The Gasification Market size was valued at US 507.30 Bn in 2023 and market revenue is growing at a CAGR of 5.3 % from 2024 to 2030, reaching nearly USD 728.22 Bn by 2030.Gasification Market Overview

Gasification stands as a pivotal thermochemical procedure converting carbonaceous substances like coal, biomass, or municipal solid waste into a valuable gaseous fuel termed synthesis gas or syngas. This method encompasses the partial oxidation of the raw material at elevated temperatures within a regulated setting, utilizing a restricted oxygen or air supply. Gasification presents numerous advantages over conventional combustion techniques. It facilitates the transformation of a diverse array of carbonaceous inputs into flexible syngas suitable for a plethora of energy and chemical utilities. This process serves as a cornerstone in modern industrial practices, offering sustainable alternatives to conventional fuel sources and contributing to a more diversified and resilient energy landscape. With its versatility and efficiency, gasification continues to garner attention and investment in various sectors, driving innovation and fostering sustainable development initiatives globally. As industries increasingly prioritize cleaner and more efficient energy solutions, gasification emerges as a pivotal technology poised to play a significant role in shaping the future of energy production and resource utilization.To know about the Research Methodology :- Request Free Sample Report

Gasification Market Dynamics

Driver Increasing Energy Demand to boost the Gasification Market growth The increasing need for energy-efficient and sustainable energy sources with the potential to convert a wide range of carbonaceous materials into versatile and clean-burning syngas used for power generation is expected to boost the Gasification Market growth. Stringent environmental regulations and carbon reduction targets are driving the adoption of cleaner energy technologies. Gasification enables the conversion of carbonaceous feedstocks with reduced emissions of greenhouse gases and other pollutants compared to traditional combustion processes, aligning with environmental goals. Gasification presents an opportunity for waste-to-energy solutions, enabling the conversion of various waste streams, such as municipal solid waste and biomass residues, into valuable syngas. It supports the transition to a circular economy by reducing waste volumes and generating energy from otherwise discarded materials. Gasification technology can utilize a wide range of feedstocks, including coal, biomass, municipal solid waste, and even plastics. This flexibility provides resilience to changes in feedstock availability and prices, reducing dependence on specific resources. The syngas produced through gasification can be utilized in various applications, such as power generation, chemical production, gas-to-liquids (GTL) technologies, and bioenergy. The versatility of syngas allows for the production of electricity, transportation fuels, chemicals, and other value-added products. Ongoing advancements in gasification technologies, process efficiencies, and gas cleanup techniques are driving the commercial viability and competitiveness of gasification and is expected to boost the Gasification industry growth.Restrain Limited financial sources to restrain the Gasification market growth Gasification projects require substantial upfront investment due to the complex nature of the technology, specialized equipment, and infrastructure requirements. The high capital costs associated with gasification can pose a barrier to entry, especially for smaller companies or regions with limited financial resources is expected to restrain the Gasification Market growth. Gasification processes involve intricate chemistry, high temperatures, and stringent control parameters. The technical complexity of gasification technologies requires skilled expertise for operation, maintenance, and troubleshooting. Lack of technical knowledge and trained personnel is a constraint in adopting and scaling up gasification projects. The availability and quality of suitable feedstocks can be a constraint in gasification projects. The consistent supply of feedstocks, such as biomass or municipal solid waste, may be limited in certain regions or subject to seasonal variations. Ensuring a reliable and sustainable feedstock supply is crucial for the viability of gasification projects and is expected to limit the Gasification industry growth. Gasification processes often produce syngas with impurities, including sulfur compounds, tars, and particulate matter. Effective gas cleanup systems are required to remove these impurities before utilizing the syngas. Implementing efficient and cost-effective gas cleanup technologies can be a technical challenge and may add complexity and cost to the gasification process. The gasification market is influenced by market dynamics, policy frameworks, and regulations. Uncertain market conditions, fluctuations in energy prices, and evolving regulations can create challenges for gasification project developers. Inconsistent or inadequate policy support and market incentives may hinder the growth of the gasification market. Public perception and acceptance of gasification technologies can influence project development and public support. Lack of awareness, and concerns about safety, environmental impacts, or potential emissions can create resistance or delay in the implementation of gasification projects and limit market growth. Opportunities in Gasification Market The Gasification Market is poised for growth amidst the global transition to renewable energy sources. Gasification technologies offer a sustainable solution by converting biomass, agricultural residues, and waste streams into syngas, supporting renewable energy goals and waste management objectives. With applications in decentralized energy generation, gasification provides localized power production, especially in areas with limited access to centralized grids. However, challenges such as cost competitiveness, technology readiness, and scalability persist. High capital and operational costs, coupled with complexities in gas cleanup, pose economic hurdles. Further research and development are required to enhance efficiency, reliability, and scalability. Additionally, addressing public concerns regarding safety, emissions, and potential impacts is crucial for gaining stakeholder acceptance. Despite these challenges, the Gasification Market presents significant opportunities for renewable energy integration and sustainable waste management solutions.

Gasification Market Segment Analysis

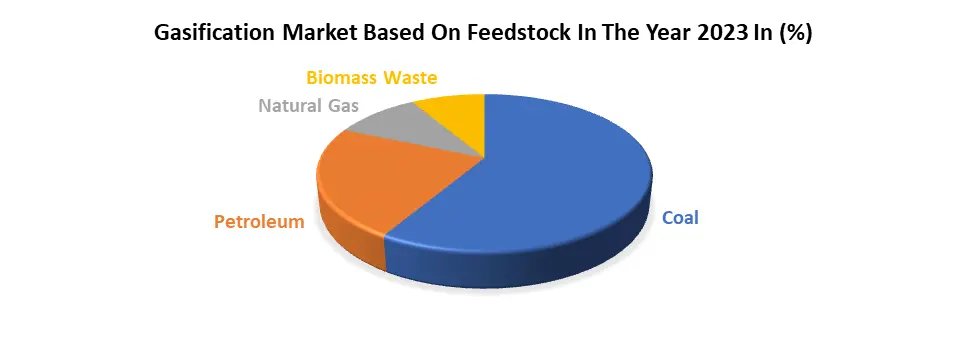

Based on Feedstock, the coal segment dominated the feedstock segment of the Gasification Market in the year 2023. Coal is abundantly available and economically feasible in many regions, making it a preferred choice for gasification projects, especially in countries with significant coal reserves. Additionally, coal gasification offers a way to utilize coal more cleanly compared to traditional combustion methods, as it enables the production of synthesis gas (syngas), which can be used for various applications including power generation, chemical production, and fuel synthesis. Also, advancements in gasification technology have enhanced the efficiency and environmental performance of coal gasification processes, further bolstering its appeal. Despite increasing interest in alternative feedstocks such as biomass and municipal solid waste, coal remains a primary choice due to its widespread availability, established infrastructure, and economic viability in many regions, thus maintaining its dominance in the gasification market.

Gasification Market Regional Insight

Asia Pacific dominated the market in 2023 and is expected to hold the largest Gasification Market share over the forecast period. Rapid urbanization and population growth in the Asia Pacific region have led to increasing volumes of municipal solid waste. Gasification offers a sustainable waste management solution by converting waste into valuable energy, reducing landfill volumes, and addressing environmental concerns. Governments in the Asia Pacific region is providing policy support, financial incentives, and favorable regulatory frameworks to promote the adoption of gasification technologies. The Asia Pacific region is witnessing advancements in gasification technologies, including improved gas cleanup systems, process efficiencies, and operational parameters, which is expected to boost the Gasification Market growth. Collaborative efforts between technology developers, research institutions, and industry players are driving innovation and the deployment of gasification projects. The European region is expected to boost the Gasification Market over the forecast period. The countries covered in the region are Germany, the United Kingdom, Sweden, the Netherlands, and Denmark. Gasification technologies are used to address waste management challenges, reduce landfill volumes, and produce renewable energy. Sweden has a strong focus on waste-to-energy and biomass gasification. The country has implemented policies and incentives to promote the use of gasification technologies in waste management and renewable energy production. The Netherlands is investing in gasification projects to support its transition towards a circular economy and reduce greenhouse gas emissions. Gasification is seen as a key technology to convert waste materials into valuable products and generate renewable energy.Gasification Market Scope: Inquire before buying

Global Gasification Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 507.3 Bn. Forecast Period 2024 to 2030 CAGR: 5.3% Market Size in 2030: US $ 728.22 Bn. Segments Covered: by Feedstock Coal Petroleum Natural Gas Biomass Waste by Application Chemical Liquid Fuel Gaseous Fuel Power Gasification Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Gasification Market Key players

North America 1. General Electric Company (USA) 2. CB&I (Chicago Bridge & Iron Company N.V.) (USA) 3. KBR Inc. (USA) 4. Synthesis Energy Systems, Inc. (USA) 5. Dakota Gasification Company (USA) 6. Air Products and Chemicals, Inc. (USA) 7. Babcock & Wilcox Enterprises, Inc. (USA) 8. Enerkem Inc (Canada) Europe 1. Royal Dutch Shell plc (Netherlands) 2. Air Liquide SA (France) 3. Siemens AG (Germany) 4. The Linde Group (Germany) 5. Foster Wheeler AG (United Kingdom) 6. GASEK GmbH (Germany) 7. Valmet Corporation (Finland) 8. Envirotherm GmbH (Germany) Asia Pacific 1. Mitsubishi Heavy Industries, Ltd. (Japan) 2. Sedin Engineering Co. Ltd. (China) 3. Linc Energy Ltd. (Australia) Frequently Asked Questions 1] What segments are covered in the Global Gasification Market report? Ans. The segments covered in the Gasification Market report are based on Feedstock, Application, and Region. 2] Which region is expected to hold the highest share of the Global Gasification Market? Ans. The Asia Pacific region is expected to hold the highest share of the Gasification Market. 3] What is the market size of the Global Gasification Market by 2030? Ans. The market size of the Gasification Market by 2030 is expected to reach US$ 728.22Bn. 4] What was the market size of the Global Gasification Market in 2023? Ans. The market size of the Gasification Market in 2023 was valued at US$ 507.30 Bn. 5] Key players in the Gasification Market. Ans. General Electric Company (USA), CB&I (Chicago Bridge & Iron Company N.V.) (USA), KBR Inc. (USA), Synthesis Energy Systems, Inc. (USA), AND Dakota Gasification Company (USA).

1. Gasification Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Gasification Market: Dynamics 2.1. Gasification Market Trends by Region 2.1.1. North America Gasification Market Trends 2.1.2. Europe Gasification Market Trends 2.1.3. Asia Pacific Gasification Market Trends 2.1.4. Middle East and Africa Gasification Market Trends 2.1.5. South America Gasification Market Trends 2.2. Gasification Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Gasification Market Drivers 2.2.1.2. North America Gasification Market Restraints 2.2.1.3. North America Gasification Market Opportunities 2.2.1.4. North America Gasification Market Challenges 2.2.2. Europe 2.2.2.1. Europe Gasification Market Drivers 2.2.2.2. Europe Gasification Market Restraints 2.2.2.3. Europe Gasification Market Opportunities 2.2.2.4. Europe Gasification Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Gasification Market Drivers 2.2.3.2. Asia Pacific Gasification Market Restraints 2.2.3.3. Asia Pacific Gasification Market Opportunities 2.2.3.4. Asia Pacific Gasification Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Gasification Market Drivers 2.2.4.2. Middle East and Africa Gasification Market Restraints 2.2.4.3. Middle East and Africa Gasification Market Opportunities 2.2.4.4. Middle East and Africa Gasification Market Challenges 2.2.5. South America 2.2.5.1. South America Gasification Market Drivers 2.2.5.2. South America Gasification Market Restraints 2.2.5.3. South America Gasification Market Opportunities 2.2.5.4. South America Gasification Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Gasification Industry 2.8. Analysis of Government Schemes and Initiatives For Gasification Industry 2.9. Gasification Market Trade Analysis 2.10. The Global Pandemic Impact on Gasification Market 3. Gasification Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Gasification Market Size and Forecast, by Feedstock (2023-2030) 3.1.1. Coal 3.1.2. Petroleum 3.1.3. Natural Gas 3.1.4. Biomass Waste 3.2. Gasification Market Size and Forecast, by Application (2023-2030) 3.2.1. Chemical 3.2.2. Liquid Fuel 3.2.3. Gaseous Fuel 3.2.4. Power 3.3. Gasification Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Gasification Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Gasification Market Size and Forecast, by Feedstock (2023-2030) 4.1.1. Coal 4.1.2. Petroleum 4.1.3. Natural Gas 4.1.4. Biomass Waste 4.2. North America Gasification Market Size and Forecast, by Application (2023-2030) 4.2.1. Chemical 4.2.2. Liquid Fuel 4.2.3. Gaseous Fuel 4.2.4. Power 4.3. North America Gasification Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Gasification Market Size and Forecast, by Feedstock (2023-2030) 4.3.1.1.1. Coal 4.3.1.1.2. Petroleum 4.3.1.1.3. Natural Gas 4.3.1.1.4. Biomass Waste 4.3.1.2. United States Gasification Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Chemical 4.3.1.2.2. Liquid Fuel 4.3.1.2.3. Gaseous Fuel 4.3.1.2.4. Power 4.3.2. Canada 4.3.2.1. Canada Gasification Market Size and Forecast, by Feedstock (2023-2030) 4.3.2.1.1. Coal 4.3.2.1.2. Petroleum 4.3.2.1.3. Natural Gas 4.3.2.1.4. Biomass Waste 4.3.2.2. Canada Gasification Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Chemical 4.3.2.2.2. Liquid Fuel 4.3.2.2.3. Gaseous Fuel 4.3.2.2.4. Power 4.3.3. Mexico 4.3.3.1. Mexico Gasification Market Size and Forecast, by Feedstock (2023-2030) 4.3.3.1.1. Coal 4.3.3.1.2. Petroleum 4.3.3.1.3. Natural Gas 4.3.3.1.4. Biomass Waste 4.3.3.2. Mexico Gasification Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Chemical 4.3.3.2.2. Liquid Fuel 4.3.3.2.3. Gaseous Fuel 4.3.3.2.4. Power 5. Europe Gasification Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Gasification Market Size and Forecast, by Feedstock (2023-2030) 5.2. Europe Gasification Market Size and Forecast, by Application (2023-2030) 5.3. Europe Gasification Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Gasification Market Size and Forecast, by Feedstock (2023-2030) 5.3.1.2. United Kingdom Gasification Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Gasification Market Size and Forecast, by Feedstock (2023-2030) 5.3.2.2. France Gasification Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Gasification Market Size and Forecast, by Feedstock (2023-2030) 5.3.3.2. Germany Gasification Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Gasification Market Size and Forecast, by Feedstock (2023-2030) 5.3.4.2. Italy Gasification Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Gasification Market Size and Forecast, by Feedstock (2023-2030) 5.3.5.2. Spain Gasification Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Gasification Market Size and Forecast, by Feedstock (2023-2030) 5.3.6.2. Sweden Gasification Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Gasification Market Size and Forecast, by Feedstock (2023-2030) 5.3.7.2. Austria Gasification Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Gasification Market Size and Forecast, by Feedstock (2023-2030) 5.3.8.2. Rest of Europe Gasification Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Gasification Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.2. Asia Pacific Gasification Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Gasification Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.3.1.2. China Gasification Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.3.2.2. S Korea Gasification Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.3.3.2. Japan Gasification Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.3.4.2. India Gasification Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.3.5.2. Australia Gasification Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.3.6.2. Indonesia Gasification Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.3.7.2. Malaysia Gasification Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.3.8.2. Vietnam Gasification Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.3.9.2. Taiwan Gasification Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Gasification Market Size and Forecast, by Feedstock (2023-2030) 6.3.10.2. Rest of Asia Pacific Gasification Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Gasification Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Gasification Market Size and Forecast, by Feedstock (2023-2030) 7.2. Middle East and Africa Gasification Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Gasification Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Gasification Market Size and Forecast, by Feedstock (2023-2030) 7.3.1.2. South Africa Gasification Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Gasification Market Size and Forecast, by Feedstock (2023-2030) 7.3.2.2. GCC Gasification Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Gasification Market Size and Forecast, by Feedstock (2023-2030) 7.3.3.2. Nigeria Gasification Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Gasification Market Size and Forecast, by Feedstock (2023-2030) 7.3.4.2. Rest of ME&A Gasification Market Size and Forecast, by Application (2023-2030) 8. South America Gasification Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Gasification Market Size and Forecast, by Feedstock (2023-2030) 8.2. South America Gasification Market Size and Forecast, by Application (2023-2030) 8.3. South America Gasification Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Gasification Market Size and Forecast, by Feedstock (2023-2030) 8.3.1.2. Brazil Gasification Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Gasification Market Size and Forecast, by Feedstock (2023-2030) 8.3.2.2. Argentina Gasification Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Gasification Market Size and Forecast, by Feedstock (2023-2030) 8.3.3.2. Rest Of South America Gasification Market Size and Forecast, by Application (2023-2030) 9. Global Gasification Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Gasification Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. General Electric Company (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. CB&I (Chicago Bridge & Iron Company N.V.) (USA) 10.3. KBR Inc. (USA) 10.4. Synthesis Energy Systems, Inc. (USA) 10.5. Dakota Gasification Company (USA) 10.6. Air Products and Chemicals, Inc. (USA) 10.7. Babcock & Wilcox Enterprises, Inc. (USA) 10.8. Enerkem Inc (Canada) 10.9. Royal Dutch Shell plc (Netherlands) 10.10. Air Liquide SA (France) 10.11. Siemens AG (Germany) 10.12. The Linde Group (Germany) 10.13. Foster Wheeler AG (United Kingdom) 10.14. GASEK GmbH (Germany) 10.15. Valmet Corporation (Finland) 10.16. Envirotherm GmbH (Germany) 10.17. Mitsubishi Heavy Industries, Ltd. (Japan) 10.18. Sedin Engineering Co. Ltd. (China) 10.19. Linc Energy Ltd. (Australia) 11. Key Findings 12. Industry Recommendations 13. Gasification Market: Research Methodology 14. Terms and Glossary