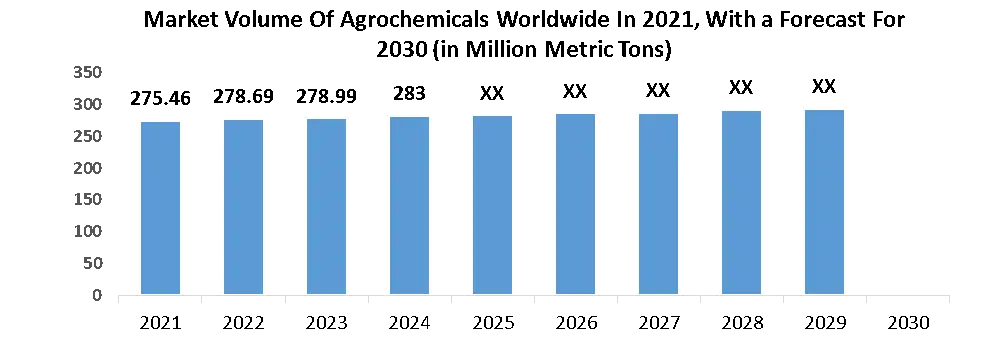

The Global Agrochemicals Market size was valued at USD 225.79 Billion in 2023 and the total Agrochemicals revenue is expected to grow at a CAGR of 4.2 % from 2024 to 2030, reaching nearly USD 301.15 Billion by 2030.Agrochemicals Market Overview

Agricultural productivity is a key metric for assessing the performance of agricultural businesses, and these businesses have become increasingly open to employing agrochemicals. The scientific community is working nonstop to create high-quality agrochemicals that boost agricultural output. The agriculture industry is undeniably under regular surveillance by national and state authorities. The requirement to maintain agricultural integrity is expected to play a significant role in increasing sales in the global agrochemicals market. The overall revenue volume in the worldwide market is expected to rise by a significant amount.To know about the Research Methodology :- Request Free Sample Report

Agrochemicals Market Trends:

The future of agrochemicals looks bright considering the global population growth rate, the growing need for more crop protection agents to protect against crop losses and increase yields, rising consumer demand for sustainably produced food, and agrochemicals’ role in tackling climate change through reducing the need to convert forests to farmlands, and thereby reducing potential greenhouse gas (GHG) emissions. However, several challenges stifle the growth potential of agrochemical companies.Agrochemicals Market Dynamics:

The imperative to enhance agricultural efficiency and protect crops drives demand for agrochemicals worldwide. The imperative to enhance agricultural efficiency and safeguard crops against pests, weeds, and diseases stands as a pivotal driver for the global agrochemicals market. 40% of global crop yields succumb to pests and diseases annually, with weeds alone slashing yields by nearly 34%. Agrochemical solutions such as herbicides, fungicides, and insecticides emerge as indispensable tools in curbing these losses and shielding crops. Climate change exacerbates crop stresses like drought, heat, cold, and salinity, further imperiling yields. Agrochemicals offer a means to bolster crop resilience in the face of such climatic challenges. Regions with tropical climates face heightened risks of insect infestations, fungal infections, and rampant weed proliferation, fueling demand for pesticides and other crop protection agents. Moreover, unsustainable agricultural practices like reduced crop rotations and continuous cropping degrade soil health and foster the emergence of resistant pests and weeds, intensifying the necessity for diverse agrochemical interventions and advanced fertilizers. As agriculture increasingly shifts towards high-value horticultural crops, which demand heightened plant protection, the need for agrochemicals remains unabated. Therefore, the persistent quest to enhance agricultural productivity and shield crops against evolving threats from pests, diseases, and weeds serves as a paramount driver propelling growth in the global agrochemicals market.Increasing stringency of regulatory requirements Stringent regulatory laws, especially in Europe, are challenging to agrochemicals market with the further development of new, innovative technologies like gene-editing in plants, and the use of some types of crop protection agents like glyphosate. The number of glyphosate-related cases for a major agrochemical company crossed 11,000, impacting its stock price performance. A ban on a prevalent crop protection chemical like glyphosate could potentially remove up to 40% of the revenues for a few companies—most agrochemical companies being highly dependent upon glyphosate to drive their revenues and margins. Government farm subsidy reduction with expectations of government subsidy cuts in the United States, farmers are likely to have less of a safety net in case of any weather-related disaster, pay more crop insurance premiums from their own pockets, and have less financial incentive to buy new and more effective crop protection products and seeds which affects to agrochemicals market. Capturing value from increasing interest in sustainable agricultural practices and precision farming: Sustainable agricultural practices include components like Integrated Pest Management (IPM), which involves proactive monitoring of pest populations, and preventing them from growing to unprecedented, damaging levels without causing irreversible soil toxicity or environmental harm all are included in the Agrochemicals Market. It comprises an integrated approach wherein the use of nonchemical tools and digital technologies is encouraged. Rigid focus on minimizing the use of agrochemicals, and greater adoption of IPM practices lead to long-term demand agrochemical market and a decline in major classes of crop protection chemicals including herbicides. However, because of IPM’s focus on natural pest control mechanisms, the demand for biologicals increases to a great extent and commands higher premiums than conventional crop protection chemicals. In fact, from 2020 to till the growth in biologicals (or biopesticides) has outpaced that of overall crop protection chemicals. For well-established innovators whose business models remain asset-heavy, leveraging the power of Machine Learning and Artificial Intelligence (AI) might help Agrochemicals Market a great deal. For instance, instead of testing the efficacy of seeds in a field, Bayer CropScience has made use of simulations and big data to test the same in a computer. This has reportedly shaved off one to two years’ worth of R&D efforts, improved the time-to-Agrochemicals Market for new seeds, and reduced its R&D expenditure.

Agrochemicals Market Segment Analysis:

Based on Crop Type, in 2023, the cereal and grains segment emerged as the dominant force in the market, commanding a substantial revenue share exceeding 47.0%. Agrochemicals play a pivotal role in the development of fruits and vegetables, ensuring their safety, quality, and cost-effectiveness. Pesticides support farmers in cultivating fruit and vegetable crops while fertilizers provide essential nutrients, nitrogen, phosphorus, and potassium (NPK), fostering optimal Agrochemicals Market growth. Asia Pacific stands as the primary consumer of cereal and grain products globally, boasting a significant portion of the world's cultivated land dedicated to grains and cereals. The widespread adoption of fertilizers has become imperative in grain cultivation to meet the escalating demand. This demand is primarily fueled by the increasing consumption of cereals and grains such as rice, wheat, rye, corn, oats, sorghum, and barley. Agrochemical utilization is particularly pronounced in the cultivation of staple crops like rice, wheat, and other cereals and grains.Agrochemicals Market Regional Insights:

In 2023, the Asia Pacific region emerged as a dominant force in the agrochemicals market, capturing a substantial revenue share exceeding 27.0%. Renowned as the leading global producer of agricultural goods, the region benefits from major contributors such as India, China, and Japan. China, in particular, holds the title of the world's largest exporter and manufacturer of pesticides, as reported by the International Trade Center (ITC) and FAO. Following closely, India ranks as the world's fourth-largest producer of agrochemicals this robust presence of key agricultural nations in the region significantly influences its Agrochemicals market share. China's prominence extends beyond production to the consumption and exportation of fertilizers and insecticides on a global scale. China leads in pesticide usage worldwide, consuming over 30% of the global supply and meeting more than 90% of the world's technical raw material requirements. The substantial utilization underscores the region pivotal role in shaping the dynamics of the agrochemicals industry, with implications for regional economic growth and per capita income.Agrochemicals Market Scope: Inquiry Before Buying

Agrochemicals Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 225.79 Bn. Forecast Period 2024 to 2030 CAGR: 4.2% Market Size in 2030: US $ 301.15 Bn. Segments Covered: by Pesticide Type Insecticides Herbicides Fungicides Nematicides Others by Fertilizer Type Nitrogenous Fertilizer Phosphatic Fertilizer Potassic Fertilizer by Crop Type Cereal & Grains Oilseeds & Pulses Fruits & Vegetables Others Global Agrochemicals Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, and Rest of ME&A) South America (Brazil, Argentina, and Rest of South America)Agrochemicals Market Key Players:

1. OCP GROUP (United States) 2. Nutrien Ltd. (United States) 3. FMC Corporation (United States) 4. DuPont de Nemours, Inc. (United States) 5. Marrone Bio Innovations, Inc. (United States) 6. Corteva Agriscience(United States) 7. Bayer AG (Germany) 8. Syngenta Group (Switzerland) 9. BASF SE (Germany) 10. Yara International ASA (Norway) 11. ADAMA Ltd. (Israel) 12. Israel Chemicals Ltd. (Israel) 13. UPL Limited(Mumbai, India) 14. Sumitomo Chemical Co., Ltd. (Japan) 15. Nufarm Limited (Australia) 16. Mitsubishi Chemical Corporation (Japan) 17. ChemChina (Syngenta Group) (Beijing, China) 18. Ihara Chemical Industry Co., Ltd. (Japan)FAQs:

1. What makes the Asia Pacific a Lucrative Market for Agrochemicals Market? Ans. Textiles, sugar, animal husbandry, and vegetable oil manufacture are among the emerging agro-based businesses that are driving this growth. 2. What are the top players operating in the Agrochemicals Market? Ans. ADAMA LTD, BAYER, BASF SE, SYNGENTA AG, UPL, COMPASS MINERALS, EUROCHEM GROUP, and OCP GROUP. 3. What is the key driving factor for the growth of the Agrochemicals Market? Ans. The requirement to maintain agricultural integrity is expected to play a significant role in increasing sales in the global agrochemicals market. 4. What is the market size of the Global Agrochemicals Market by 2029? Ans. The Agrochemicals Market size was valued at USD 225.79 Bn. In 2023 the total Agrochemicals Market revenue is growing by 4.2 % from 2024 to 2030, reaching nearly USD 301.15 Bn.

1. Agrochemicals Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Agrochemicals Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Service Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Leading Agrochemicals Market Companies, by Market Capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Agrochemicals Market: Dynamics 3.1. Agrochemicals Market Trends 3.2. Agrochemicals Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Value Chain Analysis 3.7. Regulatory Landscape by Region 3.7.1. North America 3.7.2. Europe 3.7.3. Asia Pacific 3.7.4. Middle East and Africa 3.7.5. South America 3.8. Analysis of Government Schemes and Initiatives For the Agrochemicals Market 3.9. Key Opinion Leader Analysis For Agrochemicals Market 4. Agrochemicals Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 4.1. Agrochemicals Market Size and Forecast, By Product (2023-2030) 4.1.1. Fertilizer 4.1.2. pesticides 4.1.3. Plant Growth Regulators 4.1.4. Others 4.2. Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 4.2.1. Cereal & Grains 4.2.2. Oilseeds & Pulses 4.2.3. Fruits & Vegetables 4.2.4. Others 4.3. Agrochemicals Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Agrochemicals Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 5.1. North America Agrochemicals Market Size and Forecast, By Product (2023-2030) 5.1.1. Fertilizer 5.1.2. pesticides 5.1.3. Plant Growth Regulators 5.1.4. Others 5.2. North America Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 5.2.1. Cereal & Grains 5.2.2. Oilseeds & Pulses 5.2.3. Fruits & Vegetables 5.2.4. Others 5.3. North America Agrochemicals Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Agrochemicals Market Size and Forecast, By Product (2023-2030) 5.3.1.1.1. Fertilizer 5.3.1.1.2. pesticides 5.3.1.1.3. Plant Growth Regulators 5.3.1.1.4. Others 5.3.1.2. United States Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 5.3.1.2.1. Cereal & Grains 5.3.1.2.2. Oilseeds & Pulses 5.3.1.2.3. Fruits & Vegetables 5.3.1.2.4. Others 5.3.2. Canada 5.3.2.1. Canada Agrochemicals Market Size and Forecast, By Product (2023-2030) 5.3.2.1.1. Fertilizer 5.3.2.1.2. pesticides 5.3.2.1.3. Plant Growth Regulators 5.3.2.1.4. Others 5.3.2.2. Canada Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 5.3.2.2.1. Cereal & Grains 5.3.2.2.2. Oilseeds & Pulses 5.3.2.2.3. Fruits & Vegetables 5.3.2.2.4. Others 5.3.3. Mexico 5.3.3.1. Mexico Agrochemicals Market Size and Forecast, By Product (2023-2030) 5.3.3.1.1. Fertilizer 5.3.3.1.2. pesticides 5.3.3.1.3. Plant Growth Regulators 5.3.3.1.4. Others 5.3.3.2. Mexico Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 5.3.3.2.1. Cereal & Grains 5.3.3.2.2. Oilseeds & Pulses 5.3.3.2.3. Fruits & Vegetables 5.3.3.2.4. Others 6. Europe Agrochemicals Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 6.1. Europe Agrochemicals Market Size and Forecast, By Product (2023-2030) 6.2. Europe Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 6.3. Europe Agrochemicals Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Agrochemicals Market Size and Forecast, By Product (2023-2030) 6.3.1.2. United Kingdom Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 6.3.2. France 6.3.2.1. France Agrochemicals Market Size and Forecast, By Product (2023-2030) 6.3.2.2. France Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Agrochemicals Market Size and Forecast, By Product (2023-2030) 6.3.3.2. Germany Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Agrochemicals Market Size and Forecast, By Product (2023-2030) 6.3.4.2. Italy Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Agrochemicals Market Size and Forecast, By Product (2023-2030) 6.3.5.2. Spain Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Agrochemicals Market Size and Forecast, By Product (2023-2030) 6.3.6.2. Sweden Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 6.3.7. Russia 6.3.7.1. Russia Agrochemicals Market Size and Forecast, By Product (2023-2030) 6.3.7.2. Russia Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Agrochemicals Market Size and Forecast, By Product (2023-2030) 6.3.8.2. Rest of Europe Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 7. Asia Pacific Agrochemicals Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 7.1. Asia Pacific Agrochemicals Market Size and Forecast, By Product (2023-2030) 7.2. Asia Pacific Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 7.3. Asia Pacific Agrochemicals Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Agrochemicals Market Size and Forecast, By Product (2023-2030) 7.3.1.2. China Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Agrochemicals Market Size and Forecast, By Product (2023-2030) 7.3.2.2. S Korea Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Agrochemicals Market Size and Forecast, By Product (2023-2030) 7.3.3.2. Japan Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 7.3.4. India 7.3.4.1. India Agrochemicals Market Size and Forecast, By Product (2023-2030) 7.3.4.2. India Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Agrochemicals Market Size and Forecast, By Product (2023-2030) 7.3.5.2. Australia Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 7.3.6. ASEAN 7.3.6.1. ASEAN Agrochemicals Market Size and Forecast, By Product (2023-2030) 7.3.6.2. ASEAN Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 7.3.7. Rest of Asia Pacific 7.3.7.1. Rest of Asia Pacific Agrochemicals Market Size and Forecast, By Product (2023-2030) 7.3.7.2. Rest of Asia Pacific Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 8. Middle East and Africa Agrochemicals Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 8.1. Middle East and Africa Agrochemicals Market Size and Forecast, By Product (2023-2030) 8.2. Middle East and Africa Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 8.3. Middle East and Africa Agrochemicals Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Agrochemicals Market Size and Forecast, By Product (2023-2030) 8.3.1.2. South Africa Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Agrochemicals Market Size and Forecast, By Product (2023-2030) 8.3.2.2. GCC Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 8.3.3. Rest of ME&A 8.3.3.1. Rest of ME&A Agrochemicals Market Size and Forecast, By Product (2023-2030) 8.3.3.2. Rest of ME&A Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 9. South America Agrochemicals Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 9.1. South America Agrochemicals Market Size and Forecast, By Product (2023-2030) 9.2. South America Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 9.3. South America Agrochemicals Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Agrochemicals Market Size and Forecast, By Product (2023-2030) 9.3.1.2. Brazil Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Agrochemicals Market Size and Forecast, By Product (2023-2030) 9.3.2.2. Argentina Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Agrochemicals Market Size and Forecast, By Product (2023-2030) 9.3.3.2. Rest Of South America Agrochemicals Market Size and Forecast, By Crop Type (2023-2030) 10. Company Profile: Key Players 10.1. OCP GROUP 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. Nutrien Ltd. 10.3. FMC Corporation 10.4. DuPont de Nemours, Inc. 10.5. Marrone Bio Innovations, Inc. 10.6. Corteva Agriscience 10.7. Bayer AG 10.8. Syngenta Group 10.9. BASF SE 10.10. Yara International ASA 10.11. ADAMA Ltd. 10.12. Israel Chemicals Ltd. 10.13. UPL Limited 10.14. Sumitomo Chemical Co., Ltd. 10.15. Nufarm Limited 10.16. Mitsubishi Chemical Corporation 10.17. ChemChina (Syngenta Group) 10.18. Ihara Chemical Industry Co., Ltd. 11. Key Findings 12. Industry Recommendations 13. Research Methodology