Automotive Sensor Market was valued at USD 13.5 Bn in 2023 and is expected to reach USD 23.44 Bn by 2030, at a CAGR of 8.2 % during the forecast period.Automotive Sensor Market Overview

Automotive sensors are electronic devices designed to detect and measure various parameters related to the operation and performance of vehicles. These sensors play a critical role in modern automobiles by collecting data on factors such as speed, temperature, pressure, position, proximity, and many others. This data is then used by the vehicle's electronic control systems to optimize performance, ensure safety, and improve fuel efficiency. The Automotive Sensor Market has been growing steadily, fueled by the increasing adoption of advanced driver assistance systems (ADAS), electric vehicles (EVs), and autonomous vehicles (AVs). The automotive sensors industry is geographically diverse, with key regions including North America, Europe, Asia Pacific, and the Rest of the World. Asia Pacific has emerged as a significant market due to the presence of major automotive manufacturing hubs, particularly in countries such as China, Japan, South Korea, and India. Advancements in sensor technology, such as the development of MEMS (Micro-Electro-Mechanical Systems) sensors, LiDAR (Light Detection and Ranging) sensors, and CMOS (Complementary Metal-Oxide-Semiconductor) image sensors, are driving innovation in the Automotive Sensor Market. These technologies enable higher accuracy, smaller form factors, lower power consumption, and integration with other systems. Regulatory requirements related to vehicle emissions, safety standards, and fuel efficiency are driving the adoption of sensors in vehicles. Government regulations mandating the inclusion of safety features such as TPMS (Tire Pressure Monitoring Systems) and ESC (Electronic Stability Control) further contribute to the demand for automotive sensors.To know about the Research Methodology :- Request Free Sample Report

Automotive Sensor Market Dynamics

Increased demand for Electric Vehicles to boost the Automotive Sensor Market growth Electric vehicles (EVs) necessitate precise monitoring of two critical metrics: the State of Charge (SOC), indicating the level of battery fullness relative to its total capacity, and the State of Health (SOH), which tracks the gradual degradation of battery condition over time due to wear and tear. Temperature management is particularly crucial for EV safety, as EV batteries require meticulous thermal regulation compared to internal combustion engine (ICE) vehicles. If the battery temperature falls below a specified operating range, the chemical processes involved in charging and discharging are impeded, resulting in a loss of power generation capability. To ensure optimal performance and safety, EVs rely on highly responsive Coolant Temperature Sensors (CTS) that precisely monitor the temperature of the battery coolant and consequently, the battery itself. As EV battery capacities increase, the complexities of accurately monitoring and regulating their temperatures and electrical currents also escalate, which is expected to boost the Automotive Sensor Market growth. This heightened operational demand for sensors is compounded by the expanding adoption of commercial and industrial EVs. Consequently, the enduring trend towards more potent EV batteries, alongside the proliferation of diverse EV applications, sustain a continuous and robust demand for operational sensors in the foreseeable future. Rapid advancements in sensor technology, including miniaturization, increased accuracy, and enhanced functionality, are driving innovation in the Automotive Sensor Market. Emerging technologies such as MEMS (Micro-Electro-Mechanical Systems), LiDAR (Light Detection and Ranging), and CMOS (Complementary Metal-Oxide-Semiconductor) sensors are enabling more sophisticated sensor solutions for applications in autonomous driving, connectivity, and electrification. The shift towards electrification and autonomous driving is a significant driver of the Automotive Sensor Market. Electric vehicles (EVs) and autonomous vehicles (AVs) require an array of sensors to monitor various parameters such as battery state of charge (SOC), vehicle position, and surrounding environment. This growing demand for sensors in EVs and AVs is fueling market growth. The proliferation of connected vehicles and the Internet of Things (IoT) is driving demand for sensors that enable vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. Sensors play a crucial role in collecting data on vehicle performance, traffic conditions, and road infrastructure, enabling enhanced connectivity and intelligent transportation systems. Technological Complexity and Integration Challenges to restrain Automotive Sensor Market growth The increasing complexity of automotive sensor systems, coupled with the integration of multiple sensors into vehicles, presents challenges for manufacturers in terms of design, development, and testing. Integrating sensors with existing vehicle architectures and ensuring compatibility with other systems is complex and time-consuming, leading to delays in product development and deployment. Cost pressures remain a significant restraint in the Automotive Sensor Market, as manufacturers face the challenge of balancing performance, reliability, and affordability. The commoditization of sensor technology and intense pricing competition among market players further exacerbate margin pressures, particularly for suppliers operating in highly competitive segments. The automotive industry is susceptible to supply chain disruptions and component shortages, which impact the availability and cost of sensors. Factors such as geopolitical tensions, natural disasters, trade disputes, and the COVID-19 pandemic have highlighted the vulnerabilities of global supply chains, leading to delays in automotive sensors production and delivery of sensor components. Automotive sensors are critical components that directly impact vehicle safety, performance, and reliability. Any defects, malfunctions, or inaccuracies in sensor readings lead to operational failures, safety hazards, and vehicle recalls, resulting in reputational damage and financial losses for automotive sensors manufacturers. Ensuring the quality, durability, and reliability of sensors is paramount to maintaining customer trust and brand reputation, which significantly boosts the Automotive Sensor Market growth. The production, use, and disposal of automotive sensors have environmental implications, including resource depletion, energy consumption, and electronic waste generation. As sustainability concerns gain prominence, automotive sensor manufacturers face pressure to minimize their environmental footprint through eco-friendly materials, energy-efficient processes, and recycling initiatives. Balancing environmental responsibilities with business objectives poses challenges in terms of cost-effectiveness and regulatory compliance.Trends in Automotive Sensor Market

Automotive Sensor Market Segment Analysis

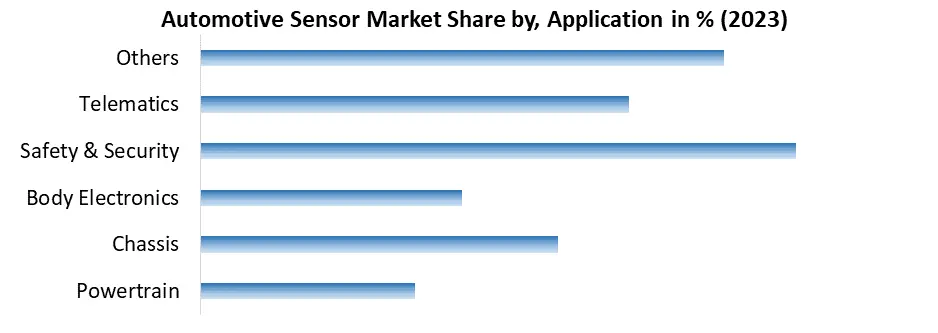

Based on Type, the market is segmented into Oxygen sensor, Mass airflow sensor, Radar sensors, LiDAR, Pressure sensors, Engine speed sensor, and others. Engine speed sensor segment dominated the market in 2023 and is expected to hold the largest Automotive Sensor Market share over the forecast period. The engine speed sensor detects the speed at which the crankshaft is rotating, typically using Hall effect sensors, magnetic reluctance sensors, or optical sensors. This information is transmitted to the engine control unit (ECU), which uses it to control fuel injection timing, ignition timing, and other engine parameters. The sensor provides real-time feedback to ensure optimal engine performance, fuel efficiency, and emissions control. The demand for engine speed sensors is driven by several factors, including the growing automotive industry, increasing adoption of advanced engine management systems, and stringent emissions regulations. As vehicle manufacturers strive to improve engine performance, fuel efficiency, and emissions compliance, the demand for accurate and reliable engine speed sensors continues to grow, which significantly boosts the Automotive Sensor Market growth. Technological advancements such as the development of more robust and compact sensor designs contribute to automotive sensors industry growth.Based on Application, the market is segmented into Powertrain, Chassis, Body Electronics, Safety & Security, Telematics, and Others. Safety & Security segment dominated the market in 2023 and is expected to hold the largest Automotive Sensor Market share over the forecast period. Ensuring the safety of vehicle occupants and pedestrians is paramount in the automotive industry. Sensors play a crucial role in safety systems such as Anti-lock Braking Systems (ABS), Electronic Stability Control (ESC), Collision Avoidance Systems, Adaptive Cruise Control, Lane Departure Warning, and Autonomous Emergency Braking. These sensors detect obstacles, monitor vehicle dynamics, and provide inputs for automated safety interventions, helping to prevent accidents and mitigate their severity. Safety features have become increasingly important to consumers when purchasing vehicles. Consumers are willing to pay a premium for vehicles equipped with advanced safety technologies that enhance their confidence and peace of mind while driving. As a result, automakers prioritize the integration of safety systems and sensors to meet consumer expectations and remain competitive in the Automotive Sensor Market.

Automotive Sensor Market Regional Insight

Growth of the Automotive Industry to boost Asia Pacific Automotive Sensor Market growth The Asia Pacific region is home to some of the world's largest automotive markets, including China, Japan, South Korea, and India. The rapid industrialization, urbanization, and rising disposable incomes in these countries are driving the demand for automobiles, both passenger and commercial vehicles. As vehicle production and sales continue to grow in the region, the demand for automotive sensors is also expected to increase significantly, which significantly boosts the Automotive Sensor Market growth. Governments across the Asia Pacific region are implementing regulations and initiatives to enhance vehicle safety, emissions standards, and fuel efficiency. For example, countries like China and India have introduced stringent emission norms such as China VI and BS-VI, respectively, driving the adoption of advanced sensors for emissions control and monitoring. Regulatory mandates for safety features such as TPMS (Tire Pressure Monitoring Systems) and ESC (Electronic Stability Control) further contribute to the demand for automotive sensors. The Asia Pacific region is at the forefront of technological advancements and innovation in the automotive industry. Major automotive manufacturers and technology companies in countries such as Japan and South Korea are investing heavily in research and development to develop advanced sensor technologies for applications such as autonomous driving, electrification, and connectivity. This focus on innovation drives the demand for cutting-edge automotive sensors in the region. The Asia Pacific region is witnessing rapid growth in the electric vehicle market, driven by government incentives, environmental regulations, and consumer preferences for clean and sustainable mobility solutions. China, in particular, is the largest market for electric vehicles globally, with significant investments in EV infrastructure and manufacturing. As EV adoption continues to increase in the region, there is a growing demand for sensors for battery management, thermal management, and EV drive train systems, which significantly boosts the Automotive Sensor Market.Automotive Sensor Market Scope: Inquiry Before Buying

Automotive Sensor Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 13.5 Bn. Forecast Period 2024 to 2030 CAGR: 8.2% Market Size in 2030: US $ 23.44 Bn. Segments Covered: by Type Oxygen sensor Mass airflow sensor Radar sensors LiDAR Pressure sensors Engine speed sensor Others by Application Powertrain Chassis Body Electronics Safety & Security Telematics Others Automotive Sensor Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Automotive Sensors manufacturers include:

North America: 1. Texas Instruments (United States) 2. Sensata Technologies (United States) 3. Delphi Technologies (United Kingdom) 4. Allegro Microsystems (United States) 5. Aptiv PLC (Ireland) 6. Analog Devices, Inc. (United States) 7. CTS Corporation (United States) 8. Honeywell International Inc. (United States) 9. 3M (United States) Europe: 10. Bosch (Germany) 11. Continental AG (Germany) 12. STMicroelectronics (Switzerland) 13. Melexis NV (Belgium) 14. HELLA GmbH & Co. KGaA (Germany) 15. ZF Friedrichshafen AG (Germany) 16. Valeo SA (France) 17. First Sensor AG (Germany) 18. AMS AG (Austria) 19. Elmos Semiconductor AG (Germany) 20. Infineon Technologies AG (Germany) 21. TE Connectivity (Switzerland) Asia Pacific: 22. Denso Corporation (Japan) 23. Panasonic Corporation (Japan) 24. Murata Manufacturing Co., Ltd. (Japan) 25. Renesas Electronics Corporation (Japan) 26. ROHM Semiconductor (Japan) 27. Omron Corporation (Japan) 28. Nidec Corporation (Japan) 29. Mitsubishi Electric Corporation (Japan) 30. Aisin Seiki Co., Ltd. (Japan)Frequently Asked Questions:

1. How is the Automotive Sensor Market growing, and what are the driving factors? Ans: The Automotive Sensor Market has been growing steadily, fueled by the increasing adoption of advanced driver assistance systems (ADAS), electric vehicles (EVs), and autonomous vehicles (AVs). Advancements in sensor technology, regulatory requirements related to vehicle emissions and safety standards, and the growing demand for electric vehicles are key drivers of market growth. 2. What are some challenges facing the Automotive Sensor Market? Ans: Challenges facing the Automotive Sensor Market include technological complexity and integration challenges, cost pressures, supply chain disruptions, and environmental considerations. Balancing performance, reliability, and affordability while meeting regulatory requirements poses significant challenges for manufacturers. 3. Which region is driving significant growth in the Automotive Sensor Market? Ans: The Asia Pacific region, particularly countries like China, Japan, South Korea, and India, is driving significant growth in the Automotive Sensor Market. Rapid industrialization, urbanization, government initiatives, and technological advancements in the automotive industry contribute to the growth in this region. 4. Which segment dominates the Automotive Sensor Market, and why? Ans: The Safety & Security segment dominates the Automotive Sensor Market due to the paramount importance of vehicle safety. Safety systems such as ABS, ESC, Collision Avoidance Systems, and others rely heavily on sensors for detection and intervention, driving the demand for sensors in this segment. 5. What are the key factors contributing to the growth of the Asia Pacific Automotive Sensor Market? Ans: Factors contributing to the growth of the Asia Pacific Automotive Sensor Market include the growth of the automotive industry, government regulations, technological advancements, electrification of vehicles, and the rapid adoption of electric vehicles in the region, particularly in countries like China and Japan.

1. Automotive Sensor Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Automotive Sensor Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Automotive Sensor Market Companies Share 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Automotive Sensor Market: Dynamics 3.1. Market Trends - Global 3.2. Market Dynamics – By Region 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for Automotive Sensors Industry 3.8. Analysis of Government Schemes and Initiatives for Automotive Sensors Industry 3.9. The Global Pandemic Impact on Automotive Sensor Market 4. Automotive Sensor Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Automotive Sensor Market Size and Forecast, by Type (2023-2030) 4.1.1. Oxygen sensor 4.1.2. Mass airflow sensor 4.1.3. Radar sensors 4.1.4. LiDAR 4.1.5. Pressure sensors 4.1.6. Engine speed sensor 4.1.7. Others 4.2. Automotive Sensor Market Size and Forecast, By Application (2023-2030) 4.2.1. Powertrain 4.2.2. Chassis 4.2.3. Body Electronics 4.2.4. Safety & Security 4.2.5. Telematics 4.2.6. Others 4.3. Automotive Sensor Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Automotive Sensor Market Size and Forecast (by Value in USD Million) (2023-2030) 5.1. North America Automotive Sensor Market Size and Forecast, by Type (2023-2030) 5.1.1. Oxygen sensor 5.1.2. Mass airflow sensor 5.1.3. Radar sensors 5.1.4. LiDAR 5.1.5. Pressure sensors 5.1.6. Engine speed sensor 5.1.7. Others 5.2. North America Automotive Sensor Market Size and Forecast, By Application (2023-2030) 5.2.1. Powertrain 5.2.2. Chassis 5.2.3. Body Electronics 5.2.4. Safety & Security 5.2.5. Telematics 5.2.6. Others 5.3. North America Automotive Sensor Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Automotive Sensor Market Size and Forecast, by Type (2023-2030) 5.3.1.1.1. Oxygen sensor 5.3.1.1.2. Mass airflow sensor 5.3.1.1.3. Radar sensors 5.3.1.1.4. LiDAR 5.3.1.1.5. Pressure sensors 5.3.1.1.6. Engine speed sensor 5.3.1.1.7. Others 5.3.1.2. United States Automotive Sensor Market Size and Forecast, By Application (2023-2030) 5.3.1.2.1. Powertrain 5.3.1.2.2. Chassis 5.3.1.2.3. Body Electronics 5.3.1.2.4. Safety & Security 5.3.1.2.5. Telematics 5.3.1.2.6. Others 5.3.2. Canada 5.3.2.1. Canada Automotive Sensor Market Size and Forecast, by Type (2023-2030) 5.3.2.1.1. Oxygen sensor 5.3.2.1.2. Mass airflow sensor 5.3.2.1.3. Radar sensors 5.3.2.1.4. LiDAR 5.3.2.1.5. Pressure sensors 5.3.2.1.6. Engine speed sensor 5.3.2.1.7. Others 5.3.2.2. Canada Automotive Sensor Market Size and Forecast, By Application (2023-2030) 5.3.2.2.1. Powertrain 5.3.2.2.2. Chassis 5.3.2.2.3. Body Electronics 5.3.2.2.4. Safety & Security 5.3.2.2.5. Telematics 5.3.2.2.6. Others 5.3.3. Mexico 5.3.3.1. Mexico Automotive Sensor Market Size and Forecast, by Type (2023-2030) 5.3.3.1.1. Oxygen sensor 5.3.3.1.2. Mass airflow sensor 5.3.3.1.3. Radar sensors 5.3.3.1.4. LiDAR 5.3.3.1.5. Pressure sensors 5.3.3.1.6. Engine speed sensor 5.3.3.1.7. Others 5.3.3.2. Mexico Automotive Sensor Market Size and Forecast, By Application (2023-2030) 5.3.3.2.1. Powertrain 5.3.3.2.2. Chassis 5.3.3.2.3. Body Electronics 5.3.3.2.4. Safety & Security 5.3.3.2.5. Telematics 5.3.3.2.6. Others 6. Europe Automotive Sensor Market Size and Forecast (by Value in USD Million) (2023-2030) 6.1. Europe Automotive Sensor Market Size and Forecast, by Type (2023-2030) 6.2. Europe Automotive Sensor Market Size and Forecast, By Application (2023-2030) 6.3. Europe Automotive Sensor Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Automotive Sensor Market Size and Forecast, by Type (2023-2030) 6.3.1.2. United Kingdom Automotive Sensor Market Size and Forecast, By Application (2023-2030) 6.3.2. France 6.3.2.1. France Automotive Sensor Market Size and Forecast, by Type (2023-2030) 6.3.2.2. France Automotive Sensor Market Size and Forecast, By Application (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Automotive Sensor Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Germany Automotive Sensor Market Size and Forecast, By Application (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Automotive Sensor Market Size and Forecast, by Type (2023-2030) 6.3.4.2. Italy Automotive Sensor Market Size and Forecast, By Application (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Automotive Sensor Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Spain Automotive Sensor Market Size and Forecast, By Application (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Automotive Sensor Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Sweden Automotive Sensor Market Size and Forecast, By Application (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Automotive Sensor Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Austria Automotive Sensor Market Size and Forecast, By Application (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Automotive Sensor Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Rest of Europe Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7. Asia Pacific Automotive Sensor Market Size and Forecast (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7.3. Asia Pacific Automotive Sensor Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.3.1.2. China Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.3.2.2. S Korea Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Japan Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7.3.4. India 7.3.4.1. India Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.3.4.2. India Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.3.5.2. Australia Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.3.6.2. Indonesia Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.3.7.2. Malaysia Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.3.8.2. Vietnam Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.3.9.2. Taiwan Automotive Sensor Market Size and Forecast, By Application (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Automotive Sensor Market Size and Forecast, by Type (2023-2030) 7.3.10.2. Rest of Asia Pacific Automotive Sensor Market Size and Forecast, By Application (2023-2030) 8. Middle East and Africa Automotive Sensor Market Size and Forecast (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Automotive Sensor Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Automotive Sensor Market Size and Forecast, By Application (2023-2030) 8.3. Middle East and Africa Automotive Sensor Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Automotive Sensor Market Size and Forecast, by Type (2023-2030) 8.3.1.2. South Africa Automotive Sensor Market Size and Forecast, By Application (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Automotive Sensor Market Size and Forecast, by Type (2023-2030) 8.3.2.2. GCC Automotive Sensor Market Size and Forecast, By Application (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Automotive Sensor Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Nigeria Automotive Sensor Market Size and Forecast, By Application (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Automotive Sensor Market Size and Forecast, by Type (2023-2030) 8.3.4.2. Rest of ME&A Automotive Sensor Market Size and Forecast, By Application (2023-2030) 9. South America Automotive Sensor Market Size and Forecast (by Value in USD Million) (2023-2030) 9.1. South America Automotive Sensor Market Size and Forecast, by Type (2023-2030) 9.2. South America Automotive Sensor Market Size and Forecast, By Application (2023-2030) 9.3. South America Automotive Sensor Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Automotive Sensor Market Size and Forecast, by Type (2023-2030) 9.3.1.2. Brazil Automotive Sensor Market Size and Forecast, By Application (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Automotive Sensor Market Size and Forecast, by Type (2023-2030) 9.3.2.2. Argentina Automotive Sensor Market Size and Forecast, By Application (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Automotive Sensor Market Size and Forecast, by Type (2023-2030) 9.3.3.2. Rest Of South America Automotive Sensor Market Size and Forecast, By Application (2023-2030) 10. Company Profile: Key Players 10.1. Texas Instruments (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Sensata Technologies (United States) 10.3. Delphi Technologies (United Kingdom) 10.4. Allegro Microsystems (United States) 10.5. Aptiv PLC (Ireland) 10.6. Analog Devices, Inc. (United States) 10.7. CTS Corporation (United States) 10.8. Honeywell International Inc. (United States) 10.9. 3M (United States) 10.10. Bosch (Germany) 10.11. Continental AG (Germany) 10.12. STMicroelectronics (Switzerland) 10.13. Melexis NV (Belgium) 10.14. HELLA GmbH & Co. KGaA (Germany) 10.15. ZF Friedrichshafen AG (Germany) 10.16. Valeo SA (France) 10.17. First Sensor AG (Germany) 10.18. AMS AG (Austria) 10.19. Elmos Semiconductor AG (Germany) 10.20. Infineon Technologies AG (Germany) 10.21. TE Connectivity (Switzerland) 10.22. Denso Corporation (Japan) 10.23. Panasonic Corporation (Japan) 10.24. Murata Manufacturing Co., Ltd. (Japan) 10.25. Renesas Electronics Corporation (Japan) 10.26. ROHM Semiconductor (Japan) 10.27. Omron Corporation (Japan) 10.28. Nidec Corporation (Japan) 10.29. Mitsubishi Electric Corporation (Japan) 10.30. Aisin Seiki Co., Ltd. (Japan) 11. Key Findings 12. Industry Recommendations 13. Automotive Sensor Market: Research Methodology