The 3D Printing Automotive Market size was valued at USD 5.18 Billion in 2024 and the total 3D Printing Automotive revenue is expected to grow at a CAGR of 21.7% from 2025 to 2032, reaching nearly USD 24.94 Billion.3D Printing Automotive Market Overview:

Industrial 3D printing software allows more efficient car model design, prototyping, testing, and production. The software allows designers to create printable designs, which are the first and most important step in creating 3D-printed automobile parts. According to MMR 3D printing for automotive parts is expected to become a game changer in the industry.Market Scope

The report includes detailed analyses of the 3D Printing Automotive Market and its segments such as, application type, technology type, and region. Also, the report includes market trends, restraints and opportunities and the key players with their capabilities and capacities in the competitive landscape. The report is a combination of primary and secondary data sources and a bottom-up approach has been used to collect the data to analyse it and estimate the total market size by region. The secondary sources provided in the report include annual reports, investor presentations, financial statements, trade, business, and manufacturing associations, government sources by each country and paid database. Primary interviews have been conducted with key players, industry experts and consultants across the regions. after acquiring knowledge about the 3D Printing Automotive market with the help of secondary research. Several primary interviews have been conducted with market experts from both, demand- and supply-sides across major countries in North America, Europe, the Middle East, and the Asia Pacific. The primary data has been collected through surveys, emails, and telephone interviews.To know about the Research Methodology :- Request Free Sample Report

3D Printing Automotive Market Dynamics:

3D Printing Investment by OMEs May transform the Value Chain 3D printing in the automotive industry is assisting OEMs in lowering costs and producing cost-effective auto parts in less time. Even though implementing this new technology is difficult at first, OEMs have seen a positive impact on their manufacturing process and end products. As a result, OEMs have increased their investments in 3D printing and made it a critical component of their manufacturing process. Companies are heavily investing in R&D, which is fueling the growth of the 3D printing market. Various technological advances in 3D printing techniques and materials over the last two decades have paved the way for new technologies that enable the production of a variety of custom products. Industry leaders such as Stratasys (Israel) and 3D Systems (US) have made significant investments in 3D printing technology, which gives them a competitive advantage. Several start-ups and small businesses are investing in research and development for automotive 3D printing technologies in order to introduce new and innovative technologies. Biomedical Modeling (US), SLM Solutions GmbH (Germany), Xilloc Medical BV (Netherlands), Surgival Group (Spain), GPI Prototype (US), and 3T RPD are some of these players (UK). The introduction of new 3D printing technologies and materials would open up new application areas and increase 3D printing's penetration in a variety of industries. R&D is primarily concerned with improving and expanding the capabilities of existing technologies, as well as related software and materials, to achieve high accuracy and efficiency. Companies are also working to create more affordable products as well as software system that is universally compatible and user-friendly for 3D printing applications. From 2025 to 2032, the factor would have a significant impact.Technological barriers to wider adoption The majority of mass-produced metal products are still made via conventional manufacturing because it is more practical and better suited to high-volume production. Current 3-D printing technology also has significant limitations. Parts larger than 30 cm2 are difficult to produce with current 3-D printers, and most printers do not allow for the mixing of materials within the same item. Despite the fact that some 3-D printer manufacturers have announced successful experiments in material mixing during printing, no such printer is currently commercially available. All of these flaws are, of course, the subject of extensive research at all levels of the value chain. The high cost of printers and metal powder is the most significant barrier to 3-D printing becoming feasible in large-scale production. Present-day powder production is inefficient, in part because it is small-scale and in part because only 50% of the atomized powder is of sufficient quality. The irregular and inconsistent particle size is the primary cause of this low yield rate. The majority of existing powder atomizers produce powders that are too coarse for many applications. The industry is working to improve yield rates, which will help lower total costs and increase the output of 3-D printing processes. Some precious metals manufacturers' tests indicate that yield rates of more than 90% are possible and anticipate that metal powder costs will fall in the near future. Printer prices are also falling, a trend that will be aided by the technology's wider adoption. Untapped Adjacent Market Creates new Opportunity in 3D Printing Market The evolution of 3D printing applications from rapid prototyping to direct digital manufacturing (DDM) of products has sparked interest in the potential applications of 3D printing technologies in fields as diverse as healthcare, consumer goods, and automotive. 3D printing has significant commercial potential and will have a significant impact on a variety of industries, including aerospace and medicine, with more customized and sophisticated applications expected in the near future.

3D Printing Automotive Market Segment Analysis:

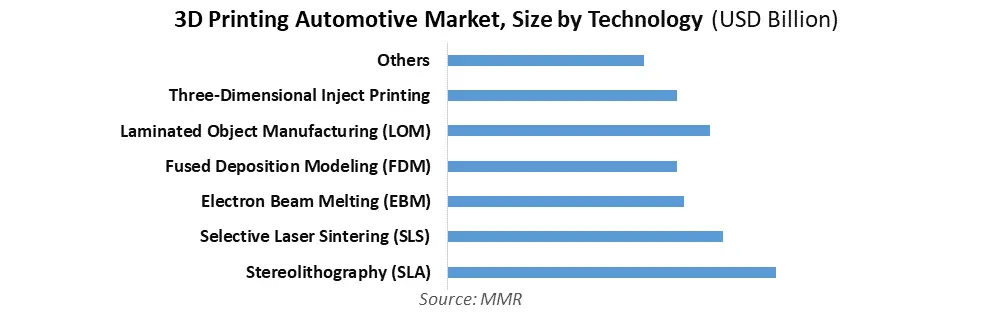

By Application, Prototyping and tooling segment is to register the largest share in the market. The segment has grown steadily over the years and will continue to grow in the future. The main reasons for this are the prototype's quick production, relatively simple process, cost reduction, filament options, adaptability to design changes, and reduced waste. In comparison to traditional practices, prototypes now require the shortest possible lead times as well as the least amount of expense and waste. Because only the final CAD design is sent for printing, design changes are possible at any time. Because there are more filament materials to choose from, prototypes can now be made using different materials and tested on different criteria and environments. Based on Technology, Stereolithography held a major market in the global 3D printing market and it is expected to dominate in the forecast period. Stereolithography, also known as SLA 3D printing, is one of the most popular and widely used additive manufacturing techniques. Laser energy is used to harden liquid resin stored in a reservoir, allowing for the creation of the desired 3D shape. Photopolymerization and a low-power laser work together to create solid plastic layers within photosensitive liquid layers. This type of 3D printing, also known as resin 3D printing, has grown in popularity due to its ability to create high-precision, watertight, and precise prototypes, parts, and components from a wide range of advanced materials with smooth surfaces. Companies such as Gillette, for example, use SLA 3D printing to develop consumer products such as 3D-printed razor handles as part of their Razor Maker platform.

3D Printing Automotive Market Regional Insights:

North America is expected to have the largest share of the global 3D printing market in 2024, owing to continuous technological advancements in this field and the region's hundreds of carmakers. Europe is expected to lead the 3D printing market and has the fastest-growing 3D printing market. The primary reason for this is that leading automotive manufacturers use additive manufacturing extensively for R&D purposes such as prototyping and fixtures. The cost-effectiveness of 3D printing in R&D is the most important factor. Polymers printed by 3D printers can be recycled for maximum efficiency. The United States is expected to dominate the North American automotive 3D printing market. Because the United States produces a large number of ICE vehicles and is rapidly developing electric vehicles, there is a high demand for 3D-printed parts. The United States is expected to lead the plastic 3D printing market. The presence of hundreds of carmakers in the country necessitates the use of plastic additive manufacturing technology for R&D and components such as interior trims, dashboards, and exterior components. As per MMR research the automotive 3D printing market dominates by a few globally established companies such as Stratasys (Israel), 3D Systems, Inc. (US), EOS (Germany), Arcam AB (Sweden), Renishaw plc. (UK), HP (US), Materialise (Belgium). These companies have adopted strategies such as new product development, expansion, mergers, and joint ventures to gain traction in the 3D printing market. The objective of the report is to present a comprehensive analysis of the 3D Printing Automotive Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants.3D Printing Automotive Market Scope: Inquire before buying

3D Printing Automotive Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5.18 Bn. Forecast Period 2025 to 2032 CAGR: 21.7% Market Size in 2032: USD 24.94 Bn. Segments Covered: by Application Prototyping & Tooling Research, Development & Innovation Manufacturing Complex Components Other by Technology Stereolithography (SLA) Selective Laser Sintering (SLS) Electron Beam Melting (EBM) Fused Deposition Modeling (FDM) Laminated Object Manufacturing (LOM) Three-Dimensional Inject Printing Others by Propulsion ICE Vehicles Electric Vehicles 3D Printing Automotive Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Belgium, Netherlands, Austria and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Israel, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina and Rest of South America)3D Printing Automotive Market, Key Players are

1. 3D Systems Corporation (US) 2. Autodesk, Inc. (US) 3. Envisiontec Inc. (US) 4. Polymaker (US) 5. Ponoko Ltd (US) 6. Webcrawler (US) 7. Local Motors Materialise Nv (US) 8. Optomec Inc. (US) 9. Exone (US) 10. Chizel Prints Manufacturing Pvt. Ltd (US) 11. Desktop Metal, Inc. (US) 12. General Electric Company (US) 13. AI Design. (US) 14. EOS GmbH (Germany) 15. Concept Laser (Germany) 16. Materialise NV (Belgium) 17. Ultimaker BV (Netherlands) 18. Arcam Ab (Sweden) 19. Hoganas Ab (Sweden) 20. Gearbest (Italy) 21. Sanya Si Hai (India) 22. Stratasys Inc. (Israel) 23. Voxeljet Ag (Germany) 24. XEV (UK) 25. Hanhook Tires (South Korea) Frequently Asked Questions: 1. What is the forecast period considered for the 3D Printing Automotive Market report? Ans. The forecast period for the 3D Printing Automotive Market is 2025-2032. 2. Which key factors are hindering the growth of the 3D Printing Automotive Market? Ans. Technological barriers to wider adoption of 3D printing. 3. What is the compound annual growth rate (CAGR) of the 3D Printing Automotive Market for the forecast period? Ans. 21.7 % of CAGR is the annual growth rate of 3D printing Automotive Market for the forecast period. 4. What are the key factors driving the growth of the 3D Printing Automotive Market? Ans. 3D Printing Investment by OMEs Driving the growth of 3D printing Market. 5. What was the Global 3D Printing Automotive Market size in 2024? Ans: The Global 3D Printing Automotive Market size was USD 5.18 Billion in 2024.

1. 3D Printing Automotive Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. 3D Printing Automotive Market: Dynamics 2.1. 3D Printing Automotive Market Trends by Region 2.1.1. North America 3D Printing Automotive Market Trends 2.1.2. Europe 3D Printing Automotive Market Trends 2.1.3. Asia Pacific 3D Printing Automotive Market Trends 2.1.4. Middle East and Africa 3D Printing Automotive Market Trends 2.1.5. South America 3D Printing Automotive Market Trends 2.2. 3D Printing Automotive Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America 3D Printing Automotive Market Drivers 2.2.1.2. North America 3D Printing Automotive Market Restraints 2.2.1.3. North America 3D Printing Automotive Market Opportunities 2.2.1.4. North America 3D Printing Automotive Market Challenges 2.2.2. Europe 2.2.2.1. Europe 3D Printing Automotive Market Drivers 2.2.2.2. Europe 3D Printing Automotive Market Restraints 2.2.2.3. Europe 3D Printing Automotive Market Opportunities 2.2.2.4. Europe 3D Printing Automotive Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific 3D Printing Automotive Market Drivers 2.2.3.2. Asia Pacific 3D Printing Automotive Market Restraints 2.2.3.3. Asia Pacific 3D Printing Automotive Market Opportunities 2.2.3.4. Asia Pacific 3D Printing Automotive Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa 3D Printing Automotive Market Drivers 2.2.4.2. Middle East and Africa 3D Printing Automotive Market Restraints 2.2.4.3. Middle East and Africa 3D Printing Automotive Market Opportunities 2.2.4.4. Middle East and Africa 3D Printing Automotive Market Challenges 2.2.5. South America 2.2.5.1. South America 3D Printing Automotive Market Drivers 2.2.5.2. South America 3D Printing Automotive Market Restraints 2.2.5.3. South America 3D Printing Automotive Market Opportunities 2.2.5.4. South America 3D Printing Automotive Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For 3D Printing Automotive Industry 2.8. Analysis of Government Schemes and Initiatives For 3D Printing Automotive Industry 2.9. 3D Printing Automotive Market Trade Analysis 2.10. The Global Pandemic Impact on 3D Printing Automotive Market 3. 3D Printing Automotive Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 3.1.1. Prototyping & Tooling 3.1.2. Research, Development & Innovation 3.1.3. Manufacturing Complex Components 3.1.4. Other 3.2. 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 3.2.1. Stereolithography (SLA) 3.2.2. Selective Laser Sintering (SLS) 3.2.3. Electron Beam Melting (EBM) 3.2.4. Fused Deposition Modeling (FDM) 3.2.5. Laminated Object Manufacturing (LOM) 3.2.6. Three-Dimensional Inject Printing 3.2.7. Others 3.3. 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 3.3.1. ICE Vehicles 3.3.2. Electric Vehicles 3.4. 3D Printing Automotive Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America 3D Printing Automotive Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 4.1.1. Prototyping & Tooling 4.1.2. Research, Development & Innovation 4.1.3. Manufacturing Complex Components 4.1.4. Other 4.2. North America 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 4.2.1. Stereolithography (SLA) 4.2.2. Selective Laser Sintering (SLS) 4.2.3. Electron Beam Melting (EBM) 4.2.4. Fused Deposition Modeling (FDM) 4.2.5. Laminated Object Manufacturing (LOM) 4.2.6. Three-Dimensional Inject Printing 4.2.7. Others 4.3. North America 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 4.3.1. ICE Vehicles 4.3.2. Electric Vehicles 4.4. North America 3D Printing Automotive Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 4.4.1.1.1. Prototyping & Tooling 4.4.1.1.2. Research, Development & Innovation 4.4.1.1.3. Manufacturing Complex Components 4.4.1.1.4. Other 4.4.1.2. United States 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 4.4.1.2.1. Stereolithography (SLA) 4.4.1.2.2. Selective Laser Sintering (SLS) 4.4.1.2.3. Electron Beam Melting (EBM) 4.4.1.2.4. Fused Deposition Modeling (FDM) 4.4.1.2.5. Laminated Object Manufacturing (LOM) 4.4.1.2.6. Three-Dimensional Inject Printing 4.4.1.2.7. Others 4.4.1.3. United States 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 4.4.1.3.1. ICE Vehicles 4.4.1.3.2. Electric Vehicles 4.4.2. Canada 4.4.2.1. Canada 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 4.4.2.1.1. Prototyping & Tooling 4.4.2.1.2. Research, Development & Innovation 4.4.2.1.3. Manufacturing Complex Components 4.4.2.1.4. Other 4.4.2.2. Canada 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 4.4.2.2.1. Stereolithography (SLA) 4.4.2.2.2. Selective Laser Sintering (SLS) 4.4.2.2.3. Electron Beam Melting (EBM) 4.4.2.2.4. Fused Deposition Modeling (FDM) 4.4.2.2.5. Laminated Object Manufacturing (LOM) 4.4.2.2.6. Three-Dimensional Inject Printing 4.4.2.2.7. Others 4.4.2.3. Canada 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 4.4.2.3.1. ICE Vehicles 4.4.2.3.2. Electric Vehicles 4.4.3. Mexico 4.4.3.1. Mexico 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 4.4.3.1.1. Prototyping & Tooling 4.4.3.1.2. Research, Development & Innovation 4.4.3.1.3. Manufacturing Complex Components 4.4.3.1.4. Other 4.4.3.2. Mexico 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 4.4.3.2.1. Stereolithography (SLA) 4.4.3.2.2. Selective Laser Sintering (SLS) 4.4.3.2.3. Electron Beam Melting (EBM) 4.4.3.2.4. Fused Deposition Modeling (FDM) 4.4.3.2.5. Laminated Object Manufacturing (LOM) 4.4.3.2.6. Three-Dimensional Inject Printing 4.4.3.2.7. Others 4.4.3.3. Mexico 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 4.4.3.3.1. ICE Vehicles 4.4.3.3.2. Electric Vehicles 5. Europe 3D Printing Automotive Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 5.2. Europe 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 5.3. Europe 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 5.4. Europe 3D Printing Automotive Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 5.4.1.2. United Kingdom 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 5.4.1.3. United Kingdom 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 5.4.2. France 5.4.2.1. France 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 5.4.2.2. France 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 5.4.2.3. France 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 5.4.3. Germany 5.4.3.1. Germany 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 5.4.3.2. Germany 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 5.4.3.3. Germany 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 5.4.4. Italy 5.4.4.1. Italy 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 5.4.4.2. Italy 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 5.4.4.3. Italy 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 5.4.5. Spain 5.4.5.1. Spain 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 5.4.5.2. Spain 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 5.4.5.3. Spain 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 5.4.6.2. Sweden 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 5.4.6.3. Sweden 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 5.4.7. Austria 5.4.7.1. Austria 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 5.4.7.2. Austria 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 5.4.7.3. Austria 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 5.4.8.2. Rest of Europe 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 5.4.8.3. Rest of Europe 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6. Asia Pacific 3D Printing Automotive Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.2. Asia Pacific 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.3. Asia Pacific 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6.4. Asia Pacific 3D Printing Automotive Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.4.1.2. China 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.4.1.3. China 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.4.2.2. S Korea 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.4.2.3. S Korea 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6.4.3. Japan 6.4.3.1. Japan 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.4.3.2. Japan 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.4.3.3. Japan 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6.4.4. India 6.4.4.1. India 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.4.4.2. India 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.4.4.3. India 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6.4.5. Australia 6.4.5.1. Australia 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.4.5.2. Australia 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.4.5.3. Australia 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.4.6.2. Indonesia 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.4.6.3. Indonesia 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.4.7.2. Malaysia 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.4.7.3. Malaysia 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.4.8.2. Vietnam 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.4.8.3. Vietnam 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.4.9.2. Taiwan 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.4.9.3. Taiwan 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 6.4.10.2. Rest of Asia Pacific 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 6.4.10.3. Rest of Asia Pacific 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 7. Middle East and Africa 3D Printing Automotive Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 7.2. Middle East and Africa 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 7.3. Middle East and Africa 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 7.4. Middle East and Africa 3D Printing Automotive Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 7.4.1.2. South Africa 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 7.4.1.3. South Africa 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 7.4.2. GCC 7.4.2.1. GCC 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 7.4.2.2. GCC 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 7.4.2.3. GCC 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 7.4.3.2. Nigeria 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 7.4.3.3. Nigeria 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 7.4.4.2. Rest of ME&A 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 7.4.4.3. Rest of ME&A 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 8. South America 3D Printing Automotive Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 8.2. South America 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 8.3. South America 3D Printing Automotive Market Size and Forecast, by Propulsion(2024-2032) 8.4. South America 3D Printing Automotive Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 8.4.1.2. Brazil 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 8.4.1.3. Brazil 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 8.4.2.2. Argentina 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 8.4.2.3. Argentina 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America 3D Printing Automotive Market Size and Forecast, by Application (2024-2032) 8.4.3.2. Rest Of South America 3D Printing Automotive Market Size and Forecast, by Technology (2024-2032) 8.4.3.3. Rest Of South America 3D Printing Automotive Market Size and Forecast, by Propulsion (2024-2032) 9. Global 3D Printing Automotive Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Leading 3D Printing Automotive Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. 3D Systems Corporation (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Autodesk, Inc. (US) 10.3. Envisiontec Inc. (US) 10.4. Polymaker (US) 10.5. Ponoko Ltd (US) 10.6. Webcrawler (US) 10.7. Local Motors Materialise Nv (US) 10.8. Optomec Inc. (US) 10.9. Exone (US) 10.10. Chizel Prints Manufacturing Pvt. Ltd (US) 10.11. Desktop Metal, Inc. (US) 10.12. General Electric Company (US) 10.13. AI Design. (US) 10.14. EOS GmbH (Germany) 10.15. Concept Laser (Germany) 10.16. Materialise NV (Belgium) 10.17. Ultimaker BV (Netherlands) 10.18. Arcam Ab (Sweden) 10.19. Hoganas Ab (Sweden) 10.20. Gearbest (Italy) 10.21. Sanya Si Hai (India) 10.22. Stratasys Inc. (Israel) 10.23. Voxeljet Ag (Germany) 10.24. XEV (UK) 10.25. Hanhook Tires (South Korea) 11. Key Findings 12. Industry Recommendations 13. 3D Printing Automotive Market: Research Methodology 14. Terms and Glossary