Aerosol Can Market size was valued at US$ 248.23 Mn. in 2021. Aerosol Can will encourage a great deal of transformation in Food & Beverage and Cosmetics Industry.Aerosol Can Market Overview:

An aerosol can is a self-contained, handheld dispenser or container that sprays small mists, sprays, or foams liquid particles. It's commonly made of aluminum, steel, or plastic, and it keeps the contents safe from light, air, humidity, gases, and microorganisms. It consists of a shell, a valve, a dip tube, a liquid product, and a liquefied-gas propellant mixture. When the valve opens, the product flows up through the dip tube, and the propellant vaporizes it into fine particles. In comparison to other packaging types, aerosol cans are more convenient to use, are hermetically sealed, and contain multi-layered laminations.To know about the Research Methodology :- Request Free Sample Report

Aerosol Can Market Dynamics:

Driver: Growth of the cosmetic & personal care industry End-use industries such as cosmetics and personal care, food and drinks, and healthcare are increasing their demand for aerosol cans. Increased demand for personal care products such as deodorants, hair sprays, and face & body creams is increasing the consumption of aerosol cans due to factors such as rising disposable income, changing consumer lifestyles, product presentation & differentiation, and rising demand for personal care products such as deodorants, hair sprays, and face & body creams. Aerosol can demand will be boosted by the retail business, which is now transitioning from disorganized to organized retail. Restraint: Availability of alternatives in terms of packaging and price The materials utilized in the production of aerosol cans are more expensive than their traditional counterparts. Moreover, manufacturing costs, as well as disposal costs, contribute to the total cost of the product. There are cheaper alternatives in the shape of a tube, thermoform various flexible containers, and stiff plastic and metal packages for applications that do not require spray dispensing. Aerosol cans are being phased out in favor of refillable spray bottles for spray applications. Opportunity: Emerging economies offer high growth potential Emerging economies like BRIC (Brazil, Russia, India, and China) and CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa) are expected to drive much of the global aerosol can growth through the forecast period. Favorable demographics, rising household incomes, and changing consumer lifestyles are all driving growth in these countries, promoting a growing desire for canned goods. These variables cause lifestyle changes, resulting in a higher need for convenience in terms of packing and use. Challenges: Stringent government regulations Aerosol cans are simple to use, but they're tough to get rid of. They may contain products or propellants that, when discarded, would be considered hazardous waste. The US EPA may classify cans that have not been entirely emptied and yet contain some propellant as hazardous trash. The Environmental Protection Agency (EPA) has issued rules for properly disposing of non-empty aerosol cans. The most common aerosol propellants are propane, carbon dioxide, and butane. This is a type of greenhouse gas that contributes to global warming and the creation of smog.COVID-19 impact on the Aerosol Cans Market

Because most aerosol can items, except healthcare, fall into the non-essential category, manufacturers have been obliged to halt production. To combat the pandemic's losses, businesses began producing sanitizer bottles, facemasks, and other vital items. Companies began manufacturing activities when the lockdown limitations were lifted, and they introduced and began producing small aerosol cans, which are smaller than the typical aerosol can size. This is due to the fear that the pandemic has instilled in the minds of buyers. Because the majority of aerosol can-packed products are non-essential, buyers are ready to spend on them for immediate and short-term usage, resulting in a smaller average can size. Personal care product demand has decreased dramatically at beauty spas, salons, and personal care parlors, but has surged at residences. People have begun to use personal care items at home more frequently, resulting in a rise in demand for aerosol cans. Consumer behavior in the areas of household care and automobile items has been observed all over the world. People who have spare time at home have begun to take care of their homes and vehicles on their own. Third-party service providers' demand for aerosol can-packed items in household care and automotive has reduced. The above-mentioned multiplicative increase in demand for aerosol cans is insufficient to cover the demand gap produced by the pandemic.Aerosol Can Market Segment Analysis:

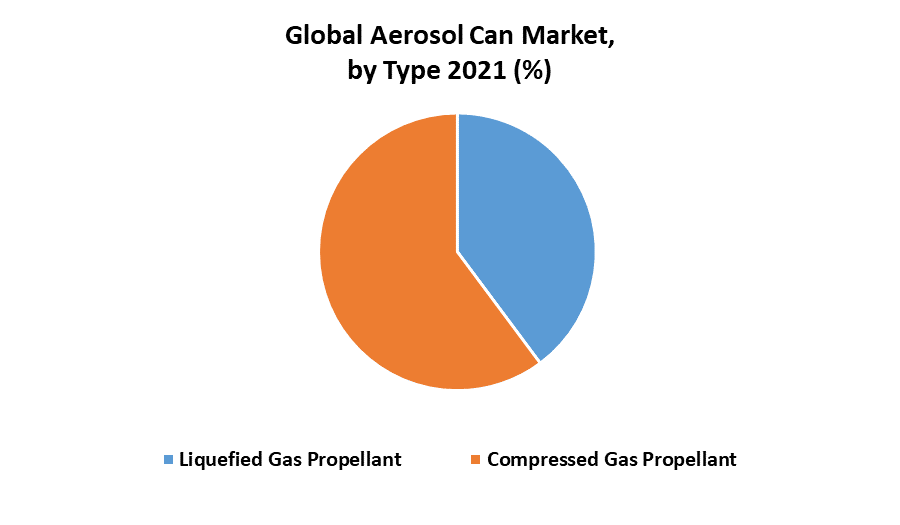

By Material, Aluminum dominated the market with a 39 % share in 2021. Because of its vast range of qualities, aluminum is one of the most used materials for packaging. It's light, shatterproof, impervious to water, flexible, corrosion-resistant, and recyclable. Aluminum aerosol cans keep the contents fresh for a long period by preventing high volatile ingredients from escaping. By Type, Liquefied Gas Propellant dominated the market with a 54% share in 2021. Even when the product level declines, more liquefied gas propellant evaporates to maintain constant pressure in the space above the product in the case of liquid gas propellant. This helps to keep the spray's performance over the life of the aerosol can.

Aerosol Can Market Regional Insights:

Through the forecast period, APAC is expected to be the fastest-growing market for aerosol cans, with a CAGR of 7.33%. The increasing disposable income in developing nations such as China and India is related to the rise of the aerosol cans market in the APAC region. Industrialization, the convenience food industry's growth, an increase in manufacturing activities, an increase in disposable income, an increase in consumption level, and an increase in retail sales have all contributed to the growth of the aerosol cans market in the region through the forecast period. The objective of the report is to present a comprehensive analysis of the Aerosol Can market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Aerosol Can market dynamics, structure by analyzing the market segments and projecting the Aerosol Can market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Aerosol Can market make the report investor’s guide.Aerosol Can Market Scope: Inquiry Before Buying

Global Aerosol Can Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2027 Historical Data: 2017 to 2021 Market Size in 2021: US $ 248.23 Mn. Forecast Period 2022 to 2027 CAGR: 5.10% Market Size in 2027: US $ 334.56 Mn. Segments Covered: by Material • Aluminum • Steel • Plastic • Others by Type • Liquefied Gas Propellant • Compressed Gas Propellant by Product • 1 piece aerosol can • 3 piece aerosol can by End-User • Personal Care • Household Care • Automotive • Healthcare • Others (food & beverage) Aerosol Can Market, by Region

• North America • Europe • Asia Pacific • MEA • Latin AmericaAerosol Can Market Key Players

• Ball Corporation • Crown Holdings Inc. • Nampak Ltd. • CCL Container (Hermitage), Inc. • Exal Corporation • Arminak & Associates LLC • Colep Scitra Aerosols • Spray Products Corporation • Mauser Packaging Solutions • DS Containers, Inc. • MidasCare Pharmaceuticals Pvt. Ltd. • Tubex Holding GmbH Frequently Asked Questions: 1. Which region has the largest share in Global Aerosol Can Market? Ans: Asia-Pacific region holds the highest share in 2021. 2. What is the growth rate of Global Aerosol Can Market? Ans: The Global Aerosol Can Market is growing at a CAGR of 5.10% during forecasting period 2022-2027. 3. What is scope of the Global Aerosol Can market report? Ans: Global Aerosol Can Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Aerosol Can market? Ans: The important key players in the Global Aerosol Can Market are – Ball Corporation, Crown Holdings Inc., Nampak Ltd., CCL Container (Hermitage), Inc., Exal Corporation, Arminak & Associates LLC, Colep Scitra Aerosols, Spray Products Corporation, Mauser Packaging Solutions, DS Containers, Inc., MidasCare Pharmaceuticals Pvt. Ltd., Tubex Holding GmbH 5. What is the study period of this market? Ans: The Global Aerosol Can Market is studied from 2021 to 2027.

1. Global Aerosol Can Market Size: Research Methodology 2. Global Aerosol Can Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Aerosol Can Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Aerosol Can Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Aerosol Can Market Size Segmentation 4.1. Global Aerosol Can Market Size, by Material (2021-2027) • Aluminum • Steel • Plastic • Others 4.2. Global Aerosol Can Market Size, by Type (2021-2027) • Liquefied Gas Propellant • Compressed Gas Propellant 4.3. Global Aerosol Can Market Size, by Product (2021-2027) • 1 piece aerosol can • 3 piece aerosol can 4.4. Global Aerosol Can Market Size, by End Use (2021-2027) • Personal Care • Household Care • Automotive • Healthcare • Others (food & beverage) 5. North America Aerosol Can Market (2021-2027) 5.1. North America Aerosol Can Market Size, by Material (2021-2027) • Aluminium • Steel • Plastic • Others 5.2. North America Aerosol Can Market Size, by Type (2021-2027) • Liquefied Gas Propellant • Compressed Gas Propellant 5.3. North America Aerosol Can Market Size, by Product (2021-2027) • 1 piece aerosol can • 3 piece aerosol can 5.4. North America Aerosol Can Market Size, by End Use (2021-2027) • Personal Care • Household Care • Automotive • Healthcare • Others (food & beverage) 5.5. North America Aerosol Can Market, by Country (2021-2027) • United States • Canada • Mexico 6. European Aerosol Can Market (2021-2027) 6.1. European Aerosol Can Market, by Material (2021-2027) 6.2. European Aerosol Can Market, by Type (2021-2027) 6.3. European Aerosol Can Market, by Product (2021-2027) 6.4. European Aerosol Can Market, by End Use (2021-2027) 6.5. European Aerosol Can Market, by Country (2021-2027) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Aerosol Can Market (2021-2027) 7.1. Asia Pacific Aerosol Can Market, by Material (2021-2027) 7.2. Asia Pacific Aerosol Can Market, by Type (2021-2027) 7.3. Asia Pacific Aerosol Can Market, by Product (2021-2027) 7.4. Asia Pacific Aerosol Can Market, by End Use (2021-2027) 7.5. Asia Pacific Aerosol Can Market, by Country (2021-2027) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Aerosol Can Market (2021-2027) 8.1. The Middle East and Africa Aerosol Can Market, by Material (2021-2027) 8.2. The Middle East and Africa Aerosol Can Market, by Type (2021-2027) 8.3. The Middle East and Africa Aerosol Can Market, by Product (2021-2027) 8.4. The Middle East and Africa Aerosol Can Market, by End Use (2021-2027) 8.5. The Middle East and Africa Aerosol Can Market, by Country (2021-2027) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Aerosol Can Market (2021-2027) 9.1. Latin America Aerosol Can Market, by Material (2021-2027) 9.2. Latin America Aerosol Can Market, by Type (2021-2027) 9.3. Latin America Aerosol Can Market, by Product (2021-2027) 9.4. Latin America Aerosol Can Market, by End Use (2021-2027) 9.5. Latin America Aerosol Can Market, by Country (2021-2027) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. Ball Corporation 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Crown Holdings Inc. 10.3. Nampak Ltd. 10.4. CCL Container (Hermitage), Inc. 10.5. Exal Corporation 10.6. Arminak & Associates LLC 10.7. Colep Scitra Aerosols 10.8. Spray Products Corporation 10.9. Mauser Packaging Solutions 10.10. DS Containers, Inc. 10.11. MidasCare Pharmaceuticals Pvt. Ltd. 10.12. Tubex Holding GmbH