The Automotive Display Market size was valued at USD 8.41 Billion in 2023 and the total Automotive Display revenue is expected to grow at a CAGR of 18.26 % from 2024 to 2030, reaching nearly USD 27.21 Billion by 2030.Automotive Display Market Overview

Automotive Display is the integration of advanced visual interfaces and technologies within vehicles, enhancing user interaction, information delivery, and entertainment systems in the automotive industry. The Automotive Display Market presents an ever-evolving landscape by the rising demand for connected cars and the transition toward electric and autonomous vehicles. The current scenario highlights a rapid growth in the adoption of advanced displays, including digital instrument clusters, infotainment systems, heads-up displays (HUDs), and rear-seat entertainment displays. This momentum primarily stems from the escalating consumer preference for an immersive in-car experience, characterized by intuitive interfaces, high-resolution graphics, and seamless connectivity. Automotive Display Market Growth is driven by several factors, including the advancements in display technologies, such as OLED and microLED, offering improved performance, flexibility, and energy efficiency. Recent developments by Automotive Display Market key players emphasize the incorporation of cutting-edge technologies into automotive displays. For instance, major manufacturers have introduced augmented reality (AR) HUDs, providing real-time navigation, safety alerts, and contextual information directly onto the driver's line of sight. The integration of larger and more sophisticated infotainment displays, often with touch and gesture recognition, represents a pivotal shift toward immersive in-car entertainment and information systems. Collaborations and partnerships among automakers, display technology providers, and software developers are fostering innovations such as curved and flexible displays, offering novel design possibilities and ergonomic advancements in the automotive interface. These developments underscore the industry's dedication to delivering next-generation automotive displays that prioritize user experience, safety, and technological innovation, driving the evolution of in-car visual interfaces to unprecedented levels of sophistication and functionality.To know about the Research Methodology :- Request Free Sample Report

Automotive Display Market Dynamics:

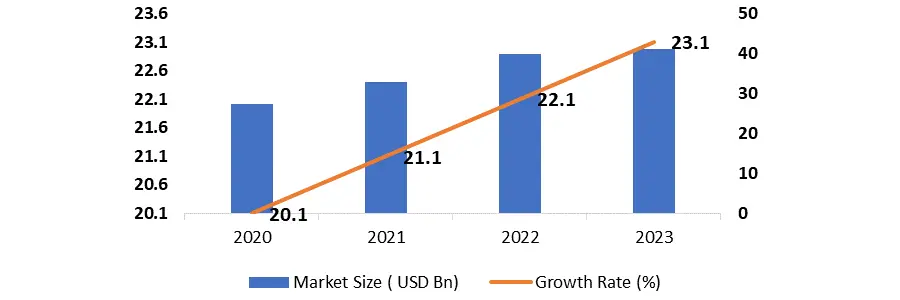

Growing Demand for Advanced Driver-Assistance Systems (ADAS) Driving Automotive Display Market Growth The integration of Advanced Driver-Assistance Systems within vehicles is significantly driving the demand for advanced displays. BMW's heads-up displays (HUDs) demonstrating real-time navigation and safety alerts epitomize this increase, intensifying the necessity for automotive displays resulting in the growth of the Automotive Display Market. The increase in electric vehicle (EV) adoption, such as in Tesla's Model S featuring an extensive touchscreen display for infotainment and battery management, is actively driving the requirement for high-resolution displays. As the automotive landscape transitions toward interconnected platforms, there's a growing emphasis on in-car entertainment and seamless connectivity, thus heightening the necessity for enhanced automotive displays. This shift is further accentuated by Mercedes-Benz models, which illustrate comprehensive connectivity and multimedia options, thereby amplifying the demand.Projected global ADAS revenue growth trend from 2020 to 2023

The emergence of Augmented Reality (AR) technology in automotive displays is enhancing driver experience and safety. Innovations from companies such as WayRay, developing holographic AR displays for navigation, highlight the rising demand for AR-enabled automotive displays. Automakers' emphasis on improved user experiences, demonstrated by Hyundai's implementation of larger touchscreens and gesture controls, is fueling the demand for more interactive and intuitive displays. Stringent safety regulations mandating features such as backup cameras and collision warnings are further driving the adoption of larger and advanced displays, evident in vehicles compliant with regulations such as FMVSS 111. Technological advancements, particularly in OLED, AMOLED, and MicroLED displays, showcased by LG Display's advanced OLED automotive displays, are driving Automotive Display Market growth. The growth of autonomous vehicles is necessitating multifunctional displays for control, navigation, and passenger engagement. Companies such as Zoox and Waymo's comprehensive display systems for passenger interaction in autonomous vehicles illustrate this trend. Rising consumer demand for sophisticated in-car entertainment systems, as evidenced by Audi's Virtual Cockpit system offering comprehensive infotainment, is bolstering the need for advanced displays. Additionally, increased automotive sales and technological advancements in emerging markets such as Asia-Pacific are bolstering the demand for automotive displays. Local players such as Geely and Tata Motors are integrating advanced displays into their vehicles, further contributing to the Automotive Display Market growth in these regions. High cost of displays Hinders the Automotive Display Market Growth The Automotive Display Market faces an several of challenges influencing production, innovation, and global operations. The ongoing semiconductor shortage has drastically impacted display manufacturing, resulting in production delays and a decreased supply of automotive displays, as, Throughout the initial half of 2023, losses attributed to the semiconductor scarcity decreased to approximately 524,000 units worldwide. While semiconductor supplies persist restricted, a relatively more predictable availability has enabled automotive manufacturers to adjust their production timelines. This shortfall has affected prominent automakers such as Ford and Toyota, impeding their production lines and adversely impacting sales. The development of sophisticated display technologies, including OLEDs, has led to increased manufacturing costs, contributing to elevated vehicle production expenses. Such advancements, witnessed in upscale models such as the Audi A8, have subsequently affected the affordability of mass-market vehicles, creating barriers to widespread adoption.Stringent regulations such as RoHS (Restriction of Hazardous Substances) have imposed constraints on sourcing and using materials for display production, in regions such as the EU. Complying with these regulations presents manufacturing challenges, influencing both processes and costs. The evolution of automotive displays towards augmented reality (AR) and heads-up display (HUD) systems demands intricate technological integration, posing technical hurdles for manufacturers. The complexity of these displays, seen in autonomous vehicles such as Tesla's Full Self-Driving (FSD) mode, necessitates sophisticated engineering, thereby impeding development and testing processes. The Automotive Display Market encounters obstacles arising from fragmented consumer preferences and regional demands, necessitating a wide array of display types and specifications. This diverse landscape, exemplified by preferences for larger displays in North America versus smaller displays in Asia-Pacific, presents substantial manufacturing complexities. Concerns surrounding intellectual property rights and patents restrict innovation and Automotive Display Market entry for manufacturers, creating barriers to adopting cutting-edge display systems. Additionally, the rapid pace of technological advancements requires continual R&D investments, pressuring manufacturers to constantly update production processes. Environmental challenges, including electronic waste disposal and recycling, coupled with sustainability goals and regulations such as the WEEE directives in Europe, further complicate production and recycling processes. Lastly, trade conflicts and tariffs impacting the import and export of raw materials or finished displays between regions significantly affect manufacturing costs and supply chains, creating disruptions for manufacturers on a global scale.

Automotive Display Market Segment Analysis:

Based on Display types, Thin-Film-Transistor Liquid Crystal Display (TFT LCD) dominated the Automotive Display Market in 2023 as it remains a prevalent choice, renowned for its versatility, high resolution, and vivid color reproduction. It finds extensive use in infotainment systems and digital clusters due to its ability to render detailed graphics and critical vehicle information. Passive-Matrix Organic Light-Emitting Diode (PMOLED) displays, although exhibiting excellent contrast levels and wide viewing angles, are typically employed in secondary or auxiliary displays within the vehicle. Their adoption is limited due to challenges related to scalability and cost-effectiveness. Passive-Matrix Liquid Crystal Display (PMLCD), while less common, serves specific functionalities in vehicle interiors, focusing on displaying auxiliary information such as HVAC controls or radio data. On the other hand, Active-Matrix Organic Light-Emitting Diode (AMOLED) displays showcase superior contrast, energy efficiency, and response times, making them increasingly prevalent in luxury vehicles and premium models for their ability to deliver sophisticated graphics in digital cockpits and augmented reality displays. The adoption of AMOLED technology continues to expand due to advancements in manufacturing processes, although cost considerations remain a factor limiting its widespread use across all vehicle segments.Based on Display Size, Smaller displays, typically ranging between 3”-5” dominated the Automotive Display Market in 2023 as it finds prevalent usage in entry-level vehicles or basic models where space constraints mandate compact screens. These smaller displays are often integrated into dashboards for basic infotainment and basic vehicle information. While, the 6”-10” category, considered a mid-range size, exhibits widespread adoption across mid-level to premium vehicles. These displays cater to a broader spectrum of functionalities, including advanced infotainment, navigation systems, and basic driver assistance features. The larger displays, exceeding 6”, are prominently featured in high-end vehicles, luxury cars, and premium SUVs, offering comprehensive multimedia interfaces, complex navigation systems, sophisticated ADAS features, and immersive infotainment experiences. The greater size allows for enhanced visibility, intricate graphical representation, and better user interaction, making them ideal for displaying a wide array of information, from multimedia content to vehicle diagnostics. The adoption of larger displays is growing, driven by the demand for more advanced features and comprehensive user interfaces within modern automotive interiors.

Automotive Display Market Regional Insights:

Asia Pacific Dominance in the Automotive Display Market One of the largest Automotive Display manufacturing regions is Asia Pacific, with countries such as China, Japan, and South Korea. China, in particular, boasts a significant share in the global Automotive Display Market due to its vast production capacity and technological advancements in display manufacturing. On the consumption front, North America and Europe emerge as major players. The United States and Germany, for instance, are key consumers, with a growing demand for advanced infotainment systems, digital clusters, and augmented reality displays in their automobiles. For example, in recent years, Chinese companies such as BOE Technology Group Co. have significantly expanded their market presence by providing high-quality automotive display panels to various automakers globally. Simultaneously, European car manufacturers such as BMW and Mercedes-Benz have increased their reliance on these displays, importing them for integration into their luxury vehicles to meet the rising demand for advanced digital cockpit experiences. This exemplifies the intricate trade relationships and the impact of regional production strengths on the automotive display market, where manufacturers and consumers across different regions collaborate for technological advancements and Automotive Display Market competitiveness.Automotive Display Market Scope: Inquire before buying

Global Automotive Display Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.41 Bn. Forecast Period 2024 to 2030 CAGR: 18.26% Market Size in 2030: US $ 27.21 Bn. Segments Covered: By Vehicle Type Passenger Vehicle Light Commercial Vehicle Heavy Commercial Vehicle By Display Type Thin-Film-Transistor Liquid Crystal Display (TFT LCD) Passive-Matrix Organic Light-Emitting Diode (PMOLED) Passive-Matrix Liquid Crystal Display (PMLCD) Active-Matrix Organic Light-Emitting Diode (AMOLED) By Display Size 3”-5” 6”-10” Greater than 6 Others By Application Telematics Navigation Infotainment Global Automotive Display Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automotive Display Market Key Players:

Major Contributors in the Automotive Display Industry in North America: 1. Visteon Corporation - United States 2. 3M - United States 3. HARMAN International - United States Leading players in the Europe Automotive Display Market: 1. Continental AG - Germany 2. Magneti Marelli S.p.A - Italy 3. Delphi Technologies - United Kingdom 4. Sharp Devices Europe - Switzerland 5. SmartKem Ltd - United Kingdom 6. Robert Bosch GmbH - Germany 7. Garmin Ltd - Switzerland 8. Valeo - France 9. Elektrobit - Finland 10. Barco - Belgium Key players driving the Asia-Pacific Automotive Display Market: 1. Panasonic Corporation - Japan 2. Nippon Seiki Co. Ltd - Japan 3. YAZAKI Corporation - Japan 4. DENSO CORPORATION - Japan 5. LG Display Co. Ltd - South Korea 6. Alpine Electronics Inc - Japan 7. Japan Display Inc - Japan 8. AU Optronics Corp - Taiwan 9. Pioneer Corporation - Japan 10. Innolux Corporation - Taiwan 11. KYOCERA Corporation - JapanFAQs:

1] What Major Key players in the Global Automotive Display Market report? Ans. The Major Key players covered in the Automotive Display Market report are Continental AG – Germany, Magneti Marelli S.p.A – Italy, Delphi Technologies - United Kingdom, Sharp Devices Europe – Switzerland, SmartKem Ltd - United Kingdom, Robert Bosch GmbH - Germany 2] Which region is expected to hold the highest share in the Global Automotive Display Market? Ans. ACAP region is expected to hold the highest share in the Automotive Display Market. 3] What is the market size of the Global Automotive Display Market by 2030? Ans. The market size of the Automotive Display Market by 2030 is expected to reach US$ 27.21 Mn. 4] What is the forecast period for the Global Automotive Display Market? Ans. The forecast period for the Automotive Display Market is 2024-2030. 5] What was the market size of the Global Automotive Display Market in 2023? Ans. The market size of the Automotive Display Market in 2023 was valued at US$ 8.41 Mn.

1. Automotive Display Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Display Market: Dynamics 2.1. Market Trends by Region 2.1.1. North America 2.1.2. Europe 2.1.3. Asia Pacific 2.1.4. Middle East and Africa 2.1.5. South America 2.2. Market Dynamics by Region 2.2.1. North America 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.2. Europe 2.2.2.1. Drivers 2.2.2.2. Restraints 2.2.2.3. Opportunities 2.2.2.4. Challenges 2.2.3. Asia Pacific 2.2.3.1. Drivers 2.2.3.2. Restraints 2.2.3.3. Opportunities 2.2.3.4. Challenges 2.2.4. Middle East and Africa 2.2.4.1. Drivers 2.2.4.2. Restraints 2.2.4.3. Opportunities 2.2.4.4. Challenges 2.2.5. South America 2.2.5.1. Drivers 2.2.5.2. Restraints 2.2.5.3. Opportunities 2.2.5.4. Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Technological Roadmap 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives For Automotive Display Industry 2.9. Key Opinion Leader Analysis 2.10. The Global Pandemic Impact on Automotive Display Market 3. Automotive Display Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 3.1.1. Passenger Vehicle 3.1.2. Light Commercial Vehicle 3.1.3. Heavy Commercial Vehicle 3.2. Automotive Display Market Size and Forecast, By Display Type (2023-2030) 3.2.1. Thin-Film-Transistor Liquid Crystal Display (TFT LCD) 3.2.2. Passive-Matrix Organic Light-Emitting Diode (PMOLED) 3.2.3. Passive-Matrix Liquid Crystal Display (PMLCD) 3.2.4. Active-Matrix Organic Light-Emitting Diode (AMOLED) 3.3. Automotive Display Market Size and Forecast, By Display Size (2023-2030) 3.3.1. 3”-5” 3.3.2. 6”-10” 3.3.3. Greater than 6 3.3.4. Others 3.4. Automotive Display Market Size and Forecast, By Application (2023-2030) 3.4.1. Telematics 3.4.2. Navigation 3.4.3. Infotainment 3.5. Automotive Display Market Size and Forecast, By Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Automotive Display Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 4.1.1. Passenger Vehicle 4.1.2. Light Commercial Vehicle 4.1.3. Heavy Commercial Vehicle 4.2. North America Automotive Display Market Size and Forecast, By Display Type (2023-2030) 4.2.1. Thin-Film-Transistor Liquid Crystal Display (TFT LCD) 4.2.2. Passive-Matrix Organic Light-Emitting Diode (PMOLED) 4.2.3. Passive-Matrix Liquid Crystal Display (PMLCD) 4.2.4. Active-Matrix Organic Light-Emitting Diode (AMOLED) 4.3. North America Automotive Display Market Size and Forecast, By Display Size (2023-2030) 4.3.1. 3”-5” 4.3.2. 6”-10” 4.3.3. Greater than 6 4.3.4. Others 4.4. North America Automotive Display Market Size and Forecast, By Application (2023-2030) 4.4.1. Telematics 4.4.2. Navigation 4.4.3. Infotainment 4.5. North America Automotive Display Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.1.1.1. Passenger Vehicle 4.5.1.1.2. Light Commercial Vehicle 4.5.1.1.3. Heavy Commercial Vehicle 4.5.1.2. United States Automotive Display Market Size and Forecast, By Display Type (2023-2030) 4.5.1.2.1. Thin-Film-Transistor Liquid Crystal Display (TFT LCD) 4.5.1.2.2. Passive-Matrix Organic Light-Emitting Diode (PMOLED) 4.5.1.2.3. Passive-Matrix Liquid Crystal Display (PMLCD) 4.5.1.2.4. Active-Matrix Organic Light-Emitting Diode (AMOLED) 4.5.1.3. United States Automotive Display Market Size and Forecast, By Display Size (2023-2030) 4.5.1.3.1. 3”-5” 4.5.1.3.2. 6”-10” 4.5.1.3.3. Greater than 6 4.5.1.3.4. Others 4.5.1.4. United States Automotive Display Market Size and Forecast, By Application (2023-2030) 4.5.1.4.1. Telematics 4.5.1.4.2. Navigation 4.5.1.4.3. Infotainment 4.5.2. Canada 4.5.2.1. Canada Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.2.1.1. Passenger Vehicle 4.5.2.1.2. Light Commercial Vehicle 4.5.2.1.3. Heavy Commercial Vehicle 4.5.2.2. Canada Automotive Display Market Size and Forecast, By Display Type (2023-2030) 4.5.2.2.1. Thin-Film-Transistor Liquid Crystal Display (TFT LCD) 4.5.2.2.2. Passive-Matrix Organic Light-Emitting Diode (PMOLED) 4.5.2.2.3. Passive-Matrix Liquid Crystal Display (PMLCD) 4.5.2.2.4. Active-Matrix Organic Light-Emitting Diode (AMOLED) 4.5.2.3. Canada Automotive Display Market Size and Forecast, By Display Size (2023-2030) 4.5.2.3.1. T 3”-5” 4.5.2.3.2. 6”-10” 4.5.2.3.3. Greater than 6 4.5.2.3.4. Others 4.5.2.4. Canada Automotive Display Market Size and Forecast, By Application (2023-2030) 4.5.2.4.1. Telematics 4.5.2.4.2. Navigation 4.5.2.4.3. Infotainment 4.5.3. Mexico 4.5.3.1. Mexico Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.3.1.1. Telematics 4.5.3.1.2. Navigation 4.5.3.1.3. Infotainment 4.5.3.2. Mexico Automotive Display Market Size and Forecast, By Display Type (2023-2030) 4.5.3.2.1. Thin-Film-Transistor Liquid Crystal Display (TFT LCD) 4.5.3.2.2. Passive-Matrix Organic Light-Emitting Diode (PMOLED) 4.5.3.2.3. Passive-Matrix Liquid Crystal Display (PMLCD) 4.5.3.2.4. Active-Matrix Organic Light-Emitting Diode (AMOLED) 4.5.3.3. Mexico Automotive Display Market Size and Forecast, By Display Size (2023-2030) 4.5.3.3.1. 3”-5” 4.5.3.3.2. 6”-10” 4.5.3.3.3. Greater than 6 4.5.3.3.4. Others 4.5.3.4. Mexico Automotive Display Market Size and Forecast, By Application (2023-2030) 4.5.3.4.1. Telematics 4.5.3.4.2. Navigation 4.5.3.4.3. Infotainment 5. Europe Automotive Display Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 5.2. Europe Automotive Display Market Size and Forecast, By Display Type (2023-2030) 5.3. Europe Automotive Display Market Size and Forecast, By Display Size (2023-2030) 5.4. Europe Automotive Display Market Size and Forecast, By Application (2023-2030) 5.5. Europe Automotive Display Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.1.2. United Kingdom Automotive Display Market Size and Forecast, By Display Type (2023-2030) 5.5.1.3. United Kingdom Automotive Display Market Size and Forecast, By Display Size (2023-2030) 5.5.1.4. United Kingdom Automotive Display Market Size and Forecast, By Application (2023-2030) 5.5.2. France 5.5.2.1. France Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.2.2. France Automotive Display Market Size and Forecast, By Display Type (2023-2030) 5.5.2.3. France Automotive Display Market Size and Forecast, By Display Size (2023-2030) 5.5.2.4. France Automotive Display Market Size and Forecast, By Application (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.3.2. Germany Automotive Display Market Size and Forecast, By Display Type (2023-2030) 5.5.3.3. Germany Automotive Display Market Size and Forecast, By Display Size (2023-2030) 5.5.3.4. Germany Automotive Display Market Size and Forecast, By Application (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.4.2. Italy Automotive Display Market Size and Forecast, By Display Type (2023-2030) 5.5.4.3. Italy Automotive Display Market Size and Forecast, By Display Size (2023-2030) 5.5.4.4. Italy Automotive Display Market Size and Forecast, By Application (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.5.2. Spain Automotive Display Market Size and Forecast, By Display Type (2023-2030) 5.5.5.3. Spain Automotive Display Market Size and Forecast, By Display Size (2023-2030) 5.5.5.4. Spain Automotive Display Market Size and Forecast, By Application (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.6.2. Sweden Automotive Display Market Size and Forecast, By Display Type (2023-2030) 5.5.6.3. Sweden Automotive Display Market Size and Forecast, By Display Size (2023-2030) 5.5.6.4. Sweden Automotive Display Market Size and Forecast, By Application (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.7.2. Austria Automotive Display Market Size and Forecast, By Display Type (2023-2030) 5.5.7.3. Austria Automotive Display Market Size and Forecast, By Display Size (2023-2030) 5.5.7.4. Austria Automotive Display Market Size and Forecast, By Application (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.8.2. Rest of Europe Automotive Display Market Size and Forecast, By Display Type (2023-2030) 5.5.8.3. Rest of Europe Automotive Display Market Size and Forecast, By Display Size (2023-2030) 5.5.8.4. Rest of Europe Automotive Display Market Size and Forecast, By Application (2023-2030) 6. Asia Pacific Automotive Display Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.2. Asia Pacific Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.3. Asia Pacific Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.4. Asia Pacific Automotive Display Market Size and Forecast, By Application (2023-2030) 6.5. Asia Pacific Automotive Display Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.1.2. China Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.5.1.3. China Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.5.1.4. China Automotive Display Market Size and Forecast, By Application (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.2.2. S Korea Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.5.2.3. S Korea Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.5.2.4. S Korea Automotive Display Market Size and Forecast, By Application (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.3.2. Japan Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.5.3.3. Japan Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.5.3.4. Japan Automotive Display Market Size and Forecast, By Application (2023-2030) 6.5.4. India 6.5.4.1. India Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.4.2. India Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.5.4.3. India Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.5.4.4. India Automotive Display Market Size and Forecast, By Application (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.5.2. Australia Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.5.5.3. Australia Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.5.5.4. Australia Automotive Display Market Size and Forecast, By Application (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.6.2. Indonesia Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.5.6.3. Indonesia Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.5.6.4. Indonesia Automotive Display Market Size and Forecast, By Application (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.7.2. Malaysia Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.5.7.3. Malaysia Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.5.7.4. Malaysia Automotive Display Market Size and Forecast, By Application (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.8.2. Vietnam Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.5.8.3. Vietnam Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.5.8.4. Vietnam Automotive Display Market Size and Forecast, By Application (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.9.2. Taiwan Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.5.9.3. Taiwan Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.5.9.4. Taiwan Automotive Display Market Size and Forecast, By Application (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Automotive Display Market Size and Forecast, By Display Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Automotive Display Market Size and Forecast, By Display Size (2023-2030) 6.5.10.4. Rest of Asia Pacific Automotive Display Market Size and Forecast, By Application (2023-2030) 7. Middle East and Africa Automotive Display Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 7.2. Middle East and Africa Automotive Display Market Size and Forecast, By Display Type (2023-2030) 7.3. Middle East and Africa Automotive Display Market Size and Forecast, By Display Size (2023-2030) 7.4. Middle East and Africa Automotive Display Market Size and Forecast, By Application (2023-2030) 7.5. Middle East and Africa Automotive Display Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 7.5.1.2. South Africa Automotive Display Market Size and Forecast, By Display Type (2023-2030) 7.5.1.3. South Africa Automotive Display Market Size and Forecast, By Display Size (2023-2030) 7.5.1.4. South Africa Automotive Display Market Size and Forecast, By Application (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 7.5.2.2. GCC Automotive Display Market Size and Forecast, By Display Type (2023-2030) 7.5.2.3. GCC Automotive Display Market Size and Forecast, By Display Size (2023-2030) 7.5.2.4. GCC Automotive Display Market Size and Forecast, By Application (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 7.5.3.2. Nigeria Automotive Display Market Size and Forecast, By Display Type (2023-2030) 7.5.3.3. Nigeria Automotive Display Market Size and Forecast, By Display Size (2023-2030) 7.5.3.4. Nigeria Automotive Display Market Size and Forecast, By Application (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 7.5.4.2. Rest of ME&A Automotive Display Market Size and Forecast, By Display Type (2023-2030) 7.5.4.3. Rest of ME&A Automotive Display Market Size and Forecast, By Display Size (2023-2030) 7.5.4.4. Rest of ME&A Automotive Display Market Size and Forecast, By Application (2023-2030) 8. South America Automotive Display Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. South America Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 8.2. South America Automotive Display Market Size and Forecast, By Display Type (2023-2030) 8.3. South America Automotive Display Market Size and Forecast, By Display Size (2023-2030) 8.4. South America Automotive Display Market Size and Forecast, By Application (2023-2030) 8.5. South America Automotive Display Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 8.5.1.2. Brazil Automotive Display Market Size and Forecast, By Display Type (2023-2030) 8.5.1.3. Brazil Automotive Display Market Size and Forecast, By Display Size (2023-2030) 8.5.1.4. Brazil Automotive Display Market Size and Forecast, By Application (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 8.5.2.2. Argentina Automotive Display Market Size and Forecast, By Display Type (2023-2030) 8.5.2.3. Argentina Automotive Display Market Size and Forecast, By Display Size (2023-2030) 8.5.2.4. Argentina Automotive Display Market Size and Forecast, By Application (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Automotive Display Market Size and Forecast, By Vehicle Type (2023-2030) 8.5.3.2. Rest Of South America Automotive Display Market Size and Forecast, By Display Type (2023-2030) 8.5.3.3. Rest Of South America Automotive Display Market Size and Forecast, By Display Size (2023-2030) 8.5.3.4. Rest Of South America Automotive Display Market Size and Forecast, By Application (2023-2030) 9. Global Automotive Display Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Service Segment 9.3.3. End Use Segment 9.3.4. Revenue (2022) 9.3.5. Manufacturing Locations 9.4. Leading Automotive Display Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Continental AG - Germany 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Magneti Marelli S.p.A - Italy 10.3. Delphi Technologies - United Kingdom 10.4. Sharp Devices Europe - Switzerland 10.5. SmartKem Ltd - United Kingdom 10.6. Robert Bosch GmbH - Germany 10.7. Garmin Ltd - Switzerland 10.8. Valeo - France 10.9. Elektrobit - Finland 10.10. Barco - Belgium 10.11. Visteon Corporation - United States 10.12. 3M - United States 10.13. HARMAN International - United States 10.14. Panasonic Corporation - Japan 10.15. Nippon Seiki Co. Ltd - Japan 10.16. YAZAKI Corporation - Japan 10.17. DENSO CORPORATION - Japan 10.18. LG Display Co. Ltd - South Korea 10.19. Alpine Electronics Inc - Japan 10.20. Japan Display Inc - Japan 10.21. AU Optronics Corp - Taiwan 10.22. Pioneer Corporation - Japan 10.23. Innolux Corporation - Taiwan 10.24. KYOCERA Corporation - Japan 11. Key Findings 12. Industry Recommendations 13. Automotive Display Market: Research Methodology.