastest growth in terms of revenue where to the increasing inclination for packaged food in countries such as China, India, Japan, and South Korea. Though, China is the leading market for baking enzymes in this region.The objective of the report is to present a comprehensive analysis of the Baking Enzymes Market including all the stakeholders of the Form. The past and current status of the Form with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the Form with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the Form to the decision-makers. The report also helps in understanding the Baking Enzymes Market dynamics, and structure by analyzing the market segments and projecting the Baking Enzymes Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Baking Enzymes Market makes the report an investor’s guide.

Baking Enzymes Market Scope: Inquiry Before Buying

Baking Enzymes Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 814.3 Mn. Forecast Period 2023 to 2029 CAGR: 5.25% Market Size in 2029: US $ 1165.08 Mn. Segments Covered: by Product Carbohydrase Protease Lipase Others by Applications Bread Cakes & Pastries Cookies & Biscuits Others by Form Powder Liquid Baking Enzymes Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Baking Enzymes Market Key Players

1. Novozymes A/S [Denmark] 2. DSM 3. Enzymes GmbH 4. DowDuPont Inc. 5. Advanced Enzyme Technologies Ltd. [India] 6. Dyadic International Inc. 7. Engrain 8. SternEnzym GmbH & Co. KG 9. Amano Enzyme Inc. 10. Aum Enzymes 11. Maps Enzyme Limited 12. AB Enzymes GmbH 13. Puratos Group NV 14. Others.Frequently Asked Questions:

1] What segments are covered in the Global Baking Enzymes Market report? Ans. The segments covered in the market report are based on Product, Applications, Form, and Region. 2] Which region is expected to hold the highest share of the Global Baking Enzymes Market? Ans. The North American region is expected to hold the highest share of the Baking Enzymes Market. 3] What is the market size of the Global Baking Enzymes Market by 2029? Ans. The market size of the market by 2029 is expected to reach US$ 1165.08 Mn. 4] What is the forecast period for the Global Baking Enzymes Market? Ans. The forecast period for the Baking Enzymes Market is 2023-2029. 5] What was the market size of the Global Baking Enzymes Market in 2022? Ans. The market size of the market in 2022 was valued at US$ 814.3 Mn.

1. Global Baking Enzymes Market: Research Methodology 2. Global Baking Enzymes Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Baking Enzymes Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Baking Enzymes Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Baking Enzymes Market Segmentation 4.1 Global Baking Enzymes Market, by Product (2022-2029) • Carbohydrase • Protease • Lipase • Others 4.2 Global Baking Enzymes Market, by Applications (2022-2029) • Bread • Cakes & Pastries • Cookies & Biscuits • Others 4.3 Global Baking Enzymes Market, by Form (2022-2029) • Powder • Liquid 5. North America Baking Enzymes Market(2022-2029) 5.1 North America Baking Enzymes Market, by Product (2022-2029) • Carbohydrase • Protease • Lipase • Others 5.2 North America Baking Enzymes Market, by Applications (2022-2029) • Bread • Cakes & Pastries • Cookies & Biscuits • Others 5.3 North America Baking Enzymes Market, by Form (2022-2029) • Powder • Liquid 5.4 North America Baking Enzymes Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Baking Enzymes Market (2022-2029) 6.1. European Baking Enzymes Market, by Product (2022-2029) 6.2. European Baking Enzymes Market, by Applications (2022-2029) 6.3. European Baking Enzymes Market, by Form (2022-2029) 6.4. European Baking Enzymes Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Baking Enzymes Market (2022-2029) 7.1. Asia Pacific Baking Enzymes Market, by Product (2022-2029) 7.2. Asia Pacific Baking Enzymes Market, by Applications (2022-2029) 7.3. Asia Pacific Baking Enzymes Market, by Form (2022-2029) 7.4. Asia Pacific Baking Enzymes Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Baking Enzymes Market (2022-2029) 8.1 Middle East and Africa Baking Enzymes Market, by Product (2022-2029) 8.2. Middle East and Africa Baking Enzymes Market, by Applications (2022-2029) 8.3. Middle East and Africa Baking Enzymes Market, by Form (2022-2029) 8.4. Middle East and Africa Baking Enzymes Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Baking Enzymes Market (2022-2029) 9.1. South America Baking Enzymes Market, by Product (2022-2029) 9.2. South America Baking Enzymes Market, by Applications (2022-2029) 9.3. South America Baking Enzymes Market, by Form (2022-2029) 9.4 South America Baking Enzymes Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Novozymes A/S 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 DSM 10.3 Enzymes GmbH 10.4 DowDuPont Inc. 10.5 Advanced Enzyme Technologies Ltd. 10.6 Dyadic International Inc. 10.7 Engrain 10.8 SternEnzym GmbH & Co. KG 10.9 Amano Enzyme Inc. 10.10 Aum Enzymes 10.11 Maps Enzyme Limited 10.12 AB Enzymes GmbH 10.13 Puratos Group NV 10.14 Others