Aerospace Adhesives and Sealants Market size is expected to reach nearly US$ 1.72 Bn. by 2029 with the CAGR of 5.42% during the forecast period. The report covers the detailed analysis of the Global aerospace adhesives and sealants industry with the classifications of the market on the basis of type, technology, application, and region. Analysis of past market dynamics from 2017 to 2021 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key player's contribution in it.To know about the Research Methodology :- Request Free Sample Report Adhesives are used to binds one or more surfaces together of two different components and resist their separation. Aerospace adhesives are mostly used in the exterior, interior, and engine compartments of aircraft. The report has profiled sixteen key players in the market from different regions. However, report has considered all market leaders, followers and new entrants with investors while analyzing the market and estimation of market size. Manufacturing environment in each region is different and focus is given to regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced technology, trusted vendors are analyzed.

Aerospace Adhesives and Sealants Market Dynamics

The widely growing demand for aerospace the sector is the major growth driver for the global aerospace adhesive and sealant market. Increasing usage of composite materials and an increasing number of aircraft Delivers are expected to drive the global market.Reduced defense investment from developed economies due to high material price are expected to restraint the growth of the global market. Also government regulations and demanding eco-friendly components restraint growth of the market as high-performance aerospace adhesives and sealants include the high amount of VOC content. The growing investment from most of the aerospace adhesive vendors in R&D activities to manufacture high quality adhesives are expected to create growth opportunity for the global aerospace adhesive and sealants market during the forecast period.Aerospace Adhesives and Sealants Market Segment Analysis

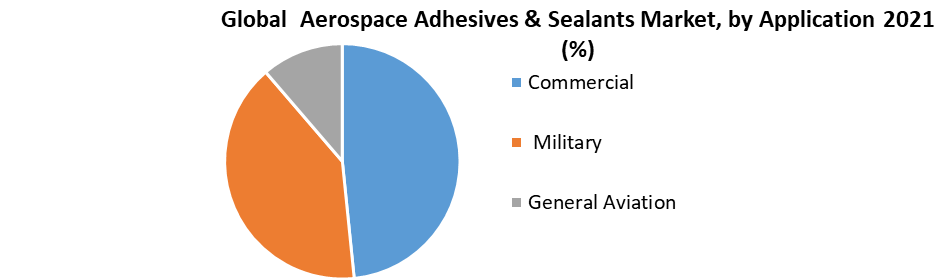

The global aerospace adhesives & sealant market is segmented as adhesives and sealants, based on types. The adhesives segment held major shares of the market and is expected to remain major during forecast period also, as considering wide increasing demand. The segment was valued at US$ xx Bn in 2021 and expected to reach US$ xx Bn by 2029 at a CAGR of xx% during the forecast period. On basis of technology, the solvent-based segment holds major shares of the global aerospace adhesives & sealant market. The growing demand from aircraft interiors as this technology empowers immediate bonding of decorative laminates is a major growth driving factor in the global market. The solvent-based segment held xx% of global market shares in 2021 and is estimated to reach US$ xx Bn by 2029. The commercial segment has great command over the global aerospace adhesives & sealants market as compared with military and general aviation segments and also expected to grow at a CAGR of xx% during the forecast period. The commercial segment held more than 50% of shares in 2021. The growing passenger demand and demand for new commercial aircraft is a growth driving factor for the commercial segment. According to the Airbus past data, the passenger’s traffic has increased by 2.4 times in the last 10 years and it is estimated to be double in the next fifteen years.

Aerospace Adhesives and Sealants Market Regional Insights

North America was valued at US$ xx Bn in 2021 with more than 37% of shares holding. The increased focus of the US government on strengthening the military is major growth driving factor for the global aerospace adhesives & sealants market in North America. North America is expected to grow at a CAGR of xx% during the forecast period to reach US$ xx Bn by 2029. Asia-Pacific held the second largest shares of the global market in 2021 and expected to grow at a CAGR of xx% during forecast period to reach US$ xx Bn by 2029, which is closer to North America. The growing demand from China and India is a major growth driver of the market in Asia-Pacific. The report helps in understanding Global aerospace adhesives and sealants Market dynamics, structure, by analyzing the market segments and projects the Global aerospace adhesives and sealants Market size. The clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global aerospace adhesives and sealants market make the report investor’s guide. The Report provides detail study of the key players of global aerospace adhesives and sealants market with their growth by conserving past data. In addition to that report helps reader with the company profile, Company Overview, Financial Overview, Product Portfolio, Business Strategy, Recent Developments and Development Footprint analysis and growth strategies for each.Scope of the Global Aerospace Adhesives and Sealants Market: Inquire before Buying

Global Aerospace Adhesives and Sealants Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US $ 1.12 Bn. Forecast Period 2022 to 2029 CAGR: 5.42% Market Size in 2029: US $ 1.72 Bn. Segments Covered: by Technology • Solvent-Based • Water-Based • Others by Type • Adhesives • Sealants by Application • Commercial • Military • General Aviation Aerospace Adhesives and Sealants Market, by Region

• North America • Asia-Pacific • Europe • Latin America • Middle East & AfricaAerospace Adhesives and Sealants Market Key Players are:

• Henkel AG & Co. • KGaA • 3M • PPG Industries Inc. • Huntsman Corporation • Cytec Solvay Group • Hexcel Corporation • Illinois Tool Works Inc • Flamemaster • Chemetall • Royal Adhesives & Sealants • Dow Corning • Permatex • Master Bond • AVIC • Solvay Frequently Asked questions 1. What is the market size of the Global Aerospace Adhesives and Sealants Market in 2021? Ans. The market size Global Aerospace Adhesives and Sealants Market in 2021 was US$ 1.12 Billion. 2. What are the different segments of the Global Aerospace Adhesives and Sealants Market? Ans. The Global Aerospace Adhesives and Sealants Market is divided into Technology, Application and Type. 3. What is the study period of this market? Ans. The Global Aerospace Adhesives and Sealants Market will be studied from 2021 to 2029. 4. Which region is expected to hold the highest Global Aerospace Adhesives and Sealants Market share? Ans. The Asia Pacific dominates the market share in the market. 5. What is the Forecast Period of Global Aerospace Adhesives and Sealants Market? Ans. The Forecast Period of the market is 2022-2029 in the market.

Global Aerospace Adhesives and Sealants Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Market Size, By Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Global Aerospace Adhesives and Sealants Market Analysis and Forecast 6.1. Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. Global Aerospace Adhesives and Sealants Market Analysis and Forecast, By Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. Market Value Share Analysis, By Type 7.4. Market Size (US$ Mn) Forecast, By Type 7.5. Market Analysis, By Type 7.6. Market Attractiveness Analysis, By Type 8. Global Aerospace Adhesives and Sealants Market Analysis and Forecast, By Technology 8.1. Introduction and Definition 8.2. Key Findings 8.3. Market Value Share Analysis, By Technology 8.4. Market Size (US$ Mn) Forecast, By Technology 8.5. Market Analysis, By Technology 8.6. Market Attractiveness Analysis, By Technology 9. Global Aerospace Adhesives and Sealants Market Analysis and Forecast By Application 9.1. Introduction and Definition 9.2. Key Findings 9.3. Market Value Share Analysis, By Application 9.4. Market Size (US$ Mn) Forecast, By Application 9.5. Market Analysis, By Application 9.6. Market Attractiveness Analysis, By Application 10. Global Aerospace Adhesives and Sealants Market Analysis, By Region 10.1. Market Value Share Analysis, By Region 10.2. Market Size (US$ Mn) Forecast, By Region 10.3. Market Attractiveness Analysis, By Region 11. North America Aerospace Adhesives and Sealants Market Analysis 11.1. Key Findings 11.2. North America Market Overview 11.3. North America Market Value Share Analysis, By Type 11.4. North America Market Forecast, By Type 11.4.1. Adhesives 11.4.2. Sealants 11.5. North America Market Value Share Analysis, By Technology 11.6. North America Market Forecast, By Technology 11.6.1. Solvent-Based 11.6.2. Water-Based 11.6.3. Others 11.7. North America Market Value Share Analysis, By Application 11.8. North America Market Forecast, By Application 11.8.1. Commercial 11.8.2. Military 11.8.3. General Aviation 11.9. North America Market Value Share Analysis, By Country 11.10. North America Market Forecast, By Country 11.10.1. U.S. 11.10.2. Canada 11.10.3. Mexico 11.11. North America Market Analysis, By Country 11.12. U.S. Market Forecast, By Type 11.12.1. Adhesives 11.12.2. Sealants 11.13. U.S. Market Forecast, By Technology 11.13.1. Solvent-Based 11.13.2. Water-Based 11.13.3. Others 11.14. U.S. Market Forecast, By Application 11.14.1. Commercial 11.14.2. Military 11.14.3. General Aviation 11.15. Canada Market Forecast, By Type 11.15.1. Adhesives 11.15.2. Sealants 11.16. Canada Market Forecast, By Technology 11.16.1. Solvent-Based 11.16.2. Water-Based 11.16.3. Others 11.17. Canada Market Forecast, By Application 11.17.1. Commercial 11.17.2. Military 11.17.3. General Aviation 11.18. Mexico Market Forecast, By Type 11.18.1. Adhesives 11.18.2. Sealants 11.19. Mexico Market Forecast, By Technology 11.19.1. Solvent-Based 11.19.2. Water-Based 11.19.3. Others 11.20. Mexico Market Forecast, By Application 11.20.1. Commercial 11.20.2. Military 11.20.3. General Aviation 11.21. North America Market Attractiveness Analysis 11.21.1. By Type 11.21.2. By Technology 11.21.3. By Application 11.22. PEST Analysis 11.23. Key Trends 11.24. Key Developments 12. Europe Aerospace Adhesives and Sealants Market Analysis 12.1. Key Findings 12.2. Europe Market Overview 12.3. Europe Market Value Share Analysis, By Type 12.4. Europe Market Forecast, By Type 12.4.1. Adhesives 12.4.2. Sealants 12.5. Europe Market Value Share Analysis, By Technology 12.6. Europe Market Forecast, By Technology 12.6.1. Solvent-Based 12.6.2. Water-Based 12.6.3. Others 12.7. Europe Market Value Share Analysis, By Application 12.8. Europe Market Forecast, By Application 12.8.1. Commercial 12.8.2. Military 12.8.3. General Aviation 12.9. Europe Market Value Share Analysis, By Country 12.10. Europe Market Forecast, By Country 12.10.1. Germany 12.10.2. U.K. 12.10.3. France 12.10.4. Italy 12.10.5. Spain 12.10.6. Sweden 12.10.7. CIS countries 12.10.8. Rest of Europe 12.11. Germany Market Forecast, By Type 12.11.1. Adhesives 12.11.2. Sealants 12.12. Germany Market Forecast, By Technology 12.12.1. Solvent-Based 12.12.2. Water-Based 12.12.3. Others 12.13. Germany Market Forecast, By Application 12.13.1. Commercial 12.13.2. Military 12.13.3. General Aviation 12.14. U.K. Market Forecast, By Type 12.14.1. Adhesives 12.14.2. Sealants 12.15. U.K. Market Forecast, By Technology 12.15.1. Solvent-Based 12.15.2. Water-Based 12.15.3. Others 12.16. U.K. Market Forecast, By Application 12.16.1. Commercial 12.16.2. Military 12.16.3. General Aviation 12.17. France Market Forecast, By Type 12.17.1. Adhesives 12.17.2. Sealants 12.18. France Market Forecast, By Technology 12.18.1. Solvent-Based 12.18.2. Water-Based 12.18.3. Others 12.19. France Market Forecast, By Application 12.19.1. Commercial 12.19.2. Military 12.19.3. General Aviation 12.20. Italy Market Forecast, By Type 12.20.1. Adhesives 12.20.2. Sealants 12.21. Italy Market Forecast, By Technology 12.21.1. Solvent-Based 12.21.2. Water-Based 12.21.3. Others 12.22. Italy Market Forecast, By Application 12.22.1. Commercial 12.22.2. Military 12.22.3. General Aviation 12.23. Spain Market Forecast, By Type 12.23.1. Adhesives 12.23.2. Sealants 12.24. Spain Market Forecast, By Technology 12.24.1. Solvent-Based 12.24.2. Water-Based 12.24.3. Others 12.25. Spain Market Forecast, By Application 12.25.1. Commercial 12.25.2. Military 12.25.3. General Aviation 12.26. Sweden Market Forecast, By Type 12.26.1. Adhesives 12.26.2. Sealants 12.27. Sweden Market Forecast, By Technology 12.27.1. Solvent-Based 12.27.2. Water-Based 12.27.3. Others 12.28. Sweden Market Forecast, By Application 12.28.1. Commercial 12.28.2. Military 12.28.3. General Aviation 12.29. CIS countries Market Forecast, By Type 12.29.1. Adhesives 12.29.2. Sealants 12.30. CIS countries Market Forecast, By Technology 12.30.1. Solvent-Based 12.30.2. Water-Based 12.30.3. Others 12.31. CIS countries Market Forecast, By Application 12.31.1. Commercial 12.31.2. Military 12.31.3. General Aviation 12.32. Rest of Europe Market Forecast, By Type 12.32.1. Adhesives 12.32.2. Sealants 12.33. Rest of Europe Market Forecast, By Technology 12.33.1. Solvent-Based 12.33.2. Water-Based 12.33.3. Others 12.34. Rest of Europe Market Forecast, By Application 12.34.1. Commercial 12.34.2. Military 12.34.3. General Aviation 12.35. Europe Market Attractiveness Analysis 12.35.1. By Technology 12.35.2. By Type 12.35.3. By Application 12.36. PEST Analysis 12.37. Key Trends 12.38. Key Developments 13. Asia Pacific Aerospace Adhesives and Sealants Market Analysis 13.1. Key Findings 13.2. Asia Pacific Market Overview 13.3. Asia Pacific Market Value Share Analysis, By Type 13.4. Asia Pacific Market Forecast, By Type 13.4.1. Adhesives 13.4.2. Sealants 13.5. Asia Pacific Market Value Share Analysis, By Technology 13.6. Asia Pacific Market Forecast, By Technology 13.6.1. Solvent-Based 13.6.2. Water-Based 13.6.3. Others 13.7. Asia Pacific Market Value Share Analysis, By Application 13.8. Asia Pacific Market Forecast, By Application 13.8.1. Commercial 13.8.2. Military 13.8.3. General Aviation 13.9. Asia Pacific Market Value Share Analysis, By Country 13.10. Asia Pacific Market Forecast, By Country 13.10.1. China 13.10.2. India 13.10.3. Japan 13.10.4. South Korea 13.10.5. Australia 13.10.6. ASEAN 13.10.7. Rest of Asia Pacific 13.11. Asia Pacific Market Analysis, By Country 13.12. China Market Forecast, By Type 13.12.1. Adhesives 13.12.2. Sealants 13.13. China Market Forecast, By Technology 13.13.1. Solvent-Based 13.13.2. Water-Based 13.13.3. Others 13.14. China Market Forecast, By Application 13.14.1. Commercial 13.14.2. Military 13.14.3. General Aviation 13.15. India Market Forecast, By Type 13.15.1. Adhesives 13.15.2. Sealants 13.16. India Market Forecast, By Technology 13.16.1. Solvent-Based 13.16.2. Water-Based 13.16.3. Others 13.17. India Market Forecast, By Application 13.17.1. Commercial 13.17.2. Military 13.17.3. General Aviation 13.18. Japan Market Forecast, By Type 13.18.1. Adhesives 13.18.2. Sealants 13.19. Japan Market Forecast, By Technology 13.19.1. Solvent-Based 13.19.2. Water-Based 13.19.3. Others 13.20. Japan Market Forecast, By Application 13.20.1. Commercial 13.20.2. Military 13.20.3. General Aviation 13.21. South Korea Market Forecast, By Type 13.21.1. Adhesives 13.21.2. Sealants 13.22. South Korea Market Forecast, By Technology 13.22.1. Solvent-Based 13.22.2. Water-Based 13.22.3. Others 13.23. South Korea Market Forecast, By Application 13.23.1. Commercial 13.23.2. Military 13.23.3. General Aviation 13.24. Australia Market Forecast, By Type 13.24.1. Adhesives 13.24.2. Sealants 13.25. Australia Market Forecast, By Technology 13.25.1. Solvent-Based 13.25.2. Water-Based 13.25.3. Others 13.26. Australia Market Forecast, By Application 13.26.1. Commercial 13.26.2. Military 13.26.3. General Aviation 13.27. ASEAN Market Forecast, By Type 13.27.1. Adhesives 13.27.2. Sealants 13.28. ASEAN Market Forecast, By Technology 13.28.1. Solvent-Based 13.28.2. Water-Based 13.28.3. Others 13.29. ASEAN Market Forecast, By Application 13.29.1. Commercial 13.29.2. Military 13.29.3. General Aviation 13.30. Rest of Asia Pacific Market Forecast, By Type 13.30.1. Adhesives 13.30.2. Sealants 13.31. Rest of Asia Pacific Market Forecast, By Technology 13.31.1. Solvent-Based 13.31.2. Water-Based 13.31.3. Others 13.32. Rest of Asia Pacific Market Forecast, By Application 13.32.1. Commercial 13.32.2. Military 13.32.3. General Aviation 13.33. Asia Pacific Market Attractiveness Analysis 13.33.1. By Type 13.33.2. By Technology 13.33.3. By Application 13.34. PEST Analysis 13.35. Key Trends 13.36. Key Developments 14. Middle East & Africa Aerospace Adhesives and Sealants Market Analysis 14.1. Key Findings 14.2. Middle East & Africa Market Overview 14.3. Middle East & Africa Market Value Share Analysis, By Type 14.4. Middle East & Africa Market Forecast, By Type 14.4.1. Adhesives 14.4.2. Sealants 14.5. Middle East & Africa Market Value Share Analysis, By Technology 14.6. Middle East & Africa Market Forecast, By Technology 14.6.1. Solvent-Based 14.6.2. Water-Based 14.6.3. Others 14.7. Middle East & Africa Market Value Share Analysis, By Application 14.8. Middle East & Africa Market Forecast, By Application 14.8.1. Commercial 14.8.2. Military 14.8.3. General Aviation 14.9. Middle East & Africa Market Value Share Analysis, By Country 14.10. Middle East & Africa Market Forecast, By Country 14.10.1. GCC Countries 14.10.2. South Africa 14.10.3. Nigeria 14.10.4. Egypt 14.10.5. Rest of Middle East & Africa 14.11. Middle East & Africa Market Analysis, By Country 14.12. GCC Countries Market Forecast, By Type 14.12.1. Adhesives 14.12.2. Sealants 14.13. GCC Countries Market Forecast, By Technology 14.13.1. Solvent-Based 14.13.2. Water-Based 14.13.3. Others 14.14. GCC Countries Market Forecast, By Application 14.14.1. Commercial 14.14.2. Military 14.14.3. General Aviation 14.15. South Africa Market Forecast, By Type 14.15.1. Adhesives 14.15.2. Sealants 14.16. South Africa Market Forecast, By Technology 14.16.1. Solvent-Based 14.16.2. Water-Based 14.16.3. Others 14.17. South Africa Market Forecast, By Application 14.17.1. Commercial 14.17.2. Military 14.17.3. General Aviation 14.18. Nigeria Market Forecast, By Type 14.18.1. Adhesives 14.18.2. Sealants 14.19. Nigeria Market Forecast, By Technology 14.19.1. Solvent-Based 14.19.2. Water-Based 14.19.3. Others 14.20. Nigeria Market Forecast, By Application 14.20.1. Commercial 14.20.2. Military 14.20.3. General Aviation 14.21. Egypt Market Forecast, By Type 14.21.1. Adhesives 14.21.2. Sealants 14.22. Egypt Market Forecast, By Technology 14.22.1. Solvent-Based 14.22.2. Water-Based 14.22.3. Others 14.23. Egypt Market Forecast, By Application 14.23.1. Commercial 14.23.2. Military 14.23.3. General Aviation 14.24. Rest of Middle East & Africa Market Forecast, By Type 14.24.1. Adhesives 14.24.2. Sealants 14.25. Rest of Middle East & Africa Market Forecast, By Technology 14.25.1. Solvent-Based 14.25.2. Water-Based 14.25.3. Others 14.26. Rest of Middle East & Africa Market Forecast, By Application 14.26.1. Commercial 14.26.2. Military 14.26.3. General Aviation 14.27. Middle East & Africa Market Attractiveness Analysis 14.27.1. By Type 14.27.2. By Technology 14.27.3. By Application 14.28. PEST Analysis 14.29. Key Trends 14.30. Key Developments 15. South America Aerospace Adhesives and Sealants Market Analysis 15.1. Key Findings 15.2. South America Market Overview 15.3. South America Market Value Share Analysis, By Type 15.4. South America Market Forecast, By Type 15.4.1. Adhesives 15.4.2. Sealants 15.5. South America Market Value Share Analysis, By Technology 15.6. South America Market Forecast, By Technology 15.6.1. Solvent-Based 15.6.2. Water-Based 15.6.3. Others 15.7. South America Market Value Share Analysis, By Application 15.8. South America Market Forecast, By Application 15.8.1. Commercial 15.8.2. Military 15.8.3. General Aviation 15.9. South America Market Value Share Analysis, By Country 15.10. South America Market Forecast, By Country 15.10.1. Brazil 15.10.2. Colombia 15.10.3. Argentina 15.10.4. Rest of South America 15.11. South America Market Analysis, By Country 15.12. Brazil Market Forecast, By Type 15.12.1. Adhesives 15.12.2. Sealants 15.13. Brazil Market Forecast, By Technology 15.13.1. Solvent-Based 15.13.2. Water-Based 15.13.3. Others 15.14. Brazil Market Forecast, By Application 15.14.1. Commercial 15.14.2. Military 15.14.3. General Aviation 15.15. Colombia Market Forecast, By Type 15.15.1. Adhesives 15.15.2. Sealants 15.16. Colombia Market Forecast, By Technology 15.16.1. Solvent-Based 15.16.2. Water-Based 15.16.3. Others 15.17. Colombia Market Forecast, By Application 15.17.1. Commercial 15.17.2. Military 15.17.3. General Aviation 15.18. Argentina Market Forecast, By Type 15.18.1. Adhesives 15.18.2. Sealants 15.19. Argentina Market Forecast, By Technology 15.19.1. Solvent-Based 15.19.2. Water-Based 15.19.3. Others 15.20. Argentina Market Forecast, By Application 15.20.1. Commercial 15.20.2. Military 15.20.3. General Aviation 15.21. Rest of South America Market Forecast, By Type 15.21.1. Adhesives 15.21.2. Sealants 15.22. Rest of South America Market Forecast, By Technology 15.22.1. Solvent-Based 15.22.2. Water-Based 15.22.3. Others 15.23. Rest of South America Market Forecast, By Application 15.23.1. Commercial 15.23.2. Military 15.23.3. General Aviation 15.24. South America Market Attractiveness Analysis 15.24.1. By Type 15.24.2. By Technology 15.24.3. By Application 15.25. PEST Analysis 15.26. Key Trends 15.27. Key Developments 16. Company Profiles 16.1. Market Share Analysis, By Company 16.2. Competition Matrix 16.2.1. Competitive Benchmarking of key players By price, presence, market share, Component, and R&D investment 16.2.2. New Product Launches and Product Enhancements 16.2.3. Market Consolidation 16.2.3.1. M&A By Regions, Investment and Component 16.2.3.2. M&A Key Players, Forward Integration and Backward Integration 16.3. Company Profiles: Key Players 16.3.1. Henkel AG & Co. 16.3.1.1. Company Overview 16.3.1.2. Financial Overview 16.3.1.3. Product Portfolio 16.3.1.4. Business Strategy 16.3.1.5. Recent Developments 16.3.1.6. Development Footprint 16.3.2. KGaA 16.3.3. 3M 16.3.4. PPG Industries Inc. 16.3.5. Huntsman Corporation 16.3.6. Cytec Solvay Group 16.3.7. Hexcel Corporation 16.3.8. Illinois Tool Works Inc 16.3.9. Flamemaster 16.3.10. Chemetall 16.3.11. Royal Adhesives & Sealants 16.3.12. Dow Corning 16.3.13. Permatex 16.3.14. Master Bond 16.3.15. AVIC 16.3.16. Solvay 17. Primary key Insights