Global Automotive Glass Market size was valued at USD 24.27 Bn in 2023 and is expected to reach USD 35.31 Bn by 2030, at a CAGR of 5.5 %.Overview

The glass that is used in automobiles is broadly termed automotive glass. It is a kind of processed float glass that undergoes heating and chemical treatments. Through this toughening process, the glass becomes sturdier and stronger to handle stress from external factors. Automotive glass also be processed to include other beneficial properties like protection against harmful infrared rays, prevention of excessive heating in the car, and reduction of noise. The Automotive Glass Market is driven by factors such as the increased use of laminated glass, rise in demand for lighter-weight glass, and safety standards implemented by various governments concerning occupant crash protection.To know about the Research Methodology:-Request Free Sample Report

Automotive Glass Market Dynamics

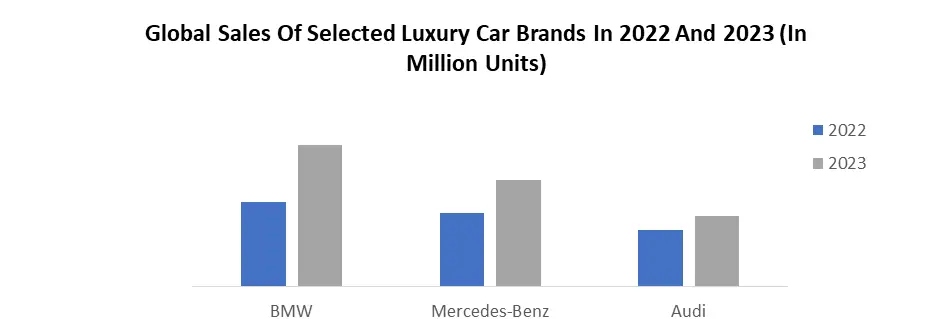

Growing Demand for Electric and Hybrid Vehicles to Drive the Market The manufacture of hybrid and electric vehicles is advancing due to a focus on pollution control and strict environmental restrictions, which is encouraging Automotive Glass Market growth. To comply with government regulations, consumers and manufacturers are forecasted to seek more environmentally friendly automobiles, putting a value on hybrid and electric vehicles, which are driving the market. In US the EV sales skyrocketed 81% in the latest month, while hybrid sales were up 32%. However, the vast majority of Ford's sales nearly 90% continued to be from traditional internal combustion engine vehicles. Hybrid vehicles continue to be a growth segment for Ford and sales have grown at a faster rate than the overall U.S. industry for much of the last year. Global EV sales continued as expected by us at the beginning of 2023. A total of 14,2 million new Battery Electric Vehicles (BEV) and Plug-in Hybrids (PHEV) were delivered during 2023, an increase of +35 %. 10 million were pure electric BEVs and 4,2 million were Plug-in Hybrids (PHEV) and Range Extender EVs (EREV). China is, by far, the largest EV market with 8,4 million units in 2023 and 59 % of global EV sales. With 9,3 million EVs made, China's role as the largest EV production base is even stronger: 65 % of global EV sales in 2023 came out of China. 900 000 EVs were exported from China, most of them (530k) by Western brands. The largest exporters were Tesla, SAIC (MG, Maxus), Geely (Volvo, Polestar, Lynk, Smart) BYD, Renault (Dacia), BMW and Great Wall. All others exported below 20 000 units each. Smart glass is regarded as the car Market's future. Smart glass is being researched to improve and make it useful in popular automobiles. This might be utilized to provide a head-up display in vehicles, similar to the glass cockpit of a helicopter. This would make access to all controls more convenient while also improving the vehicle's ambiance. Over the forecast period, the adoption of smart glass is expected to raise the value of the automotive glass market. Rising use of sunroof glass in high-end vehicles, rising glass adoption, development of new iterations of glass design, technological advances in the auto market, consumers' high living standards, increasing urbanization and industrialization, worldwide economic growth, and increased production of electric cars are all contributing to global market growth. The U.S. car ownership landscape reflects a robust market, with 278,063,737 vehicles registered in 2021, showcasing a 3.66% increase since 2017. Also, 91.7% of households owned at least one vehicle, and trucks dominated with 166,079,082 registrations compared to 101,601,344 cars. The Ford F-Series led sales in 2022-23. Geographically, Idaho and Wyoming boasted the highest car ownership rates at 96.2%, while the District of Columbia had the lowest at 64.3%. The U.S. observed a 5.7% decrease in households without vehicles from 2018 to 2022, emphasizing the growing importance of car ownership. In terms of electric vehicles, California led with 1.61% of total registered vehicles, showcasing a broader shift towards sustainable transportation. Car ownership costs, including gas, repairs, insurance, and monthly payments, averaged $10,728 annually, up 10.99% from 2021.Government Imposes Strict Safety Regulations to Promote Market Growth: The Automotive Glass Market growth of cost-effective glass for vehicles has been driven by the stabilization of prices of Glass such as soda ash, lime, oxides of magnesium, potassium, and aluminum, as well as increasing gasoline prices. The market is growing due to rising demand for cars in the transportation and logistics market, as well as a focus on enhancing vehicle aerodynamics due to safety standards. Also, the expansion of this market is being fueled by an increase in the sale of crossovers and SUVs, as well as increased disposable income, particularly in developing countries. For instance, The Infrastructure Investment and Jobs Act, signed into law in November 2021, allocated $7.5 billion to building out a nationwide charging network. The funding has initially focused on installing fast chargers along the interstate highway system, which would help mitigate battery range fears and enable long-distance travel. The legislation also included large investments to upgrade the nation’s power grid key for accommodating rising electricity demand as EV adoption grows—and to expand domestic battery production and recycling capacity. On the consumer side, tax credits spur demand. For instance, the Inflation Reduction Act, signed into law in August 2022, extended a tax credit of up to $7,500 for the purchase of new EVs until 2032 and provided, for the first time, that tax credits could be used for purchasing used EVs. State government policies also offer incentives, such as rebates, to encourage EV ownership by helping offset the high upfront costs of EVs. Several states have also implemented a zero-emission vehicle (ZEV) program, which requires auto manufacturers to sell a set quota of battery-electric or plug-in hybrid-electric vehicles, and have passed laws that ban the sale of new gas-powered vehicles by 2035. Such government policies drive the demand for electric vehicles and drive the automotive glass market growth. Requirement of High Costs and Large Capital Investment to Restrain the Market Growth Automotive glass is significantly more expensive than tempered glass, and poor adoption in developing nations limits its use. In contrast, R&D and the production of thin laminated glass for side windows have a high capital cost. This investment, combined with a focus on lowering production costs and the cost burden on consumers, is expected to limit the Automotive Glass Market growth. For instance, R&D, including new material discovery, novel technological approaches, as well as applied engineering, is key to addressing many of the performance and cost challenges faced by the industry to produce highly efficient affordable windows that can achieve mainstream market acceptance. These technologies are generally expected to offer significant energy savings compared to the current cost-effective technology, but they also have other energy and nonenergy benefits reduced peak load, time-shifted envelope-related thermal loads to match distributed renewable generation availability, reduced glare, increased thermal comfort, and improved occupant satisfaction and productivity. High-performance windows are crucial to achieving low-energy buildings. Modifications to the frame, advanced glazing packages, and subcomponents are essential to achieving window performance that surpasses Energy Star performance by more than three times. These all factors require a high initial amount and this is expected to hinder the automotive glass market growth. Increasing Demand for Luxury Cars to Provide Attractive Options and Create Lucrative Opportunity for Market Growth Luxury car sales in India reached a record high of 42,731 units in 2023, marking a 20% YoY increase. Carmakers attribute the surge to post-Covid lifestyle changes, with younger professionals opting for high-end cars. This trend is expected to continue due to rising disposable incomes. The best-ever sales in the Indian market last year and outlined plans to launch a dozen vehicles, including electric ones, in 2024. BMW, with over 50% market share, anticipates double-digit growth in 2024. Experts suggest the shift to electric vehicles will further boost luxury car sales, driven by strong payouts, corporate earnings, and economic recovery. India's luxury car market is transitioning from explosive growth to sustained, quality-driven expansion, with a positive long-term outlook based on evolving consumer preferences and strong fundamentals. Thus, growing demand for luxury cars or vehicles is expected to drive the Automotive Glass Market growth over the forecast period. In the next few days, the growing demand for luxury cars is set to provide market participants with numerous chances. The desire for luxury automobiles is expected to increase the need for automotive glass. To increase safety and the overall appearance of luxury vehicles, expensive automotive glass is employed.

Automotive Glass Market Segment Analysis

By Glass Type Based on the glass type, the laminated segment held the largest Automotive Glass Market share in 2023. Its large share is attributed to factors including low cost, high strength, and robustness. The glass type has a strength that is 4-5 times greater than a basic float and is more cost-effective than laminated automotive glass. As a result, it is the most preferred type of glass in automotive, particularly for windows and backlights. The structure consists of a PVB layer sandwiched between two glass layers. It mainly finds application in windscreens owing to safety characteristics that allow it to stay intact even after accidents occur, which prevents the passengers in the vehicle from getting hurt or injured. It is preferred for sunroofs as well, which is expected to drive segment growth. Companies such as Volvo, Ferrari, and Tesla use laminated glass in all their cars that have panoramic sunroofs. By Vehicle: Passenger cars surpassed trucks as the most popular vehicle type in 2023 and are expected to grow at a CAGR of 4.3% in terms of sales over the forecasted period. This is due to a variety of factors, including shifting consumer preferences, a growing middle-class population, and growing environmental concerns about the use of low-emission and lightweight vehicles on the road. Over the forecast period, the passenger car category is expected to dominate the market. Increased passenger car sales in China and India are expected to propel this category forward. Because of the expanding popularity of crossover SUVs and the high need for intra-city trucks and buses, the LCV segment is expected to rise steadily in the market. Because of the early adoption of technology such as head-up displays and smart glass for the panoramic sunroof, the EV segment is expected to rise significantly in this market. By Application Based on application, the Windshield segment held the largest market share in 2023. Windscreen carries significant importance in a vehicle structure, this both automotive and glass manufacturers are engaged in developing new technologies for enhancing its appearance and features. For instance, the introduction of new types of windshields with self-cleaning glass is anticipated to drive segment growth over the forecast period.Automotive Glass Market Regional Insight

The Asia-Pacific region held the largest Automotive Glass Market share accounting for XX % in 2023. The Asia-Pacific region is expected to witness significant growth at a CAGR of 7.2% through the forecast period. China and India are the two most important countries in this region for market growth. Vehicle production has increased as a result of improving economic conditions and rapid population growth. This has raised the demand for the product, and consumer preference for SUVs in China and India, which require greater glass volume than other vehicles, is expected to fuel market growth in this region. Europe has the second-largest share of the Automotive Glass Market and is expected to increase at a substantial rate over the forecast period. Strict car safety standards, the presence of prominent innovators like Saint-Gobain Sekurit, and the growing number of electric vehicles are all contributing to the region's market growth. North America Automotive Glass Market is expected to advance at a CAGR of 3.4% during the forecast period. The region has been witnessing a significant increase in the sale of commercial vehicles, which is anticipated to play a major role in propelling the demand for automotive glass in the coming years. Value-added features such as solar control, de-icing & de-misting, integrated antennas, and integrated rain and light sensors for automatic wiper or headlight activation, are being included by manufacturers to offer differentiated products and drive profit.Automotive Glass Market Scope: Inquire before buying

Global Automotive Glass Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 24.27 Bn. Forecast Period 2024 to 2030 CAGR: 5.5% Market Size in 2030: US $ 35.31 Bn. Segments Covered: by Glass Type Laminated Tempered by Vehicle Passenger Car Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles by Application Windshield Sidelite Backlite Sunroof Others Automotive Glass Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Automotive Glass Key players

North America 1. PPG Industries - (USA) 2. Corning - (USA) 3. Gentex Corporation - (USA) 4. LKQ Corporation - (USA) 5. Magna International Inc. - (Canada) 6. Vitro, S.A.B. de C.V. - (Mexico) 7. Guardian Industries Corporation - (USA) Asia Pacific 8. Asahi Glass Co., Ltd. - (Japan) 9. Fuyao Glass Market Group Co., Ltd. - (China) 10. Nippon Sheet Glass Co., Ltd. - (Japan) 11. Xinyi Glass Holdings Ltd. - (China) 12. Samvardhana Motherson - (India) 13. Shenzhen Benson Automobile Glass Co., Ltd. - (China) 14. Central Glass Co., Ltd. - (Japan) 15. AGC Ltd. - (Japan) 16. NSG Group - (Japan) Europe 17. Webasto - (Germany) 18. Pilkington Glass - (United Kingdom) 19. Glas Trösch Holding AG - (Switzerland) 20. Saint-Gobain S.A. - (France) Frequently Asked Questions: 1] What is the growth rate of the Global Automotive Glass Market? Ans. The Global Automotive Glass Market is growing at a significant rate of 5.5 % during the forecast period. 2] Which region is expected to dominate the Global Automotive Glass Market? Ans. APAC is expected to dominate the Automotive Glass Market during the forecast period. 3] What is the expected Global Automotive Glass Market size by 2030? Ans. The Automotive Glass Market size is expected to reach USD 35.31 Bn by 2030. 4] Which are the top players in the Global Automotive Glass Market? Ans. The major top players in the Global Automotive Glass Market are PPG Industries, Corning and others. 5] What are the factors driving the Global Automotive Glass Market growth? Ans. The consumer disposable income growth and rise in demand for luxury and passenger vehicles are the primary drivers of the Automotive Glass Market. 6] Which country held the largest Global Automotive Glass Market share in 2023? Ans. Japan held the largest Automotive Glass Market share in 2023.

1. Automotive Glass Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Glass Market: Dynamics 2.1. Automotive Glass Market Trends by Region 2.1.1. North America Automotive Glass Market Trends 2.1.2. Europe Automotive Glass Market Trends 2.1.3. Asia Pacific Automotive Glass Market Trends 2.1.4. Middle East and Africa Automotive Glass Market Trends 2.1.5. South America Automotive Glass Market Trends 2.2. Automotive Glass Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive Glass Market Drivers 2.2.1.2. North America Automotive Glass Market Restraints 2.2.1.3. North America Automotive Glass Market Opportunities 2.2.1.4. North America Automotive Glass Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive Glass Market Drivers 2.2.2.2. Europe Automotive Glass Market Restraints 2.2.2.3. Europe Automotive Glass Market Opportunities 2.2.2.4. Europe Automotive Glass Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive Glass Market Drivers 2.2.3.2. Asia Pacific Automotive Glass Market Restraints 2.2.3.3. Asia Pacific Automotive Glass Market Opportunities 2.2.3.4. Asia Pacific Automotive Glass Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive Glass Market Drivers 2.2.4.2. Middle East and Africa Automotive Glass Market Restraints 2.2.4.3. Middle East and Africa Automotive Glass Market Opportunities 2.2.4.4. Middle East and Africa Automotive Glass Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive Glass Market Drivers 2.2.5.2. South America Automotive Glass Market Restraints 2.2.5.3. South America Automotive Glass Market Opportunities 2.2.5.4. South America Automotive Glass Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Automotive Glass Industry 2.8. Analysis of Government Schemes and Initiatives For Automotive Glass Industry 2.9. Automotive Glass Market Trade Analysis 2.10. The Global Pandemic Impact on Automotive Glass Market 3. Automotive Glass Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 3.1.1. Laminated 3.1.2. Tempered 3.2. Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 3.2.1. Passenger Car 3.2.2. Light Commercial Vehicles 3.2.3. Heavy Commercial Vehicles 3.2.4. Electric Vehicles 3.3. Automotive Glass Market Size and Forecast, by Application (2023-2030) 3.3.1. Windshield 3.3.2. Sidelite 3.3.3. Backlite 3.3.4. Sunroof 3.3.5. Others 3.4. Automotive Glass Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Automotive Glass Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 4.1.1. Laminated 4.1.2. Tempered 4.2. North America Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 4.2.1. Passenger Car 4.2.2. Light Commercial Vehicles 4.2.3. Heavy Commercial Vehicles 4.2.4. Electric Vehicles 4.3. North America Automotive Glass Market Size and Forecast, by Application (2023-2030) 4.3.1. Windshield 4.3.2. Sidelite 4.3.3. Backlite 4.3.4. Sunroof 4.3.5. Others 4.4. North America Automotive Glass Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 4.4.1.1.1. Laminated 4.4.1.1.2. Tempered 4.4.1.2. United States Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 4.4.1.2.1. Passenger Car 4.4.1.2.2. Light Commercial Vehicles 4.4.1.2.3. Heavy Commercial Vehicles 4.4.1.2.4. Electric Vehicles 4.4.1.3. United States Automotive Glass Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Windshield 4.4.1.3.2. Sidelite 4.4.1.3.3. Backlite 4.4.1.3.4. Sunroof 4.4.1.3.5. Others 4.4.2. Canada 4.4.2.1. Canada Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 4.4.2.1.1. Laminated 4.4.2.1.2. Tempered 4.4.2.2. Canada Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 4.4.2.2.1. Passenger Car 4.4.2.2.2. Light Commercial Vehicles 4.4.2.2.3. Heavy Commercial Vehicles 4.4.2.2.4. Electric Vehicles 4.4.2.3. Canada Automotive Glass Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Windshield 4.4.2.3.2. Sidelite 4.4.2.3.3. Backlite 4.4.2.3.4. Sunroof 4.4.2.3.5. Others 4.4.3. Mexico 4.4.3.1. Mexico Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 4.4.3.1.1. Laminated 4.4.3.1.2. Tempered 4.4.3.2. Mexico Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 4.4.3.2.1. Passenger Car 4.4.3.2.2. Light Commercial Vehicles 4.4.3.2.3. Heavy Commercial Vehicles 4.4.3.2.4. Electric Vehicles 4.4.3.3. Mexico Automotive Glass Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Windshield 4.4.3.3.2. Sidelite 4.4.3.3.3. Backlite 4.4.3.3.4. Sunroof 4.4.3.3.5. Others 5. Europe Automotive Glass Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 5.2. Europe Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 5.3. Europe Automotive Glass Market Size and Forecast, by Application (2023-2030) 5.4. Europe Automotive Glass Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 5.4.1.2. United Kingdom Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 5.4.1.3. United Kingdom Automotive Glass Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 5.4.2.2. France Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 5.4.2.3. France Automotive Glass Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 5.4.3.2. Germany Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 5.4.3.3. Germany Automotive Glass Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 5.4.4.2. Italy Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 5.4.4.3. Italy Automotive Glass Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 5.4.5.2. Spain Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 5.4.5.3. Spain Automotive Glass Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 5.4.6.2. Sweden Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 5.4.6.3. Sweden Automotive Glass Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 5.4.7.2. Austria Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 5.4.7.3. Austria Automotive Glass Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 5.4.8.2. Rest of Europe Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 5.4.8.3. Rest of Europe Automotive Glass Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Automotive Glass Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.2. Asia Pacific Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.3. Asia Pacific Automotive Glass Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Automotive Glass Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.4.1.2. China Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.4.1.3. China Automotive Glass Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.4.2.2. S Korea Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.4.2.3. S Korea Automotive Glass Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.4.3.2. Japan Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.4.3.3. Japan Automotive Glass Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.4.4.2. India Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.4.4.3. India Automotive Glass Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.4.5.2. Australia Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.4.5.3. Australia Automotive Glass Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.4.6.2. Indonesia Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.4.6.3. Indonesia Automotive Glass Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.4.7.2. Malaysia Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.4.7.3. Malaysia Automotive Glass Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.4.8.2. Vietnam Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.4.8.3. Vietnam Automotive Glass Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.4.9.2. Taiwan Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.4.9.3. Taiwan Automotive Glass Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 6.4.10.3. Rest of Asia Pacific Automotive Glass Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Automotive Glass Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 7.2. Middle East and Africa Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 7.3. Middle East and Africa Automotive Glass Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Automotive Glass Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 7.4.1.2. South Africa Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 7.4.1.3. South Africa Automotive Glass Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 7.4.2.2. GCC Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 7.4.2.3. GCC Automotive Glass Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 7.4.3.2. Nigeria Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 7.4.3.3. Nigeria Automotive Glass Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 7.4.4.2. Rest of ME&A Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 7.4.4.3. Rest of ME&A Automotive Glass Market Size and Forecast, by Application (2023-2030) 8. South America Automotive Glass Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 8.2. South America Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 8.3. South America Automotive Glass Market Size and Forecast, by Application(2023-2030) 8.4. South America Automotive Glass Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 8.4.1.2. Brazil Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 8.4.1.3. Brazil Automotive Glass Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 8.4.2.2. Argentina Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 8.4.2.3. Argentina Automotive Glass Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Automotive Glass Market Size and Forecast, by Glass Type (2023-2030) 8.4.3.2. Rest Of South America Automotive Glass Market Size and Forecast, by Vehicle (2023-2030) 8.4.3.3. Rest Of South America Automotive Glass Market Size and Forecast, by Application (2023-2030) 9. Global Automotive Glass Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Automotive Glass Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. PPG Industries - (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Corning - (USA) 10.3. Gentex Corporation - (USA) 10.4. LKQ Corporation - (USA) 10.5. Magna International Inc. - (Canada) 10.6. Vitro, S.A.B. de C.V. - (Mexico) 10.7. Guardian Industries Corporation - (USA) 10.8. Asahi Glass Co., Ltd. - (Japan) 10.9. Fuyao Glass Market Group Co., Ltd. - (China) 10.10. Nippon Sheet Glass Co., Ltd. - (Japan) 10.11. Xinyi Glass Holdings Ltd. - (China) 10.12. Samvardhana Motherson - (India) 10.13. Shenzhen Benson Automobile Glass Co., Ltd. - (China) 10.14. Central Glass Co., Ltd. - (Japan) 10.15. AGC Ltd. - (Japan) 10.16. NSG Group - (Japan) 10.17. Webasto - (Germany) 10.18. Pilkington Glass - (United Kingdom) 10.19. Glas Trösch Holding AG - (Switzerland) 10.20. Saint-Gobain S.A. - (France) 11. Key Findings 12. Industry Recommendations 13. Automotive Glass Market: Research Methodology 14. Terms and Glossary