Automotive Engineering Service Provider Market was valued at USD 174.75 Mn in 2023 and is expected to reach USD 301.44 Mn by 2030, at a CAGR of 8.1 % during the forecast period.Automotive Engineering Service Provider Market Overview

An Automotive Engineering Service Provider offers a range of engineering services tailored specifically to the automotive industry. These services include design, development, testing, validation, and consulting services for various components, systems, and vehicles within the automotive sector. Automotive engineering service providers play a crucial role in supporting the automotive industry by providing specialized expertise, resources, and services to address the complex engineering challenges and demands of modern vehicles and automotive systems.To know about the Research Methodology :- Request Free Sample Report The automotive engineering service provider market is a dynamic sector within the automotive industry that encompasses a wide range of companies offering specialized engineering services to automotive manufacturers, suppliers, and other stakeholders. These service providers play a crucial role in supporting the development, design, testing, and manufacturing of vehicles and automotive systems. Automotive engineering service providers offer a diverse range of services tailored to the specific needs of the automotive industry. These services include product design and development, simulation and analysis, testing and validation, electronics and embedded systems development, manufacturing engineering, consulting, and supply chain management. The increasing integration of digital technologies and connectivity features in vehicles is driving demand for engineering services related to automotive electronics, infotainment systems, vehicle connectivity, and cybersecurity.

Automotive Engineering Service Provider Market Dynamics

Increasing Complexity of Vehicle Systems to boost Automotive Engineering Service Provider Market growth Modern vehicles are becoming increasingly complex, incorporating advanced technologies such as electric propulsion, autonomous driving capabilities, and connected features. This complexity requires specialized engineering expertise, driving demand for automotive engineering service providers who design, develop, and validate these intricate systems. Stringent regulations related to safety, emissions, and fuel efficiency are driving automakers to invest in engineering services to ensure compliance. Automotive engineering service providers play a crucial role in helping Automotive manufacturers navigate complex regulatory landscapes, ensuring that vehicles meet evolving standards without compromising performance or cost-efficiency. The automotive industry is undergoing a technological revolution, with innovations such as electrification, artificial intelligence, and advanced driver assistance systems (ADAS) reshaping the landscape. Automotive engineering service providers are at the forefront of integrating these technologies into vehicle design and development processes, driving innovation and differentiation for automakers, which significantly boosts the Automotive Engineering Service Provider Market growth. Growing concerns about environmental sustainability and climate change are prompting automakers to prioritize eco-friendly solutions. This includes the development of electric and hybrid vehicles, lightweight materials, and energy-efficient propulsion systems. Automotive engineering service providers play a vital role in supporting these initiatives by offering expertise in alternative powertrains, aerodynamics, and materials science. The automotive industry is increasingly globalized, with manufacturers operating in multiple regions and markets. Automotive engineering service providers facilitate this globalization by offering localized expertise and support, enabling automakers to develop vehicles tailored to the preferences and requirements of diverse Automotive Engineering Service Provider Market worldwide. Dependence on Automotive Industry Trends to limit Automotive Engineering Service Provider Market growth The automotive engineering service provider market is heavily dependent on the trends and dynamics of the automotive industry. Fluctuations in vehicle production volumes, changes in consumer preferences, and shifts in technology adoption directly impact demand for engineering services. Providers must closely monitor industry trends and adapt their strategies to align with evolving market dynamics. The automotive engineering service provider market is highly competitive, with numerous players vying for market share. This intense competition lead to price pressures, margin erosion, and challenges in differentiating services. Providers must continually invest in innovation, talent acquisition, and market differentiation to maintain a competitive edge in the crowded marketplace. The automotive industry is subject to a complex regulatory environment, with stringent requirements related to safety, emissions, and quality standards. Compliance with these regulations adds complexity and cost to engineering processes, requiring providers to invest in specialized expertise and resources. Failure to meet regulatory requirements result in legal and financial liabilities, posing a significant restraint for service providers. Automotive engineering service providers often rely heavily on original equipment manufacturers (OEMs) and tier-1 suppliers for business opportunities. This dependency make providers vulnerable to fluctuations in OEM spending, changes in supplier relationships, and shifts in outsourcing strategies. Diversification of client portfolios and expansion into adjacent markets help mitigate this dependency risk.Automotive Engineering Service Provider Market Segment Analysis

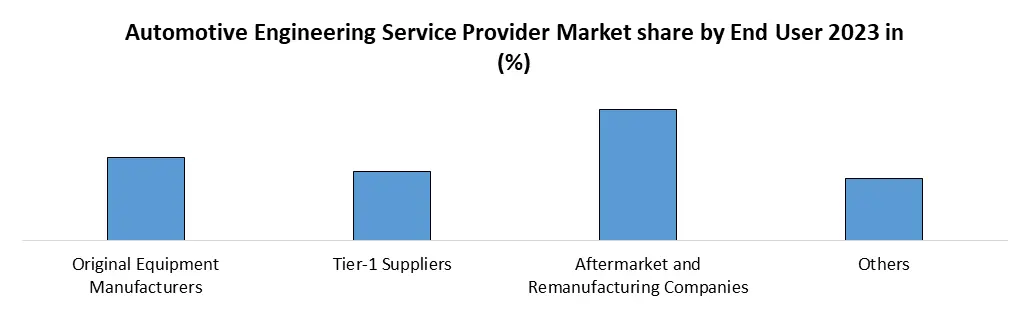

Based on Services Offered, the market is segmented into Design and Development Services, Testing and Validation Services, Manufacturing Support Services, Consulting and Advisory Services, and Others. Testing and Validation Services segment dominated the market in 2023 and is expected to hold the largest Automotive Engineering Service Provider Market share over the forecast period. Automotive engineering service providers conduct regulatory compliance testing to ensure that vehicles and components meet the safety, emissions, and performance standards set by regulatory authorities such as the National Highway Traffic Safety Administration (NHTSA) in the United States, the European Union, and other regulatory bodies worldwide. This includes testing for crashworthiness, emissions levels, fuel efficiency, and other regulatory requirements. The Testing and Validation Services segment in the Automotive Engineering Service Provider Market encompasses a range of activities aimed at ensuring the safety, reliability, and performance of automotive components, systems, and vehicles. These services play a crucial role in the automotive industry by verifying that vehicles meet regulatory standards, quality requirements, and customer expectations before they are brought to market. Based on End User, the market is segmented into Original Equipment Manufacturers, Tier-1 Suppliers, Aftermarket and Remanufacturing Companies, and Others. Aftermarket and Remanufacturing Companies segment dominated the market in 2023 and is expected to hold the largest Automotive Engineering Service Provider Market share over the forecast period. In the automotive engineering service provider industry, the "Aftermarket and Remanufacturing Companies" segment refers to a specific sector within the broader automotive industry that focuses on providing services and products after the original sale of vehicles by the manufacturer. These are businesses that offer parts, accessories, equipment, and services for vehicles after they have been sold by the original equipment manufacturer (OEM). Aftermarket companies cater to the needs of vehicle owners who seek customization, repair, maintenance, or upgrades for their vehicles. They provide a wide range of products such as tires, brakes, exhaust systems, performance enhancements, and electronic gadgets. These companies often offer alternatives to OEM parts, sometimes at lower costs or with additional features, giving consumers more choices in maintaining or enhancing their vehicles.

Automotive Engineering Service Provider Market Regional Insight

Technological Innovation in providing services to boost North America Automotive Engineering Service Provider Market growth North America is a hub for technological innovation in the automotive industry, with a focus on areas such as electric vehicles (EVs), autonomous driving, connected cars, and advanced driver assistance systems (ADAS). Automotive engineering service providers play a crucial role in supporting innovation by offering specialized expertise in areas such as software development, electronics, and system integration, driving demand for their services, which significantly boosts North America Automotive Engineering Service Provider Market growth. The automotive industry in North America is subject to stringent regulatory requirements related to safety, emissions, and fuel efficiency. Compliance with these regulations is essential for automakers to ensure market access and avoid penalties. Automotive engineering service providers help manufacturers navigate regulatory complexities by offering expertise in regulatory compliance, testing, and validation, driving demand for their services. The shift towards electric mobility is gaining momentum in North America, driven by factors such as environmental concerns, government incentives, and advancements in battery technology. Automotive engineering service providers are at the forefront of supporting EV development, offering expertise in battery systems, power electronics, and EV architecture design to automakers and electric vehicle manufacturers. North America is witnessing significant investment and development in connected and autonomous vehicle technologies, with companies striving to enhance safety, convenience, and mobility, which is expected to boost the Automotive Engineering Service Provider Market growth. Automotive engineering service providers play a critical role in CAV development, offering expertise in sensor fusion, artificial intelligence, vehicle-to-everything (V2X) communication, and cybersecurity, driving demand for their services.Automotive Engineering Service Provider Market Scope: Inquire before buying

Global Automotive Engineering Service Provider Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 174.75 Bn. Forecast Period 2024 to 2030 CAGR: 8.1% Market Size in 2030: US $ 301.44 Bn. Segments Covered: by Services Offered Design and Development Services Testing and Validation Services Manufacturing Support Services Consulting and Advisory Services Others by End User Original Equipment Manufacturers Tier-1 Suppliers Aftermarket and Remanufacturing Companies Others Automotive Engineering Service Provider Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Automotive Engineering Service Provider includes:

Asia Pacific: 1. Aisin Seiki Co., Ltd. - Japan 2. Denso Corporation - Kariya, Aichi, Japan 3. Toyota Motor Corporation - Toyota City, Aichi, Japan 4. Hyundai Motor Company - Seoul, South Korea 5. Mahindra & Mahindra Limited - Mumbai, Maharashtra, India 6. BYD Company Limited - Shenzhen, Guangdong, China Europe: 7. Robert Bosch GmbH - Stuttgart, Germany 8. Continental AG - Hanover, Germany 9. Volkswagen AG - Wolfsburg, Germany 10. BMW Group - Munich, Germany 11. Daimler AG (Mercedes-Benz) - Stuttgart, Germany 12. Fiat Chrysler Automobiles (FCA) - Amsterdam, Netherlands North America: 13. General Motors Company - Detroit, Michigan, USA 14. Ford Motor Company - Dearborn, Michigan, USA 15. Tesla, Inc. - Palo Alto, California, USA 16. Delphi Technologies (now Aptiv) - Troy, Michigan, USA) 17. Magna International Inc. - Aurora, Ontario, Canada Frequently asked Questions: 1: What is an Automotive Engineering Service Provider? Ans: An Automotive Engineering Service Provider offers specialized engineering services tailored to the automotive industry, including design, development, testing, validation, and consulting for various automotive components, systems, and vehicles. 2: What services do Automotive Engineering Service Providers offer? Ans: They offer a range of services such as product design and development, simulation and analysis, testing and validation, electronics and embedded systems development, manufacturing engineering, consulting, and supply chain management. 3: What are the main drivers of growth in the Automotive Engineering Service Provider market? Ans: Increasing complexity of vehicle systems, technological innovations in the automotive industry, growing concerns about environmental sustainability, and globalization of the automotive industry are key drivers of growth. 4: What challenges do Automotive Engineering Service Providers face? Ans: Challenges include dependence on automotive industry trends, intense competition leading to price pressures, regulatory complexities, and vulnerability to fluctuations in OEM spending and outsourcing strategies.

1. Automotive Engineering Service Provider Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Engineering Service Provider Market: Dynamics 2.1. Automotive Engineering Service Provider Market Trends by Region 2.1.1. North America Automotive Engineering Service Provider Market Trends 2.1.2. Europe Automotive Engineering Service Provider Market Trends 2.1.3. Asia Pacific Automotive Engineering Service Provider Market Trends 2.1.4. Middle East and Africa Automotive Engineering Service Provider Market Trends 2.1.5. South America Automotive Engineering Service Provider Market Trends 2.2. Automotive Engineering Service Provider Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive Engineering Service Provider Market Drivers 2.2.1.2. North America Automotive Engineering Service Provider Market Restraints 2.2.1.3. North America Automotive Engineering Service Provider Market Opportunities 2.2.1.4. North America Automotive Engineering Service Provider Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive Engineering Service Provider Market Drivers 2.2.2.2. Europe Automotive Engineering Service Provider Market Restraints 2.2.2.3. Europe Automotive Engineering Service Provider Market Opportunities 2.2.2.4. Europe Automotive Engineering Service Provider Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive Engineering Service Provider Market Drivers 2.2.3.2. Asia Pacific Automotive Engineering Service Provider Market Restraints 2.2.3.3. Asia Pacific Automotive Engineering Service Provider Market Opportunities 2.2.3.4. Asia Pacific Automotive Engineering Service Provider Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive Engineering Service Provider Market Drivers 2.2.4.2. Middle East and Africa Automotive Engineering Service Provider Market Restraints 2.2.4.3. Middle East and Africa Automotive Engineering Service Provider Market Opportunities 2.2.4.4. Middle East and Africa Automotive Engineering Service Provider Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive Engineering Service Provider Market Drivers 2.2.5.2. South America Automotive Engineering Service Provider Market Restraints 2.2.5.3. South America Automotive Engineering Service Provider Market Opportunities 2.2.5.4. South America Automotive Engineering Service Provider Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Automotive Engineering Service Provider Industry 2.8. Analysis of Government Schemes and Initiatives For Automotive Engineering Service Provider Industry 2.9. Automotive Engineering Service Provider Market Trade Analysis 2.10. The Global Pandemic Impact on Automotive Engineering Service Provider Market 3. Automotive Engineering Service Provider Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 3.1.1. Design and Development Services 3.1.2. Testing and Validation Services 3.1.3. Manufacturing Support Services 3.1.4. Consulting and Advisory Services 3.1.5. Others 3.2. Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 3.2.1. Original Equipment Manufacturers 3.2.2. Tier-1 Suppliers 3.2.3. Aftermarket and Remanufacturing Companies 3.2.4. Others 3.3. Automotive Engineering Service Provider Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Automotive Engineering Service Provider Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 4.1.1. Design and Development Services 4.1.2. Testing and Validation Services 4.1.3. Manufacturing Support Services 4.1.4. Consulting and Advisory Services 4.1.5. Others 4.2. North America Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 4.2.1. Original Equipment Manufacturers 4.2.2. Tier-1 Suppliers 4.2.3. Aftermarket and Remanufacturing Companies 4.2.4. Others 4.3. North America Automotive Engineering Service Provider Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 4.3.1.1.1. Design and Development Services 4.3.1.1.2. Testing and Validation Services 4.3.1.1.3. Manufacturing Support Services 4.3.1.1.4. Consulting and Advisory Services 4.3.1.1.5. Others 4.3.1.2. United States Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 4.3.1.2.1. Original Equipment Manufacturers 4.3.1.2.2. Tier-1 Suppliers 4.3.1.2.3. Aftermarket and Remanufacturing Companies 4.3.1.2.4. Others 4.3.2. Canada 4.3.2.1. Canada Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 4.3.2.1.1. Design and Development Services 4.3.2.1.2. Testing and Validation Services 4.3.2.1.3. Manufacturing Support Services 4.3.2.1.4. Consulting and Advisory Services 4.3.2.1.5. Others 4.3.2.2. Canada Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 4.3.2.2.1. Original Equipment Manufacturers 4.3.2.2.2. Tier-1 Suppliers 4.3.2.2.3. Aftermarket and Remanufacturing Companies 4.3.2.2.4. Others 4.3.3. Mexico 4.3.3.1. Mexico Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 4.3.3.1.1. Design and Development Services 4.3.3.1.2. Testing and Validation Services 4.3.3.1.3. Manufacturing Support Services 4.3.3.1.4. Consulting and Advisory Services 4.3.3.1.5. Others 4.3.3.2. Mexico Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 4.3.3.2.1. Original Equipment Manufacturers 4.3.3.2.2. Tier-1 Suppliers 4.3.3.2.3. Aftermarket and Remanufacturing Companies 4.3.3.2.4. Others 5. Europe Automotive Engineering Service Provider Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 5.2. Europe Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 5.3. Europe Automotive Engineering Service Provider Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 5.3.1.2. United Kingdom Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 5.3.2. France 5.3.2.1. France Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 5.3.2.2. France Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 5.3.3.2. Germany Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 5.3.4.2. Italy Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 5.3.5.2. Spain Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 5.3.6.2. Sweden Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 5.3.7.2. Austria Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 5.3.8.2. Rest of Europe Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Automotive Engineering Service Provider Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.2. Asia Pacific Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6.3. Asia Pacific Automotive Engineering Service Provider Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.3.1.2. China Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.3.2.2. S Korea Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.3.3.2. Japan Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6.3.4. India 6.3.4.1. India Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.3.4.2. India Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.3.5.2. Australia Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.3.6.2. Indonesia Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.3.7.2. Malaysia Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.3.8.2. Vietnam Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.3.9.2. Taiwan Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 6.3.10.2. Rest of Asia Pacific Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Automotive Engineering Service Provider Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 7.2. Middle East and Africa Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 7.3. Middle East and Africa Automotive Engineering Service Provider Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 7.3.1.2. South Africa Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 7.3.2.2. GCC Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 7.3.3.2. Nigeria Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 7.3.4.2. Rest of ME&A Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 8. South America Automotive Engineering Service Provider Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 8.2. South America Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 8.3. South America Automotive Engineering Service Provider Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 8.3.1.2. Brazil Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 8.3.2.2. Argentina Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Automotive Engineering Service Provider Market Size and Forecast, by Services Offered (2023-2030) 8.3.3.2. Rest Of South America Automotive Engineering Service Provider Market Size and Forecast, by End User (2023-2030) 9. Global Automotive Engineering Service Provider Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Automotive Engineering Service Provider Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Aisin Seiki Co., Ltd. - Japan 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Denso Corporation - Kariya, Aichi, Japan 10.3. Toyota Motor Corporation - Toyota City, Aichi, Japan 10.4. Hyundai Motor Company - Seoul, South Korea 10.5. Mahindra & Mahindra Limited - Mumbai, Maharashtra, India 10.6. BYD Company Limited - Shenzhen, Guangdong, China 10.7. Robert Bosch GmbH - Stuttgart, Germany 10.8. Continental AG - Hanover, Germany 10.9. Volkswagen AG - Wolfsburg, Germany 10.10. BMW Group - Munich, Germany 10.11. Daimler AG (Mercedes-Benz) - Stuttgart, Germany 10.12. Fiat Chrysler Automobiles (FCA) - Amsterdam, Netherlands 10.13. General Motors Company - Detroit, Michigan, USA 10.14. Ford Motor Company - Dearborn, Michigan, USA 10.15. Tesla, Inc. - Palo Alto, California, USA 10.16. Delphi Technologies (now Aptiv) - Troy, Michigan, USA) 10.17. Magna International Inc. - Aurora, Ontario, Canada 11. Key Findings 12. Industry Recommendations 13. Automotive Engineering Service Provider Market: Research Methodology 14. Terms and Glossary