Automotive Air Purifier Market was valued at USD 1.75 Bn in 2023 and is expected to reach USD 3.52 Bn by 2030, at a CAGR of 10.5 percent during the forecast period.Automotive Air Purifier Market Overview

An automotive air purifier is designed to improve the air quality inside a vehicle by removing pollutants, allergens, and other particles from the air. These devices typically use various technologies such as HEPA (High-Efficiency Particulate Air) filters, activated carbon filters, ionizers, and UV-C light to capture or neutralize airborne particles and eliminate odors. The main goal of automotive air purifiers is to create a healthier and more comfortable environment within the vehicle, especially for passengers who are sensitive to allergens or pollutants. These devices are often portable and are plugged into the vehicle power outlet or USB port. It's essential to follow the manufacturer's instructions and maintenance guidelines to ensure the effective and safe operation of automotive air purifiers.To know about the Research Methodology :- Request Free Sample Report With the rapid pace of urbanization, many cities around the world are grappling with high levels of air pollution. People spend a substantial amount of time in their vehicles, especially in densely populated urban areas, making the need for clean and healthy air inside vehicles more crucial, which significantly boosts the Automotive Air Purifier Market growth. The integration of smart and connected features in automotive air purifiers has gained traction. Consumers buying pattern in Automotive Air Purifier Market appreciate features such as real-time air quality monitoring, filter replacement indicators, and smartphone connectivity, allowing them to control and monitor air purification settings remotely.

Automotive Air Purifier Market Dynamics

Increasing Concerns about Air Quality due to air pollution to boost the Automotive Air Purifier Market growth Growing awareness and concern regarding air quality is the significant driver of the Automotive Air Purifier Market. Urbanization and industrialization have led to increased levels of air pollution, both outdoors and indoors. As people spend a considerable amount of time in their vehicles, there is a heightened focus on ensuring clean and healthy air inside the vehicle cabin. The rising awareness of the adverse effects of air pollution on respiratory health is a key factor driving the demand for automotive air purifiers. The global emphasis on health and wellness has extended to various aspects of life, including the air we breathe. Consumers are becoming more health-conscious, and this trend is influencing their purchasing decisions, which significantly boosts the Automotive Air Purifier industry growth. Automotive air purifiers are seen as a proactive measure to create a healthier environment within the vehicle, addressing concerns related to allergens, particulate matter, and other pollutants that affect respiratory health. Governments and regulatory bodies worldwide are implementing stringent standards and emission norms to address environmental and public health concerns. These regulations often include guidelines for indoor air quality, which encompasses the air quality inside vehicles. Automotive manufacturers are increasingly incorporating air purification systems to meet these standards and ensure compliance with regulatory requirements. Ongoing advancements in air purification technologies have played a crucial role in driving the Automotive Air Purifier market. Manufacturers are constantly innovating to improve the efficiency of air purifiers by incorporating advanced filtration technologies such as HEPA filters, activated carbon filters, UV-C light sterilization, and ionizers. These technological enhancements enhance the capability of automotive air purifiers to capture and eliminate a wide range of airborne contaminants. The demand for enhanced vehicle interior comfort and experience has driven the inclusion of various features, including air purification systems. Consumers are seeking a more pleasant and comfortable driving environment, free from unpleasant odors, allergens, and pollutants. Automotive air purifiers contribute to creating a cleaner and more enjoyable in-car experience, which is a significant factor influencing consumer preferences. As disposable income increases, particularly in emerging markets, consumers have more purchasing power to invest in additional features and accessories for their vehicles. The urban lifestyle, characterized by longer commuting times and exposure to traffic-related pollution, further amplifies the demand for solutions that improve in-car air quality. Price Sensitivity and Affordability to limit Automotive Air Purifier Market Growth Automotive air purifiers come with a price tag that is perceived as high by certain consumer segments. Price sensitivity hinder widespread adoption, especially in markets where consumers prioritize cost-effective solutions. Automotive Air Purifier Manufacturers face the challenge in balancing the inclusion of advanced features and technologies while keeping the product affordable for a broader customer base. Despite increasing awareness about air quality concerns, there remains a significant portion of the consumer market that is not well-informed about the benefits and functionality of automotive air purifiers. Limited awareness lead to lower adoption rates as potential consumers may not recognize the value of these devices in improving in-car air quality. Educating consumers about the importance and effectiveness of air purifiers is a critical challenge for Automotive Air Purifier market players. Some air purification technologies, such as ozone generators, have raised concerns about their long-term effects on human health. Ozone, when present in high concentrations, is harmful to respiratory systems. While many modern air purifiers avoid using ozone generators, addressing concerns about potential health risks associated with certain technologies remains a challenge for the Automotive Air Purifier industry. Automotive air purifiers require regular maintenance, including filter replacements. Consumers are deterred by the ongoing costs associated with maintaining these devices. Automotive Air Purifier Manufacturers need to design products with user-friendly maintenance features and communicate the importance of timely filter replacements to ensure optimal performance. Failure to address maintenance concerns leads to dissatisfaction among users. Retrofitting air purification systems into existing vehicle designs is challenging. Integrating air purifiers seamlessly without compromising other features or aesthetics poses a technical challenge for both aftermarket and original equipment manufacturers. Design considerations, space constraints, and compatibility with different vehicle models impact the ease of installation and integration. While automotive air purifiers are effective in smaller vehicles, their performance in larger vehicles such as buses or open environments, such as convertible cars, are limited. Achieving uniform air purification in larger spaces presents technical challenges that need to be addressed to cater to a diverse range of vehicle types and sizes.Automotive Air Purifier Market Segment Analysis

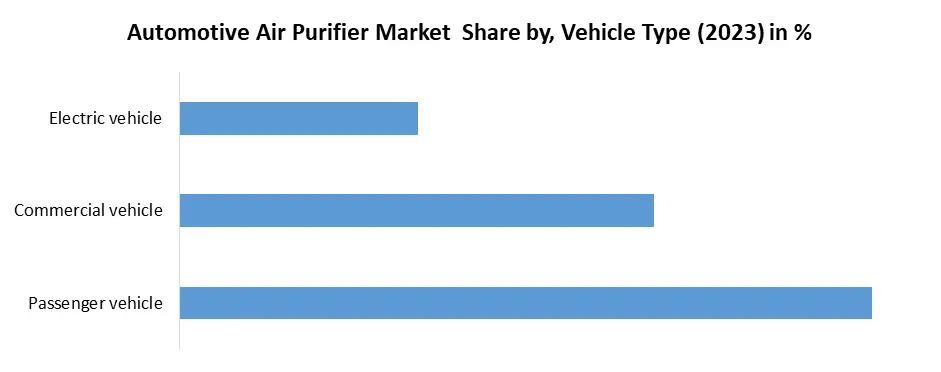

Based on Offering, the market is segmented into HEPA, Activated Carbon, Photocatalytic, and Ionic filter. HEPA segment dominated the market in 2023 and is expected to hold the largest Automotive Air Purifier Market share over the forecast period. The High-Efficiency Particulate Air (HEPA) segment in the Automotive Air Purifier market pertains to the use and incorporation of HEPA filters as a key technology in air purification systems designed for vehicles. HEPA filters are recognized for their high efficiency in capturing and trapping small particles, making them a popular choice for various air purification applications, including those in automobiles. HEPA filters are mechanical air filters that are designed to capture particles of a specific size with a high level of efficiency. To meet the HEPA standard, a filter must remove at least 99.97% of particles that are 0.3 micrometers in diameter. HEPA filters are composed of dense, interlaced fibers that create a labyrinthine structure, effectively trapping particles such as dust, pollen, pet dander, and other airborne pollutants. The primary advantage of HEPA filters in automotive air purifiers is their ability to efficiently remove a wide range of airborne particles. This includes not only larger particles but also very small particles that is harmful to respiratory health, which is expected to boost the Automotive Air Purifier Market growth. As vehicles move through various environments, HEPA filters help ensure that the air inside the cabin remains clean and free from contaminants.Based on Vehicle Type, the market is segmented into Passenger vehicle, Commercial vehicle, and Electric vehicle. Passenger vehicle segment dominated the market in 2023 and is expected to hold the largest Automotive Air Purifier Market share over the forecast period. The passenger vehicle segment in the Automotive Air Purifier market is purification systems designed specifically for use in passenger cars. These air purifiers are intended to enhance the air quality inside the cabin of cars, providing occupants with a cleaner and healthier environment. The passenger vehicle segment is a significant and prominent category within the broader automotive air purifier market, considering the widespread use of cars for daily commuting and transportation. Passenger vehicle air purifiers are designed to address indoor air quality issues within the confined space of car cabins. They aim to remove airborne particles, allergens, odors, and pollutants that are present in the air, creating a more comfortable and healthier driving experience. Passenger vehicle air purifiers are designed for easy installation and use. They are often user-friendly, with simple controls and features to ensure that drivers and passengers operate them without distraction.

Automotive Air Purifier Market Regional Insight

Rising Urbanization and Traffic Congestion to boost Automotive Air Purifier Market growth Asia Pacific dominated the market in 2023 and is expected to hold the largest Asia Pacific Automotive Air Purifier Market share over the forecast period. The Asia Pacific region is experiencing rapid urbanization, leading to increased traffic congestion in major cities. As people spend more time commuting in densely populated urban areas, the exposure to vehicular emissions and pollutants has risen. Automotive air purifiers address the need for cleaner air within vehicles, making them particularly relevant in urban environments. Several countries in the Asia Pacific region face challenges related to high levels of air pollution, resulting from industrial activities, vehicular emissions, and other sources. The deteriorating air quality has raised health concerns, and consumers are seeking solutions to mitigate the impact of pollution, especially during daily commutes. Automotive air purifiers serve as a practical measure to combat the adverse effects of air pollution inside vehicles. The growing middle-class population in countries such as China, India, Japan and Southeast Asian nations has led to increased purchasing power and higher disposable income, which is expected to boost the Automotive Air Purifier Market growth. As a result, consumers in the Asia Pacific region are more inclined to invest in accessories and technologies that enhance their overall driving experience, including air purification systems for their vehicles. There is a growing awareness of health and wellness in the Asia Pacific, with consumers becoming more conscious of the impact of environmental factors on their well-being, which is expected to boost the Automotive Air Purifier Market growth. As respiratory health concerns rise, the demand for automotive air purifiers as a preventive measure to reduce exposure to allergens and pollutants has increased. Governments in the Asia Pacific region are implementing stringent emission standards and regulations to address environmental and health issues. These regulations often extend to the air quality within vehicles. Automotive manufacturers are incorporating air purifiers to comply with these standards, contributing to the market growth. The Asia Pacific region has become a hub for technological advancements and innovation. Local Automotive Air Purifier manufacturers and global players are investing in research and development to introduce advanced features and technologies in automotive air purifiers. This includes the integration of smart features, air quality sensors, and energy-efficient systems.Automotive Air Purifier Market Scope: Inquire before buying

Global Automotive Air Purifier Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.75 Bn. Forecast Period 2024 to 2030 CAGR: 10.5% Market Size in 2030: US $ 3.52 Bn. Segments Covered: by Offering HEPA Activated Carbon Photocatalytic Ionic filter by Type Purifier Ionizer Hybrid by Vehicle Type Passenger vehicle Commercial vehicle Electric vehicle by Sales Channel OEM Aftermarket Automotive Air Purifier Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automotive Air Purifier Manufacturers include:

North America: 1. Honeywell International Inc. (Charlotte, North Carolina, USA) 2. Blueair AB (Chicago, Illinois, USA) 3. Sharp Corporation (Osaka, Japan) Europe: 4. Philips N.V. (Amsterdam, Netherlands) 5. Mann+Hummel Group (Ludwigsburg, Germany) 6. Blaupunkt (Hildesheim, Germany) Asia Pacific: 7. Panasonic Corporation (Osaka, Japan) 8. Xiaomi Corporation (Beijing, China) 9. Samsung Electronics Co., Ltd. (Suwon, South Korea) 10. Daikin Industries, Ltd. (Osaka, Japan) 11. Kent RO Systems Ltd. (Noida, India) 12. Toyota Boshoku Corporation (Kariya, Japan) 13. LG Electronics Inc. (Seoul, South Korea) Latin America: 14. Electrolux AB (Stockholm, Sweden) Middle East and Africa: 15. Sharp Middle East FZE (Dubai, United Arab Emirates) Global/International: 16. Dyson Ltd. (Malmesbury, United Kingdom) 17. Blue Pure AB (Stockholm, Sweden) 18. 3M Company (St. Paul, Minnesota, USA) 19. Smith Corporation (Milwaukee, Wisconsin, USA) 20. Coway Co., Ltd. (Seoul, South Korea) Frequently asked Questions: 1. What technologies are commonly used in automotive air purifiers? Ans: Automotive air purifiers commonly use technologies such as HEPA filters, activated carbon filters, ionizers, and UV-C light to capture or neutralize airborne particles and eliminate odors. 2. How are automotive air purifiers powered? Ans: Automotive air purifiers are often portable and can be plugged into the vehicle's power outlet or USB port. Some may also have battery-powered options for greater flexibility. 3. Why is the demand for automotive air purifiers increasing? Ans: The demand for automotive air purifiers is increasing due to growing concerns about air quality, especially in urban areas with high levels of air pollution. Consumers are seeking cleaner and healthier air inside their vehicles. 4. What are the key drivers of the Automotive Air Purifier Market? Ans: The key drivers include growing concerns about air quality, increasing awareness and health consciousness, regulatory standards and emission norms, technological advancements, the desire for enhanced vehicle interior comfort, rising disposable income, and the impact of global health events. 5. How is the Asia Pacific region contributing to the growth of the Automotive Air Purifier Market? Ans: The Asia Pacific region is contributing to market growth due to rapid urbanization, high levels of air pollution, growing middle-class population with increased purchasing power, awareness of health and wellness, and government initiatives implementing stringent emission standards.

1. Automotive Air Purifier Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Air Purifier Market: Dynamics 2.1. Automotive Air Purifier Market Trends by Region 2.1.1. North America Automotive Air Purifier Market Trends 2.1.2. Europe Automotive Air Purifier Market Trends 2.1.3. Asia Pacific Automotive Air Purifier Market Trends 2.1.4. Middle East and Africa Automotive Air Purifier Market Trends 2.1.5. South America Automotive Air Purifier Market Trends 2.2. Automotive Air Purifier Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive Air Purifier Market Drivers 2.2.1.2. North America Automotive Air Purifier Market Restraints 2.2.1.3. North America Automotive Air Purifier Market Opportunities 2.2.1.4. North America Automotive Air Purifier Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive Air Purifier Market Drivers 2.2.2.2. Europe Automotive Air Purifier Market Restraints 2.2.2.3. Europe Automotive Air Purifier Market Opportunities 2.2.2.4. Europe Automotive Air Purifier Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive Air Purifier Market Drivers 2.2.3.2. Asia Pacific Automotive Air Purifier Market Restraints 2.2.3.3. Asia Pacific Automotive Air Purifier Market Opportunities 2.2.3.4. Asia Pacific Automotive Air Purifier Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive Air Purifier Market Drivers 2.2.4.2. Middle East and Africa Automotive Air Purifier Market Restraints 2.2.4.3. Middle East and Africa Automotive Air Purifier Market Opportunities 2.2.4.4. Middle East and Africa Automotive Air Purifier Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive Air Purifier Market Drivers 2.2.5.2. South America Automotive Air Purifier Market Restraints 2.2.5.3. South America Automotive Air Purifier Market Opportunities 2.2.5.4. South America Automotive Air Purifier Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Automotive Air Purifier Industry 2.8. Analysis of Government Schemes and Initiatives For Automotive Air Purifier Industry 2.9. Automotive Air Purifier Market Trade Analysis 2.10. The Global Pandemic Impact on Automotive Air Purifier Market 3. Automotive Air Purifier Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 3.1.1. HEPA 3.1.2. Activated Carbon 3.1.3. Photocatalytic 3.1.4. Ionic filter 3.2. Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 3.2.1. Purifier 3.2.2. Ionizer 3.2.3. Hybrid 3.3. Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 3.3.1. Passenger vehicle 3.3.2. Commercial vehicle 3.3.3. Electric vehicle 3.4. Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 3.4.1. OEM 3.4.2. Aftermarket 3.5. Automotive Air Purifier Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Automotive Air Purifier Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 4.1.1. HEPA 4.1.2. Activated Carbon 4.1.3. Photocatalytic 4.1.4. Ionic filter 4.2. North America Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 4.2.1. Purifier 4.2.2. Ionizer 4.2.3. Hybrid 4.3. North America Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 4.3.1. Passenger vehicle 4.3.2. Commercial vehicle 4.3.3. Electric vehicle 4.4. North America Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 4.4.1. OEM 4.4.2. Aftermarket 4.5. North America Automotive Air Purifier Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 4.5.1.1.1. HEPA 4.5.1.1.2. Activated Carbon 4.5.1.1.3. Photocatalytic 4.5.1.1.4. Ionic filter 4.5.1.2. United States Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 4.5.1.2.1. Purifier 4.5.1.2.2. Ionizer 4.5.1.2.3. Hybrid 4.5.1.3. United States Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.1.3.1. Passenger vehicle 4.5.1.3.2. Commercial vehicle 4.5.1.3.3. Electric vehicle 4.5.1.4. United States Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 4.5.1.4.1. OEM 4.5.1.4.2. Aftermarket 4.5.2. Canada 4.5.2.1. Canada Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 4.5.2.1.1. HEPA 4.5.2.1.2. Activated Carbon 4.5.2.1.3. Photocatalytic 4.5.2.1.4. Ionic filter 4.5.2.2. Canada Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 4.5.2.2.1. Purifier 4.5.2.2.2. Ionizer 4.5.2.2.3. Hybrid 4.5.2.3. Canada Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.2.3.1. Passenger vehicle 4.5.2.3.2. Commercial vehicle 4.5.2.3.3. Electric vehicle 4.5.2.4. Canada Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 4.5.2.4.1. OEM 4.5.2.4.2. Aftermarket 4.5.3. Mexico 4.5.3.1. Mexico Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 4.5.3.1.1. HEPA 4.5.3.1.2. Activated Carbon 4.5.3.1.3. Photocatalytic 4.5.3.1.4. Ionic filter 4.5.3.2. Mexico Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 4.5.3.2.1. Purifier 4.5.3.2.2. Ionizer 4.5.3.2.3. Hybrid 4.5.3.3. Mexico Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 4.5.3.3.1. Passenger vehicle 4.5.3.3.2. Commercial vehicle 4.5.3.3.3. Electric vehicle 4.5.3.4. Mexico Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 4.5.3.4.1. OEM 4.5.3.4.2. Aftermarket 5. Europe Automotive Air Purifier Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 5.2. Europe Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 5.3. Europe Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 5.4. Europe Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 5.5. Europe Automotive Air Purifier Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 5.5.1.2. United Kingdom Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 5.5.1.3. United Kingdom Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.1.4. United Kingdom Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 5.5.2. France 5.5.2.1. France Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 5.5.2.2. France Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 5.5.2.3. France Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.2.4. France Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 5.5.3.2. Germany Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 5.5.3.3. Germany Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.3.4. Germany Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 5.5.4.2. Italy Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 5.5.4.3. Italy Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.4.4. Italy Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 5.5.5.2. Spain Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 5.5.5.3. Spain Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.5.4. Spain Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 5.5.6.2. Sweden Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 5.5.6.3. Sweden Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.6.4. Sweden Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 5.5.7.2. Austria Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 5.5.7.3. Austria Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.7.4. Austria Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 5.5.8.2. Rest of Europe Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 5.5.8.3. Rest of Europe Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.8.4. Rest of Europe Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6. Asia Pacific Automotive Air Purifier Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.2. Asia Pacific Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.4. Asia Pacific Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6.5. Asia Pacific Automotive Air Purifier Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.5.1.2. China Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.5.1.3. China Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.1.4. China Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.5.2.2. S Korea Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.5.2.3. S Korea Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.2.4. S Korea Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.5.3.2. Japan Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.5.3.3. Japan Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.3.4. Japan Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6.5.4. India 6.5.4.1. India Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.5.4.2. India Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.5.4.3. India Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.4.4. India Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.5.5.2. Australia Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.5.5.3. Australia Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.5.4. Australia Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.5.6.2. Indonesia Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.5.6.3. Indonesia Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.6.4. Indonesia Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.5.7.2. Malaysia Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.5.7.3. Malaysia Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.7.4. Malaysia Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.5.8.2. Vietnam Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.5.8.3. Vietnam Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.8.4. Vietnam Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.5.9.2. Taiwan Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.5.9.3. Taiwan Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.9.4. Taiwan Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 6.5.10.2. Rest of Asia Pacific Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.10.4. Rest of Asia Pacific Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 7. Middle East and Africa Automotive Air Purifier Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 7.2. Middle East and Africa Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 7.4. Middle East and Africa Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 7.5. Middle East and Africa Automotive Air Purifier Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 7.5.1.2. South Africa Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 7.5.1.3. South Africa Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.1.4. South Africa Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 7.5.2.2. GCC Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 7.5.2.3. GCC Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.2.4. GCC Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 7.5.3.2. Nigeria Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 7.5.3.3. Nigeria Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.3.4. Nigeria Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 7.5.4.2. Rest of ME&A Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 7.5.4.3. Rest of ME&A Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.4.4. Rest of ME&A Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 8. South America Automotive Air Purifier Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 8.2. South America Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 8.3. South America Automotive Air Purifier Market Size and Forecast, by Vehicle Type(2023-2030) 8.4. South America Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 8.5. South America Automotive Air Purifier Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 8.5.1.2. Brazil Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 8.5.1.3. Brazil Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.1.4. Brazil Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 8.5.2.2. Argentina Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 8.5.2.3. Argentina Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.2.4. Argentina Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Automotive Air Purifier Market Size and Forecast, by Offering (2023-2030) 8.5.3.2. Rest Of South America Automotive Air Purifier Market Size and Forecast, by Type (2023-2030) 8.5.3.3. Rest Of South America Automotive Air Purifier Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.3.4. Rest Of South America Automotive Air Purifier Market Size and Forecast, by Sales Channel (2023-2030) 9. Global Automotive Air Purifier Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Automotive Air Purifier Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Honeywell International Inc. (Charlotte, North Carolina, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Blueair AB (Chicago, Illinois, USA) 10.3. Sharp Corporation (Osaka, Japan) 10.4. Philips N.V. (Amsterdam, Netherlands) 10.5. Mann+Hummel Group (Ludwigsburg, Germany) 10.6. Blaupunkt (Hildesheim, Germany) 10.7. Panasonic Corporation (Osaka, Japan) 10.8. Xiaomi Corporation (Beijing, China) 10.9. Samsung Electronics Co., Ltd. (Suwon, South Korea) 10.10. Daikin Industries, Ltd. (Osaka, Japan) 10.11. Kent RO Systems Ltd. (Noida, India) 10.12. Toyota Boshoku Corporation (Kariya, Japan) 10.13. LG Electronics Inc. (Seoul, South Korea) 10.14. Electrolux AB (Stockholm, Sweden) 10.15. Sharp Middle East FZE (Dubai, United Arab Emirates) 10.16. Dyson Ltd. (Malmesbury, United Kingdom) 10.17. Blue Pure AB (Stockholm, Sweden) 10.18. 3M Company (St. Paul, Minnesota, USA) 10.19. Smith Corporation (Milwaukee, Wisconsin, USA) 10.20. Coway Co., Ltd. (Seoul, South Korea) 11. Key Findings 12. Industry Recommendations 13. Automotive Air Purifier Market: Research Methodology 14. Terms and Glossary