The Automotive Embedded System Market size was valued at USD 4.8 Billion in 2023 and the total Automotive Embedded System revenue is expected to grow at a CAGR of 5.6% from 2024 to 2030, reaching nearly USD 6.98 Billion by 2030Automotive Embedded System Market Overview:

Automotive embedded systems play a crucial role in modern vehicles, serving as the technological backbone for a wide range of applications aimed at enhancing safety, efficiency, and overall driving experience. These systems encompass a diverse array of components, including microcontrollers, sensors, actuators, and communication interfaces, seamlessly integrated into various vehicle subsystems. One of the primary applications of automotive embedded systems is in advanced driver assistance systems (ADAS), which utilize sensors and control algorithms to provide features such as adaptive cruise control, lane-keeping assistance, and collision avoidance. Additionally, embedded systems enable the implementation of infotainment systems, navigation systems, and connectivity features that enhance driver convenience and entertainment. Furthermore, automotive embedded systems play a crucial role in powertrain control, vehicle diagnostics, and electronic stability control systems, contributing to improved fuel efficiency, emissions reduction, and overall vehicle performance. With the increasing demand for connected, autonomous, and electric vehicles, the production of automotive embedded systems continues to grow, driven by advancements in semiconductor technology, software development, and integration capabilities, shaping the future of the automotive industry toward safer, more efficient, and intelligent transportation solutions.To know about the Research Methodology :- Request Free Sample Report The increasing integration of advanced electronics and software into modern vehicles. With the rising demand for connected, autonomous, and electric vehicles, automotive embedded systems play a crucial role in enabling key functionalities such as advanced driver assistance systems (ADAS), infotainment systems, telematics, and vehicle diagnostics. Factors contributing to the Automotive Embedded System Market growth include stringent safety regulations, consumer demand for enhanced driving experiences, and technological advancements in semiconductor technology and software development. Key players in the Automotive Embedded System Market, such as Bosch, Continental AG, and Aptiv PLC, are investing in research and development to innovate new solutions, enhance product performance, and address evolving industry requirements. Recent developments in the Automotive Embedded System Market include the introduction of advanced ADAS features such as autonomous emergency braking, lane-keeping assistance, and adaptive cruise control, as well as the integration of artificial intelligence and machine learning algorithms for predictive maintenance and enhanced vehicle cybersecurity. Moreover, partnerships and collaborations between automotive manufacturers, technology companies, and semiconductor suppliers are driving innovation and accelerating the adoption of embedded systems in the automotive industry, shaping the future of transportation towards safer, more efficient, and intelligent mobility solutions .

Automotive Embedded System Market Dynamics:

Embedded Systems in Electric Vehicle Management Drives the Thawing System Market Growth The increasing integration of advanced electronics and software in vehicles. The growing demand for advanced driver assistance systems (ADAS) drives market growth. For example, companies like Mobileye, a subsidiary of Intel Corporation, develop ADAS solutions that utilize automotive embedded systems to enable features such as collision avoidance and pedestrian detection, enhancing vehicle safety. Additionally, the rise of connected vehicles fuels market expansion, with companies like Harman International Industries developing embedded systems for vehicle connectivity, enabling features like remote diagnostics and over-the-air updates, enhancing user experience and convenience. The shift towards electric vehicles (EVs) drives demand for embedded systems to manage powertrain control and battery management, exemplified by Tesla's development of sophisticated embedded systems for its EVs, contributing to the market's growth as EV adoption increases. Furthermore, the emergence of autonomous vehicles presents opportunities for embedded systems in autonomous driving technology, with companies like NVIDIA developing embedded platforms for autonomous vehicle control and perception, shaping the future of automotive mobility. The high development costs associated with creating advanced embedded systems act as a significant barrier, particularly for smaller players looking to enter the market. Developing complex systems for applications like autonomous driving demands substantial investments in research, development, and testing, limiting market entry for companies with restricted financial resources. Moreover, the complexity of integrating these systems into existing vehicle architectures adds another layer of challenge. Manufacturers must navigate intricate processes to ensure seamless integration, especially when introducing advanced driver assistance systems (ADAS) into vehicles with diverse hardware and software configurations. This complexity often results in extended development timelines and may delay product launches, affecting market entry and competitiveness. Regulatory Compliance Challenges in the Automotive Embedded System Market Growth Compliance with stringent regulatory requirements presents a formidable challenge for the Automotive Embedded System Market. Adhering to standards for functional safety and cybersecurity demands rigorous testing and validation processes. These regulations aim to ensure vehicle safety and protect against cybersecurity threats, but they also increase development timelines and costs for Automotive Embedded System Market players. Furthermore, the lack of interoperability between different embedded systems and vehicle components complicates integration efforts. Manufacturers often face compatibility issues when integrating third-party infotainment systems or telematics solutions with vehicle electronics, requiring customizations and adaptations that add to development complexity and costs. The rapid pace of technological advancements and short product lifecycles pose significant challenges for embedded system manufacturers. New hardware and software platforms emerge frequently, rendering older embedded systems obsolete and necessitating costly upgrades or replacements. This constant need for innovation and updates to remain competitive imposes substantial financial burdens on manufacturers and consumers. Additionally, disruptions in the automotive supply chain, such as shortages of semiconductor components or raw materials, further exacerbate challenges faced by embedded system suppliers, leading to delays and production bottlenecks. These challenges collectively underscore the complexities and uncertainties inherent in the Automotive Embedded System Market, requiring strategic navigation and innovative solutions to foster growth and sustainability in the industry.Automotive Embedded System Market Segment Analysis:

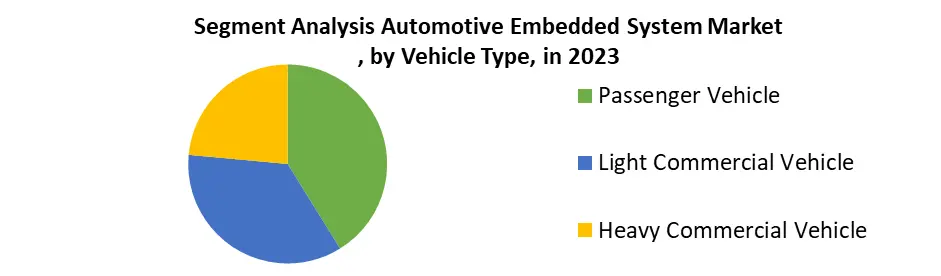

Based on Vehicle Type, the market is divided into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger Vehicles witnessed the highest Automotive Embedded System Market share in 2023 and are expected to continue their dominance over the forecast period. This dominance stems from several factors. The rising consumer demand for advanced features and technologies in passenger vehicles, such as advanced driver assistance systems (ADAS), infotainment systems, and connectivity solutions, drives the integration of embedded systems. These systems enhance vehicle safety, comfort, and convenience, catering to the evolving preferences of consumers. Additionally, the increasing adoption of electric vehicles (EVs) among passenger car buyers further fuels the demand for embedded systems, particularly in powertrain control and battery management. Moreover, the continuous innovation in autonomous driving technology and the development of semi-autonomous features in passenger vehicles contribute to the sustained dominance of this segment. Manufacturers prioritize the integration of embedded systems to enable autonomous driving functionalities, such as adaptive cruise control and lane-keeping assistance, enhancing vehicle automation and safety. As passenger vehicles remain at the forefront of automotive innovation and technological advancements, their continued dominance in the Automotive Embedded System Market is anticipated, driving Automotive Embedded System Market growth and expansion in the forecast period.

Automotive Embedded System Market Regional Insight:

North America witnessed the highest market share in 2023 and is expected to continue its dominance over the forecast period. North America is home to a highly developed automotive industry, characterized by robust research and development activities, technological innovation, and a strong focus on vehicle safety and connectivity. The region's high adoption rate of advanced driver assistance systems (ADAS) and connected vehicle technologies, driven by stringent safety regulations and consumer demand for cutting-edge features, further solidifies its market leadership. Additionally, the presence of leading automotive manufacturers and technology companies, along with a favorable regulatory environment supporting innovation and investment in automotive technologies, contributes to North America's prominence in the Automotive Embedded System Market. Moreover, ongoing initiatives to promote electric vehicle (EV) adoption and infrastructure development, coupled with increasing investments in autonomous driving technologies, continue to drive the integration of embedded systems in vehicles across the region. As such, North America remains a key growth engine in the Automotive Embedded System Market, offering significant opportunities for market players to capitalize on the region's technological advancements and consumer preferences.Automotive Embedded System Market Scope: Inquire before buying

Global Automotive Embedded System Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.8 Bn. Forecast Period 2024 to 2030 CAGR: 5.6% Market Size in 2030: US $ 6.98 Bn. Segments Covered: by Type Hardware Software by Vehicle Type Passenger Vehicle Light Commercial Vehicle Heavy Commercial Vehicle by Component Sensors Microcontrollers Transceivers Memory Devices by Application Infotainment and Telematics Body Electronics Safety and Security Power Control and Chassis Control Automotive Embedded System Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automotive Embedded System Market Key Players:

Major Contributors in the Automotive Embedded System Market in North America: 1. Harman International Industries, Incorporated (USA) 2. NVIDIA Corporation (USA) 3. Texas Instruments Incorporated (USA) 4. Intel Corporation (USA) 5. Visteon Corporation (USA) 6. BlackBerry QNX (Canada) 7. Microchip Technology Inc. (USA) 8. Magna International Inc. (Canada) 9. Lear Corporation (USA) Major Contributors in the Automotive Embedded System Market in Europe: 1. Bosch (Germany) 2. Continental AG (Germany) 3. Delphi Technologies (UK) 4. Infineon Technologies AG (Germany) 5. NXP Semiconductors N.V. (Netherlands) 6. STMicroelectronics (Switzerland) 7. Aptiv PLC (Ireland) Major Leading Players in the Automotive Embedded System Market in Asia Pacific: 1. Denso Corporation (Japan) 2. Panasonic Corporation (Japan) 3. Renesas Electronics Corporation (Japan) FAQs: 1. What are the growth drivers for the Automotive Embedded System Market? Ans. The growth drivers for the Automotive Embedded System Market include increasing demand for advanced driver assistance systems (ADAS) and connected vehicles, as well as the shift towards electric vehicles (EVs) and the emergence of autonomous driving technology, propelling innovation and expansion in the automotive industry. 2. What are the major restraints for the Automotive Embedded System Market growth? Ans. The Automotive Embedded System Market faces significant growth restraints, including high development costs associated with advanced technologies and stringent regulatory requirements for safety and cybersecurity compliance. 3. Which region is expected to lead the global Automotive Embedded System Market during the forecast period? Ans. North America is expected to lead the global Automotive Embedded System Market during the forecast period. 4. What is the projected market size and growth rate of the Automotive Embedded System Market? Ans. The Automotive Embedded System Market size was valued at USD 4.8 Billion in 2023 and the total revenue is expected to grow at a CAGR of 5.6% from 2024 to 2030, reaching nearly USD 6.98 Billion by 2030. 5. What segments are covered in the Market report? Ans. The Automotive Embedded System report covers Type, Vehicle Type, Component, Application, and Region.

1. Automotive Embedded System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Embedded System Market: Dynamics 2.1. Automotive Embedded System Market Trends by Region 2.1.1. North America Automotive Embedded System Market Trends 2.1.2. Europe Automotive Embedded System Market Trends 2.1.3. Asia Pacific Automotive Embedded System Market Trends 2.1.4. Middle East and Africa Automotive Embedded System Market Trends 2.1.5. South America Automotive Embedded System Market Trends 2.2. Automotive Embedded System Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive Embedded System Market Drivers 2.2.1.2. North America Automotive Embedded System Market Restraints 2.2.1.3. North America Automotive Embedded System Market Opportunities 2.2.1.4. North America Automotive Embedded System Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive Embedded System Market Drivers 2.2.2.2. Europe Automotive Embedded System Market Restraints 2.2.2.3. Europe Automotive Embedded System Market Opportunities 2.2.2.4. Europe Automotive Embedded System Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive Embedded System Market Drivers 2.2.3.2. Asia Pacific Automotive Embedded System Market Restraints 2.2.3.3. Asia Pacific Automotive Embedded System Market Opportunities 2.2.3.4. Asia Pacific Automotive Embedded System Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive Embedded System Market Drivers 2.2.4.2. Middle East and Africa Automotive Embedded System Market Restraints 2.2.4.3. Middle East and Africa Automotive Embedded System Market Opportunities 2.2.4.4. Middle East and Africa Automotive Embedded System Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive Embedded System Market Drivers 2.2.5.2. South America Automotive Embedded System Market Restraints 2.2.5.3. South America Automotive Embedded System Market Opportunities 2.2.5.4. South America Automotive Embedded System Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Automotive Embedded System Industry 2.8. Analysis of Government Schemes and Initiatives For Automotive Embedded System Industry 2.9. Automotive Embedded System Market Trade Analysis 2.10. The Global Pandemic Impact on Automotive Embedded System Market 3. Automotive Embedded System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.2. Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 3.2.1. Passenger Vehicle 3.2.2. Light Commercial Vehicle 3.2.3. Heavy Commercial Vehicle 3.3. Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 3.3.1. Sensors 3.3.2. Microcontrollers 3.3.3. Transceivers 3.3.4. Memory Devices 3.4. Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 3.4.1. Infotainment and Telematics 3.4.2. Body Electronics 3.4.3. Safety and Security 3.4.4. Power Control and Chassis Control 3.5. Automotive Embedded System Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Automotive Embedded System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.2. North America Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 4.2.1. Passenger Vehicle 4.2.2. Light Commercial Vehicle 4.2.3. Heavy Commercial Vehicle 4.3. North America Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 4.3.1. Sensors 4.3.2. Microcontrollers 4.3.3. Transceivers 4.3.4. Memory Devices 4.4. North America Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 4.4.1. Infotainment and Telematics 4.4.2. Body Electronics 4.4.3. Safety and Security 4.4.4. Power Control and Chassis Control 4.5. North America Automotive Embedded System Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 4.5.1.1.1. Hardware 4.5.1.1.2. Software 4.5.1.2. United States Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.1.2.1. Passenger Vehicle 4.5.1.2.2. Light Commercial Vehicle 4.5.1.2.3. Heavy Commercial Vehicle 4.5.1.3. United States Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 4.5.1.3.1. Sensors 4.5.1.3.2. Microcontrollers 4.5.1.3.3. Transceivers 4.5.1.3.4. Memory Devices 4.5.1.4. United States Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 4.5.1.4.1. Infotainment and Telematics 4.5.1.4.2. Body Electronics 4.5.1.4.3. Safety and Security 4.5.1.4.4. Power Control and Chassis Control 4.5.2. Canada 4.5.2.1. Canada Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 4.5.2.1.1. Hardware 4.5.2.1.2. Software 4.5.2.2. Canada Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.2.2.1. Passenger Vehicle 4.5.2.2.2. Light Commercial Vehicle 4.5.2.2.3. Heavy Commercial Vehicle 4.5.2.3. Canada Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 4.5.2.3.1. Sensors 4.5.2.3.2. Microcontrollers 4.5.2.3.3. Transceivers 4.5.2.3.4. Memory Devices 4.5.2.4. Canada Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 4.5.2.4.1. Infotainment and Telematics 4.5.2.4.2. Body Electronics 4.5.2.4.3. Safety and Security 4.5.2.4.4. Power Control and Chassis Control 4.5.3. Mexico 4.5.3.1. Mexico Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 4.5.3.1.1. Hardware 4.5.3.1.2. Software 4.5.3.2. Mexico Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.3.2.1. Passenger Vehicle 4.5.3.2.2. Light Commercial Vehicle 4.5.3.2.3. Heavy Commercial Vehicle 4.5.3.3. Mexico Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 4.5.3.3.1. Sensors 4.5.3.3.2. Microcontrollers 4.5.3.3.3. Transceivers 4.5.3.3.4. Memory Devices 4.5.3.4. Mexico Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 4.5.3.4.1. Infotainment and Telematics 4.5.3.4.2. Body Electronics 4.5.3.4.3. Safety and Security 4.5.3.4.4. Power Control and Chassis Control 5. Europe Automotive Embedded System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 5.2. Europe Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 5.3. Europe Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 5.4. Europe Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 5.5. Europe Automotive Embedded System Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 5.5.1.2. United Kingdom Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.1.3. United Kingdom Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 5.5.1.4. United Kingdom Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 5.5.2. France 5.5.2.1. France Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 5.5.2.2. France Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.2.3. France Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 5.5.2.4. France Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 5.5.3.2. Germany Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.3.3. Germany Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 5.5.3.4. Germany Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 5.5.4.2. Italy Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.4.3. Italy Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 5.5.4.4. Italy Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 5.5.5.2. Spain Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.5.3. Spain Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 5.5.5.4. Spain Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 5.5.6.2. Sweden Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.6.3. Sweden Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 5.5.6.4. Sweden Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 5.5.7.2. Austria Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.7.3. Austria Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 5.5.7.4. Austria Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 5.5.8.2. Rest of Europe Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.8.3. Rest of Europe Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 5.5.8.4. Rest of Europe Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Automotive Embedded System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.3. Asia Pacific Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.4. Asia Pacific Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6.5. Asia Pacific Automotive Embedded System Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.5.1.2. China Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.1.3. China Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.5.1.4. China Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.5.2.2. S Korea Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.2.3. S Korea Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.5.2.4. S Korea Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.5.3.2. Japan Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.3.3. Japan Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.5.3.4. Japan Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6.5.4. India 6.5.4.1. India Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.5.4.2. India Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.4.3. India Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.5.4.4. India Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.5.5.2. Australia Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.5.3. Australia Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.5.5.4. Australia Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.5.6.2. Indonesia Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.6.3. Indonesia Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.5.6.4. Indonesia Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.5.7.2. Malaysia Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.7.3. Malaysia Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.5.7.4. Malaysia Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.5.8.2. Vietnam Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.8.3. Vietnam Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.5.8.4. Vietnam Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.5.9.2. Taiwan Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.9.3. Taiwan Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.5.9.4. Taiwan Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 6.5.10.4. Rest of Asia Pacific Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Automotive Embedded System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 7.3. Middle East and Africa Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 7.4. Middle East and Africa Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 7.5. Middle East and Africa Automotive Embedded System Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 7.5.1.2. South Africa Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.1.3. South Africa Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 7.5.1.4. South Africa Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 7.5.2.2. GCC Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.2.3. GCC Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 7.5.2.4. GCC Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 7.5.3.2. Nigeria Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.3.3. Nigeria Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 7.5.3.4. Nigeria Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 7.5.4.2. Rest of ME&A Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.4.3. Rest of ME&A Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 7.5.4.4. Rest of ME&A Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 8. South America Automotive Embedded System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 8.2. South America Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 8.3. South America Automotive Embedded System Market Size and Forecast, by Component(2023-2030) 8.4. South America Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 8.5. South America Automotive Embedded System Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 8.5.1.2. Brazil Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.1.3. Brazil Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 8.5.1.4. Brazil Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 8.5.2.2. Argentina Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.2.3. Argentina Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 8.5.2.4. Argentina Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Automotive Embedded System Market Size and Forecast, by Type (2023-2030) 8.5.3.2. Rest Of South America Automotive Embedded System Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.3.3. Rest Of South America Automotive Embedded System Market Size and Forecast, by Component (2023-2030) 8.5.3.4. Rest Of South America Automotive Embedded System Market Size and Forecast, by Application (2023-2030) 9. Global Automotive Embedded System Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Automotive Embedded System Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Harman International Industries, Incorporated (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. NVIDIA Corporation (USA) 10.3. Texas Instruments Incorporated (USA) 10.4. Intel Corporation (USA) 10.5. Visteon Corporation (USA) 10.6. BlackBerry QNX (Canada) 10.7. Microchip Technology Inc. (USA) 10.8. Magna International Inc. (Canada) 10.9. Lear Corporation (USA) 10.10. Bosch (Germany) 10.11. Continental AG (Germany) 10.12. Delphi Technologies (UK) 10.13. Infineon Technologies AG (Germany) 10.14. NXP Semiconductors N.V. (Netherlands) 10.15. STMicroelectronics (Switzerland) 10.16. Aptiv PLC (Ireland) 10.17. Denso Corporation (Japan) 10.18. Panasonic Corporation (Japan) 10.19. Renesas Electronics Corporation (Japan) 11. Key Findings 12. Industry Recommendations 13. Automotive Embedded System Market: Research Methodology 14. Terms and Glossary