The Fashion Accessories Market size was valued at USD 1640.06 Billion in 2024 and the total Fashion Accessories revenue is expected to grow at a CAGR of 14.56% from 2025 to 2032, reaching nearly USD 4865.47 Billion. The fashion accessories market is a rapidly growing industry, which includes a wide range of products such as jewellery, bags, belts, scarves, watches, and eyewear. The market is driven by factors such as changing fashion trends, rising disposable income, and increasing awareness about the latest fashion trends among consumers. The increasing influence of social media on fashion trends is also fuelling the demand for fashion accessories. Fashion accessories are now available in curated collections through luxury boutiques, high street brands, international accessories chains, international brands with accessories sections, and multi-brand outlets. The market is segmented based on product type, distribution channel, and geography. The product type segment includes jewellery, bags, belts, scarves, watches, and eyewear, among others. The distribution channel segment includes offline retail stores, online stores, and other distribution channels. The market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa regions. From 2020, the fashion accessories market witnessed a surge in demand for face masks as an essential accessory due to the COVID-19 pandemic. The market responded to the increased demand by offering a wide range of face masks with different designs, colours, and materials. The market is also witnessing a shift towards personalized and customizable accessories, with consumers looking for unique and exclusive products that reflect their individual style. Several companies in the market are offering customized products, such as personalized jewellery, bags, and watches. Fashion can be defined as the prevailing style or styles of clothing and accessories worn by different groups of people at a particular time. The fashion industry is known for its vast range of products, short product life cycles, and unstable and unpredictable demand. Additionally, it has rigid and lengthy supply procedures. The fashion accessories report provides in-depth and statistical insights into the current state of the global and regional fashion retail market. It encompasses all aspects of fashion, including apparel, footwear, and luxury goods, and highlights the prominent players in the industry, consumer purchasing behaviors, and the latest trends being pursued by both physical and online fashion retailers. This information can be beneficial for individuals and businesses looking to keep up with the fashion industry's ever-changing trends and developments.To know about the Research Methodology :- Request Free Sample Report

Fashion Accessories Market Dynamics

The global fashion accessories markets highly competitive and fragmented, with a large number of players operating in the market. The online channel is emerging as a major distribution channel for fashion accessories, with the increasing popularity of e-commerce platforms like Amazon, Myntra, and Flipkart. The market is also witnessing a trend towards eco-friendly and sustainable fashion accessories, driven by rising environmental concerns. The COVID-19 pandemic has impacted the market, leading to a shift towards comfortable and practical fashion accessories suitable for remote work and online meetings. The fashion accessories market is a rapidly growing industry with several opportunities and driving factors. The market is witnessing an increasing demand for eco-friendly and sustainable accessories, as consumers are becoming more conscious of the environment. The rise in disposable income and changing fashion trends are driving the demand for premium and high-quality accessories. The online channel is emerging as a major distribution channel, with e-commerce platforms offering a wide range of products at competitive prices, making it convenient for consumers to shop from home. The popularity of headwear products, such as hats, caps, headbands, and beanies, is increasing among individuals of all age groups, owing to their functional and fashionable appeal. The growing preference for winter apparel and accessories like hats, beanies, and winter headwear products is attributed to changing weather conditions due to global warming, especially in established regions. Leading companies in the industry are focusing on offering a variety of winter hats with new designs to meet unique customer requirements. Additionally, the market is seeing a surge in popularity of technologically advanced products like smart helmets, which come equipped with microphones, voice commands, lights, and smart software. There are some challenges and restraints that are faced by the fashion accessories market. The fashion industry is highly competitive, and new players must compete with established and well-known brands to gain market share. The industry is vulnerable to changing fashion trends, which can affect consumer demand and sales. Another challenge is the issue of sustainability and ethical practices in the supply chain, as consumers are becoming more aware of environmental and social issues and are demanding more eco-friendly and ethical products. This can lead to additional costs and complexity in the manufacturing and sourcing of materials. Finally, the ongoing COVID-19 pandemic has disrupted the industry, leading to supply chain disruptions, reduced consumer demand, and increased costs for businesses. These challenges and restraints must be addressed by industry players to ensure long-term growth and sustainability in the market. Import and Export in the Fashion accessories Industry The fashion industry is a global industry with extensive imports and exports of various products. The major importing countries in the fashion industry include the United States, Japan, Germany, the United Kingdom, and France. These countries are known for their high spending power and fashion-conscious population. They import fashion products such as clothing, footwear, accessories, and textiles from various countries. The major exporting countries in the fashion industry include China, Bangladesh, India, Vietnam, and Turkey. These countries have a strong manufacturing base and low labor costs, which make them attractive for fashion companies looking to source products at competitive prices. They export a wide range of fashion products to various countries around the world. The global fashion industry has experienced increasing popularity of e-commerce and the rise of fast fashion. This has led to an increase in imports and exports of fashion products, as companies look to source products from different countries to cater to the demands of consumers in various regions. The fashion industry also faces challenges related to imports and exports, such as supply chain disruptions, trade barriers, and changing regulations. The ongoing COVID-19 pandemic has also had a significant impact on the fashion industry's import and export activities, with disruptions in transportation and manufacturing leading to supply chain challenge Sustainable Fashion Accessories: The Growing Trend in the Market The fashion accessories market is dynamic, with trends constantly evolving to keep up with changing consumer preferences. One of the key trends in the market is the growing demand for sustainable and eco-friendly products. Consumers are becoming increasingly conscious of the environmental impact of fashion accessories and are looking for products made from sustainable materials, such as organic cotton, recycled plastic, and upcycled fabrics. The rise of social media and influencer culture has also had a significant impact on the fashion accessories market, with trends and styles quickly gaining popularity and driving demand for certain products. Another trend in the market is the growing popularity of customization, with consumers seeking to personalize their accessories to match their individual style. This has led to an increase in demand for products that can be easily customized, such as bags with detachable straps or jewelry with interchangeable charms. The rise of technology is also impacting the market, with the emergence of smart accessories, such as smartwatches and fitness trackers, that combine functionality with style. The fashion accessories market is highly competitive, with companies constantly innovating to keep up with the latest trends and consumer preferences.Fashion accessories Market Segmentation

The Fashion Accessories market is segmented by product type, distribution channel, end-user and region. Based on product type, the market is further segmented into bags, jewellery, watches, apparel, footwear and others. In the fashion accessories market, the watches & jewelry segment holds a significant share, accounting for over 40% of the total revenue in 2024. This segment is projected to grow at a CAGR of 15.2% from 2025 to 2032. The watches & jewelry category includes a variety of products, such as fine jewelry made of precious metals like silver, gold, and titanium, as well as fashion jewelry. With the increasing popularity of eCommerce, young consumers are inclined to purchase watches & jewelry online due to transparency in pricing and the reliable supply chain. As a result, the demand for watches & jewelry has witnessed a surge, contributing to substantial revenue generation in the fashion accessories market. In terms of distribution channels, the fashion accessories market is segmented into online and offline channels. The online channel is expected to grow at a faster CAGR of xx% during the forecast period due to the increasing penetration of smartphones and the internet, making it convenient for consumers to shop from the comfort of their homes. Most offline accessories brands have ventured into e-commerce, offering their products through their own websites, as well as on the major e-commerce sites. Smaller brands and unbranded sellers have also capitalized on the major e-commerce sites, creating the digital equivalent of the street markets. In terms of user segmentation, the fashion accessories market is broadly categorized into men, women, and children. Women's fashion accessories have traditionally dominated the market due to the wide range of product offerings, changing fashion trends, and higher purchasing power. However, the men's segment is gradually gaining traction, driven by the increasing awareness of fashion trends and a growing preference for fashion accessories among men. The children's segment is also witnessing growth, with parents willing to spend more on their children's fashion accessories. The report also covers a comprehensive analysis of the Fashion Accessories market across various regions, including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The Asia Pacific region dominates the market, accounting for a market share of xxx in 2024. The region is expected to maintain its dominance during the forecast period due to the rising disposable income and changing fashion trends. The report includes in-depth insights into the demand and sales of each Fashion Accessories product, consumer buying behaviour across different distribution channels, market size, growth rate, and opportunities across regions.Fashion Accessories Market Regional Insights

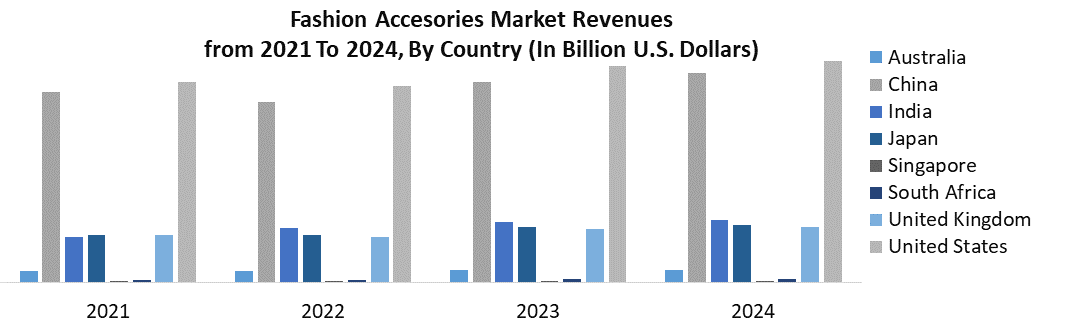

the fashion accessories market is experiencing significant growth worldwide. In terms of revenue, the Asia Pacific region dominates the market, accounting for more than 48% of the total revenue share in 2024. China is the fastest-growing country in the region, and the increasing usage of mobile and growing penetration of the internet are key factors driving the market expansion. The Middle East & Africa region is expected to register the second-highest CAGR of 14.6% from 2025 to 2032, owing to the growing opportunities and various investments made in new eCommerce channels in the region. The high penetration of the internet is also contributing to the market growth, making the region much easier to penetrate as compared to the market that is growing slowly as they are matured. Europe accounted for the second-largest revenue share of over 18% in 2024 and is expected to grow at a substantial CAGR in the forecast period. The growth of the region is attributed to the increasing spending of the population on fashion accessories over eCommerce. The increasing inclination of consumers toward eCommerce is also contributing to the market expansion. North America is one of the prominent regions in the fashion accessories market and accounted for a significant revenue share of over 20% in 2024. The increasing trend of online shopping among the consumers in the region is one of the major driving factors of market growth. Furthermore, the presence of major market players such as Amazon, Walmart, and Nordstrom in the region is contributing to the market expansion. The region is also characterized by a high demand for luxury fashion accessories and increasing consumer preference for eco-friendly and sustainable products. As a result, the North American market is projected to exhibit a substantial CAGR of 12.5% from 2025 to 2032. Revenue in the Luxury Fashion segment amounts to US$111.50bn in 2023 Latin America is another emerging region in the fashion accessories market and is estimated to expand at a significant CAGR of 14.5% during the forecast period. Brazil is the leading country in the region owing to its growing fashion industry and increasing demand for fashion accessories. The region is also characterized by the presence of numerous small and medium-sized market players offering a wide range of products at competitive prices, which is further fueling the market growth The report provides a comprehensive analysis of the fashion accessories market in North America, Europe, Asia-Pacific, South America and Middle East & Africa covering all the key metrics such as market size, market share, growth rate, regulatory landscape, and competitive landscape.

Fashion Accessories Market Competitive Landscape

The fashion accessories industry is highly competitive, with a large number of global and regional players competing for market share. The market is characterized by the presence of a few dominant players who account for a significant share of the market. Some of the major players in the market include LVMH Moet Hennessy Louis Vuitton SE, Richemont, Kering SA, Tiffany & Co., Coach, Inc., Burberry Group, Inc., Ralph Lauren Corporation, and Swatch Group AG. These companies are primarily engaged in the production and marketing of a wide range of fashion accessories such as bags, jewellery, watches, and other luxury items. In order to maintain their market position, these players focus on product innovation, marketing, and strategic partnerships. Many of these companies also invest heavily in research and development to create new and innovative products that cater to the changing needs and preferences of consumers In December 2022, House of Titan introduced IRTH, its latest women's handbag brand, which provides a range of handbags suitable for different occasions such as night outs, weekend getaways, workdays, and more. The company anticipates generating a turnover of around Rs 1000 crores over the next five years through this launch.Fashion Accessories Market Scope: Inquire before buying

Fashion Accessories Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1640.06 Bn. Forecast Period 2025 to 2032 CAGR: 14.56% Market Size in 2032: USD 4865.47 Bn. Segments Covered: by Product Type Bags Jewellery Watches Apparel Footwear Others by Type Online Offline by End User Men Women Children Fashion accessories Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Fashion accessories Market, Key Players

1. Coach (Premium) - United States 2. Michael Kors - United States 3. Kate Spade - United States 4. Vera Bradley - United States 5. American Eagle Outfitters - United States 6. Superdry (United Kingdom) 7. Mulberry (Premium) - United Kingdom 8. Longchamp - France 9. Bally - Switzerland 10.Fred Perry - United Kingdom 11.Shiseido (Premium) - Japan 12.Samsonite - Hong Kong 13.Li-Ning - China 14.Anta - China 15.Oroton - Australia 16.Burberry (Premium) - United Arab Emirates 17.Pasha - India 18.Okhtein - Egypt 19.Le BHV Marais - Saudi Arabia 20.Sunuva - South Africa 21.Renner - Brazil 22.Chamelle - Colombia 23.LOB - Mexico 24.Prüne - Argentina 25.Vélez - Colombia FAQ 1: What is the fashion accessories market? Ans: The fashion accessories market includes a wide range of products such as jewelry, bags, belts, scarves, watches, and eyewear. It is a rapidly growing industry driven by changing fashion trends, rising disposable income, and increasing awareness about the latest fashion trends among consumers. 2: What is the size of the fashion accessories market? Ans: The Fashion Accessories Market size was valued at USD 1640.06 Billion in 2024 and the total Fashion Accessories revenue is expected to grow at a CAGR of 14.56% from 2025 to 2032, reaching nearly USD 4865.47 Billion. 3: What are the factors driving the growth of the fashion accessories market? Ans: The fashion accessories market is driven by factors such as changing fashion trends, rising disposable income, increasing awareness about the latest fashion trends among consumers, and the influence of social media on fashion trends. 4: How is the fashion accessories market segmented? Ans: The market is segmented based on product type, distribution channel, and geography. The product type segment includes jewelry, bags, belts, scarves, watches, and eyewear, among others. The distribution channel segment includes offline retail stores, online stores, and other distribution channels. The market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa regions. 5: How has the COVID-19 pandemic impacted the fashion accessories market? Ans: The fashion accessories market witnessed a surge in demand for face masks as an essential accessory due to the COVID-19 pandemic. The market responded to the increased demand by offering a wide range of face masks with different designs, colors, and materials. 6: What are the latest trends in the fashion accessories market? Ans: The market is witnessing a shift towards personalized and customizable accessories, with consumers looking for unique and exclusive products that reflect their individual style. Several companies in the market are offering customized products, such as personalized jewelry, bags, and watches.

1. Fashion Accessories Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Fashion Accessories Market: Dynamics 2.1. Fashion Accessories Market Trends by Region 2.1.1. North America Fashion Accessories Market Trends 2.1.2. Europe Fashion Accessories Market Trends 2.1.3. Asia Pacific Fashion Accessories Market Trends 2.1.4. Middle East and Africa Fashion Accessories Market Trends 2.1.5. South America Fashion Accessories Market Trends 2.2. Fashion Accessories Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Fashion Accessories Market Drivers 2.2.1.2. North America Fashion Accessories Market Restraints 2.2.1.3. North America Fashion Accessories Market Opportunities 2.2.1.4. North America Fashion Accessories Market Challenges 2.2.2. Europe 2.2.2.1. Europe Fashion Accessories Market Drivers 2.2.2.2. Europe Fashion Accessories Market Restraints 2.2.2.3. Europe Fashion Accessories Market Opportunities 2.2.2.4. Europe Fashion Accessories Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Fashion Accessories Market Drivers 2.2.3.2. Asia Pacific Fashion Accessories Market Restraints 2.2.3.3. Asia Pacific Fashion Accessories Market Opportunities 2.2.3.4. Asia Pacific Fashion Accessories Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Fashion Accessories Market Drivers 2.2.4.2. Middle East and Africa Fashion Accessories Market Restraints 2.2.4.3. Middle East and Africa Fashion Accessories Market Opportunities 2.2.4.4. Middle East and Africa Fashion Accessories Market Challenges 2.2.5. South America 2.2.5.1. South America Fashion Accessories Market Drivers 2.2.5.2. South America Fashion Accessories Market Restraints 2.2.5.3. South America Fashion Accessories Market Opportunities 2.2.5.4. South America Fashion Accessories Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Fashion Accessories Industry 2.8. Analysis of Government Schemes and Initiatives For Fashion Accessories Industry 2.9. Fashion Accessories Market Trade Analysis 2.10. The Global Pandemic Impact on Fashion Accessories Market 3. Fashion Accessories Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 3.1.1. Bags 3.1.2. Jewellery 3.1.3. Watches 3.1.4. Apparel 3.1.5. Footwear 3.1.6. Others 3.2. Fashion Accessories Market Size and Forecast, by Type (2024-2032) 3.2.1. Online 3.2.2. Offline 3.3. Fashion Accessories Market Size and Forecast, by End User (2024-2032) 3.3.1. Men 3.3.2. Women 3.3.3. Children 3.4. Fashion Accessories Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Fashion Accessories Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Bags 4.1.2. Jewellery 4.1.3. Watches 4.1.4. Apparel 4.1.5. Footwear 4.1.6. Others 4.2. North America Fashion Accessories Market Size and Forecast, by Type (2024-2032) 4.2.1. Online 4.2.2. Offline 4.3. North America Fashion Accessories Market Size and Forecast, by End User (2024-2032) 4.3.1. Men 4.3.2. Women 4.3.3. Children 4.4. North America Fashion Accessories Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 4.4.1.1.1. Bags 4.4.1.1.2. Jewellery 4.4.1.1.3. Watches 4.4.1.1.4. Apparel 4.4.1.1.5. Footwear 4.4.1.1.6. Others 4.4.1.2. United States Fashion Accessories Market Size and Forecast, by Type (2024-2032) 4.4.1.2.1. Online 4.4.1.2.2. Offline 4.4.1.3. United States Fashion Accessories Market Size and Forecast, by End User (2024-2032) 4.4.1.3.1. Men 4.4.1.3.2. Women 4.4.1.3.3. Children 4.4.2. Canada 4.4.2.1. Canada Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 4.4.2.1.1. Bags 4.4.2.1.2. Jewellery 4.4.2.1.3. Watches 4.4.2.1.4. Apparel 4.4.2.1.5. Footwear 4.4.2.1.6. Others 4.4.2.2. Canada Fashion Accessories Market Size and Forecast, by Type (2024-2032) 4.4.2.2.1. Online 4.4.2.2.2. Offline 4.4.2.3. Canada Fashion Accessories Market Size and Forecast, by End User (2024-2032) 4.4.2.3.1. Men 4.4.2.3.2. Women 4.4.2.3.3. Children 4.4.3. Mexico 4.4.3.1. Mexico Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 4.4.3.1.1. Bags 4.4.3.1.2. Jewellery 4.4.3.1.3. Watches 4.4.3.1.4. Apparel 4.4.3.1.5. Footwear 4.4.3.1.6. Others 4.4.3.2. Mexico Fashion Accessories Market Size and Forecast, by Type (2024-2032) 4.4.3.2.1. Online 4.4.3.2.2. Offline 4.4.3.3. Mexico Fashion Accessories Market Size and Forecast, by End User (2024-2032) 4.4.3.3.1. Men 4.4.3.3.2. Women 4.4.3.3.3. Children 5. Europe Fashion Accessories Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 5.1. Europe Fashion Accessories Market Size and Forecast, by Type (2024-2032) 5.1. Europe Fashion Accessories Market Size and Forecast, by End User (2024-2032) 5.4. Europe Fashion Accessories Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 5.4.1.2. United Kingdom Fashion Accessories Market Size and Forecast, by Type (2024-2032) 5.4.1.3. United Kingdom Fashion Accessories Market Size and Forecast, by End User (2024-2032) 5.4.2. France 5.4.2.1. France Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 5.4.2.2. France Fashion Accessories Market Size and Forecast, by Type (2024-2032) 5.4.2.3. France Fashion Accessories Market Size and Forecast, by End User (2024-2032) 5.4.3. Germany 5.4.3.1. Germany Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 5.4.3.2. Germany Fashion Accessories Market Size and Forecast, by Type (2024-2032) 5.4.3.3. Germany Fashion Accessories Market Size and Forecast, by End User (2024-2032) 5.4.4. Italy 5.4.4.1. Italy Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 5.4.4.2. Italy Fashion Accessories Market Size and Forecast, by Type (2024-2032) 5.4.4.3. Italy Fashion Accessories Market Size and Forecast, by End User (2024-2032) 5.4.5. Spain 5.4.5.1. Spain Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 5.4.5.2. Spain Fashion Accessories Market Size and Forecast, by Type (2024-2032) 5.4.5.3. Spain Fashion Accessories Market Size and Forecast, by End User (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 5.4.6.2. Sweden Fashion Accessories Market Size and Forecast, by Type (2024-2032) 5.4.6.3. Sweden Fashion Accessories Market Size and Forecast, by End User (2024-2032) 5.4.7. Austria 5.4.7.1. Austria Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 5.4.7.2. Austria Fashion Accessories Market Size and Forecast, by Type (2024-2032) 5.4.7.3. Austria Fashion Accessories Market Size and Forecast, by End User (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 5.4.8.2. Rest of Europe Fashion Accessories Market Size and Forecast, by Type (2024-2032) 5.4.8.3. Rest of Europe Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6. Asia Pacific Fashion Accessories Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.2. Asia Pacific Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.3. Asia Pacific Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6.4. Asia Pacific Fashion Accessories Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.4.1.2. China Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.4.1.3. China Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.4.2.2. S Korea Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.4.2.3. S Korea Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6.4.3. Japan 6.4.3.1. Japan Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.4.3.2. Japan Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.4.3.3. Japan Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6.4.4. India 6.4.4.1. India Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.4.4.2. India Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.4.4.3. India Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6.4.5. Australia 6.4.5.1. Australia Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.4.5.2. Australia Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.4.5.3. Australia Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.4.6.2. Indonesia Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.4.6.3. Indonesia Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.4.7.2. Malaysia Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.4.7.3. Malaysia Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.4.8.2. Vietnam Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.4.8.3. Vietnam Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.4.9.2. Taiwan Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.4.9.3. Taiwan Fashion Accessories Market Size and Forecast, by End User (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 6.4.10.2. Rest of Asia Pacific Fashion Accessories Market Size and Forecast, by Type (2024-2032) 6.4.10.3. Rest of Asia Pacific Fashion Accessories Market Size and Forecast, by End User (2024-2032) 7. Middle East and Africa Fashion Accessories Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 7.2. Middle East and Africa Fashion Accessories Market Size and Forecast, by Type (2024-2032) 7.3. Middle East and Africa Fashion Accessories Market Size and Forecast, by End User (2024-2032) 7.4. Middle East and Africa Fashion Accessories Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 7.4.1.2. South Africa Fashion Accessories Market Size and Forecast, by Type (2024-2032) 7.4.1.3. South Africa Fashion Accessories Market Size and Forecast, by End User (2024-2032) 7.4.2. GCC 7.4.2.1. GCC Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 7.4.2.2. GCC Fashion Accessories Market Size and Forecast, by Type (2024-2032) 7.4.2.3. GCC Fashion Accessories Market Size and Forecast, by End User (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 7.4.3.2. Nigeria Fashion Accessories Market Size and Forecast, by Type (2024-2032) 7.4.3.3. Nigeria Fashion Accessories Market Size and Forecast, by End User (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 7.4.4.2. Rest of ME&A Fashion Accessories Market Size and Forecast, by Type (2024-2032) 7.4.4.3. Rest of ME&A Fashion Accessories Market Size and Forecast, by End User (2024-2032) 8. South America Fashion Accessories Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 8.2. South America Fashion Accessories Market Size and Forecast, by Type (2024-2032) 8.3. South America Fashion Accessories Market Size and Forecast, by End User(2024-2032) 8.4. South America Fashion Accessories Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 8.4.1.2. Brazil Fashion Accessories Market Size and Forecast, by Type (2024-2032) 8.4.1.3. Brazil Fashion Accessories Market Size and Forecast, by End User (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 8.4.2.2. Argentina Fashion Accessories Market Size and Forecast, by Type (2024-2032) 8.4.2.3. Argentina Fashion Accessories Market Size and Forecast, by End User (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Fashion Accessories Market Size and Forecast, by Product Type (2024-2032) 8.4.3.2. Rest Of South America Fashion Accessories Market Size and Forecast, by Type (2024-2032) 8.4.3.3. Rest Of South America Fashion Accessories Market Size and Forecast, by End User (2024-2032) 9. Global Fashion Accessories Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Fashion Accessories Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Coach (Premium) - United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Michael Kors - United States 10.3. Kate Spade - United States 10.4. Vera Bradley - United States 10.5. American Eagle Outfitters - United States 10.6. Superdry (United Kingdom) 10.7. Mulberry (Premium) - United Kingdom 10.8. Longchamp - France 10.9. Bally - Switzerland 10.10. Fred Perry - United Kingdom 10.11. Shiseido (Premium) - Japan 10.12. Samsonite - Hong Kong 10.13. Li-Ning - China 10.14. Anta - China 10.15. Oroton - Australia 10.16. Burberry (Premium) - United Arab Emirates 10.17. Pasha - India 10.18. Okhtein - Egypt 10.19. Le BHV Marais - Saudi Arabia 10.20. Sunuva - South Africa 10.21. Renner - Brazil 10.22. Chamelle - Colombia 10.23. LOB - Mexico 10.24. Prüne - Argentina 10.25. Vélez - Colombia 11. Key Findings 12. Industry Recommendations 13. Fashion Accessories Market: Research Methodology 14. Terms and Glossary