The Application Container Market size was valued at USD 3.99 Billion in 2023 and the total Application Container revenue is expected to grow at a CAGR of 33.84 % from 2024 to 2030, reaching nearly USD 30.70 Billion by 2030. Application Container is self-contained software units containing application code, libraries, and dependencies, designed for universal execution across diverse environments, including desktops, traditional IT systems, and cloud platforms. The Application Container Market is expected rapid growth, driven by the escalating demand for efficient and scalable software deployment solutions across diverse industries. With the increasing adoption of cloud computing and the need for agile application development, the market is witnessing a surge in prominence. The current scenario reflects a dynamic landscape, with Application Container Market key players such as Docker Inc., Red Hat, Inc., Google LLC, and Microsoft Corporation leading the charge. These industry giants are actively contributing to the Application Container Market growth through innovations and strategic collaborations. The Application Container Market growth is driven by factors such as the rising trend of microservices architecture, which emphasizes modular and independent components for application development, enhancing scalability and flexibility. The containerization technology's ability to streamline the deployment process, improve resource utilization, and facilitate seamless integration across various platforms has boosted its adoption globally. Organizations are increasingly recognizing the benefits of container orchestration tools like Kubernetes, contributing to the market's upward trajectory. The Application Container Market competitive landscape is characterized by continual advancements and partnerships, exemplified by Docker Inc.'s introduction of Docker Enterprise 3.0, focusing on enhanced security and scalability features, reinforcing its position as a key player. Similarly, Red Hat, Inc. has made significant strides with OpenShift, a comprehensive Kubernetes platform, to address the evolving needs of enterprises in deploying and managing containerized applications. Google LLC, through Google Kubernetes Engine (GKE), and Microsoft Corporation, with Azure Kubernetes Service (AKS), are also pivotal in shaping the market dynamics. Recent developments indicate a shift towards containerization in edge computing and serverless architectures, expanding the market's reach. As the Application Container Market continues to evolve, the emphasis on container security, compliance, and management solutions is becoming more pronounced. The market is poised for sustained growth as businesses across sectors increasingly recognize the pivotal role of containerization in achieving operational efficiency, cost-effectiveness, and accelerated application delivery, solidifying the position of key players and fostering innovation in the rapidly advancing landscape.To know about the Research Methodology :- Request Free Sample Report

Application Container Market Dynamics:

The growing adoption of microservices architecture boost the use of containers for modular and independent application development The increasing shift to cloud computing, where application containers play a pivotal role in meeting the dynamic resource scaling demands of businesses driving the growth of Application Container Market, for instance, Netflix harnesses the power of Docker containers to efficiently manage its extensive streaming services on the cloud. By optimizing resource utilization and enhancing scalability, Netflix exemplifies the transformative impact of application containers in addressing the challenges posed by large-scale cloud-based operations. The increased adoption of microservices architecture further driving the Application Container Market growth. For example, Amazon's utilization of containerization through AWS Fargate underscores the advantages of microservices, showcasing how it achieves flexibility and efficient resource allocation. This exemplifies the pivotal role that application containers play in facilitating modern software development practices, aligning seamlessly with the growing emphasis on microservices. Containers streamline agile development methodologies, exemplified by Google's continuous integration and delivery platform, Google Cloud Build. Leveraging containers, Google Cloud Build enables organizations to execute rapid and reliable software development cycles. The Application Container Market is driven by the indispensable role that application containers play in DevOps practices, fostering collaboration between development and operations teams. Kubernetes, embraced by industry leaders like Spotify, stands out as an efficient container orchestration tool that facilitates seamless DevOps integration for continuous deployment, marking a critical milestone in the evolution of software development and deployment practices.Containers also optimize resource utilization, enabling more applications to run on a single host. Facebook's strategic use of Docker for containerization showcases how this approach enhances resource efficiency, reducing the infrastructure footprint and operational costs. Furthermore, the market is characterized by the inherent portability of containers, ensuring consistent application execution across diverse environments. Microsoft Azure's container service, AKS, is a prime example, allowing the seamless deployment and management of containerized applications across both on-premises and cloud infrastructures, providing organizations with unmatched flexibility and consistency. As the market continues to expand, the integration of containers into edge computing architectures and their seamless deployment across hybrid cloud environments, as demonstrated by Docker Edge and IBM Cloud Kubernetes Service, respectively, are pivotal factors driving the sustained growth of the Application Container Market. Overcoming Container Networking Challenges for Seamless Communication in Service Discovery and Load Balancing for Market Growth Security concern is emerging as a paramount challenge to the Application Container Market growth, as vulnerabilities within these containers pose the potential threat of exposing sensitive data. For instance, The Equifax breach in 2017, underlining the critical need for fortifying container security measures. This incident prompted the industry to reevaluate its approach, emphasizing the imperative of addressing potential threats and bolstering security frameworks to safeguard against unauthorized access and data breaches. Orchestrating and managing overabundance of containers introduces complexities, particularly evident in large-scale deployments. Instances of security lapses due to misconfigured Kubernetes settings underscore the challenge of streamlining orchestration practices. As organizations increasingly adopt containers, the industry grapples with a shortage of skilled professionals proficient in container technologies. This talent gap, observed during the initial stages of container adoption, necessitates focused training initiatives and educational programs to bridge the divide and ensure effective implementation. The scarcity of expertise presents a hurdle for businesses striving to maximize the benefits of containerization, hindering widespread adoption and the realization of full potential. Compatibility issues across various container runtimes and orchestration platforms hinders the growth of Application Container Market. Docker and Kubernetes compatibility challenges underscore the importance of standardized practices and rigorous compatibility testing to ensure a cohesive and interoperable container ecosystem. Managing software licenses within containerized environments introduces complexities, as seen in instances of open-source license violations in containerized applications. Robust license management strategies become imperative to prevent legal ramifications and ensure compliance with licensing agreements. Containers may introduce resource overhead, impacting performance. Instances of resource contention due to excessive container proliferation underscore the importance of optimizing containerized applications for efficient resource utilization, striking a balance between performance and resource consumption. Ensuring regulatory compliance in containerized environments remains complex, particularly in industries such as finance and healthcare, where stringent regulatory requirements demand careful consideration of compliance frameworks and container security measures. Application Container Market growth driven by Escalating Demand for Business Agility and Swift Time-to-Market The accelerating demand for business agility and expedited time-to-market is a pivotal driver of market growth trends. In the competitive landscape, enterprises are increasingly recognizing the imperative of adopting cutting-edge technologies for developing and delivering modern applications, fostering coordination and growth. Legacy environments, acting as impediments to technological evolution, necessitate transformations in applications, platforms, and technology. Application containers emerge as catalysts in expediting the application development lifecycle, curtailing testing time, and simplifying testing processes to enhance agility. Container orchestration further facilitates the deployment of applications across diverse environments, encompassing physical or virtual, as well as public, private, or hybrid cloud infrastructures. This not only furnishes enterprises with a competitive edge but also translates into heightened efficiency, diminished application-related costs, and a more favorable Return on Investment (ROI), thereby propelling the market's Compound Annual Growth Rate (CAGR). The imperative for collaboration in response to intensified competition mandates the adoption of new technologies and contemporary application design. Legacy settings, posing as obstacles to technology adoption, require comprehensive upgrades in applications, systems, and technology. Application containers play a pivotal role in expediting software development, mitigating complexity, reducing validation time, and enhancing overall agility. The streamlined process of installing applications through container orchestration, adaptable to various settings including physical, virtualized, public, private, and hybrid clouds, not only augments ROI but also confers a competitive advantage, ultimately reducing application costs. In tandem with these market dynamics, numerous innovations are emerging as frontline technologies for businesses globally. The gradual integration of diverse technologies across the world underscores the pivotal role of the application container platform in harnessing the benefits of the Internet of Things (IoT). Application containers facilitate seamless application mobility across IoT devices, host switching, service registration, and accelerated application setup and upgrades. With minimal assistance and limited resource requirements for lightweight operating systems, application containers can efficiently run programs on IoT edge devices. The escalating need for frequent and efficient updates of IoT applications at scale propels the demand for application containers, thereby driving the revenue of the Application Container market.

Application Container Market Segment Analysis:

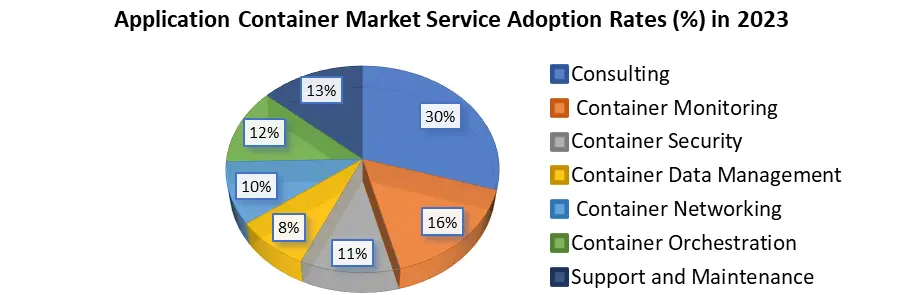

Based on Services, Consulting services segment dominated the Application Container Market in 2023 and is expected to maintain its dominance over the forecast period. It plays a pivotal role in guiding enterprises through the adoption and implementation of container technologies. Container monitoring services ensure the seamless operation of applications, tracking their performance and identifying potential issues. Container security services address the critical need for safeguarding containerized applications against cyber threats. Container data management services focus on efficiently handling and storing data within containers, enhancing overall data accessibility. Container networking services facilitate communication between containers, optimizing data flow. Container orchestration services streamline the deployment and management of containerized applications, promoting scalability and efficiency. Additionally, support and maintenance services are crucial for sustaining the continuous functionality of containerized environments. The comparative analysis of these services reveals their diverse applications and varying degrees of adoption, underscoring the multifaceted landscape of the Application Container Market.

Application Container Market Regional Insights:

North Americas Dominance in the Application Container Market The North American region dominated the Application Container Market in 2023 and is expected to maintain its dominance over the forecast period. The adoption of microservices architecture by enterprises stands out as a primary catalyst, providing a framework for scalable and agile application development. Simultaneously, the ongoing transformation of business-critical applications further propels market growth, as organizations pivot towards container technology to modernize and optimize their software infrastructure. This strategic shift is complemented by a steady influx of financial investments in container technology, fostering innovation and development within the ecosystem. Notably, the presence of a diverse array of small and large players in North America contributes to a dynamic landscape, offering myriad opportunities for market growth. Cloud adoption has become a cornerstone of North America's influence on the application container market. The region has swiftly embraced cloud and related services, establishing an extensive network facilitated by major cloud service providers. This robust cloud infrastructure serves as a linchpin for the growth of containerized applications. Additionally, the heightened demand for DevOps practices in North America significantly contributes to market proliferation. DevOps adoption serves as a driving force behind the seamless integration and deployment of application containers, aligning with the region's tech-savvy landscape. As startups, including Bluedata, ClusterHQ, CoreOS, Docker, Sysdig, and Twistlock, thrive in the North American ecosystem, they inject innovation and competitiveness into the market. The region's commitment to developing and adhering to standards and guidelines for securing containerized infrastructure further solidifies its role as a trendsetter, shaping the trajectory of the global application container market.

Date Company Development October 6, 2023 Veracode Launch of Container Security offering as part of the Continuous Software Security Platform, enhancing security for cloud-native application development. Early access program initiated for existing customers. January 2023 Landis+Gyr and MicroEJ Partnership announced to enhance app development for the next generation of smart meters, setting the digital groundwork for more effective and environmentally friendly energy management. October 2022 Oracle Introduction of serverless Kubernetes container management through Oracle Container Engine for Kubernetes Virtual Nodes infrastructure. Facilitates easier application development and trustworthy operations at scale. October 31, 2022 Nokia and Kinetic Nokia announces Kinetic by Windstream as the first communications service provider (CSP) using its application in containers solution. Container framework deployed on Nokia Beacon 6 broadband devices for enhanced cybersecurity and parental control. Application Container Market Scope: Inquiry Before Buying

Application Container Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.99 Bn. Forecast Period 2024 to 2030 CAGR: 33.84% Market Size in 2030: US $ 30.70 Bn. Segments Covered: by Service Consulting Container monitoring Container security Container data management Container networking Container orchestration Support and maintenance by Deployment Mode Cloud On-premises by Organization Size SMEs Large enterprises by Application Area Production Collaboration Modernization Others by End User BFSI Healthcare and life science Telecommunication and IT Retail and e-commerce Education Media and entertainment Others Application Container Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Application Container Market Key Players:

Major Contributors in the Application Container Industry in North America: 1. Docker, Inc. - San Francisco, California, USA 2. Amazon Web Services (AWS) - Amazon ECS - Seattle, Washington, USA 3. Google Cloud Platform (GCP) - Google Kubernetes Engine (GKE) - Mountain View, California, USA 4. Microsoft Azure - Azure Kubernetes Service (AKS) - Redmond, Washington, USA 5. Red Hat, Inc. - OpenShift - Raleigh, North Carolina, USA 6. IBM - IBM Cloud Kubernetes Service - Armonk, New York, USA 7. VMware, Inc. - Tanzu - Palo Alto, California, USA 8. Rancher Labs, Inc. - Cupertino, California, USA 9. Mesosphere, Inc. (Now D2iQ) - Kubernetes - San Francisco, California, USA 10. Pivotal Software, Inc. (Acquired by VMware) - Palo Alto, California, USA Leading players in the Europe Application Container Market: 1. Canonical Ltd. - Charmed Kubernetes - London, United Kingdom 2. SUSE - SUSE CaaS Platform - Nuremberg, Germany 3. SysEleven GmbH - Berlin, Germany 4. Amazic - Amsterdam, Netherlands 5. Storm Reply - Turin, Italy 6. Eficode - Helsinki, Finland Key players driving the Asia-Pacific Application Container Market: 1. Alibaba Cloud (China) 2. Tencent Cloud (China) 3. Huawei Cloud (China) 4. Naver Cloud (South Korea) 5. NTT Communications (Japan) 6. SK Telecom (South Korea) 7. SAP Cloud Platform 8. Fujitsu Cloud (Japan) 9. NEC Corporation (Japan) 10. Infosys (India)FAQs:

1] What Major Key players in the Global Application Container Market report? Ans. The Major Key players covered in the Application Container Market report are Docker, Inc., Amazon Web series, Google Cloud, Red Hat, Inc., IBM. 2] Which region is expected to hold the highest share in the Global Application Container Market? Ans. North America region is expected to hold the highest share in the Application Container Market. 3] What is the market size of the Global Application Container Market by 2030? Ans. The market size of the Application Container Market by 2030 is expected to reach US$ 30.70 Billion. 4] What is the forecast period for the Global Application Container Market? Ans. The forecast period for the Application Container Market is 2024-2030. 5] What was the market size of the Global Application Container Market in 2023? Ans. The market size of the Application Container Market in 2023 was valued at US$ 3.99 Billion.

1. Application Container Market: Research Methodology 2. Application Container Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Application Container Market: Dynamics 3.1. Application Container Market Trends by Region 3.1.1. North America Application Container Market Trends 3.1.2. Europe Application Container Market Trends 3.1.3. Asia Pacific Application Container Market Trends 3.1.4. Middle East and Africa Application Container Market Trends 3.1.5. South America Application Container Market Trends 3.2. Application Container Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Application Container Market Drivers 3.2.1.2. North America Application Container Market Restraints 3.2.1.3. North America Application Container Market Opportunities 3.2.1.4. North America Application Container Market Challenges 3.2.2. Europe 3.2.2.1. Europe Application Container Market Drivers 3.2.2.2. Europe Application Container Market Restraints 3.2.2.3. Europe Application Container Market Opportunities 3.2.2.4. Europe Application Container Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Application Container Market Drivers 3.2.3.2. Asia Pacific Application Container Market Restraints 3.2.3.3. Asia Pacific Application Container Market Opportunities 3.2.3.4. Asia Pacific Application Container Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Application Container Market Drivers 3.2.4.2. Middle East and Africa Application Container Market Restraints 3.2.4.3. Middle East and Africa Application Container Market Opportunities 3.2.4.4. Middle East and Africa Application Container Market Challenges 3.2.5. South America 3.2.5.1. South America Application Container Market Drivers 3.2.5.2. South America Application Container Market Restraints 3.2.5.3. South America Application Container Market Opportunities 3.2.5.4. South America Application Container Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Application Container End Use Industry 3.8. Analysis of Government Schemes and Initiatives For Application Container End Use Industry 3.9. The Global Pandemic Impact on Application Container Market 4. Application Container Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Application Container Market Size and Forecast, by Service (2023-2030) 4.1.1. Bitcoin 4.1.2. Ethereum 4.1.3. Litecoin 4.1.4. Various Altcoins 4.2. Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 4.2.1. Buy-Only ATMs 4.2.2. Sell-Only ATMs 4.2.3. Two-Way ATMs (Buying and Selling) 4.3. Application Container Market Size and Forecast, by Organization Size (2023-2030) 4.3.1. Airports 4.3.2. Shopping Malls 4.3.3. Retail Stores 4.3.4. Standalone Installations 4.4. Application Container Market Size and Forecast, by Application Area (2023-2030) 4.4.1. Public ATMs 4.4.2. Private ATMs 4.5. Application Container Market Size and Forecast, by End User (2023-2030) 4.5.1. Cryptocurrency Company Operated 4.5.2. Financial Institution Operated 4.5.3. Independent Operators 4.6. Application Container Market Size and Forecast, by Region (2023-2030) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Application Container Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Application Container Market Size and Forecast, by Service (2023-2030) 5.1.1. Consulting 5.1.2. Container monitoring 5.1.3. Container security 5.1.4. Container data management 5.1.5. Container networking 5.1.6. Container orchestration 5.1.7. Support and maintenance 5.2. North America Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 5.2.1. Cloud 5.2.2. On-premises 5.3. North America Application Container Market Size and Forecast, by Organization Size (2023-2030) 5.3.1. SMEs 5.3.2. Large enterprises 5.4. North America Application Container Market Size and Forecast, by Application Area (2023-2030) 5.4.1. Production 5.4.2. Collaboration 5.4.3. Modernization 5.4.4. Others 5.5. North America Application Container Market Size and Forecast, by End User (2023-2030) 5.5.1. BFSI 5.5.2. Healthcare and life science 5.5.3. Telecommunication and IT 5.5.4. Retail and e-commerce 5.5.5. Education 5.5.6. Media and entertainment 5.5.7. Others 5.6. Application Container Market Size and Forecast, by Country (2023-2030) 5.6.1. United States 5.6.1.1. United States Application Container Market Size and Forecast, by Service (2023-2030) 5.6.1.1.1. Consulting 5.6.1.1.2. Container monitoring 5.6.1.1.3. Container security 5.6.1.1.4. Container data management 5.6.1.1.5. Container networking 5.6.1.1.6. Container orchestration 5.6.1.1.7. Support and maintenance 5.6.1.2. United States Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 5.6.1.2.1. Cloud 5.6.1.2.2. On-premises 5.6.1.3. United States Application Container Market Size and Forecast, by Organization Size (2023-2030) 5.6.1.3.1. SMEs 5.6.1.3.2. Large enterprises 5.6.1.4. United States Application Container Market Size and Forecast, by Application Area (2023-2030) 5.6.1.4.1. Production 5.6.1.4.2. Collaboration 5.6.1.4.3. Modernization 5.6.1.4.4. Others 5.6.1.5. United States Application Container Market Size and Forecast, by End User (2023-2030) 5.6.1.5.1. BFSI 5.6.1.5.2. Healthcare and life science 5.6.1.5.3. Telecommunication and IT 5.6.1.5.4. Retail and e-commerce 5.6.1.5.5. Education 5.6.1.5.6. Media and entertainment 5.6.1.5.7. Others 5.6.2. Canada 5.6.2.1. Canada Application Container Market Size and Forecast, by Service (2023-2030) 5.6.2.1.1. Consulting 5.6.2.1.2. Container monitoring 5.6.2.1.3. Container security 5.6.2.1.4. Container data management 5.6.2.1.5. Container networking 5.6.2.1.6. Container orchestration 5.6.2.1.7. Support and maintenance 5.6.2.2. Canada Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 5.6.2.2.1. Cloud 5.6.2.2.2. On-premises 5.6.2.3. Canada Application Container Market Size and Forecast, by Organization Size (2023-2030) 5.6.2.3.1. SMEs 5.6.2.3.2. Large enterprises 5.6.2.4. Canada Application Container Market Size and Forecast, by Application Area (2023-2030) 5.6.2.4.1. Production 5.6.2.4.2. Collaboration 5.6.2.4.3. Modernization 5.6.2.4.4. Others 5.6.2.5. Canada Application Container Market Size and Forecast, by End User (2023-2030) 5.6.2.5.1. BFSI 5.6.2.5.2. Healthcare and life science 5.6.2.5.3. Telecommunication and IT 5.6.2.5.4. Retail and e-commerce 5.6.2.5.5. Education 5.6.2.5.6. Media and entertainment 5.6.2.5.7. Others 5.6.3. Mexico 5.6.3.1. Mexico Application Container Market Size and Forecast, by Service (2023-2030) 5.6.3.1.1. Consulting 5.6.3.1.2. Container monitoring 5.6.3.1.3. Container security 5.6.3.1.4. Container data management 5.6.3.1.5. Container networking 5.6.3.1.6. Container orchestration 5.6.3.1.7. Support and maintenance 5.6.3.2. Mexico Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 5.6.3.2.1. Cloud 5.6.3.2.2. On-premises 5.6.3.3. Mexico Application Container Market Size and Forecast, by Organization Size (2023-2030) 5.6.3.3.1. SMEs 5.6.3.3.2. Large enterprises 5.6.3.4. Mexico Application Container Market Size and Forecast, by Application Area (2023-2030) 5.6.3.4.1. Production 5.6.3.4.2. Collaboration 5.6.3.4.3. Modernization 5.6.3.4.4. Others 5.6.3.5. Mexico Application Container Market Size and Forecast, by End User (2023-2030) 5.6.3.5.1. BFSI 5.6.3.5.2. Healthcare and life science 5.6.3.5.3. Telecommunication and IT 5.6.3.5.4. Retail and e-commerce 5.6.3.5.5. Education 5.6.3.5.6. Media and entertainment 5.6.3.5.7. Others 6. Europe Application Container Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Application Container Market Size and Forecast, by Service (2023-2030) 6.2. Europe Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 6.3. Europe Application Container Market Size and Forecast, by Organization Size (2023-2030) 6.4. Europe Application Container Market Size and Forecast, by Application Area (2023-2030) 6.5. Europe Application Container Market Size and Forecast, by End User (2023-2030) 6.6. Europe Application Container Market Size and Forecast, by Country (2023-2030) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Application Container Market Size and Forecast, by Service (2023-2030) 6.6.1.2. United Kingdom Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 6.6.1.3. United Kingdom Application Container Market Size and Forecast, by Organization Size (2023-2030) 6.6.1.4. United Kingdom Application Container Market Size and Forecast, by Application Area (2023-2030) 6.6.1.5. United Kingdom Application Container Market Size and Forecast, by End User (2023-2030) 6.6.2. France 6.6.2.1. France Application Container Market Size and Forecast, by Service (2023-2030) 6.6.2.2. France Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 6.6.2.3. France Application Container Market Size and Forecast, by Organization Size (2023-2030) 6.6.2.4. France Application Container Market Size and Forecast, by Application Area (2023-2030) 6.6.2.5. France Application Container Market Size and Forecast, by End User (2023-2030) 6.6.3. Germany 6.6.3.1. Germany Application Container Market Size and Forecast, by Service (2023-2030) 6.6.3.2. Germany Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 6.6.3.3. Germany Application Container Market Size and Forecast, by Organization Size (2023-2030) 6.6.3.4. Germany Application Container Market Size and Forecast, by Application Area (2023-2030) 6.6.3.5. Germany Application Container Market Size and Forecast, by End User (2023-2030) 6.6.4. Italy 6.6.4.1. Italy Application Container Market Size and Forecast, by Service (2023-2030) 6.6.4.2. Italy Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 6.6.4.3. Italy Application Container Market Size and Forecast, by Organization Size (2023-2030) 6.6.4.4. Italy Application Container Market Size and Forecast, by Application Area (2023-2030) 6.6.4.5. Italy Application Container Market Size and Forecast, by End User (2023-2030) 6.6.5. Spain 6.6.5.1. Spain Application Container Market Size and Forecast, by Service (2023-2030) 6.6.5.2. Spain Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 6.6.5.3. Spain Application Container Market Size and Forecast, by Organization Size (2023-2030) 6.6.5.4. Spain Application Container Market Size and Forecast, by Application Area (2023-2030) 6.6.5.5. Spain Application Container Market Size and Forecast, by End User (2023-2030) 6.6.6. Sweden 6.6.6.1. Sweden Application Container Market Size and Forecast, by Service (2023-2030) 6.6.6.2. Sweden Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 6.6.6.3. Sweden Application Container Market Size and Forecast, by Organization Size (2023-2030) 6.6.6.4. Sweden Application Container Market Size and Forecast, by Application Area (2023-2030) 6.6.6.5. Sweden Application Container Market Size and Forecast, by End User (2023-2030) 6.6.7. Austria 6.6.7.1. Austria Application Container Market Size and Forecast, by Service (2023-2030) 6.6.7.2. Austria Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 6.6.7.3. Austria Application Container Market Size and Forecast, by Organization Size (2023-2030) 6.6.7.4. Austria Application Container Market Size and Forecast, by Application Area (2023-2030) 6.6.7.5. Austria Application Container Market Size and Forecast, by End User (2023-2030) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Application Container Market Size and Forecast, by Service (2023-2030) 6.6.8.2. Rest of Europe Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 6.6.8.3. Rest of Europe Application Container Market Size and Forecast, by Organization Size (2023-2030) 6.6.8.4. Rest of Europe Application Container Market Size and Forecast, by Application Area (2023-2030) 6.6.8.5. Rest of Europe Application Container Market Size and Forecast, by End User (2023-2030) 7. Asia Pacific Application Container Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Application Container Market Size and Forecast, by Service (2023-2030) 7.2. Asia Pacific Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.3. Asia Pacific Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.4. Asia Pacific Application Container Market Size and Forecast, by Application Area (2023-2030) 7.5. Asia Pacific Application Container Market Size and Forecast, by End User (2023-2030) 7.6. Asia Pacific Application Container Market Size and Forecast, by Country (2023-2030) 7.6.1. China 7.6.1.1. China Application Container Market Size and Forecast, by Service (2023-2030) 7.6.1.2. China Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.6.1.3. China Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.6.1.4. China Application Container Market Size and Forecast, by Application Area (2023-2030) 7.6.1.5. China Application Container Market Size and Forecast, by End User (2023-2030) 7.6.2. S Korea 7.6.2.1. S Korea Application Container Market Size and Forecast, by Service (2023-2030) 7.6.2.2. S Korea Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.6.2.3. S Korea Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.6.2.4. S Korea Application Container Market Size and Forecast, by Application Area (2023-2030) 7.6.2.5. S Korea Application Container Market Size and Forecast, by End User (2023-2030) 7.6.3. Japan 7.6.3.1. Japan Application Container Market Size and Forecast, by Service (2023-2030) 7.6.3.2. Japan Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.6.3.3. Japan Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.6.3.4. Japan Application Container Market Size and Forecast, by Application Area (2023-2030) 7.6.3.5. Japan Application Container Market Size and Forecast, by End User (2023-2030) 7.6.4. India 7.6.4.1. India Application Container Market Size and Forecast, by Service (2023-2030) 7.6.4.2. India Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.6.4.3. India Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.6.4.4. India Application Container Market Size and Forecast, by Application Area (2023-2030) 7.6.4.5. India Application Container Market Size and Forecast, by End User (2023-2030) 7.6.5. Australia 7.6.5.1. Australia Application Container Market Size and Forecast, by Service (2023-2030) 7.6.5.2. Australia Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.6.5.3. Australia Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.6.5.4. Australia Application Container Market Size and Forecast, by Application Area (2023-2030) 7.6.5.5. Australia Application Container Market Size and Forecast, by End User (2023-2030) 7.6.6. Indonesia 7.6.6.1. Indonesia Application Container Market Size and Forecast, by Service (2023-2030) 7.6.6.2. Indonesia Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.6.6.3. Indonesia Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.6.6.4. Indonesia Application Container Market Size and Forecast, by Application Area (2023-2030) 7.6.6.5. Indonesia Application Container Market Size and Forecast, by End User (2023-2030) 7.6.7. Malaysia 7.6.7.1. Malaysia Application Container Market Size and Forecast, by Service (2023-2030) 7.6.7.2. Malaysia Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.6.7.3. Malaysia Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.6.7.4. Malaysia Application Container Market Size and Forecast, by Application Area (2023-2030) 7.6.7.5. Malaysia Application Container Market Size and Forecast, by End User (2023-2030) 7.6.8. Vietnam 7.6.8.1. Vietnam Application Container Market Size and Forecast, by Service (2023-2030) 7.6.8.2. Vietnam Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.6.8.3. Vietnam Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.6.8.4. Vietnam Application Container Market Size and Forecast, by Application Area (2023-2030) 7.6.8.5. Vietnam Application Container Market Size and Forecast, by End User (2023-2030) 7.6.9. Taiwan 7.6.9.1. Taiwan Application Container Market Size and Forecast, by Service (2023-2030) 7.6.9.2. Taiwan Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.6.9.3. Taiwan Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.6.9.4. Taiwan Application Container Market Size and Forecast, by Application Area (2023-2030) 7.6.9.5. Taiwan Application Container Market Size and Forecast, by End User (2023-2030) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Application Container Market Size and Forecast, by Service (2023-2030) 7.6.10.2. Rest of Asia Pacific Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 7.6.10.3. Rest of Asia Pacific Application Container Market Size and Forecast, by Organization Size (2023-2030) 7.6.10.4. Rest of Asia Pacific Application Container Market Size and Forecast, by Application Area (2023-2030) 7.6.10.5. Rest of Asia Pacific Application Container Market Size and Forecast, by End User (2023-2030) 8. Middle East and Africa Application Container Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Application Container Market Size and Forecast, by Service (2023-2030) 8.2. Middle East and Africa Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 8.3. Middle East and Africa Application Container Market Size and Forecast, by Organization Size (2023-2030) 8.4. Middle East and Africa Application Container Market Size and Forecast, by Application Area (2023-2030) 8.5. Middle East and Africa Application Container Market Size and Forecast, by End User (2023-2030) 8.6. Middle East and Africa Application Container Market Size and Forecast, by Country (2023-2030) 8.6.1. South Africa 8.6.1.1. South Africa Application Container Market Size and Forecast, by Service (2023-2030) 8.6.1.2. South Africa Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 8.6.1.3. South Africa Application Container Market Size and Forecast, by Organization Size (2023-2030) 8.6.1.4. South Africa Application Container Market Size and Forecast, by Application Area (2023-2030) 8.6.1.5. South Africa Application Container Market Size and Forecast, by End User (2023-2030) 8.6.2. GCC 8.6.2.1. GCC Application Container Market Size and Forecast, by Service (2023-2030) 8.6.2.2. GCC Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 8.6.2.3. GCC Application Container Market Size and Forecast, by Organization Size (2023-2030) 8.6.2.4. GCC Application Container Market Size and Forecast, by Application Area (2023-2030) 8.6.2.5. GCC Application Container Market Size and Forecast, by End User (2023-2030) 8.6.3. Nigeria 8.6.3.1. Nigeria Application Container Market Size and Forecast, by Service (2023-2030) 8.6.3.2. Nigeria Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 8.6.3.3. Nigeria Application Container Market Size and Forecast, by Organization Size (2023-2030) 8.6.3.4. Nigeria Application Container Market Size and Forecast, by Application Area (2023-2030) 8.6.3.5. Nigeria Application Container Market Size and Forecast, by End User (2023-2030) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Application Container Market Size and Forecast, by Service (2023-2030) 8.6.4.2. Rest of ME&A Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 8.6.4.3. Rest of ME&A Application Container Market Size and Forecast, by Organization Size (2023-2030) 8.6.4.4. Rest of ME&A Application Container Market Size and Forecast, by Application Area (2023-2030) 8.6.4.5. Rest of ME&A Application Container Market Size and Forecast, by End User (2023-2030) 9. South America Application Container Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Application Container Market Size and Forecast, by Service (2023-2030) 9.2. South America Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 9.3. South America Application Container Market Size and Forecast, by Organization Size (2023-2030) 9.4. South America Application Container Market Size and Forecast, by Application Area (2023-2030) 9.5. South America Application Container Market Size and Forecast, by End User (2023-2030) 9.6. South America Application Container Market Size and Forecast, by Country (2023-2030) 9.6.1. Brazil 9.6.1.1. Brazil Application Container Market Size and Forecast, by Service (2023-2030) 9.6.1.2. Brazil Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 9.6.1.3. Brazil Application Container Market Size and Forecast, by Organization Size (2023-2030) 9.6.1.4. Brazil Application Container Market Size and Forecast, by Application Area (2023-2030) 9.6.1.5. Brazil Application Container Market Size and Forecast, by End User (2023-2030) 9.6.2. Argentina 9.6.2.1. Argentina Application Container Market Size and Forecast, by Service (2023-2030) 9.6.2.2. Argentina Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 9.6.2.3. Argentina Application Container Market Size and Forecast, by Organization Size (2023-2030) 9.6.2.4. Argentina Application Container Market Size and Forecast, by Application Area (2023-2030) 9.6.2.5. Argentina Application Container Market Size and Forecast, by End User (2023-2030) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Application Container Market Size and Forecast, by Service (2023-2030) 9.6.3.2. Rest Of South America Application Container Market Size and Forecast, by Deployment Mode (2023-2030) 9.6.3.3. Rest Of South America Application Container Market Size and Forecast, by Organization Size (2023-2030) 9.6.3.4. Rest Of South America Application Container Market Size and Forecast, by Application Area (2023-2030) 9.6.3.5. Rest Of South America Application Container Market Size and Forecast, by End User (2023-2030) 10. Global Application Container Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Application Container Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Docker, Inc. - San Francisco, California, USA 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Amazon Web Services (AWS) - Amazon ECS - Seattle, Washington, USA 11.3. Google Cloud Platform (GCP) - Google Kubernetes Engine (GKE) - Mountain View, California, USA 11.4. Microsoft Azure - Azure Kubernetes Service (AKS) - Redmond, Washington, USA 11.5. Red Hat, Inc. - OpenShift - Raleigh, North Carolina, USA 11.6. IBM - IBM Cloud Kubernetes Service - Armonk, New York, USA 11.7. VMware, Inc. - Tanzu - Palo Alto, California, USA 11.8. Rancher Labs, Inc. - Cupertino, California, USA 11.9. Mesosphere, Inc. (Now D2iQ) - Kubernetes - San Francisco, California, USA 11.10. Pivotal Software, Inc. (Acquired by VMware) - Palo Alto, California, USA 11.11. Canonical Ltd. - Charmed Kubernetes - London, United Kingdom 11.12. SUSE - SUSE CaaS Platform - Nuremberg, Germany 11.13. SysEleven GmbH - Berlin, Germany 11.14. Amazic - Amsterdam, Netherlands 11.15. Storm Reply - Turin, Italy 11.16. Eficode - Helsinki, Finland 11.17. Alibaba Cloud (China) 11.18. Tencent Cloud (China) 11.19. Huawei Cloud (China) 11.20. Naver Cloud (South Korea) 11.21. NTT Communications (Japan) 11.22. SK Telecom (South Korea) 11.23. SAP Cloud Platform 11.24. Fujitsu Cloud (Japan) 11.25. NEC Corporation (Japan) 11.26. Infosys (India) 12. Key Findings 13. End User Recommendations