Automotive Cup Holder Market size was valued at USD 2.39 Bn. in 2022 and the total Automotive Cup Holder revenue is expected to grow by 5.38 % from 2023 to 2029, reaching nearly USD 3.45 Bn.Automotive Cup Holder Market Overview:

The Automotive Cup Holder Market is a dynamic sector focused on the design, production, and distribution of cup holders specifically tailored for vehicle installation. These specialized compartments within vehicles play a vital role in securely accommodating and protecting beverage containers, including cups, bottles, and cans. Beyond the convenience they offer, cup holders also contribute to safety for both drivers and passengers. In recent years, the Automotive Cup Holder Market has experienced remarkable growth, driven by the escalating consumer demand for enhanced convenience and comfort features within vehicles. What were once simple, static storage spaces have evolved into versatile and technologically advanced solutions, featuring capabilities such as heating and cooling. This transformation has driven cup holders into a central position within the broader realm of vehicle interior design and functionality.Automotive Cup Holder Market Snapshot

To know about the Research Methodology :- Request Free Sample Report The intensifying competition among emerging automotive manufacturers globally, coupled with relentless innovation in the domain of automotive luxury amenities, is a significant growth driver for market expansion. A primary focus for cup holder manufacturers worldwide is the implementation of spill-free systems, especially critical for journeys across rugged terrains and uneven road surfaces. To tackle this challenge, ingenious technologies such as 360-degree spinning cup holders and free-moving cup holders have been introduced, elevating the functionality and desirability of these automotive essentials. Automotive Cup Holder Market Scope and Research Methodology The Automotive Cup Holder Market report offers a thorough evaluation of the market for the forecast period. It examines patterns and factors shaping the market, including drivers, constraints, opportunities, and challenges. The report also provides expected revenue growth for the Automotive Cup Holder Market during the forecast period. The research on the Automotive Cup Holder Market analyses major applications, business strategies, and influencing factors. The report examines market trends, volume, cost, share, supply, and demand, and utilizes methods like SWOT and PESTLE analysis. Primary research resources include databases and surveys.

Automotive Cup Holder Market Dynamics:

Automotive Cup Holder Market Drivers Luxury Vehicle Drive Cup Holder Market Expansion The increasing demand for luxury vehicles and the contemporary trend of consuming beverages on the go are primary drivers, underscoring the market's expansion. As the changing consumer preferences when purchasing cars, emphasizing aesthetics, technological features, accessories, and interior comfort over traditional factors like fuel economy and engine specifications, significantly support market growth. The modern lifestyle characterized by hectic schedules, leading to in-vehicle consumption of food and beverages during commuting, has made cup holders an indispensable vehicle feature, further propelling market demand. The rise of electric and autonomous vehicles has accentuated the importance of innovative interior designs, integrating cup holders seamlessly and thereby boosting the market. Automotive Cup Holder Market players' continuous innovations in cup holder technology, including heating and cooling functions, adjustability, and spill-proof designs, have attracted consumers and driven market expansion. The growing urbanization trend, resulting in longer commutes, has further fueled the need for cup holders to accommodate on-the-go eating and drinking, especially in urban areas. Diverse vehicle types, such as compact cars, SUVs, and trucks, now demand specialized cup holder solutions, opening up niche markets and driving overall growth. Technological innovations in cup holder features, including spill-prevention mechanisms and smart connectivity, have garnered consumer attention, with sensors preventing spills on rough terrains exemplifying these advancements.Automotive Cup Holder Adoption by Vehicle Type (%), in 2022

Automotive Cup Holder Market Restraint High-Cost Raw Materials are Hurdles in the Cup Holder Market The high cost of automotive cup holders deters some consumers from investing in this accessory, particularly in budget or entry-level vehicles, limiting market potential in this segment. The increasing maintenance factor of cup holders can dissuade consumers, as they may perceive ongoing maintenance as burdensome and costly. Safety concerns are a considerable challenge, as poorly designed cup holders can become potential hazards in accidents, contributing to injuries during collisions and prompting some automotive manufacturers to refuse their installation in vehicles to ensure driver safety. The intricate task of designing cup holders to accommodate various cup and bottle sizes without obstructing the driver's view or interfering with vehicle controls presents another hurdle, hampering market expansion. Fluctuations in the costs of cup holder materials, like plastics and metals, affect market growth, as sudden increases in material prices lead to higher production costs, potentially impacting consumer pricing. Economic downturns can also lead to reduced consumer spending on vehicles and accessories, including cup holders, further impeding market growth. The competition from alternative storage solutions within vehicles, such as door pockets and center console compartments, adds to these challenges by limiting the growth potential of the cup holder market as consumers explore alternatives. Automotive Cup Holder Market Opportunities Multifunctional Cup Holders with Customized Solutions offers Market Growth Opportunities The integration of intelligent features into cup holders presents a compelling opportunity to enhance the in-vehicle experience. These features, including wireless charging, beverage temperature control, and touch-sensitive controls, offer advanced and convenient solutions, catering to the evolving demands of consumers. As the electric vehicle market continues to expand, customizing cup holders to accommodate charging cables and electric vehicle-specific requirements, such as integrated cable management, opens doors to a burgeoning segment of environmentally-conscious consumers. Embracing sustainability through eco-friendly materials and sustainable manufacturing practices aligns with prevailing environmental trends and taps into a growing market of individuals who prioritize eco-conscious choices. Developing cup holders with enhanced safety features, such as secure locking mechanisms and airbag compatibility, not only addresses the concerns of safety-conscious consumers but also ensures compliance with evolving safety regulations, thereby fostering market growth. Innovative cup holder designs optimized for space efficiency, particularly in compact vehicles, attract consumers seeking creative and practical interior solutions. In emerging markets where the automotive industry is booming, adapting cup holder designs and pricing strategies to local preferences and budgets is a key strategy to gain a significant foothold. Integrating cup holders with in-car entertainment systems, such as tablet or smartphone mounts, caters to tech-savvy consumers in search of a comprehensive in-vehicle experience. Collaboration with automotive manufacturers to create customized cup holder solutions that seamlessly integrate with specific vehicle models not only opens doors to niche markets but also strengthens brand recognition. Designing cup holders with ergonomic considerations, such as adjustable heights and angles, enhances user comfort and convenience, appealing to consumers in pursuit of personalized solutions.

Vehicle Type Built-in Cup Holders (%) Removable Cup Holders (%) Foldable Cup Holders (%) Sedan 75% 15% 10% SUV 60% 20% 20% Truck 40% 30% 30% Hatchback 70% 10% 20% Minivan 55% 25% 20% Automotive Cup Holder Market Segment Analysis:

Based on Type, Fixed cup holders dominated the Automotive Cup Holder Market in 2022 and are expected to continue their dominance during the forecast period. They are known for their stability and reliability and find widespread adoption across various vehicle types, including compact cars, sedans, and SUVs. They are favored for their ability to securely hold beverages during daily commutes and long journeys. Folding cup holders are fast fast-growing segment in the Automotive Cup Holder Market and they are valued for their versatility and space-saving design. Their popularity is particularly evident in smaller vehicles where optimizing interior space is essential. Removable cup holders offer flexibility as they can be adjusted or relocated as needed, making them suitable for multifunctional interiors and customizable vehicle designs. Built-in cup holders are integrated into the vehicle's interior, providing a sleek and polished look. They are commonly found in luxury cars and high-end models, emphasizing aesthetics and ergonomic design.Automotive Cup Holder Market ,By Type(%) In 2022

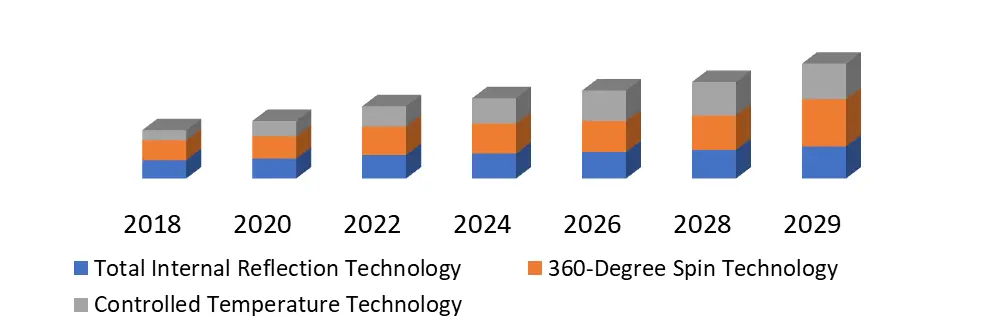

Based on the Technology, cup holder equipped with 360-degree Spin Technology dominated the Automotive Cup Holder Market in 2022 and is expected to continue its dominance during the forecast period. 360-degree Spin Technology provides practicality and convenience, allowing users to access their drinks effortlessly, especially valuable for on-the-go consumers. These cup holders are commonly integrated into family cars and SUVs, focusing on ease of use. Cup holders incorporating Total Internal Reflection (TIR) technology offer modern solutions, often found in high-end luxury vehicles. TIR cup holders create an elegant visual effect by illuminating the beverage container, enhancing the overall in-vehicle ambiance. In contrast, Controlled Temperature Technology cup holders are designed to cater to those who desire their beverages at specific temperatures, making them particularly appealing in regions with extreme weather conditions. This segment analysis underscores the diversity of cup holder technologies, each tailored to distinct automotive applications and consumer preferences, ultimately driving innovation and enhancing the in-vehicle experience.

Automotive Cup Holder Market Forecast ,By Technology (%) through 2018-2023

Automotive Cup Holder Market Regional Insights:

North America's region dominated the Automotive Cup Holder Market in 2022 and is expected to maintain its dominance during the forecast period. This dominion is primarily driven by the United States and Canada, emblematic of a mature market fueled by consumers' escalating appetite for cutting-edge cup holder functionalities. Europe and Asia-Pacific emerge as dynamic hotspots within the Automotive Cup Holder Market. Both regions are experiencing an impressive surge in growth, catalyzed by burgeoning automotive industries and rising disposable incomes among their populations. Europe, with its well-established automotive sector, is seeing an increasing adoption of advanced cup holder designs. Simultaneously, the Asia-Pacific region, home to a burgeoning middle-class population, is displaying a growing affinity for vehicles equipped with innovative cup holder solutions.Automotive Cup Holder Market Regional Insights, in 2022

Competitive Landscape Automotive Cup Holder Market: The global automotive cup-holder market boasts fierce competition among industry leaders and key service providers. American Van Equipment Inc has recently launched customizable cup holders, while Callmate India introduced technologically advanced options with wireless charging and smart sensors. JVIS USA's collaboration with a major automaker for integrated cup holder solutions has solidified its position, and Seiko Sangyo's sleek cup holders have caught the eye of automakers. Napolex is emphasizing sustainability with eco-friendly cup holders, and ELPIS AUTO's partnership for temperature-controlled holders is adding innovation. Dorman Products, Inc acquired a cup holder technology startup, CupHolders Plus offers niche customization, and Voltage Automotive is venturing into IoT-enabled cup holders. Hansshow Technology Co., LTD unveiled premium motorized cup holders, and Welson is expanding its global reach through strategic partnerships. These developments underscore the market's dynamism and commitment to meeting consumer demands for convenience and innovation.

Automotive Cup Holder Market Scope: Inquire Before Buying

Global Automotive Cup Holder Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2.39 Bn. Forecast Period 2023 to 2029 CAGR: 5.38% Market Size in 2029: US $ 3.45 Bn. Segments Covered: by Type Fixed Cup Holders Folding Cup Holders Removable Cup Holders Built-in Cup Holders by Material Plastic Cup Holders Metal Cup Holders Synthetic fibre cup Holders by Technology Total Internal Reflection Technology Type 360-Degree Spin Technology Type Controlled Temperature Technology Type by Vehicle Type Passenger Cars Commercial Vehicles Others Automotive Cup Holder Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Automotive Cup Holder Market Key Players

1. American Van Equipment Inc 2. Callmate India 3. JVIS USA 4. Seiko Sangyo 5. Napolex 6. ELPIS AUTO 7. Dorman Products, Inc 8. CupHolders Plus 9. Voltage Automotive 10. Hansshow Technoloy Co., LTD 11. WelsonFrequently Asked Questions:

1] What segments are covered in the Global Automotive Cup Holder Market report? Ans. The segments covered in the Market report are based on Type, Material, Technology, Vehicle Type, and Region. 2] Which region is expected to hold the highest share of the Global Automotive Cup Holder Market? Ans. The North America region is expected to hold the highest share of the Market. 3] What is the market size of the Global Automotive Cup Holder Market by 2029? Ans. The market size of the Market by 2029 is expected to reach US$ 3.45Bn. 4] What is the forecast period for the Global Automotive Cup Holder Market? Ans. The forecast period for the Market is 2022-2029. 5] What was the market size of the Global Automotive Cup Holder Market in 2022? Ans. The market size of the Market in 2022 was valued at US$ 2.39 Bn.

1. Automotive Cup Holder Market: Research Methodology 2. Automotive Cup Holder Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Automotive Cup Holder Market: Dynamics 3.1. Automotive Cup Holder Market Trends by Region 3.1.1. Global Automotive Cup Holder Market Trends 3.1.2. North America Automotive Cup Holder Market Trends 3.1.3. Europe Automotive Cup Holder Market Trends 3.1.4. Asia Pacific Automotive Cup Holder Market Trends 3.1.5. Middle East and Africa Automotive Cup Holder Market Trends 3.1.6. South America Automotive Cup Holder Market Trends 3.2. Automotive Cup Holder Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Automotive Cup Holder Market Drivers 3.2.1.2. North America Automotive Cup Holder Market Restraints 3.2.1.3. North America Automotive Cup Holder Market Opportunities 3.2.1.4. North America Automotive Cup Holder Market Challenges 3.2.2. Europe 3.2.2.1. Europe Automotive Cup Holder Market Drivers 3.2.2.2. Europe Automotive Cup Holder Market Restraints 3.2.2.3. Europe Automotive Cup Holder Market Opportunities 3.2.2.4. Europe Automotive Cup Holder Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Automotive Cup Holder Market Drivers 3.2.3.2. Asia Pacific Automotive Cup Holder Market Restraints 3.2.3.3. Asia Pacific Automotive Cup Holder Market Opportunities 3.2.3.4. Asia Pacific Automotive Cup Holder Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Automotive Cup Holder Market Drivers 3.2.4.2. Middle East and Africa Automotive Cup Holder Market Restraints 3.2.4.3. Middle East and Africa Automotive Cup Holder Market Opportunities 3.2.4.4. Middle East and Africa Automotive Cup Holder Market Challenges 3.2.5. South America 3.2.5.1. South America Automotive Cup Holder Market Drivers 3.2.5.2. South America Automotive Cup Holder Market Restraints 3.2.5.3. South America Automotive Cup Holder Market Opportunities 3.2.5.4. South America Automotive Cup Holder Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. Global 3.6.2. North America 3.6.3. Europe 3.6.4. Asia Pacific 3.6.5. Middle East and Africa 3.6.6. South America 3.7. Key Opinion Leader Analysis For Automotive Cup Holder Industry 3.8. Analysis of Government Schemes and Initiatives For Automotive Cup Holder Industry 3.9. The Global Pandemic Impact on Automotive Cup Holder Market 4. Automotive Cup Holder Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 4.1.1. Fixed Cup Holders 4.1.2. Folding Cup Holders 4.1.3. Removable Cup Holders 4.1.4. Built-in Cup Holders 4.2. Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 4.2.1. Plastic Cup Holders 4.2.2. metal Cup Holders 4.2.3. Synthetic fiber cup Holders 4.3. Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 4.3.1. Total Internal Reflection Technology Type 4.3.2. 360-Degree Spin Technology Type 4.3.3. Controlled Temperature Technology Type 4.4. Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 4.4.1. Passenger Cars 4.4.2. Commercial Vehicles 4.4.3. Others 4.5. Automotive Cup Holder Market Size and Forecast, by Region (2022-2029) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Automotive Cup Holder Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. North America Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 5.1.1. Fixed Cup Holders 5.1.2. Folding Cup Holders 5.1.3. Removable Cup Holders 5.1.4. Built-in Cup Holders 5.2. North America Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 5.2.1. Plastic Cup Holders 5.2.2. metal Cup Holders 5.2.3. Synthetic fiber cup Holders 5.3. North America Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 5.3.1. Total Internal Reflection Technology Type 5.3.2. 360-Degree Spin Technology Type 5.3.3. Controlled Temperature Technology Type 5.4. North America Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.1. Passenger Cars 5.4.2. Commercial Vehicles 5.4.3. Others 5.5. North America Automotive Cup Holder Market Size and Forecast, by Country (2022-2029) 5.5.1. United States 5.5.1.1. United States Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 5.5.1.1.1. Fixed Cup Holders 5.5.1.1.2. Folding Cup Holders 5.5.1.1.3. Removable Cup Holders 5.5.1.1.4. Built-in Cup Holders 5.5.1.2. United States Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 5.5.1.2.1. Plastic Cup Holders 5.5.1.2.2. metal Cup Holders 5.5.1.2.3. Synthetic fibre cup Holders 5.5.1.3. United States Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 5.5.1.3.1. Total Internal Reflection Technology Type 5.5.1.3.2. 360-Degree Spin Technology Type 5.5.1.3.3. Controlled Temperature Technology Type 5.5.1.4. United States Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.1.4.1. Passenger Cars 5.5.1.4.2. Commercial Vehicles 5.5.1.4.3. Others 5.5.2. Canada 5.5.2.1. Canada Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 5.5.2.1.1. Fixed Cup Holders 5.5.2.1.2. Folding Cup Holders 5.5.2.1.3. Removable Cup Holders 5.5.2.1.4. Built-in Cup Holders 5.5.2.2. Canada Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 5.5.2.2.1. Plastic Cup Holders 5.5.2.2.2. metal Cup Holders 5.5.2.2.3. Synthetic fibre cup Holders 5.5.2.3. Canada Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 5.5.2.3.1. Total Internal Reflection Technology Type 5.5.2.3.2. 360-Degree Spin Technology Type 5.5.2.3.3. Controlled Temperature Technology Type 5.5.2.4. Canada Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.2.4.1. Passenger Cars 5.5.2.4.2. Commercial Vehicles 5.5.2.4.3. Others 5.5.3. Mexico 5.5.3.1. Mexico Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 5.5.3.1.1. Fixed Cup Holders 5.5.3.1.2. Folding Cup Holders 5.5.3.1.3. Removable Cup Holders 5.5.3.1.4. Built-in Cup Holders 5.5.3.2. Mexico Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 5.5.3.2.1. Plastic Cup Holders 5.5.3.2.2. metal Cup Holders 5.5.3.2.3. Synthetic fibre cup Holders 5.5.3.3. Mexico Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 5.5.3.3.1. Total Internal Reflection Technology Type 5.5.3.3.2. 360-Degree Spin Technology Type 5.5.3.3.3. Controlled Temperature Technology Type 5.5.3.4. Mexico Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.3.4.1. Passenger Cars 5.5.3.4.2. Commercial Vehicles 5.5.3.4.3. Others 6. Europe Automotive Cup Holder Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Europe Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 6.2. Europe Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 6.3. Europe Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 6.4. Europe Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 6.5. Europe Automotive Cup Holder Market Size and Forecast, by Country (2022-2029) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 6.5.1.2. United Kingdom Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 6.5.1.3. United Kingdom Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 6.5.1.4. United Kingdom Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.2. France 6.5.2.1. France Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 6.5.2.2. France Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 6.5.2.3. France Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 6.5.2.4. France Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.3. Germany 6.5.3.1. Germany Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 6.5.3.2. Germany Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 6.5.3.3. Germany Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 6.5.3.4. Germany Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.4. Italy 6.5.4.1. Italy Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 6.5.4.2. Italy Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 6.5.4.3. Italy Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 6.5.4.4. Italy Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.5. Spain 6.5.5.1. Spain Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 6.5.5.2. Spain Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 6.5.5.3. Spain Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 6.5.5.4. Spain Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.6. Sweden 6.5.6.1. Sweden Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 6.5.6.2. Sweden Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 6.5.6.3. Sweden Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 6.5.6.4. Sweden Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.7. Austria 6.5.7.1. Austria Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 6.5.7.2. Austria Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 6.5.7.3. Austria Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 6.5.7.4. Austria Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 6.5.8.2. Rest of Europe Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 6.5.8.3. Rest of Europe Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 6.5.8.4. Rest of Europe Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7. Asia Pacific Automotive Cup Holder Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.2. Asia Pacific Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.3. Asia Pacific Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.4. Asia Pacific Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7.5. Asia Pacific Automotive Cup Holder Market Size and Forecast, by Country (2022-2029) 7.5.1. China 7.5.1.1. China Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.5.1.2. China Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.5.1.3. China Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.5.1.4. China Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.2. S Korea 7.5.2.1. S Korea Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.5.2.2. S Korea Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.5.2.3. S Korea Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.5.2.4. S Korea Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.3. Japan 7.5.3.1. Japan Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.5.3.2. Japan Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.5.3.3. Japan Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.5.3.4. Japan Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.4. India 7.5.4.1. India Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.5.4.2. India Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.5.4.3. India Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.5.4.4. India Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.5. Australia 7.5.5.1. Australia Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.5.5.2. Australia Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.5.5.3. Australia Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.5.5.4. Australia Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.6. Indonesia 7.5.6.1. Indonesia Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.5.6.2. Indonesia Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.5.6.3. Indonesia Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.5.6.4. Indonesia Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.7. Malaysia 7.5.7.1. Malaysia Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.5.7.2. Malaysia Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.5.7.3. Malaysia Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.5.7.4. Europe Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.8. Vietnam 7.5.8.1. Vietnam Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.5.8.2. Vietnam Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.5.8.3. Vietnam Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.5.8.4. Vietnam Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.9. Taiwan 7.5.9.1. Taiwan Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.5.9.2. Taiwan Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.5.9.3. Taiwan Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.5.9.4. Taiwan Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 7.5.10.2. Rest of Asia Pacific Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 7.5.10.3. Rest of Asia Pacific Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 7.5.10.4. Rest of Asia Pacific Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 8. Middle East and Africa Automotive Cup Holder Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 8.2. Middle East and Africa Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 8.3. Middle East and Africa Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 8.4. Middle East and Africa Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 8.5. Middle East and Africa Automotive Cup Holder Market Size and Forecast, by Country (2022-2029) 8.5.1. South Africa 8.5.1.1. South Africa Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 8.5.1.2. South Africa Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 8.5.1.3. South Africa Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 8.5.1.4. South Africa Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 8.5.2. GCC 8.5.2.1. GCC Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 8.5.2.2. GCC Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 8.5.2.3. GCC Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 8.5.2.4. GCC Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 8.5.3. Nigeria 8.5.3.1. Nigeria Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 8.5.3.2. Nigeria Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 8.5.3.3. Nigeria Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 8.5.3.4. Nigeria Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 8.5.4.2. Rest of ME&A Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 8.5.4.3. Rest of ME&A Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 8.5.4.4. Rest of ME&A Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 9. South America Automotive Cup Holder Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 9.1. South America Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 9.2. South America Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 9.3. South America Automotive Cup Holder Market Size and Forecast, by Technology 0(2022-2029) 9.4. South America Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 9.5. South America Automotive Cup Holder Market Size and Forecast, by Country (2022-2029) 9.5.1. Brazil 9.5.1.1. Brazil Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 9.5.1.2. Brazil Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 9.5.1.3. Brazil Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 9.5.1.4. Brazil Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 9.5.2. Argentina 9.5.2.1. Argentina Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 9.5.2.2. Argentina Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 9.5.2.3. Argentina Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 9.5.2.4. Argentina Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Automotive Cup Holder Market Size and Forecast, by Type (2022-2029) 9.5.3.2. Rest Of South America Automotive Cup Holder Market Size and Forecast, by Material (2022-2029) 9.5.3.3. Rest Of South America Automotive Cup Holder Market Size and Forecast, by Technology (2022-2029) 9.5.3.4. Rest Of South America Automotive Cup Holder Market Size and Forecast, by Vehicle Type (2022-2029) 10. Global Automotive Cup Holder Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Automotive Cup Holder Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. American Van Equipment Inc 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Callmate India 11.3. JVIS USA 11.4. Seiko Sangyo 11.5. Napolex 11.6. ELPIS AUTO 11.7. Dorman Products, Inc 11.8. CupHolders Plus 11.9. Voltage Automotive 11.10. Hansshow Technoloy Co., LTD 11.11. Welson 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary