Abrasives Market was valued at US$ 37.67 Bn. in 2022 and it expected to reach US$ 52.31 Bn. by 2029, at a CAGR of 4.8% throughout the forecast period.Abrasives Market Overview:

Abrasives are mineral-based hard material substances used for polishing, grinding, and cleaning surfaces. They are generally used in ultrasonic machining, abrasive jet machining, and magnetic field-assisted polishing. They are widely used in the fabrication of delicate components or the creation of ultra-smooth surfaces for machines and aircraft as they aid to remove superfluous sizing, slicing, and material. They are also used in the automotive industry to reduce noise, reduce carbon emissions, and manufacture vehicle parts like mirrors, valve springs, and fuel and de-aeration tanks.To know about the Research Methodology :- Request Free Sample Report

Global Abrasives Market Dynamics:

Automobile sales have increased globally as a result of rapid urbanisation, rising economic levels, and a growing global population. This, together with the growing use of abrasives to reduce CO2 emissions from high-performance engines and noise levels in automobiles, is boosting the abrasive market growth across the globe. The growing electronics and manufacturing industries contribute to the growth of the economy. Abrasives are used in these industries to scrape small amounts of metal for precision manufacture of semiconductors and other electronic equipment. In addition, the growing construction activities across developing and developed countries are causing an increase in demand for super abrasives. Precision tooling, which is used in the creation of smaller components with better accuracy, has also improved as a result of advancements in the manufacturing industry. This, in turn, is having a beneficial impact on abrasive demand. The Key players across the globe are focusing on a variety of product advancements, including the advancement of polyester and fabric-based abrasives. They're also launching improved coated abrasives for metal manufacturing, which is expected to drive the abrasives market growth during the forecast period. Super-abrasives, such as industrial diamonds, are seeing increased use for precision grinding and cutting of hard metals, which is fueling the abrasives market growth across the globe. Moreover, growth in the manufacturing sector of developing economies of Asia is boosting the demand for super abrasives. For instance, in April 2020, the government of India announced production-linked incentives for large-scale electronic goods makers for the next five years to attract investments in mobile phone manufacturing and electronic component units. Such initiatives are contributing to industrial growth in the country, thereby driving the overall market. The growing need for super abrasives in Asia's manufacturing sector is propelling the region's abrasive market growth over forecast period. For instance, in April 2020, the Indian government announced production-linked incentives for large-scale electronic products manufacturers for the next five years in order to encourage investments in cell phone manufacturing and electronic component facilities. Such initiatives contribute to the country's industrial growth, as a result the abrasive market is expected to grow significantly during the forecast period. The market growth is expected to be restrained during the forecast period, as volatile raw material prices across the globe. Abrasive mass production necessitates enormous quantities of raw ingredients, such as aluminium oxide. The shifting transportation costs influenced by fuel prices causes’ drastic price change of bauxite and other raw minerals, which are expected to affect abrasive production costs and pricing.Global Abrasives Market Segment Analysis:

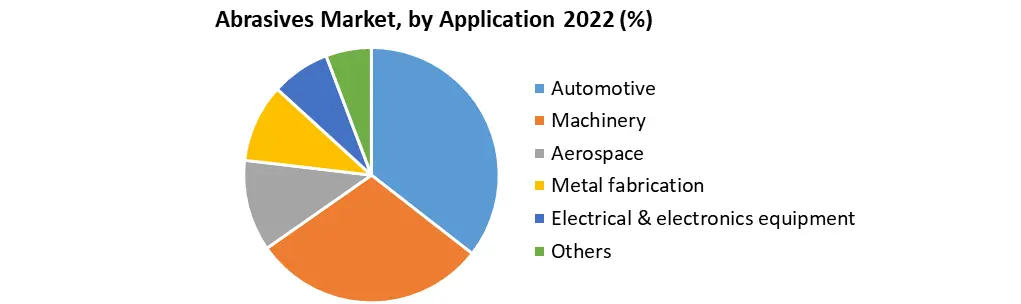

Based on the Material, the Abrasives Market is segmented into Natural and Synthetic. The Natural Abrasives segment held the largest market share, accounting for xx% in 2020. The segment growth is attributed to growing construction sector across the globe. Natural abrasives such as calcite, diamond, pumice, corundum, and sandstone are used because of their hardness and stiffness. The natural abrasives aid in the smoothing of welding in building and bridge construction. The global construction sector is expected to grow at worth more than USD 8000000 million by 2030. The Synthetic Abrasives segment is expected to witness significant growth at a CAGR of xx% during the forecast period. Synthetic abrasives include ceramic, borazon, and silicon carbide. In the manufacturing industry, the synthetic abrasives helps in providing a mirror quality to machined components. In addition, Growing manufacturing sectors in India and China as a result of favourable government initiatives have positive impact on product demand. Based on the Application, the Abrasives Market is segmented into Automotive, Machinery, Aerospace, Metal fabrication, Electrical & electronics equipment, and others. The Automotive segment held the largest market share, accounting for 35% in 2020. The Abrasives are utilised in the automotive industry for a variety of purposes, including coarse and lacquer sanding. The super abrasives in the form of diamond discs are preferred for grinding and polishing automobile components to improve the surface finish. The growing use of abrasives in automotive industry is boosting the abrasives market growth for this segment. Automobile production declined by about 2% in 2021 compared to 2022, reaching a total of 25.23 million units. As a result, demand for abrasives in vehicle manufacture for applications such as cutting and grinding has decreased. The Electrical & electronics equipment segment is expected to grow at the fastest rate at a CAGR of 6.3 % during the forecast period. Abrasives are used to slice and grinding electronic components and different hard materials, such as glass, silicon, zirconia, and quartz, to manufacture circuit components and compact discs. Furthermore, as a result of the easing of limitations placed across numerous regions due to COVID-19, countries are reopening their electrical and electronics manufacturing sectors, which is also fueling the abrasives market growth for this segment.

Global Abrasives Market Regional Insights:

Asia Pacific region held the largest market share accounted for 53% in 2022. The abrasives market in Asia Pacific, driven by South Korea, Japan, India, Australia, and China, is expected to grow as a result of increased construction activity. By polishing and grinding building materials, the products are utilised to surface and shape it. China's construction sector is booming at a rapid pace. The country is the world's largest construction market, accounting for 20% of all worldwide construction investment. By 2030, it is expected to spend US $ 13000000 million on construction. Southeast Asian countries are the prime market for abrasives. For instance, in the first half of 2022, Vietnam's industrial production increased by 2.7% in 2022. Vietnam has become a popular Asian investment destination and a compact industrial base as a result of the trade war between the U. S. and China. The country's growing manufacturing increased the demand for machinery, and hence the product demand. The North America region is expected to witness significant growth at a CAGR of 7.2% during the forecast period. Growing Infrastructure, rising manufacturing investments, and increased EV production in the region's countries such as U.S. and Canada, are driving market growth for this region. The demand for abrasives for durable products in the United States was US $ 4420 million in 2014, and it is expected to rise to US $ 6350 million in 2024. The objective of the report is to present a comprehensive analysis of the Abrasives Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Abrasives Market dynamic, structure by analyzing the market segments and projecting the Abrasives Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Abrasives Market make the report investor’s guide.Global Abrasives Market Scope: Inquire before buying

Global Abrasives Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 37.67 Bn. Forecast Period 2023 to 2029 CAGR: 4.8% Market Size in 2029: US $ 52.32 Bn. Segments Covered: by Product Coated Abrasive Bonded Abrasive Super Abrasive by Material Natural Synthetic by Application Automotive Machinery Aerospace Metal fabrication Electrical & electronics equipment Others Abrasives Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Abrasives Market, Key Players are

1. Robert Bosch GmbH 2. 3M Company 3. Compagnie De Saint-Gobain S.A. 4. Henkel 5. Asahi Diamond Industrial 6. Dowdupont 7. Fujimi Incorporated 8. Carborundum Universal 9. Krebs & Riedel Schleifscheibenfabrik 10. Deerfos 11. Tyrolit Group 12. Nippon Resibon Corporation 13. Sankyo-Rikagaku 14. Abrasiflex 15. Noritake 16. Kier Group PLC 17. Carillon Frequently Asked Questions: 1] What segments are covered in the Abrasives Market report? Ans. The segments covered in the Abrasives Market report are based on Product, Material, and Application. 2] Which region is expected to hold the highest share in the Abrasives Market? Ans. The Asia Pacific region is expected to hold the highest share in the Abrasives Market. 3] What is the market size of the Abrasives Market by 2029? Ans. The market size of the Abrasives Market by 2029 is US $ 52.32 Mn. 4] What is the forecast period for the Abrasives Market? Ans. The Forecast period for the Abrasives Market is 2023-2029. 5] What was the market size of the Abrasives Market in 2022? Ans. The market size of the Abrasives Market in 2022 was US $ 37.67 Mn.

1. Global Abrasives Market Size: Research Methodology 2. Global Abrasives Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Abrasives Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Abrasives Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Abrasives Market Size Segmentation 4.1. Global Abrasives Market Size, by Product (2022-2029) • Coated Abrasive • Bonded Abrasive • Super Abrasive 4.2. Global Abrasives Market Size, by Material (2022-2029) • Natural • Synthetic 4.3. Global Abrasives Market Size, by Application (2022-2029) • Automotive • Machinery • Aerospace • Metal fabrication • Electrical & electronics equipment • Others 5. North America Abrasives Market (2022-2029) 5.1. Global Abrasives Market Size, by Product (2022-2029) • Coated Abrasive • Bonded Abrasive • Super Abrasive 5.2. Global Abrasives Market Size, by Material(2022-2029) • Natural • Synthetic 5.3. Global Abrasives Market Size, by Application (2022-2029) • Automotive • Machinery • Aerospace • Metal fabrication • Electrical & electronics equipment • Others 5.4. North America Abrasives Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Abrasives Market (2022-2029) 6.1. European Abrasives Market, by Product (2022-2029) 6.2. European Abrasives Market, by Material (2022-2029) 6.3. European Abrasives Market, by Application (2022-2029) 6.4. European Abrasives Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Abrasives Market (2022-2029) 7.1. Asia Pacific Abrasives Market, by Product (2022-2029) 7.2. Asia Pacific Abrasives Market, by Material (2022-2029) 7.3. Asia Pacific Abrasives Market, by Application (2022-2029) 7.4. Asia Pacific Abrasives Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Abrasives Market (2022-2029) 8.1. The Middle East and Africa Abrasives Market, by Product (2022-2029) 8.2. The Middle East and Africa Abrasives Market, by Material (2022-2029) 8.3. The Middle East and Africa Abrasives Market, by Application (2022-2029) 8.4. The Middle East and Africa Abrasives Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Abrasives Market (2022-2029) 9.1. Latin America Abrasives Market, by Product (2022-2029) 9.2. Latin America Abrasives Market, by Material (2022-2029) 9.3. Latin America Abrasives Market, by Application (2022-2029) 9.4. Latin America Abrasives Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. Robert Bosch GmbH 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. 3M Company 10.3. Compagnie De Saint-Gobain S.A. 10.4. Henkel 10.5. Asahi Diamond Industrial 10.6. Dowdupont 10.7. Fujimi Incorporated 10.8. Carborundum Universal 10.9. Krebs & Riedel Schleifscheibenfabrik 10.10. Deerfos 10.11. Tyrolit Group 10.12. Nippon Resibon Corporation 10.13. Sankyo-Rikagaku 10.14. Abrasiflex 10.15. Noritake 10.16. Kier Group PLC 10.17. Carillon