Flex Fuel Vehicle Market was valued at US$ 70.41 Bn. in 2022. Flex Fuel Vehicle Market size is expected to grow at a CAGR of 5.7% through the forecast period.Flex Flue Vehicle Market Overview:

Through the forecast period, excess supply for carbon-neutral automobiles around the globe to combat rising global pollution levels pulls the flex fuel engine market forward. Flex-fuels have a number of advantages, including the capacity to be produced domestically and the ability to be renewed, which might reduce the country's dependency on imported petroleum. E85 emits fewer greenhouse gases and benzene than gasoline, allowing flex-fuel engines to be used more frequently. General Motors Company, for example, launched the Chevrolet Silverado HD and GMC Sierra HD in June 2022, both of which are loaded with Flex Fuel-capable engines that can operate on E85 ethanol and gasoline. Such advances are projected to fuel growth in the flex-fuel motor market over the forecast period. Flex-fuel engines have an internal combustion that can run on multiple fuels, including gasoline alone or a mixture of gasoline and ethanol up to 83 % (E85). To compensate for the varied chemical characteristics and energy content in ethanol, changes to the fuel pump and injection system are given, ensuring the engine's smooth operation and durability.To know about the Research Methodology :- Request Free Sample Report

Flex Fuel Vehicle Market Covid-19 Insights:

Since the pandemic has touched people's lives and, as a result, entered the manufacturing and production chains of numerous industries throughout the world, the automobile flex engine market size has been one of the most affected. The markets have been experiencing substantial functioning challenges and constraints brought on by a lack of competent personnel, raw materials, and resources as a result of the pandemic's high positive rate. Moreover, rising fuel prices, such as petroleum and diesel, are a source of concern for the target audience, who come from a variety of socioeconomic backgrounds. Global administrations, on the other hand, are increasing their interventions to assist the markets in covering the losses caused by the pandemic. The hour requires creating profitable market trends to promote a high demand level. This is made possible by investments in research and development departments, which aid in the production and introduction of numerous products and services in the worldwide market situation during the projected period, which ends in 2029.Flex Fuel Vehicle Market Dynamics:

Market Drivers: Depleting natural sources of petroleum, as well as rising car emission standards, are two significant factors impacting the flex-fuel vehicle market. The market is expected to develop due to the need to minimize reliance on non-renewable energy sources and tight emission regulations. Because fossil fuels are non-renewable energy sources, all should limit our reliance on them. It means that if they're depleted, it might take millions of years for them to recover. As a result, it is critical to seek out alternative and renewable energy sources. Moreover, the usage of fossil fuels such as coal and petroleum has been increasingly harming the environment and contributing to global warming. These factors are driving the growth of flex fuel vehicle market. Market Restraints: Lower FFV fuel economy and concerns about engine damage due to ethanol's ability to absorb dirt are expected to limit the market's growth. Ethanol is added to gasoline as required by the EPA to reduce carbon emissions and make the operation of such engines more environmentally friendly. Untreated ethanol-blended fuels can start "phasing." Phase separation occurs when ethanol in the fuel takes too much water and separates from gasoline, which causes the ethanol and water mixture to settle at the bottom of the tank because it is heavier than gasoline. Water-ethanol solutions can harm fuel systems and engines, necessitating a system flush to avoid further damage.Flex Fuel Vehicle Market Segment Analysis:

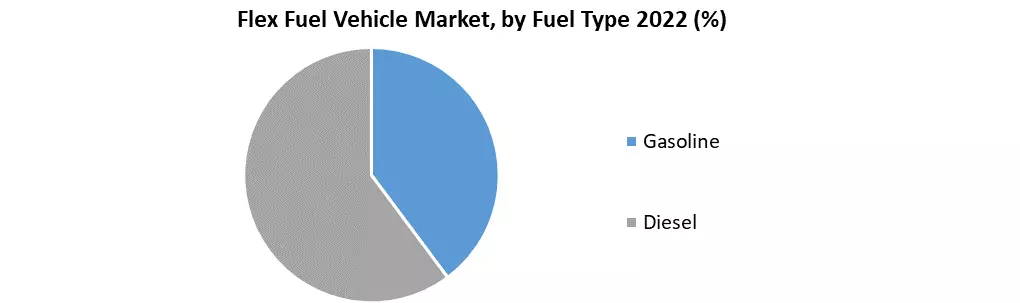

Based on Fuel Type, the Flex Fuel Vehicle Market is segmented into Gasoline and Diesel. The flexible-fuel vehicle (FFV) market is divided into two categories: fuel type and vehicle type. The market is divided into two categories: gasoline flexes fuel and diesel flex-fuel. Due to rising consumer preference toward eco-friendly vehicles, existing technology improvements, and a high rate of adoption of FFVs in developing regions, the gasoline flex-fuel sector is expected to dominate the market. Due to increased research and development by manufacturers to raise the blend quantity for diesel and continued acceptance of this technology in heavy-duty pickup applications, the diesel flex-fuel segment is expected to see stable growth in the market. Flexible fuel vehicles (FFVs) are automobiles with an internal combustion engine that can run on gasoline or a mixture of gasoline and ethanol up to 83 percent. E85 (also known as flex-fuel) is a gasoline-ethanol blend that contains between 51 and 83 % ethanol, depending on the region and season.

Flex Fuel Vehicle Market Regional Insights:

The North America region dominated the market with highest share in 2022. The Asia Pacific region is expected to witness significant growth at a CAGR of 6.5% through the forecast period. Due to rising demand for alternative fuel vehicles and the need to enhance the existing air quality in countries such as China and India. In India, for example, the Ministry of Road Transport and Highways has set various deadlines for introducing ethanol-based fuel in the country to reduce fossil fuel consumption and reduce fuel costs. Furthermore, India produces only 2% of worldwide flex-fuel production, which is insufficient to meet the country's needs. As a result, domestic ethanol output is expected to increase from 70 to 150 million liters in the next years. The objective of the report is to present a comprehensive analysis of the global Flex Fuel Vehicle Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Flex Fuel Vehicle Market dynamic, structure by analyzing the market segments and projecting the Flex Fuel Vehicle Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Flex Fuel Vehicle Market make the report investor’s guide.Flex Fuel Vehicle Market Scope: Inquiry Before Buying

Flex Fuel Vehicle Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 70.41 Bn. Forecast Period 2023 to 2029 CAGR: 5.7% Market Size in 2029: US$ 103.80 Bn. Segments Covered: by Vehicle Type • Passengers Cars • Commercial Cars by Fuel Type • Gasoline • Diesel Flex Fuel Vehicle Market, by Region:

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Flex Fuel Vehicle Market Key Players are:

• Mitsubishi Motors • Volvo Cars • Fiat Chrysler • Audi • Toyota • Ford • Volkswagen • Nisan • Hyundai • Kia Motors • Renault • Cummins Inc • Honda • General Motors Company Frequently Asked Questions: 1] What segments are covered in the Global Flex Fuel Vehicle Market report? Ans. The segments covered in the Flex Fuel Vehicle Market report are based on vehicle Type and Fuel Type. 2] Which region is expected to hold the highest share in the Global Flex Fuel Vehicle Market? Ans. The North America region is expected to hold the highest share in the Market. 3] What is the market size of the Global Flex Fuel Vehicle Market by 2029? Ans. The market size of the Flex Fuel Vehicle Market by 2029 is expected to reach US$ 103.80 Bn. 4] What is the forecast period for the Global Flex Fuel Vehicle Market? Ans. The forecast period for the Flex Fuel Vehicle Market is 2023-2029. 5] What was the market size of the Global Flex Fuel Vehicle Market in 2022? Ans. The market size of the Flex Fuel Vehicle Market in 2022 was valued at US$ 70.41 Bn.

1. Global Flex Fuel Vehicle Market Size: Research Methodology 2. Global Flex Fuel Vehicle Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Flex Fuel Vehicle Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Flex Fuel Vehicle Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Flex Fuel Vehicle Market Size Segmentation 4.1. Global Flex Fuel Vehicle Market Size, by Vehicle Type (2022-2029) • Commercial Cars • Passengers Cars 4.2. Global Flex Fuel Vehicle Market Size, by Fuel Type (2022-2029) • Gasoline • Diesel 5. North America Flex Fuel Vehicle Market (2022-2029) 5.1. North America Flex Fuel Vehicle Market Size, by Vehicle Type (2022-2029) • Commercial Cars • Passenger Cars 5.2. North America Flex Fuel Vehicle Market Size, by Fuel Type (2022-2029) • Gasoline • Diesel 5.3. North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Flex Fuel Vehicle Market (2022-2029) 6.1. European Flex Fuel Vehicle Market, by Vehicle Type (2022-2029) 6.2. European Flex Fuel Vehicle Market, by Fuel Type (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Flex Fuel Vehicle Market (2022-2029) 7.1. Asia Pacific Flex Fuel Vehicle Market, by Vehicle Type (2022-2029) 7.2. Asia Pacific Flex Fuel Vehicle Market, by Fuel Type (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Flex Fuel Vehicle Market (2022-2029) 8.1. Middle East and Africa Flex Fuel Vehicle Market, by Vehicle Type (2022-2029) 8.2. Middle East and Africa Flex Fuel Vehicle Market, by Fuel Type (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Flex Fuel Vehicle Market (2022-2029) 9.1. South America Flex Fuel Vehicle Market, by Vehicle Type (2022-2029) 9.2. South America Flex Fuel Vehicle Market, by Fuel Type (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Mitsubishi Motors 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Volvo Cars 10.3. Fiat Chrysler 10.4. Audi 10.5. Toyota Motors 10.6. Ford 10.7. Volkswagen 10.8. Nisan 10.9. Hyundai 10.10. Kia Motors 10.11. Renault 10.12. Peugeot 10.13. Cummins Inc 10.14. Honda 10.15. General Motors Company