The Fly Traps Market size was valued at USD 303.68 Million in 2024 and the total Fly Traps revenue is expected to grow at a CAGR of 5.8% from 2025 to 2032, reaching nearly USD 476.76 Million.Fly Traps Industry Snapshot:

Fly traps serve as effective tools to capture and eliminate disease-carrying flies and other flying insects such as house flies, horse flies, mosquitoes, and black flies, which are known to spread serious illnesses like dysentery, typhoid fever, leprosy, cholera, and anthrax. The fly traps market has a huge range of products designed to control and manage fly populations in various settings, including homes, businesses, and agricultural areas. This market includes both traditional methods, such as flypaper and chemical sprays, as well as more advanced solutions like electronic traps and biological control agents. One major driver propelling the growth of the fly traps market is the increasing awareness and emphasis on eco-friendly and non-toxic pest control methods. As concerns about environmental impact and human health grow, there's a rising demand for fly traps that use natural and sustainable approaches, spurring innovation in the development of biological and non-chemical solutions in pest control. This heightened awareness has led to a surge in demand for fly traps as an effective means of preventing the spread of diseases and ensuring public health. As consumers and businesses alike prioritize health and hygiene, the Fly Traps market is witnessing a notable boost in adoption. Additionally, more than 16.2% of infectious diseases are transmitted by vectors like flies, causing over 680,000 deaths globally each year. As a result, the increasing incidence of infectious diseases due to these insects is anticipated to fuel the demand for fly traps, consequently propelling growth in the fly traps market during the projected period. Spectrum Brands Holdings, Inc., based in the United States, stands as a diversified consumer goods entity boasting a robust lineup of fly traps under renowned brands like Black Flag, Catchmaster, and Victor. Celebrated for their efficacy and user-friendly designs, Spectrum Brands has a rich history of pioneering innovation within the fly trap market, consistently crafting new and enhanced products that cater to consumer demands. With a solid global footprint, their offerings span across 160 countries. On the other hand, Sterifab, LLC, also based in the United States, holds a prominent position as a top manufacturer of insect control solutions, including fly traps designed for diverse settings like households, commercial spaces, and farms. These companies represent just a fraction of the influential players in the expanding global fly traps market, a domain poised for continuous growth, primarily fueled by escalating demand for eco-friendly and potent pest control remedies.To know about the Research Methodology :- Request Free Sample Report

Fly Traps Market Key Dynamics

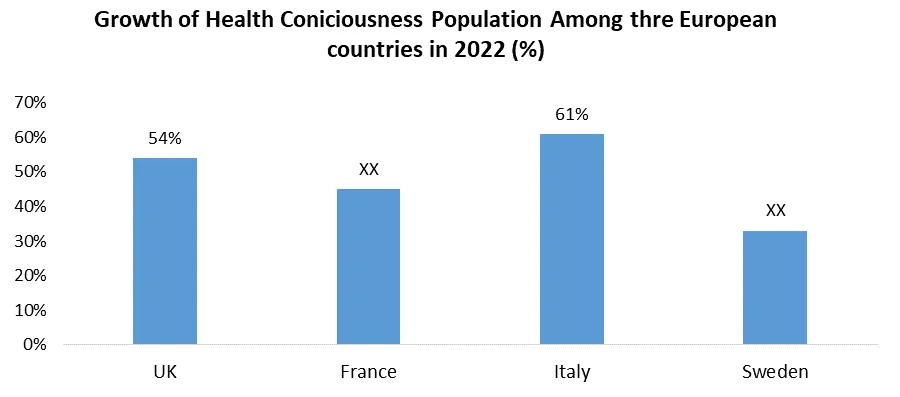

Ensuring Food Safety and Compliance Catalyst for Fly Trap Market Growth The catalytic force driving the growth of the fly trap market lies in its pivotal role in ensuring food safety and compliance across various industries. With a heightened focus on maintaining stringent hygiene standards and complying with regulatory measures, the demand for effective fly control solutions has surged. Flies, notorious carriers of harmful bacteria such as Salmonella and E. coli, pose significant risks of foodborne illnesses. This recognition has propelled consumers and industries alike to seek more efficient fly control methods. Governments worldwide are reinforcing strict food safety regulations, amplifying the necessity for fly traps in food processing units, restaurants, and other food service establishments. Moreover, the increasing preference for sustainable pest control measures aligns perfectly with fly traps' chemical-free operation, contributing to their adoption in diverse settings. As these devices play a critical role in preventing contamination in food processing, dining areas, farms, hospitals, and households, the escalating awareness of foodborne illness risks and the imperative of maintaining food safety is expected to drive substantial growth in the Fly Traps Market. The rise in health consciousness among consumers has heightened awareness regarding the significance of maintaining hygienic conditions in food handling and processing areas. This awareness has resulted in increased adoption of fly traps as an essential component of pest control measures. As the focus on food safety intensifies and regulations become more stringent globally, the demand for advanced and efficient fly traps continues to surge, positioning the fly trap market for substantial growth. Industries, including hospitality, agriculture, healthcare, and residential sectors, are increasingly investing in innovative fly trap solutions to ensure a safer and more hygienic environment, thereby driving the expansion of the fly trap market. Growing demand for eco-friendly fly traps to drive the market growth The surging demand for eco-friendly fly traps reflects a broader societal shift towards sustainable practices, with consumers placing a premium on pest control solutions that effectively manage infestations while minimizing environmental impact. Pioneering this movement, Catchmaster has introduced an innovative fly trap crafted from recycled and biodegradable materials, aligning seamlessly with the preferences of environmentally conscious consumers. Recent market data reveals a substantial increase, with a 17.8 uptick in sales of eco-friendly fly traps, highlighting a definitive shift in consumer preferences towards sustainability in pest control. Government regulations further bolster this trend, with recent policy changes incentivizing businesses to invest in sustainable alternatives, consequently driving the demand for compliant fly traps. This collective industry response signifies a remarkable paradigm shift towards environmentally friendly pest control solutions, shaping the landscape in both residential and industrial settings. Fly traps market increase in the adoption of eco-friendly fly traps, emphasizing the tangible impact of this sustainability-driven transformation across sectors. Rising adoption of fly traps in commercial and residential settings Flies are more than just a pesky annoyance—they bring significant challenges to both homes and businesses by contaminating food, spreading diseases like Salmonella and E. coli, and causing property damage. In places like restaurants, hospitals, and food processing plants, they pose serious health risks, potentially leading to foodborne illnesses and damaging a company's reputation. In homes, they create disruptions by contaminating food, biting, and causing discomfort, especially for those with allergies or asthma. Enter fly traps, the effective answer to controlling these pesky populations. Available in adhesive, electric, and bait variations, these traps play a crucial role in tackling fly-related challenges by capturing them using sticky surfaces, electrical currents, or baited lures. Industrially, these traps are indispensable across various sectors like food processing, agriculture, and manufacturing, ensuring cleaner and healthier work environments. Recent market developments showcase innovations in trap types and technologies, incorporating ultraviolet light and pheromones to attract flies. Additionally, there's a noticeable shift toward eco-friendly fly traps made from recycled materials and free of harmful chemicals. With a significant increase in their use in commercial and residential settings over the past years and a projected growth in eco-friendly options, the rising adoption of fly traps continues, driven by awareness, eco-conscious demands, and ongoing technological advancements, positioning these traps as crucial solutions in the ongoing battle against fly-related challenges in diverse settings.Fly Traps Market Challenges and Restraints

The commercial availability of fly traps remains limited compared to alternative pest control methods like pesticides and nets. This scarcity poses a challenge in meeting the diverse needs of consumers seeking effective fly control solutions. Fly Traps Market elevated costs associated with electric fly traps present a barrier, particularly for low and middle-income consumers, potentially impacting the market's revenue streams negatively. The accessibility issues and cost constraints underscore the necessity for addressing affordability and widespread availability in the fly traps market to enhance its appeal across various consumer demographics. Efforts to overcome these challenges may involve innovations in cost-effective technologies and strategic market positioning to ensure that fly traps become more widely accessible and affordable for a broader spectrum of consumers. Despite the surging demand for fly traps, the market confronts several challenges that could impede its future growth. A prominent obstacle lies in public perception, where flies are often regarded as harmless pests, leading to a general lack of awareness about the health risks they pose. Convincing consumers to invest in fly traps becomes challenging amid this prevailing perception. Additionally, price sensitivity poses a hurdle, as even though fly traps are relatively inexpensive, consumers remain discerning about pest control product costs. This constrains manufacturers from raising prices, even in the face of increased production costs. Environmental concerns add another layer of complexity, with traditional fly traps utilizing chemicals that raise apprehensions about their ecological impact. The shift towards eco-friendly fly traps, while addressing environmental issues, introduces a new challenge – these products tend to be pricier and potentially less effective. competition from alternative pest control methods, such as insecticides and fumigation, poses a considerable threat. While these methods may be more expensive, their perceived effectiveness divert consumer preferences away from fly traps. In Europe, stringent regulations on pesticide use create obstacles to the sale of fly traps containing harmful chemicals. the fly traps market is poised for growth during the forecast year.

Fly Traps Market Segment Overview

Based on Type, The sticky fly trap segment holds dominance in the market due to its versatility and effectiveness. Sticky traps offer a chemical-free solution, appealing to eco-conscious consumers. Their simplicity in design and ease of use makes them highly accessible for both residential and commercial settings. Unlike electric or UV light traps requiring power sources, sticky traps operate independently, making them convenient and cost-effective. Their non-toxic nature and suitability for various environments have elevated their popularity, resulting in widespread adoption and dominance within the fly traps market.Based on Application, The commercial segment currently dominates the fly traps market due to high demand in industries like food processing, hospitality, and healthcare. In these settings, fly control is critical for maintaining hygiene standards and preventing diseases. Commercial spaces, such as restaurants and hospitals, require stringent pest control measures to comply with regulations, driving the adoption of fly traps. While residential use is significant, the sheer volume and necessity in commercial settings amplify the demand for fly traps, making the commercial segment the dominant force in the market, addressing crucial health and regulatory concerns in various industries.

Based on Distribution Channel, The E-Commerce segment is currently dominating the fly traps market due to its convenience, wider product availability, and increasing online shopping trends. E-Commerce platforms offer a vast array of fly trap options, providing consumers easy access to various brands and types. The convenience of purchasing online, coupled with extensive product information and customer reviews, attracts consumers seeking effective pest control solutions. While supermarkets and independent retail outlets remain significant, the rapid digital shift and preference for hassle-free shopping experiences have propelled E-Commerce to dominance in the fly traps market, catering to the evolving consumer preferences for easy accessibility and comprehensive product selection.

Fly traps Regional Growth Analysis

North America held the largest Fly Traps Market Share with 39.22% in 2024. The region's high disposable incomes have fueled increased consumer spending on pest control products, including fly traps. Stringent regulations governing pest control have further accelerated the adoption of fly traps across various commercial and residential settings. stringent regulations in the region emphasize food safety standards in industries like food processing, restaurants, and healthcare, driving the demand for effective pest control measures. This necessitates the widespread use of fly traps to maintain hygienic conditions and comply with regulations, especially considering the health risks associated with flies. North America's high awareness of health concerns related to flies and other pests contributes to the market's dominance. Consumers prioritize cleanliness and disease prevention, leading to increased adoption of fly traps in both residential and commercial settings. the region's robust infrastructure and advanced technology encourage innovation in fly trap design, offering efficient and eco-friendly solutions that align with the growing trend towards sustainability. the market dominance in North America is fueled by a strong presence of key market players, both established brands and innovative startups. These companies continuously introduce new and improved fly trap technologies, catering to diverse consumer needs and preferences. Europe claimed its position as the second-largest market, contributing 28.54% to the global revenue in 2024. The regions heightened health concerns have stimulated a growing demand for fly traps, complemented by stringent regulations about pest control practices. Meanwhile, the Asia Pacific region is poised to experience the fastest growth in the fly traps market, Several factors propel the global fly traps market, including escalating health concerns linked to vector-borne diseases transmitted by flies, an increasing awareness of the pivotal role of fly control in both commercial and residential settings, a growing demand for eco-friendly fly traps, and the enforcement of stringent regulations governing pest control practices. Key market players driving innovation and market dynamics include Asahi Industry, DAINIHON JOCHUGIKU, Xiamen Consolidates Manufacture, Ecotrap Guard, Katchy Bug, Sterling International, RedTop, AP&G Co, Inc., and Woodstream.While heightened hygiene awareness and sanitation needs led to an increased demand for fly traps, the economic slowdown resulted in reduced spending on pest control products, presenting challenges. Despite these hurdles, the market is poised for growth, driven by ongoing urbanization trends and rising disposable incomes worldwide.Fly Traps Market Competitive Landscape

The insect traps market is a lively battlefield where big players like Terminix and S.C. Johnson clash with newer, eco-friendly-focused companies armed with smart features. Established brands rely on their physical stores, while newer ones capture attention online through social media. They offer traps with essential oils or smart designs that ditch chemicals, appealing to eco-conscious consumers. Companies like Victor Pest Control and EnviroMonitor not only promise bug control but also try to forecast and stop infestations before they happen. In the global fly traps market, there's a mix of big and small players, but even the top ones together have less than 30% of the market, making it fiercely competitive. These companies fight for attention by playing with prices, making unique traps, and finding better ways to sell them. Key players like Havahart Industry from Japan, DAINIHON JOCHUGIKU from Japan, Xiamen Consolidates Manufacture from China, Ecotrap Guard from Germany, and Katchy Bug from America each have their own special traps and dominate different parts of the world. Fly traps haven't spread widely in developing countries yet, so there's lots of room for growth. With cities growing and more people wanting eco-friendly pest control, the fly traps market could be worth around 494 million dollars by 2028, driven by people becoming more aware of the health risks linked to flies and choosing eco-friendly solutions for homes and businesses. DynaTrap has emerged as a premier provider of insect traps catering to both indoor and outdoor needs. Its exponential growth has positioned it as the top-ranking insect trap company in North America. DynaTrap's products are prominently featured in renowned home and hardware retail chains like Home Depot, Costco, Sam's, Bed Bath & Beyond, Amazon, and Ace Hardware. Additionally, they are available through QVC, HSN, and various online retailers. Adhering strictly to the highest safety and quality benchmarks, DynaTrap's insect traps offer effective protection against mosquitoes and other flying pests, boasting a pesticide-free approach. Miguel Nistal, Woodstream's CEO, highlighted that the inclusion of DynaTrap not only enriches their product line but also introduces them to esteemed clients, aligning with their existing top-tier customer base. The escalating demand for DynaTrap insect traps, attributed to the emergence of increasingly potent mosquito viruses annually, amplifies this acquisition's significance. Woodstream eagerly embraces the DynaTrap team and continues its pursuit of strategic acquisitions that complement the company's robust organic growth. The objective of the report is to present a comprehensive analysis of the Fly Traps Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Fly Traps Market dynamic, and structure by analyzing the market segments and projecting the Fly Traps Market size. Clear representation of competitive analysis of key players by Design, price, financial position, product portfolio, growth strategies, and regional presence in the Fly Traps Market make the report investor’s guide.Fly Traps Market Scope: Inquiry Before Buying

Fly Traps Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 303.68 Mn. Forecast Period 2025 to 2032 CAGR: 5.8% Market Size in 2032: USD 476.76 Mn. Segments Covered: by Type Container Trap Sticky Trap Electric Trap UV light Trap by Application Residential Commercial Other by Distribution Channel Supermarket Independent Retail E-Commerce Others Fly Traps Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Leading Companies in the Fly Traps Industry

1. Catchmaster 2. Flowtronics 3. Havahart 4. Kness Fly Traps 5. DynaTrap 6. POMEL Sp. z o. o. 7. Bell Labs, Inc. 8. Trece, Inc. 9. DAINIHON JOCHUGIKU 10. International Pheromone Systems Ltd. 11. Suterra 12. Orkin Pest Control 13. PEST-O-FLASH 14. Rentokil Initial Plc 15. SC Johnson & Son 16. Victor Pest Control 17. Dynatrap 18. Woodstream Corporation. 19. Xiamen Consolidates Manufacture 20. The Scotts Miracle-Gro Company 21. Bayer AG 22. Bell Laboratories Inc. 23. JT Eaton & Co. Inc. 24. Gardner Inc.Frequently asked questions:

1. What is the market growth of the Fly Traps Market? Ans. The Fly Traps Market size was valued at USD 303.68 Million in 2024 and the total Fly Traps revenue is expected to grow at a CAGR of 5.8% from 2025 to 2032, reaching nearly USD 476.76 Million. 2. Which are the major key players in the Fly Traps Market? Ans. The key players in this Fly Traps Market are Catchmaster, Flowtronics, Havahart, Kness Fly Traps, DynaTrap. 3. Which region is anticipated to account for the largest market share? Ans. North America is anticipated to dominate the Fly Traps Market. 4. What are the new opportunities for Fly Traps Market entrants? Ans. New opportunities for the Fly Traps Market include expanding adoption in developing regions, driven by increasing urbanization and disposable incomes. Growing awareness of fly-related health risks and the trend towards eco-friendly solutions further propel market growth, offering potential in both residential and commercial segments worldwide. 5. What is the forecast period for the Fly Traps Market? Ans. The forecast period for the Fly Traps Market is from 2025 to 2032.

1. Fly Traps Market Introduction 1.1 Study Assumption and Market Definition 1.2 Scope of the Study 1.3 Executive Summary 2. Fly Traps Market: Dynamics 2.1 Fly Traps Market Trends by Region 2.1.1 North America 2.1.2 Europe 2.1.3 Asia Pacific 2.1.4 Middle East and Africa 2.1.5 South America 2.2 Fly Traps Market Drivers by Region 2.2.1 North America 2.2.2 Europe 2.2.3 Asia Pacific 2.2.4 Middle East and Africa 2.2.5 South America 2.3 Fly Traps Market Restraints 2.4 Fly Traps Market Opportunities 2.5 Fly Traps Market Challenges 2.6 PORTER’s Five Forces Analysis 2.6.1 Bargaining Power Of Suppliers 2.6.2 Bargaining Power Of Buyers 2.6.3 Threat Of New Entrants 2.6.4 Threat Of Substitutes 2.6.5 Intensity Of Rivalry 2.7 PESTLE Analysis 2.8 Regulatory Landscape by Region 2.8.1 North America 2.8.2 Europe 2.8.3 Asia Pacific 2.8.4 Middle East and Africa 2.8.5 South America 2.9 Analysis of Government Schemes and Initiatives For Fly Traps Industry 2.10 The Global Pandemic and Redefining Fly Traps Industry Landscape 2.11 Price Trend Analysis 2.12 Technological Road Map 3. Fly Traps Market: Global Market Size and Forecast (Value and Volume) 3.1 Global Fly Traps Market, by Type (2024-2032) 3.1.1 Container Trap 3.1.2 Sticky Trap 3.1.3 Electric Trap 3.1.4 UV light Trap 3.2 Global Fly Traps Market, by Application (2024-2032) 3.2.1 Residential 3.2.2 Commercial 3.3 Global Fly Traps Market, by Distribution Channel (2024-2032) 3.3.1 Supermarket 3.3.2 Independent Retail 3.3.3 E-Commerce 3.3.4 Others 3.4 Global Fly Traps Market, by Region (2024-2032) 3.4.1 North America 3.4.2 Europe 3.4.3 Asia Pacific 3.4.4 Middle East and Africa 3.4.5 South America 4. North American Fly Traps Market Size and Forecast (Value and Volume) 4.1 North America Fly Traps Market, by Type (2024-2032) 4.1.1 Container Trap 4.1.2 Sticky Trap 4.1.3 Electric Trap 4.1.4 UV light Trap 4.2 North America Fly Traps Market, by Application (2024-2032) 4.2.1 Residential 4.2.2 Commercial 4.3 Fly Traps Market, by Distribution Channel (2024-2032) 4.3.1 Supermarket 4.3.2 Independent Retail 4.3.3 E-Commerce 4.3.4 Others 4.4 North America Fly Traps Market, by Country (2024-2032) 4.4.1 United States 4.4.1.1 United States Fly Traps Market, by Type (2024-2032) 4.4.1.1.1 Container Trap 4.4.1.1.2 Sticky Trap 4.4.1.1.3 Electric Trap 4.4.1.1.4 UV light Trap 4.4.1.2 United States Fly Traps Market, by Application(2024-2032) 4.4.1.2.1 Residential 4.4.1.2.2 Commercial 4.4.1.3 United States Fly Traps Market, by Distribution Channel (2024-2032) 4.4.1.3.1 Supermarket 4.4.1.3.2 Independent Retail 4.4.1.3.3 E-Commerce 4.4.1.3.4 Others 4.4.2 Canada 4.4.2.1 Canada Fly Traps Market, by Type (2024-2032) 4.4.2.1.1 Container Trap 4.4.2.1.2 Sticky Trap 4.4.2.1.3 Electric Trap 4.4.2.1.4 UV light Trap 4.4.2.2 Canada Fly Traps Market, by Application(2024-2032) 4.4.2.2.1 Residential 4.4.2.2.2 Commercial 4.4.2.3 Canada Fly Traps Market, by Distribution Channel (2024-2032) 4.4.2.3.1 Supermarket 4.4.2.3.2 Independent Retail 4.4.2.3.3 E-Commerce 4.4.2.3.4 Others 4.4.3 Mexico 4.4.3.1 Mexico Fly Traps Market, by Type (2024-2032) 4.4.3.1.1 Container Trap 4.4.3.1.2 Sticky Trap 4.4.3.1.3 Electric Trap 4.4.3.1.4 UV light Trap 4.4.3.2 Mexico Fly Traps Market, by Application (2024-2032) 4.4.3.2.1 Residential 4.4.3.2.2 Commercial 4.4.3.3 Mexico Fly Traps Market, by Distribution Channel (2024-2032) 4.4.3.3.1 Supermarket 4.4.3.3.2 Independent Retail 4.4.3.3.3 E-Commerce 4.4.3.3.4 Others 5. Europe Fly Traps Market Size and Forecast (Value and Volume) 5.1 Europe Fly Traps Market, by Type (2024-2032) 5.2 Europe Fly Traps Market, by Application(2024-2032) 5.3 Europe Fly Traps Market, by Distribution Channel (2024-2032) 5.4 Europe Fly Traps Market, by Country (2024-2032) 5.4.1 United Kingdom 5.4.1.1 United Kingdom Fly Traps Market, by Type (2024-2032) 5.4.1.2 United Kingdom Fly Traps Market, by Application(2024-2032) 5.4.1.3 United Kingdom Fly Traps Market, by Distribution Channel (2024-2032) 5.4.2 France 5.4.2.1 France Fly Traps Market, by Type (2024-2032) 5.4.2.2 France Fly Traps Market, by Application(2024-2032) 5.4.2.3 France Fly Traps Market, by Distribution Channel (2024-2032) 5.4.2.4 5.4.3 Germany 5.4.3.1 Germany Fly Traps Market, by Type (2024-2032) 5.4.3.2 Germany Fly Traps Market, by Application(2024-2032) 5.4.3.3 Germany Fly Traps Market, by Distribution Channel (2024-2032) 5.4.4 Italy 5.4.4.1 Italy Fly Traps Market, by Type (2024-2032) 5.4.4.2 Italy Fly Traps Market, by Application(2024-2032) 5.4.4.3 Italy Fly Traps Market, by Distribution Channel (2024-2032) 5.4.5 Spain 5.4.5.1 Spain Fly Traps Market, by Type (2024-2032) 5.4.5.2 Spain Fly Traps Market, by Application(2024-2032) 5.4.5.3 Spain Fly Traps Market, by Distribution Channel (2024-2032) 5.4.6 Sweden 5.4.6.1 Sweden Fly Traps Market, by Type (2024-2032) 5.4.6.2 Sweden Fly Traps Market, by Application(2024-2032) 5.4.6.3 Sweden Fly Traps Market, by Distribution Channel (2024-2032) 5.4.7 Austria 5.4.7.1 Austria Fly Traps Market, by Type (2024-2032) 5.4.7.2 Austria Fly Traps Market, by Application(2024-2032) 5.4.7.3 Austria Fly Traps Market, by Distribution Channel (2024-2032) 5.4.8 Rest of Europe 5.4.8.1 Rest of Europe Fly Traps Market, by Type (2024-2032) 5.4.8.2 Rest of Europe Fly Traps Market, by Application (2024-2032). 5.4.8.3 Rest of Europe Fly Traps Market, by Distribution Channel (2024-2032) 6. Asia Pacific Fly Traps Market Size and Forecast (Value and Volume) 6.1 Asia Pacific Fly Traps Market, by Type (2024-2032) 6.2 Asia Pacific Fly Traps Market, by Application(2024-2032) 6.3 Asia Pacific Fly Traps Market, by Distribution Channel (2024-2032) 6.4 Asia Pacific Fly Traps Market, by Country (2024-2032) 6.4.1 China 6.4.1.1 China Fly Traps Market, by Type (2024-2032) 6.4.1.2 China Fly Traps Market, by Application(2024-2032) 6.4.1.3 China Fly Traps Market, by Distribution Channel (2024-2032) 6.4.2 South Korea 6.4.2.1 S Korea Fly Traps Market, by Type (2024-2032) 6.4.2.2 S Korea Fly Traps Market, by Application(2024-2032) 6.4.2.3 S Korea Fly Traps Market, by Distribution Channel (2024-2032) 6.4.3 Japan 6.4.3.1 Japan Fly Traps Market, by Type (2024-2032) 6.4.3.2 Japan Fly Traps Market, by Application(2024-2032) 6.4.3.3 Japan Fly Traps Market, by Distribution Channel (2024-2032) 6.4.4 India 6.4.4.1 India Fly Traps Market, by Type (2024-2032) 6.4.4.2 India Fly Traps Market, by Application(2024-2032) 6.4.4.3 India Fly Traps Market, by Distribution Channel (2024-2032) 6.4.5 Australia 6.4.5.1 Australia Fly Traps Market, by Type (2024-2032) 6.4.5.2 Australia Fly Traps Market, by Application(2024-2032) 6.4.5.3 Australia Fly Traps Market, by Distribution Channel (2024-2032) 6.4.6 Indonesia 6.4.6.1 Indonesia Fly Traps Market, by Type (2024-2032) 6.4.6.2 Indonesia Fly Traps Market, by Application(2024-2032) 6.4.6.3 Indonesia Fly Traps Market, by Distribution Channel (2024-2032) 6.4.7 Malaysia 6.4.7.1 Malaysia Fly Traps Market, by Type (2024-2032) 6.4.7.2 Malaysia Fly Traps Market, by Application(2024-2032) 6.4.7.3 Malaysia Fly Traps Market, by Distribution Channel (2024-2032) 6.4.8 Vietnam 6.4.8.1 Vietnam Fly Traps Market, by Type (2024-2032) 6.4.8.2 Vietnam Fly Traps Market, by Application(2024-2032) 6.4.8.3 Vietnam Fly Traps Market, by Distribution Channel (2024-2032) 6.4.9 Taiwan 6.4.9.1 Taiwan Fly Traps Market, by Type (2024-2032) 6.4.9.2 Taiwan Fly Traps Market, by Application(2024-2032) 6.4.9.3 Taiwan Fly Traps Market, by Distribution Channel (2024-2032) 6.4.10 Bangladesh 6.4.10.1 Bangladesh Fly Traps Market, by Type (2024-2032) 6.4.10.2 Bangladesh Fly Traps Market, by Application(2024-2032) 6.4.10.3 Bangladesh Fly Traps Market, by Distribution Channel (2024-2032) 6.4.11 Pakistan 6.4.11.1 Pakistan Fly Traps Market, by Type (2024-2032) 6.4.11.2 Pakistan Fly Traps Market, by Application(2024-2032) 6.4.11.3 Pakistan Fly Traps Market, by Distribution Channel (2024-2032) 6.4.12 Rest of Asia Pacific 6.4.12.1 Rest of Asia Pacific Fly Traps Market, by Type (2024-2032) 6.4.12.2 Rest of Asia Pacific Fly Traps Market, by Application(2024-2032) 6.4.12.3 Rest of Asia Pacific Fly Traps Market, by Distribution Channel (2024-2032) 7. Middle East and Africa Fly Traps Market Size and Forecast (Value and Volume) 7.1 Middle East and Africa Fly Traps Market, by Type (2024-2032) 7.2 Middle East and Africa Fly Traps Market, by Application(2024-2032) 7.3 Middle East and Africa Fly Traps Market, by Distribution Channel (2024-2032) 7.4 Middle East and Africa Fly Traps Market, by Country (2024-2032) 7.4.1 South Africa 7.4.1.1 South Africa Fly Traps Market, by Type (2024-2032) 7.4.1.2 South Africa Fly Traps Market, by Application(2024-2032) 7.4.1.3 South Africa Fly Traps Market, by Distribution Channel (2024-2032) 7.4.2 GCC 7.4.2.1 GCC Fly Traps Market, by Type (2024-2032) 7.4.2.2 GCC Fly Traps Market, by Application(2024-2032) 7.4.2.3 GCC Fly Traps Market, by Distribution Channel (2024-2032) 7.4.3 Egypt 7.4.3.1 Egypt Fly Traps Market, by Type (2024-2032) 7.4.3.2 Egypt Fly Traps Market, by Application(2024-2032) 7.4.3.3 Egypt Fly Traps Market, by Distribution Channel (2024-2032) 7.4.4 Nigeria 7.4.4.1 Nigeria Fly Traps Market, by Type (2024-2032) 7.4.4.2 Nigeria Fly Traps Market, by Application(2024-2032) 7.4.4.3 Nigeria Fly Traps Market, by Distribution Channel (2024-2032) 7.4.5 Rest of ME&A 7.4.5.1 Rest of ME&A Fly Traps Market, by Type (2024-2032) 7.4.5.2 Rest of ME&A Fly Traps Market, by Application(2024-2032) 7.4.5.3 Rest of ME&A Fly Traps Market, by Distribution Channel (2024-2032) 8. South America Fly Traps Market Size and Forecast (Value and Volume) 8.1 South America Fly Traps Market, by Type (2024-2032) 8.2 South America Fly Traps Market, by Application(2024-2032) 8.3 South America Fly Traps Market, by Distribution Channel (2024-2032) 8.4 South America Fly Traps Market, by Country (2024-2032) 8.4.1 Brazil 8.4.1.1 Brazil Fly Traps Market, by Type (2024-2032) 8.4.1.2 Brazil Fly Traps Market, by Application(2024-2032) 8.4.1.3 Brazil Fly Traps Market, by Distribution Channel (2024-2032) 8.4.2 Argentina 8.4.2.1 Argentina Fly Traps Market, by Type (2024-2032) 8.4.2.2 Argentina Fly Traps Market, by Application(2024-2032) 8.4.2.3 Argentina Fly Traps Market, by Distribution Channel (2024-2032) 8.4.3 Rest Of South America 8.4.3.1 Rest Of South America Fly Traps Market, by Type (2024-2032) 8.4.3.2 Rest Of South America Fly Traps Market, by Application(2024-2032) 8.4.3.3 Rest Of South America Fly Traps Market, by Distribution Channel (2024-2032) 9. Global Fly Traps Market: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Product Segment 9.3.3 End-user Segment 9.3.4 Revenue (2022) 9.3.5 Manufacturing Locations 9.4 Market Analysis by Organized Players vs. Unorganized Players 9.4.1 Organized Players 9.4.2 Unorganized Players 9.5 Leading Fly Traps Global Companies, by market capitalization 9.6 Market Structure 9.6.1 Market Leaders 9.6.2 Market Followers 9.6.3 Emerging Players 9.7 Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1 Catchmaster 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Details on Partnership 10.1.7 Regulatory Accreditations and Certifications Received by Them 10.1.8 Recent Development 10.2 Flowtronics 10.3 Havahart 10.4 Kness Fly Traps 10.5 Orkin Pest Control 10.6 PEST-O-FLASH 10.7 Rentokil Initial Plc 10.8 SC Johnson & Son 10.9 Victor Pest Control 10.10 Dynatrap 10.11 Woodstream Corporation. 10.12 Xiamen Consolidates Manufacture 10.13 Rentokil Initial Plc 10.14 The Scotts Miracle-Gro Company 10.15 Bayer AG 10.16 Bell Laboratories Inc. 10.17 JT Eaton & Co. Inc. 10.18 Gardner Inc. 11. Key Findings 12. Industry Recommendations 13. Fly Traps Market: Research Methodology 14. Terms and Glossary