The Feminine Hygiene Products Market size was valued at USD 35.70 Billion in 2022 and the total Feminine Hygiene Product revenue is expected to grow at a CAGR of 6.43% from 2023 to 2029, reaching nearly USD 54.31 Billion By 2029.Feminine Hygiene Products Market Definition Scope:

Feminine hygiene products are personal care products used during menstruation, vaginal discharge, and other bodily functions related to the vulva and vagina. They are designed to help women maintain a clean, comfortable, and healthy intimate area. The choice of sanitary protection is a personal decision, which is mainly influenced by availability, cultural acceptability, and financial affordability. Women and girls who use unhygienic alternatives for sanitary pads or tampons face health issues. Most women in developing countries, particularly in Asia-Pacific and SubSaharan Africa, do not use adequate female hygiene products. A lack of awareness about the usages of Feminine hygiene products are expected to limit the Feminine Hygiene Products Market growth in developing and underdeveloped countries. Social enterprises have responded by evolving low-cost methods of sanitary pad production coupled with innovative models for distribution and marketing. The market for feminine hygiene products is huge.To know about the Research Methodology :- Request Free Sample Report Feminine hygiene products reduce health risks like reproductive tract infections which can lead to infertility and other child birth complications. Today, consumers are more aware that protecting the environment is fundamental. Four out of five European consumers are expected to buy more environmentally friendly products, provided that they are properly certified by an independent organisation. Strong volume growth in the feminine hygiene products segment is being driven by a combination of extremely low category penetration, with rural penetration in single-digits, earlier price cuts boosting product affordability and growing distribution reach. Feminine Hygiene is among the most under-penetrated segments in the Consumer space. With higher product affordability, rising distribution reach of incumbents, increasing education and income levels among females, rapid urbanization, rising proportion of working women, higher product awareness through media, breaking of taboos and category development efforts by companies operating in the Feminine Hygiene Products Market are driving the demand for feminine hygiene product. Consumers are becoming more aware of the importance of using safe and healthy feminine hygiene products. As a result of these trends, there is a significant change in consumer behavior in the feminine hygiene space. Consumers are now more likely to research products carefully before making a purchase. Women are expected to choose feminine hygiene product that are safe, healthy, and affordable.

Feminine Hygiene Products Market Dynamics:

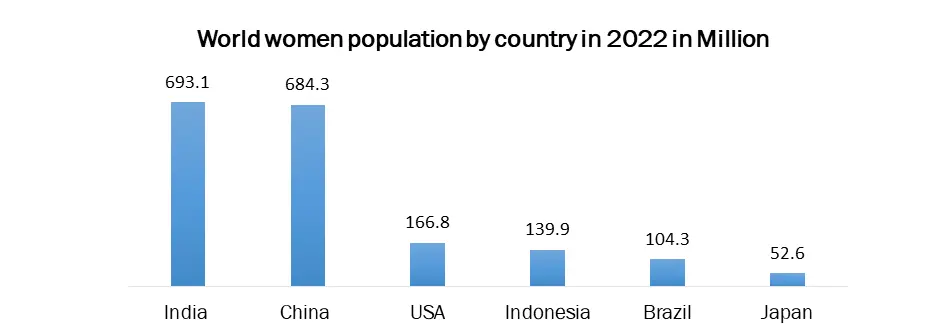

Sanitary pads and tampons are the go-to-choice Option as younger women are trying newer options for Feminine Hygiene Products across the globe. Pads and tampons are indeed the most popular feminine hygiene products used during menstruation. They offer convenience, absorbency, and discretion, making them suitable for a wide range of activities. Pads are absorbent materials that adhere to the underside of underwear to absorb menstrual flow. They come in various sizes and absorbencies to suit different needs and flow levels. Pads are generally considered comfortable and easy to use, and they can be changed as frequently as needed. Sanitary pads are the dominant product in this region, accounting for over 80% of the market. The high demand for feminine hygiene product is attributed to the factors such as cultural preferences, affordability, and ease of use. Tampons are becoming increasingly popular, but they still lag behind pads in terms of market share. Tampons are more popular in these regions compared to Asia Pacific, with pads holding a slightly smaller market share. Growth in disposable incomes, greater awareness of tampons, and the perception of tampons as being more comfortable and discreet are some of the factors that drive the demand for tampons feminine hygiene products across North America and Europe.Period poverty is a significant issue affecting millions of people, which is expected to drive the need for adoption of Feminine Hygiene Product. The period poverty is a significant issue affecting millions of people across the globe, and it is expected to drive the demand for feminine hygiene products. According to UNICEF, approximately 500 million women and girls worldwide lack adequate access to menstrual hygiene products and facilities, and this number is expected to increase as the global population grows and need for the usages of feminine hygiene product among young population. There is a growing global awareness of the issue of period poverty, which is leading to increased demand for affordable and accessible menstrual products. As disposable incomes rise in developing countries, more women and girls are able to afford menstrual products. As more women move to cities, there is a greater need for access to feminine hygiene products and facilities. The lack of adequate menstrual hygiene can lead to physical and emotional distress, social isolation, and missed educational opportunities for girls and women. Affordability of the Feminine Hygiene Products with price cuts are expected to drive the Feminine Hygiene Products Market Growth. Feminine hygiene products are considered essential items for women, and price is a crucial factor influencing purchasing decisions. Price cuts make Feminine hygiene products more accessible to a broader range of consumers, particularly in developing regions where disposable income may be lower. Lower prices enable manufacturers to penetrate new markets and reach a wider customer base, including those in rural or underserved areas. Affordability encourages women to use feminine hygiene products more frequently, leading to increased consumption and driving Feminine hygiene products market growth. As demand grows, manufacturers are incentivized to increase production, expand distribution channels, and introduce new product variants. The expansion of the Feminine hygiene products further fuels Feminine hygiene products market growth. Increased affordability has broadened the potential reach of products s in the feminine hygiene product industry. An introduction of innovative feminine care products are expected to boost the Feminine Hygiene Products Market Growth. The introduction of innovative feminine care products is fuelling market growth. Innovations are catering to the evolving needs and preferences of women, which is offering enhanced comfort, convenience, and protection. Examples include organic and natural pads and tampons, reusable menstrual cups, and period-tracking apps. Women are increasingly aware of the importance of feminine hygiene and its impact on their overall health and well-being. The awareness about the innovative feminine care products are driving demand for products that promote intimate wellness and prevent infections and other health issues. Consumers are shifting their preferences from solely cost-focused hygiene products to those that offer greater convenience and comfort. The shift is evident in the growing popularity of individually wrapped pads, applicator tampons, and menstrual cups. As disposable incomes rise, women are more willing to spend on high-quality feminine care products that meet their specific needs and preferences. The trend is particularly pronounced in developing countries that boost the demand for the feminine hygiene product. Technological advancements are leading to the development of smart feminine care products, such as tampons with integrated sensors that track menstrual flow and provide personalized insights. Environmental concerns are driving a demand for sustainable feminine care products, such as those made from organic materials or designed for reusability. The changing lifestyles of women, with increased participation in sports, outdoor activities, and travel, are influencing their feminine care product choices. Products that offer leak protection, discretion, and comfort during various activities are gaining popularity.

Feminine Hygiene Products Market Segment Analysis:

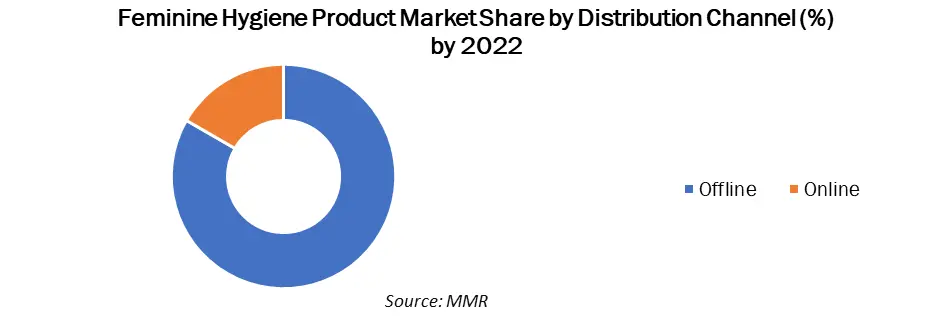

Based on the nature, Feminine Hygiene Products Market is segmented into disposable and reusable. Disposable feminine hygiene products have indeed dominated the market for quite some time, and their popularity stems from several factors, including their convenience, affordability, and widespread availability. Disposable feminine hygiene products offer a hassle-free experience, eliminating the need for cleaning and reusing, which is particularly appealing to women with busy lifestyles or those who prefer not to deal with the mess of reusable products. Disposable feminine hygiene products are generally less expensive than reusable options, making them more accessible to a broader range of consumers. The affordability of the feminine hygiene product plays a crucial role in driving market growth, especially in regions with lower disposable incomes. Disposable feminine hygiene products are readily available in retail markets, including supermarkets, drugstores, and convenience stores. The accessibility of feminine hygiene product ensures that women can easily find and purchase the products they need, regardless of their location. Despite the disposable feminine hygiene products held the dominant share in the Feminine Hygiene Products Market, reusable options are gaining traction due to their environmental benefits and cost-effectiveness. Reusable products, such as menstrual cups and washable pads, offer a sustainable alternative, reducing waste and promoting eco-consciousness among women. Reusable feminine hygiene products significantly reduce the environmental impact associated with disposable products, which contribute to landfills and pollution. The eco-friendly aspect of reusable feminine hygiene product appeals to environmentally conscious women who seek sustainable solutions. The reusable feminine hygiene products prove to be more cost-effective than disposable options. The initial investment in reusable products is offset by the elimination of recurring purchases of disposable products. Reusable feminine hygiene products are often made from soft, comfortable fabrics that are gentle on the skin. Additionally, some reusable products offer customization options based on size and flow, allowing women to tailor their experience to their specific needs for the feminine hygiene products. As the demand for sustainable and eco-friendly products grows, reusable feminine hygiene products are expected to gain further traction in the market. The combination of environmental benefits, cost-effectiveness, and comfort makes reusable options increasingly appealing of feminine hygiene products to women worldwide. Based on Product Type, Feminine Hygiene Products Market is segmented into sanitary pads, tampons and menstrual cup, panty liners and shields, internal cleansers and sprays and others. The sanitary pads held the dominant position in 2022 and is projected to continue its dominance during the forecast period. Sanitary pads are the most widely used feminine hygiene products globally, with a high penetration rate across various regions. The popularity stems of sanitary pads from their ease of use, comfort, and effectiveness in managing menstrual flow. The sanitary pads represent a mature product category with well-established brands and a strong presence in retail channels. Manufacturers are constantly introducing innovative features and variants within the sanitary pad. Asia Pacific is the largest and fastest-growing market for sanitary pads, accounting for over 45% of the global market share in 2022. The growth of the sanitary pads, which is a feminine hygiene product driven by a large and growing female population, rising disposable incomes, and increasing awareness about menstrual hygiene. As disposable incomes rise, women are more likely to purchase sanitary pads instead of relying on traditional methods such as cloth rags. A growing demand for organic and biodegradable sanitary pads, as consumers become more aware of the environmental impact of traditional pads are some of the prominent driving factors that are boosting the demand for feminine hygiene product across the globe. By Distribution Channel, Feminine Hygiene Products Market is segmented into Offline and Online. The offline segment, which includes supermarkets and hypermarkets held a dominant share of the market in 2022, and their popularity stems from several factors, including their physical presence, product visibility, and ability to provide a hands-on shopping experience. Supermarkets and hypermarkets offer a physical shopping environment where women can browse through a wide selection of feminine hygiene products, inspect them closely, and compare different brands and options. Supermarkets and hypermarkets allow women to touch, examine, and test certain feminine hygiene products, such as sanitary napkins and panty liners. On the other hand, as e-commerce continues to expand and consumer preferences evolve, the online channel is expected to witness significant growth in the feminine hygiene products market. Online retailers offer a vast selection of feminine hygiene products from various brands, often at competitive prices. The wider selection of feminine hygiene product provides women with more choices and the ability to find products that meet their specific needs. Social media platforms have become powerful tools for promoting feminine hygiene products. Online shopping offers convenience and discretion, allowing women to purchase feminine hygiene products from the comfort of their homes without the need to visit a physical store.

Feminine Hygiene Products Market Regional Insights:

Key Findings Europe Feminine Hygiene Products Market: 1. Around 22 items are used per cycle and around 11,000 will be used in a lifetime. 4.3 billion items are used per year in the UK. 2. Re-useable menstrual hygiene products such as menstrual cups have gained popularity in recent years. 3. Liners are very adaptable products used to absorb everyday discharge, for extra protection during a period or for when menstrual flow is very light. 4. Many women choose to use pant liners for personal freshness throughout the month. Women also use pads following childbirth for around one month, for the absorption of lochia. 5.Online shopping is becoming increasingly popular for sanitary napkins, as consumers appreciate the convenience and discretion of buying these products from the comfort of their own homes.India Feminine Hygiene Products Market Overview:

Governments play a crucial role in addressing period poverty and ensuring access to feminine hygiene products through various public policy initiatives. The Government of India is committed to addressing these challenges and ensuring that all women and girls in India have access to safe and effective menstrual hygiene products and services. The Government of India has implemented several initiatives to address the issue of menstrual hygiene and ensure access to safe and effective sanitary products for women and girls. The government has offered the national menstrual hygiene scheme, which provides free sanitary napkins to adolescent girls in rural areas. The NMHS was launched in 2014 and is implemented by the Ministry of Health and Family Welfare. The menstrual hygiene swachhta Abhiyan campaign aims to raise awareness about menstrual hygiene and promote the use of sanitary napkins. The MHSAB was launched in 2016 and is implemented by the Ministry of Jal Shakti. The Scheme for Adolescent Girls scheme provides a range of services to adolescent girls, including menstrual hygiene education and access to sanitary napkins. The SAG is implemented by the Ministry of Women and Child Development. Social enterprises and NGOs are also producing both sanitary products and simple machines that allow women in villages to produce sanitary pads. Manufacturers of sanitary products acquire the raw materials, produce the products, and organize distribution. The percentage of women using sanitary napkins is highest in Karnataka, followed by local sanitary pads. Menstrual cups and tampons are used by a much smaller percentage of women. In Karnataka, 69.1% women use Sanitary napkins, menstrual cups are 0.3%, 21.9% are local sanitary pads, and tampons are 2.9%. According to the latest available data from the National Family Health Survey, 72.1% of women in Maharashtra use sanitary napkins during their menstrual periods, which is a significant increase from the 63.6% and increased demand for feminine hygiene products in India. The use of sanitary napkins has increased in both urban and rural areas, with 81.6% of urban women and 62.9% of rural women using sanitary napkins. The use of other menstrual hygiene products, such as menstrual cups and tampons, is still relatively low in Maharashtra. Only 0.5% of women use menstrual cups and 3.5% use tampons. The use of cloth pads is also declining, with 18.9% of women using cloth pads, down from 25.4%. According to the MMR Analysis, 77.6% of women aged 15-24 in India use a hygienic method of menstrual protection, such as sanitary napkins, menstrual cups, or locally prepared napkins. However, there is a significant disparity between urban and rural areas. In urban areas, 89.1% of women use hygienic methods, while in rural areas, only 63.1%, which are expected to boost the adoption of feminine hygiene product. Feminine Hygiene Products Market Competitive Landscape: Key players operating in the Feminine Hygiene Products Market are investing in research and development to develop new and innovative products that meet the needs of consumers. For example, P&G has introduced a line of organic sanitary napkins, while Kimberly-Clark has introduced a line of pads with a built-in odor neutralizer. Manufacturers are increasingly focused on developing sustainable sanitary napkins that have a minimal environmental impact, which is leading to the development of products made from recycled materials, and products that are biodegradable or compostable. P&G is the global leader in the Feminine Hygiene Products Market, with a strong presence in all major markets. The company's brands, including Always and Whisper, are among the most recognizable in the world. P&G has a diversified product portfolio that includes sanitary napkins, tampons, pantyliners, and feminine wipes. The company also has a strong history of innovation, and it has been at the forefront of developing new and innovative products. Whisper is a brand of feminine hygiene products owned by Procter & Gamble. It is one of the leading brands in the world, with a presence in over 100 countries. Whisper products are known for their comfort, absorbency, and affordability. Whisper is the leading brand of sanitary napkins in India, with a market share of over 50%. The brand is also popular in other countries, such as China, Brazil, and Mexico. Modibodi is an Australian company that makes period underwear that is absorbent, leak-proof, and odor-resistant. The company's underwear is made from a blend of Merino wool and microfibers and is designed to be worn for up to 12 hours. The competitive landscape in the global Feminine Hygiene Products Market is dynamic and constantly evolving. Players are constantly innovating and developing new products to meet the needs of consumers. They are also expanding into new markets and distribution channels. As a result, it is important for players to stay ahead of the curve and to adapt to changing market conditions.Feminine Hygiene Products Market Scope: Inquire Before Buying

Global Feminine Hygiene Products Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 35.70 Bn. Forecast Period 2023 to 2029 CAGR: 6.43% Market Size in 2029: US $ 54.31 Bn. Segments Covered: by Nature Disposable Reusable by Product Type Sanitary Pads Tampons and Menstrual Cup Panty liners and Shields Internal cleansers and Sprays Others by Distribution Channel Offline Online Feminine Hygiene Products Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Feminine Hygiene Products Market, Key Players are

1. Procter & Gamble Company6. 2. Kimberly-Clark Corporation 3. Unicharm Corporation6. 4. Johnson & Johnson Services, Inc 5. Essity AB 6. Ontex Group NV 7. Edgewell Personal Care Company 8. Unilever PLC6 9. TZMO SA 10. Kao Corporation Source 11. Seventh Generation 12. The Honest Company 13. Lil-Lets 14. Cora 15. L. Organic 16. Rael 17. Organyc 18. Hengan International Group Co., Ltd. FAQs: 1. What are the growth drivers for the Feminine Hygiene Products Market? Ans. Rising Disposable Incomes, growing female population and increasing awareness of menstrual health are expected to be the major drivers for the Feminine Hygiene Products Market. 2. What is the major restraint for the Feminine Hygiene Products Market growth? Ans. Lack of awareness is expected to be the major restraining factor for the Feminine Hygiene Products Market growth. 3. Which region is expected to lead the global Feminine Hygiene Products Market during the forecast period? Ans. Asia Pacific is expected to lead the global Feminine Hygiene Products Market during the forecast period. 4. What is the projected market size & and growth rate of the Feminine Hygiene Products Market? Ans. The Feminine Hygiene Products Market size was valued at USD 32.70 Billion in 2022 and the total Feminine Hygiene Product revenue is expected to grow at a CAGR of 6.43% from 2023 to 2029, reaching nearly USD 54.31 Million By 2029. 5. What segments are covered in the Feminine Hygiene Products Market report? Ans. The segments covered in the Feminine Hygiene Products Market report are Nature, Distribution Channel, Product Type and Region.

1. Feminine Hygiene Products Market: Research Methodology 2. Feminine Hygiene Products Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Feminine Hygiene Products Market: Dynamics 3.1. Feminine Hygiene Products Market Trends by Region 3.2. Feminine Hygiene Products Market Dynamics by Region 3.2.1. Feminine Hygiene Products Market Drivers 3.2.2. Feminine Hygiene Products Market Restraints 3.2.3. Feminine Hygiene Products Market Opportunities 3.2.4. Feminine Hygiene Products Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. Global 3.5.2. North America 3.5.3. Europe 3.5.4. Asia Pacific 3.5.5. Middle East and Africa 3.5.6. South America 3.6. Analysis of Government Schemes and Initiatives For Feminine Hygiene Product Industry 3.7. The Global Pandemic Impact on Feminine Hygiene Products Market 4. Feminine Hygiene Products Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 4.1.1. Disposable 4.1.2. Reusable 4.2. Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 4.2.1. Offline 4.2.2. Online 4.3. Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 4.3.1. Sanitary Pads 4.3.2. Tampons and Menstrual Cup 4.3.3. Panty liners and Shields 4.3.4. Internal cleansers and Sprays 4.3.5. Others 4.4. Feminine Hygiene Products Market Size and Forecast, by Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Feminine Hygiene Products Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. North America Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 5.1.1. Disposable 5.1.2. Reusable 5.2. North America Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 5.2.1. Offline 5.2.2. Online 5.3. North America Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 5.3.1. Sanitary Pads 5.3.2. Tampons and Menstrual Cup 5.3.3. Panty liners and Shields 5.3.4. Internal cleansers and Sprays 5.3.5. Others 5.4. Feminine Hygiene Products Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 5.4.1.1.1. Disposable 5.4.1.1.2. Reusable 5.4.1.2. United States Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.1.2.1. Offline 5.4.1.2.2. Online 5.4.1.3. United States Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 5.4.1.3.1. Sanitary Pads 5.4.1.3.2. Tampons and Menstrual Cup 5.4.1.3.3. Panty liners and Shields 5.4.1.3.4. Internal cleansers and Sprays 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 5.4.2.1.1. Disposable 5.4.2.1.2. Reusable 5.4.2.2. Canada Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.2.2.1. Offline 5.4.2.2.2. Online 5.4.2.3. Canada Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 5.4.2.3.1. Sanitary Pads 5.4.2.3.2. Tampons and Menstrual Cup 5.4.2.3.3. Panty liners and Shields 5.4.2.3.4. Internal cleansers and Sprays 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 5.4.3.1.1. Disposable 5.4.3.1.2. Reusable 5.4.3.2. Mexico Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.3.2.1. Offline 5.4.3.2.2. Online 5.4.3.3. Mexico Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 5.4.3.3.1. Sanitary Pads 5.4.3.3.2. Tampons and Menstrual Cup 5.4.3.3.3. Panty liners and Shields 5.4.3.3.4. Internal cleansers and Sprays 5.4.3.3.5. Others 6. Europe Feminine Hygiene Products Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Europe Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 6.2. Europe Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 6.3. Europe Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 6.4. Europe Feminine Hygiene Products Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 6.4.1.2. United Kingdom Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.1.3. United Kingdom Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 6.4.2. France 6.4.2.1. France Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 6.4.2.2. France Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2.3. France Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 6.4.3. Germany 6.4.3.1. Germany Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 6.4.3.2. Germany Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3.3. Germany Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 6.4.4. Italy 6.4.4.1. Italy Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 6.4.4.2. Italy Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4.3. Italy Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 6.4.5. Spain 6.4.5.1. Spain Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 6.4.5.2. Spain Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5.3. Spain Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 6.4.6.2. Sweden Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6.3. Sweden Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 6.4.7. Austria 6.4.7.1. Austria Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 6.4.7.2. Austria Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7.3. Austria Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 6.4.8.2. Rest of Europe Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8.3. Rest of Europe Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7. Asia Pacific Feminine Hygiene Products Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.2. Asia Pacific Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.3. Asia Pacific Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7.4. Asia Pacific Feminine Hygiene Products Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.4.1.2. China Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.1.3. China Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.4.2.2. S Korea Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2.3. S Korea Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7.4.3. Japan 7.4.3.1. Japan Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.4.3.2. Japan Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3.3. Japan Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7.4.4. India 7.4.4.1. India Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.4.4.2. India Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4.3. India Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7.4.5. Australia 7.4.5.1. Australia Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.4.5.2. Australia Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.5.3. Australia Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.4.6.2. Indonesia Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.6.3. Indonesia Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.4.7.2. Malaysia Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.7.3. Malaysia Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.4.8.2. Vietnam Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.8.3. Vietnam Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.4.9.2. Taiwan Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.9.3. Taiwan Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 7.4.10.2. Rest of Asia Pacific Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.10.3. Rest of Asia Pacific Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 8. Middle East and Africa Feminine Hygiene Products Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 8.2. Middle East and Africa Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 8.3. Middle East and Africa Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 8.4. Middle East and Africa Feminine Hygiene Products Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 8.4.1.2. South Africa Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.1.3. South Africa Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 8.4.2. GCC 8.4.2.1. GCC Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 8.4.2.2. GCC Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2.3. GCC Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 8.4.3.2. Nigeria Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3.3. Nigeria Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 8.4.4.2. Rest of ME&A Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.4.3. Rest of ME&A Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 9. South America Feminine Hygiene Products Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 9.1. South America Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 9.2. South America Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 9.3. South America Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 9.4. South America Feminine Hygiene Products Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 9.4.1.2. Brazil Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 9.4.1.3. Brazil Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 9.4.2.2. Argentina Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 9.4.2.3. Argentina Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Feminine Hygiene Products Market Size and Forecast, by Nature (2022-2029) 9.4.3.2. Rest Of South America Feminine Hygiene Products Market Size and Forecast, by Distribution Channel (2022-2029) 9.4.3.3. Rest Of South America Feminine Hygiene Products Market Size and Forecast, by Product Type (2022-2029) 10. Global Feminine Hygiene Products Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Market Segment 10.3.3. Product Type Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Feminine Hygiene Products Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Procter & Gamble Company 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Kimberly-Clark Corporation 11.3. Unicharm Corporation6. 11.4. Johnson & Johnson Services, Inc 11.5. Essity AB 11.6. Ontex Group NV 11.7. Edgewell Personal Care Company 11.8. Unilever PLC6 11.9. TZMO SA 11.10. Kao Corporation Source 11.11. Seventh Generation 11.12. The Honest Company 11.13. Lil-Lets 11.14. Cora 11.15. L. Organic 11.16. Rael 11.17. Organyc 11.18. Hengan International Group Co., Ltd. 12. Key Findings 13. Industry Recommendations 14. Research Methodology