The Global GI Stool Testing Market size was valued at USD 790.45 Million in 2022 and the total GI Stool Testing Market revenue is expected to grow at a CAGR of 7.23 % from 2023 to 2029, reaching nearly USD 1288.51 Million. Gastrointestinal (GI) stool testing refers to diagnostic tests that analyze stool samples for the detection of gastrointestinal diseases, including infections, bleeding, inflammation, and colorectal cancer. It includes various tests like fecal occult blood tests (FOBT), DNA-based stool tests, and other advanced methods aimed at detecting biomarkers indicative of diseases like colorectal cancer. The GI Stool Testing Market is driven by factors such as the rise in adoption of direct-to-consumer laboratory testing, increasing awareness and screening programs, and technological advancements in point-of-care tests. The most commonly used test for bowel cancer screening is the fecal occult blood test (FOBT), which is non-specific for colorectal cancer and has limited sensitivity. The GI Stool Testing Market trend is witnessing a surge in non-invasive and at-home stool testing solutions, due to technological advancements and consumer preferences for convenient diagnostics. Key drivers include the development of innovative devices like Shineco Inc.'s patented fecal specimen sampling device, streamlining sample collection, and enhancing the user experience during self-collection. Additionally, the introduction of novel screening tests, such as ColoClear by Prenetics Group Limited and New Horizon Health, utilizing advanced DNA biomarkers to detect early colorectal cancer signs, further propels market growth and fosters increased adoption of non-invasive testing methods. These recent developments by GI Stool Testing Market players signify a shift towards user-friendly, non-invasive, and efficient stool-based screening options, contributing to the market's growth and providing individuals with accessible and effective means of gastrointestinal disease detection and early intervention.GI Stool Testing Market Scope and Research Methodology:

The GI Stool Testing Market's scope involves a broad range of diagnostic tests conducted on stool samples to identify and monitor gastrointestinal disorders and diseases. It includes various testing approaches, including fecal occult blood tests (FOBT), stool DNA tests, and other stool-based examinations, contributing to the detection and management of gastrointestinal ailments. The market involves both traditional and innovative screening methods, catering to different disease detection needs within the gastrointestinal domain. The research methodology employed in analyzing the GI Stool Testing Market typically involves a comprehensive approach. It incorporates primary and secondary research techniques to gather relevant data and insights. Primary research involves conducting surveys, interviews, and interactions with industry experts, healthcare professionals, and key stakeholders. It helps in acquiring firsthand information and market dynamics, offering valuable insights into market trends, challenges, and opportunities. The analysis often includes qualitative and quantitative assessments to evaluate market size, growth prospects, and competitive scenarios. This involves studying market trends, market share analysis, growth rates, market segmentation, and forecasting future market trends. Additionally, the research methodology involves examining geographical trends, regulatory factors, technological advancements, and key market players' strategies to comprehend the market's dynamics comprehensively.To know about the Research Methodology :- Request Free Sample Report

GI Stool Testing Market Dynamics:

Geriatric Population and Regulatory Support Drive Growth in the Stool-Based Testing Market: The increasing adoption of direct-to-consumer laboratory testing, such as fecal and occult blood tests like Hemoccult, is expected to drive market growth. This trend allows individuals to conveniently access and perform stool-based tests at home, leading to market growth. Ongoing advancements in testing technologies, such as the development of improved fecal and occult blood tests like Hemoccult II SENSA, contribute to market growth by enhancing test accuracy and clinical sensitivity, thereby driving demand for these products. Growing emphasis on early detection of gastrointestinal diseases, including colorectal cancer, through stool-based tests like Cologuard, is propelling market growth. These tests enable the identification of conditions in their early stages, leading to higher demand and market growth. The convenience and noninvasiveness of stool-based tests, such as Cologuard, which can be performed at home without special preparation, changes in diet, or medication adjustments, are driving the GI Stool Testing Market growth. This ease of use encourages more individuals to undergo screening, contributing to the GI Stool Testing Market growth. Technological innovations in sample collection, such as the Stool Sample Quantitative Collection and Extraction Device (SQED), are streamlining the collection process and improving the accuracy of stool specimen extraction. This innovation is driving market growth by enhancing the efficiency and reliability of stool-based tests. Rising awareness about the importance of gastrointestinal screening and the implementation of screening programs, such as for colorectal cancer using tests like Cologuard, is driving the GI Stool Testing Market growth. These initiatives lead to higher test uptake and market growth. Robust clinical research collaborations, as seen with Cologuard's development in collaboration with Mayo Clinic, contribute to market growth by validating the effectiveness and accuracy of stool-based tests. This scientific validation drives market growth by increasing confidence in these tests. The growing geriatric population, who are at higher risk of gastrointestinal diseases, is driving market growth for stool-based tests. The increased prevalence of these conditions among the elderly leads to higher demand for screening, contributing to GI Stool Testing Market growth. The expansion of automated immunoassay systems, facilitated by innovations like the SQED, is driving market growth by enabling direct use of extracted stool samples for automated testing. This streamlines the testing process and contributes to market growth. Supportive regulatory frameworks and reimbursement policies for stool-based tests, such as Cologuard, are driving market growth. These policies encourage healthcare providers and individuals to adopt these tests, leading to market growth. These market growth drivers collectively contribute to the expansion of the GI stool testing market, fostering innovation, accessibility, and effectiveness in the diagnosis and monitoring of gastrointestinal diseases.Technological Innovations in Stool DNA Testing Propelled Market Expansion: The development of advanced point-of-care fecal occult blood tests (FOBT), such as Hemoccult, with improved sensitivity and specificity, presents a significant growth opportunity. These tests offer convenient and rapid screening for gastrointestinal bleeding, driving market growth through increased adoption and demand. The increasing adoption of direct-to-consumer laboratory testing for fecal occult blood, including at-home screening tests like ColoClear, presents a growth opportunity. This trend allows individuals to conveniently access and perform stool-based tests at home, contributing to market growth. The GI stool testing market is expected to witness substantial growth in developing countries, such as Brazil, South Africa, Mexico, and others. This presents an opportunity for market growth through increased demand and adoption of stool-based tests in these regions. Ongoing technological innovations in stool DNA testing, such as the development of multitarget fecal DNA and RNA assays, present a significant growth opportunity. These tests, which detect key mutations and epigenetic changes, offer enhanced diagnostic sensitivity and specificity, driving GI Stool Testing Market growth due to increased demand for advanced screening methods. The expansion of automated immunoassay systems, facilitated by innovations like the in-situ fecal specimen sampling device by Shineco, Inc., presents a growth opportunity. These advancements streamline the collection and testing process, contributing to market growth through improved efficiency and accessibility. Growing awareness of gastrointestinal diseases and the implementation of screening programs present a growth opportunity. This trend leads to higher test uptake and market growth through increased demand for stool-based tests, especially in asymptomatic individuals at average risk of colorectal cancer. The GI stool testing market is dominated by North America and Europe, with the U.S. being a major contributor. This presents an opportunity for market growth due to continued technological advancements and increased adoption of point-of-care testing products in these regions. The focus on non-invasive testing methods, such as the development of novel at-home screening tests like ColoClear, presents a growth opportunity. These tests offer a non-invasive and convenient option for individuals, driving market growth by increasing screening compliance and demand. Efforts to reduce the costs of stool DNA tests and implement them as point-of-care diagnostics present a significant growth opportunity. This initiative aims to make advanced DNA tests more accessible, driving GI Stool Testing Market growth due to increased adoption and demand for these tests. Regulatory support and patent grants for innovative stool sample collection devices, such as the in-situ fecal specimen sampling device, present a growth opportunity. These developments encourage innovation and market growth through the protection of novel technologies and devices. These growth opportunities collectively contribute to the expansion of the GI stool testing market, fostering innovation, accessibility, and effectiveness in the diagnosis and monitoring of gastrointestinal diseases.

Table 1. Components of the Fecal Dysbiosis Marker Analysis

The Invasive Nature of Total Colonoscopy Hindering Comprehensive Screening Programs: The non-specific nature of the fecal occult Blood Test (FOBT) poses a challenge to the GI stool testing market. As it primarily detects blood in the stool, it lacks specificity for colorectal cancer, leading to potential false-positive results and the need for additional confirmatory tests, hindering its effectiveness. The low acceptance of invasive methods, such as total colonoscopy, presents a restraint on the market. Despite being the most reliable investigation for colorectal cancer diagnosis, its invasive nature and associated costs limit its widespread acceptance, creating a challenge for comprehensive screening programs. The high costs associated with advanced stool DNA tests, such as multitarget fecal DNA and RNA assays, pose a challenge to market growth. These tests, while promising in their sensitivity and specificity, are currently limited by high costs, potentially restricting their widespread adoption and accessibility. The GI stool testing market faces challenges in developing countries, where limited resources and infrastructure hinder the adoption of advanced screening methods. This presents a restraint on market growth, particularly in regions with low healthcare infrastructure and accessibility. The need for further confirmatory tests, such as colonoscopy, for patients identified by screening tools like FOBT and stool DNA tests, poses a challenge. This requirement adds complexity and cost to the screening process, potentially impacting patient compliance and hindering market growth. The sensitivity of traditional FOBTs to numerous interfering substances and dietary factors presents a challenge. This leads to false-positive results, necessitating additional confirmatory tests and potentially impacting the efficiency of colorectal cancer detection. Regulatory challenges and reimbursement policies for advanced stool testing methods hinder market growth. The need for regulatory approvals and reimbursement support impacts the accessibility and adoption of innovative stool testing technologies, posing a challenge to market growth. Technological barriers to developing advanced point-of-care tests for stool-based screening present a challenge. While there is a rise in the adoption of direct-to-consumer laboratory testing, the development of cost-effective and accurate point-of-care tests remains a challenge for market growth. Patient acceptance and compliance with stool-based screening methods pose a challenge to market growth. The acceptance of at-home screening tests and the willingness of individuals to undergo stool-based testing impact the overall effectiveness of colorectal cancer screening programs. The high treatment costs associated with gastrointestinal disorders and colorectal cancer pose a challenge to the stool testing market. In price-sensitive markets, such as developing and emerging economies, the high costs associated with devices and treatment negatively impact market growth. These challenges highlight the complexities and barriers that impact the GI stool testing market, influencing the adoption, accessibility, and effectiveness of stool-based screening methods for colorectal cancer and gastrointestinal diseases.

Markers Analytes Digestion Triglycerides Chymotrypsin Iso-butyrate, iso-valerate, and n-valerate Meat and vegetable fibers Absorption Long-chain fatty acids Cholesterol Total fecal fat Total short-chain fatty acids Microbiology Levels of Lactobacilli, bifidobacteria, Escherichiacoli, and other “potential pathogens,” including Aeromonas, Bacillus cereus, Campylobacter, Citrobacter, Klebsiella, Proteus, Pseudomonas, Salmonella, Shigella, Staphylococcus aureus, and Vibrio Identification and quantitation of fecal yeast (including Candida albicans, Candida tropicalis, Rhodotorula, and Geotrichum) (optional viral and/or parasitology components) Metabolic N-butyrate (considered a key energy source for colonic epithelial cells) β-glucuronidase pH Short-chain fatty acid distribution (adequate amounts and proportions of the different short-chain fatty acids reflect the basic status of intestinal metabolism) Immunology Fecal secretory immunoglobulin A (as a measure of luminal immunologic function) Calprotectina

GI Stool Testing Market Segment Analysis:

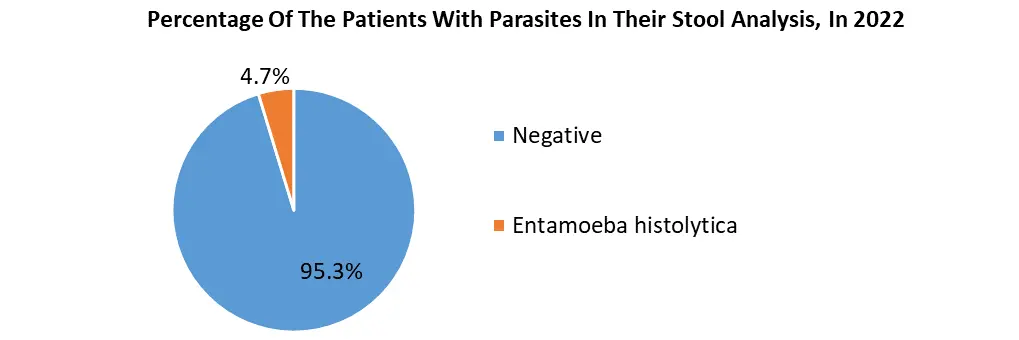

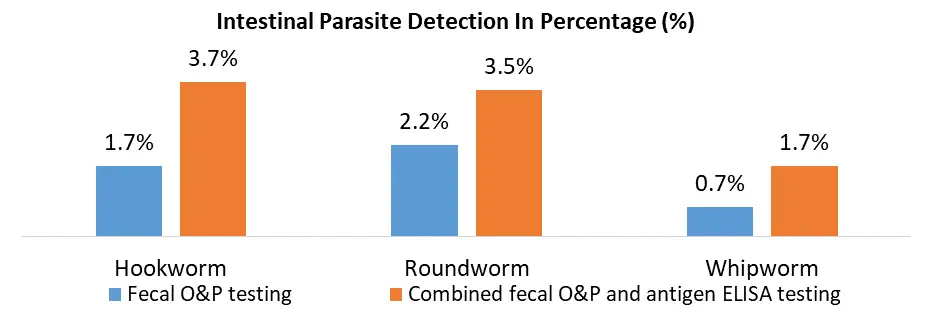

Based on Product Type, The GI Stool Testing Market presents diverse test types catering to various applications, each witnessing varying degrees of adoption and relevance within gastrointestinal diagnostics. Occult Blood Tests, including Guaiac FOB, Immuno FOB Agglutination, Lateral Flow Immuno FOB, and Immuno FOB ELISA, primarily focus on detecting microscopic blood in stool, aiding in colorectal cancer screening. These tests, especially Immuno FOB ELISA due to its enhanced sensitivity and specificity, exhibit high adoption rates for colorectal cancer screening among asymptomatic individuals and those at average risk. Ova and Parasite Tests and Bacteria Tests are predominantly applied for diagnosing gastrointestinal infections caused by pathogens or parasites, finding considerable adoption in clinical settings for identifying infectious agents causing diseases like gastroenteritis. The Fecal Biomarkers Test segment, encompassing Tumor M2-PK Stool Tests and Transferrin Assays, stands out for its utilization in detecting biomarkers associated with gastrointestinal disorders, including colorectal cancer. Tumor M2-PK Stool Tests exhibit promising adoption for their role in identifying early-stage colorectal cancer and monitoring disease progression. Transferrin Assays demonstrate significant application in detecting gastrointestinal bleeding. Despite their efficacy, these biomarker-based tests encounter moderate adoption due to cost considerations and technological complexities. Occult blood tests like Immuno FOB ELISA dominate colorectal cancer screening. Biomarker tests exhibit promise but face challenges in extensive adoption due to cost constraints and technological complexities.

GI Stool Testing Market Regional Insights:

North America is dominating the GI Stool Testing market due to factors such as the rising burden of colon cancer and gastroesophageal reflux disease (GERD) among the population, increasing product launches, and the presence of major players like Abbott Laboratories, Genova Diagnostics, bioMérieux SA, Cardinal Health, and Danaher Corporation. The region is expected to hold the largest market share, with the United States being a major contributor to the market's growth. The market is witnessing steady growth, driven by continuous technological advancements, growing environmental awareness, and the rising need for streamlined operations. Additionally, the FDA's stringent regulatory standards ensure the validation and approval of innovative stool testing technologies, fostering market growth and adoption. In Europe's GI Stool Testing Market, countries like Germany, France, and the UK boast well-established healthcare systems and early adoption of innovative medical technologies. The European population's increasing awareness of gastrointestinal diseases and government initiatives promoting colorectal cancer screening programs contribute to market growth. Moreover, the emphasis on preventive healthcare measures and comprehensive screening programs, alongside favorable reimbursement policies, boosts the uptake of stool-based tests. Collaborations between research institutions and market players facilitate advancements in testing methodologies, enhancing market dominance. The Asia-Pacific region, particularly countries like China, Japan, and India, displays burgeoning growth potential in the GI stool testing market. Factors such as the rising prevalence of gastrointestinal disorders, a growing geriatric population, and increasing healthcare expenditure contribute to market expansion. Improving healthcare infrastructure, coupled with a surge in healthcare awareness and the adoption of preventive healthcare measures, fuels the demand for stool-based tests. Furthermore, increasing government initiatives to address colorectal cancer and gastrointestinal diseases through awareness campaigns and screening programs are propelling market growth in the region.Table 2. The Following CPT Codes Are Used To Identify Individual Components Of Fecal Analysis:

Code Description 82239 Bile acids; total 82271 Blood, occult, by peroxidase activity (eg, guaiac), qualitative; other sources 82272 Blood, occult, by peroxidase activity (eg, guaiac), qualitative, feces, 1-3 simultaneous determinations, performed for other than colorectal neoplasm screening 82271 Blood, occult, by peroxidase activity (eg, guaiac), qualitative; other sources 82274 Blood, occult, by fecal hemoglobin determination by immunoassay, qualitative, feces, 1-3 simultaneous determinations 82542 Column chromatography, includes mass spectrometry, if performed (eg, HPLC, LC, LC/MS, LC/MS-MS, GC, GC/MS-MS, GC/MS, HPLC/MS), non-drug analyte(s) not elsewhere specified, qualitative or quantitative, each specimen 82656 Elastase, pancreatic (EL-1), fecal, qualitative or semi-quantitative 82710 Fat or lipids, feces; quantitative 82715 Fat differential, feces, quantitative 82725 Fatty acids, nonesterified 82784 Gammaglobulin (immunoglobulin); IgA, IgD, IgG, IgM, each 83520 Immunoassay for analyte other than infectious agent antibody or infectious agent antigen; quantitative, not otherwise specified 83630 Lactoferrin, fecal; qualitative 83986 pH; body fluid, not otherwise specified 83993 Calprotectin, fecal 84311 Spectrophotometry, analyte not elsewhere specified 87045 Culture, bacterial; stool, aerobic, with isolation and preliminary examination (eg, KIA, LIA), Salmonella and Shigella species 87177 Ova and parasites, direct smears, concentration, and identification 87209 Smear, a primary source with interpretation; complex special stain (eg, trichrome, iron hemotoxylin) for ova and parasites 89160 Meat fibers, feces Competitive Landscape

Key Players of the GI Stool Testing Market profiled in the report are AdvaCare Pharma, Biomrieux Inc., Bio-Rad Laboratory, Cardinal Health, Cenogenics Corporation, CTK Biotech Inc., Danaher Corp., Diasorin S P A, Eiken Chemical Co. Ltd., Epitope Diagnostics Inc., Exact Sciences Corp., F. Hoffmann-La Roche Ltd., Genova Diagnostics, Helena Laboratories Corp., Hologic, Inc., McKesson Corp., Meridian Bioscience Inc. This provides huge opportunities to serve many End-users and customers and expand the GI Stool Testing Market. In December 2022, Shineco, Inc. attained FDA approval and secured a USPTO patent safeguarding its innovative in-situ fecal specimen sampling device. This device integrates a massager-like fingertip swab, a collection tube, and a lid featuring a unidirectional sampling inlet, enhancing stool sample collection efficacy and convenience. In June 2022, Prenetics Group Limited, in collaboration with New Horizon Health, unveiled ColoClear by Circle. This pioneering at-home screening test employs sophisticated technology to identify multiple DNA biomarkers and blood cells in human stool, enabling non-invasive early detection of colorectal cancer. These advancements reflect a growing trend towards non-invasive and convenient stool testing methods, aligning with the increasing demand for streamlined operations and the rising need for early detection of gastrointestinal diseases, including colorectal cancer. The GI stool testing market is projected to witness substantial growth, driven by factors such as the high burden of gastrointestinal diseases, technological advancements, and the increasing demand for advanced screening methods. The rising prevalence of GI diseases due to factors such as junk food consumption, hectic lifestyles, and an aging population is further propelling the growth of the GI stool testing market. These recent developments are anticipated to contribute to the market's expansion by offering more accurate, convenient, and non-invasive screening options, thereby addressing the growing need for effective diagnostic tools in the field of gastrointestinal health.GI Stool Testing Market Scope: Inquiry Before Buying

GI Stool Testing Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 790.45 Mn. Forecast Period 2023 to 2029 CAGR: 7.23% Market Size in 2029: US $ 1288.51 Mn. Segments Covered: by Product Type Consumables Analyzers by Test Type Occult Blood Test Guaiac FOB Stool Test Immuno FOB Agglutination Test Lateral Flow Immuno FOB Test Immuno FOB ELISA Test Ova and Parasites Test Bacteria Test Faecal Biomarkers Test Tumor M2-PK Stool Test Transferrin Assays Others Others by Application Infection Inflammatory Bowel Disease Gastroesophageal Reflux Disease (GERD) Cancer Others by Distribution Channel Hospital & clinic pharmacies Brick & Mortar E-commerce by End-Use Hospitals & Clinics Diagnostic Centers Homecare Settings Others GI Stool Testing Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)GI Stool Testing Market Key Players:

1. AdvaCare Pharma 2. Biomrieux Inc 3. Bio-Rad Laboratory 4. Cardinal Health 5. Cenogenics Corporation 6. CTK Biotech Inc. 7. Danaher Corp. 8. Diasorin S P A 9. Eiken Chemical Co. Ltd. 10. Epitope Diagnostics Inc. 11. Exact Sciences Corp. 12. F. Hoffmann-La Roche Ltd. 13. Genova Diagnostics 14. Helena Laboratories Corp. 15. Hologic, Inc. 16. McKesson Corp. 17. Meridian Bioscience Inc 18. Pinnacle BioLabs 19. Prenetics Group Limited 20. QIAGEN 21. Quest Diagnostics Incorporated 22. Quidelortho Corp. 23. ScheBo Biotech AG 24. Shineco, Inc. 25. Siemens Healthineers AGFAQs:

1. What are the growth drivers for the GI Stool Testing Market? Ans. Geriatric Population and Regulatory Support Drive Growth in the Stool-Based Testing Market and are expected to be the major driver for the GI Stool Testing Market. 2. What is the major opportunity for the GI Stool Testing Market growth? Ans. Technological Innovations in Stool DNA Testing Propelled Market Expansion and is expected to be a major Opportunity in the GI Stool Testing Market. 3. Which country is expected to lead the global GI Stool Testing Market during the forecast period? Ans. North America is expected to lead the GI Stool Testing Market during the forecast period. 4. What is the projected market size and growth rate of the GI Stool Testing Market? Ans. The GI Stool Testing Market size was valued at USD 790.45 Million in 2022 and the total GI Stool Testing Market revenue is expected to grow at a CAGR of 7.23 % from 2023 to 2029, reaching nearly USD 1288.51 Million. 5. What segments are covered in the GI Stool Testing Market report? Ans. The segments covered in the GI Stool Testing Market report are by Product Type, Test Type, Application, Distribution Channel, End-Use, and Region.

1. GI Stool Testing Market: Research Methodology 2. GI Stool Testing Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. GI Stool Testing Market: Dynamics 3.1 GI Stool Testing Market Trends by Region 3.1.1 North America GI Stool Testing Market Trends 3.1.2 Europe GI Stool Testing Market Trends 3.1.3 Asia Pacific GI Stool Testing Market Trends 3.1.4 Middle East and Africa GI Stool Testing Market Trends 3.1.5 South America GI Stool Testing Market Trends 3.2 GI Stool Testing Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America GI Stool Testing Market Drivers 3.2.1.2 North America GI Stool Testing Market Restraints 3.2.1.3 North America GI Stool Testing Market Opportunities 3.2.1.4 North America GI Stool Testing Market Challenges 3.2.2 Europe 3.2.2.1 Europe GI Stool Testing Market Drivers 3.2.2.2 Europe GI Stool Testing Market Restraints 3.2.2.3 Europe GI Stool Testing Market Opportunities 3.2.2.4 Europe GI Stool Testing Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific GI Stool Testing Market Drivers 3.2.3.2 Asia Pacific GI Stool Testing Market Restraints 3.2.3.3 Asia Pacific GI Stool Testing Market Opportunities 3.2.3.4 Asia Pacific GI Stool Testing Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa GI Stool Testing Market Drivers 3.2.4.2 Middle East and Africa GI Stool Testing Market Restraints 3.2.4.3 Middle East and Africa GI Stool Testing Market Opportunities 3.2.4.4 Middle East and Africa GI Stool Testing Market Challenges 3.2.5 South America 3.2.5.1 South America GI Stool Testing Market Drivers 3.2.5.2 South America GI Stool Testing Market Restraints 3.2.5.3 South America GI Stool Testing Market Opportunities 3.2.5.4 South America GI Stool Testing Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 By Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives For the GI Stool Testing Industry 3.8 The Global Pandemic and Redefining of The GI Stool Testing Industry Landscape 3.9 Technological Road Map 4. Global GI Stool Testing Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (By Value) (2022-2029) 4.1 Global GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 4.1.1 Consumables 4.1.2 Analyzers 4.2 Global GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 4.2.1 Occult Blood Test 4.2.1.1 Guaiac FOB Stool Test 4.2.1.2 Immuno FOB Agglutination Test 4.2.1.3 Lateral Flow Immuno FOB Test 4.2.1.4 Immuno FOB ELISA Test 4.2.2 Ova and Parasites Test 4.2.3 Bacteria Test 4.2.4 Fecal Biomarkers Test 4.2.4.1 Tumor M2-PK Stool Test 4.2.4.2 Transferrin Assays 4.2.4.3 Others 4.2.5 Others 4.3 Global GI Stool Testing Market Size and Forecast, by Application (2022-2029) 4.3.1 Infection 4.3.2 Inflammatory Bowel Disease 4.3.3 Gastroesophageal Reflux Disease (GERD) 4.3.4 Cancer 4.3.5 Others 4.4 Global GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1 Hospital & clinics pharmacies 4.4.2 Brick & Mortar 4.4.3 E-commerce 4.5 Global GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 4.5.1 Hospitals & Clinics 4.5.2 Diagnostic Centers 4.5.3 Homecare Settings 4.5.4 Others 4.6 Global GI Stool Testing Market Size and Forecast, by Region (2022-2029) 4.6.1 North America 4.6.2 Europe 4.6.3 Asia Pacific 4.6.4 Middle East and Africa 4.6.5 South America 5. North America GI Stool Testing Market Size and Forecast by Segmentation for Demand and Supply Side (By Value) (2022-2029) 5.1 North America GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 5.1.1 Consumables 5.1.2 Analyzers 5.2 North America GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 5.2.1 Occult Blood Test 5.2.1.1 Guaiac FOB Stool Test 5.2.1.2 Immuno FOB Agglutination Test 5.2.1.3 Lateral Flow Immuno FOB Test 5.2.1.4 Immuno FOB ELISA Test 5.2.2 Ova and Parasites Test 5.2.3 Bacteria Test 5.2.4 Fecal Biomarkers Test 5.2.4.1 Tumor M2-PK Stool Test 5.2.4.2 Transferrin Assays 5.2.4.3 Others 5.2.5 Others 5.3 North America GI Stool Testing Market Size and Forecast, by Application (2022-2029) 5.3.1 Infection 5.3.2 Inflammatory Bowel Disease 5.3.3 Gastroesophageal Reflux Disease (GERD) 5.3.4 Cancer 5.3.5 Others 5.4 North America GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.1 Hospital & clinics pharmacies 5.4.2 Brick & Mortar 5.4.3 E-commerce 5.5 North America GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 5.5.1 Hospitals & Clinics 5.5.2 Diagnostic Centers 5.5.3 Homecare Settings 5.5.4 Others 5.6 North America GI Stool Testing Market Size and Forecast, by Country (2022-2029) 5.6.1 United States 5.6.1.1 United States GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 5.6.1.1.1 Consumables 5.6.1.1.2 Analyzers 5.6.1.2 United States GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 5.6.1.2.1 Occult Blood Test 5.6.1.2.1.1 Guaiac FOB Stool Test 5.6.1.2.1.2 Immuno FOB Agglutination Test 5.6.1.2.1.3 Lateral Flow Immuno FOB Test 5.6.1.2.1.4 Immuno FOB ELISA Test 5.6.1.2.2 Ova and Parasites Test 5.6.1.2.3 Bacteria Test 5.6.1.2.4 Fecal Biomarkers Test 5.6.1.2.4.1 Tumor M2-PK Stool Test 5.6.1.2.4.2 Transferrin Assays 5.6.1.2.4.3 Others 5.6.1.2.5 Others 5.6.1.3 United States GI Stool Testing Market Size and Forecast, by Application (2022-2029) 5.6.1.3.1 Infection 5.6.1.3.2 Inflammatory Bowel Disease 5.6.1.3.3 Gastroesophageal Reflux Disease (GERD) 5.6.1.3.4 Cancer 5.6.1.3.5 Others 5.6.1.4 United States GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.1.4.1 Hospital & clinics pharmacies 5.6.1.4.2 Brick & Mortar 5.6.1.4.3 E-commerce 5.6.1.5 United States GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 5.6.1.5.1 Hospitals & Clinics 5.6.1.5.2 Diagnostic Centers 5.6.1.5.3 Homecare Settings 5.6.1.5.4 Others 5.6.2 Canada 5.6.2.1 Canada GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 5.6.2.1.1 Consumables 5.6.2.1.2 Analyzers 5.6.2.2 Canada GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 5.6.2.2.1 Occult Blood Test 5.6.2.2.1.1 Guaiac FOB Stool Test 5.6.2.2.1.2 Immuno FOB Agglutination Test 5.6.2.2.1.3 Lateral Flow Immuno FOB Test 5.6.2.2.1.4 Immuno FOB ELISA Test 5.6.2.2.2 Ova and Parasites Test 5.6.2.2.3 Bacteria Test 5.6.2.2.4 Fecal Biomarkers Test 5.6.2.2.4.1 Tumor M2-PK Stool Test 5.6.2.2.4.2 Transferrin Assays 5.6.2.2.4.3 Others 5.6.3 Other 5.6.3.1 Canada GI Stool Testing Market Size and Forecast, by Application (2022-2029) 5.6.3.1.1 Infection 5.6.3.1.2 Inflammatory Bowel Disease 5.6.3.1.3 Gastroesophageal Reflux Disease (GERD) 5.6.3.1.4 Cancer 5.6.3.1.5 Others 5.6.3.2 Canada GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.3.2.1 Hospital & clinics pharmacies 5.6.3.2.2 Brick & Mortar 5.6.3.2.3 E-commerce 5.6.3.3 Canada GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 5.6.3.3.1 Hospitals & Clinics 5.6.3.3.2 Diagnostic Centers 5.6.3.3.3 Homecare Settings 5.6.3.3.4 Others 5.6.4 Mexico 5.6.4.1 Mexico GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 5.6.4.1.1 Consumables 5.6.4.1.2 Analyzers 5.6.4.2 Mexico GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 5.6.4.2.1 Occult Blood Test 5.6.4.2.1.1 Guaiac FOB Stool Test 5.6.4.2.1.2 Immuno FOB Agglutination Test 5.6.4.2.1.3 Lateral Flow Immuno FOB Test 5.6.4.2.1.4 Immuno FOB ELISA Test 5.6.4.2.2 Ova and Parasites Test 5.6.4.2.3 Bacteria Test 5.6.4.2.4 Fecal Biomarkers Test 5.6.4.2.4.1 Tumor M2-PK Stool Test 5.6.4.2.4.2 Transferrin Assays 5.6.4.2.4.3 Others 5.6.4.2.5 Others 5.6.4.3 Mexico GI Stool Testing Market Size and Forecast, by Application (2022-2029) 5.6.4.3.1 Infection 5.6.4.3.2 Inflammatory Bowel Disease 5.6.4.3.3 Gastroesophageal Reflux Disease (GERD) 5.6.4.3.4 Cancer 5.6.4.3.5 Others 5.6.4.4 Mexico GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.4.4.1 Hospital & clinics pharmacies 5.6.4.4.2 Brick & Mortar 5.6.4.4.3 E-commerce 5.6.4.5 Mexico GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 5.6.4.5.1 Hospitals & Clinics 5.6.4.5.2 Diagnostic Centers 5.6.4.5.3 Homecare Settings 5.6.4.5.4 Others 6. Europe GI Stool Testing Market Size and Forecast by Segmentation for Demand and Supply Side (By Value) (2022-2029) 6.1 Europe GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 6.2 Europe GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 6.3 Europe GI Stool Testing Market Size and Forecast, by Application (2022-2029) 6.4 Europe GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 6.5 Europe GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 6.6 Europe GI Stool Testing Market Size and Forecast, by Country (2022-2029) 6.6.1 United Kingdom 6.6.1.1 United Kingdom GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 6.6.1.2 United Kingdom GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 6.6.1.3 United Kingdom GI Stool Testing Market Size and Forecast, by Application (2022-2029) 6.6.1.4 United Kingdom GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.1.5 United Kingdom GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 6.6.2 France 6.6.2.1 France GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 6.6.2.2 France GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 6.6.2.3 France GI Stool Testing Market Size and Forecast, by Application (2022-2029) 6.6.2.4 France GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.2.5 France GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 6.6.3 Germany 6.6.3.1 Germany GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 6.6.3.2 Germany GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 6.6.3.3 Germany GI Stool Testing Market Size and Forecast, by Application (2022-2029) 6.6.3.4 Germany GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.3.5 Germany GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 6.6.4 Italy 6.6.4.1 Italy GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 6.6.4.2 Italy GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 6.6.4.3 Italy GI Stool Testing Market Size and Forecast, by Application (2022-2029) 6.6.4.4 Italy GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.4.5 Italy GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 6.6.5 Spain 6.6.5.1 Spain GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 6.6.5.2 Spain GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 6.6.5.3 Spain GI Stool Testing Market Size and Forecast, by Application (2022-2029) 6.6.5.4 Spain GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.5.5 Spain GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 6.6.6 Sweden 6.6.6.1 Sweden GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 6.6.6.2 Sweden GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 6.6.6.3 Sweden GI Stool Testing Market Size and Forecast, by Application (2022-2029) 6.6.6.4 Sweden GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.6.5 Sweden GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 6.6.7 Austria 6.6.7.1 Austria GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 6.6.7.2 Austria GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 6.6.7.3 Austria GI Stool Testing Market Size and Forecast, by Application (2022-2029) 6.6.7.4 Austria GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.7.5 Austria GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 6.6.8 Rest of Europe 6.6.8.1 Rest of Europe GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 6.6.8.2 Rest of Europe GI Stool Testing Market Size and Forecast, by Test Type (2022-2029). 6.6.8.3 Rest of Europe GI Stool Testing Market Size and Forecast, by Application (2022-2029) 6.6.8.4 Rest of Europe GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.8.5 Rest of Europe GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7. Asia Pacific GI Stool Testing Market Size and Forecast by Segmentation for Demand and Supply Side (By Value) (2022-2029) 7.1 Asia Pacific GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.2 Asia Pacific GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.3 Asia Pacific GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.4 Asia Pacific GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.5 Asia Pacific GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6 Asia Pacific GI Stool Testing Market Size and Forecast, by Country (2022-2029) 7.6.1 China 7.6.1.1 China GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.1.2 China GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.1.3 China GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.1.4 China GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.1.5 China GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.2 South Korea 7.6.2.1 S Korea GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.2.2 S Korea GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.2.3 S Korea GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.2.4 S Korea GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.2.5 S Korea GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.3 Japan 7.6.3.1 Japan GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.3.2 Japan GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.3.3 Japan GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.3.4 Japan GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.3.5 Japan GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.4 India 7.6.4.1 India GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.4.2 India GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.4.3 India GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.4.4 India GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.4.5 India GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.5 Australia 7.6.5.1 Australia GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.5.2 Australia GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.5.3 Australia GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.5.4 Australia GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.5.5 Australia GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.6 Indonesia 7.6.6.1 Indonesia GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.6.2 Indonesia GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.6.3 Indonesia GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.6.4 Indonesia GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.6.5 Indonesia GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.7 Malaysia 7.6.7.1 Malaysia GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.7.2 Malaysia GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.7.3 Malaysia GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.7.4 Malaysia GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.7.5 Malaysia GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.8 Vietnam 7.6.8.1 Vietnam GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.8.2 Vietnam GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.8.3 Vietnam GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.8.4 Vietnam GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.8.5 Vietnam GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.9 Taiwan 7.6.9.1 Taiwan GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.9.2 Taiwan GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.9.3 Taiwan GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.9.4 Taiwan GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.9.5 Taiwan GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.10 Bangladesh 7.6.10.1 Bangladesh GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.10.2 Bangladesh GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.10.3 Bangladesh GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.10.4 Bangladesh GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.10.5 Bangladesh GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.11 Pakistan 7.6.11.1 Pakistan GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.11.2 Pakistan GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.11.3 Pakistan GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.11.4 Pakistan GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.11.5 Pakistan GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 7.6.12 Rest of Asia Pacific 7.6.12.1 Rest of Asia Pacific GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 7.6.12.2 Rest of Asia Pacific GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 7.6.12.3 Rest of Asia Pacific GI Stool Testing Market Size and Forecast, by Application (2022-2029) 7.6.12.4 Rest of Asia Pacific GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.12.5 Rest of Asia Pacific GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 8. Middle East and Africa GI Stool Testing Market Size and Forecast by Segmentation for Demand and Supply Side (By Value) (2022-2029) 8.1 Middle East and Africa GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 8.2 Middle East and Africa GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 8.3 Middle East and Africa GI Stool Testing Market Size and Forecast, by Application (2022-2029) 8.4 Middle East and Africa GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 8.5 Middle East and Africa GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 8.6 Middle East and Africa GI Stool Testing Market Size and Forecast, by Country (2022-2029) 8.6.1 South Africa 8.6.1.1 South Africa GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 8.6.1.2 South Africa GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 8.6.1.3 South Africa GI Stool Testing Market Size and Forecast, by Application (2022-2029) 8.6.1.4 South Africa GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.1.5 South Africa GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 8.6.2 GCC 8.6.2.1 GCC GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 8.6.2.2 GCC GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 8.6.2.3 GCC GI Stool Testing Market Size and Forecast, by Application (2022-2029) 8.6.2.4 GCC GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.2.5 GCC GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 8.6.3 Egypt 8.6.3.1 Egypt GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 8.6.3.2 Egypt GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 8.6.3.3 Egypt GI Stool Testing Market Size and Forecast, by Application (2022-2029) 8.6.3.4 Egypt GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.3.5 Egypt GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 8.6.4 Nigeria 8.6.4.1 Nigeria GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 8.6.4.2 Nigeria GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 8.6.4.3 Nigeria GI Stool Testing Market Size and Forecast, by Application (2022-2029) 8.6.4.4 Nigeria GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.4.5 Nigeria GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 8.6.5 Rest of ME&A 8.6.5.1 Rest of ME&A GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 8.6.5.2 Rest of ME&A GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 8.6.5.3 Rest of ME&A GI Stool Testing Market Size and Forecast, by Application (2022-2029) 8.6.5.4 Rest of ME&A GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.5.5 Rest of ME&A GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 9. South America GI Stool Testing Market Size and Forecast by Segmentation for Demand and Supply Side (By Value) (2022-2029) 9.1 South America GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 9.2 South America GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 9.3 South America GI Stool Testing Market Size and Forecast, by Application (2022-2029) 9.4 South America GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 9.5 South America GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 9.6 South America GI Stool Testing Market Size and Forecast, by Country (2022-2029) 9.6.1 Brazil 9.6.1.1 Brazil GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 9.6.1.2 Brazil GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 9.6.1.3 Brazil GI Stool Testing Market Size and Forecast, by Application (2022-2029) 9.6.1.4 Brazil GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 9.6.1.5 Brazil GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 9.6.2 Argentina 9.6.2.1 Argentina GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 9.6.2.2 Argentina GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 9.6.2.3 Argentina GI Stool Testing Market Size and Forecast, by Application (2022-2029) 9.6.2.4 Argentina GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 9.6.2.5 Argentina GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 9.6.3 Rest Of South America 9.6.3.1 Rest Of South America GI Stool Testing Market Size and Forecast, by Product Type (2022-2029) 9.6.3.2 Rest Of South America GI Stool Testing Market Size and Forecast, by Test Type (2022-2029) 9.6.3.3 Rest Of South America GI Stool Testing Market Size and Forecast, by Application (2022-2029) 9.6.3.4 Rest Of South America GI Stool Testing Market Size and Forecast, by Distribution Channel (2022-2029) 9.6.3.5 Rest Of South America GI Stool Testing Market Size and Forecast, by End-Use (2022-2029) 10. Global GI Stool Testing Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Type Segment 10.3.3 End-User Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading GI Stool Testing Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 AdvaCare Pharma 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Biomrieux Inc 11.3 Bio-Rad Laboratory 11.4 Cardinal Health 11.5 Cenogenics Corporation 11.6 CTK Biotech Inc. 11.7 Danaher Corp. 11.8 Diasorin S P A 11.9 Eiken Chemical Co. Ltd. 11.10 Epitope Diagnostics Inc. 11.11 Exact Sciences Corp. 11.12 F. Hoffmann-La Roche Ltd. 11.13 Genova Diagnostics 11.14 Helena Laboratories Corp. 11.15 Hologic, Inc. 11.16 McKesson Corp. 11.17 Meridian Bioscience Inc 11.18 Pinnacle BioLabs 11.19 Prenetics Group Limited 11.20 QIAGEN 11.21 Quest Diagnostics Incorporated 11.22 Quidelortho Corp. 11.23 ScheBo Biotech AG 11.24 Shineco, Inc. 11.25 Siemens Healthineers AG 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary