The Aseptic Packaging Market size was valued at USD 69.7 Bn in 2023 and market revenue is growing at a CAGR of 10.47 % from 2024 to 2030, reaching nearly USD 139.94 Bn by 2030Aseptic Packaging Market

Aseptic packaging is the filling of a commercially sterile product into a sterile container under aseptic conditions and hermetically sealing the containers so that reinfection is prevented. This results in a product, which is shelf-stable at ambient conditions. In recent years, the aseptic packaging market has seen significant growth, driven by factors such as increasing demand for convenient and long-lasting food and beverage products, rising consumer awareness about food safety and hygiene, and advancements in packaging technology. Ongoing advancements in aseptic packaging technology have improved efficiency, sustainability, and product differentiation. Innovations such as advanced sterilization techniques, barrier materials, and packaging designs contribute to the growth of the Aseptic Packaging Market. Also, In the medical industry, aseptic packaging plays a pivotal role in ensuring the safety and efficacy of pharmaceuticals, biologics, and medical devices. Aseptic packaging techniques help maintain sterility throughout the supply chain, from manufacturing to patient administration, reducing the risk of contamination and infection. The demand for aseptic packaging in the medical sector is driven by regulatory requirements for product safety and quality assurance, as well as the need to extend shelf life and preserve the potency of sensitive medical products. This factor is responsible for the growth of Aseptic Packaging Market.To know about the Research Methodology :- Request Free Sample Report

Aseptic Packaging Market Dynamics

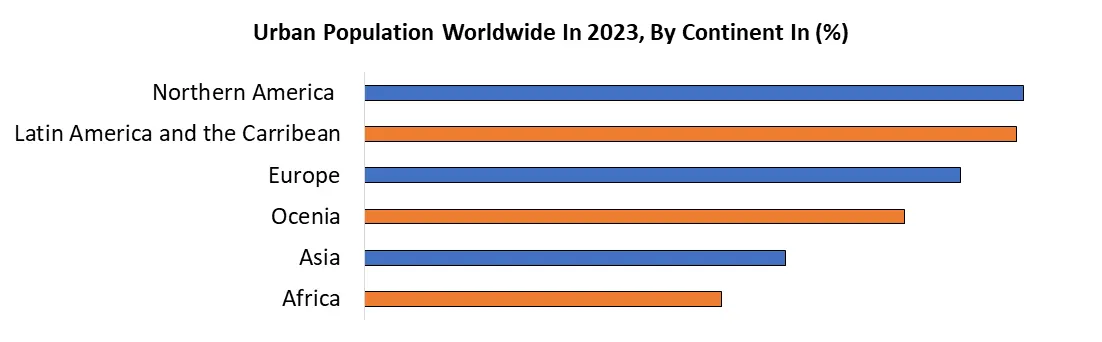

Driver Growth of the dairy industry and demand for ready-to-eat food products boost the Aseptic Packaging Market Growth The dairy industry has experienced a surge in demand for extended shelf-life (ESL) products, which are made using various processing techniques, including ultra-high temperature (UHT) pasteurization, microfiltration, and aseptic packaging. These techniques ensure that both food and packaging materials are free of harmful bacteria when food is packaged, thus enhancing food safety and extending the shelf life of dairy products this factor is mainly responsible for the Aseptic Packaging Market. Aseptic packaging is particularly beneficial for the dairy industry because it allows products to be transported and sold without the need for refrigeration, extending the reach of dairy products to more areas and consumers. The process ensures that products are not contaminated by microorganisms, keeping them fresh and safe for consumption. The growth of the dairy industry has also been driven by the rise of urbanization and changing lifestyles, which have led to an increased demand for on-the-go food options, including dairy products. Consumers are increasingly interested in extended shelf-life dairy products, and this trend is expected to continue as more people move to urban areas and adopt more convenient lifestyles. Therefore, the growth of the dairy industry and the demand for ready-to-eat food products have significantly boosted the Aseptic Packaging Market. The market is expected to continue growing due to the benefits offered by aseptic packaging, and the Rising import and export of Dairy products especially boosts the growth of the Aseptic Packaging industry. According to MMR Study Report, India holds the distinction of being the world's top milk producer, accounting for 24.64% of global milk production in the year 2021-22. Here are some notable facts about India such as During the fiscal year 2022-23, India exported a total of 67,572.99 metric tons of dairy products valued at $284.65 million globally. Key export destinations included Bangladesh, the United Arab Emirates, Saudi Arabia, the USA, and Bhutan. India's export of butter, ghee, and dairy spreads amounted to $43.65 million, with 8,106.54 metric tons shipped during the same period. Major export destinations for these products included Saudi Arabia, Bahrain, the UAE, the USA, and Qatar. Also, India exported 9,262.63 metric tons of cheese valued at $46.84 million in 2022-23. The primary destinations for Indian cheese were the UAE, the USA, Bhutan, Singapore, and Saudi Arabia. Furthermore, India exported 16,696.75 metric tons of skimmed milk powder worth $63.90 million during the same fiscal year. The major export destinations for skimmed milk powder were Bangladesh, the UAE, Sri Lanka, Kuwait, and Oman.Restrain High Fluctuation in raw material prices Limits the Growth of Aseptic Packaging Market Fluctuations in raw material prices are important in aseptic packaging production. The volatility in the raw material prices not only escalates production costs but also disrupts the supply chain, causing delays and impacting customer satisfaction. So, market players are compelled to explore alternative materials and packaging technologies to sustain profitability and competitiveness. This shift away from aseptic packaging has impeded the growth of the Aseptic Packaging market. However, it has prompted innovation towards more cost-effective solutions in the long term. Despite challenges, the industry's adaptability to market dynamics remains crucial in navigating packaging demands and cost constraints. So, when prices of materials go up and down, it's tough for the packaging industry. But it also pushes them to come up with new ideas. Industry people need to be ready for these challenges, so they bounce back and make packaging that's good for the economy and the environment. This constant cycle of facing problems and finding solutions is what shapes the Aseptic Packaging Market, especially when materials prices keep changing. Opportunity Urbanization and On-the-Go Lifestyles create lucrative growth opportunities for the Aseptic Packaging Market As urban areas expand, there is a growing demand for convenient, ready-to-eat, and on-the-go food and beverage products. Aseptic packaging plays an important in meeting this demand by providing products that are safe, convenient, and have an extended shelf life without the need for refrigeration. This packaging method allows perishable food items transported and stored without the risk of contamination, making them ideal for busy urban consumers this factor significantly creates ample opportunities for the growth of the Aseptic Packaging Market. Also, the increasing focus on sustainability and health-conscious consumer preferences further drives the demand for aseptic packaging. Consumers are seeking products that are minimally processed, free of preservatives, and environmentally friendly. Aseptic packaging aligns with these trends by preserving the quality, taste, and nutrients of products while ensuring food safety and reducing the carbon footprint of distribution. This combination of convenience, sustainability, and health benefits creates lucrative growth opportunities for the Aseptic Packaging Market.

Aseptic Packaging Market Segment Analysis

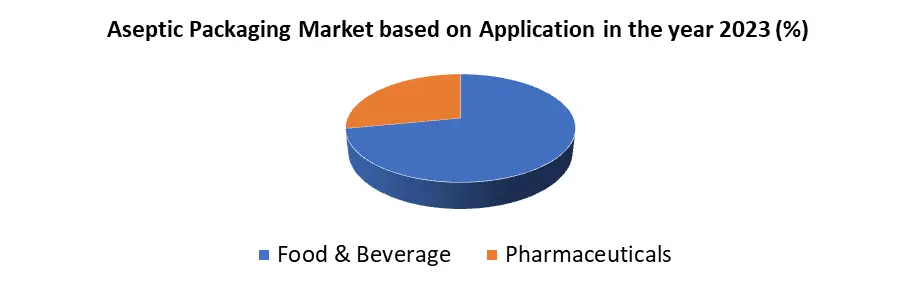

Based On Application, the Food & Beverage segment dominated the Application segment of the Aseptic Packaging Market in the year 2023. In the modern food and beverage industry, aseptic packaging has emerged as a dominant force, revolutionizing the way products are preserved, transported, and consumed. With its ability to maintain product freshness without the need for refrigeration for extended periods, aseptic packaging has become indispensable across various segments, particularly in dairy, desserts, juices, soups, and sauces. Versatility is the major factor responsible for the growth of Aseptic Packaging in the Food and Beverage industry. Aseptic containers come in various sizes and shapes, from small drink boxes to large tanks, catering to the diverse needs of manufacturers and consumers alike. This flexibility enables the packaging of a wide range of products, including those with particulates, growing the Aseptic Packaging market's reach and appeal. Also, advancements in technology have enhanced the safety and efficiency of aseptic packaging processes, ensured the sterility of products, and extended their shelf life. With innovations such as Tetra Pak's aseptic cartons and pouches, manufacturers deliver food products safely across global markets, tapping into new opportunities for export and import. The convenience offered by aseptic packaging, such as easy storage, transport, and microwave compatibility, has made it a preferred choice for both consumers and producers.

Aseptic Packaging Market Regional Analysis

Asia Pacific region dominated the Aseptic Packaging market in the year 2023. This region has seen rapid industrialization and urbanization, leading to a higher demand for packaged food and beverages. Also, the region is home to a large population, including a growing middle class with more disposable income. As people's lifestyles become busier, they prefer convenient, ready-to-eat products that are safe and healthy. Aseptic packaging meets these needs perfectly. As well, the advancement of technology and manufacturing processes in countries such as China, Japan, and South Korea has made aseptic packaging more affordable and accessible. This has encouraged both producers and consumers to adopt it more widely. The focus on sustainability and environmental consciousness has also played a role. Aseptic packaging reduces food waste by extending the shelf life of products, which aligns with the region's growing concern for eco-friendly practices. All these factors are responsible for the growth of the Aseptic Packaging Market Aseptic Packaging Market Competitive Analysis The Aseptic Packaging Market is highly competitive the various key players dominate the Market. They are majorly focusing on Innovation, partnerships, and collaboration.The significant development in the aseptic packaging market is the partnership between companies such as NotCo and SIG, which has led to the introduction of plant-based high-protein products in SIG carton boxes. This collaboration reflects the growing trend towards plant-based foods and the importance of innovative packaging solutions in meeting consumer demands. Also, Tetra Pak's release of India's first Tetra Stelo aseptic package. This packaging innovation has been embraced by leading brands such as Minute Maid, a part of The Coca-Cola Company's portfolio in India. The introduction of Tetra Stelo packaging underscores the increasing adoption of aseptic packaging solutions by major players in the food and beverage industry. The aseptic packaging market is witnessing steady expansion as companies strive to meet the evolving needs of consumers for safe, convenient, and sustainable packaging solutions. With ongoing advancements in technology and collaborations between industry players, the future of aseptic packaging looks promising, offering opportunities for further innovation and growth.Aseptic Packaging Market Scope: Inquiry Before Buying

Aseptic Packaging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 69.7 Bn. Forecast Period 2024 to 2030 CAGR: 10.47% Market Size in 2030: US $ 139.94 Bn. Segments Covered: by Material Plastic Glass & Wood Metal Paper & Paperboard by Type Cartons Bottles Bags & Pouches Cans by Application Food & Beverage Pharmaceuticals Aseptic Packaging Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Aseptic Packaging Market

North America 1. Scholle IPN (United States) 2. Sealed Air Corporation (United States) 3. Evergreen Packaging (United States) 4. Printpack (United States) 5. WestRock Company (United States) 6. Amcor Flexibles (United States) Europe 1. Tetra Pak (Switzerland) 2. SIG Combibloc Group (Switzerland) 3. Elopak (Norway) 4. Amcor plc (Switzerland) 5. Ecolean AB (Sweden) 6. IPI S.r.l. (Italy) 7. Refresco Group (Netherlands) 8. Goglio S.p.A. (Italy) 9. Schott AG (Germany) 10. Stora Enso Oyj (Finland) 11. Clondalkin Group Holdings B.V. (Netherlands) Asia Pacific 1. Reynolds Group Holdings Limited (New Zealand) 2. Greatview Aseptic Packaging Co., Ltd. (China) Frequently Asked Questions 1] What segments are covered in the Global Aseptic Packaging Market report? Ans. The segments covered in the Aseptic Packaging Market report are based on, Material, Type, Application, and Regions. 2] Which region is expected to hold the highest share of the Global Aseptic Packaging Market? Ans. The Asia Pacific region is expected to hold the highest share of the Aseptic Packaging Market. 3] What is the market size of the Global Aseptic Packaging Market by 2023? Ans. The market size of the Aseptic Packaging Market by 2023 is expected to reach US$ 69.7 Bn. 4] What was the market size of the Global Aseptic Packaging Market in 2030? Ans. The market size of the Aseptic Packaging Market in 2030 was valued at US$ 139.94 Bn. 5] Key players in the Aseptic Packaging Market. Ans. Scholle IPN (United States), Sealed Air Corporation (United States), Evergreen Packaging (United States), Printpack (United States) and WestRock Company (United States).

1. Aseptic Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Aseptic Packaging Market: Dynamics 2.1. Aseptic Packaging Market Trends by Region 2.1.1. North America Aseptic Packaging Market Trends 2.1.2. Europe Aseptic Packaging Market Trends 2.1.3. Asia Pacific Aseptic Packaging Market Trends 2.1.4. Middle East and Africa Aseptic Packaging Market Trends 2.1.5. South America Aseptic Packaging Market Trends 2.2. Aseptic Packaging Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Aseptic Packaging Market Drivers 2.2.1.2. North America Aseptic Packaging Market Restraints 2.2.1.3. North America Aseptic Packaging Market Opportunities 2.2.1.4. North America Aseptic Packaging Market Challenges 2.2.2. Europe 2.2.2.1. Europe Aseptic Packaging Market Drivers 2.2.2.2. Europe Aseptic Packaging Market Restraints 2.2.2.3. Europe Aseptic Packaging Market Opportunities 2.2.2.4. Europe Aseptic Packaging Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Aseptic Packaging Market Drivers 2.2.3.2. Asia Pacific Aseptic Packaging Market Restraints 2.2.3.3. Asia Pacific Aseptic Packaging Market Opportunities 2.2.3.4. Asia Pacific Aseptic Packaging Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Aseptic Packaging Market Drivers 2.2.4.2. Middle East and Africa Aseptic Packaging Market Restraints 2.2.4.3. Middle East and Africa Aseptic Packaging Market Opportunities 2.2.4.4. Middle East and Africa Aseptic Packaging Market Challenges 2.2.5. South America 2.2.5.1. South America Aseptic Packaging Market Drivers 2.2.5.2. South America Aseptic Packaging Market Restraints 2.2.5.3. South America Aseptic Packaging Market Opportunities 2.2.5.4. South America Aseptic Packaging Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Aseptic Packaging Industry 2.8. Analysis of Government Schemes and Initiatives For Aseptic Packaging Industry 2.9. Aseptic Packaging Market Trade Analysis 2.10. The Global Pandemic Impact on Aseptic Packaging Market 3. Aseptic Packaging Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 3.1.1. Plastic 3.1.2. Glass & Wood 3.1.3. Metal 3.1.4. Paper & Paperboard 3.2. Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 3.2.1. Cartons 3.2.2. Bottles 3.2.3. Bags & Pouches 3.2.4. Cans 3.3. Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 3.3.1. Food & Beverage 3.3.2. Pharmaceuticals 3.4. Aseptic Packaging Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Aseptic Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 4.1.1. Plastic 4.1.2. Glass & Wood 4.1.3. Metal 4.1.4. Paper & Paperboard 4.2. North America Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 4.2.1. Cartons 4.2.2. Bottles 4.2.3. Bags & Pouches 4.2.4. Cans 4.3. North America Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 4.3.1. Food & Beverage 4.3.2. Pharmaceuticals 4.4. North America Aseptic Packaging Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 4.4.1.1.1. Plastic 4.4.1.1.2. Glass & Wood 4.4.1.1.3. Metal 4.4.1.1.4. Paper & Paperboard 4.4.1.2. United States Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 4.4.1.2.1. Cartons 4.4.1.2.2. Bottles 4.4.1.2.3. Bags & Pouches 4.4.1.2.4. Cans 4.4.1.3. United States Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Food & Beverage 4.4.1.3.2. Pharmaceuticals 4.4.2. Canada 4.4.2.1. Canada Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 4.4.2.1.1. Plastic 4.4.2.1.2. Glass & Wood 4.4.2.1.3. Metal 4.4.2.1.4. Paper & Paperboard 4.4.2.2. Canada Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 4.4.2.2.1. Cartons 4.4.2.2.2. Bottles 4.4.2.2.3. Bags & Pouches 4.4.2.2.4. Cans 4.4.2.3. Canada Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Food & Beverage 4.4.2.3.2. Pharmaceuticals 4.4.3. Mexico 4.4.3.1. Mexico Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 4.4.3.1.1. Plastic 4.4.3.1.2. Glass & Wood 4.4.3.1.3. Metal 4.4.3.1.4. Paper & Paperboard 4.4.3.2. Mexico Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 4.4.3.2.1. Cartons 4.4.3.2.2. Bottles 4.4.3.2.3. Bags & Pouches 4.4.3.2.4. Cans 4.4.3.3. Mexico Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Food & Beverage 4.4.3.3.2. Pharmaceuticals 5. Europe Aseptic Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 5.2. Europe Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 5.3. Europe Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 5.4. Europe Aseptic Packaging Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.1.2. United Kingdom Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 5.4.1.3. United Kingdom Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.2.2. France Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 5.4.2.3. France Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.3.2. Germany Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 5.4.3.3. Germany Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.4.2. Italy Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 5.4.4.3. Italy Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.5.2. Spain Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 5.4.5.3. Spain Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.6.2. Sweden Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 5.4.6.3. Sweden Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.7.2. Austria Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 5.4.7.3. Austria Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.8.2. Rest of Europe Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 5.4.8.3. Rest of Europe Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Aseptic Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.2. Asia Pacific Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Aseptic Packaging Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.1.2. China Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.4.1.3. China Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.2.2. S Korea Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.4.2.3. S Korea Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.3.2. Japan Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.4.3.3. Japan Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.4.2. India Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.4.4.3. India Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.5.2. Australia Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.4.5.3. Australia Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.6.2. Indonesia Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.4.6.3. Indonesia Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.7.2. Malaysia Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.4.7.3. Malaysia Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.8.2. Vietnam Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.4.8.3. Vietnam Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.9.2. Taiwan Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.4.9.3. Taiwan Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.10.2. Rest of Asia Pacific Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Aseptic Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 7.2. Middle East and Africa Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Aseptic Packaging Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 7.4.1.2. South Africa Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 7.4.1.3. South Africa Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 7.4.2.2. GCC Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 7.4.2.3. GCC Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 7.4.3.2. Nigeria Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 7.4.3.3. Nigeria Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 7.4.4.2. Rest of ME&A Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 7.4.4.3. Rest of ME&A Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 8. South America Aseptic Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 8.2. South America Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 8.3. South America Aseptic Packaging Market Size and Forecast, by Application(2023-2030) 8.4. South America Aseptic Packaging Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 8.4.1.2. Brazil Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 8.4.1.3. Brazil Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 8.4.2.2. Argentina Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 8.4.2.3. Argentina Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Aseptic Packaging Market Size and Forecast, by Material (2023-2030) 8.4.3.2. Rest Of South America Aseptic Packaging Market Size and Forecast, by Type (2023-2030) 8.4.3.3. Rest Of South America Aseptic Packaging Market Size and Forecast, by Application (2023-2030) 9. Global Aseptic Packaging Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Aseptic Packaging Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Scholle IPN (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sealed Air Corporation (United States) 10.3. Evergreen Packaging (United States) 10.4. Printpack (United States) 10.5. WestRock Company (United States) 10.6. Amcor Flexibles (United States) 10.7. Tetra Pak (Switzerland) 10.8. SIG Combibloc Group (Switzerland) 10.9. Elopak (Norway) 10.10. Amcor plc (Switzerland) 10.11. Ecolean AB (Sweden) 10.12. IPI S.r.l. (Italy) 10.13. Refresco Group (Netherlands) 10.14. Goglio S.p.A. (Italy) 10.15. Schott AG (Germany) 10.16. Stora Enso Oyj (Finland) 10.17. Clondalkin Group Holdings B.V. (Netherlands) 10.18. Reynolds Group Holdings Limited (New Zealand) 10.19. Greatview Aseptic Packaging Co., Ltd. (China) 11. Key Findings 12. Industry Recommendations 13. Aseptic Packaging Market: Research Methodology 14. Terms and Glossary