By 2029, the Europe Immunoassay Analyzers Market is expected to reach US $ 3.09 billion, thanks to growth in the industrial processes segment. The report Europe Immunoassay Analyzer Medicine market dynamics by region and end-user industries.Europe Immunoassay Analyzers Market Overview:

In hospital and clinical laboratories, an immunoassay analyzer is used to perform automated biochemical tests to detect the presence and concentration of chemicals in samples. Immunoassay analyzers can perform a variety of assays, including cancer marker detection, infectious disease diagnosis, cardiac analysis, therapeutic medication monitoring, and allergy testing. An immunoassay analyzer can process a sample in two ways: random sampling and continuous access sampling. Immunoassays for microparticle enzyme, ion capture, fluorescence polarisation, and chemiluminescence can be performed on the samples. When picking an immunoassay analyzer, think about the sorts of tests and reagents you'll need, if you'll need automatic repetition and dilution, and how quickly you'll be able to finish the tests.To know about the Research Methodology :- Request Free Sample Report

Europe Immunoassay Analyzers Market Dynamics:

Europe Immunoassay Analyzers Market size was valued at US$ 1.11 Bn. in 2021 and the total revenue is expected to grow at 13.6% through 2022 to 2029, reaching nearly US$ 3.09 Bn. Immunoassays are decisive in the diagnosis and treatment preparation of diseases. As a result of the rise in the prevalence of chronic diseases such as cancer, cardiovascular disease, and diabetes mellitus, as well as the development of technologically advanced automated immunoassay analyzers for their diagnosis, the market has risen. There has been a critical demand for diagnostic solutions, especially immunoassay analyzers, since the emergence of the new coronavirus (COVID-19), as it is regarded as a cornerstone in the management of pandemics. Confirmatory testing aids in the rapid discovery of viruses and the isolation of patients, which helps to prevent future transmission. COVID-19 instances have been reported in the greatest number of European countries, including France, Russia, the United Kingdom, Italy, Spain, and Germany. The idea of mass testing has surfaced as a strategy to combat the pandemic. As a result of the epidemic, various government agencies are focusing on mass COVID-19 testing and are launching a series of programs to increase the number of analyzers, devices, and testing kits available in their country. The introduction of technologically superior analyzers into the European market has boosted the market growth in the region tremendously. For example, Roche, based in Switzerland, enhanced its analyzer, Cobas pre-integrated solutions, and offered eight new configurations across countries that accept the CE mark in March 2021. The enhanced version can run up to 4,400 tests each hour, more than double its previous testing capability. In December 2021, for example, Eurofins Abraxis, a biotechnology business, developed the CAAS Cube, an automated ELISA Analyzer that facilitates increased data analysis and configurable settings to satisfy laboratory testing requirements.Europe Immunoassay Analyzers Market Segment Analysis:

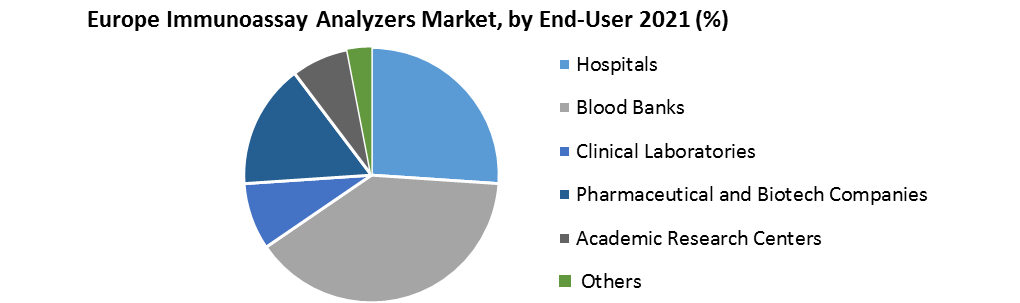

The Enzyme Immunoassay (EIA) analyzers segment is dominating the Procedure Type segment of the Europe Immunoassay Analyzers Market: The Enzyme Immunoassay (EIA) analyzers segment led the market in 2021, accounting for 62.7 % of total revenue. During the projected period, the segment is likely to grab more attention in the market. In bioanalytical, industrial, and healthcare settings, EIA analyzers have been the most widely used immunodiagnostic technology. It uses enzyme assays' reactivity and an antibody's specificity to identify and measure substances including antibodies, peptides, proteins, and hormones. Since this test is based on the antigen-antibody response, EIA analyses have great sensitivity, efficiency, and specificity without the use of radioactive substances. Another element enabling its adoption across diverse applications is its capacity to execute analysis simultaneously without complex sample preparation. Furthermore, expanding R&D activity in the areas of EIA testing and equipment will provide a plethora of market expansion potential. The hospital's segment is considered to supplement the growth of the Europe Immunoassay Analyzers Market. The hospital's sector dominated the market in 2021, accounting for 33.1 % of total sales. The category is predicted to maintain its dominance over the forecast period. The strong demand for immunoassay products in hospitals, which has increased due to increased hospitalizations due to chronic and infectious diseases, can be ascribed to the huge share. The market for automated immunoassay analyzers is being boosted by the growing number of corporate hospital chains.

Europe Immunoassay Analyzer Market Regional Insight:

Germany dominated the market in 2021, accounting for 23.7 % of total revenue, and is likely to hold this position throughout the forecast period. Because of Germany's supporting healthcare legislation, the market is likely to rise significantly. Furthermore, the presence of a sizable senior population in this country is a significant market driver. According to UN population data, one out of every 20 Germans is above the age of 80, with that number anticipated to rise to six by 2050. Due to the beginning of senescence and weakened immunity, the chance of developing chronic diseases such as cardiovascular disease, diabetes, and neurovascular disorders rises with age. The objective of the report is to present a comprehensive analysis of the Europe Immunoassay Analyzers Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Europe Immunoassay Analyzers Market dynamics, structure by analyzing the market segments and projecting the Europe Immunoassay Analyzers Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the Europe Immunoassay Analyzers Market make the report investor’s guide.Europe Immunoassay Analyzers Market Scope: Inquire before buying

Europe Immunoassay Analyzers Market Base Year 2021 Forecast Period 2022-2029 Historical Data CAGR Market Size in 2021 Market Size in 2029 2017 to 2021 13.6% US$ 1.11 Bn US$ 3.09 Bn Segments Covered by Procedure Type • Invasive Procedures • Enzyme Immunoassay (EIA) Analyzers o Chemiluminescence Immunoassay (CLIA) Analyzers o Fluorescence Immunoassay (FIA) Analyzers • Radioimmunoassay (RIA) Analyzers • Other Analyzers by End-User • Hospitals • Blood Banks • Clinical Laboratories • Pharmaceutical and Biotech Companies • Academic Research Centers • Others Europe Immunoassay Analyzers Market Key Player

• Siemens Healthineers • bioMérieux SA • Abbott Laboratories • Danaher Corporation (Beckman Coulter) • Quidel Corporation • Ortho Clinical Diagnostics • Sysmex Corporation • Bio-Rad Laboratories, Inc. • Becton, Dickinson, and Company • F. Hoffmann-La Roche AG • Thermo Fisher Scientific, Inc. • Pfizer • Merck KGA • Olympus Corporation • Nova Century Scientific Inc.FAQs:

1. What is the Europe Immunoassay Analyzers market value in 2021? Ans: Europe Immunoassay Analyzers market value in 2021 was estimated as 1.11 Billion USD. 2. What is the Europe Immunoassay Analyzers market growth? Ans: The Europe Immunoassay Analyzers market is anticipated to grow with a CAGR of 13.6 % in the forecast period and is likely to reach USD 3.09 Billion by the end of 2029. 3. Which segment is expected to dominate the Europe Immunoassay Analyzers market during the forecast period? Ans: In 2021, the Enzyme Immunoassay (EIA) analyzers segment dominated the Europe immunoassay analyzers market and accounted for the largest revenue share of 62.7%. 4. Who are the key players in the Europe Immunoassay Analyzers market? Ans: Some key players operating in the Europe immunoassay analyzers market include Siemens Healthineers; bioMérieux SA; Abbott Laboratories; Danaher Corporation (Beckman Coulter); Quidel Corporation; Ortho Clinical Diagnostics; Sysmex Corporation; Bio-Rad Laboratories, Inc.; Becton, Dickinson and Company; F. Hoffmann-La Roche AG; and Thermo Fisher Scientific, Inc. 5. What is the key driving factor for the growth of the Europe Immunoassay Analyzers market? Ans: Key factors that are driving the Europe Immunoassay Analyzers market growth include shifting trend towards maintaining optimal aesthetic beauty, the rise in medical tourism, high popularity of minimally invasive procedures, and the growing geriatric population prone to different skin conditions

1. Europe Immunoassay Analyzers Market: Research Methodology 2. Europe Immunoassay Analyzers Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Europe Immunoassay Analyzers Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Europe Immunoassay Analyzers Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Drivers Developments by Companies 3.4 Market 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • Europe 3.12 COVID-19 Impact 4. Europe Immunoassay Analyzers Market Segmentation 4.1 Europe Immunoassay Analyzers Market, by Procedure Type (2021-2029) • Invasive Procedures • Enzyme Immunoassay (EIA) Analyzers o Chemiluminescence Immunoassay (CLIA) Analyzers o Fluorescence Immunoassay (FIA) Analyzers • Radioimmunoassay (RIA) Analyzers • Other Analyzers 4.2 Europe Immunoassay Analyzers Market, by End-User (2021-2029) • Hospitals • Blood Banks • Clinical Laboratories • Pharmaceutical and Biotech Companies • Academic Research Centers • Others 4.3 European Ethernet Hard Drive Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 5. Company Profile: Key players 5.1 Cutera 5.1.1 Company Overview 5.1.2 Financial Overview 5.1.3 Global Presence 5.1.4 Procedure Type Portfolio 5.1.5 Business Strategy 5.1.6 Recent Developments 5.2 Siemens Healthineers 5.3 bioMérieux SA 5.4 Abbott Laboratories 5.5 Danaher Corporation (Beckman Coulter) 5.6 Quidel Corporation 5.7 Ortho Clinical Diagnostics 5.8 Sysmex Corporation 5.9 Bio-Rad Laboratories, Inc. 5.10 Becton, Dickinson and Company 5.11 F. Hoffmann-La Roche AG 5.12 Thermo Fisher Scientific, Inc. 5.13 Pfizer 5.14 Merck KGA 5.15 Olympus Corporation 5.16 Nova Century Scientific Inc.