The Automotive Ethernet Market size was USD 3.4 Billion in 2023 and is predicted to grow with a CAGR of 22.2% by generating a revenue of USD 13.83 Billion by 2030.Automotive Ethernet Market Overview:

Automotive Ethernet is a high-speed networking technology used in vehicles to transmit data between various electronic components and systems. It leverages Ethernet protocols to provide reliable communication, offering faster data transfer rates, lower latency, and improved bandwidth compared to traditional automotive communication buses like CAN and LIN. This technology enables advanced driver assistance systems (ADAS), infotainment systems, vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, and autonomous driving functionalities. With Automotive Ethernet, vehicles can handle the increasing complexity of electronic systems and support the integration of emerging technologies, enhancing safety, efficiency, and connectivity on the road. The automotive Ethernet market is experiencing significant growth driven by the increasing adoption of Ethernet technology in modern vehicles. As automobiles become more connected and autonomous, Ethernet has emerged as a robust networking solution capable of meeting the high bandwidth and reliability requirements of advanced automotive applications. Ethernet facilitates communication between various electronic control units (ECUs) and in-vehicle systems, enabling features such as advanced driver assistance systems (ADAS), infotainment systems, telematics, and autonomous driving functionalities. This technology offers advantages such as faster data transmission, reduced latency, and scalability, making it well-suited for the complex and data-intensive requirements of next-generation vehicles. Key players in the market, such as Broadcom Inc., Marvell Technology Group Ltd., and NXP Semiconductors N.V., are driving innovation through the development of Ethernet controllers, switches, and PHYs optimized for automotive applications. Recent advancements include the introduction of multi-gigabit Ethernet solutions, enhanced security features, and support for emerging automotive standards like Automotive Ethernet PHY (AEP) and Time-Sensitive Networking (TSN). With the increasing demand for connected and autonomous vehicles, the automotive Ethernet market is expected to witness continued growth, fuelled by the ongoing digitalization and electrification trends in the automotive industry.To know about the Research Methodology :- Request Free Sample Report

Automotive Ethernet Market Dynamics:

Enhancing Road Safety with V2X Communication is driving the Automotive Ethernet Market The rising demand for connected vehicles by advancements in technology and consumer preferences for enhanced connectivity features. Ethernet technology enables high-speed data transmission within vehicles, supporting a wide range of applications such as infotainment systems, vehicle-to-everything (V2X) communication, and over-the-air (OTA) updates. This connectivity empowers drivers and passengers with access to real-time information, entertainment options, and advanced driver assistance features, enhancing the overall driving experience.The increasing complexity of in-vehicle electronics necessitates robust communication networks capable of handling large volumes of data efficiently. As vehicles become more sophisticated with the integration of advanced driver assistance systems (ADAS) and autonomous driving technologies, Ethernet provides the bandwidth and reliability required for seamless communication between various electronic control units (ECUs), sensors, and actuators. This enables functionalities such as lane-keeping assistance, adaptive cruise control, and collision avoidance systems, contributing to improved vehicle safety and performance. Another significant driver of growth in the automotive Ethernet market is the demand for enhanced infotainment systems. Consumers expect modern vehicles to offer advanced multimedia capabilities, navigation services, and smartphone integration. Ethernet technology facilitates the delivery of high-quality multimedia content, enabling smooth streaming of music, videos, and other entertainment options. Additionally, Ethernet-based infotainment systems support advanced features such as voice recognition, gesture control, and integration with mobile devices, enhancing the overall convenience and connectivity of the vehicle interior.

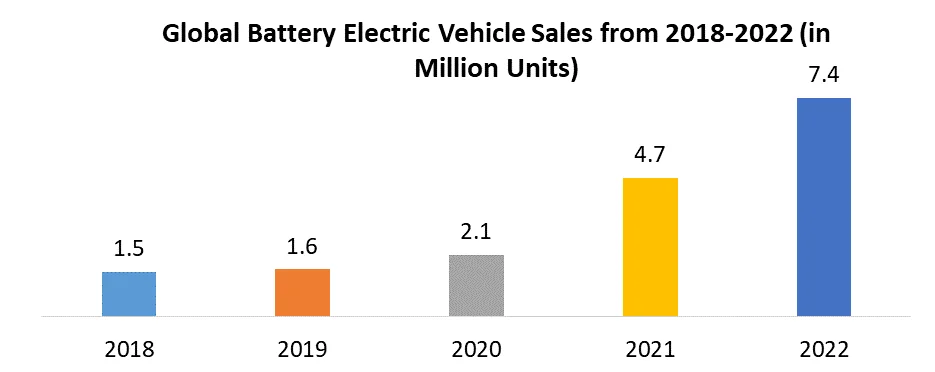

The transition to electric and hybrid vehicles also contributes to the growth of the automotive Ethernet market. Electric vehicles (EVs) and hybrid electric vehicles (HEVs) rely on sophisticated powertrain systems and battery management functions, which require efficient communication networks for optimal performance. Ethernet solutions with low-power consumption and high reliability are essential for managing power distribution, battery charging, and vehicle monitoring in electric and hybrid vehicles, supporting the industry's shift towards electrification and sustainability. Furthermore, the adoption of vehicle-to-everything (V2X) communication technologies is driving demand for automotive Ethernet solutions. V2X communication enables vehicles to communicate with each other, as well as with roadside infrastructure and other connected devices, facilitating cooperative driving and enhancing road safety. Ethernet-based V2X systems enable secure and reliable data exchange in connected vehicle ecosystems, supporting applications such as collision avoidance, traffic management, and emergency vehicle notification, thereby reducing accidents and congestion on roadways. Compliance with automotive industry standards such as Automotive Ethernet PHY (AEP) and Time-Sensitive Networking (TSN) is driving the development of Ethernet solutions tailored for automotive applications. Manufacturers such as Renesas Electronics ensure their Ethernet controllers and switches comply with industry standards, ensuring interoperability and compatibility with other automotive systems and components. This adherence to standards promotes ecosystem integration and facilitates the deployment of Ethernet-based solutions across a wide range of vehicles and platforms. Investments in research and development (R&D) are also fueling innovation in the automotive Ethernet market. Key players like STMicroelectronics collaborate with automotive manufacturers and industry partners to develop next-generation Ethernet solutions with improved performance, reliability, and security features. These investments drive technological advancements, enabling Ethernet technology to address the evolving connectivity requirements of modern vehicles and support the industry's ongoing digital transformation.

Increasing Service and Maintenance Costs for Vehicle Manufacturers is Restraining the Market Growth The significant constraint is the cost associated with implementing Ethernet solutions, particularly for manufacturers targeting budget-conscious vehicle segments. Integrating Ethernet technology into entry-level or economy vehicles can substantially increase production costs, limiting its adoption and market penetration in these segments. Compatibility issues also pose challenges, as the coexistence of multiple communication protocols within vehicles, such as Controller Area Network (CAN) and Local Interconnect Network (LIN), may lead to functionality conflicts and system malfunctions. Furthermore, ensuring compatibility between Ethernet-based systems and legacy communication protocols requires careful integration and interoperability testing. Data security concerns are another major challenge, with the increasing connectivity of vehicles exposing them to cybersecurity threats. Hackers exploit vulnerabilities in Ethernet networks to gain unauthorized access to vehicle systems, compromising safety and privacy. Manufacturers must implement robust security measures, such as encryption and intrusion detection systems, to safeguard against cyber threats and protect sensitive vehicle data. By 2023 there will be over 85 million new cars sold worldwide.

Electromagnetic interference (EMI) and electromagnetic compatibility (EMC) issues also present challenges for automotive Ethernet deployment. EMI from onboard electronics and external sources can degrade Ethernet signal quality, leading to communication errors and system instability. Addressing EMC challenges requires implementing shielding techniques, ground isolation, and signal filtering to ensure reliable Ethernet communication in the presence of electromagnetic disturbances. Additionally, the complexity of managing in-vehicle networks with multiple electronic control units (ECUs) interconnected via Ethernet poses challenges for network diagnostics and troubleshooting. Ensuring network reliability and identifying the root causes of communication failures require specialized skills and diagnostic tools, increasing service and maintenance costs for vehicle manufacturers and service providers. These challenges highlight the need for ongoing innovation and collaboration within the automotive Ethernet ecosystem to address technical, regulatory, and market challenges and accelerate the adoption of Ethernet technology in modern vehicles.

Year Worldwide China US Japan Europe 2005 65378605 57,58,189 17444329 58,52,034 21069257 2006 67934506 72,15,972 17048981 57,39,520 21851445 2007 71153079 87,91,528 16460315 53,09,200 22994011 2008 68032740 93,80,502 13493165 50,82,233 21859239 2009 65382664 13644794 10601368 46,09,333 18637363 2010 74662939 18061936 11772219 49,56,148 18798802 2011 78078513 18505114 13040613 42,10,224 19730242 2012 82059897 19306435 14785936 53,69,721 18658263

Automotive Ethernet Market Segment Analysis:

Based on Component, the market is divided into hardware, software, and services. Among these hardware segment hold major share in the Automotive Ethernet Market in 2023. The hardware segment of the Automotive Ethernet market plays a crucial role in revolutionizing the automotive industry by providing robust networking solutions tailored to the complex communication requirements of modern vehicles. Industrially, Automotive Ethernet hardware encompasses a range of components such as switches, controllers, connectors, cables, and transceivers, engineered to facilitate high-speed data transmission and reliable connectivity within automotive networks. Implementation of Automotive Ethernet hardware involves the integration of Ethernet-based communication systems into various vehicle components and subsystems. Key players in the automotive ecosystem, including OEMs (Original Equipment Manufacturers) and Tier-1 suppliers, collaborate with semiconductor manufacturers and networking specialists to design and deploy Ethernet-enabled hardware solutions across different automotive platforms. One of the key benefits of Automotive Ethernet hardware is its ability to support high-bandwidth communication, enabling seamless connectivity between diverse vehicle systems and electronic components. By leveraging Ethernet technology, automotive manufacturers can achieve faster data transfer rates, lower latency, and enhanced reliability compared to traditional automotive communication protocols like CAN (Controller Area Network) and LIN (Local Interconnect Network). Automotive Ethernet hardware facilitates the integration of advanced features and functionalities in vehicles, such as infotainment systems, advanced driver assistance systems (ADAS), telematics, and in-vehicle networking. Ethernet-based networking solutions enable the convergence of multiple data streams, allowing vehicles to process and exchange information efficiently, thereby enhancing overall performance, safety, and user experience. The growth of the Automotive Ethernet hardware segment is driven by several factors, including the increasing adoption of connected vehicles, the proliferation of electric and autonomous vehicles, and the demand for advanced in-vehicle technologies. As automotive systems become more sophisticated and data-driven, the need for high-speed, reliable, and scalable communication networks continues to grow, fueling the demand for Ethernet-based hardware solutions. The automotive industry's transition towards software-defined vehicles and over-the-air (OTA) updates further underscores the importance of Automotive Ethernet hardware in enabling flexible and future-proof networking architectures. By investing in Automotive Ethernet hardware, automotive stakeholders can capitalize on emerging opportunities, address evolving customer demands, and accelerate innovation in the automotive ecosystem.

Automotive Ethernet Market Regional Insights:

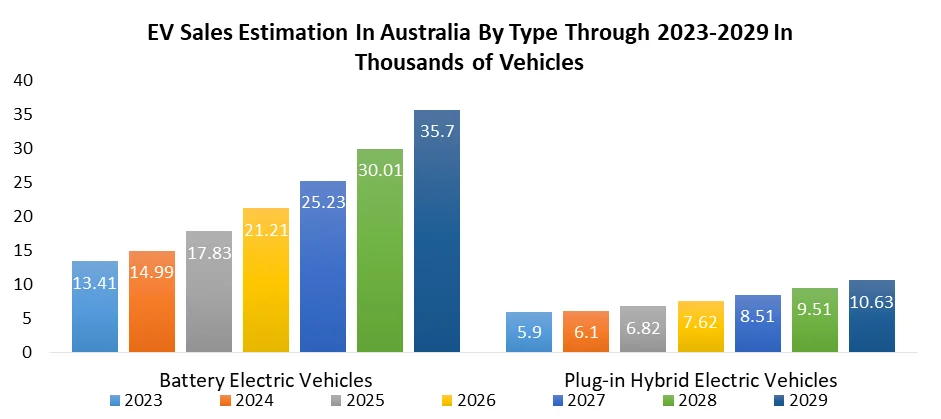

Asia Pacific held the largest market share in Automotive Ethernet Market in 2023. In 2023, the Asia Pacific region emerged as the dominant player in the Automotive Ethernet market, capturing the largest market share. This significant market dominance can be attributed to several key factors, including the region's rapid industrialization, technological advancements in the automotive sector, and the increasing adoption of connected vehicles across Asia Pacific countries. One of the primary drivers of the Automotive Ethernet market's growth in the Asia Pacific region is the burgeoning automotive industry in countries such as China, Japan, South Korea, and India. These countries have witnessed a substantial rise in vehicle production and sales over the past decade, fueled by rising consumer demand, economic growth, and government initiatives to promote the automotive sector. As a result, automakers in the Asia Pacific region are increasingly integrating advanced technologies like Automotive Ethernet into their vehicles to meet evolving consumer preferences and regulatory requirements. China, in particular, has emerged as a global automotive powerhouse, boasting the largest automotive market in the world. With a rapidly growing middle class and urban population, China has witnessed a surge in demand for automobiles, including electric vehicles (EVs) and connected cars. Automotive manufacturers in China are leveraging Ethernet technology to enhance vehicle connectivity, enable advanced driver assistance systems (ADAS), and support other innovative features, thereby driving the growth of the Automotive Ethernet market in the region. Japan and South Korea are renowned for their automotive engineering prowess and technological innovation. Japanese automakers, such as Toyota, Honda, and Nissan, are at the forefront of developing cutting-edge automotive technologies, including Ethernet-based networking solutions. Similarly, South Korean companies like Hyundai and Kia are investing heavily in research and development to integrate advanced connectivity features into their vehicles, contributing to the expansion of the Automotive Ethernet market in the region. Government regulations and initiatives aimed at promoting vehicle safety, emissions reduction, and smart transportation systems are driving the adoption of Automotive Ethernet in the Asia Pacific region. Governments across Asia Pacific countries are implementing stringent fuel efficiency standards and emission regulations, which necessitate the deployment of advanced automotive technologies to meet compliance requirements. Public charging infrastructure in AustraliaAdditionally, initiatives to develop smart cities and intelligent transportation infrastructure are spurring the demand for connected vehicles equipped with Ethernet-based communication systems. Another significant factor contributing to the growth of the Automotive Ethernet market in the Asia Pacific region is the increasing collaboration between automotive OEMs, semiconductor manufacturers, and technology providers. Partnerships and strategic alliances are forming across the automotive ecosystem to develop and deploy Ethernet-based networking solutions that address the evolving needs of vehicle manufacturers and consumers in the region.

VIC ACT SA NSW TAS QLD NT WA Total number of charging stations 216 20 76 161 21 162 5 122 Charging stations per 100,000 residents 3.4 3.17 4.4 2.04 4.02 3.27 2.03 4.72 Total 208 17 70 148 21 138 5 107 8 3 6 13 0 24 0 15 Total 114 20 32 86 4 58 3 77 102 0 44 75 17 104 2 45 Scope of the Global Automotive Ethernet Market Report: Inquire before buying

Global Automotive Ethernet Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.4 Bn. Forecast Period 2024 to 2030CAGR: 22.2% Market Size in 2030: US $ 13.83 Bn. Segments Covered: By Component Hardware Software Services Consulting Implementation Training and Support By Bandwidth 10Mbps 100Mbps 1Gbps 2.5/5/10Gbps By Vehicle Type Passenger Cars Commercial Vehicles Farming and Off-Highway Vehicles By Application Advanced Driver Assistance Systems (ADAS) Infotainment Powertrain Body and Comfort Chassis Global Automotive Ethernet Market, By Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players Operating in the Global Automotive Ethernet Market:

1.Broadcom 2.NXP 3.Marvell 4.Microchip 5.Molex 6.Texas Instruments 7.Cadence Major Contributors in the Automotive Ethernet Market in North America: 1. Broadcom Inc. (USA) 2. Marvell Technology Group Ltd. (USA) 3. Microchip Technology Inc. (USA) 4. Texas Instruments Incorporated (USA) 5. Analog Devices, Inc. (USA) 6. Intel Corporation (USA) 7. ON Semiconductor Corporation (USA) 8. Xilinx, Inc. (USA) 9. Cadence Design Systems, Inc. (USA) 10. Maxim Integrated Products, Inc. (USA) 11. Silicon Laboratories, Inc. (USA) 12. Integrated Device Technology, Inc. (USA) 13. Synopsys, Inc. (USA) Major Leading Player in the Automotive Ethernet Market in Europe: 1. NXP Semiconductors N.V. (Netherlands) 2. Melexis NV (Belgium) 3. STMicroelectronics N.V. (Switzerland) 4. Infineon Technologies AG (Germany) Major Leading Player in the Automotive Ethernet Market in Asia Pacific: 1. Renesas Electronics Corporation (Japan) 2. Toshiba Electronic Devices & Storage Corporation (Japan) 3. ROHM Semiconductor (Japan) FAQ: 1] What segments are covered in the Automotive Ethernet Market report? Ans. The segments covered in the Automotive Ethernet Market report are based on Component, Component, Vehicle Type, Application, and Region. 2] Which region is expected to hold the highest share in the Global Automotive Ethernet Market? Ans. North America region is expected to hold the highest market share in the Automotive Ethernet market. 3] What is the market size of the Global Automotive Ethernet Market by 2030? Ans. The market size of the Automotive Ethernet Market by 2030 is expected to reach USD 13.83 Billion. 4] What is the forecast period for the Global Automotive Ethernet Market? Ans. The forecast period for the Automotive Ethernet Market is 2024-2030. 5] What was the market size of the Global Automotive Ethernet Market in 2023? Ans. The market size of the Automotive Ethernet Market in 2023 was valued at USD 3.4 Billion.

1. Automotive Ethernet Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Ethernet Market: Dynamics 2.1. Automotive Ethernet Market Trends by Region 2.1.1. North America Automotive Ethernet Market Trends 2.1.2. Europe Automotive Ethernet Market Trends 2.1.3. Asia Pacific Automotive Ethernet Market Trends 2.1.4. Middle East and Africa Automotive Ethernet Market Trends 2.1.5. South America Automotive Ethernet Market Trends 2.2. Automotive Ethernet Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive Ethernet Market Drivers 2.2.1.2. North America Automotive Ethernet Market Restraints 2.2.1.3. North America Automotive Ethernet Market Opportunities 2.2.1.4. North America Automotive Ethernet Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive Ethernet Market Drivers 2.2.2.2. Europe Automotive Ethernet Market Restraints 2.2.2.3. Europe Automotive Ethernet Market Opportunities 2.2.2.4. Europe Automotive Ethernet Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive Ethernet Market Drivers 2.2.3.2. Asia Pacific Automotive Ethernet Market Restraints 2.2.3.3. Asia Pacific Automotive Ethernet Market Opportunities 2.2.3.4. Asia Pacific Automotive Ethernet Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive Ethernet Market Drivers 2.2.4.2. Middle East and Africa Automotive Ethernet Market Restraints 2.2.4.3. Middle East and Africa Automotive Ethernet Market Opportunities 2.2.4.4. Middle East and Africa Automotive Ethernet Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive Ethernet Market Drivers 2.2.5.2. South America Automotive Ethernet Market Restraints 2.2.5.3. South America Automotive Ethernet Market Opportunities 2.2.5.4. South America Automotive Ethernet Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Analysis of Government Schemes and Initiatives For the Automotive Ethernet Industry 2.8. The Covid-19 Pandemic's Impact on the Automotive Ethernet Market 3. Automotive Ethernet Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 3.1. Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 3.2.1. 10Mbps 3.2.2. 100Mbps 3.2.3. 1Gbps 3.2.4. 2.5/5/10Gbps 3.3. Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 3.3.1. Passenger Cars 3.3.2. Commercial Vehicles 3.3.3. Farming and Off-Highway Vehicles 3.4. Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 3.4.1. Advanced Driver Assistance Systems (ADAS) 3.4.2. Infotainment 3.4.3. Powertrain 3.4.4. Body and Electronics 3.4.5. Chassis 3.5. Automotive Ethernet Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Automotive Ethernet Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 4.1. North America Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. North America Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 4.2.1. 10Mbps 4.2.2. 100Mbps 4.2.3. 1Gbps 4.2.4. 2.5/5/10Gbps 4.3. North America Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 4.3.1. Passenger Cars 4.3.2. Commercial Vehicles 4.3.3. Farming and Off-Highway Vehicles 4.4. North America Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 4.4.1. Advanced Driver Assistance Systems (ADAS) 4.4.2. Infotainment 4.4.3. Powertrain 4.4.4. Body and Electronics 4.4.5. Chassis 4.5. North America Automotive Ethernet Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 4.5.1.1.1. Hardware 4.5.1.1.2. Software 4.5.1.1.3. Services 4.5.1.1.4. 4.5.1.2. United States Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 4.5.1.2.1. 10Mbps 4.5.1.2.2. 100Mbps 4.5.1.2.3. 1Gbps 4.5.1.2.4. 2.5/5/10Gbps 4.5.1.3. United States Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.1.3.1. Passenger Cars 4.5.1.3.2. Commercial Vehicles 4.5.1.3.3. Farming and Off-Highway Vehicles 4.5.1.4. United States Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 4.5.1.4.1. Advanced Driver Assistance Systems (ADAS) 4.5.1.4.2. Infotainment 4.5.1.4.3. Powertrain 4.5.1.4.4. Body and Electronics 4.5.1.4.5. Chassis 4.5.2. Canada 4.5.2.1. Canada Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 4.5.2.1.1. Hardware 4.5.2.1.2. Software 4.5.2.1.3. Services 4.5.2.2. Canada Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 4.5.2.2.1. 10Mbps 4.5.2.2.2. 100Mbps 4.5.2.2.3. 1Gbps 4.5.2.2.4. 2.5/5/10Gbps 4.5.2.3. Canada Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.2.3.1. Passenger Cars 4.5.2.3.2. Commercial Vehicles 4.5.2.3.3. Farming and Off-Highway Vehicles 4.5.2.4. Canada Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 4.5.2.4.1. Advanced Driver Assistance Systems (ADAS) 4.5.2.4.2. Infotainment 4.5.2.4.3. Powertrain 4.5.2.4.4. Body and Electronics 4.5.2.4.5. Chassis 4.5.3. Mexico 4.5.3.1. Mexico Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 4.5.3.1.1. Hardware 4.5.3.1.2. Software 4.5.3.1.3. Services 4.5.3.2. Mexico Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 4.5.3.2.1. 10Mbps 4.5.3.2.2. 100Mbps 4.5.3.2.3. 1Gbps 4.5.3.2.4. 2.5/5/10Gbps 4.5.3.3. Mexico Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.3.3.1. Passenger Cars 4.5.3.3.2. Commercial Vehicles 4.5.3.3.3. Farming and Off-Highway Vehicles 4.5.3.4. Mexico Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 4.5.3.4.1. Advanced Driver Assistance Systems (ADAS) 4.5.3.4.2. Infotainment 4.5.3.4.3. Powertrain 4.5.3.4.4. Body and Electronics 4.5.3.4.5. Chassis 5. Europe Automotive Ethernet Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 5.1. Europe Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 5.2. Europe Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 5.3. Europe Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 5.4. Europe Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 5.5. Europe Automotive Ethernet Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 5.5.1.2. United Kingdom Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 5.5.1.3. United Kingdom Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.1.4. United Kingdom Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 5.5.2. France 5.5.2.1. France Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 5.5.2.2. France Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 5.5.2.3. France Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.2.4. France Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 5.5.3.2. Germany Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 5.5.3.3. Germany Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.3.4. Germany Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 5.5.4.2. Italy Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 5.5.4.3. Italy Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.4.4. Italy Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 5.5.5.2. Spain Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 5.5.5.3. Spain Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.5.4. Spain Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 5.5.6.2. Sweden Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 5.5.6.3. Sweden Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.6.4. Sweden Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 5.5.7.2. Austria Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 5.5.7.3. Austria Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.7.4. Austria Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 5.5.8.2. Rest of Europe Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 5.5.8.3. Rest of Europe Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.8.4. Rest of Europe Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Automotive Ethernet Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 6.1. Asia Pacific Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.3. Asia Pacific Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.4. Asia Pacific Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6.5. Asia Pacific Automotive Ethernet Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.5.1.2. China Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.5.1.3. China Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.1.4. China Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.5.2.2. S Korea Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.5.2.3. S Korea Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.2.4. S Korea Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.5.3.2. Japan Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.5.3.3. Japan Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.3.4. Japan Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6.5.4. India 6.5.4.1. India Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.5.4.2. India Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.5.4.3. India Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.4.4. India Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.5.5.2. Australia Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.5.5.3. Australia Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.5.4. Australia Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.5.6.2. Indonesia Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.5.6.3. Indonesia Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.6.4. Indonesia Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.5.7.2. Malaysia Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.5.7.3. Malaysia Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.7.4. Malaysia Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.5.8.2. Vietnam Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.5.8.3. Vietnam Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.8.4. Vietnam Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.5.9.2. Taiwan Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.5.9.3. Taiwan Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.9.4. Taiwan Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 6.5.10.2. Rest of Asia Pacific Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 6.5.10.3. Rest of Asia Pacific Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.10.4. Rest of Asia Pacific Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Automotive Ethernet Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 7.1. Middle East and Africa Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 7.3. Middle East and Africa Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 7.4. Middle East and Africa Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 7.5. Middle East and Africa Automotive Ethernet Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 7.5.1.2. South Africa Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 7.5.1.3. South Africa Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.1.4. South Africa Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 7.5.2.2. GCC Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 7.5.2.3. GCC Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.2.4. GCC Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 7.5.3.2. Nigeria Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 7.5.3.3. Nigeria Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.3.4. Nigeria Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 7.5.4.2. Rest of ME&A Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 7.5.4.3. Rest of ME&A Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.4.4. Rest of ME&A Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 8. South America Automotive Ethernet Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn)(2023-2030) 8.1. South America Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 8.2. South America Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 8.3. South America Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 8.4. South America Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 8.5. South America Automotive Ethernet Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 8.5.1.2. Brazil Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 8.5.1.3. Brazil Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.1.4. Brazil Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 8.5.2.2. Argentina Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 8.5.2.3. Argentina Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.2.4. Argentina Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Automotive Ethernet Market Size and Forecast, by Component (2023-2030) 8.5.3.2. Rest Of South America Automotive Ethernet Market Size and Forecast, by Bandwidth (2023-2030) 8.5.3.3. Rest Of South America Automotive Ethernet Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.3.4. Rest Of South America Automotive Ethernet Market Size and Forecast, by Application (2023-2030) 9. Global Automotive Ethernet Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.4. Leading Automotive Ethernet Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Broadcom Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Marvell Technology Group Ltd. (USA) 10.3. Microchip Technology Inc. (USA) 10.4. Texas Instruments Incorporated (USA) 10.5. Analog Devices, Inc. (USA) 10.6. Intel Corporation (USA) 10.7. ON Semiconductor Corporation (USA) 10.8. Xilinx, Inc. (USA) 10.9. Cadence Design Systems, Inc. (USA) 10.10. Maxim Integrated Products, Inc. (USA) 10.11. Silicon Laboratories, Inc. (USA) 10.12. Integrated Device Technology, Inc. (USA) 10.13. Synopsys, Inc. (USA) 10.14. NXP Semiconductors N.V. (Netherlands) 10.15. Melexis NV (Belgium) 10.16. STMicroelectronics N.V. (Switzerland) 10.17. Infineon Technologies AG (Germany) 10.18. Renesas Electronics Corporation (Japan) 10.19. Toshiba Electronic Devices & Storage Corporation (Japan) 10.20. ROHM Semiconductor (Japan) 11. Key Findings 12. Analyst Recommendations 13. Automotive Ethernet Market: Research Methodology