Artificial Intelligence in Oil and Gas Market size is expected to reach US$ 5.28 Bn by 2029 from US$ 2.71 Bn in 2022, at a CAGR of 10.02% during the forecast period.Artificial Intelligence in Oil and Gas Market Overview:

Artificial intelligence (AI) is attractive the first in line as the key technology with all the potential to expose a productivity revolution in the oil & gas industry. The AI market in oil & gas industry has been forecast to grow to $5.28 billion by 2029 at a CAGR of 10.02%. North America is the dominant and most innovative market, because of the top AI players in the oil & gas industry are based in North America such as Google, IBM, Microsoft and Oracle. The applications of AI and machine learning (ML) in the oil & gas industry are many, and some of them can really make the difference in a sector that is looking for to renew itself. Just by leveraging the potential of predictive analytics, big data and ML in upstream oil & gas doings alone, costs could be cut by $50 billion.To know about the Research Methodology :- Request Free Sample Report

Artificial Intelligence in Oil and Gas Market Dynamics:

An increased focus on improving efficiency, and reducing downtime has been a priority for the oil and gas companies, on accounts of fluctuating oil prices. Though, as concerns over the environmental impact of energy production and consumption persevere, oil and gas companies are looking for innovative approaches to achieve their business goals, while reducing environmental impact. In addition, the Oil and Gas Authority (OGA) is making use of AI in parallel ways, thanks to the UK's first oil and gas National Data Repository (NDR), launched in March 2019, using AI to interpret data, according to the OGA expectations, is likely to support to discover new oil and gas forecast and permit more production from existing infrastructures. The offshore oil and gas business use AI in data science to make the complex data used for oil and gas exploration and production more reachable, which lets companies to make more use out of existing infrastructures. For example, in January 2019, BP invested in Houston-based technology start-up, Belmont Technology, to bolster the company's AI capabilities, emerging a cloud-based geoscience platform. The increasing demand for oil and gas makes the discovery of new oil fields a high priority need for companies in this space. This operation is generally termed the Exploration and Production (E&P) or the upstream level of the oil and gas industry. Finding ways to make E&P processes more efficient and optimize operations in this field are applications where AI might help oil and gas companies. For example, recently, Total Oil announced an agreement with Google Cloud to together develop an AI system to analyze subsurface data aimed at improving their E&P processes. Nevertheless, high capital investments for the integration of AI technologies, along with the lack of skilled AI professionals, could hamper the growth of the artificial intelligence in oil and gas market. A recent survey validated that 56% of senior AI professionals considered that a lack of additional and qualified AI workers was the only biggest obstacle to be overcome, in terms of obtaining the necessary level of AI implementation across business operations. For instance, Baker Hughes, a GE oilfield services company (BHGE) and NVIDIA recently announced a partnership to use AI-based analytics to help oil and gas companies gain insights from their data. This includes seismic data, well logs, data from sensors in machinery, and supply chain data that can be input to AI software to gain insights aimed at reducing the cost of exploring, extracting, processing, and delivering oil, which is support to overcome this market challenges.Using Intelligent Drones for Aerial Inspections:

Oil & gas operators must run regular inspections of their assets, like pipelines and wells, to ensure their proper management and maintenance. Traditional methods of inspection, however, are costly, time-intensive or dangerous when roustabouts on trucks are sent to inspect equipment manually. Now, AI comes to the save even in this instance, and helps reduce all the dangers, time and effort needed to perform these inspections through cheap, safe and intelligent drones. This solution has been provided by PrecisionHawk, a company that combines drone technology, aerial mapping and modeling software, along with AI and machine vision to replace dangerous manned aircraft inspections with drone deployments. High-resolution remote sensing is also more efficient at detecting and indicative the type and extent of damage than visual inspections.Artificial Intelligence in Oil and Gas Market Segment Overview:

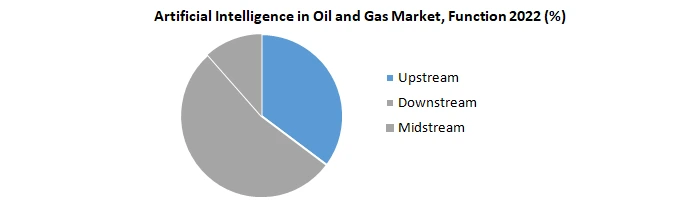

By application, the AI in oil & gas market is segmented Upstream, Midstream, and Downstream. Among these, Upstream segment expected to witness a significant growth in the market during the forecast period. This growth is attributed to Oil and gas companies can potentially gain key insights to improve their business outcomes in their upstream processes with the integration of AI software. This process would involve the feeding of curated data records and information from data sources to the software that could include structured documents, PDFs, handwritten notes, audio, or video files.Artificial Intelligence in Oil and Gas Market Regional Insights:

North America is expected to hold the largest market share of xx% of the global market by 2029. Because of the increasing adoption of AI technologies across the oilfield operators and service providers and the existence of prominent AI software and system suppliers, particularly in the U.S and Canada. Factors, such as the strong economy, combined investment by government and private organizations for the development and growth of R&D activities are drive the demand for AI in oil and gas sector, in the North America. ExxonMobil, one of the leading oil producers in the country, announced its plans to increase the production activity in the Permian Basin of West Texas, by producing above 1 million barrels per day (BPD) of oil-equivalent by as early as 2024. This is equivalent to an increase of nearly 80% compared to the present production capacity. The report focuses on artificial intelligence in oil and gas market value at the top regions and countries of the world, which shows a regional development, including market size, share, revenue, and much more across the globe. The report has covered, capacity, production value, cost/profit, and supply/demand by statistical analysis. A brief analysis of drivers, restraints, opportunities, and challenges in the market is also covered with examples by region. To make the most of the opportunities, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments. It also has covered the analysis of key player’s growth strategies, micro and macro analysis of markets, key developments, and key trends in the market.Artificial Intelligence in Oil and Gas Market Scope: Inquire before buying

Global Artificial Intelligence in Oil and Gas Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2.71 Bn. Forecast Period 2023 to 2029 CAGR: 10.02% Market Size in 2029: US $ 5.28 Bn. Segments Covered: by Function Upstream Downstream Midstream by Type Hardware Software Hybrid by Application Reclamation Material Movement Production Planning Field Services Quality Control Artificial Intelligence in Oil and Gas Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Artificial Intelligence in Oil and Gas Market Key Players:

1. IBM 2. Intel 3. Microsoft 4. Accenture (Republic of Ireland) 5. Google 6. Microsoft 7. Oracle 8. Numenta 9. Sentient technologies 10.Inbenta 11.General Vision 12.Cisco 13.FuGenX Technologies 14.Infosys 15.Hortonworks 16.Royal Dutch Shell 17.PJSC Gazprom Neft 18.Huawei Technologies Co. Ltd. 19.NVIDIA Corp. 20.Neudax 21.Cloudera, Inc. Frequently Asked Questions: 1. Which region has the largest share in Global Artificial Intelligence in Oil and Gas Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Artificial Intelligence in Oil and Gas Market? Ans: The Global artificial intelligence in Oil & Gas Market is expected to grow at a CAGR of 10.02% during forecast period 2023-2029. 3. What is scope of the Global Artificial Intelligence in Oil and Gas Market report? Ans: Global artificial intelligence in Oil & Gas Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. What is the study period of this market? Ans: The Global artificial intelligence in Oil & Gas Market is studied from 2022 to 2029.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Artificial Intelligence in Oil and Gas Market Size, by Market Value (US$ Bn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Artificial Intelligence in Oil and Gas Market 3.4. Geographical Snapshot of the Artificial Intelligence in Oil and Gas Market, By Manufacturer share 4. Global Artificial Intelligence in Oil and Gas Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Artificial Intelligence in Oil and Gas Market 5. Supply Side and Demand Side Indicators 6. Global Artificial Intelligence in Oil and Gas Market Analysis and Forecast, 2022-2029 6.1. Global Artificial Intelligence in Oil and Gas Market Size & Y-o-Y Growth Analysis. 7. Global Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 7.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 7.1.1. Hardware 7.1.2. Software 7.1.3. Hybrid 7.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 7.2.1. Upstream 7.2.2. Downstream 7.2.3. Midstream 7.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 7.3.1. Predictive maintenance and machinery inspection 7.3.2. Material movement 7.3.3. Production planning 7.3.4. Field services 7.3.5. Quality control 7.3.6. Reclamation 8. Global Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 9.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 9.1.1. Hardware 9.1.2. Software 9.1.3. Hybrid 9.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 9.2.1. Upstream 9.2.2. Downstream 9.2.3. Midstream 9.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 9.3.1. Predictive maintenance and machinery inspection 9.3.2. Material movement 9.3.3. Production planning 9.3.4. Field services 9.3.5. Quality control 9.3.6. Reclamation 10. North America Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 11.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 11.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 11.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 12. Canada Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 12.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 12.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 12.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 13. Mexico Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 13.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 13.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 13.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 14. Europe Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 14.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 14.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 14.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 15. Europe Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 16.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 16.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 16.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 17. France Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 17.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 17.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 17.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 18. Germany Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 18.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 18.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 18.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 19. Italy Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 19.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 19.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 19.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 20. Spain Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 20.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 20.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 20.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 21. Sweden Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 21.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 21.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 21.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 22. CIS Countries Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 22.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 22.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 22.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 23. Rest of Europe Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 23.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 23.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 23.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 24. Asia Pacific Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 24.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 24.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 24.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 25. Asia Pacific Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 26.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 26.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 26.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 27. India Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 27.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 27.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 27.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 28. Japan Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 28.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 28.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 28.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 29. South Korea Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 29.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 29.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 29.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 30. Australia Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 30.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 30.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 30.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 31. ASEAN Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 31.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 31.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 31.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 32. Rest of Asia Pacific Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 32.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 32.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 32.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 33. Middle East Africa Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 33.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 33.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 33.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 34. Middle East Africa Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 35.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 35.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 35.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 36. GCC Countries Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 36.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 36.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 36.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 37. Egypt Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 37.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 37.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 37.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 38. Nigeria Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 38.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 38.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 38.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 39. Rest of ME&A Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 39.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 39.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 39.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 40. South America Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 40.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 40.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 40.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 41. South America Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 42.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 42.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 42.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 43. Argentina Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 43.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 43.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 43.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 44. Rest of South America Artificial Intelligence in Oil and Gas Market Analysis and Forecasts, 2022-2029 44.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 44.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 44.3. Market Size (Value) Estimates & Forecast By Function, 2022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Artificial Intelligence in Oil and Gas Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1. IBM 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Intel 45.3.3. Microsoft 45.3.4. Accenture (Republic of Ireland) 45.3.5. Google 45.3.6. Microsoft 45.3.7. Oracle 45.3.8. Numenta 45.3.9. Sentient technologies 45.3.10. Inbenta 45.3.11. General Vision 45.3.12. Cisco 45.3.13. FuGenX Technologies 45.3.14. Infosys 45.3.15. Hortonworks 45.3.16. Royal Dutch Shell 45.3.17. PJSC Gazprom Neft 45.3.18. Huawei Technologies Co. Ltd. 45.3.19. NVIDIA Corp. 45.3.20. Neudax 45.3.21. Cloudera, Inc. 46. Primary Key Insights