Global Gambling and Betting Sponsorship Landscape Market size was valued at USD 1.7 Bn. in 2022 and the total Gambling and Betting Sponsorship revenue is expected to grow by 7.3% from 2023 to 2029, reaching nearly USD 2.8 Bn.Gambling and Betting Sponsorship Landscape Market Overview:

The practice of sports teams, events, and athletes working with the gambling industry to promote their brands and products is known as "gambling and betting sponsorship in sports. The global gaming and betting industry is likely to develop significantly due to more countries legalizing these activities. Gambling and Betting Sponsorship is important in the current sports industry, which significantly helps to boost the sports industry. Sponsorship by sports betting operators offers great opportunities for sports organizations, clubs, teams, leagues, and competitions. However, it must be considered that this kind of sponsorship carries some risk factors, such as the possibility of manipulating a competition. Betting Sponsorships are major in the sports industry which can help to promote the sports industry and generates revenue. For Example, Betway is the major company that sponsors premier league football. Also, Betfred is known for horse racing sponsorship. The gambling and betting sponsorship landscape is subject to regulatory restrictions and evolving societal attitudes toward gambling. Different countries and regions have varying regulations regarding gambling advertising and sponsorships.To know about the Research Methodology :- Request Free Sample Report

Gambling and Betting Sponsorship Landscape Market Dynamics:

Market Drivers Increasing the legalization of gambling and betting boosts the market growth The sports betting and gambling industry is rapidly growing. Nowadays gambling is becoming more social and people are willing to participate in sports gambling. Gambling and betting sponsorship can provide a significant source of revenue to sports teams and organizations which can be helpful for the sportsman, sports team, and fan as well. On the other hand gambling addiction is a very serious problem that can create financial problems and mental disturbance in individuals and communities. To understand people’s addiction to gambling some countries legalize gambling and introduce some rules and regulations around gambling sponsorship in sports. Therefore people are aware of the associated risks with gambling and betting and they wisely invest in gambling, therefore, the probability of loss is minimized. This factor significantly helps to boost the sponsorship landscape in the Gambling and Betting Industry. For Example, the UK and US governments legalized gambling and betting to protect the individual. The UK Gambling Act 2005 was introduced to regulate gambling and betting. So through the regulation, more people enter the gambling market, which is expected to drive growth in the Gambling and Betting Sponsorship landscape. Increasing Popularity of sports betting boosts the market Gambling Sports betting has significant popularity worldwide. The number of growth opportunities for betting on both live sports as well as online sports. The growth of online betting platforms growing due to people having easy access to place bets on various sports events easily. Online betting is increasingly popular because it provides convenience and flexibility this trend drives market growth. With the increasing popularity of global sports leagues also the rising urbanization of the world’s population more people betting on sports so there is a great opportunity for the sponsors to reach a wider audience through the sponsorship this factor significantly drives the market growth. Strict Regulatory Restrictions Restrain the Market Growth Gambling and betting are associated with negative social implications such as addiction, and financial problems. Which is harmful to society. Therefore people may have a negative opinion of gambling and betting and view sponsorship by gambling companies as unethical. This factor can lead to public pressure and calls for stricter regulations on gambling sponsorships. Betting activities are largely regulated by many rules and regulations. The government and regulatory bodies put some stringent restrictions on gambling sponsorship to protect individuals from risk, avert problem gambling and ensure fair competition. To protect individuals from the risk of gambling and betting government put restrictions on the advertisement of sponsorship. These Regulations can limit the growth of sponsorship The growth of e-Sports sponsorship creates lucrative growth opportunities for the market. The rapid growth seen in digitalization and mobile platforms for gaming has opened up new opportunities for sponsorship. To target the audience directly the digital channels including mobile apps, and social media utilized by operators. Through digital sponsorship, the companies reach the younger generation. Therefore the rise of e-sports creates lucrative growth opportunities for the market growth. E-sports has a rapidly growing fan base therefore it can provide multiple sponsorship options. Also, the growth of fantasy sports is also creating ample growth opportunities online fantasy sports gaming (OFSG) is a skill-based online sport where sports fans can create their own team of real-life players from upcoming matches. It is widely played in cricket, football, kabaddi, basketball, and other popular sports games.Competitive Landscape:

The global Gambling and Betting Sponsorship Landscape Market is highly competitive numerous key players significantly drive the market growth such as Betway, Sky Bet, Sportsbet.io, BetClic, Tipico, Spor Toto, Betano, Bet365, Unibet, 888 Sports, Svenska Spel, 1XBET, Fonbet, Genius Sports, Unibet, Francaise des Jeux, and Betsson. Betway: This is an online gambling and betting company the company is founded in 2006 and offers betting and gambling products such as sports books and online casinos. Betway has a strong presence worldwide including in Europe, America, and Africa. The company has more than 50 brands and partnerships with teams worldwide. Unibet: Unibet is one of the largest online gambling company in Europe. The company offers sports betting, poker, Casino, and games. The company is consistently known for its excellent products and practical approach to responsible gaming. The Key players in the Market are majorly focusing on the increase in targeting audience and maximum investment in Gambling and Betting Sponsorship through global popular events, sports, venues, and athletes.Gambling and Betting Sponsorship Landscape Market Segment Analysis:

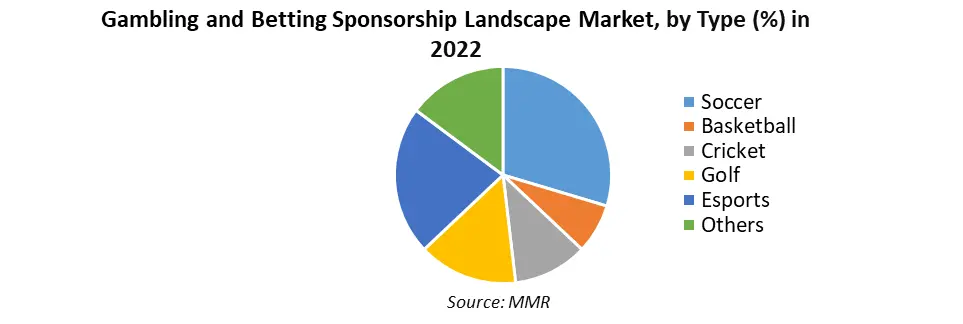

Based on Sports, Soccer (Football) dominates the sports segment of the global Gambling and betting sponsorship landscape market in the year 2022. Soccer is a famous game played in more than 200 countries and territories around the world. Most betting companies such as Betway, W88, and Dafabet targeted football for sponsorship and advertisement. The generation of young men is strongly associated with football, therefore, gambling and betting sponsorship companies majorly focus on football. The connection between football and betting has always been strong one experience is proved that where there is football, there is betting. Football and betting are inseparable in some countries such as the UK, and the US. A significant increase in gambling and betting sponsorship is seen in football as the introduction of Football’s premier leagues because the leagues created more global audiences for batting and gambling.

Gambling and Betting Sponsorship Landscape Market Regional Analysis:

European region dominated the Gambling and Betting Sponsorship Landscape market in the year 2021. Due to the positive regulatory environment, Europe is a significant market for Gambling and Betting Sponsorship. Increasing betting and gambling sponsorship in European Premier League significantly drive market growth. Long-term association of betting companies with football (Soccer) teams is expected to boost the market growth. The government passes the Gambling Act 2005 which help to regulate the European gambling and betting market. Asia Pacific is expected fastest growing market for Gambling and Betting Sponsorship the countries such as China, South Korea, and Japan, attract sponsorship for football, baseball, and e-sports accelerating the growth of the Gambling and Betting Sponsorship Market. The Indian Premium League is the best attraction for the people. China is considered one of the leading players in Casinos.Gambling and Betting Sponsorship Landscape Market Scope: Inquire before buying

Gambling and Betting Sponsorship Landscape Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 7.3 Bn. Forecast Period 2023 to 2029 CAGR: 7.3% Market Size in 2029: US $ 2.8 Bn. Segments Covered: by Sports 1. Soccer 2. Basketball 3. Cricket 4. Golf 5. E-sports 6. Others by Categories 1. Federations 2. Teams 3. Series 4. Venues 5. Events 6. Athletes Gambling and Betting Sponsorship Landscape Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Gambling and Betting Sponsorship Landscape Market Key Players

1. Betway 2. Bwin 3. Sky Bet, 4. Sportsbet.io 5. BetClic 6. Tipico 7. Spor Toto, 8. Betano 9. Bet365 10. Unibet 11. 888 Sports 12. Svenska Spel 13. 1XBET 14. Fonbet 15. Genius Sports 16. Unibet 17. Francaise des Jeux 18. BetssonFrequently Asked Questions:

1] What segments are covered in the Global Market report? Ans. The segments covered in the Market report are based on Sports, Categories, and Regions. 2] Which region is expected to hold the highest share in the Global Gambling and Betting Sponsorship Landscape Market? Ans. The Europe region is expected to hold the highest share of the Gambling and Betting Sponsorship Landscape Market. 3] What is the market size of the Global Gambling and Betting Sponsorship Landscape Market by 2029? Ans. The market size of the Gambling and Betting Sponsorship Landscape Market by 2029 is expected to reach US$ 2.8 Bn. 4] What is the forecast period for the Global Gambling and Betting Sponsorship Landscape Market? Ans. The forecast period for the Gambling and Betting Sponsorship Landscape Market is 2023-2029. 5] What was the market size of the Global Gambling and Betting Sponsorship Landscape Market in 2022? Ans. The market size of the Gambling and Betting Sponsorship Landscape Market in 2022 was valued at US$ 1.7 Bn.

1. Gambling and Betting Sponsorship Landscape Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Gambling and Betting Sponsorship Landscape Market: Dynamics 2.1. Gambling and Betting Sponsorship Landscape Market Trends by Region 2.1.1. North America Gambling and Betting Sponsorship Landscape Market Trends 2.1.2. Europe Gambling and Betting Sponsorship Landscape Market Trends 2.1.3. Asia Pacific Gambling and Betting Sponsorship Landscape Market Trends 2.1.4. Middle East and Africa Gambling and Betting Sponsorship Landscape Market Trends 2.1.5. South America Gambling and Betting Sponsorship Landscape Market Trends 2.2. Gambling and Betting Sponsorship Landscape Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Gambling and Betting Sponsorship Landscape Market Drivers 2.2.1.2. North America Gambling and Betting Sponsorship Landscape Market Restraints 2.2.1.3. North America Gambling and Betting Sponsorship Landscape Market Opportunities 2.2.1.4. North America Gambling and Betting Sponsorship Landscape Market Challenges 2.2.2. Europe 2.2.2.1. Europe Gambling and Betting Sponsorship Landscape Market Drivers 2.2.2.2. Europe Gambling and Betting Sponsorship Landscape Market Restraints 2.2.2.3. Europe Gambling and Betting Sponsorship Landscape Market Opportunities 2.2.2.4. Europe Gambling and Betting Sponsorship Landscape Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Gambling and Betting Sponsorship Landscape Market Drivers 2.2.3.2. Asia Pacific Gambling and Betting Sponsorship Landscape Market Restraints 2.2.3.3. Asia Pacific Gambling and Betting Sponsorship Landscape Market Opportunities 2.2.3.4. Asia Pacific Gambling and Betting Sponsorship Landscape Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Gambling and Betting Sponsorship Landscape Market Drivers 2.2.4.2. Middle East and Africa Gambling and Betting Sponsorship Landscape Market Restraints 2.2.4.3. Middle East and Africa Gambling and Betting Sponsorship Landscape Market Opportunities 2.2.4.4. Middle East and Africa Gambling and Betting Sponsorship Landscape Market Challenges 2.2.5. South America 2.2.5.1. South America Gambling and Betting Sponsorship Landscape Market Drivers 2.2.5.2. South America Gambling and Betting Sponsorship Landscape Market Restraints 2.2.5.3. South America Gambling and Betting Sponsorship Landscape Market Opportunities 2.2.5.4. South America Gambling and Betting Sponsorship Landscape Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Gambling and Betting Sponsorship Landscape Industry 2.8. Analysis of Government Schemes and Initiatives For Gambling and Betting Sponsorship Landscape Industry 2.9. Gambling and Betting Sponsorship Landscape Market Trade Analysis 2.10. The Global Pandemic Impact on Gambling and Betting Sponsorship Landscape Market 3. Gambling and Betting Sponsorship Landscape Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 3.1.1. Soccer 3.1.2. Basketball 3.1.3. Cricket 3.1.4. Golf 3.1.5. E-sports 3.1.6. Others 3.2. Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 3.2.1. Federations 3.2.2. Teams 3.2.3. Series 3.2.4. Venues 3.2.5. Events 3.2.6. Athletes 3.3. Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Gambling and Betting Sponsorship Landscape Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 4.1.1. Soccer 4.1.2. Basketball 4.1.3. Cricket 4.1.4. Golf 4.1.5. E-sports 4.1.6. Others 4.2. North America Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 4.2.1. Federations 4.2.2. Teams 4.2.3. Series 4.2.4. Venues 4.2.5. Events 4.2.6. Athletes 4.3. North America Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 4.3.1.1.1. Soccer 4.3.1.1.2. Basketball 4.3.1.1.3. Cricket 4.3.1.1.4. Golf 4.3.1.1.5. E-sports 4.3.1.1.6. Others 4.3.1.2. United States Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 4.3.1.2.1. Federations 4.3.1.2.2. Teams 4.3.1.2.3. Series 4.3.1.2.4. Venues 4.3.1.2.5. Events 4.3.1.2.6. Athletes 4.3.2. Canada 4.3.2.1. Canada Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 4.3.2.1.1. Soccer 4.3.2.1.2. Basketball 4.3.2.1.3. Cricket 4.3.2.1.4. Golf 4.3.2.1.5. E-sports 4.3.2.1.6. Others 4.3.2.2. Canada Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 4.3.2.2.1. Federations 4.3.2.2.2. Teams 4.3.2.2.3. Series 4.3.2.2.4. Venues 4.3.2.2.5. Events 4.3.2.2.6. Athletes 4.3.3. Mexico 4.3.3.1. Mexico Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 4.3.3.1.1. Soccer 4.3.3.1.2. Basketball 4.3.3.1.3. Cricket 4.3.3.1.4. Golf 4.3.3.1.5. E-sports 4.3.3.1.6. Others 4.3.3.2. Mexico Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 4.3.3.2.1. Federations 4.3.3.2.2. Teams 4.3.3.2.3. Series 4.3.3.2.4. Venues 4.3.3.2.5. Events 4.3.3.2.6. Athletes 5. Europe Gambling and Betting Sponsorship Landscape Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 5.1. Europe Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 5.3. Europe Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 5.3.1.2. United Kingdom Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 5.3.2. France 5.3.2.1. France Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 5.3.2.2. France Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 5.3.3.2. Germany Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 5.3.4.2. Italy Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 5.3.5.2. Spain Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 5.3.6.2. Sweden Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 5.3.7.2. Austria Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 5.3.8.2. Rest of Europe Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6. Asia Pacific Gambling and Betting Sponsorship Landscape Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.2. Asia Pacific Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6.3. Asia Pacific Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.3.1.2. China Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.3.2.2. S Korea Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.3.3.2. Japan Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6.3.4. India 6.3.4.1. India Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.3.4.2. India Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.3.5.2. Australia Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.3.6.2. Indonesia Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.3.7.2. Malaysia Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.3.8.2. Vietnam Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.3.9.2. Taiwan Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 6.3.10.2. Rest of Asia Pacific Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 7. Middle East and Africa Gambling and Betting Sponsorship Landscape Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 7.2. Middle East and Africa Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 7.3. Middle East and Africa Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 7.3.1.2. South Africa Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 7.3.2.2. GCC Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 7.3.3.2. Nigeria Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 7.3.4.2. Rest of ME&A Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 8. South America Gambling and Betting Sponsorship Landscape Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 8.2. South America Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 8.3. South America Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 8.3.1.2. Brazil Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 8.3.2.2. Argentina Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Sports (2022-2029) 8.3.3.2. Rest Of South America Gambling and Betting Sponsorship Landscape Market Size and Forecast, by Categories (2022-2029) 9. Global Gambling and Betting Sponsorship Landscape Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Gambling and Betting Sponsorship Landscape Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Betway 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bwin 10.3. Sky Bet, 10.4. Sportsbet.io 10.5. BetClic 10.6. Tipico 10.7. Spor Toto, 10.8. Betano 10.9. Bet365 10.10. Unibet 10.11. 888 Sports 10.12. Svenska Spel 10.13. 1XBET 10.14. Fonbet 10.15. Genius Sports 10.16. Unibet 10.17. Francaise des Jeux 10.18. Betsson 11. Key Findings 12. Industry Recommendations 13. Gambling and Betting Sponsorship Landscape Market: Research Methodology 14. Terms and Glossary