The Autonomous Vehicle Market size was valued at USD 42.30 billion in 2023 and the total Autonomous Vehicle Market Size is expected to grow at a CAGR of 33.5% from 2024 to 2030, reaching nearly USD 319.68 billion in 2030.The Autonomous Vehicle Industry Overview:

Autonomous vehicles also commonly known as driverless or self-driving vehicles, are automobiles that require no human involvement for operating or controlling them. Automated vehicles have been generating significant attention and discussion, recently with almost every automobile company trying to develop their respective Autonomous vehicle concept and are successful in achieving some levels of autonomy and are planning to start production of driverless vehicles. The emergence of the new-age automotive industry with the onset of connected, Autonomous, shared, and electric vehicles, is expected to accelerate the growth of the sector, which has been moving at a slow year-on-year growth rate owing to a gradually decreasing rate of car sales. As companies attempt to expand their businesses across the new ancillary services for Autonomous vehicles, new players with innovative business models are also emerging.To know about the Research Methodology :- Request Free Sample Report The concept of self-driving cars, once considered science fiction, is rapidly Increasing Autonomous Vehicle Market. Consumers are increasingly intrigued by the convenience, safety, and potential cost savings offered by autonomous vehicles. With advancements in technology, vehicles are becoming more reliable, and capable of navigating complex traffic situations and adapting to various weather conditions. The market has also witnessed the emergence of innovative business models, such as ride-sharing and autonomous taxi services, which are transforming the traditional car ownership model. Major automotive companies (Audi, BMW, Daimler, Ford, GM, Nissan, Toyota, Volkswagen, Volvo, etc.) and Vehicle Type companies (Google, Induct, etc.) have already demonstrated Autonomous driving through working prototypes and pilots. Several advanced driver assistance systems (ADAS) such as active lane keep assist, adaptive cruise control, and self-parking are already available as combined functions on current-generation cars. Additional functionality is expected to be rolled out in the Forecast Period. Furthermore, significant efforts are being made to advance existing Vehicle Types and to address cost-side challenges. Both the availability and affordability of key technologies to enable Autonomous driving are expected to greatly increase in the forecast Period. 1. Omniq, a company specializing in providing artificial intelligence-based solutions, has introduced an innovative in-car face detection feature capable of identifying and recognizing faces within a vehicle.

Autonomous Vehicle Market Dynamics:

Promoting Safety, Reducing Pollution, and Enhancing Infrastructure The rise in the development of smart cities is a key factor driving the growth of Autonomous vehicles helps reduce air pollution in smart cities and also helps to fight climate change. Driverless vehicles decrease 90 % the chances of accidents, by significantly improving the safety of roads. Countries such as the United States, Canada, and Mexico, are deploying digital infrastructure to promote communication between vehicles and networks to collect essential information, thereby reducing traffic congestion and improving road safety. Government funding, supportive regulatory framework, and investment in digital infrastructure are pretended to positively drive the demand for Autonomous cars during the forecast period.Integrating Computer Vision and Hybrid Technologies The rapid progress in Autonomous Vehicle Type is being driven by the integration of advanced computer vision Vehicle Type, which incorporates next-generation sensors, cameras, and sometimes biometric algorithms for various purposes such as driver assistance, surveillance, and entertainment. Within the field of in-car imaging systems, a wide range of hardware and software components are at play, and there has been significant growth in the development of semiconductor devices that embed advanced computer vision models at the edge. The rise of hybrid technologies used in traditional cars and trucks currently, along with the use of pure electric and hybrid electric technologies in future autonomous cars and trucks, would together assist in saving energy and increasing the efficiency of the drive. The sharing economy would also increase energy savings with the use of Autonomous cars and trucks. Challenges Hindering the Growth of the Autonomous Car Market The high cost of Autonomous vehicles, rising concern for security & safety, and lack of proper infrastructure to support automated vehicles in developing countries restrict the growth of the market. Ambiguous laws and regulations regarding the use of Autonomous cars are expected to restrain the growth of the global Autonomous car market during the forecast period. The main pillars of Autonomous vehicles are policies and regulations, technological innovation, infrastructure, and adoption by customers. The self-driving vehicle is dependent on factors such as continuously maintained road infrastructure, road signs, and updated maps or navigation systems. In many developing countries such as India, Mexico, and Brazil, the road infrastructure is not as developed as compared to developed countries such as the U.S., Singapore, and Sweden, which are causing a hindrance in the development of Autonomous vehicles.

Autonomous Vehicle Market Segmentation:

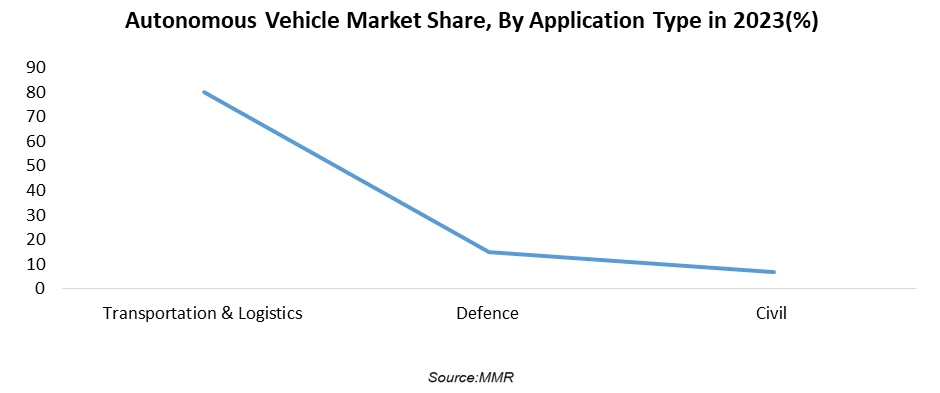

Based on Application, The Transportation and Logistics segment accounted for the largest market share in 2023 and is expected to grow with the highest CAGR of 17.4%% during the forecasted period. The rising adoption of electric and hybrid vehicles with various levels of automation has significantly triggered the demand for Autonomous vehicles in transportation applications. Public awareness and government support for shared mobility in the commercial sector have prominently boosted the trend of Autonomous vehicles in the segment. Autonomous vehicles have the potential to generate significant cost savings in transportation and logistics. By eliminating the need for human drivers, companies reduce labour costs associated with driver wages, benefits, and rest periods. Companies in the transportation and logistics industry recognize the potential benefits of Autonomous vehicles in terms of cost savings, efficiency, and improved customer satisfaction. Consequently, there is a race among companies to develop and deploy Autonomous vehicle solutions to stay ahead of the competition and meet customers’ evolving demands.

Autonomous Vehicle Market Regional Insight:

North America is a dominant region in the Autonomous Vehicle market and is expected to grow at a CAGR of 21.9 % through the forecast period. The prime factor supporting the accelerating growth of the North American region was amendments from the government in the traffic regulations to support Autonomous mobility on public roads. The region’s population is generally receptive to innovative technologies, creating a substantial market for autonomous vehicles, drones, and other autonomous systems. The consumer demand and acceptance drive further development in autonomous vehicles. The U.S. is expected to dominate the North American autonomous/self-driving cars market owing to increasing customer inclinations toward Autonomous cars. The region has been a pioneer of Autonomous vehicles owing to factors like strong and established automotive company clusters and being home to the world's biggest Vehicle Type companies like Google, Microsoft, Apple, etc. Particularly in the US, self-driving cars have already been tested and used in California, Texas, Arizona, Washington, Michigan, and other states of the US. However, their mobility is currently restricted to specific test areas and driving conditions.Automotive Carbon Wheel Market Competitive Landscape: 1. In Feb. 2024, Ryder System, a supply chain, dedicated transportation and fleet management Solutions Company, and Kodiak Robotics, an autonomous trucking company, announced a collaboration to leverage Ryder’s service network to enable the commercialization and scaling of Kodiak’s autonomous truck solution. 2. December 2023, Kodiak and Ryder established their first truck port in Houston, strategically located at an existing Ryder fleet maintenance facility. The truck port enables Kodiak to launch and land autonomous trucks as well as transfer freight to serve routes between Houston, Dallas and Oklahoma City. 3. In July 2023, HCL Tech., the Noida-headquartered IT services company announced that it had signed a definitive agreement to acquire a 100 per cent equity stake in ASAP Group, an automotive engineering services provider. 4. In August 2023, Pony.ai, a U.S.-based software company, partnered with Toyota Motor (China) Investment Co., Ltd. and GAC Toyota Motor Co., Ltd. to create a joint venture aimed at advancing fully driverless robotaxis for mass production and deployment. The initiative combines Pony.ai's autonomous driving tech, Toyota's branded electric vehicles, and GTMC's production expertise. Together, they'll offer safe and convenient robotaxi services, propelling the industry towards commercialized autonomous mobility.

Autonomous Vehicle Market Scope: Inquire before buying

Global Autonomous Vehicle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 42.30 Bn. Forecast Period 2024 to 2030 CAGR: 33.5% Market Size in 2030: US $ 319.68 Bn. Segments Covered: by Application Transportation & Logistics Defence Civil by Vehicle Type Passenger Car Commercial Vehicle by Propulsion Type Semi-Autonomous Fully Autonomous Autonomous Vehicle Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Autonomous Market Industry:

1. Delphi 2. Ford Motors 3. Tesla 4. Alphabet 5. Intel 6. Daimler Group 7. Baidu 8. Google 9. Volkswagen 10. Jaguar 11. BMW 12. General Motors 13. Toyota 14. AB Volvo 15. Autoliv 16. Bosch 17. Renault-Nissan-Mitsubishi alliance 18. Audi AG 19. General Motors Company 20. Honda Motor Co., Ltd. 21. Nissan Motor Company Frequently Asked Questions: 1] What segments are covered in the Autonomous Vehicle Market report? Ans. The segments covered in the Autonomous Vehicle Market report are based on Application, Vehicle Type, and Propulsion Type. 2] Which region is expected to hold the highest share in the Autonomous Vehicle Market? Ans. The Asia Pacific region is expected to hold the highest share of the Autonomous Vehicle Market. 3] What is the market size of the Autonomous Vehicle Market by 2030? Ans. The market size of the Autonomous Vehicle Market by 2030 is US$ 319.68 Billion. 4] What is the forecast period for the Autonomous Vehicle Market? Ans. The Forecast period for the Autonomous Vehicle Market is 2024- 2030. 5] What is the expected growth rate and market size of the Autonomous Vehicle Market by 2030? Ans. The Autonomous Vehicle Market is expected to grow at a CAGR of 33.5 % from 2024 to 2030, reaching nearly USD 319.68 Billion.

1. Autonomous Vehicle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Autonomous Vehicle Market: Dynamics 2.1. Autonomous Vehicle Market Trends by Region 2.1.1. North America Autonomous Vehicle Market Trends 2.1.2. Europe Autonomous Vehicle Market Trends 2.1.3. Asia Pacific Autonomous Vehicle Market Trends 2.1.4. Middle East and Africa Autonomous Vehicle Market Trends 2.1.5. South America Autonomous Vehicle Market Trends 2.2. Autonomous Vehicle Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Autonomous Vehicle Market Drivers 2.2.1.2. North America Autonomous Vehicle Market Restraints 2.2.1.3. North America Autonomous Vehicle Market Opportunities 2.2.1.4. North America Autonomous Vehicle Market Challenges 2.2.2. Europe 2.2.2.1. Europe Autonomous Vehicle Market Drivers 2.2.2.2. Europe Autonomous Vehicle Market Restraints 2.2.2.3. Europe Autonomous Vehicle Market Opportunities 2.2.2.4. Europe Autonomous Vehicle Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Autonomous Vehicle Market Drivers 2.2.3.2. Asia Pacific Autonomous Vehicle Market Restraints 2.2.3.3. Asia Pacific Autonomous Vehicle Market Opportunities 2.2.3.4. Asia Pacific Autonomous Vehicle Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Autonomous Vehicle Market Drivers 2.2.4.2. Middle East and Africa Autonomous Vehicle Market Restraints 2.2.4.3. Middle East and Africa Autonomous Vehicle Market Opportunities 2.2.4.4. Middle East and Africa Autonomous Vehicle Market Challenges 2.2.5. South America 2.2.5.1. South America Autonomous Vehicle Market Drivers 2.2.5.2. South America Autonomous Vehicle Market Restraints 2.2.5.3. South America Autonomous Vehicle Market Opportunities 2.2.5.4. South America Autonomous Vehicle Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Autonomous Vehicle Industry 2.8. Analysis of Government Schemes and Initiatives For Autonomous Vehicle Industry 2.9. Autonomous Vehicle Market Trade Analysis 2.10. The Global Pandemic Impact on Autonomous Vehicle Market 3. Autonomous Vehicle Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 3.1.1. Transportation & Logistics 3.1.2. Defence 3.1.3. Civil 3.2. Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 3.2.1. Passenger Car 3.2.2. Commercial Vehicle 3.3. Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 3.3.1. Semi-Autonomous 3.3.2. Fully Autonomous 3.4. Autonomous Vehicle Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Autonomous Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 4.1.1. Transportation & Logistics 4.1.2. Defence 4.1.3. Civil 4.2. North America Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.2.1. Passenger Car 4.2.2. Commercial Vehicle 4.3. North America Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 4.3.1. Semi-Autonomous 4.3.2. Fully Autonomous 4.4. North America Autonomous Vehicle Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 4.4.1.1.1. Transportation & Logistics 4.4.1.1.2. Defence 4.4.1.1.3. Civil 4.4.1.2. United States Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.1.2.1. Passenger Car 4.4.1.2.2. Commercial Vehicle 4.4.1.3. United States Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 4.4.1.3.1. Semi-Autonomous 4.4.1.3.2. Fully Autonomous 4.4.2. Canada 4.4.2.1. Canada Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 4.4.2.1.1. Transportation & Logistics 4.4.2.1.2. Defence 4.4.2.1.3. Civil 4.4.2.2. Canada Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.2.2.1. Passenger Car 4.4.2.2.2. Commercial Vehicle 4.4.2.3. Canada Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 4.4.2.3.1. Semi-Autonomous 4.4.2.3.2. Fully Autonomous 4.4.3. Mexico 4.4.3.1. Mexico Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 4.4.3.1.1. Transportation & Logistics 4.4.3.1.2. Defence 4.4.3.1.3. Civil 4.4.3.2. Mexico Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.3.2.1. Passenger Car 4.4.3.2.2. Commercial Vehicle 4.4.3.3. Mexico Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 4.4.3.3.1. Semi-Autonomous 4.4.3.3.2. Fully Autonomous 5. Europe Autonomous Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 5.2. Europe Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.3. Europe Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 5.4. Europe Autonomous Vehicle Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.1.2. United Kingdom Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.1.3. United Kingdom Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 5.4.2. France 5.4.2.1. France Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.2.2. France Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.2.3. France Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.3.2. Germany Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.3.3. Germany Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.4.2. Italy Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.4.3. Italy Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.5.2. Spain Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.5.3. Spain Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.6.2. Sweden Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.6.3. Sweden Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.7.2. Austria Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.7.3. Austria Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 5.4.8.2. Rest of Europe Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.8.3. Rest of Europe Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6. Asia Pacific Autonomous Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.3. Asia Pacific Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6.4. Asia Pacific Autonomous Vehicle Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.1.2. China Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.1.3. China Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.2.2. S Korea Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.2.3. S Korea Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.3.2. Japan Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.3.3. Japan Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6.4.4. India 6.4.4.1. India Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.4.2. India Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.4.3. India Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.5.2. Australia Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.5.3. Australia Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.6.2. Indonesia Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.6.3. Indonesia Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.7.2. Malaysia Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.7.3. Malaysia Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.8.2. Vietnam Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.8.3. Vietnam Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.9.2. Taiwan Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.9.3. Taiwan Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 6.4.10.2. Rest of Asia Pacific Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 7. Middle East and Africa Autonomous Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.3. Middle East and Africa Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 7.4. Middle East and Africa Autonomous Vehicle Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.1.2. South Africa Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.1.3. South Africa Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.2.2. GCC Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.2.3. GCC Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.3.2. Nigeria Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.3.3. Nigeria Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 7.4.4.2. Rest of ME&A Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.4.3. Rest of ME&A Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 8. South America Autonomous Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 8.2. South America Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.3. South America Autonomous Vehicle Market Size and Forecast, by Propulsion Type(2023-2030) 8.4. South America Autonomous Vehicle Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 8.4.1.2. Brazil Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.1.3. Brazil Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 8.4.2.2. Argentina Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.2.3. Argentina Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Autonomous Vehicle Market Size and Forecast, by Application (2023-2030) 8.4.3.2. Rest Of South America Autonomous Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.3.3. Rest Of South America Autonomous Vehicle Market Size and Forecast, by Propulsion Type (2023-2030) 9. Global Autonomous Vehicle Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Autonomous Vehicle Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Delphi 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ford Motors 10.3. Tesla 10.4. Alphabet 10.5. Intel 10.6. Daimler Group 10.7. Baidu 10.8. Google 10.9. Volkswagen 10.10. Jaguar 10.11. BMW 10.12. General Motors 10.13. Toyota 10.14. AB Volvo 10.15. Autoliv 10.16. Bosch 10.17. Renault-Nissan-Mitsubishi alliance 10.18. Audi AG 10.19. General Motors Company 10.20. Honda Motor Co., Ltd. 10.21. Nissan Motor Company 11. Key Findings 12. Industry Recommendations 13. Autonomous Vehicle Market: Research Methodology 14. Terms and Glossary