France Electric Vehicle Market size was valued at USD 18.88 Bn in 2022 and the total revenue is expected to grow at 9.1% through 2023 to 2029, reaching nearly USD 34.74 Bn by 2029.France Electric Vehicle Market Overview

France has a strong automotive industry, having huge number of automakers that are producing electric vehicles. The country is a leader in the electric vehicle charging infrastructure development. One of the primary factors driving the France market's growth is the increasing need to meet future demands of energy. The country also has a growing network of public charging stations, which is making it increasingly convenient for EV owners to charge their vehicles. Both urban and highway charging infrastructure is highly developing in the country. French consumers are having access to a diverse range of EV models, from compact city cars to high-end electric luxury vehicles. Many global and domestic EV manufacturers offer EVs tailored to different preferences and budgets that caters to a broad spectrum of buyers. As per the study, the France Electric Vehicle industry is expected to grow rapidly during the forecast period.To know about the Research Methodology :- Request Free Sample Report

France Electric Vehicle Market Dynamics

Rising Electric Vehicle Sales Trend in the France Electric Vehicle Market The increasing sales of EVs in France is a result of various factors that collectively create a conducive environment for EV adoption. The growing sales of EVs is reflecting their increasing market share. As more people are increasingly purchasing EVs, the market naturally growing. Initiatives taken for the improvement of urban air quality and reduction in pollution, such as low-emission zones and restrictions on high-emission vehicles in city centers is creating favorable environment for EVs. These policies highly contribute to the EV sales growth. Many businesses and government agencies in France are incorporating EVs into their fleets, which is majorly contributing to the growth of France Plug-in Hybrid Vehicles (PHEVs) market, France Battery Electric Vehicles (BEVs) Market and France Hybrid Electric Vehicles (HEVs) Market. In November 2022, some 40,202 plug-in vehicles have been registered - new monthly record (up 8% year-over-year), including 38,658 passenger plug-ins and 1,544 commercial vehicles. The increasing sales for PHEVs is creating various opportunities for Plug-in Hybrid Vehicles market in France.EV Sales in France, From 2017 To 2029 (in thousand vehicles)

Government Initiatives for EV Adoption Creating Opportunities for the France Electric Vehicle Market Growth The government's coordinated programs and measures to promote the expansion of the electric vehicle market in France. France is a member of the EV30@30 Campaign, which aims to accelerate the adoption of electric vehicles. It establishes a common aspirational objective. The French government stated in 2018 that new cars generating greenhouse emissions will be banned from the market by 2040. The French government declared that by 2022, it plans to have a fleet of 1 million BEVs and PHEVs. In the framework of the France 2030 investment plan, the French government will invest USD 2.67 billion to support the production of nearly two million electric and hybrid vehicles. On 17th of March 2022, the government also stated the opening of a call for projects to support the deployment of high power charging stations for electric vehicles. The amount of aid for the deployment of charging infrastructure is expected to reach 40% of eligible costs. This scheme has a total budget of USD 320.87 million, including EUR 106.96 million from 2022. Projects is expected to be submitted until December 31, 2024. The Green Vehicle Incentives by European Government such as the recent introduced in 2023, the ‘green score’ system aim to champion not just the greenest EVs, but those predominantly manufactured in the European Union (EU) and, ideally, France. This system is expected to factor in six fresh CO2 emission variables, accounting for emissions from steel and aluminum production, usage of vital raw materials in the structure and battery of car and the logistics of transporting the car to its final destination. The incentives is expected to climb to USD 5341.18 per car and peak at USD 7477.65 for households with lower incomes. Battery Degradation and Replacement Costs Restraining the France Electric Vehicle Market growth The high costs of battery degradation and replacement is one of the primary restraints of the market. Despite the numerous advantages such as reduced emissions and lower operating costs, these issues cause concern among potential buyers. This affects the growth France’s Electric Car Models Market and EV Battery Technology Market resulting in the negative impact on EV market. Battery degradation leads to an increase operating costs. As the capacity of battery declines, the energy efficiency of vehicle also decreases. This means that owners have to charge their EV more frequently, which leads to higher electricity costs and potentially negating some of the cost savings associated with EV ownership. Some consumers are hesitant to purchase an EV due to the uncertainty of costs of future battery replacement, which range from several thousand euros to more than the value of the vehicle itself.

France Electric Vehicle Market Regional Insights

The Electric Vehicle Market of Paris has witnessed significant growth in the adoption of EVs. This is majorly attributed to a dense population, high urban traffic, and increasing efforts of governments to combat air pollution. Paris is strictly implementing air quality regulations and creating low-emission zones, which is promoting the use of EVs. To increase the number of EVs on the road and reduce air pollution, the Paris City Council has set ambitious targets. The region is significantly investing in public charging infrastructure, which is contributing to the growth of Electric Vehicle Charging Infrastructure Market and Electric Vehicle Charging Solutions Market in France. Rural regions of France have traditionally lagged behind in adoption of Electric Vehicles due to lower population density and fewer charging stations. However, government initiatives aim to address this issue by focusing on charging infrastructure in rural areas and providing incentives to promote their adoption in semi-urban and rural regions.France Electric Vehicle Market Segment Analysis

Based on Vehicle Type: the market is segmented into Hybrid Electric Passenger cars, Hybrid Electric light commercial vehicles, Plug-in Hybrid Passenger cars, Plug-in hybrid light commercial vehicles, Battery electric passenger cars and Battery electric light commercial vehicles. The Battery Electric Passenger Cars segment held the largest France Electric Vehicle Market share of around 44.6% in 2022. This is attributed to the rising popularity of Battery Electric Passenger Cars, which are also known as “BEVs”. The technological advancements in batteries have led to with extended driving ranges. Many modern BEVs offering wide range that comfortably cover daily commutes and longer trips, which reduces concerns about running out of power while on the road.Number of New Battery Electric Passenger Car Registrations in France from 2017 to 2022

Based on Charging Type: The market is divided into Normal Charging and Fast Charging. The Normal Charging segment dominated the market with the largest share. In France, many EV owners in France prefer to charge their vehicles at home using a normal charging station. This is because it is convenient option for them for overnight charging, especially for needs of daily commuting. It takes several hours which is suitable for overnight charging. Normal charging stations are also commonly used to provide a convenient and slow-charging solution for employees who park their EVs during the workday.

France Electric Vehicle Market Competitive Landscape

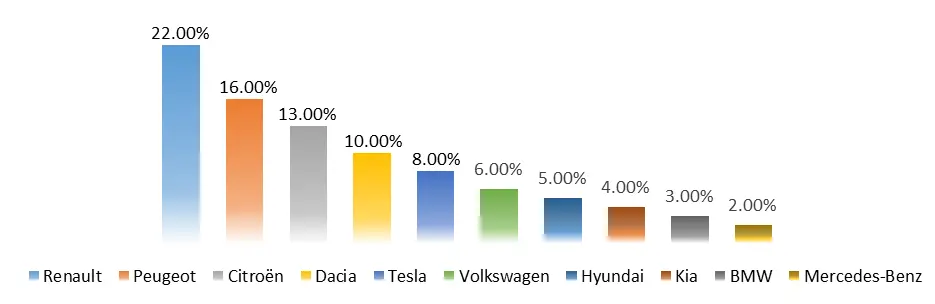

As per the study, the market is highly competitive, with several France Electric Vehicle manufacturers vying for market share. It has attracted many startups and new entrants, focusing on innovative EV solutions, which includes micro-mobility companies providing electric scooters and e-bikes for urban transportation. Automakers and tech companies in France are forming partnerships and collaborations for the development and deployment of electric vehicles, batteries and charging infrastructure. In February 2021, Jaguar and Land Rover revealed a dramatic change to its future product plans. The new road map is expected to see the companies focusing on the development of new electric models and platforms, consolidating their manufacturing and management processes, and transforming Jaguar into an all-electric brand by 2025.France Electric Vehicle Market Share of Key Players (%) in 2022

France Electric Vehicle Market Scope: Inquiry Before Buying

France Electric Vehicle Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: 18.88Bn Forecast Period 2023 to 2029 CAGR: 9.1 % Market Size in 2029: 34.74 Bn Segments Covered: by Product Two-Wheeler Passenger Car Commercial Vehicle by Vehicle Type Hybrid Electric Passenger cars Hybrid Electric light commercial vehicles Plug-in Hybrid Passenger cars Plug-in hybrid light commercial vehicles Battery electric passenger cars Battery electric light commercial vehicles by Charging Type Normal Charging Fast Charging France Electric Vehicle Key Players

1. Renault 2. Tesla 3. Nissan 4. Volkswagen 5. Hyundai 6. BMW 7. Kia 8. Audi 9. Mercedes-Benz 10. Peugeot 11. Volvo 12. Ford 13. Land Rover 14. Jaguar 15. Citroën 16. Dacia Frequently Asked Questions: 1) What was the France Electric Vehicle market size in 2022? Ans - France Electric Vehicle Market 2) What are the France Electric Vehicle Market segments? Ans -The market segments are based on Product, Vehicle Type and Charging Type. 3) What is the forecast period for the France Electric Vehicle Market report? Ans -The forecast period for France Electric Vehicle Market is 2023 to 2029. 4) What is the expected France Electric Vehicle market size in 2029? Ans – France Electric Vehicle Market is estimated as worth 34.74 Bn. Units. 5) Who are the top 5 Key players in France EV Market? Ans – Renault, Peugeot, Citroën, Dacia and Tesla are the top five key players in the France EV Market.

1. France Electric Vehicle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. France Electric Vehicle Market: Dynamics 2.1. France Electric Vehicle Market Trends 2.2. France Electric Vehicle Market Dynamics 2.2.1. Drivers 2.2.2. Restraints 2.2.3. Opportunities 2.2.4. Challenges 2.3. PORTER’s Five Modes Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape 2.7. Key Opinion Leader Analysis For the France Electric Vehicle Industry 2.8. Analysis of Government Schemes and Initiatives For the France Electric Vehicle Industry 2.9. The Global Pandemic Impact on the France Electric Vehicle Market 3. France Electric Vehicle Market: Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 3.1. France Electric Vehicle Market Size and Forecast, by Product (2022-2029) 3.1.1. Two-Wheeler 3.1.2. Passenger Car 3.1.3. Commercial Vehicle 3.2. France Electric Vehicle Market Size and Forecast, by Vehicle Type (2022-2029) 3.2.1. Hybrid Electric Passenger cars 3.2.2. Hybrid Electric light commercial vehicles 3.2.3. Plug-in Hybrid Passenger cars 3.2.4. Plug-in hybrid light commercial vehicles 3.2.5. Battery electric passenger cars 3.2.6. Battery electric light commercial vehicles 3.3. France Electric Vehicle Market Size and Forecast, by Charging Type (2022-2029) 3.3.1. Normal Charging 3.3.2. Fast Charging 4. France Electric Vehicle Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.3.1. Company Name 4.3.2. Product Segment 4.3.3. End-user Segment 4.3.4. Revenue (2022) 4.3.5. Company Locations 4.3.6. SKU Details 4.3.7. Production Capacity 4.3.8. Production for 2022 4.3.9. No. of Stores 4.4. Leading France Electric Vehicle Market Companies, by market capitalization 4.5. Market Structure 4.5.1. Market Leaders 4.5.2. Market Followers 4.5.3. Emerging Players 4.6. Mergers and Acquisitions Details 5. Company Profile: Key Players 5.1. Renault 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Scale of Operation (small, medium, and large) 5.1.7. Details on Partnership 5.1.8. Regulatory Accreditations and Certifications Received by Them 5.1.9. Awards Received by the Firm 5.1.10. Recent Developments 5.2. Tesla 5.3. Nissan 5.4. Volkswagen 5.5. Hyundai 5.6. BMW 5.7. Kia 5.8. Audi 5.9. Mercedes-Benz 5.10. Peugeot 5.11. Volvo 5.12. Ford 5.13. Land Rover 5.14. Jaguar 5.15. Citroën 5.16. Dacia 6. Key Findings 7. Industry Recommendations 8. France Electric Vehicle Market: Research Methodology 9. Terms and Glossary