Germany Dairy Products Market size is expected to reach nearly US$ 3546.1 Mn by 2026 with the CAGR of 6.53% during the forecast period.To Know About The Research Methodology :- Request Free Sample Report

Germany Dairy Products Market Overview:

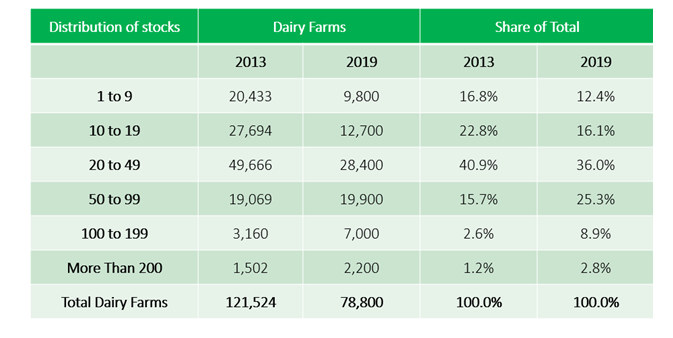

In the year 2018, the price of usually produced cow’s milk touched a long-standing low in Germany. For the 1st time, the German distribution volume was lower than in a similar month in 2017. From this time on also in 2018 the distributions reduced compared to the last year. Milk distributions by German & European producers to German dairy firms for 2018 amounted to 31.9 Mn tons, which was 0.1 percent below the level of the year 2017. German dairy makers’ milk distributions declined by 0.2 percent compared to the last year. A special degree to decrease procurement showed only a provisional effect. After the end of the holding period, from June 2018 onwards, there was a further rise in milk distributions compared to the last year, which began in northern Germany & spread south & then east. Previous year 7.7 Mn tons of cow’s milk were supplied in Bavaria, the major amount. Manufacturers from Bavaria, Lower Saxony & North Rhine-Westphalia, the 3 federal states with the major delivery volumes, together delivered 17.8 Mn tons of milk to the dairy firms in 2018. The share of these 3 federal states in the total supply of German manufacturers thus agrees to 56.8 percent. A decrease in milk delivery is also owing to the minor number of dairy cows. Between November 2016 & November 2017, the number of dairy cows reduced by 1.6 percent, and in November 2018 a further 0.4 percent fewer cows were calculated. 32.7 Mn tons of cow’s milk was produced in the Country in 2018. 31.3 Mn tons were provided to dairy firms. The average milk yield per cow & year in the country changed from 7,746 kg in 2017 to 7,780 kg in 2018. The German dairy supply chain is one of the major agri-food supply chains in the country. In the year 2018, raw milk procurement accounted for 19.2 percent of the total local agricultural procurement value & dairy products summed up 8.17 percent of total German agri-food exports. However, the economic achievement of the supply chain is dominated by reports on market power harmed by dairies & retailers. Powered by complaints of dairy planters & dairies on non-competitive conduct of downstream supply chain managers, the German anti-trust agency led a segment analysis between 2017 and 2019. In its concluding report, the anti-trust agency approved the threat of oligopsony power at both markets, raw milk & dairy output market, but could not discover any sign. Thus, the main evidence of the existing work is to empirically examine the German dairy supply chain for the presence of oligopsony power at the raw milk & dairy product market. Structure of German dairy cow farming in 2013 & 2019:

The European dairy market includes many consistent dairy products that differ in geographic scope from regional Specialities to global reach, reliant on the product. As the trade of dairy products becomes more inclusive, with national & multinational firms challenging in nearly every region, numerous products are also becoming more global. However, customers of milk & dairy products through European regions show extensively varying inclinations for taste & packaging. Dairy products variety from equally standardized goods, like milk, butter, & non-fat dry milk powder, to multi-variety, flavored products, like specialty cheeses, fermented drinks, & milk protein segments used in food & beverage products. Some dairy products are made& consumed domestically, countrywide, while others are consumed globally. Products like fresh milk, yogurt, & cheese are proposed for direct consumption. Growth in Dairy Products: Retail dairy purchases are rising at extensivelychanged rates among the European nations in response to increasing incomes &growing urban populations. Mass media raises& new forms of retail channels are also pouringdevelopment in nations where dairy products are promoted to Europe’s aging population &naturally affluent senior demographic who form an eye-catching target market for useful dairy food & drink, for instance: Functional rights are serving this increase by providing customers access to expanded product choices& brands. Some European administrations are also helping the access by inspiring milk consumption in schools as a means to increase the diets of children. Younger populations through the top 5 European economies are both the key demographic for purchasing dairy drinks in general & for purchasing those products they consider to have health aids. Launches of Dairy Products in major European Markets:

Cheese: The European cheese market will keep steady developmentthrough Europe through 2021. However, this development has been continued by lowering costs & because Europeans are no longer sighted cheese as just a separate after a meal dish. It has now branched into the snacking segment& is being gradually used in meal preparation. Top Cheese Markets the World in 2019:

Forecast Cheese Value Sales by Key Markets 2020/2025 & Ranking:

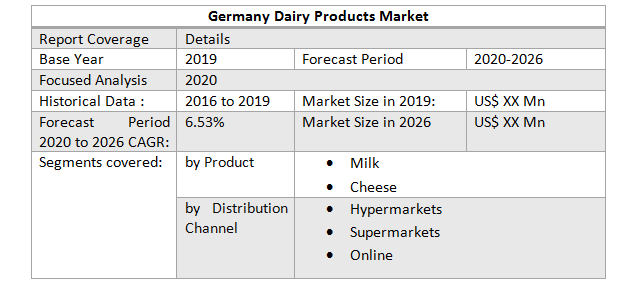

The report covers Milk, Cheese,analysis, with detailed analysis Germany Dairy Products Market industry with the classifications of the market on the, Product, Distribution Channel, & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Products, labor cost, availability of advanced Plastic Products, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing &COVID 19 impact on demand side is covered in the report.

Germany Dairy Products Market Scope: Inquire before buying

Germany Dairy Products Market Key Players

• Nestle • Lactalis • Danone • Fonterra • Dairy Farmers of America • FrieslandCampina • Arla FoodsSaputo • Dean Foods • Yili • Mengniu • Unilever • Sodiaal • DMK • Savencia • Kraft Foods • Meiji • Schreiber Foods • Land O’Lakes • Muller

Germany Dairy Products Market

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Germany Dairy Products Market Size, by Market Value (US$ Mn) 3.1. Germany Market Segmentation 3.2. Germany Market Segmentation Share Analysis, 2019 3.3. Geographical Snapshot of the Dairy Products Market 3.4. Geographical Snapshot of the Dairy Products Market, By Manufacturer share 4. Germany Dairy Products Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Germany Dairy Products Market 5. Supply Side and Demand Side Indicators 6. Germany Dairy Products Market Analysis and Forecast, 2019-2026 6.1. Germany Dairy Products Market Size & Y-o-Y Growth Analysis. 7. Germany Dairy Products Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Product, 2019-2026 7.1.1. Milk 7.1.2. Cheese 7.2. Market Size (Value) Estimates & Forecast By Distribution Channel, 2019-2026 7.2.1.1. Hypermarkets 7.2.1.2. Supermarkets 7.2.1.3. Online 8. Competitive Landscape 8.1. Geographic Footprint of Major Players in the Germany Dairy Products Market 8.2. Competition Matrix 8.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Distribution Channels and R&D Investment 8.2.2. New Product Launches and Product Enhancements 8.2.3. Market Consolidation 8.2.3.1. M&A by Regions, Investment and Verticals 8.2.3.2. M&A, Forward Integration and Backward Integration 8.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 8.3. Company Profile : Key Players 8.3.1. Nestle 8.3.1.1. Company Overview 8.3.1.2. Financial Overview 8.3.1.3. Geographic Footprint 8.3.1.4. Product Portfolio 8.3.1.5. Business Strategy 8.3.1.6. Recent Developments 8.3.2. Lactalis 8.3.3. Danone 8.3.4. Fonterra 8.3.5. Dairy Farmers of America 8.3.6. FrieslandCampina 8.3.7. Arla FoodsSaputo 8.3.8. Dean Foods 8.3.9. Yili 8.3.10. Mengniu 8.3.11. Unilever 8.3.12. Sodiaal 8.3.13. DMK 8.3.14. Savencia 8.3.15. Kraft Foods 8.3.16. Meiji 8.3.17. Schreiber Foods 8.3.18. Land O’Lakes 8.3.19. Muller 9. Primary Key Insights