Anomaly Detection Market was valued at USD 5.44 Billion in 2023, and it is expected to reach USD 15.48 Billion by 2030, exhibiting a CAGR of 16.1% during the forecast period (2024-2030) Anomaly Detection Software is the identification of events or observations, which do not conform to an expected pattern in a dataset. In various sectors, these non-conforming patterns are referred to as anomalies, outliers, discordant observations, exceptions, aberrations, or contaminants. Many organizations use Anomaly Detection software to secure their systems. Anomaly detection is widely used in a broad range of applications like a credit card, insurance, and health-care fraud detection, intrusion detection for cyber-security, defect detection in safety-critical systems, and military surveillance for enemy activities. Numenta, AVORA, Splunk Enterprise, Loom Systems, Elastic X-Pack, Anodot, and Crunch Metrics are some of the Top Anomaly Detection Softwares which are globally used. Anomaly Detection Plays an important role in the world of Industrial IoT. According to MMR analysis, the potential economic impact of IIoT is $10 to $ 11 trillion a year by 2025. This rapid growth of data shows a challenge and an opportunity for the Anomaly Detection Market. The data explosion can be converted into a powerhouse of infinite value for all industries with accurate anomaly detection at the right time. The growing number of connected devices in the banking and financial sector, healthcare, manufacturing, IT and telecom, defense, and the government is likely to boost the anomaly detection market over the forecast period. These sectors handle sensitive data daily, making them vulnerable to significant frauds, thefts, and hacking, which allows criminals to take over control of the company's infrastructure.To know about the Research Methodology:-Request Free Sample Report

Anomaly Detection Market Dynamics:

The rising incidence of internal threats and cyber fraud The rising incidence of internal threats and cyber frauds has established anomaly detection as a big trend with global awareness. Businesses are adopting these technologies to detect unusual patterns in the network data flow that indicate a hacking attempt or fraudulent activity. Anomaly detection is used not just to identify fraud in online transactions, but also to detect defects in operating environments. The growth of IoT and the increasing demands for advanced solutions to monitor connected use cases are driving a rise in interest in anomaly detection. The growing usage of anomaly detection systems in software testing as well as increased focus on high-performance data analysis are driving the market growth. A growing introduction of advanced solutions with new functionalities and features is also driving global demand for anomaly detection. Several industry players are using machine learning and AI technology to provide solutions that will assist users in quickly identifying unexpected changes in patterns and behavior.Anomaly Detection Tools are gaining traction in the banking, financial services, and insurance sector

As compared to prescriptive and predictive analytics, anomaly detection-based fraud prevention and detection solutions are much more common. Such applications require the standard machine-learning model, which is trained on constantly flowing incoming data. This model in anomaly detection tools is trained to have a baseline sense of normalcy for loan applications, financial activities, and information for creating a new account. Anomaly detection software is gaining popularity since it alerts human monitors to any deviations from the normal pattern. Anomaly detection systems are also used by the BFSI sector for interactions with various other financial institutions or activities, thanks to machine learning technology. As a result, this sector is rapidly adopting IT solutions to reduce manual dependency and improve processing efficiency. For instance, CSI's fraud anomaly detection software for banks informs the bank about suspicious activity by providing automated alerts, allowing them to maintain vigilance and compliance. Various guidelines or rules released by regulatory agencies and authorities are projected to drive the market during the forecast period. The Federal Financial Institutions Examination Council (FFIEC) requires financial institutions to have a mechanism in place that assists in the monitoring of suspected anomalous activity within online banking. Cyberattacks on connected automobiles are becoming more common. The Anomaly Detection System (ADS) protects the automobile sector using modern technology. It is a comprehensive security solution for vehicle operation. To identify anomalies in vehicle movements, image processing, and machine learning approaches are used. Standing and traveling in the opposite direction are examples of these anomalies. CCTV cameras on the front and back sides of the car record images. This feature makes the findings more resilient to changes in operational and environmental conditions. The Anomaly Detection System (ADS) protects the automobile sector using modern technology. It is a complete vehicle security solution that notifies of potential and current OT network risks.High Installation cost Hider the Market Growth

Growing real-time data sources largely drives Anomaly Detection Systems tools demand. However, the high cost of anomaly detection tools along with the availability of open-source alternatives is largely hindering the growth of the market. Skills and expertise are required to operate tools and solutions. Less availability of skilled labor act as a challenge for the market growth.Anomaly Detection Market Segment Analysis:

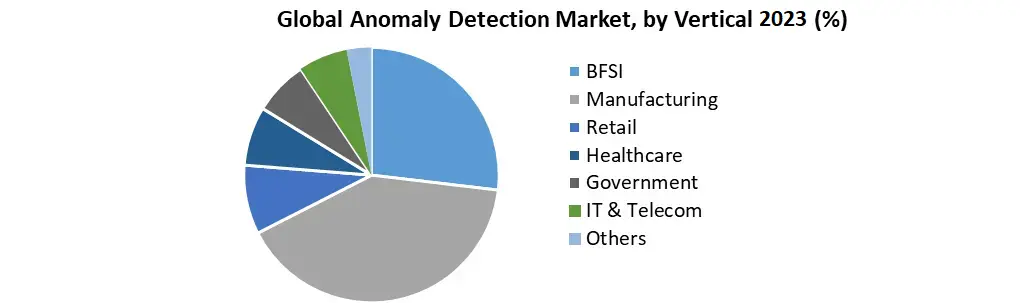

By Component, the market is segmented into solutions and services. The two subsets of the solution are network behavior anomaly detection and user behavior anomaly detection. Anomaly detection in network behavior has been subdivided into network traffic analysis, network intelligence, security, and management. Identity and access management, threat intelligence and management, data loss prevention, security information, and event management are all sub-categories of user behavior anomaly detection. Professional and managed services have been added to the list of offerings. Deployment and integration, consulting services, and support and maintenance are the three subcategories of professional services. Managed network monitoring and maintenance, managed internet access and network infrastructure provisioning, and managed network security are all examples of managed services. By examining available features to identify what makes a “normal” class, the PCA- based anomaly detection component solves the problem. This method allows for the training of a model with data that is already unbalanced. By Vertical, the market is segmented into banking, financial services, insurance, retail, manufacturing, IT and telecom, defense, government, and healthcare. Fraud is one of the most serious threats to banking, financial services, and insurance businesses, as well as to their customers. Banks are increasingly employing machine learning models to detect suspicious and fraudulent transactions in near real-time, preventing them from occurring and even alerting authorities automatically. Machine learning algorithms can detect 30% more scams with 90% accuracy, as a result, AI and machine learning security have become an important part of many banking systems. The Healthcare segment use anomaly detection with the help of machine learning to predict anomalies in heart rate data. Machine learning algorithms used to healthcare data can improve patient care while reducing the cognitive load on health professionals. These algorithms can be used to identify abnormal physiological measurements, potentially resulting in a quicker emergency response or new knowledge on the progression of a health condition.

Anomaly Detection Market Regional Insights

North America is predicted to have the greatest market share and dominate the anomaly detection market during the forecast period. The region is witnessing trends such as Bring Your Own Device (BYOD), growing usage of smart connected devices, and the Industrial Internet of Everything (IIoE). North America has always been the most affected region in the world in terms of threats, intrusions, and security breaches, and as a result, it has the most security vendors. Furthermore, higher budgets and incentives have encouraged a number of large firms to make significant investments in this region. These are some of the key reasons driving market growth in North America. Furthermore, the growth of Small and Medium-Sized Enterprises (SMEs) and the startup environment in North America is growing at a high rate as compared to the other regions. Asia Pacific (APAC) has always been a profitable market for Anomaly Detection due to its sophisticated and active adoption of new technology. The region is expected to develop at the highest CAGR in the anomaly detection market during the forecast period. Furthermore, the rapid development of IT infrastructure and the implementation of new technologies such as big data and analytics, augmented reality, industrial Internet of Things (IoT), remote asset management, cloud, and cyber security are driving the market growth. Furthermore, companies in the APAC area are increasing their investments in large-scale infrastructure projects. Competition from open-source alternatives, as well as a shortage of knowledge and expertise, are some of the market restraints for anomaly detection. However, recent advancements, new product launches, and acquisitions by leading market players are accelerating market growth.Report Scope and Research Methodology:

The report provides a quantitative analysis of the Anomaly Detection market drivers, restraints, trends, and estimations. PORTER's five forces analysis shows the ability of buyers and suppliers to make profit-oriented strategic decisions and build their supplier-buyer network. In-depth analysis as well as the market size and segmentation assist in determining the current Anomaly Detection market potential. The report also includes the factors that are supposed to affect the business positively or negatively and will give a clear futuristic view of the industry to the decision-makers. The report contains strategic profiling of top key players in the market, a wide-ranging analysis of their core competencies, and their strategies, growths, agreements, joint ventures, partnerships, and acquisitions that apply to the businesses. The bottom-up approach has been used to estimate the market size of the global industry. A special focus has been given to each economy and arrived at a market estimate for region and global. Primary and secondary data collection methods have been used to collect the data. Secondary sources include paid sources, annual reports of key players, and manufacturing associations of industrial robotics. Detailed secondary sources are provided in the report. Primary interviews were carried out with stakeholders in the industry that including manufacturers, end users, and consultants. A combination of secondary and primary data collection made this report authentic.Anomaly Detection Market Scope: Inquire before buying

Anomaly Detection Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.44 Bn. Forecast Period 2024 to 2030 CAGR: 16.1% Market Size in 2030: US $ 15.48 Bn. Segments Covered: by Component 1. Solution Network behavior anomaly detection User behavior anomaly detection 2. Services Professional services Managed services by Deployment Mode 1. Cloud 2. On-Premise by Technology 1. Machine Learning & Artificial Intelligence 2. Big Data Analytics 3. Business Intelligence & Data Mining by End-Use 1. BFSI 2. Retail 3. IT & Telecom 4. Healthcare 5. Manufacturing 6. Government & Defense 7. Others Anomaly Detection Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Anomaly Detection Market, Key Players are:

1. Anodot, Ltd. 2. Cisco Systems, Inc. 3. Guardian Analytics 4. SAS Institute Inc 5. Symantec Corporation 6. Trustwave Holdings, Inc 7. Wipro Limited 8. TIBCO Software Inc. 9. Crunch Metrics 10. Dynatrace LLC 11. KNIME 12. Microsoft 13. PROPHIX 14. Zoho Corp. 15. SolarWinds Worldwide, LLC 16. Flowmon Networks 17. Accenture 18. Avora 19. Mechademy Incorporated. 20. Intel Corporation 21. Profit Software 22. Dell Technologies, Inc. 23. Happiest Minds Technologies Limited 24. Hewlett Packard Enterprise Development LP 25. International Business Machines Corporation 26. Microsoft Corporation 27. Nippon Telegraph and Telephone Corporation 28. Splunk, Inc. 29.Trend Micro Incorporated 30. Verint Systems Inc. FAQs: 1. Which is the potential market for Anomaly Detection in terms of the region? Ans. In the Asia Pacific region, the rapid development of IT infrastructure and the implementation of new technologies such as big data and analytics, augmented reality, industrial Internet of Things (IoT), remote asset management, cloud, and cyber security are expected to drive the market. 2. What is expected to drive the growth of the Anomaly Detection market in the forecast period? Ans. The rising incidence of internal threats and cyber fraud are major factors driving the market growth during the forecast period. 3. What is the projected market size & growth rate of the Anomaly Detection Market? Ans. Anomaly Detection Market was valued at USD 5.44 Billion in 2023, and it is expected to reach USD 15.48 Billion by 2030, exhibiting a CAGR of 16.1% during the forecast period (2024-2030). 4. What segments are covered in the Anomaly Detection Market report? Ans. The segments covered are Component, Deployment mode, Technology, End-Use and region.

1. Global Anomaly Detection Market: Research Methodology 2. Global Anomaly Detection Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Anomaly Detection Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Anomaly Detection Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Anomaly Detection Market Segmentation 4.1 Global Anomaly Detection Market, by Component (2023-2030) • Solution Network behavior anomaly detection User behavior anomaly detection • Services Professional services Managed services 4.2 Global Anomaly Detection Market, by Deployment mode (2023-2030) • Cloud • On-Premise 4.3 Global Anomaly Detection Market, by Technology (2023-2030) • Machine Learning & Artificial Intelligence • Big Data Analytics • Business Intelligence & Data Mining 4.4 Global Anomaly Detection Market, by End-Use (2023-2030) • BFSI • Retail • IT & Telecom • Healthcare • Manufacturing • Government & Defense • Others 5. North America Anomaly Detection Market(2023-2030) 5.1 North America Anomaly Detection Market, by Component (2023-2030) • Solution Network behavior anomaly detection User behavior anomaly detection • Services Professional services Managed services 5.2 North America Anomaly Detection Market, by Deployment mode (2023-2030) • Cloud • On-Premise 5.3 North America Anomaly Detection Market, by Technology (2023-2030) • Machine Learning & Artificial Intelligence • Big Data Analytics • Business Intelligence & Data Mining 5.4 North America Anomaly Detection Market, by End-Use (2023-2030) • BFSI • Retail • IT & Telecom • Healthcare • Manufacturing • Government & Defense • Others 5.5 North America Anomaly Detection Market, by Country (2023-2030) • United States • Canada • Mexico 6. Europe Anomaly Detection Market (2023-2030) 6.1. European Anomaly Detection Market, by Component (2023-2030) 6.2. European Anomaly Detection Market, by Deployment mode (2023-2030) 6.3. European Anomaly Detection Market, by Technology (2023-2030) 6.4. European Anomaly Detection Market, by End-Use (2023-2030) 6.5. European Anomaly Detection Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Anomaly Detection Market (2023-2030) 7.1. Asia Pacific Anomaly Detection Market, by Component (2023-2030) 7.2. Asia Pacific Anomaly Detection Market, by Deployment mode (2023-2030) 7.3. Asia Pacific Anomaly Detection Market, by Technology (2023-2030) 7.4. Asia Pacific Anomaly Detection Market, by End-Use (2023-2030) 7.5. Asia Pacific Anomaly Detection Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Anomaly Detection Market (2023-2030) 8.1 Middle East and Africa Anomaly Detection Market, by Component (2023-2030) 8.2. Middle East and Africa Anomaly Detection Market, by Deployment mode (2023-2030) 8.3. Middle East and Africa Anomaly Detection Market, by Technology (2023-2030) 8.4. Middle East and Africa Anomaly Detection Market, by End-Use (2023-2030) 8.5. Middle East and Africa Anomaly Detection Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Anomaly Detection Market (2023-2030) 9.1. South America Anomaly Detection Market, by Component (2023-2030) 9.2. South America Anomaly Detection Market, by Deployment mode (2023-2030) 9.3. South America Anomaly Detection Market, by Technology (2023-2030) 9.4. South America Anomaly Detection Market, by End-Use (2023-2030) 9.5. South America Anomaly Detection Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Anodot, Ltd. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Cisco Systems, Inc. 10.3 Guardian Analytics 10.4 SAS Institute Inc 10.5 Symantec Corporation 10.6 Trustwave Holdings, Inc 10.7 Wipro Limited 10.8 TIBCO Software Inc. 10.9 Crunch Metrics 10.10 Dynatrace LLC 10.11 KNIME 10.12 Microsoft 10.13 PROPHIX 10.14 Zoho Corp. 10.15 SolarWinds Worldwide, LLC 10.16 Flowmon Networks 10.17 Accenture 10.18 Avora 10.19 Mechademy Incorporated. 10.20 Intel Corporation 10.21 Profit Software 10.22 Dell Technologies, Inc. 10.23 Happiest Minds Technologies Limited 10.24 Hewlett Packard Enterprise Development LP 10.25 International Business Machines Corporation 10.26 Microsoft Corporation 10.27 Nippon Telegraph and Telephone Corporation 10.28 Splunk, Inc. 10.29 Trend Micro Incorporated 10.30 Verint Systems Inc.