The Food Safety Testing Market size was valued at USD 23.24 Billion in 2023 and the total Food Safety Testing revenue is expected to grow at a CAGR of 8.34% from 2024 to 2030, reaching nearly USD 40.72 Billion by 2030.Food Safety Testing Market Overview

The Global Food Safety Testing Market is a crucial component of the food safety ecosystem of food testing, which gives consumers reliance that the food is safe to ingest. Foods contaminated with physical, chemical, and microbial hazards from farm to fork, including production, processing, distribution, and storage pose a public health risk.To know about the Research Methodology :- Request Free Sample Report The substantial element stimulating the Food Safety Testing Market is the increasing occurrence of food-borne infections, adulterations in food, and risks to public health stimulating the government to apply stringent rules. As foodborne infections keep hindering productivity and pose a burden on public health, government agencies all over the globe foster food safety testing. The expansion of the global food supply chain necessitates comprehensive testing to ensure the safety of products crossing borders. Growing awareness among consumers regarding food safety issues and a demand for transparent information drive the need for robust testing. Different regions have varying regulatory standards, making compliance complex for businesses operating in multiple markets. While technological advancements enhance testing capabilities, adopting technologies can be slow. The food safety testing market includes a range of companies like Eurofins Scientific SE., SGS Group, and NSF International offering testing services, equipment, and solutions that drive the food safety testing market. The Food Testing Market is pivoting and leading to grow as an essential part of human health and food and nutrition security. Europe dominated the Food Safety Testing Market in 2023 with an annual revenue of around USD 3.5 - 4.2 billion, as it boasts rigorous food safety regulations like general food law, and Hazard Analysis & Critical Control Point (HACCP) systems. European customers are highly conscious of food safety and demand assurance through testing practices. Asia Pacific holds a market share of 28% and is the fastest-growing region due to rising incomes, international trade, stringent import regulations, and increasing awareness. China dominates the APAC region and is investing in advanced technologies to drive import and export to expand the market further.

Food Safety Testing Market Dynamics

Factors Driving Growth of Food Safety Testing Market The increasing awareness about safe and healthy food is the major driver for the Food Safety Testing Market. Customers are becoming mindful of nutritional choices and opting the products that are organic, non-GMO, and contribute to overall health. With the rising consciousness about various allergens and other dietary limitations, consumers are looking for products with specific dietary needs. The inclination towards products labelled with minimal additives, preservatives, and artificial agents and seeking food testing services to ensure the products are free from GMOs and other harmful pollutants are driving the Food Safety Testing Market. Integration of rapid technology such as PCR, LC-MS/MS, and immunoassay provide swift and precise results. As a result, it is beneficial for the detection of heavy metals, pathogens, and other contaminants. The Government and Regulatory bodies around the world are applying strict food safety regulations to guarantee the safety of food. As the food manufacturers need to comply with the rules and regulations the demand for the Food Safety Testing Market is burgeoning.Challenges Faced by Small and Medium Enterprises The food testing market faces a major challenge due to the high cost associated with the equipment and technology. Small and medium-sized enterprises (SEMEs) find it difficult to allocate resources for these advanced technology solutions, impacting their ability to conduct food testing. Addressing this challenge is crucial to ensure accessibility and uniform standards in food safety testing. Shortage of Skilled Professionals The food testing market encounters a notable hurdle as a major challenge is finding and retaining skilled individuals with expertise to operate the equipment, interpret the results, and stay updated with the advancement. The absence of skilled professionals affects food testing efficiency and poses a blockage for companies. As a result, the shortage of skilled professionals is a major challenge for companies looking to expand their services. Impact of Technological Advancements and Innovative Tools in the Global Market Technological advancements are developing rapidly in the food safety arena. Nanobiotechnology, Remote Senescing, Automation, and artificial intelligence in the food industry have started to garner attention by offering applications and benefits in nutrition and safety by providing better tools for detecting traceability and contaminants. Scientific innovation, digitalization, and technological advancements can pace faster international trade, be cost-effective, with greater market access, and increase food safety. Countries most affected by foodborne illness where analytical tools will be beneficial along with developing technical expertise to facilitate the understanding of new technology can be an opportunity for the Food Safety Testing Market.

Food Safety Testing Market Segment Analysis

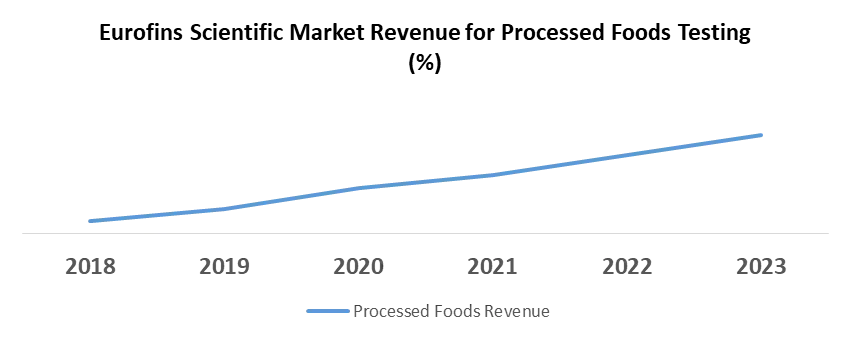

Based on Foods Tested, the Meat, poultry, and seafood segment held the largest market share of about 30% in the global food safety testing market in 2023. According to the MMR analysis, the segment is further expected to grow at a CAGR of 8.5 % during the forecast period and stands out as the dominant segment within the food safety testing market. Consumers being health conscious and increasing focus on the higher amount of protein intake the food safety strengthened this market segment analysis. Additionally, the quality of the meat, poultry, and fish is dependable on its tenderness, firmness, and toughness. While other food products can incorporate a variety of flavors to win consumer acceptance, meat, poultry, and seafood are dependable solely on the sensory evaluation for customer satisfaction. The stringent standards put forth by the regulatory bodies contribute to the testing at the manufacturing sites and assist the use of technology.Apart from that, the processed food segment is expected to grow at a rapid CAGR and be profitable for all the Food Safety Testing Industries around the globe in the forecast period. Processed foods require minimal preparation, are easy to store, and are easy to pack into lunchboxes. Convenience makes processed foods popular among busy customers in urban areas. To enhance the quality of processed foods manufacturers incorporate several colors, additives, and flavors to improve the texture, appearance, and shelf life of the product, which progressively have an impact on consumers depending upon their daily intake. Government agencies worldwide are imposing strict regulations on the safety of processed foods that necessitate frequent and rigorous testing. Overall the processed food segment is a significant and growing part of the food safety testing market.

Food Safety Testing Market Regional Insights

Europe dominated the global food safety testing market with the highest market share of over 22% in 2023. The region is expected to grow at a CAGR of 8.34% during the forecast period and maintain its dominance by 2030. Europe is at the forefront of adopting new technologies, raising consumer awareness, and focusing on organic foods driving the food safety testing market. In alignment with European Food Safety Regulations (EFSA), every food-related business is required to obtain food safety certification. There is a strong collaboration between government agencies, research institutions, and industry stakeholders that facilitates the development and implementation of an effective food safety testing market. North America is projected to witness significant growth in the global food safety testing market. The region is witnessing rapid technological advancements and progress in food safety science. Regulations like FSMA (Food Safety Modernization Act) by the FDA and USFDA make the region a top player in the market. Additionally, shifting consumption patterns, incidents of foodborne illnesses, limited availability of skilled personnel, and economic fluctuations are driving the demand for enhanced safety measures in the food industry. The Food Safety Testing Market in Asia Pacific is vibrant and rapidly growing. The rapid economic development, leading to increased urbanization and changes in lifestyle and dietary patterns results in growing demand for safe and quality food. Government authorities in the region are recognizing the importance of food safety to public health which is increasing focus on the safety regulations. With globalization, there is emphasis on the international trade and export of food from the Asia Pacific region necessitating the need for forceful food safety testing to ensure the quality of food. The Asia Pacific Food Safety Testing Market is growing through the combination of economic development, regulatory initiatives, international trade, consumer awareness, and technological advancements. Food Safety Testing Market Competitive Landscapes The global food safety testing market is expected to be highly competitive due to the active presence of numerous market players. Major companies are striving to introduce innovative testing methods, implement effective marketing strategies, and advertise their services to cater to the rising demand for safe food, ultimately pushing the market toward further growth. Additionally, the demand for reliable, rapid, and cost-effective testing solutions across various food segments, including processed foods, meat products, and fruits and vegetables, fuels innovation and product development within the market. 1. Eurofins Scientific, a global leader in agro science contract research services, announces the signing of an agreement to acquire the operations of SGS Crop Science in 14 countries in 2023. 2. In 2023, Merieux NutriSciences, a world leader in food safety, quality, and sustainability, announced the acquisition of Blonk, a leading international expert in food system sustainability. Blonk supports organizations to better understand their environmental impact in the agri-food value chain by offering LCA-based advice (Life Cycle Assessment) and developing tailored software tools based on the latest scientific developments and data. 3. For expansion with Electrical Safety, Electromagnetic Compatibility (EMC), Medical Device Biocompatibility, Toxicity, and Microbiology testing and certification services, TUV SUD in 2023 launched a laboratory and training Center at the Bengaluru Campus in India. Invests Euro 15 million in this state-of-the-art facility enabling faster access to domestic and international markets. 4. AsureQuality Limited a core company in food quality assurance offering certification, inspection, testing, and training announces its accreditation by IANZ (International Accreditation New Zealand) for rope spores; a defect occurred in most of the flour-based foods. 5. In 2023, Neogen launched a highly sensitive quantitative ELISA (Enzyme-Linked Immuno Sorbent Assay) for the detection of Walnut Allergens.

Food Safety Testing Market Scope: Inquiry Before Buying

Global Food Safety Testing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 23.24Bn. Forecast Period 2024 to 2030 CAGR: 8.34% Market Size in 2030: US$ 40.72 Bn. Segments Covered: by Food Tested Meat, Poultry, and Sea Food Dairy Products Processed Foods Fruits and Vegetables Cereals and Grains Beverages by Contaminants Targeted Pathogens Chemical Contaminants Allergens by Technology Polymerase Chain Reaction ImmunoAssay Technologies Chromatography and Spectroscopy Food Safety Testing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Food Safety Testing Market Key Players:

1. SGS S.A. 2. NSF International 3. Eurofins Scientific SE 4. Intertek Group PLC 5. Merieux Nutrisciences 6. TUV SUD 7. UL LLC 8. AsureQuality Limited 9. Bureau Veritas S.A. 10. Intertek Group plc 11. ALS Limited 12. Thermo Fisher Scientific Inc. 13. Mérieux NutriSciences Corporation 14. Neogen Corporation 15. Bio-Rad Laboratories, Inc. 16. PerkinElmer, Inc. 17. Romer Labs Division Holding GmbHFAQs:

1. What are the growth drivers for the Food Safety Testing market? Ans. Increasing urbanization, Rising Health Concerns, Shifting Consumer Preferences, etc. are expected to be the major drivers for the Food Safety Testing market. 2. What is the major challenge for the market growth? Ans. Consumer Awareness and demand, emerging contaminants, and technological advancements are expected to be the challenges in the food safety testing market. 3. Which region is expected to lead the global market during the forecast period? Ans. Asia Pacific is expected to lead the global Food Safety Testing market during the forecast period. 4. What is the projected market size & and growth rate of the Market? Ans. The Food Safety Testing Market size was valued at USD 23.24 Billion in 2023 and the total Food Safety Testing revenue is expected to grow at a CAGR of 8.34% from 2024 to 2030, reaching nearly USD 40.72 Billion By 2030. 5. What segments are covered in the Food Safety Testing Market report? Ans. The segments covered in the Food Safety Testing market report are Food Tested Type, Contaminants Targeted, Technology, and Region.

1. Food Safety Testing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Food Safety Testing Market: Dynamics 2.1. Preference Analysis 2.2. Food Safety Testing Market Trends by Region 2.2.1. North America Food Safety Testing Market Trends 2.2.2. Europe Food Safety Testing Market Trends 2.2.3. Asia Pacific Food Safety Testing Market Trends 2.2.4. Middle East and Africa Food Safety Testing Market Trends 2.2.5. South America Food Safety Testing Market Trends 2.3. Food Safety Testing Market Dynamics by Region 2.3.1. North America 2.3.1.1. North America Food Safety Testing Market Drivers 2.3.1.2. North America Food Safety Testing Market Restraints 2.3.1.3. North America Food Safety Testing Market Opportunities 2.3.1.4. North America Food Safety Testing Market Challenges 2.3.2. Europe 2.3.2.1. Europe Food Safety Testing Market Drivers 2.3.2.2. Europe Food Safety Testing Market Restraints 2.3.2.3. Europe Food Safety Testing Market Opportunities 2.3.2.4. Europe Food Safety Testing Market Challenges 2.3.3. Asia Pacific 2.3.3.1. Asia Pacific Food Safety Testing Market Drivers 2.3.3.2. Asia Pacific Food Safety Testing Market Restraints 2.3.3.3. Asia Pacific Food Safety Testing Market Opportunities 2.3.3.4. Asia Pacific Food Safety Testing Market Challenges 2.3.4. Middle East and Africa 2.3.4.1. Middle East and Africa Food Safety Testing Market Drivers 2.3.4.2. Middle East and Africa Food Safety Testing Market Restraints 2.3.4.3. Middle East and Africa Food Safety Testing Market Opportunities 2.3.4.4. Middle East and Africa Food Safety Testing Market Challenges 2.3.5. South America 2.3.5.1. South America Food Safety Testing Market Drivers 2.3.5.2. South America Food Safety Testing Market Restraints 2.3.5.3. South America Food Safety Testing Market Opportunities 2.3.5.4. South America Food Safety Testing Market Challenges 2.4. PORTER’s Five Forces Analysis 2.5. PESTLE Analysis 2.6. Value Chain - Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Key Opinion Leader Analysis For the Food Safety Testing Industry 2.9. Analysis of Government Schemes and Initiatives For the Food Safety Testing Industry 2.10. The Global Pandemic's Impact on the Food Safety Testing Market 2.11. Food Safety Testing Price Trend Analysis (2021-22) 3. Food Safety Testing Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 3.1. Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 3.1.1. Meat, Processed Foods and Sea Food 3.1.2. Dairy Products 3.1.3. Processed Foods 3.1.4. Fruits and Vegetables 3.1.5. Cereals and Grains 3.1.6. Beverages 3.2. Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 3.2.1. Pathogens 3.2.2. Chemical Contaminants 3.2.3. Allergens 3.3. Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 3.3.1. Polymerase Chain Reaction 3.3.2. ImmunoAssay Technologies 3.4. Food Safety Testing Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Food Safety Testing Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 4.1. North America Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 4.1.1. Meat, Processed Foods and Sea Food 4.1.2. Dairy Products 4.1.3. Processed Foods 4.1.4. Fruits and Vegetables 4.1.5. Cereals and Grains 4.1.6. Beverages 4.2. North America Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 4.2.1. Pathogens 4.2.2. Chemical Contaminants 4.2.3. Allergens 4.3. North America Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 4.3.1. Polymerase Chain Reaction 4.3.2. ImmunoAssay Technologies 4.4. North America Food Safety Testing Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 4.4.1.1.1. Meat, Processed Foods and Sea Food 4.4.1.1.2. Dairy Products 4.4.1.1.3. Processed Foods 4.4.1.1.4. Fruits and Vegetables 4.4.1.1.5. Cereals and Grains 4.4.1.1.6. Beverages 4.4.1.2. United States Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 4.4.1.2.1. Pathogens 4.4.1.2.2. Chemical Contaminants 4.4.1.2.3. Allergens 4.4.1.3. United States Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 4.4.1.3.1. Polymerase Chain Reaction 4.4.1.3.2. ImmunoAssay Technologies 4.4.2. Canada 4.4.2.1. Canada Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 4.4.2.1.1. Meat, Processed Foods and Sea Food 4.4.2.1.2. Dairy Products 4.4.2.1.3. Processed Foods 4.4.2.1.4. Fruits and Vegetables 4.4.2.1.5. Cereals and Grains 4.4.2.1.6. Beverages 4.4.2.2. Canada Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 4.4.2.2.1. Pathogens 4.4.2.2.2. Chemical Contaminants 4.4.2.2.3. Allergens 4.4.2.3. Canada Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 4.4.2.3.1. Polymerase Chain Reaction 4.4.2.3.2. ImmunoAssay Technologies 4.4.3. Mexico 4.4.3.1. Mexico Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 4.4.3.1.1. Meat, Processed Foods and Sea Food 4.4.3.1.2. Dairy Products 4.4.3.1.3. Processed Foods 4.4.3.1.4. Fruits and Vegetables 4.4.3.1.5. Cereals and Grains 4.4.3.1.6. Beverages 4.4.3.2. Mexico Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 4.4.3.2.1. Pathogens 4.4.3.2.2. Chemical Contaminants 4.4.3.2.3. Allergens 4.4.3.3. Mexico Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 4.4.3.3.1. Polymerase Chain Reaction 4.4.3.3.2. ImmunoAssay Technologies 5. Europe Food Safety Testing Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 5.1. Europe Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 5.2. Europe Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 5.3. Europe Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 5.4. Europe Food Safety Testing Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 5.4.1.2. United Kingdom Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 5.4.1.3. United Kingdom Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 5.4.2. France 5.4.2.1. France Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 5.4.2.2. France Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 5.4.2.3. France Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 5.4.3.2. Germany Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 5.4.3.3. Germany Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 5.4.4. Italy 5.4.4.1. Italy Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 5.4.4.2. Italy Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 5.4.4.3. Italy Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 5.4.5.2. Spain Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 5.4.5.3. Spain Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 5.4.6.2. Sweden Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 5.4.6.3. Sweden Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 5.4.7. Austria 5.4.7.1. Austria Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 5.4.7.2. Austria Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 5.4.7.3. Austria Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 5.4.8.2. Rest of Europe Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 5.4.8.3. Rest of Europe Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6. Asia Pacific Food Safety Testing Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 6.1. Asia Pacific Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.2. Asia Pacific Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.3. Asia Pacific Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6.4. Asia Pacific Food Safety Testing Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.4.1.2. China Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.4.1.3. China Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.4.2.2. S Korea Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.4.2.3. S Korea Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6.4.3. Japan 6.4.3.1. Japan Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.4.3.2. Japan Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.4.3.3. Japan Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6.4.4. India 6.4.4.1. India Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.4.4.2. India Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.4.4.3. India Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6.4.5. Australia 6.4.5.1. Australia Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.4.5.2. Australia Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.4.5.3. Australia Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.4.6.2. Indonesia Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.4.6.3. Indonesia Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.4.7.2. Malaysia Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.4.7.3. Malaysia Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.4.8.2. Vietnam Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.4.8.3. Vietnam Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.4.9.2. Taiwan Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.4.9.3. Taiwan Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 6.4.10.2. Rest of Asia Pacific Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 6.4.10.3. Rest of Asia Pacific Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 7. Middle East and Africa Food Safety Testing Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030 7.1. Middle East and Africa Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 7.2. Middle East and Africa Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 7.3. Middle East Asia and Africa Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 7.4. Middle East and Africa Food Safety Testing Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 7.4.1.2. South Africa Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 7.4.1.3. South Africa Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 7.4.2. GCC 7.4.2.1. GCC Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 7.4.2.2. GCC Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 7.4.2.3. GCC Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 7.4.3.2. Nigeria Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 7.4.3.3. Nigeria Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 7.4.4.2. Rest of ME&A Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 7.4.4.3. Rest of ME&A Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 8. South America Food Safety Testing Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030 8.1. South America Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 8.2. South America Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 8.3. South America Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 8.4. South America Food Safety Testing Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 8.4.1.2. Brazil Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 8.4.1.3. Brazil Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 8.4.2.2. Argentina Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 8.4.2.3. Argentina Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Food Safety Testing Market Size and Forecast, by Food Tested (2023-2030) 8.4.3.2. Rest Of South America Food Safety Testing Market Size and Forecast, by Contaminants Targeted(2023-2030) 8.4.3.3. Rest of South America Food Safety Testing Market Size and Forecast, by Technology(2023-2030) 9. Global Food Safety Testing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Food Tested Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Food Safety Testing Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Boston Food Safety Testing Co. LLC. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Conagra Brands 10.3. Country Archer Food Safety Testing Co 10.4. Devour Foods 10.5. Golden Island Food Safety Testing Company Inc 10.6. Jack Link's Meat, Processed Foods, and Sea Food Food Safety Testing 10.7. Newport Food Safety Testing Company 10.8. Oberto Snacks Inc 10.9. The Blue Ox Food Safety Testing Company 10.10. The Hershey Company 10.11. Old Trapper Meat, Processed Foods, and Sea Food Food Safety Testing 10.12. General Mills Inc. 10.13. Chef's Cut Real Food Safety Testing 10.14. Frito-Lay North America, Inc. 10.15. Tillamook Country Smoker 10.16. The Meatsnacks Group 11. Key Findings 12. Industry Recommendations 13. Food Safety Testing Market: Research Methodology