The Fuel Cell UAV Market size was valued at USD 1457.60 Million in 2023 and the total Anime revenue is expected to grow at a CAGR of 13.27% from 2024 to 2030, reaching nearly USD 3545.44 Million by 2030. A Fuel Cell UAV, or Unmanned Aerial Vehicle, utilizes fuel cell technology as its primary power source, distinguishing it from traditional internal combustion engines or battery-powered alternatives. These UAVs leverage fuel cells to convert chemical energy directly into electricity through an electrochemical reaction, providing a cleaner and more efficient means of propulsion. The Fuel Cell UAVs Market, valued at USD 1457.60 Million in 2023, is projected to exhibit a compound annual growth rate (CAGR) of 13.27% from 2023 to 2029. The growth of the fuel cell UAV market can be attributed to the increasing emphasis on sustainable and environmentally friendly aviation solutions. Fuel cell-powered UAVs offer advantages such as longer flight durations, reduced environmental impact, and lower operating costs compared to traditional fossil fuel-powered counterparts. This growth is further propelled by advancements in fuel cell technology, enabling efficient power generation with minimal emissions. A key driver behind this Fuel Cell UAV Market expansion is the escalating awareness of environmental concerns and the aviation sector's need for cleaner energy sources. Governments and regulatory bodies are actively promoting green technologies, and fuel cell-powered UAVs align with these sustainability goals. Beyond environmental benefits, these UAVs offer operational advantages, including longer endurance and quieter operation, making them suitable for applications such as precision farming, infrastructure monitoring, and search and rescue missions. The UAV market is witnessing a notable interest in hydrogen fuel cells due to their ability to provide extended endurance and range, surpassing conventional battery-powered alternatives. Companies are investing in advancing hydrogen fuel cell technology to address limitations posed by battery-powered UAVs, aiming for prolonged flight durations and extended operational reach. This trend reflects a strategic shift toward sustainable and high-performance energy solutions, showcasing the industry's commitment to innovation. In North America, the Fuel Cell UAV market is undergoing a transformative shift with the growing popularity of green hydrogen. The U.S. National Clean Hydrogen Strategy and Roadmap, unveiled in June, set ambitious targets for clean hydrogen production, aligning with the government's commitment to achieving net-zero carbon emissions. Initiatives such as the Infrastructure and Jobs Act allocate substantial funds to develop regional hydrogen hubs and enhance electrolysis efficiency. The adoption of fuel cell UAVs in North America is influenced by their superior energy density and the region's focus on eco-friendly and efficient thermal management solutions. This alignment with sustainable practices encourages the growth and adoption of fuel cell technology in UAVs within the North American Fuel cell UAV Market. 1. Examples of industry initiatives include Honeywell's collaboration with the National Renewable Energy Laboratory (NREL) to develop a hydrogen fuel storage system for UAVs. Additionally, the Association for Uncrewed Vehicle Systems International (AUVSI) has launched the "Drone Prepared" campaign to assist policymakers in preparing for the anticipated surge in drone usage across various sectors. 2. As of October 2022, there are 864,000 registered drones, with over 300,000 engaged in commercial operations. Recognizing the pivotal role of state, local, and tribal governments, the Drone Prepared initiative provides essential resources to empower communities and comprehend the dynamic drone industry, fostering preparations for its presence and associated benefits. 3. Furthermore, a new pilot initiative aims to expand cyber credentialing across the U.S. industrial base, enhancing capabilities for the Department of Defense (DoD) and the broader U.S. government. The Defense Innovation Unit (DIU) Blue sUAS list, initially designed for the DoD, has gained widespread adoption by federal agencies, states, and the General Services Administration (GSA) for general procurement purposes. However, this expanded adoption has imposed a significant administrative burden on DIU, which lacks the necessary personnel to review all qualifying platforms. The fuel cell UAV market covered the detailed analysis of Fuel Cell UAV market-leading companies and also covered the organized as well as unorganized fuel cell UAV market player analysis. Analysis of Fuel cell UAV industry capitalization, benchmarking, and competitive landscape for Fuel cell UAV Market.To know about the Research Methodology :- Request Free Sample Report

Fuel Cell UAV Market Dynamics:

Fuel Cell UAVs Elevate Military Operations with Extended Endurance and Strategic Advantages The escalating demand for uninterrupted and continuous surveillance in defense, public safety, and critical infrastructure is propelling the Tethered Drone Market into a phase of unprecedented expansion. Tethered drones, securely connected to the ground, present a paradigm shift in monitoring capabilities compared to conventional battery-powered UAVs by offering extended flight durations. This aligns seamlessly with the global Fuel Cell UAV Market imperative for sustained surveillance, particularly crucial during times of crisis. Given that the United States commands nearly 40% of global military expenditures, the Tethered Drone Market is poised for substantial growth in the Fuel Cell UAV Market. Tethered drones signify a significant advancement in aerial surveillance technology, characterized by prolonged flight times, stability, and heightened payload capacity, positioning them as indispensable tools for worldwide surveillance and crisis management. The U.S. military is leveraging the potential of fuel cells across diverse applications, simultaneously enhancing national security and energy efficiency. Fuel cells, adept at converting hydrogen into clean on-site electricity, have become instrumental in powering Unmanned Aerial Vehicles (UAVs), extending flight durations to an impressive 8 hours and allowing rapid refueling within 15 minutes. Collaborative efforts with General Motors have seen the Navy exploring fuel cell integration in unmanned undersea vehicles, optimizing endurance and payload capabilities. This strategic embrace of fuel cell technologies underscores the military's dedication to innovation and operational effectiveness, exemplified by partnerships for the development of hydrogen fuel cell-powered vehicles, which increases demand for the Fuel Cell UAV Market. In the realm of defense and security, tethered drones emerge as invaluable assets, providing persistent aerial surveillance for border control, critical infrastructure protection, and military operations. Leading the way is xCraft's Shadow V2.0, a tethered UAV setting new standards with its 24-hour runtime, altitude capabilities, flight stabilization software, and HD video streaming. This technological evolution shapes the landscape of persistent surveillance across diverse sectors, enhancing situational awareness and fortifying response capabilities.The United States, holding the position of the world's largest military spender, allocated $877 billion to military spending in 2022, comprising 39% of the global total. This surge in defense spending carries significant implications for the Fuel Cell UAV market, reflecting a commitment to cutting-edge technologies, including fuel-cell-powered UAVs. As defense budgets expand, the Fuel Cell UAV market stands to benefit, offering substantial opportunities for growth and innovation within the UAV sector. Global Innovations Drive Fuel Cell UAVs Governments and industry stakeholders are taking steps to showcase the capabilities of fuel cell UAVs through demonstration projects and pilot programs. The success of these initiatives is seen as crucial for accelerating the acceptance and adoption of fuel cell UAVs across various sectors. Notable efforts include the implementation of the "Act for Promoting Drone Usage" and the establishment of Special Free Drone Zones, contributing to the growth of the Fuel Cell UAV industry. South Korea, in particular, is actively working towards lifting drone flying restrictions and has invested in UV Land, a regulation-free drone theme park. The Korean Urban Air Mobility (K-UAM) roadmap, introduced in 2020-21, envisions the introduction of drone taxis by 2025, with a targeted domestic UAM market worth around $10 billion. The government is taking proactive measures to relax regulations, support related services, and expand the UAM market in the country, which accelerates the South Korea Fuel Cell UAV Market. In the maritime industry, there is a growing emphasis on hydrogen-based fuels through initiatives like Zero Emission Pilots and Demonstration Projects. A comprehensive mapping of 106 projects highlights the industry's shift towards zero-emission fuels, covering various aspects such as ship technologies, fuel production, and bunkering/recharging. Fuel Cell UAV Market in marine industry trends include a focus on ammonia for large ship projects, advancements in methanol/ethanol usage, and a preference for hydrogen in smaller vessels. Power-to-X fuels derived from hydrogen are dominant in fuel production projects. Europe leads in significant projects, while Asia, particularly Japan and China, is witnessing a rise in initiatives. The mapping, updated biannually, aims to inspire and support early adopters in transitioning to zero-emission maritime fuels. Additionally, J-PAL's Innovation in Government Initiative (IGI) is playing a crucial role in empowering governments globally to enhance social programs with evidence-informed innovations. The initiative focuses on vital services like education and health, bridging the gap between research and implementation. J-PAL, along with its partners, provides funding for technical assistance to governments, enabling them to adapt, pilot, and scale impactful interventions. The goal is to foster long-term collaborations with governments, guiding them in prioritizing evidence-based policies, piloting programs, and establishing scalable, data-driven delivery systems. This strategic approach aims to leverage evidence effectively, ensuring positive outcomes for millions living in poverty to drive the Fuel Cell UAV Market growth globally. Fuel Cell UAVs Face Operational Challenges in Europe's Diverse Climate The Fuel Cell UAV market in Europe faces formidable challenges due to adverse environmental and weather conditions. The diverse climate in European regions, marked by snow, rain, wind, and sunlight variations, hampers the widespread acceptance and use of fuel cell-powered UAVs. These conditions significantly affect the efficient and reliable operation of drones. Snow and rain, common weather elements, have a detrimental impact on the functionality and performance of fuel cell-powered UAVs. Accumulation of snow or heavy rainfall can disrupt the delicate internal components, potentially causing damage or malfunction. Consequently, operating drones in such conditions results in reduced flight stability, impaired visibility, and an increased risk of accidents, limiting their applicability for critical missions. In certain European regions, high wind speeds pose additional challenges for fuel cell-powered UAVs. Strong gusts destabilize drones during flight, affecting maneuverability and raising safety concerns. Successfully managing drones equipped with fuel cell technology in windy conditions necessitates advanced stabilization mechanisms to ensure safe and steady flight. The varying intensity and duration of sunlight across Europe further impact the performance of fuel cell systems, which often rely on solar energy for hydrogen production. Inadequate or inconsistent sunlight availability hinders the efficient generation of hydrogen, affecting the endurance and overall performance of fuel cell-powered drones. To address these challenges, it is crucial to implement robust design modifications and technological advancements in fuel cell systems. Such enhancements should ensure resilience against diverse weather conditions prevalent in Europe. Innovative solutions involving improved weather-resistant materials, enhanced stabilization mechanisms, and efficient energy storage technologies are imperative to overcome these environmental hurdles and promote the widespread adoption of fuel cell-powered UAVs in the European Fuel Cell UAV Market. Furthermore, regulatory initiatives and industry collaborations focusing on weather-proofing and enhancing drone durability play a pivotal role in mitigating these restraints. These efforts facilitate the integration of fuel cell-powered UAVs into various applications and industries across Europe.

Fuel Cell UAV Market Segment Analysis:

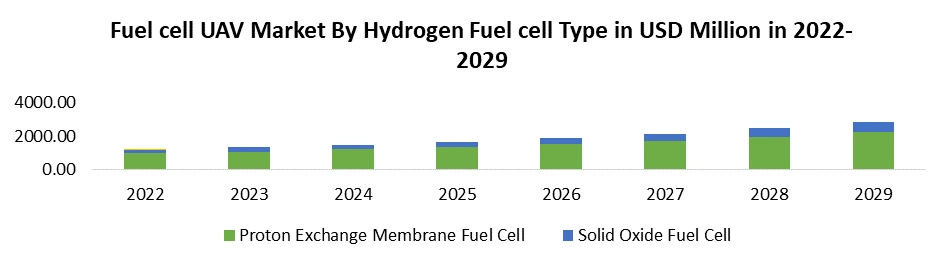

By Hydrogen fuel cell Type, Proton Exchange Membrane Fuel Cell (PEMFC) accounted for 79.18 % of the market share in 2023. Proton Exchange Membrane Fuel Cells (PEMFCs) have emerged as dominant power sources for Unmanned Aerial Vehicles (UAVs), revolutionizing the landscape of drone technology. The key advantages of PEMFCs in the Fuel Cell UAV Market make them particularly well-suited for UAV applications. These fuel cells offer high power density, enabling UAVs to achieve longer flight durations and cover larger distances compared to traditional battery-powered counterparts. Additionally, PEMFCs operate at relatively low temperatures, enhancing their efficiency and reliability in UAV systems. Fuel Cell UAV Market drive due to their quick start-up times and ability to provide consistent power makes them ideal for meeting the dynamic energy demands of UAVs during take-off, flight, and landing. Moreover, the lightweight and compact nature of PEMFCs contributes to overall weight reduction, a critical factor for UAVs where minimizing weight directly impacts performance.

Fuel Cell UAV Market Regional Insights:

North America and Asia Pacific are expected to grow with CAGRs of 14.46% and 12.69% respectively. In North America Fuel Cell UAV Market has grown due to, a robust ecosystem of research and development, coupled with a strong presence of aerospace and defense industries, which has fostered the growth of the Fuel Cell UAV Market. These drones find applications in sectors such as agriculture, energy, and surveillance, benefitting from the region's emphasis on innovation and sustainability.Similarly, in the Asia-Pacific, countries like China and Japan have been at the forefront of fuel cell UAV development and deployment. Fuel cell technology, with its longer endurance, rapid refueling capabilities, and reduced environmental impact, aligns well with the diverse applications in agriculture, forestry, and disaster management prevalent in the Asia-Pacific region. As these regions continue to invest in research, development, and infrastructure, North America and the Asia-Pacific are likely to remain dominant forces in shaping the trajectory of Fuel Cell UAV Market new technology on a global scale.

Global Fuel Cell UAV Market Scope: Inquire before buying

Global Fuel Cell UAV Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1457.60 Mn. Forecast Period 2024 to 2030 CAGR: 13.27 % Market Size in 2030: US $ 3545.44 Mn. Segments Covered: by Fuel Type Hydrogen Other by Product Type Proton Exchange Membrane Fuel Cell Solid Oxide Fuel Cell Others by Weight Less Than 50 Kg More Than 50 Kg by End-User Military & Defence Civil & Commercial Logistics & Transportation Construction & Mining Others Fuel Cell UAV Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Fuel Cell UAV Market Key Players:

1. Adelan 2. Doosan Mobility Innovation. 3. Edge Autonomy 4. Heven Drones 5. HyFly 6. Hylium Industries, Inc. 7. HYPOWER LAB Co.,Ltd 8. ISS Aerospace 9. Royal Nlr – Netherlands Aerospace Centre 10. Shanghai Pearl Hydrogen Energy Technology Co. 11. Spectronik 12. Stratospheric Platforms Ltd FAQs: 1. What is a Fuel Cell UAV? Ans. A Fuel Cell UAV refers to an Unmanned Aerial Vehicle that utilizes fuel cell technology for its power source. Instead of relying on traditional internal combustion engines or batteries, these UAVs employ fuel cells to generate electrical power for propulsion. Fuel cells convert the chemical energy of a fuel directly into electricity through an electrochemical reaction, offering a clean and efficient alternative for powering drones and other unmanned vehicles. 2. What is the top 5 Fuel cell UAV Market players in the industry? Ans. Doosan Mobility Innovation, ISS Aerospace, HyFly, Royal Nlr – Netherlands Aerospace Centre, and Edge Autonom are the Top 5 Fuel Cell UAV Market key players. 3. Which region is expected to lead the global Fuel Cell UAV Market during the forecast period? Ans. North America is expected to lead the global Fuel Cell UAV Market during the forecast period. 4. What is the projected market size and growth rate of the Fuel Cell UAV Market? Ans. The Fuel Cell UAV Market size was valued at USD 1457.60 Million in 2022 and the total Anime revenue is expected to grow at a CAGR of 13.27% from 2023 to 2029, reaching nearly USD 3545.44 Million. 5. What segments are covered in the Fuel Cell UAV Market report? Ans. The segments covered in the Fuel Cell UAV Market report are fuel type, Product Type, Weight, End-User and region.

1. Fuel Cell UAV Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Fuel Cell UAV Market: Dynamics 2.1. Fuel Cell UAV Market Trends by Region 2.1.1. North America Fuel Cell UAV Market Trends 2.1.2. Europe Fuel Cell UAV Market Trends 2.1.3. Asia Pacific Fuel Cell UAV Market Trends 2.1.4. Middle East and Africa Fuel Cell UAV Market Trends 2.1.5. South America Fuel Cell UAV Market Trends 2.2. Fuel Cell UAV Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Fuel Cell UAV Market Drivers 2.2.1.2. North America Fuel Cell UAV Market Restraints 2.2.1.3. North America Fuel Cell UAV Market Opportunities 2.2.1.4. North America Fuel Cell UAV Market Challenges 2.2.2. Europe 2.2.2.1. Europe Fuel Cell UAV Market Drivers 2.2.2.2. Europe Fuel Cell UAV Market Restraints 2.2.2.3. Europe Fuel Cell UAV Market Opportunities 2.2.2.4. Europe Fuel Cell UAV Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Fuel Cell UAV Market Drivers 2.2.3.2. Asia Pacific Fuel Cell UAV Market Restraints 2.2.3.3. Asia Pacific Fuel Cell UAV Market Opportunities 2.2.3.4. Asia Pacific Fuel Cell UAV Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Fuel Cell UAV Market Drivers 2.2.4.2. Middle East and Africa Fuel Cell UAV Market Restraints 2.2.4.3. Middle East and Africa Fuel Cell UAV Market Opportunities 2.2.4.4. Middle East and Africa Fuel Cell UAV Market Challenges 2.2.5. South America 2.2.5.1. South America Fuel Cell UAV Market Drivers 2.2.5.2. South America Fuel Cell UAV Market Restraints 2.2.5.3. South America Fuel Cell UAV Market Opportunities 2.2.5.4. South America Fuel Cell UAV Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Fuel Cell UAV Industry 2.8. Analysis of Government Schemes and Initiatives For Fuel Cell UAV Industry 2.9. Fuel Cell UAV Market Trade Analysis 2.10. The Global Pandemic Impact on Fuel Cell UAV Market 3. Fuel Cell UAV Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 3.1.1. Hydrogen 3.1.2. Other 3.2. Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 3.2.1. Proton Exchange Membrane Fuel Cell 3.2.2. Solid Oxide Fuel Cell 3.2.3. Others 3.3. Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 3.3.1. Less Than 50 Kg 3.3.2. More Than 50 Kg 3.4. Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 3.4.1. Military & Defence 3.4.2. Civil & Commercial 3.4.3. Logistics & Transportation 3.4.4. Construction & Mining 3.4.5. Others 3.5. Fuel Cell UAV Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Fuel Cell UAV Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 4.1.1. Hydrogen 4.1.2. Other 4.2. North America Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 4.2.1. Proton Exchange Membrane Fuel Cell 4.2.2. Solid Oxide Fuel Cell 4.2.3. Others 4.3. North America Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 4.3.1. Less Than 50 Kg 4.3.2. More Than 50 Kg 4.4. North America Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 4.4.1. Military & Defence 4.4.2. Civil & Commercial 4.4.3. Logistics & Transportation 4.4.4. Construction & Mining 4.4.5. Others 4.5. North America Fuel Cell UAV Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 4.5.1.1.1. Hydrogen 4.5.1.1.2. Other 4.5.1.2. United States Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 4.5.1.2.1. Proton Exchange Membrane Fuel Cell 4.5.1.2.2. Solid Oxide Fuel Cell 4.5.1.2.3. Others 4.5.1.3. United States Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 4.5.1.3.1. Less Than 50 Kg 4.5.1.3.2. More Than 50 Kg 4.5.1.4. United States Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 4.5.1.4.1. Military & Defence 4.5.1.4.2. Civil & Commercial 4.5.1.4.3. Logistics & Transportation 4.5.1.4.4. Construction & Mining 4.5.1.4.5. Others 4.5.2. Canada 4.5.2.1. Canada Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 4.5.2.1.1. Hydrogen 4.5.2.1.2. Other 4.5.2.2. Canada Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 4.5.2.2.1. Proton Exchange Membrane Fuel Cell 4.5.2.2.2. Solid Oxide Fuel Cell 4.5.2.2.3. Others 4.5.2.3. Canada Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 4.5.2.3.1. Less Than 50 Kg 4.5.2.3.2. More Than 50 Kg 4.5.2.4. Canada Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 4.5.2.4.1. Military & Defence 4.5.2.4.2. Civil & Commercial 4.5.2.4.3. Logistics & Transportation 4.5.2.4.4. Construction & Mining 4.5.2.4.5. Others 4.5.3. Mexico 4.5.3.1. Mexico Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 4.5.3.1.1. Hydrogen 4.5.3.1.2. Other 4.5.3.2. Mexico Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 4.5.3.2.1. Proton Exchange Membrane Fuel Cell 4.5.3.2.2. Solid Oxide Fuel Cell 4.5.3.2.3. Others 4.5.3.3. Mexico Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 4.5.3.3.1. Less Than 50 Kg 4.5.3.3.2. More Than 50 Kg 4.5.3.4. Mexico Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 4.5.3.4.1. Military & Defence 4.5.3.4.2. Civil & Commercial 4.5.3.4.3. Logistics & Transportation 4.5.3.4.4. Construction & Mining 4.5.3.4.5. Others 5. Europe Fuel Cell UAV Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 5.2. Europe Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 5.3. Europe Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 5.4. Europe Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 5.5. Europe Fuel Cell UAV Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 5.5.1.2. United Kingdom Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 5.5.1.3. United Kingdom Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 5.5.1.4. United Kingdom Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 5.5.2. France 5.5.2.1. France Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 5.5.2.2. France Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 5.5.2.3. France Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 5.5.2.4. France Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 5.5.3.2. Germany Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 5.5.3.3. Germany Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 5.5.3.4. Germany Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 5.5.4.2. Italy Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 5.5.4.3. Italy Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 5.5.4.4. Italy Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 5.5.5.2. Spain Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 5.5.5.3. Spain Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 5.5.5.4. Spain Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 5.5.6.2. Sweden Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 5.5.6.3. Sweden Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 5.5.6.4. Sweden Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 5.5.7.2. Austria Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 5.5.7.3. Austria Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 5.5.7.4. Austria Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 5.5.8.2. Rest of Europe Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 5.5.8.3. Rest of Europe Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 5.5.8.4. Rest of Europe Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Fuel Cell UAV Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.2. Asia Pacific Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.3. Asia Pacific Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.4. Asia Pacific Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6.5. Asia Pacific Fuel Cell UAV Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.5.1.2. China Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.5.1.3. China Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.5.1.4. China Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.5.2.2. S Korea Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.5.2.3. S Korea Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.5.2.4. S Korea Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.5.3.2. Japan Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.5.3.3. Japan Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.5.3.4. Japan Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6.5.4. India 6.5.4.1. India Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.5.4.2. India Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.5.4.3. India Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.5.4.4. India Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.5.5.2. Australia Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.5.5.3. Australia Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.5.5.4. Australia Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.5.6.2. Indonesia Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.5.6.3. Indonesia Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.5.6.4. Indonesia Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.5.7.2. Malaysia Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.5.7.3. Malaysia Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.5.7.4. Malaysia Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.5.8.2. Vietnam Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.5.8.3. Vietnam Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.5.8.4. Vietnam Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.5.9.2. Taiwan Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.5.9.3. Taiwan Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.5.9.4. Taiwan Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 6.5.10.4. Rest of Asia Pacific Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Fuel Cell UAV Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 7.2. Middle East and Africa Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 7.3. Middle East and Africa Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 7.4. Middle East and Africa Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 7.5. Middle East and Africa Fuel Cell UAV Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 7.5.1.2. South Africa Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 7.5.1.3. South Africa Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 7.5.1.4. South Africa Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 7.5.2.2. GCC Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 7.5.2.3. GCC Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 7.5.2.4. GCC Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 7.5.3.2. Nigeria Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 7.5.3.3. Nigeria Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 7.5.3.4. Nigeria Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 7.5.4.2. Rest of ME&A Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 7.5.4.3. Rest of ME&A Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 7.5.4.4. Rest of ME&A Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 8. South America Fuel Cell UAV Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 8.2. South America Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 8.3. South America Fuel Cell UAV Market Size and Forecast, by Weight(2023-2030) 8.4. South America Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 8.5. South America Fuel Cell UAV Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 8.5.1.2. Brazil Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 8.5.1.3. Brazil Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 8.5.1.4. Brazil Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 8.5.2.2. Argentina Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 8.5.2.3. Argentina Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 8.5.2.4. Argentina Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Fuel Cell UAV Market Size and Forecast, by Fuel Type (2023-2030) 8.5.3.2. Rest Of South America Fuel Cell UAV Market Size and Forecast, by Product Type (2023-2030) 8.5.3.3. Rest Of South America Fuel Cell UAV Market Size and Forecast, by Weight (2023-2030) 8.5.3.4. Rest Of South America Fuel Cell UAV Market Size and Forecast, by End-User (2023-2030) 9. Global Fuel Cell UAV Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Fuel Cell UAV Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Adelan 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Doosan Mobility Innovation. 10.3. Edge Autonomy 10.4. Heven Drones 10.5. HyFly 10.6. Hylium Industries, Inc. 10.7. HYPOWER LAB Co.,Ltd 10.8. ISS Aerospace 10.9. Royal Nlr – Netherlands Aerospace Centre 10.10. Shanghai Pearl Hydrogen Energy Technology Co. 10.11. Spectronik 10.12. Stratospheric Platforms Ltd 11. Key Findings 12. Industry Recommendations 13. Fuel Cell UAV Market: Research Methodology 14. Terms and Glossary