The Foam Market size was valued at USD 108.44 Billion in 2024 and the total Foam revenue is expected to grow at a CAGR of 4.81% from 2025 to 2032, reaching nearly USD 157.92 Billion.Foam Market overview:

Foams are materials created by trapping pockets of gas within a liquid or solid matrix. Solid foams belong to a class of lightweight cellular engineering materials. The primary chemical resins used in foam production include polyurethane, polystyrene, phenolic, and polyvinyl chloride (PVC). Based on their cell structure, such as open-cell or closed-cell foams can be broadly categorized as flexible or rigid. They provide excellent insulation and protection against abrasion, temperature variations, moisture, impact, and corrosion. Foams offer several advantages, including being lightweight, non-toxic, and hypoallergenic. Consequently, they are widely utilized across various industries, including furniture, construction, packaging, electronics, aerospace, and medical sectors. The construction and automotive industries, in particular, benefit from the versatility of polyurethane (PU) foam, which helps address challenges such as weight reduction, stress absorption, improved fuel efficiency, and enhanced durability. These factors are expected to drive the growth of the global Foam Market during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Foam Market Dynamics

Increase in Demand for Polyurethane Foam in Building Insulation for Energy Conservation to Favor the Foam Industry Growth Polyurethane foam is used in the furniture, construction and manufacturing, telecommunications, and automotive sectors. In the automobile sector, flexible polyurethane foam is commonly utilized for cushioning. It is one of the most effective insulating materials known, making it ideal for use in the electrical sector, particularly in refrigerators and freezers. The construction sector consumes the most polyurethane foam, which is used in stiff insulation, coatings, and sealants and adhesives. Polyurethane foams are extremely flexible materials that contribute to lower total infrastructure costs by reducing energy consumption in buildings. This is due to the fact that they are easily available and inexpensive solutions that last longer and are utilized for energy storage, resulting in lower carbon emissions. As a result, there is a significant demand for polyurethane foam in building insulation for energy saving, which is expected to drive the Foam Market. Foam is utilized in the construction and industrial industries for sealing and thermal insulation. Because of its flexibility and non-fibrous characteristics, it is an excellent thermal and acoustic insulator. The foam is increasingly being utilized in household buildings in cold countries, where there are large temperature changes between the interior and outdoors, to assist in preserving warmth during cold periods. Increasing Demand for Lightweight and Fuel-Efficient Aircraft to Drive Foam Industry Due to the increased need for qualities such as weight reduction, extreme resistance, insulation, radar absorption, and fuel economy, the use of foams in aerospace production has increased in recent years. The foam materials help reduce aircraft maintenance costs since they do not rust or corrode. Aside from these benefits, foam decreases the total weight of the airplane because of its excellent strength-to-weight ratios when compared to metals, allowing the aircraft to travel farther and carry more people. Polyurethane foam is widely used in rigid foam insulation panels, high-resiliency flexible foam seating, robust elastomeric tires and wheels, microcellular foam seals and gaskets, and hard plastic parts, electronic mechanisms, and many other applications. Polyurethane can withstand environments that most other materials cannot. This is due mostly to its adaptability during manufacturing. PU foam is also a wonder worker for spaceships. This is estimated to drive the growth of the Foam Market during the forecast period.Rise in Demand of Foam in Electronics Packaging: A Driver of Foam Market Growth An increase in the use of electronic items such as smartphones and LED televisions is expected to fuel market demand for foam in electronics packaging. Such foams can absorb stress and vibration while also providing cushioning capabilities, making them an excellent alternative for electronic equipment protective packaging. Polyurethane foam is commonly used in refrigerators and freezers that require not only interior temperature maintenance but also thermal isolation from external surroundings. Polyurethane's adhesive capabilities guarantee that the material is placed evenly during the production process, reducing drop, surface unevenness, and other unwanted attributes. This prevents heat transmission between layers and helps appliances improve their energy ratings. Polyurethane helps to protect the appliance from rust and heat over time, preserving both the device's beauty and performance. Polyurethane may be used to apply a wide range of colors on the outer casing for coatings, due to which the demand for polyurethane in the electronics industry has increased. This increased demand for polyurethane in the electronics industry is estimated to drive the growth of the Foam Market during the forecast period. Production of Bio-Based Polyols to Increase the Foam Demand Polyols are a kind of polymer that is utilized in the production of polyurethane foam. Because of growing worries about our reliance on fossil fuels and the environmental effects of plastics, the polyurethane foam sector is always striving toward sustainability. Previous years were uncertain for the oil sector, and this had a significant impact on the competitiveness of the polyurethane foam industry. It provided foam market players with a good chance to develop bio-based polyols for use in the production of polyurethane foams and other applications. Polyols improve efficiency and sustainability. They are appropriate raw materials for the production of a wide variety of end goods and applications, such as flexible foam, rigid foam, coatings, adhesives, sealants, and elastomers. Thanks to this, the demand for bio-based polyols has increased and is estimated to drive the growth of the foam market. Stringent Regulations Regarding the Use of PU Foams to Restrain the Growth of Foam Market The specific laws governing the production of flexible polyurethane foam are viewed as a barrier to the expansion of the polyurethane foam market. The U.S. Environmental Protection Agency's (EPA) National Emission Standards for Hazardous Air Pollutants (NESHAP) environmental laws contain some criteria for new and existing plant locations that make flexible polyurethane foam. Stringent environmental laws and the health risks connected with the usage of toluene diisocyanate (TDI) and methylenediphenyl diisocyanate (MDI) as raw ingredients in the manufacturing of PU foams are the key obstacles impeding global foam market growth. The health consequences of TDI and MDI are dependent on how frequently and for how long a consumer is exposed. Certain individuals who have been exposed to TDI and MDI have developed asthma symptoms such as wheezing and shortness of breath. During the forecast period, these health hazards are expected to restrain foam industry growth. As a result, such rigorous laws surrounding the use of PU foams that are still in place, as well as the new regulations that are being implemented, may operate as limitations in the foam industry.

Foam Market Segment Analysis

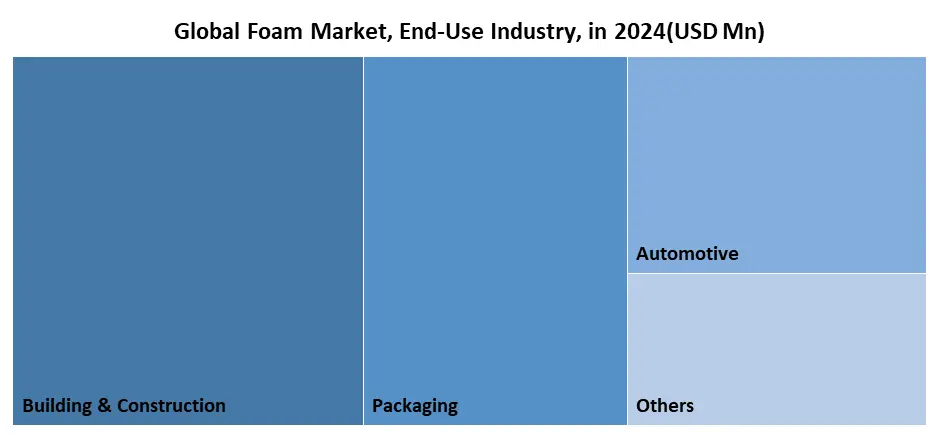

Based on Resin Type, the Foam Market is segmented into Polyurethane, Polystyrene, Polyolefin, Phenolic, PET, and Others. The Polyurethane segment held the largest market share in 2024. The growing need for lightweight and extremely durable goods in sectors such as automotive, construction, and electronics, particularly in emerging nations such as China, India, and Indonesia, is expected to boost the polyurethane segment. Flexible foam is in great demand in a variety of items, including mattresses, pillows, and automotive seats, as well as insulative products. Flexible polyurethane foams (FPU) are totally recyclable, which is bolstered by legislative backing for their use. Polyurethane (PU) demand in building components such as insulative protective materials, external panels, and housing electronics is likely to be driven by the Asia Pacific's developing construction sector. The growing automotive and packaging sectors are also contributing to the APAC Foam Market’s rapid growth. The Polystyrene segment is expected to witness significant growth over the forecast period. (PS) Foam is utilized in clear items such as food packaging. Polystyrene food service packaging is more insulating, lasts longer, and costs less than alternatives. Polystyrene foam is commonly used in the production of lightweight and safe packaging. It is also often used in various forms of packaging to protect CD and DVD cases and other electronic equipment from damage or spoilage. The increased use and demand for lightweight and durable packaging are driving up the need for EPS.Based on End-Use Industry, the Foam Market is segmented into Building & Construction, Packaging, Automotive, Furniture & Bedding, Footwear, Sports & Recreational, and Others. Thanks to the growing construction sector around the world, the Building & Construction segment is expected to account for a sizably substantial revenue share over the forecast period. Research indicates that by 2032, the global construction market is expected to reach USD 15.5 trillion. With 57% of global growth coming from China, the United States, and India, these three countries are leading the way, and structural foam is expected to be in high demand. The Packaging segment is expected to witness significant growth over the forecast period. High-density foams are mainly used for the packaging industry. The foams used in electronics packaging are able to dissipate the energies of an impact and spread the absorption out over time. Such foams are able to absorb shock and vibration while allowing cushioning properties, which makes them an appropriate choice for the protective packaging of electronic appliances. The rise in demand for various lightweight foams in food and electronics packaging applications positively influences market growth. Furthermore, foams used as reusable packaging have wide applications for packaging highly sensitive units.

Foam Market Regional Insights

The Foam industry growth in the Asia Pacific is primarily driven by the massive growth of the construction and building sector, as well as the rising demand for foam in the furniture industry. The widespread use of various home furnishing items, such as foam-based mattresses, pillows, bed linens, etc., that provide superior comfort by evenly distributing body weight and pressure, is escalating product demand. Additionally, foam is becoming more popular for making a variety of automobile parts, including seats, bumpers, and other exterior parts, which help to further improve the overall fuel efficiency of the vehicle. These factors are expected to drive the growth of the Foam Market in the APAC region. The North America foam industry is expected to grow at the highest growth rate through the forecast period. The region’s growth is attributed to the growing use of foam in wind turbines, automobiles, and building and construction projects, particularly in the U.S. and Canada. Research indicates that the construction sector contributed USD 900 billion to the American economy in the first three months of 2020, fueling a significant demand for structural foam in the nation. The lightweight core of the structural foam is also ideal for wind turbine blades. Foam is in great demand due to the region's increasing use of wind energy.The United States added a record 16,836 Megawatts (MW) of wind power capacity in 2020, bringing the country's total to 121,955 MW. With an investment of USD 24.6 billion, wind power installations recently surpassed solar power installations for the first time. In 16 states, wind power generates more than 10% of the electricity, while in Kansas, Iowa, Oklahoma, North Dakota, and South Dakota, it generates more than 30%. These factors are expected to drive the growth of the Foam Market in the North America region.

Foam Market Scope: Inquire before buying

Global Foam Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 108.44 Bn. Forecast Period 2025 to 2032 CAGR: 4.81 % Market Size in 2032: USD 157.92 Bn. Segments Covered: by Resin Type Polyurethane Polystyrene Polyolefin Phenolic PET Others by Type Flexible Foam Rigid Foam Building & Construction Packaging by End-Use Industry Automotive Others Foam Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Foam Market, Key Players are

1. Rogers Corporation (U.S.) 2. Sealed Air Corporation(U.S.) 3. DuPont (U.S.) 4. The Dow Company (US) 5. Nova Chemicals Corp (Canada) 6. Alpek (Mexico) 7. JSP (Japan) 8. Kaneka Corporation (Japan) 9. Loyal Group (China) 10. Jiangsu Leasty Chemicals Co., Ltd. (China) 11. Wuxi Xingda New Foam Plastics Materials Co., Ltd. (China) 12. Taita Chemical Co., Ltd.. (Taiwan) 13. Reliance Industries (India) 14. BASF (Germany) 15. Armacell International S.A. (Germany) 16. Recticel (Belgium) 17. Arkema (France) 18. Zotefoams Plc (UK) 19. Synthos S.A (Poland) 20. Total SE (France) 21. Versalis S.p.A (Italy) 22. SABIC (Saudi Arabia)Frequently Asked Questions:

1] What was the Global Foam Market size in 2024? Ans: The Global Foam Market size was USD 108.44 Billion in 2024. 2] What are the major players currently dominating the global Foam market? Ans. Rogers Corporation (U.S.), JSP (Japan), Kaneka Corporation (Japan), DuPont (U.S.), The Dow Company (US), Jiangsu Leasty Chemicals Co., Ltd. (China), BASF SE (Germany), and Total SE (France) are among the major players currently dominating the global foam market. 3] Which Foam market segment has the potential to register the highest market share during the forecast period? Ans. The Building & Construction end-user segment has the potential to generate highest revenue share of the Foam market, in terms of volume and value, during the forecast period. 4] Which is the dominating region in the global Foam market? Ans. Asia Pacific region is the dominating region in the global Foam market. Countries like China, India, Taiwan, Japan, Malaysia, Thailand, South Korea are emerging economies with the fastest-growing market share of the region. 5] What is the major factor driving the growth of Foam market in the Asia Pacific region? Ans. Increase in demand for polyurethane foam in building insulation for energy conservation is one of the factors driving the growth of Foam market in Asia Pacific region.

1. Foam Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Foam Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Foam Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Foam Market: Dynamics 3.1. Foam Market Trends by Region 3.1.1. North America Foam Market Trends 3.1.2. Europe Foam Market Trends 3.1.3. Asia Pacific Foam Market Trends 3.1.4. Middle East and Africa Foam Market Trends 3.1.5. South America Foam Market Trends 3.2. Foam Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Foam Market Drivers 3.2.1.2. North America Foam Market Restraints 3.2.1.3. North America Foam Market Opportunities 3.2.1.4. North America Foam Market Challenges 3.2.2. Europe 3.2.2.1. Europe Foam Market Drivers 3.2.2.2. Europe Foam Market Restraints 3.2.2.3. Europe Foam Market Opportunities 3.2.2.4. Europe Foam Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Foam Market Drivers 3.2.3.2. Asia Pacific Foam Market Restraints 3.2.3.3. Asia Pacific Foam Market Opportunities 3.2.3.4. Asia Pacific Foam Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Foam Market Drivers 3.2.4.2. Middle East and Africa Foam Market Restraints 3.2.4.3. Middle East and Africa Foam Market Opportunities 3.2.4.4. Middle East and Africa Foam Market Challenges 3.2.5. South America 3.2.5.1. South America Foam Market Drivers 3.2.5.2. South America Foam Market Restraints 3.2.5.3. South America Foam Market Opportunities 3.2.5.4. South America Foam Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Foam Industry 3.8. Analysis of Government Schemes and Initiatives For Foam Industry 3.9. Foam Market Trade Analysis 3.10. The Global Pandemic Impact on Foam Market 4. Foam Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2025-2032 4.1. Foam Market Size and Forecast, by Resin Type (2025-2032) 4.1.1. Polyurethane 4.1.2. Polystyrene 4.1.3. Polyolefin 4.1.4. Phenolic 4.1.5. PET 4.1.6. Others 4.2. Foam Market Size and Forecast, by Type (2025-2032) 4.2.1. Flexible Foam 4.2.2. Rigid Foam 4.2.3. Building & Construction 4.2.4. Packaging 4.3. Foam Market Size and Forecast, by End Use Industry (2025-2032) 4.3.1. Automotive 4.3.2. Others 4.4. Foam Market Size and Forecast, by Region (2025-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Foam Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 5.1. North America Foam Market Size and Forecast, by Resin Type (2025-2032) 5.1.1. Polyurethane 5.1.2. Polystyrene 5.1.3. Polyolefin 5.1.4. Phenolic 5.1.5. PET 5.1.6. Others 5.2. North America Foam Market Size and Forecast, by Type (2025-2032) 5.2.1. Flexible Foam 5.2.2. Rigid Foam 5.2.3. Building & Construction 5.2.4. Packaging 5.3. North America Foam Market Size and Forecast, by End Use Industry (2025-2032) 5.3.1. Automotive 5.3.2. Others 5.4. North America Foam Market Size and Forecast, by Country (2025-2032) 5.4.1. United States 5.4.1.1. United States Foam Market Size and Forecast, by Resin Type (2025-2032) 5.4.1.1.1. Polyurethane 5.4.1.1.2. Polystyrene 5.4.1.1.3. Polyolefin 5.4.1.1.4. Phenolic 5.4.1.1.5. PET 5.4.1.1.6. Others 5.4.1.2. United States Foam Market Size and Forecast, by Type (2025-2032) 5.4.1.2.1. Flexible Foam 5.4.1.2.2. Rigid Foam 5.4.1.2.3. Building & Construction 5.4.1.2.4. Packaging 5.4.1.3. United States Foam Market Size and Forecast, by End Use Industry (2025-2032) 5.4.1.3.1. Automotive 5.4.1.3.2. Others 5.4.2. Canada 5.4.2.1. Canada Foam Market Size and Forecast, by Resin Type (2025-2032) 5.4.2.1.1. Polyurethane 5.4.2.1.2. Polystyrene 5.4.2.1.3. Polyolefin 5.4.2.1.4. Phenolic 5.4.2.1.5. PET 5.4.2.1.6. Others 5.4.2.2. Canada Foam Market Size and Forecast, by Type (2025-2032) 5.4.2.2.1. Flexible Foam 5.4.2.2.2. Rigid Foam 5.4.2.2.3. Building & Construction 5.4.2.2.4. Packaging 5.4.2.3. Canada Foam Market Size and Forecast, by End Use Industry (2025-2032) 5.4.2.3.1. Automotive 5.4.2.3.2. Others 5.4.3. Mexico 5.4.3.1. Mexico Foam Market Size and Forecast, by Resin Type (2025-2032) 5.4.3.1.1. Polyurethane 5.4.3.1.2. Polystyrene 5.4.3.1.3. Polyolefin 5.4.3.1.4. Phenolic 5.4.3.1.5. PET 5.4.3.1.6. Others 5.4.3.2. Mexico Foam Market Size and Forecast, by Type (2025-2032) 5.4.3.2.1. Flexible Foam 5.4.3.2.2. Rigid Foam 5.4.3.2.3. Building & Construction 5.4.3.2.4. Packaging 5.4.3.3. Mexico Foam Market Size and Forecast, by End Use Industry (2025-2032) 5.4.3.3.1. Automotive 5.4.3.3.2. Others 6. Europe Foam Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 6.1. Europe Foam Market Size and Forecast, by Resin Type (2025-2032) 6.2. Europe Foam Market Size and Forecast, by Type (2025-2032) 6.3. Europe Foam Market Size and Forecast, by End Use Industry (2025-2032) 6.4. Europe Foam Market Size and Forecast, by Country (2025-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Foam Market Size and Forecast, by Resin Type (2025-2032) 6.4.1.2. United Kingdom Foam Market Size and Forecast, by Type (2025-2032) 6.4.1.3. United Kingdom Foam Market Size and Forecast, by End Use Industry (2025-2032) 6.4.2. France 6.4.2.1. France Foam Market Size and Forecast, by Resin Type (2025-2032) 6.4.2.2. France Foam Market Size and Forecast, by Type (2025-2032) 6.4.2.3. France Foam Market Size and Forecast, by End Use Industry (2025-2032) 6.4.3. Germany 6.4.3.1. Germany Foam Market Size and Forecast, by Resin Type (2025-2032) 6.4.3.2. Germany Foam Market Size and Forecast, by Type (2025-2032) 6.4.3.3. Germany Foam Market Size and Forecast, by End Use Industry (2025-2032) 6.4.4. Italy 6.4.4.1. Italy Foam Market Size and Forecast, by Resin Type (2025-2032) 6.4.4.2. Italy Foam Market Size and Forecast, by Type (2025-2032) 6.4.4.3. Italy Foam Market Size and Forecast, by End Use Industry (2025-2032) 6.4.5. Spain 6.4.5.1. Spain Foam Market Size and Forecast, by Resin Type (2025-2032) 6.4.5.2. Spain Foam Market Size and Forecast, by Type (2025-2032) 6.4.5.3. Spain Foam Market Size and Forecast, by End Use Industry (2025-2032) 6.4.6. Sweden 6.4.6.1. Sweden Foam Market Size and Forecast, by Resin Type (2025-2032) 6.4.6.2. Sweden Foam Market Size and Forecast, by Type (2025-2032) 6.4.6.3. Sweden Foam Market Size and Forecast, by End Use Industry (2025-2032) 6.4.7. Austria 6.4.7.1. Austria Foam Market Size and Forecast, by Resin Type (2025-2032) 6.4.7.2. Austria Foam Market Size and Forecast, by Type (2025-2032) 6.4.7.3. Austria Foam Market Size and Forecast, by End Use Industry (2025-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Foam Market Size and Forecast, by Resin Type (2025-2032) 6.4.8.2. Rest of Europe Foam Market Size and Forecast, by Type (2025-2032) 6.4.8.3. Rest of Europe Foam Market Size and Forecast, by End Use Industry (2025-2032) 7. Asia Pacific Foam Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 7.1. Asia Pacific Foam Market Size and Forecast, by Resin Type (2025-2032) 7.2. Asia Pacific Foam Market Size and Forecast, by Type (2025-2032) 7.3. Asia Pacific Foam Market Size and Forecast, by End Use Industry (2025-2032) 7.4. Asia Pacific Foam Market Size and Forecast, by Country (2025-2032) 7.4.1. China 7.4.1.1. China Foam Market Size and Forecast, by Resin Type (2025-2032) 7.4.1.2. China Foam Market Size and Forecast, by Type (2025-2032) 7.4.1.3. China Foam Market Size and Forecast, by End Use Industry (2025-2032) 7.4.2. S Korea 7.4.2.1. S Korea Foam Market Size and Forecast, by Resin Type (2025-2032) 7.4.2.2. S Korea Foam Market Size and Forecast, by Type (2025-2032) 7.4.2.3. S Korea Foam Market Size and Forecast, by End Use Industry (2025-2032) 7.4.3. Japan 7.4.3.1. Japan Foam Market Size and Forecast, by Resin Type (2025-2032) 7.4.3.2. Japan Foam Market Size and Forecast, by Type (2025-2032) 7.4.3.3. Japan Foam Market Size and Forecast, by End Use Industry (2025-2032) 7.4.4. India 7.4.4.1. India Foam Market Size and Forecast, by Resin Type (2025-2032) 7.4.4.2. India Foam Market Size and Forecast, by Type (2025-2032) 7.4.4.3. India Foam Market Size and Forecast, by End Use Industry (2025-2032) 7.4.5. Australia 7.4.5.1. Australia Foam Market Size and Forecast, by Resin Type (2025-2032) 7.4.5.2. Australia Foam Market Size and Forecast, by Type (2025-2032) 7.4.5.3. Australia Foam Market Size and Forecast, by End Use Industry (2025-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Foam Market Size and Forecast, by Resin Type (2025-2032) 7.4.6.2. Indonesia Foam Market Size and Forecast, by Type (2025-2032) 7.4.6.3. Indonesia Foam Market Size and Forecast, by End Use Industry (2025-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Foam Market Size and Forecast, by Resin Type (2025-2032) 7.4.7.2. Malaysia Foam Market Size and Forecast, by Type (2025-2032) 7.4.7.3. Malaysia Foam Market Size and Forecast, by End Use Industry (2025-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Foam Market Size and Forecast, by Resin Type (2025-2032) 7.4.8.2. Vietnam Foam Market Size and Forecast, by Type (2025-2032) 7.4.8.3. Vietnam Foam Market Size and Forecast, by End Use Industry (2025-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Foam Market Size and Forecast, by Resin Type (2025-2032) 7.4.9.2. Taiwan Foam Market Size and Forecast, by Type (2025-2032) 7.4.9.3. Taiwan Foam Market Size and Forecast, by End Use Industry (2025-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Foam Market Size and Forecast, by Resin Type (2025-2032) 7.4.10.2. Rest of Asia Pacific Foam Market Size and Forecast, by Type (2025-2032) 7.4.10.3. Rest of Asia Pacific Foam Market Size and Forecast, by End Use Industry (2025-2032) 8. Middle East and Africa Foam Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 8.1. Middle East and Africa Foam Market Size and Forecast, by Resin Type (2025-2032) 8.2. Middle East and Africa Foam Market Size and Forecast, by Type (2025-2032) 8.3. Middle East and Africa Foam Market Size and Forecast, by End Use Industry (2025-2032) 8.4. Middle East and Africa Foam Market Size and Forecast, by Country (2025-2032) 8.4.1. South Africa 8.4.1.1. South Africa Foam Market Size and Forecast, by Resin Type (2025-2032) 8.4.1.2. South Africa Foam Market Size and Forecast, by Type (2025-2032) 8.4.1.3. South Africa Foam Market Size and Forecast, by End Use Industry (2025-2032) 8.4.2. GCC 8.4.2.1. GCC Foam Market Size and Forecast, by Resin Type (2025-2032) 8.4.2.2. GCC Foam Market Size and Forecast, by Type (2025-2032) 8.4.2.3. GCC Foam Market Size and Forecast, by End Use Industry (2025-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Foam Market Size and Forecast, by Resin Type (2025-2032) 8.4.3.2. Nigeria Foam Market Size and Forecast, by Type (2025-2032) 8.4.3.3. Nigeria Foam Market Size and Forecast, by End Use Industry (2025-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Foam Market Size and Forecast, by Resin Type (2025-2032) 8.4.4.2. Rest of ME&A Foam Market Size and Forecast, by Type (2025-2032) 8.4.4.3. Rest of ME&A Foam Market Size and Forecast, by End Use Industry (2025-2032) 9. South America Foam Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 9.1. South America Foam Market Size and Forecast, by Resin Type (2025-2032) 9.2. South America Foam Market Size and Forecast, by Type (2025-2032) 9.3. South America Foam Market Size and Forecast, by End Use Industry(2025-2032) 9.4. South America Foam Market Size and Forecast, by Country (2025-2032) 9.4.1. Brazil 9.4.1.1. Brazil Foam Market Size and Forecast, by Resin Type (2025-2032) 9.4.1.2. Brazil Foam Market Size and Forecast, by Type (2025-2032) 9.4.1.3. Brazil Foam Market Size and Forecast, by End Use Industry (2025-2032) 9.4.2. Argentina 9.4.2.1. Argentina Foam Market Size and Forecast, by Resin Type (2025-2032) 9.4.2.2. Argentina Foam Market Size and Forecast, by Type (2025-2032) 9.4.2.3. Argentina Foam Market Size and Forecast, by End Use Industry (2025-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Foam Market Size and Forecast, by Resin Type (2025-2032) 9.4.3.2. Rest Of South America Foam Market Size and Forecast, by Type (2025-2032) 9.4.3.3. Rest Of South America Foam Market Size and Forecast, by End Use Industry (2025-2032) 10. Company Profile: Key Players 10.1. Rogers Corporation (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sealed Air Corporation(U.S.) 10.3. DuPont (U.S.) 10.4. The Dow Company (US) 10.5. Nova Chemicals Corp (Canada) 10.6. Alpek (Mexico) 10.7. JSP (Japan) 10.8. Kaneka Corporation (Japan) 10.9. Loyal Group (China) 10.10. Jiangsu Leasty Chemicals Co., Ltd. (China) 10.11. Wuxi Xingda New Foam Plastics Materials Co., Ltd. (China) 10.12. Taita Chemical Co., Ltd.. (Taiwan) 10.13. Reliance Industries (India) 10.14. BASF (Germany) 10.15. Armacell International S.A. (Germany) 10.16. Recticel (Belgium) 10.17. Arkema (France) 10.18. Zotefoams Plc (UK) 10.19. Synthos S.A (Poland) 10.20. Total SE (France) 10.21. Versalis S.p.A (Italy) 10.22. SABIC (Saudi Arabia) 11. Key Findings 12. Industry Recommendations 13. Foam Market: Research Methodology 14. Terms and Glossary