The Atomic Fluorescence Spectrometers Market was valued at USD 6.37 billion in 2023 & is expected to grow to USD 9.77 billion by 2030, representing a compound annual growth rate (CAGR) of 6.3% during the forecast period.Atomic Absorption Spectrometer Market Overview

Atomic fluorescence spectrometer market is steadily growing and is expected to expand in the future. Precise and sensitive analytical instruments are in high demand in industries such as environmental monitoring, pharmaceuticals, food and beverages and research labs, driving the market. Atomic fluorescence spectrometers are commonly used due to regulatory compliance and quality control measures. Manufacturers enhance instrument performance through technology advancements. Enhancing sensitivity, precision and detection limits is a key aspect. New atomic fluorescence spectrometers are faster and can detect more elements.To know about the Research Methodology :- Request Free Sample Report Atomic fluorescence spectrometers have various uses. These instruments have diverse applications in environmental, pharmaceutical, food and beverage, clinical and forensic analysis. Trace elements, such as heavy metals, can be accurately measured in different sample types with the help of these essential tools. The global market for atomic fluorescence spectrometers is active in North America, Europe, Asia Pacific and Latin America. Demand for atomic fluorescence spectrometers is driven by strong market players, research institutions and industrial applications in these regions. Competitive environment is defined by major firms in the Atomic Absorption Spectrometer Market. Major atomic fluorescence spectrometer manufacturers are Thermo Fisher Scientific, PerkinElmer, Shimadzu Corporation, Agilent Technologies, Analytik Jena AG and Hitachi High-Tech Corporation. Businesses aim to improve their products to meet changing market demands. Atomic Fluorescence Spectrometers Market Report Scope An atomic fluorescence spectrometers market report provides an extensive analysis of the market, encompassing various aspects of the industry. The report includes a comprehensive market segmentation based on factors such as product type, application, end-user industry and geographic region. This segmentation allows for a detailed examination of different market segments, enabling stakeholders to understand the specific dynamics and trends influencing each segment. The report encompasses the market size and growth of the atomic fluorescence spectrometers market, presenting historical data and projecting the market's growth rate during the forecast period. This report analyses market trends, drivers, challenges and opportunities affecting market growth. A key component of the market report is the competitive analysis, which identifies and profiles key players operating in the atomic fluorescence spectrometers market. The report highlights their product portfolios, business strategies, financial performance and recent developments. This analysis offers insights into the competitive landscape, helping stakeholders understand the market's competitive intensity and the strategies employed by market players. The report analyses the atomic fluorescence spectrometers market regionally, covering market size, growth rate and trends in each geographic area. Regional factors like regulations, economy and technology are studied to determine their effect on market growth. Regional analysis helps stakeholders identify growth opportunities by providing a comprehensive view of the market's regional dynamics. Furthermore, the report delves into the application analysis of atomic fluorescence spectrometers across various industries. It examines the market demand, growth potential and specific requirements of each application segment, including environmental analysis, pharmaceuticals, food and beverages, clinical diagnostics and others. This analysis aids in understanding the diverse application landscape of atomic fluorescence spectrometers. The technological trends section of the report highlights the latest advancements and innovations in atomic fluorescence spectrometry. It covers topics such as improved detection limits, enhanced sensitivity, automation and integration with other analytical techniques. The report discusses the challenges and opportunities faced by the atomic fluorescence spectrometers market. The report examines the regulatory landscape governing the use of atomic fluorescence spectrometers in different regions. It discusses relevant regulations, compliance requirements and their impact on market players and end-users. Understanding the regulatory framework is crucial for stakeholders to ensure compliance and make informed business decisions.

Atomic Fluorescence Spectrometers Market Dynamics

Market Drivers: The atomic fluorescence spectrometers market is driven by the increasing demand for accurate and sensitive analysis in various industries such as environmental monitoring, pharmaceuticals, food and beverages and research laboratories. These industries require precise measurements of trace metals and metalloids and atomic fluorescence spectrometers provide the necessary capabilities to meet this demand. Stringent regulatory requirements for environmental protection and product quality further drive the adoption of atomic fluorescence spectrometers in compliance and quality control activities. Market Trends: Technological advancements play a crucial role in the atomic fluorescence spectrometers market. Manufacturers are continuously improving the sensitivity, detection limits and automation capabilities of these instruments. Advanced features increase analysis speed and accuracy, improving productivity. A growing trend is the combination of atomic fluorescence spectrometry with other analytical methods like liquid chromatography and mass spectrometry. Our integration offers a comprehensive sample characterization approach by combining various techniques for multi-dimensional analysis. Market Opportunities: The atomic fluorescence spectrometers market presents opportunities in emerging applications. The demand for atomic fluorescence spectrometers is expected to increase due to new applications in industries and research fields like nanotechnology, materials science and metallurgy. Developing regions with expanding industrial sectors and increasing regulatory scrutiny present untapped markets for accurate elemental analysis. This offers opportunities for market players to establish a presence and cater to the growing demand. Threats and Challenges: One of the challenges in the atomic fluorescence spectrometers market is the high cost associated with these instruments. High costs may discourage small and medium-sized businesses from buying due to budget constraints. Atomic fluorescence spectrometers compete with inductively coupled plasma-optical emission spectroscopy (ICP-OES) and inductively coupled plasma-mass spectrometry (ICP-MS). Established techniques may compete with atomic fluorescence spectrometers. Another challenge in atomic fluorescence spectrometry is the complexity of sample matrices and the need for extensive sample preparation. Certain sample types may require time-consuming and labor-intensive preparation steps, which can impact the overall efficiency of the analysis process and pose challenges in terms of workflow and throughput.Atomic Fluorescence Spectrometers Market Regional Analysis

Atomic fluorescence spectrometers have strong markets in North America and Europe due to their established industrial bases, strict regulations and emphasis on quality control. North America's market emphasises R&D, tech advancements and key players. Atomic fluorescence spectrometers are highly sought after in industries such as environmental monitoring, pharmaceuticals and food and beverages. Europe's market is dominated by Germany, the UK and France. Atomic fluorescence spectrometer growth in the region is driven by regulatory requirements, R&D and environmental focus. Asia Pacific, the South American region and the Middle East and Africa have increasing markets for atomic fluorescence spectrometers. The Asia-Pacific region is growing rapidly due to industrialization, urbanisation and environmental concerns. The pharmaceutical and food and beverage industries are driving the need for accurate and sensitive analytical instruments. South America, particularly Brazil and Argentina, are experiencing growth in industrialization and environmental consciousness. Atomic fluorescence spectrometers are commonly used for environmental monitoring and quality control. MEA market is impacted by environmental regulations in oil and gas and emphasis on quality control and safety standards in pharmaceuticals and food processing. The UAE, Saudi Arabia and South Africa are important contributors to the market growth of this region. Atomic Fluorescence Spectrometers Market is experiencing significant growth in the Asia Pacific region. The demand for fluoropolymer materials and processing aids is increasing in countries such as China, India and Japan. Major consumers in this region include the automotive, electronics and chemical processing industries. Growing population, urbanisation and higher disposable income drive demand for automobiles, electronics and infrastructure, leading to market growth opportunities. South America is an emerging market for Atomic Fluorescence Spectrometers. Brazil is witnessing increased industrial activities and investments across various sectors. Fluoropolymer materials and processing aids are in high demand in this region due to their use in the automotive and electrical industries. Demand for durable and efficient materials drives market growth in these industries. Oil and gas infrastructure and renewable energy investments drive demand for high-performance plastics and processing aids. The Middle East and Africa region has growth potential in Atomic Fluorescence Spectrometers Market. Fluoropolymer materials and processing aids are in high demand due to industries like oil and gas, petrochemicals and construction. Investment in infrastructure development in the region is driving demand for high-performance materials in various applications. Strict safety and environmental regulations in this region are increasing the use of compliant processing aids.Atomic Fluorescence Spectrometers Market Segment Analysis

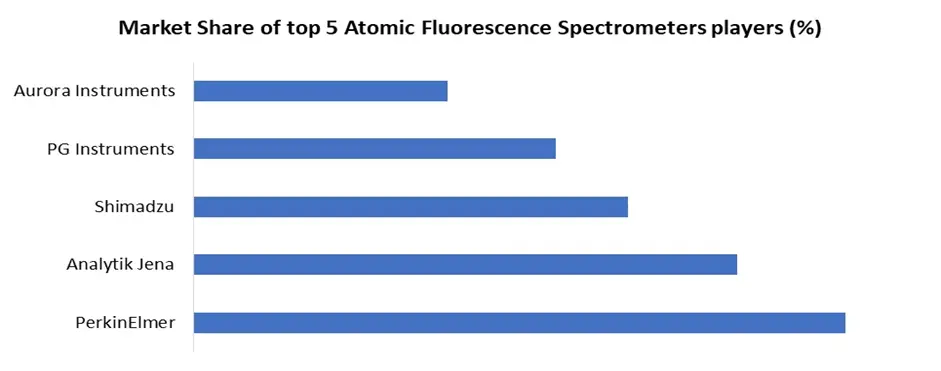

Based on End Use Industry: The market is segmented into the Pharmaceutical Industry, Mining Industry, Petrochemical Industry, Agriculture Industry and Others. The Pharmaceutical Industry segment held the largest Atomic Fluorescence Spectrometers Market share in 2023 and is expected to grow at a high CAGR during the forecast period. Pharmaceutical manufacturing processes may result in trace amounts of catalysts, typically metallic, being present in the final product. Analyzing these minute quantities can be accomplished using Atomic Absorption Spectroscopy (AAS). Atomic Fluorescence Spectrometers Market Competitive Landscape Thermo Fisher Scientific, PerkinElmer, Shimadzu Corporation, Agilent Technologies, Inc., Hitachi High-Tech Corporation, and Analytik Jena AG dominate the atomic fluorescence spectrometer market. These companies have considerable market presence, large product portfolios and powerful R&D. Market share analysis helps stakeholders understand the dominance and competitive advantages of important companies. Due to their strong brands and wide product lines, Thermo Fisher Scientific Inc., PerkinElmer Inc. and other prominent manufacturers generally dominate the market. The competitive landscape analysis examines significant firms' product launches, collaborations, partnerships, mergers and acquisitions and R&D investments. These initiatives help organisations grow their portfolios, tech and market presence. Product innovation, price strategies, distribution networks, customer connections and after-sales service are studied. Superior product performance, reliability and customer service give these companies an edge. The competitive outlook in the report predicts future participants, market disruptors and competitive scenarios.

Atomic Fluorescence Spectrometers Market Scope: Inquire Before Buying

Global Atomic Fluorescence Spectrometers Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.37 Bn. Forecast Period 2024 to 2030 CAGR: 6.3% Market Size in 2030: US $ 9.77 Bn. Segments Covered: by Application Environmental analysis Food and beverages testing Biotechnology Others by End Use Industry Pharmaceutical Industry Mining Industry Petrochemical Industry Agriculture Industry Others Atomic Fluorescence Spectrometers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Atomic Fluorescence Spectrometers Key Players

North America: 1. Thermo Fisher Scientific Inc. (United States) 2. PerkinElmer Inc. (United States) 3. Agilent Technologies, Inc. (United States) 4. Teledyne Leeman Labs (United States) 5. Buck Scientific (United States) 6. Analytical Spectral Devices (United States) 7. Applied Spectra, Inc. (United States) 8. GBC Scientific Equipment Pty Ltd (United States) 9. S.I.S. Scientific Instruments Services, Inc. (United States) 10. A.P.E. Research (United States) 11. Aurora Instruments (United States) 12. Instrulab (Mexico) 13. Valvitronic (Mexico) Europe: 1. Analytik Jena AG (Germany) 2. Bruker Corporation (Germany) 3. Analytikhaus (Germany) 4. Lumex Instruments (Russia) 5. Horiba Jobin Yvon S.A.S. (France) 6. Metrohm AG (Switzerland) 7. GBC Scientific Equipment Pty Ltd (Australia) 8. PG Instruments (United Kingdom) Asia Pacific: 1. Shimadzu Corporation (Japan) 2. Hitachi High-Tech Corporation (Japan) 3. JASCO Corporation (Japan) 4. Beijing Titan Instruments Co., Ltd. (China) 5. Beijing Beifen-Ruili Analytical Instrument (China) 6. Shanghai Jingke Scientific Instrument Co., Ltd. (China) 7. Beijing Rayleigh Analytical Instrument Corporation (China) 8. Hiranuma Sangyo Co., Ltd. (Japan) 9. Nippon Instruments Corporation (Japan) 10. Beijing Purkinje General Instrument Co., Ltd. (China) South America: 1. Digimed (Brazil) 2. Control Equipamentos Ltda (Brazil) 3. Lasen, Inc. (Argentina) 4. Tecnopon (Chile) 5. Laboratorio Tecnológico (Colombia) 6. Analytical Services (Peru) 7. Labco (Argentina) 8. Biodinamica (Brazil) Middle East and Africa: 1. Bruker Middle East FZE (United Arab Emirates) 2. Shimadzu Middle East & Africa FZE (United Arab Emirates) 3. Metrohm Middle East (United Arab Emirates) 4. SciMed Middle East FZCO (United Arab Emirates) FAQs Q: Which industries use Atomic Fluorescence Spectrometers? A: Atomic Fluorescence Spectrometers find applications in various industries, including automotive, electrical and electronics, chemical processing, medical, packaging and others where fluoropolymers are used in manufacturing processes. Q: What are the key factors driving the growth of the Atomic Fluorescence Spectrometers market? A: The growth of the Atomic Fluorescence Spectrometers market is driven by factors such as the increasing demand for high-performance materials, advancements in processing technologies, the need for improved process efficiency and the growing applications of fluoropolymers in various industries. Q: Are there any environmental considerations related to Atomic Fluorescence Spectrometers? A: Some Atomic Fluorescence Spectrometers formulations are designed to be environmentally friendly, complying with regulations and sustainability initiatives. These formulations aim to reduce the environmental impact while maintaining the desired performance characteristics. Q: What are the challenges faced by the Atomic Fluorescence Spectrometers market? A: Challenges in the Atomic Fluorescence Spectrometers market include the need for continuous research and development to meet evolving industry requirements, managing the cost-effectiveness of the additives, ensuring compatibility with various fluoropolymer grades and addressing regulatory compliance in different regions. Q: How does the Atomic Fluorescence Spectrometers market vary by region? A: The Atomic Fluorescence Spectrometers market varies by region in terms of demand, adoption and regulatory landscape. Factors such as industrial growth, manufacturing capabilities and regional preferences influence the market dynamics and opportunities in each region.

1. Atomic Fluorescence Spectrometers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Atomic Fluorescence Spectrometers Market: Dynamics 2.1. Atomic Fluorescence Spectrometers Market Trends by Region 2.1.1. North America Atomic Fluorescence Spectrometers Market Trends 2.1.2. Europe Atomic Fluorescence Spectrometers Market Trends 2.1.3. Asia Pacific Atomic Fluorescence Spectrometers Market Trends 2.1.4. Middle East and Africa Atomic Fluorescence Spectrometers Market Trends 2.1.5. South America Atomic Fluorescence Spectrometers Market Trends 2.2. Atomic Fluorescence Spectrometers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Atomic Fluorescence Spectrometers Market Drivers 2.2.1.2. North America Atomic Fluorescence Spectrometers Market Restraints 2.2.1.3. North America Atomic Fluorescence Spectrometers Market Opportunities 2.2.1.4. North America Atomic Fluorescence Spectrometers Market Challenges 2.2.2. Europe 2.2.2.1. Europe Atomic Fluorescence Spectrometers Market Drivers 2.2.2.2. Europe Atomic Fluorescence Spectrometers Market Restraints 2.2.2.3. Europe Atomic Fluorescence Spectrometers Market Opportunities 2.2.2.4. Europe Atomic Fluorescence Spectrometers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Atomic Fluorescence Spectrometers Market Drivers 2.2.3.2. Asia Pacific Atomic Fluorescence Spectrometers Market Restraints 2.2.3.3. Asia Pacific Atomic Fluorescence Spectrometers Market Opportunities 2.2.3.4. Asia Pacific Atomic Fluorescence Spectrometers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Atomic Fluorescence Spectrometers Market Drivers 2.2.4.2. Middle East and Africa Atomic Fluorescence Spectrometers Market Restraints 2.2.4.3. Middle East and Africa Atomic Fluorescence Spectrometers Market Opportunities 2.2.4.4. Middle East and Africa Atomic Fluorescence Spectrometers Market Challenges 2.2.5. South America 2.2.5.1. South America Atomic Fluorescence Spectrometers Market Drivers 2.2.5.2. South America Atomic Fluorescence Spectrometers Market Restraints 2.2.5.3. South America Atomic Fluorescence Spectrometers Market Opportunities 2.2.5.4. South America Atomic Fluorescence Spectrometers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Atomic Fluorescence Spectrometers Industry 2.8. Analysis of Government Schemes and Initiatives For Atomic Fluorescence Spectrometers Industry 2.9. Atomic Fluorescence Spectrometers Market Trade Analysis 2.10. The Global Pandemic Impact on Atomic Fluorescence Spectrometers Market 3. Atomic Fluorescence Spectrometers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 3.1.1. Environmental analysis 3.1.2. Food and beverages testing 3.1.3. Biotechnology 3.1.4. Others 3.2. Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 3.2.1. Pharmaceutical Industry 3.2.2. Mining Industry 3.2.3. Petrochemical Industry 3.2.4. Agriculture Industry 3.2.5. Others 3.3. Atomic Fluorescence Spectrometers Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Atomic Fluorescence Spectrometers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 4.1.1. Environmental analysis 4.1.2. Food and beverages testing 4.1.3. Biotechnology 4.1.4. Others 4.2. North America Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 4.2.1. Pharmaceutical Industry 4.2.2. Mining Industry 4.2.3. Petrochemical Industry 4.2.4. Agriculture Industry 4.2.5. Others 4.3. North America Atomic Fluorescence Spectrometers Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 4.3.1.1.1. Environmental analysis 4.3.1.1.2. Food and beverages testing 4.3.1.1.3. Biotechnology 4.3.1.1.4. Others 4.3.1.2. United States Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 4.3.1.2.1. Pharmaceutical Industry 4.3.1.2.2. Mining Industry 4.3.1.2.3. Petrochemical Industry 4.3.1.2.4. Agriculture Industry 4.3.1.2.5. Others 4.3.2. Canada 4.3.2.1. Canada Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 4.3.2.1.1. Environmental analysis 4.3.2.1.2. Food and beverages testing 4.3.2.1.3. Biotechnology 4.3.2.1.4. Others 4.3.2.2. Canada Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 4.3.2.2.1. Pharmaceutical Industry 4.3.2.2.2. Mining Industry 4.3.2.2.3. Petrochemical Industry 4.3.2.2.4. Agriculture Industry 4.3.2.2.5. Others 4.3.3. Mexico 4.3.3.1. Mexico Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 4.3.3.1.1. Environmental analysis 4.3.3.1.2. Food and beverages testing 4.3.3.1.3. Biotechnology 4.3.3.1.4. Others 4.3.3.2. Mexico Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 4.3.3.2.1. Pharmaceutical Industry 4.3.3.2.2. Mining Industry 4.3.3.2.3. Petrochemical Industry 4.3.3.2.4. Agriculture Industry 4.3.3.2.5. Others 5. Europe Atomic Fluorescence Spectrometers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 5.2. Europe Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 5.3. Europe Atomic Fluorescence Spectrometers Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 5.3.1.2. United Kingdom Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 5.3.2. France 5.3.2.1. France Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 5.3.2.2. France Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 5.3.3.2. Germany Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 5.3.4.2. Italy Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 5.3.5.2. Spain Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 5.3.6.2. Sweden Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 5.3.7.2. Austria Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 5.3.8.2. Rest of Europe Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6. Asia Pacific Atomic Fluorescence Spectrometers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6.3. Asia Pacific Atomic Fluorescence Spectrometers Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6.3.4. India 6.3.4.1. India Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 7. Middle East and Africa Atomic Fluorescence Spectrometers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 7.3. Middle East and Africa Atomic Fluorescence Spectrometers Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 7.3.1.2. South Africa Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 7.3.2.2. GCC Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 7.3.3.2. Nigeria Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 7.3.4.2. Rest of ME&A Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 8. South America Atomic Fluorescence Spectrometers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 8.2. South America Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 8.3. South America Atomic Fluorescence Spectrometers Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 8.3.1.2. Brazil Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 8.3.2.2. Argentina Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Atomic Fluorescence Spectrometers Market Size and Forecast, by Application (2023-2030) 8.3.3.2. Rest Of South America Atomic Fluorescence Spectrometers Market Size and Forecast, by End Use Industry (2023-2030) 9. Global Atomic Fluorescence Spectrometers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Atomic Fluorescence Spectrometers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Thermo Fisher Scientific Inc. (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. PerkinElmer Inc. (United States) 10.3. Agilent Technologies, Inc. (United States) 10.4. Teledyne Leeman Labs (United States) 10.5. Buck Scientific (United States) 10.6. Analytical Spectral Devices (United States) 10.7. Applied Spectra, Inc. (United States) 10.8. GBC Scientific Equipment Pty Ltd (United States) 10.9. S.I.S. Scientific Instruments Services, Inc. (United States) 10.10. A.P.E. Research (United States) 10.11. Aurora Instruments (United States) 10.12. Instrulab (Mexico) 10.13. Valvitronic (Mexico) 10.14. Analytik Jena AG (Germany) 10.15. Bruker Corporation (Germany) 10.16. Analytikhaus (Germany) 10.17. Lumex Instruments (Russia) 10.18. Horiba Jobin Yvon S.A.S. (France) 10.19. Metrohm AG (Switzerland) 10.20. GBC Scientific Equipment Pty Ltd (Australia) 10.21. PG Instruments (United Kingdom) 10.22. Shimadzu Corporation (Japan) 10.23. Hitachi High-Tech Corporation (Japan) 10.24. JASCO Corporation (Japan) 10.25. Beijing Titan Instruments Co., Ltd. (China) 10.26. Beijing Beifen-Ruili Analytical Instrument (China) 10.27. Shanghai Jingke Scientific Instrument Co., Ltd. (China) 10.28. Beijing Rayleigh Analytical Instrument Corporation (China) 10.29. Hiranuma Sangyo Co., Ltd. (Japan) 10.30. Nippon Instruments Corporation (Japan) 10.31. Beijing Purkinje General Instrument Co., Ltd. (China) 10.32. Digimed (Brazil) 10.33. Control Equipamentos Ltda (Brazil) 10.34. Lasen, Inc. (Argentina) 10.35. Tecnopon (Chile) 10.36. Laboratorio Tecnológico (Colombia) 10.37. Analytical Services (Peru) 10.38. Labco (Argentina) 10.39. Biodinamica (Brazil) 10.40. Bruker Middle East FZE (United Arab Emirates) 11. Key Findings 12. Industry Recommendations 13. Atomic Fluorescence Spectrometers Market: Research Methodology 14. Terms and Glossary