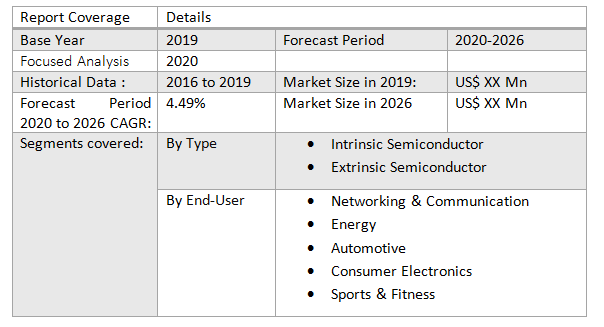

European Semiconductor Market is expected to grow at a CAGR of 19.8% during the forecast period. European Semiconductor Market is expected to reach US$ 59.87 Bn. by 2026. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region.

European Semiconductor Market Overview:

The EU has a solid base in the manufacturing, design & research of established technology nodes, & this can be leveraged to rebuild its semiconductor industry. In engineering, 49 percent of all installed capacity is for nodes of ≥0.2 micrometers, the maximum share in the world. This ensures a robust base to build on & availability of skilled labor for a manufacturing scale-up. Main production centers in the EU & European Free Trade Association (EFTA) comprise Austria, France, Germany, Italy, Ireland & the Netherlands, all of which are home to some top manufacturers.Using pandemic recovery funds, the EU moves to build up its semiconductor industry:

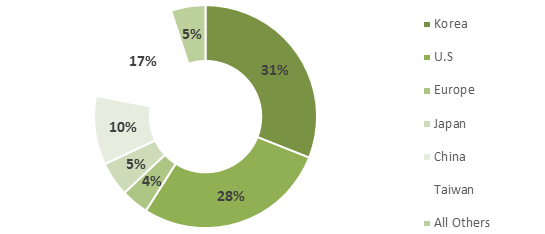

Half the republics in the EU, with Germany & France, are joining forces to develop semiconductors for use in self-driving cars, data centers, A.I., & supercomputers. EU already has a sizable semiconductor industry with particular assets in areas like smart cards & sensors, but it’s still small compared with those in the United States, South Korea, & Taiwan; European companies hold just a 10th of the $530 Bn global semiconductor market.European Semiconductor Sales Fell by 6 percent in the year 2020:

The EU semiconductor market has experienced negative development for another year, according to the MMR. In the year 2020, Europe’s semiconductor market weakened further, unlike most markets in the rest of the world. The EU semiconductor sales indeed increased by 12.1 percent in 2018 but declined by 7.3 percent in the year 2019, & by 6 percent in 2020. The global semiconductor market decreased in the year 2019, owing largely to cyclicality in the memory market. In 2020, the worldwide semiconductor sales returned to development & amounted to $439 Bn, up 6.5 percent YoY. For the month of December 2020, sales reached $39.2 Bn, an increase of 8.3percent compared to the December 2019 total & 2percent less than the November 2020 total. Q4 sales reached $117.5 Bn, up 8.3 percent YoY & up 3.5 percent sequentially. Global semiconductor sales improved moderately on a yearly basis in the year 2020, weathering a challenging macroeconomic environment brought on by the Corona Virus & other factors. All geographic areas, apart from the EU, reported a YoY growth. Sales into the Americas market stood out, growing by 19.8 percent in the year 2020. Today, the US accounts for 12.5 percent of total installed semiconductor manufacturing, with more than 80 percent of production now happening in APAC. The United States fabless establishments now almost exclusively rely on Asian manufacturers for leading-edge, 7-nm-&-below chip production.

Semiconductor Manufacturing Companies:

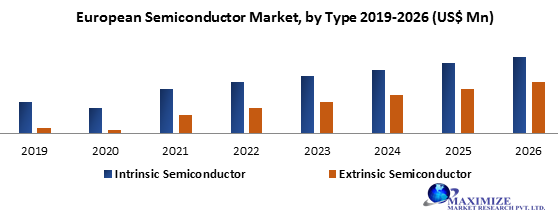

Intel Corporation: is the world's 2nd largest semiconductor chipmaker based on revenue, behind only Samsung. It is the inventor of the x86 series of microprocessors found in most personal computers today. NVIDIA Corporation designs graphics processing units for both gaming & professional markets, and system-on-a-chip units for automotive & mobile computing markets. Its primary GPU product line directly competes with Advanced Micro Devices' GPU products. Nvidia also provides parallel processing capabilities to researchers and scientists for high-performance supercomputing applications. It produces mobile processors for smartphones and tablets as well as vehicle navigation and entertainment systems. Texas Instruments Incorporated is one of the top 10 semiconductor manufacturing & design establishments worldwide with more than 43,000 the United States & international patents. TI focuses on emerging analog chips & embedded processors, accounting for more than 80 percent of their revenue. TI also produces digital light processing technology & education technology products with calculators, microcontrollers, & multi-core processors. The report covers Intrinsic Semiconductor, Extrinsic Semiconductor, with detailed analysis of European Semiconductor Market industry with the classifications of the market on the Type, End-User & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled twelve key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced Plastic Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major countries’ policies about manufacturing & Covid 19 impact on the on-demand side are covered in the report.Scope of the European Semiconductor Market:

European Semiconductor Market, by Region

• Europe o UK o Germany o France o Spain o Italy o Sweden o CIS countries o Rest of EuropeEuropean Semiconductor Market Key Players

• Intel Corporation • NVIDIA Corporation • Texas Instruments Incorporated • Micron Technology, Inc. • Analog Devices, Inc. • Microchip Technology Incorporated • Skyworks Solutions, Inc. • Maxim Integrated Products, Inc • Xilinx, Inc. • Advanced Micro Devices, Inc.

European Semiconductor Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: European Semiconductor Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. European Semiconductor Market Analysis and Forecast 7. European Semiconductor Market Analysis and Forecast, by Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. European Semiconductor Market Value Share Analysis, by Type 7.4. European Semiconductor Market Size (US$ Mn) Forecast, by Type 7.5. European Semiconductor Market Analysis, by Type 8. European Semiconductor Market Analysis and Forecast, by End-User 8.1. Introduction and Definition 8.2. Key Findings 8.3. European Semiconductor Market Value Share Analysis, by End-User 8.4. European Semiconductor Market Size (US$ Mn) Forecast, by End-User 8.5. European Semiconductor Market Analysis, by End-User 8.6. European Semiconductor Market Attractiveness Analysis, by End-User 9. European Semiconductor Market Analysis and Forecast, by Region 9.1. Introduction and Definition 9.2. Key Findings 9.3. European Semiconductor Market Value Share Analysis, by Region 9.4. European Semiconductor Market Size (US$ Mn) Forecast, by Region 9.5. European Semiconductor Market Analysis, by Region 10. European Semiconductor Market Analysis 10.1. Key Findings 10.2. European Semiconductor Market Overview 10.3. European Semiconductor Market Forecast, by Type 10.3.1. Intrinsic Semiconductor 10.3.2. Extrinsic Semiconductor 10.4. European Semiconductor Market Forecast, by End-User 10.4.1. Networking & Communication 10.4.2. Energy 10.4.3. Automotive 10.4.4. Consumer Electronics 10.4.5. Sports & Fitness 10.5. European Semiconductor Market Forecast, by Region 10.5.1. UK 10.5.2. France 10.5.3. Germany 10.5.4. Russia 10.5.5. Italy 10.5.6. Rest of Europe 10.6. PEST Analysis 10.7. Key Trends 10.8. Key Developments 11. Europe European Semiconductor Market Analysis 11.1. Key Findings 11.2. Europe European Semiconductor Market Overview 11.3. European Semiconductor Market Forecast, by Type 11.3.1. Intrinsic Semiconductor 11.3.2. Extrinsic Semiconductor 11.4. European Semiconductor Market Forecast, by End-User 11.4.1. Networking & Communication 11.4.2. Energy 11.4.3. Automotive 11.4.4. Consumer Electronics 11.4.5. Sports & Fitness 11.5. Europe European Semiconductor Market Forecast, by Country 11.5.1. UK 11.5.2. France 11.5.3. Germany 11.5.4. Russia 11.5.5. Italy 11.5.6. Rest of Europe 11.6. UK Semiconductor Market Forecast, by Type 11.6.1. Intrinsic Semiconductor 11.6.2. Extrinsic Semiconductor 11.7. UK Semiconductor Market Forecast, by End-User 11.7.1. Networking & Communication 11.7.2. Energy 11.7.3. Automotive 11.7.4. Consumer Electronics 11.7.5. Sports & Fitness 11.8. France Semiconductor Market Forecast, by Type 11.8.1. Intrinsic Semiconductor 11.8.2. Extrinsic Semiconductor 11.9. France Semiconductor Market Forecast, by End-User 11.9.1. Networking & Communication 11.9.2. Energy 11.9.3. Automotive 11.9.4. Consumer Electronics 11.9.5. Sports & Fitness 11.10. Germany Semiconductor Market Forecast, by Type 11.10.1. Intrinsic Semiconductor 11.10.2. Extrinsic Semiconductor 11.11. Germany Semiconductor Market Forecast, by End-User 11.11.1. Networking & Communication 11.11.2. Energy 11.11.3. Automotive 11.11.4. Consumer Electronics 11.11.5. Sports & Fitness 11.12. Russia Semiconductor Market Forecast, by Type 11.12.1. Intrinsic Semiconductor 11.12.2. Extrinsic Semiconductor 11.13. Russia Semiconductor Market Forecast, by End-User 11.13.1. Networking & Communication 11.13.2. Energy 11.13.3. Automotive 11.13.4. Consumer Electronics 11.13.5. Sports & Fitness 11.14. Rest of Europe Semiconductor Market Forecast, by Type 11.14.1. Intrinsic Semiconductor 11.14.2. Extrinsic Semiconductor 11.15. Rest of Europe Semiconductor Market Forecast, by End-User 11.15.1. Networking & Communication 11.15.2. Energy 11.15.3. Automotive 11.15.4. Consumer Electronics 11.15.5. Sports & Fitness 11.16. PEST Analysis 11.17. Key Trends 11.18. Key Developments 12. Company Profiles 12.1. Market Share Analysis, by Company 12.2. Market Share Analysis, by Region 12.3. Market Share Analysis, by Country 12.4. Competition Matrix 12.4.1. Competitive Benchmarking of key players by price, presence, market share, Raw material and R&D investment 12.4.2. New Raw material Launches and Raw material Enhancements 12.4.2.1. Market Consolidation 12.4.2.2. M&A by Regions, Investment and Raw material 12.4.2.3. M&A Key Players, Forward Integration and Backward Integration 12.5. Company Profiles: Key Players 12.5.1. Intel Corporation 12.5.2. NVIDIA Corporation 12.5.3. Texas Instruments Incorporated 12.5.4. Micron Technology, Inc. 12.5.5. Analog Devices, Inc. 12.5.6. Microchip Technology Incorporated 12.5.7. Skyworks Solutions, Inc. 12.5.8. Maxim Integrated Products, Inc 12.5.9. Xilinx, Inc. 12.5.10. Advanced Micro Devices, Inc.