Automotive Turbocharger Market size was valued at USD 16.24 Bn. in 2024, and the total Automotive Turbocharger Market revenue is expected to grow 8.2% from 2025 to 2032, reaching nearly USD 30.51 Bn.Automotive Turbocharger Market Overview

An automotive turbocharger is a device that forces extra air into the engine, increasing power and efficiency by using exhaust gases to spin a turbine. It allows a smaller engine to produce more power while improving fuel economy and reducing emissions. The Automotive Turbocharger industry is experiencing robust growth, fueled by automakers' recognition of the need for enhanced fuel efficiency and performance. This has prompted increased research and development efforts focused on turbocharger technology improvement. The global Automotive Turbocharger Market is highly fragmented, characterized by intricate technology and robust R&D requirements, which deter new entrants. The popularity of next-generation turbochargers in automobiles drives the Automobile turbocharger Market demand due to their compact size, and they deliver power akin to larger engines while consuming less fuel. For example, a naturally aspirated internal combustion engine producing 200 horsepower with six cylinders can be equaled by a turbocharged engine with just four cylinders. This fuel efficiency advantage is driving demand for the Automotive Turbocharger Market. The Automotive Turbocharger Market Report covered the Automotive Turbocharger Market dynamics, structure by analyzing market segments and projecting the Automotive Turbocharger Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategy, and regional presence in the Market.To know about the Research Methodology :- Request Free Sample Report

Automotive Turbocharger Market Dynamics

Leading innovation and development in the vehicle to drive the Automotive Turbocharger Market Growth

As the automotive industry transitions toward sustainable mobility, turbochargers have emerged as a crucial component for improving engine performance and fuel efficiency. Traditionally powered by exhaust gases, turbochargers have evolved significantly, with innovations such as electric turbochargers (e-turbos) now reshaping the Automotive Turbocharger Market. These e-turbos use electric motors to eliminate turbo lag and provide immediate power delivery, thereby enhancing responsiveness and acceleration. A notable advancement came from Mercedes-AMG demonstrated cutting-edge solutions at Auto Shanghai 2023, including VNTs and DAVNTs, designed to optimize power and reduce emissions. These innovations are particularly valuable in plug-in hybrid electric vehicles (PHEVs), especially in the expanding Chinese market. Further showcase the industry's commitment to balancing performance with environmental goals. These advancements highlight how turbocharging continues to play a vital role in the journey toward greener, more efficient automotive technologies.Turbocharged Innovations and Hybrid Advancements to Create Automotive Turbocharger Market Opportunity

The automotive industry is experiencing a dynamic transformation, driven by sustainability goals and technological innovation, especially within the turbocharger market. Industry leaders like BorgWarner and Cummins are spearheading this change. BorgWarner’s upgraded S410 turbocharger for Mercedes-Benz trucks enhances fuel efficiency and engine performance, while its compact B01 turbo, launched for the Volkswagen Nivus in Brazil, supports emissions reduction with high-temperature durability. Meanwhile, BorgWarner’s twin-scroll and R2S turbo systems for BMW highlight cutting-edge solutions for high-performance and efficient engines. Cummins complements this with its versatile Series 800 Holset turbochargers, designed for engines up to 100L, and its 7th-gen 400 Series VGT promising a 5% efficiency gain in both medium- and heavy-duty vehicles.Automotive Turbocharger Market Segments

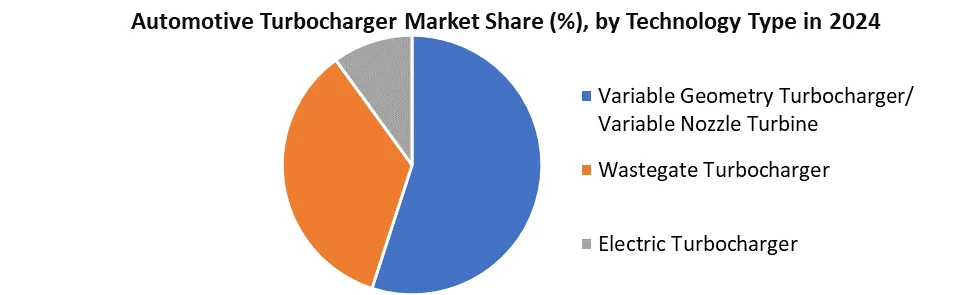

Based on the Fuel Type, the Gasoline segment is expected to dominate the Automotive Turbocharger Market in 2024. The market for turbochargers is experiencing robust growth, driven by several key factors. Firstly, there is a surging demand for fuel-efficient vehicles, and turbochargers have emerged as a pivotal solution in this regard. They offer superior fuel economy and performance compared to naturally aspirated engines, making them increasingly attractive to consumers, particularly in the passenger car segment. Furthermore, the imposition of stringent emission norms has accelerated the adoption of turbochargers as they contribute to reduced emissions. Notably, major original equipment manufacturers (OEMs) such as BMW, Mercedes-Benz, Audi, and Porsche are making concerted efforts to strike a balance between fuel economy and high performance. This strategic focus is expected to boost the demand for aftermarket turbochargers in the foreseeable future. Another significant market driver is the growing popularity of diesel engines in developed countries. This shift has prompted consumers to consider gasoline engines equipped with turbochargers as aftermarket add-on devices. Turbochargers have garnered attention from sports car enthusiasts who seek enhanced vehicle performance without resorting to costly modifications or engine rebuilds. These devices elevate horsepower and torque while minimizing exhaust backpressure, making them a favored choice among tuner car owners worldwide. Moreover, turbochargers also enhance efficiency by increasing airflow density, resulting in reduced fuel consumption compared to their naturally aspirated counterparts. This advantage extends across various vehicle types, encompassing passenger cars and light commercial vehicles (LCVs). In sum, the market for turbochargers is being propelled by the collective forces of fuel efficiency, emission regulations, OEM strategies, and consumer preferences for enhanced performance, making it a dynamic and promising sector within the automotive industry. Based on Technology Type, the Variable Geometry Turbocharger (VGT) / Variable Nozzle Turbine (VNT) segment dominated the automotive turbocharger market in 2024. This is primarily due to its superior performance in enhancing engine efficiency and reducing turbo lag, making it ideal for both diesel and increasingly for gasoline engines. VGTs adapt to different engine speeds and loads, improving fuel economy and meeting stricter emission standards. Their widespread adoption in passenger and light commercial vehicles has significantly driven their market share. Additionally, the regulatory push for cleaner engines continues to favor VGT technology over conventional types.

Automotive Turbocharger Market Regional Insights

North America is expected to dominate the Automotive Turbocharger Market during the forecast period. The U.S. held the largest market share in 2024. The continued growth of turbocharging technologies will be driven by requirements for manufacturers to meet End users' towing requirements and not global environmental regulations. The downsizing of engines in the industry has been going on for the past 11 years. This results in a shift from large naturally aspirated engines to smaller turbocharged ones in the less than 3L engine segments. Many V6 and V8 engines powering pickups continue to remain naturally aspirated, though. Ford, with 56% turbo penetration, leads the market in the US. GM has about 40% penetration. FCA (Fiat Chrysler Automobiles) with 10% penetration is the least among the leading OEMs in the American Automotive Turbocharger Market. 1. Turbocharger import shipments in the United States stood at 26.7K, imported by 1,833 United States Importers from 2,480 Suppliers. 2. The United States imports most of its turbochargers from China, India, and Germany, and is the 2nd largest importer of turbochargers in the World. 3. The top 3 importers of Turbocharger are India with 132,564 shipments, followed by the United States with 26,672, and Vietnam at the 3rd spot with 21,543 shipments.Automotive Turbocharger Market Competitive Landscape

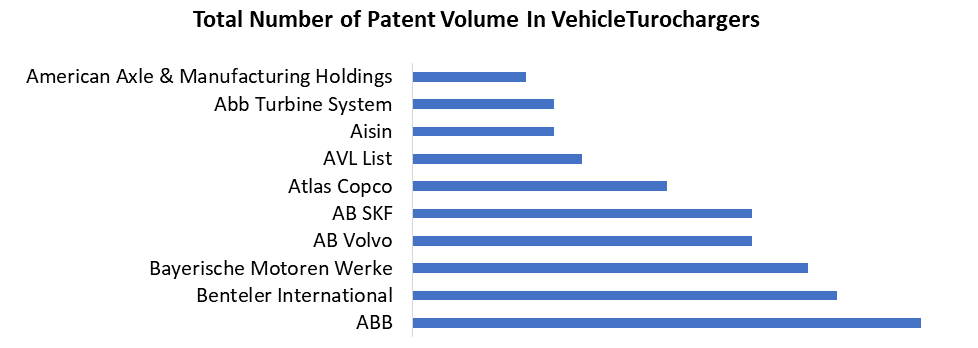

The automotive turbocharger market is dominated by key players like BorgWarner, Garrett Motion, Mitsubishi Heavy Industry, and IHI Corporation, which are led by their technological innovation and strategic expansion. BorgWarner excels with advanced solutions like variable geometry (VTG) turbochargers and eTurbo systems, enhancing fuel efficiency and performance. Garrett Motion (formerly Honeywell Turbo Technologies) maintains leadership with high-performance turbochargers for both passenger and commercial vehicles, through its strong R&D and global supply chain. In the Automotive Turbocharger Industry, BorgWarner stands as a prominent innovator, boasting an impressive portfolio of 423 filed patents. Their offerings for light vehicles encompass cutting-edge technologies such as the regulated two-stage (R2S) turbocharging system and advanced turbine geometry (VTG) turbochargers. The VTG turbochargers excel in precise adjustment to engine operative points, thanks to adjustable, electrically actuated vanes controlling turbine pressure. This results in nearly rapid acceleration and optimal power output. Noteworthy competitors include Porsche, Mitsubishi, Honeywell International, IHI, and Toyota, all of which have made significant patent filings in the field of the Automotive Turbocharger Market. Garrett Advancing Motion, formerly known as Honeywell Turbo Technologies, is the market leader, closely followed by BorgWarner, and together, they command a substantial 65% share of the global Automotive Turbocharger Market.

Automotive Turbocharger Market Key Trends

1) Electrification & Hybrid Turbochargers – Automakers are integrating electric assist turbos (e-turbos) to enhance efficiency in hybrid and mild-hybrid vehicles. Companies like BorgWarner and Garrett Motion are leading with 48V e-turbos, reducing turbo lag and improving fuel economy. 2) Stricter Emission Regulations – With Euro 7 and China VI norms, demand for advanced turbochargers (like VGT and wastegate turbos) is rising to cut CO₂ emissions while maintaining engine performance. 3) Downsized Turbocharged Gasoline Engines – As diesel declines, automakers adopt smaller, turbocharged petrol engines (e.g., Ford EcoBoost) to balance power and efficiency, boosting gasoline turbo demand. 4) Lightweight & Compact Turbo Designs – Manufacturers use advanced materials (aluminium, titanium) to reduce weight and improve thermal efficiency, crucial for EVs and high-performance cars.Automotive Turbocharger Market Recent Development

1. BorgWarner Inc. (United States) Feb 6, 2025 – Solidified and extended contracts with a major North American OEM to supply electrically actuated wastegate turbochargers for midsize gasoline SUV and truck platforms through 2028 and beyond. 2. Garrett Motion Inc. (Switzerland) April 22, 2025 – Presented its 3‑in‑1 E‑Powertrain and E‑Cooling Compressor for the first time in China at Auto Shanghai 2025. April 23, 2025 – Signed a strategic partnership with Shaanxi HanDe Axle Co., securing a series‑production contract to co-develop heavy‑duty truck E‑Axle systems.Automotive Turbocharger Market Scope : Inquire Before Buying

Automotive Turbocharger Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 16.24 Bn Forecast Period 2025 to 2032 CAGR: 8.2% Market Size in 2032: USD 30.51 Bn Segments Covered: by Vehicle Type LCV HCV Agricultural Machinery Construction Machinery by Fuel Type Gasoline Diesel by Technology Type Variable Geometry Turbocharger/ Variable Nozzle Turbine Wastegate Turbocharger Electric Turbocharger by Sales Channel/Type OEM Replacement/Aftermarket Automotive Turbocharger Market, by region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Automotive Turbocharger Market Key Players

North America 1. BorgWarner (United States) 2. Cummins Turbo Technologies (United States) 3. Turbo International (United States) 4. Bullseye Power LLC (United States) 5. TiAL Sport Inc (United States) 6. Turbo Solutions (United States) 7. Innovative Turbo Systems (United States) Europe 8. Garrett Motion (United Kingdom) 9. BMTS Technology (United Kingdom) 10. Continental Automotive (Germany) 11. KBB Turbo (United Kingdom) 12. Turbo Technics (United Kingdom) 13. Mahle (Germany) Asia Pacific 14. Mitsubishi Heavy Industries (Japan) 15. IHI Corporation (Japan) 16. HKS Company (Japan) 17. GReddy Performance Products (Japan) 18. Weifang FuYuan Turbochargers Co., Ltd. (China) 19. Toyota Industries (Japan) 20. Datong North Great Power Turbocharging Tech (China) 21. Wuxi Xinan Technology (China)FAQ:

1. What are the growth drivers for the Automotive Turbocharger Market? Ans. Stringent government regulations are expected to be the major driver for the Automotive Turbocharger Market. 2. What is the major restraint for the Automotive Turbocharger Market growth? Ans. Turbo lag is expected to be the major restraining factor for the Automotive Turbocharger Market growth. 3. Which Region is expected to lead the global Automotive Turbocharger Market during the forecast period? Ans. North America is expected to lead the global Automotive Turbocharger Market during the forecast period. 4. What is the projected Europe Automotive Turbocharger Market size & growth rate of the Automotive Turbocharger Market? Ans. The Automotive Turbocharger Market size was valued at USD 16.24 billion in 2024, and the total revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 30.51 billion. 5. What segments are covered in the Automotive Turbocharger Market report? Ans. The segments covered in the Automotive Turbocharger Market report are Vehicle, Fuel, Technology, and Region.

1. Automotive Turbocharger Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Automotive Turbocharger Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Service Segment 2.4.4. End-User Segment 2.4.5. Revenue (2024) 2.4.6. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Automotive Turbocharger Market: Dynamics 3.1. Region-wise Trends of Automotive Turbocharger Market 3.1.1. North America Automotive Turbocharger Market Trends 3.1.2. Europe Automotive Turbocharger Market Trends 3.1.3. Asia Pacific Automotive Turbocharger Market Trends 3.1.4. Middle East and Africa Automotive Turbocharger Market Trends 3.1.5. South America Automotive Turbocharger Market Trends 3.2. Automotive Turbocharger Market Dynamics 3.2.1. Automotive Turbocharger Market Drivers 3.2.1.1. Shift Toward Sustainability 3.2.1.2. Rise of E-Turbochargers 3.2.2. Automotive Turbocharger Market Restraints 3.2.3. Automotive Turbocharger Market Opportunities 3.2.3.1. Hybrid Turbo Integration 3.2.3.2. Expansion in Emerging Markets 3.2.4. Automotive Turbocharger Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Emission Regulation Shifts 3.4.2. Heavy-Duty Market Growth 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Automotive Turbocharger Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 4.1.1. LCV 4.1.2. HCV 4.1.3. Agricultural Machinery 4.1.4. Construction Machinery 4.2. Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 4.2.1. Gasoline 4.2.2. Diesel 4.3. Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 4.3.1. Variable Geometry Turbocharger/ Variable Nozzle Turbine 4.3.2. Wastegate Turbocharger 4.3.3. Electric Turbocharger 4.4. Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 4.4.1. OEM 4.4.2. Replacement/Aftermarket 4.5. Automotive Turbocharger Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Automotive Turbocharger Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 5.1.1. LCV 5.1.2. HCV 5.1.3. Agricultural Machinery 5.1.4. Construction Machinery 5.2. North America Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 5.2.1. Gasoline 5.2.2. Diesel 5.3. North America Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 5.3.1. Variable Geometry Turbocharger/ Variable Nozzle Turbine 5.3.2. Wastegate Turbocharger 5.3.3. Electric Turbocharger 5.4. North America Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 5.4.1. OEM 5.4.2. Replacement/Aftermarket 5.5. North America Automotive Turbocharger Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 5.5.1.1.1. LCV 5.5.1.1.2. HCV 5.5.1.1.3. Agricultural Machinery 5.5.1.1.4. Construction Machinery 5.5.1.2. United States Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 5.5.1.2.1. Gasoline 5.5.1.2.2. Diesel 5.5.1.3. United States Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 5.5.1.3.1. Variable Geometry Turbocharger/ Variable Nozzle Turbine 5.5.1.3.2. Wastegate Turbocharger 5.5.1.3.3. Electric Turbocharger 5.5.1.4. United States Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 5.5.1.4.1. OEM 5.5.1.4.2. Replacement/Aftermarket 5.5.2. Canada 5.5.2.1. Canada Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 5.5.2.1.1. LCV 5.5.2.1.2. HCV 5.5.2.1.3. Agricultural Machinery 5.5.2.1.4. Construction Machinery 5.5.2.2. Canada Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 5.5.2.2.1. Gasoline 5.5.2.2.2. Diesel 5.5.2.3. Canada Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 5.5.2.3.1. Variable Geometry Turbocharger/ Variable Nozzle Turbine 5.5.2.3.2. Wastegate Turbocharger 5.5.2.3.3. Electric Turbocharger 5.5.2.4. Canada Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 5.5.2.4.1. OEM 5.5.2.4.2. Replacement/Aftermarket 5.5.3. Mexico 5.5.3.1. Mexico Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 5.5.3.1.1. LCV 5.5.3.1.2. HCV 5.5.3.1.3. Agricultural Machinery 5.5.3.1.4. Construction Machinery 5.5.3.2. Mexico Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 5.5.3.2.1. Gasoline 5.5.3.2.2. Diesel 5.5.3.3. Mexico Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 5.5.3.3.1. Variable Geometry Turbocharger/ Variable Nozzle Turbine 5.5.3.3.2. Wastegate Turbocharger 5.5.3.3.3. Electric Turbocharger 5.5.3.4. Mexico Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 5.5.3.4.1. OEM 5.5.3.4.2. Replacement/Aftermarket 6. Europe Automotive Turbocharger Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 6.2. Europe Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 6.3. Europe Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 6.4. Europe Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 6.5. Europe Automotive Turbocharger Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.1.2. United Kingdom Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 6.5.1.3. United Kingdom Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 6.5.1.4. United Kingdom Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 6.5.2. France 6.5.2.1. France Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.2.2. France Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 6.5.2.3. France Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 6.5.2.4. France Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.3.2. Germany Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 6.5.3.3. Germany Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 6.5.3.4. Germany Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.4.2. Italy Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 6.5.4.3. Italy Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 6.5.4.4. Italy Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.5.2. Spain Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 6.5.5.3. Spain Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 6.5.5.4. Spain Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.6.2. Sweden Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 6.5.6.3. Sweden Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 6.5.6.4. Sweden Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.7.2. Russia Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 6.5.7.3. Russia Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 6.5.7.4. Russia Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.8.2. Rest of Europe Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 6.5.8.3. Rest of Europe Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 6.5.8.4. Rest of Europe Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7. Asia Pacific Automotive Turbocharger Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.2. Asia Pacific Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.3. Asia Pacific Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.4. Asia Pacific Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5. Asia Pacific Automotive Turbocharger Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.1.2. China Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.1.3. China Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.1.4. China Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.2.2. S Korea Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.2.3. S Korea Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.2.4. S Korea Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.3.2. Japan Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.3.3. Japan Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.3.4. Japan Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5.4. India 7.5.4.1. India Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.4.2. India Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.4.3. India Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.4.4. India Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.5.2. Australia Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.5.3. Australia Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.5.4. Australia Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.6.2. Indonesia Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.6.3. Indonesia Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.6.4. Indonesia Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.7.2. Malaysia Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.7.3. Malaysia Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.7.4. Malaysia Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.8.2. Philippines Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.8.3. Philippines Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.8.4. Philippines Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.9.2. Thailand Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.9.3. Thailand Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.9.4. Thailand Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.10.2. Vietnam Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.10.3. Vietnam Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.10.4. Vietnam Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 7.5.11.4. Rest of Asia Pacific Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 8. Middle East and Africa Automotive Turbocharger Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 8.2. Middle East and Africa Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 8.3. Middle East and Africa Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 8.4. Middle East and Africa Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 8.5. Middle East and Africa Automotive Turbocharger Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.1.2. South Africa Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 8.5.1.3. South Africa Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 8.5.1.4. South Africa Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.2.2. GCC Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 8.5.2.3. GCC Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 8.5.2.4. GCC Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.3.2. Egypt Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 8.5.3.3. Egypt Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 8.5.3.4. Egypt Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.4.2. Nigeria Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 8.5.4.3. Nigeria Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 8.5.4.4. Nigeria Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.5.2. Rest of ME&A Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 8.5.5.3. Rest of ME&A Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 8.5.5.4. Rest of ME&A Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 9. South America Automotive Turbocharger Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 9.2. South America Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 9.3. South America Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 9.4. South America Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 9.5. South America Automotive Turbocharger Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.1.2. Brazil Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 9.5.1.3. Brazil Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 9.5.1.4. Brazil Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.2.2. Argentina Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 9.5.2.3. Argentina Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 9.5.2.4. Argentina Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.3.2. Colombia Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 9.5.3.3. Colombia Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 9.5.3.4. Colombia Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.4.2. Chile Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 9.5.4.3. Chile Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 9.5.4.4. Chile Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Automotive Turbocharger Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.5.2. Rest Of South America Automotive Turbocharger Market Size and Forecast, By Fuel Type (2024-2032) 9.5.5.3. Rest Of South America Automotive Turbocharger Market Size and Forecast, By Technology Type (2024-2032) 9.5.5.4. Rest Of South America Automotive Turbocharger Market Size and Forecast, By Sales Channel/Type (2024-2032) 10. Company Profile: Key Players 10.1. BorgWarner (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Cummins Turbo Technologies (United States) 10.3. Turbo International (United States) 10.4. Bullseye Power LLC (United States) 10.5. TiAL Sport Inc (United States) 10.6. Turbo Solutions (United States) 10.7. Innovative Turbo Systems (United States) 10.8. Garrett Motion (United Kingdom) 10.9. BMTS Technology (United Kingdom) 10.10. Continental Automotive (Germany) 10.11. KBB Turbo (United Kingdom) 10.12. Turbo Technics (United Kingdom) 10.13. Mahle (Germany) 10.14. Mitsubishi Heavy Industries (Japan) 10.15. IHI Corporation (Japan) 10.16. HKS Company (Japan) 10.17. GReddy Performance Products (Japan) 10.18. Weifang FuYuan Turbochargers Co., Ltd. (China) 10.19. Toyota Industries (Japan) 10.20. Datong North Great Power Turbocharging Tech (China) 10.21. Wuxi Xinan Technology (China) 11. Key Findings 12. Industry Recommendations 13. Automotive Turbocharger Market: Research Methodology