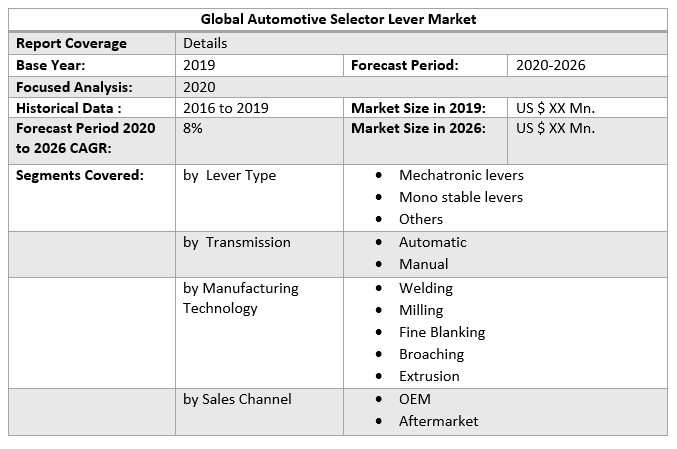

Global Automotive Selector Lever Market size was valued at US$ XX Mn in 2019 and expected to reach US$ XX Mn by 2019 at a CAGR of 8% during the forecast period. The Global Automotive Selector Lever market report is a comprehensive analysis of the industry, market, and key players. The report has covered the market by demand and supply-side by segments. The Global Automotive Selector Lever report also provides trends by market segments, technology, and investment with a competitive landscape.To know about the Research Methodology :- Request Free Sample Report

Global Automotive Selector Lever Market Overview:

Automotive Selector Lever is an important part of the gearbox transmission mechanism. The selector lever is mainly used in automatic transmission to select the required drive position by the driver. Moreover, selector levers facilitate the driver to adapt to the gear shifting mechanism. Automotive selector levers are made by chrome-plated surface to meet the high standards of automation and requirements. As a selector lever is a component used mainly in the passenger compartment, high standards for safety is needed while manufacturing and installation of the levers. The increasing need to use the space of a car in an efficient way and increasing demand for weight reduction of the engine control mechanism owing to stringent government norms regarding vehicle emission are the key factors considered to drive the automotive selector lever market growth. Furthermore, increasing vehicle sales across the globe has boosted the demand for selector levers in the market exponentially. According to Statistical reports published by Automotive Manufacturers Association (AMA) in 2019, 65.5 million cars were sold in the year in which the passenger cars share accounted for approximately 25 million USD. AMA predicted the worldwide sales to grow at a CAGR of 6.3% owing to increasing manufacturing of vehicles post-pandemic.Global Automotive Selector Lever Market Dynamics:

Increasing demand for compact vehicle designs across the globe and rising demand for ergonomic comfort of drivers are the key factors considered to drive the automotive selector lever market growth. Moreover, the exponential adoption of driver assistance system by the automotive sector owing to the increasing inclination of manufacturers towards drivers’ comfort is the key supporting factor considered to drive the market growth. According to Chalmers Survey on Ergonomic Driver Assistance, approximately 69% of automotive manufacturers for passenger and commercial cars are inclined towards the development of a highly adaptive gear shifting mechanism. Also, electric cars manufacturers are keen on using comfortable gear shifting technology for the drivers. In addition, the increasing need for the safety of the lever shifting mechanism is expected to boost the market during the forecast period. Electric gear shifting mechanism with control knobs is the key factor considered to restrain the automotive selector lever market growth. Furthermore, increasing adoption of drive by wire technology which totally eliminates the lever system and connects the gear shifting mechanism with computers is the factor considered to hamper the market during the forecast period. The highly untapped market of the APAC region and increasing interconnected smart transportation system are the key factors expected to create opportunities in the market.Mechatronic Levers are dominating the Automotive Selector Lever Market:

Increasing demand for augmented electric automation and rising demand for weight reduction of the gear shifting mechanism are the key factors considered to drive the mechatronic levers segment in the market. Furthermore, mechatronics levers have design advantages over simple mechanical levers including adoption in electric cars as well as applications in autonomous vehicles also. Increasing demand for electric vehicles owing to sustainable development imitative taken by governments is the key factor expected to drive the segment growth during the forecast period. According to the research and development cell of AUDI, mechatronics levers is expected to pose many opportunities in the market owing to the design ergonomics of mechatronics levers. According to the Annual report of Audi, the company installs approximately 8 million units of mechatronic levers by far since the adoption of design in the market.Manual Transmission Segment is boosting the Automotive Selector Lever Market Sales:

Many developing economies and manufacturers within it are still preferring manual transmission system in commercial vehicles as well as in passenger cars owing to their low cost and simplicity of mechanism. According to Volkswagen, more than 10 million units of manual transmission mechanism are sold each year owing to the adoption of manual system by luxury cars manufacturers. But, factors including fuel efficiency, ease in shifting of gears and increasing demand in the developed regions are the factors expected to dominate the electronic transmission segment during the forecast period. Moreover, the increasing adoption of electric transmission in electric and autonomous cars is the key supporting factor considered to boost the electric transmission segment during the forecast period.OEM holds the largest share in the Automotive Selector Lever Market:

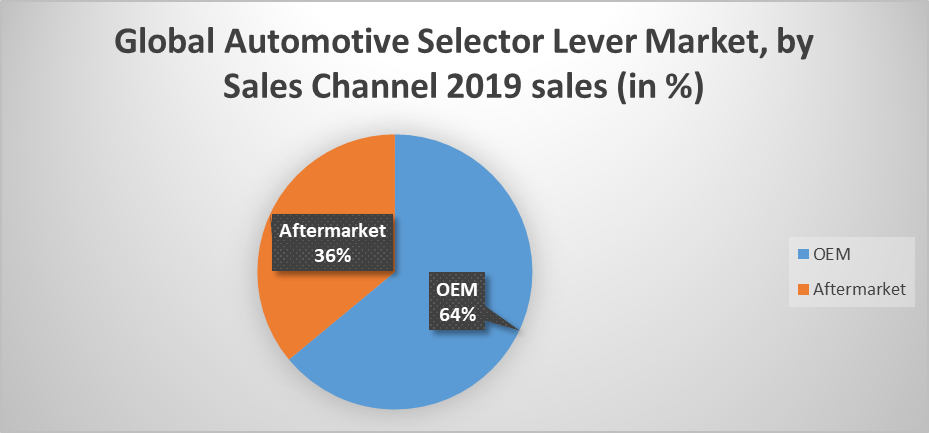

According to Tokai Rika Annual report, the OEM segment holds the largest share in the automotive selector lever market with approximately 64% market share owing to the increasing adoption of shift by wire transmission system for automated manual and dual-clutch transmission system. Easy gear shifting mechanism provided by shift by wire technology is boosting the demand for selector levers and in turn, increases the sales for OEMs on the global level. Moreover, OEMs are inclining towards a less complex mechanism for transmission system including electronic transmission system owing to less complex interlocking patterns in the electronic transmission mechanism which is hampering the selector levers market. The adoption of a miniaturized gear system is boosting the OEM segment in the market and creating a positive environment for the market.

Impact of Covid pandemic on the Automotive Selector Lever market:

The covid pandemic posed a negative impact on the Automotive Selector Lever market owing to delayed manufacturing activities and halting of shipments for Automotive Selector Levers due to disruptions in supply chains for manufacturers across the globe. Moreover, changes in dealer inventories and the sudden closing of manufacturing activities in factories across the globe has induced a drop in the Automotive Selector Lever market. Furthermore, the unavailability of the workforce owing to stringent rules and regulations of social distancing has expected to hamper the market growth by approximately 12%. Steady demand for Automotive Selector Lever and growing manufacturing activities across the automotive industries especially in passenger cars and commercial vehicles segment are the factors expected to create a positive atmosphere in the market. Moreover, manufacturers are also seeing the pandemic as a new way to incorporate their supply chains and integrate their operational demands and dive for cost-cutting Automotive Selector Lever solutions to adhere to the market growth during the forecast period.Global Automotive Selector Lever Market Regional Insights:

Europe holds the major share in the Automotive Selector Lever Market with approximately 53% of the total market share in the year 2019 owing to increasing infrastructure development for the automotive sector in the region due to booming economic growth. Furthermore, increasing consumer preferences towards the latest technologies is the key supporting factor considered to drive the market growth. Germany is the dominating market in the region in terms of volume share of approximately 68% as Germany is the largest industrial components manufacturer across the globe owing to the abundance of manufacturing infrastructure and high transportation capabilities across the market. The UK is expected to pose a relatively high share in the market as many key players in the market are investing dominantly in the region. For instance, Kongsberg Automotive has installed a plant for selector levers in the year 2015 which is producing approximately 5-6 million units per year. The Asia Pacific is the fastest-growing region in the Automotive Selector Lever Market with approximately 34% market share. Factors attributing growth in the market are the abundance of domestic manufacturers of Automotive Selector Lever in the region. China holds the largest market share of approximately 49% along with India and Japan owing to established infrastructure for automotive components manufacturing and increasing disposable income of consumers. North America holds the dominant share in the market owing to highly increasing transportation capabilities in the region and increasing sales of passenger and commercial vehicles in the region. According to Hyundai, more than 18 million cars have been sold in the year 2019 in the North American region owing to the increasing popularity of premium vehicles and dominance of luxury cars over the regional market. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global Automotive Selector Lever Market dynamics, structure by analyzing the market segments and project the Global Automotive Selector Lever Market size. Clear representation of competitive analysis of key players by Type, price, financial position, Type portfolio, growth strategies, and regional presence in the Global Automotive Selector Lever Market make the report investor’s guideGlobal Automotive Selector Lever Market Scope: Inquire before buying

Global Automotive Selector Lever Market, by Region

• North America o US o Canada o Mexico • Europe o U.K o France o Germany o Italy o Spain o Sweden o CIS Countries o Rest of Europe • Asia Pacific o China o India o Japan o South Korea o Australia o ASEAN o Rest of Asia Pacific • Middle East and Africa o South Africa o GCC Countries o Egypt o Nigeria o Rest of ME&A • South America o Brazil o Argentina o Rest of South AmericaGlobal Automotive Selector Lever Market Key Players

• Ficosa International SA • Kongsberg Automotive • SELZER Fertigungstechnik GmbH& Co. KG • TOKAIRIKA Co. Ltd. • Fuji Kiko Co. Ltd. • Aisin Seiki • ZF Steering Gear Co. Ltd. • CIE Automotive • Audi AG • Ford Motor Co. • Astra Automotive • TVS Motor Co. Ltd. • Mahindra Sona Ltd. • SL Corporation • Xian Sanming • BMW Automobiles • Jaguar Land Rover Ltd. • Sapura Group of companies

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Automotive Selector Lever Market Type , by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Automotive Selector Lever Market 3.4. Geographical Snapshot of the Automotive Selector Lever Market, By Manufacturer share 4. Global Automotive Selector Lever Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Lever Type s 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Automotive Selector Lever Market 5. Supply Side and Demand Side Indicators 6. Global Automotive Selector Lever Market Analysis and Forecast, 2019-2026 6.1. Global Automotive Selector Lever Market Size & Y-o-Y Growth Analysis. 7. Global Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 7.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 7.1.1. Mechatronic Levers 7.1.2. Mono Stable Levers 7.1.3. Others 7.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 7.2.1. Automatic 7.2.2. Manual 7.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 7.3.1. Welding 7.3.2. Milling 7.3.3. Fine Blanking 7.3.4. Broaching 7.3.5. Extrusion 7.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 7.4.1. OEM 7.4.2. Aftermarket 8. Global Automotive Selector Lever Market Analysis and Forecasts, By Region 8.1. Market Lever Type(Value) Estimates & Forecast By Region, 2019-2026 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 9.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 9.1.1. Mechatronic Levers 9.1.2. Mono Stable Levers 9.1.3. Others 9.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 9.2.1. Automatic 9.2.2. Manual 9.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 9.3.1. Welding 9.3.2. Milling 9.3.3. Fine Blanking 9.3.4. Broaching 9.3.5. Extrusion 9.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 9.4.1. OEM 9.4.2. Aftermarket 10. North America Automotive Selector Lever Market Analysis and Forecasts, By Country 10.1. Market Type (Value) Estimates & Forecast By Country, 2019-2026 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 11.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 11.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 11.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 11.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 12. Canada Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 12.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 12.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 12.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 12.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 13. Mexico Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 13.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 13.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 13.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 13.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 14. Europe Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 14.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 14.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 14.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 14.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 15. Europe Automotive Selector Lever Market Analysis and Forecasts, By Country 15.1. Market Type (Value) Estimates & Forecast By Country, 2019-2026 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 16.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 16.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 16.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 16.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 17. France Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 17.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 17.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 17.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 17.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 18. Germany Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 18.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 18.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 18.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 18.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 19. Italy Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 19.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 19.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 19.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 19.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 20. Spain Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 20.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 20.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 20.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 20.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 21. Sweden Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 21.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 21.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 21.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 21.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 22. CIS Countries Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 22.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 22.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 22.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 22.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 23. Rest of Europe Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 23.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 23.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 23.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 23.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 24. Asia Pacific Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 24.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 24.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 24.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 24.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 25. Asia Pacific Automotive Selector Lever Market Analysis and Forecasts, by Country 25.1. Market Type (Value) Estimates & Forecast By Country, 2019-2026 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 26.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 26.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 26.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 26.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 27. India Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 27.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 27.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 27.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 27.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 28. Japan Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 28.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 28.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 28.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 28.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 29. South Korea Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 29.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 29.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 29.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 29.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 30. Australia Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 30.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 30.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 30.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 30.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 31. ASEAN Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 31.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 31.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 31.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 31.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 32. Rest of Asia Pacific Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 32.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 32.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 32.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 32.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 33. Middle East Africa Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 33.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 33.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 33.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 33.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 34. Middle East Africa Automotive Selector Lever Market Analysis and Forecasts, by Country 34.1. Market Type (Value) Estimates & Forecast by Country, 2019-2026 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 35.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 35.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 35.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 35.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 36. GCC Countries Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 36.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 36.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 36.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 36.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 37. Egypt Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 37.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 37.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 37.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 37.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 38. Nigeria Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 38.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 38.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 38.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 38.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 39. Rest of ME&A Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 39.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 39.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 39.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 39.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 40. South America Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 40.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 40.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 40.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 40.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 41. South America Automotive Selector Lever Market Analysis and Forecasts, by Country 41.1. Market Type (Value) Estimates & Forecast by Country, 2019-2026 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 42.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 42.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 42.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 42.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 43. Argentina Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 43.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 43.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 43.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 43.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 44. Rest of South America Automotive Selector Lever Market Analysis and Forecasts, 2019-2026 44.1. Market Type (Value) Estimates & Forecast By Lever Type , 2019-2026 44.2. Market Type (Value) Estimates & Forecast By Transmission, 2019-2026 44.3. Market Type (Value) Estimates & Forecast By Manufacturing Technology, 2019-2026 44.4. Market Type (Value) Estimates & Forecast By Sales Channel, 2019-2026 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Automotive Selector Lever Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1. Ficosa International SA 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Kongsberg Automotive 45.3.3. SELZER Fertigungstechnik GmbH& Co. KG 45.3.4. TOKAIRIKA Co. Ltd. 45.3.5. Fuji Kiko Co. Ltd. 45.3.6. Aisin Seiki 45.3.7. ZF Steering Gear Co. Ltd. 45.3.8. CIE Automotive 45.3.9. Audi AG 45.3.10. Ford Motor Co. 45.3.11. Astra Automotive 45.3.12. TVS Motor Co. Ltd. 45.3.13. Mahindra Sona Ltd. 45.3.14. SL Corporation 45.3.15. Xian Sanming 45.3.16. BMW Automobiles 45.3.17. Jaguar Land Rover Ltd. 45.3.18. Sapura Group of companies 46. Primary Key Insights