The Aluminum Cans Market size was valued at USD 60.33 Billion in 2024 and the total Aluminum Cans revenue is expected to grow at a CAGR of 4.3% from 2025 to 2032, reaching nearly USD 84.50 Billion.Overview of the Global Aluminum Cans Market

Aluminum cans, often colloquially known as "tin cans," are single-use packaging containers primarily composed of Aluminum material. They boast an impeccable safety record and have become one of the most widely utilized packaging solutions due to their exceptional ability to preserve the quality and flavour of their contents. These versatile containers find extensive application across a range of industries, including the packaging of chemicals, food and beverages, oils, and various other products. The graphical representation and structural exclusive information showed the dominating region of the Global Aluminum Cans Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Aluminum Cans Market.To know about the Research Methodology :- Request Free Sample Report

Aluminum Cans Market Dynamics

Sustainability, Growing Beverage Industry and Recycling Initiatives are driving the Aluminum Cans Market The Aluminum Cans Market, including aluminum soda cans, gains momentum as environmental sustainability and stringent regulations take center stage. The recyclability of aluminum cans and their reduced environmental footprint make them the favored choice, promoting market growth. The beverage industry, covering carbonated soft drinks, beer, and energy drinks, continues to drive demand for aluminum cans, particularly aluminum beverage cans. The shift towards lightweight and practical packaging aligns with consumer preferences, underpinning market growth. The popularity of aluminum cans, especially aluminum soda cans, is propelled by their inherent convenience, portability, and ease of storage. Consumers choose these containers for on-the-go consumption, making them the preferred option for various beverages and canned products. Advancements in printing technology create opportunities for creative and customizable packaging in the Aluminum Can Market. Aluminum cans, adorned with eye-catching designs and branding, enhance brand visibility and cater to consumers seeking visually appealing products, contributing to market growth. Aluminum cans' remarkable ability to ensure the quality and safety of their contents, particularly in the context of health and hygiene, solidifies their position in the market for beverages and food products. Consumer prioritization of these factors bolsters the market. Customization and Branding with Alternative Applications are creating new opportunities in Aluminum Cans Market Aluminum cans are diversifying beyond beverages, finding utility in packaging personal care products and pharmaceuticals. This expansion into alternative applications opens new doors of opportunity, enabling aluminum cans to cater to a broader range of products. Developing regions, including India, with rising disposable incomes and urbanization, present substantial growth opportunities for the Aluminum Cans Market in India. Evolving consumer preferences and a growing middle class create a conducive environment for market expansion in these areas. Brands can leverage opportunities for custom-designed aluminum cans to distinguish their products and foster personal connections with consumers. Personalized packaging and limited editions carve out a niche market, allowing brands to establish unique identities. Collaborating with recycling programs and advocating for increased aluminum cans recycling rates amplifies the sustainability aspect of these containers. This makes them even more appealing to environmentally conscious consumers, presenting a promising avenue for growth. The burgeoning e-commerce sector, with unique packaging needs, offers an opportunity for aluminum cans, especially in shipping liquid products. By providing suitable packaging solutions, aluminum cans can expand their presence and market share in the online retail landscape. Competition from Other Materials and Changing Consumer Perception are the factors restraining the Aluminum Cans Market Fluctuations in global aluminum prices can impact the production cost of aluminum cans, affecting pricing and profit margins. This price volatility poses a challenge to market stability. Aluminum cans face competition from alternative packaging materials, such as plastic and glass, impacting market share. Consumer preferences for these materials make it essential for aluminum cans to maintain their competitive edge in the aluminum cans for beverages market. While generally considered safe, concerns have arisen about potential health risks associated with the lining of aluminum cans, particularly aluminum soda cans. These concerns can lead to consumer scepticism, potentially hindering market growth. Global supply chain disruptions, including raw material shortages and transportation challenges, can disrupt the production and distribution of aluminum cans, leading to delays and increased operational costs, which affect market dynamics. Negative perceptions and misconceptions about aluminum cans, including beliefs that they affect the taste of their contents, can pose a hurdle to market growth. Addressing these concerns may necessitate education and awareness campaigns to dispel myths and misconceptions in the Aluminum Can Market Analysis.

Aluminum Cans Market Segment Analysis

Structure: In the realm of the Aluminum Cans Market, 2 piece cans stand as a prominent choice. These cans are characterized by their uncomplicated structure, consisting of a single body and end, typically crafted from aluminum. Renowned for their cost-effectiveness and lightweight nature, they emerge as versatile packaging solutions suitable for a wide spectrum of products, including the ever-popular aluminum soda cans. The Aluminum Cans Market recognizes the strength of 3 piece cans due to their robust construction. These cans feature distinct bottom, body, and top components, making them ideal for products that require heightened durability and protection. Their reliability is particularly valuable in industries like the beverage can industry, ensuring the safe containment of canned beverages. Application: The food and beverage sector, within the Aluminum Cans Market, bears witness to the extensive use of aluminum cans. These cans play a vital role in packaging a diverse array of products, encompassing soft drinks, beer, canned food items, and various other consumables. Their lightweight and protective attributes make them the preferred choice for the food and beverage industry, especially in the context of canned beverages. The pharmaceutical industry leverages the dependability of aluminum cans for the secure packaging of medications, pills, and a variety of healthcare products. Aluminum cans, with their ability to extend shelf life and preserve the integrity of pharmaceuticals, are instrumental in upholding the quality and safety of these essential items, aligning with the need for aluminum cans in the pharmaceutical and aluminium cans recycling industry. Within the Aluminum Cans Market, aluminum cans find a niche in the packaging of chemical products, including paints, solvents, and industrial chemicals. Their corrosion resistance and protective qualities make them highly effective in safeguarding chemical contents from external factors, reinforcing their significance in the aluminium cans for beverages market and the chemicals industry. Aluminum cans, recognized for their versatility, extend their utility to a wide range of applications beyond the predominant food, beverage, and pharmaceutical sectors. They prove suitable for packaging various other products, such as personal care items, automotive fluids, and more, demonstrating their adaptability and relevance across diverse industrial segments and the canned beverage market. Type: Slim aluminum cans, characterized by their slender and elongated design, offer a unique and distinctive choice within the Aluminum Cans Market. They are frequently chosen for packaging beverages like energy drinks and specialty juices, presenting a modern and appealing aesthetic that resonates with the preferences of specific consumer segments, contributing to the aluminum can market analysis. Sleek aluminum cans combine a slim profile with a distinctive shape, making them an alluring option for premium and specialty beverages. The elegance and unique design of sleek cans enhance the visual appeal of the products they contain, positioning them as a favored choice for brands targeting a sophisticated market, reinforcing their significance in the Aluminum Beverage Cans industry. Standard aluminum cans, characterized by their traditional cylindrical shape, maintain a widespread presence within the Aluminum Cans Market. They are commonly used for mainstream beverages, including carbonated soft drinks and beer. These cans are synonymous with familiar and dependable packaging solutions, cementing their role as a staple in the Beverage Can Industry. The Aluminum Cans Market offers a diverse array of specialized can types that go beyond the conventional categories. These may encompass custom-designed cans and proprietary shapes tailored to meet specific product or market requirements. These unique can types open up avenues for brands to distinguish themselves and fulfil distinct packaging needs, making them a pivotal part of the Aluminum Can Market Analysis.Aluminum Cans Market Regional Analysis

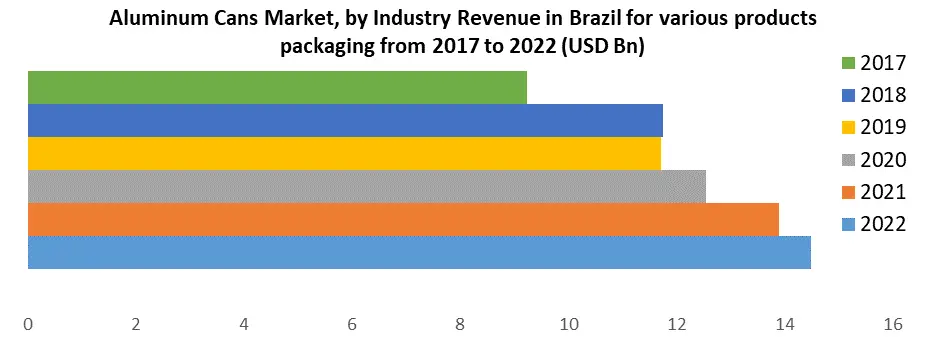

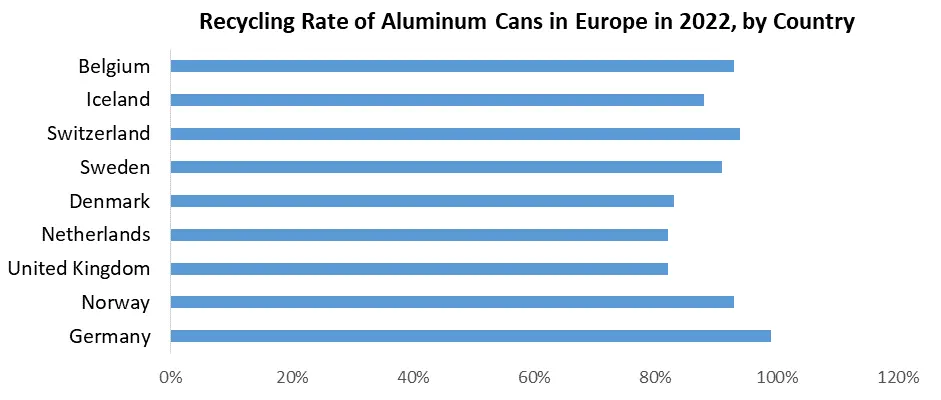

In the North American region, the Aluminum Cans Market demonstrates a robust growth trajectory and holds immense market potential. North America boasts a well-established aluminum beverage cans industry and serves as a significant consumer of aluminum soda cans. The market's consistent expansion is primarily attributed to the strong presence of the beverage can industry. Aluminum cans, particularly those employed for packaging canned beverages, have become a preferred choice for consumers. Furthermore, the market's growth in North America is underscored by recycling initiatives, with widespread adoption of aluminium cans recycling, reflecting the region's unwavering commitment to sustainability. The Aluminum Can Market Analysis underscores the mature state of the market and the promising potential for further market penetration, especially within the context of heightened environmental awareness. The Asia-Pacific region emerges as a focal point within the Aluminum Cans Market, characterizing remarkable market growth and extensive untapped potential. Notably, countries like India have witnessed a surge in the demand for aluminum cans, particularly for beverages. Aluminum cans have swiftly gained prominence as the preferred choice for packaging canned beverages, riding the wave of the booming canned beverage market in India. The beverage can industry, inclusive of the production of aluminum beverage cans, thrives in the Asia-Pacific region, catering to the ever-increasing demand for canned beverages. The market for aluminium cans for beverages is experiencing substantial growth, primarily propelled by the soaring consumption of canned beverages. Moreover, the popularity of aluminum soda cans further augments the market's ongoing penetration within the region. The European Aluminum Cans Market boasts a rich historical legacy, marked by significant and sustained market growth. Europe is positioned as a pioneering region in aluminium cans recycling, firmly emphasizing its commitment to sustainability. The beverage can industry plays a pivotal role within the European market, with aluminum beverage cans being the preferred choice for packaging a diverse range of canned beverages. The aluminium cans for beverages market forms a substantial segment of the industry, reflecting the considerable demand for these cans. Europe is currently witnessing an upswing in market penetration as consumer preferences align with the ecological advantages offered by aluminum cans. The Aluminum Can Market Analysis underscores Europe's mature market status and the potential for further expansion, driven by the region's unwavering focus on sustainability and the enduring popularity of canned beverages.

Aluminum Cans Market Competitive landscape

Ball Corporation and Sodexo Live! have announced the expansion of their partnership to introduce infinitely recyclable Aluminum Beverage Cans into additional sports and entertainment venues, responding to the growing consumer preference for more sustainable products. Ball Corporation, a global leader in sustainable aluminum beverage packaging, designed these lightweight aluminum cups as part of their commitment to bringing circularity to beverage packaging. Together with Sodexo Live!, they aim to foster recycling and sustainability behaviors among sports fans, concert-goers, and various communities, further enhancing market growth, potential, and penetration in the Aluminum Can Market. For the third consecutive year, Ball Corporation, a leading provider of infinitely recyclable aluminum beverage packaging, has partnered with Anheuser-Busch to offer fans Infinitely Recyclable Aluminum Cups at the Big Game. This initiative aligns with the rising consumer demand for sustainable products and circular packaging in sports and entertainment venues. Anheuser-Busch, as the NFL's official beer sponsor and presenting sponsor of Super Bowl LVI, is leveraging its Bud Light brand and sports partnerships to encourage recycling and sustainability behaviors among sports enthusiasts. These ongoing efforts contribute to the advancement of the Aluminum Can Market, enhancing its growth, potential, and penetration.Amcor, Delterra, Mars, and P&G have forged a strategic partnership to address plastic waste and foster a circular economy, committing $6 million USD over five years. This partnership is a collaborative response to combat plastic pollution in the Global South, encompassing upstream and downstream solutions for a circular plastics economy. The commitment to sustainability and the fight against plastic waste align with the objectives of the Global Plastics Treaty's negotiating committee. Such collaborations demonstrate a shared dedication to resolving environmental challenges, promoting market growth, potential, and penetration in the Aluminum Can Market. Amcor's new alliance with the Alliance to End Plastic Waste underscores the shared belief that collective action and collaboration are pivotal to eradicating plastic waste. Both parties recognize the importance of working together to fulfill their commitment to creating recyclable or reusable packaging by 2025. Amcor's dedication extends to enhancing waste management and recycling infrastructure, an essential element in keeping waste out of the environment. This alliance represents a crucial forum for collaborative efforts among stakeholders who are united in the pursuit of sustainable outcomes. Amcor's proactive leadership role within the Alliance to End Plastic Waste contributes to market growth, potential, and penetration in the Aluminum Can Market, emphasizing the significance of a collective approach in addressing pressing environmental issues.

Aluminum Cans Market Scope: Inquiry Before Buying

Aluminum Cans Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 60.33 Bn. Forecast Period 2025 to 2032 CAGR: 4.3% Market Size in 2032: USD 84.50 Bn. Segments Covered: by Structure 2 Piece Cans 3 Piece Cans by Application Food & Beverage Pharmaceuticals Chemicals Others by Type Slim Sleek Standard Other Types Aluminum Cans Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Aluminum Cans Market, Key players

1. Ball Corporation 2. Amcor 3. ORG Packaging 4. CPMC 5. Shengxing Group 6. Toyo Seikan Co., Ltd. 7. Crown 8. EXAL 9. Rexam 10. Massilly Group 11. DS container 12. TUBEX GmbH 13. Alltub Group 14. Shengya 15. Linhardt 16. Matrametal Kft. 17. James Briggs 18. CCL Container 19. Shandong Meiduo 20. Botny Chemical 21. TAKEUCHI PRESS 22. Ardagh Group 23. Silgan Holding Inc. 24. CAN-PACK SA Frequently Asked Questions 1. What is the global market size of aluminum cans? Ans: The Aluminum Cans Market size was valued at USD 60.33 Billion in 2024 and the total Aluminum Cans revenue is expected to grow at a CAGR of 4.3% from 2025 to 2032, reaching nearly USD 84.50 Billion. 2. What was the Global Aluminum Cans Market size in 2024? Ans: The Global Aluminum Cans Market size was USD 60.33 Billion in 2024. 3. What are the benefits of aluminum cans? Ans: Aluminum cans are lighter by Volume Units than most other metals, easier to handle, and less expensive to ship. They also offer high strength, corrosion resistance, and long-term food quality preservation. 4. Which region will lead the global aluminium cans market? Ans: North America region will lead the global aluminium cans market during the forecast period 2025 to 2032. 5. Who are the prominent players operating in the aluminium cans market? Ans: The major players operating in the aluminium cans market are Crown Holdings Inc., CCL Industries Inc., CPMC Holdings Inc., Ball Corporation, Ardagh Group S.A., Silgan Containers LLC, Toyo Seikan Co., Ltd., Nampak Ltd.

1. Aluminum Cans Market: Research Methodology 2. Aluminum Cans Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Aluminum Cans Market: Dynamics 3.1. Aluminum Cans Market Trends by Region 3.1.1. Global Aluminum Cans Market Trends 3.1.2. North America Aluminum Cans Market Trends 3.1.3. Europe Aluminum Cans Market Trends 3.1.4. Asia Pacific Aluminum Cans Market Trends 3.1.5. Middle East and Africa Aluminum Cans Market Trends 3.1.6. South America Aluminum Cans Market Trends 3.2. Aluminum Cans Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Aluminum Cans Market Drivers 3.2.1.2. North America Aluminum Cans Market Restraints 3.2.1.3. North America Aluminum Cans Market Opportunities 3.2.1.4. North America Aluminum Cans Market Challenges 3.2.2. Europe 3.2.2.1. Europe Aluminum Cans Market Drivers 3.2.2.2. Europe Aluminum Cans Market Restraints 3.2.2.3. Europe Aluminum Cans Market Opportunities 3.2.2.4. Europe Aluminum Cans Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Aluminum Cans Market Drivers 3.2.3.2. Asia Pacific Aluminum Cans Market Restraints 3.2.3.3. Asia Pacific Aluminum Cans Market Opportunities 3.2.3.4. Asia Pacific Aluminum Cans Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Aluminum Cans Market Drivers 3.2.4.2. Middle East and Africa Aluminum Cans Market Restraints 3.2.4.3. Middle East and Africa Aluminum Cans Market Opportunities 3.2.4.4. Middle East and Africa Aluminum Cans Market Challenges 3.2.5. South America 3.2.5.1. South America Aluminum Cans Market Drivers 3.2.5.2. South America Aluminum Cans Market Restraints 3.2.5.3. South America Aluminum Cans Market Opportunities 3.2.5.4. South America Aluminum Cans Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. Global 3.6.2. North America 3.6.3. Europe 3.6.4. Asia Pacific 3.6.5. Middle East and Africa 3.6.6. South America 3.7. Key Opinion Leader Analysis For Aluminum Cans Industry 3.8. Analysis of Government Schemes and Initiatives For Aluminum Cans Industry 3.9. The Global Pandemic Impact on Aluminum Cans Market 4. Aluminum Cans Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume Units) (2024-2032) 4.1. Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 4.1.1. 2 Piece Cans 4.1.2. 3 Piece Cans 4.2. Aluminum Cans Market Size and Forecast, by Application (2024-2032) 4.2.1. Food & Beverage 4.2.2. Pharmaceuticals 4.2.3. Chemicals 4.2.4. Others 4.3. Aluminum Cans Market Size and Forecast, by Type (2024-2032) 4.3.1. Slim 4.3.2. Sleek 4.3.3. Standard 4.3.4. Other Types 4.4. Aluminum Cans Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Aluminum Cans Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume Units) (2024-2032) 5.1. North America Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 5.1.1. 2 Piece Cans 5.1.2. 3 Piece Cans 5.2. North America Aluminum Cans Market Size and Forecast, by Application (2024-2032) 5.2.1. Food & Beverage 5.2.2. Pharmaceuticals 5.2.3. Chemicals 5.2.4. Others 5.3. North America Aluminum Cans Market Size and Forecast, by Type (2024-2032) 5.3.1. Slim 5.3.2. Sleek 5.3.3. Standard 5.3.4. Other Types 5.4. North America Aluminum Cans Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 5.4.1.1.1. 2 Piece Cans 5.4.1.1.2. 3 Piece Cans 5.4.1.2. United States Aluminum Cans Market Size and Forecast, by Application (2024-2032) 5.4.1.2.1. Food & Beverage 5.4.1.2.2. Pharmaceuticals 5.4.1.2.3. Chemicals 5.4.1.2.4. Others 5.4.1.3. United States Aluminum Cans Market Size and Forecast, by Type (2024-2032) 5.4.1.3.1. Slim 5.4.1.3.2. Sleek 5.4.1.3.3. Standard 5.4.1.3.4. Other Types 5.4.2. Canada 5.4.2.1. Canada Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 5.4.2.1.1. 2 Piece Cans 5.4.2.1.2. 3 Piece Cans 5.4.2.2. Canada Aluminum Cans Market Size and Forecast, by Application (2024-2032) 5.4.2.2.1. Food & Beverage 5.4.2.2.2. Pharmaceuticals 5.4.2.2.3. Chemicals 5.4.2.2.4. Others 5.4.2.3. Canada Aluminum Cans Market Size and Forecast, by Type (2024-2032) 5.4.2.3.1. Slim 5.4.2.3.2. Sleek 5.4.2.3.3. Standard 5.4.2.3.4. Other Types 5.4.3. Mexico 5.4.3.1. Mexico Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 5.4.3.1.1. 2 Piece Cans 5.4.3.1.2. 3 Piece Cans 5.4.3.2. Mexico Aluminum Cans Market Size and Forecast, by Application (2024-2032) 5.4.3.2.1. Food & Beverage 5.4.3.2.2. Pharmaceuticals 5.4.3.2.3. Chemicals 5.4.3.2.4. Others 5.4.3.3. Mexico Aluminum Cans Market Size and Forecast, by Type (2024-2032) 5.4.3.3.1. Slim 5.4.3.3.2. Sleek 5.4.3.3.3. Standard 5.4.3.3.4. Other Types 6. Europe Aluminum Cans Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume Units) (2024-2032) 6.1. Europe Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 6.2. Europe Aluminum Cans Market Size and Forecast, by Application (2024-2032) 6.3. Europe Aluminum Cans Market Size and Forecast, by Type(2024-2032) 6.4. Europe Aluminum Cans Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 6.4.1.2. United Kingdom Aluminum Cans Market Size and Forecast, by Application (2024-2032) 6.4.1.3. United Kingdom Aluminum Cans Market Size and Forecast, by Type(2024-2032) 6.4.2. France 6.4.2.1. France Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 6.4.2.2. France Aluminum Cans Market Size and Forecast, by Application (2024-2032) 6.4.2.3. France Aluminum Cans Market Size and Forecast, by Type(2024-2032) 6.4.3. Germany 6.4.3.1. Germany Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 6.4.3.2. Germany Aluminum Cans Market Size and Forecast, by Application (2024-2032) 6.4.3.3. Germany Aluminum Cans Market Size and Forecast, by Type(2024-2032) 6.4.4. Italy 6.4.4.1. Italy Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 6.4.4.2. Italy Aluminum Cans Market Size and Forecast, by Application (2024-2032) 6.4.4.3. Italy Aluminum Cans Market Size and Forecast, by Type(2024-2032) 6.4.5. Spain 6.4.5.1. Spain Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 6.4.5.2. Spain Aluminum Cans Market Size and Forecast, by Application (2024-2032) 6.4.5.3. Spain Aluminum Cans Market Size and Forecast, by Type(2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 6.4.6.2. Sweden Aluminum Cans Market Size and Forecast, by Application (2024-2032) 6.4.6.3. Sweden Aluminum Cans Market Size and Forecast, by Type(2024-2032) 6.4.7. Austria 6.4.7.1. Austria Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 6.4.7.2. Austria Aluminum Cans Market Size and Forecast, by Application (2024-2032) 6.4.7.3. Austria Aluminum Cans Market Size and Forecast, by Type(2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 6.4.8.2. Rest of Europe Aluminum Cans Market Size and Forecast, by Application (2024-2032) 6.4.8.3. Rest of Europe Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7. Asia Pacific Aluminum Cans Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume Units) (2024-2032) 7.1. Asia Pacific Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.2. Asia Pacific Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.3. Asia Pacific Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7.4. Asia Pacific Aluminum Cans Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.4.1.2. China Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.4.1.3. China Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.4.2.2. S Korea Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.4.2.3. S Korea Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7.4.3. Japan 7.4.3.1. Japan Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.4.3.2. Japan Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.4.3.3. Japan Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7.4.4. India 7.4.4.1. India Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.4.4.2. India Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.4.4.3. India Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7.4.5. Australia 7.4.5.1. Australia Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.4.5.2. Australia Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.4.5.3. Australia Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.4.6.2. Indonesia Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.4.6.3. Indonesia Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.4.7.2. Malaysia Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.4.7.3. Malaysia Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.4.8.2. Vietnam Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.4.8.3. Vietnam Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.4.9.2. Taiwan Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.4.9.3. Taiwan Aluminum Cans Market Size and Forecast, by Type(2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 7.4.10.2. Rest of Asia Pacific Aluminum Cans Market Size and Forecast, by Application (2024-2032) 7.4.10.3. Rest of Asia Pacific Aluminum Cans Market Size and Forecast, by Type(2024-2032) 8. Middle East and Africa Aluminum Cans Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume Units) (2024-2032 8.1. Middle East and Africa Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 8.2. Middle East and Africa Aluminum Cans Market Size and Forecast, by Application (2024-2032) 8.3. Middle East and Africa Aluminum Cans Market Size and Forecast, by Type(2024-2032) 8.4. Middle East and Africa Aluminum Cans Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 8.4.1.2. South Africa Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 8.4.1.3. South Africa Aluminum Cans Market Size and Forecast, by Application (2024-2032) 8.4.1.4. South Africa Aluminum Cans Market Size and Forecast, by Type(2024-2032) 8.4.2. GCC 8.4.2.1. GCC Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 8.4.2.2. GCC Aluminum Cans Market Size and Forecast, by Application (2024-2032) 8.4.2.3. GCC Aluminum Cans Market Size and Forecast, by Type(2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 8.4.3.2. Nigeria Aluminum Cans Market Size and Forecast, by Application (2024-2032) 8.4.3.3. Nigeria Aluminum Cans Market Size and Forecast, by Type(2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 8.4.4.2. Rest of ME&A Aluminum Cans Market Size and Forecast, by Application (2024-2032) 8.4.4.3. Rest of ME&A Aluminum Cans Market Size and Forecast, by Type(2024-2032) 9. South America Aluminum Cans Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume Units) (2024-2032 9.1. South America Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 9.2. South America Aluminum Cans Market Size and Forecast, by Application (2024-2032) 9.3. South America Aluminum Cans Market Size and Forecast, by Type(2024-2032) 9.4. South America Aluminum Cans Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 9.4.1.2. Brazil Aluminum Cans Market Size and Forecast, by Application (2024-2032) 9.4.1.3. Brazil Aluminum Cans Market Size and Forecast, by Type(2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 9.4.2.2. Argentina Aluminum Cans Market Size and Forecast, by Application (2024-2032) 9.4.2.3. Argentina Aluminum Cans Market Size and Forecast, by Type(2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Aluminum Cans Market Size and Forecast, by Structure (2024-2032) 9.4.3.2. Rest Of South America Aluminum Cans Market Size and Forecast, by Application (2024-2032) 9.4.3.3. Rest Of South America Aluminum Cans Market Size and Forecast, by Type(2024-2032) 10. Global Aluminum Cans Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Aluminum Cans Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Ball Corporation 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Amcor 11.3. ORG Packaging 11.4. CPMC 11.5. Shengxing Group 11.6. Toyo Seikan Co., Ltd. 11.7. Crown 11.8. EXAL 11.9. Rexam 11.10. Massilly Group 11.11. DS container 11.12. TUBEX GmbH 11.13. Alltub Group 11.14. Shengya 11.15. Linhardt 11.16. Matrametal Kft. 11.17. James Briggs 11.18. CCL Container 11.19. Shandong Meiduo 11.20. Botny Chemical 11.21. TAKEUCHI PRESS 11.22. Ardagh Group 11.23. Silgan Holding Inc. 11.24. CAN-PACK SA 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary