Europe Image Sensor Market is expected to grow at a CAGR of 8.2% during the forecast period and market is expected to reach US$ 4.12 Bn. by 2026.To know about the Research Methodology :- Request Free Sample Report

Europe Image Sensor Market Overview:

The growing need for minor pixel devices offering high resolution with a cost-effective method is anticipated to fuel the market development during the forecast period. The Image Sensor Market has been facing a major change in the past few years. The technical improvements & intense usage of images through many applications have driven the transformation of image sensors in the Europe market. With the growing research & development investments, sensing equipment has become inexpensive, compact, & power-efficient, posing opportunities to the industry companies. The growing mobile phone sector, specifically, smartphones, is expected to spur the sector development over the forecast period.Growing Mobile Phone Sector:

The global mobile phone market will reach 1,687.1 Mn unit shipments in 2021, from the 1,794.2 million units shipped in the year 2020. From there, whole mobile phone shipments will incline to 1,729.6 million units globally by the year 2024, causing a CAGR of -0.7 percent from 2020 to 2024. The global smartphone market regaining will be impacted in 2020 as uncertainties about Corona Virus endure increasing concerns in most key markets. The Corona Virus outbreak is anticipated to stress the short-term situation, with smartphone shipments falling 10.6 percent YoY in the 1st half of the year 2020. Global smartphone shipments are estimated to return to growth in the year 2022 driven by quicker 5G efforts & the arrival of more reasonable 5G handsets in many markets. Global Smartphone Quarterly Data: (Global Smartphone Shipments Market Share (%))The growing worries for surveillance and security in public places counting parks, public squares, malls, & railway stations as well as the growing terrorist attacks are the key factors increasing the necessity for improved resolution cameras for security & surveillance. However, the surging requirement for cell phones & digital still cameras has caused shortages in lenses & picture sensors. Also, the active nature of the semiconductor business might restrain the sector growth during the forecast period.

Europe Image Sensor Segment Analysis:

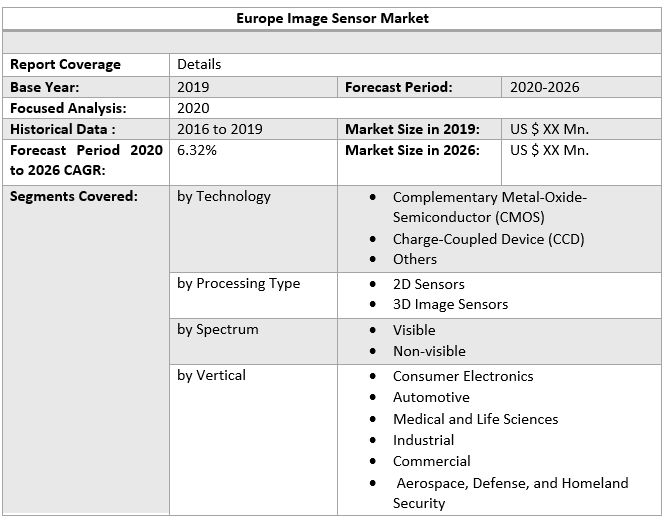

The image Sensors application sector can be segmented into automotive, consumer electronics, medical, and security & surveillance. Consumer electronics led the industry in terms of revenue in the year 2018. The proliferation & acceptance of multiple cameras in smartphones are projected to push the demand towards the north. Advanced Driver Assistance Systems is estimated to be the important driver for sector growth during the forecast period. Depending on the machine vision, the system responds to the condition met while driving. Also, smarter & compressed cameras can also support in handling traffic inducing the demand for traffic surveillance cameras which is estimated to further considerably raise the market development. However, the technology has found a major shift toward the occurrence through other car sectors. The demand is further estimated to spur due to the strict governing norms aiming to increase road safety for drivers & walkers during the forecast period. The rising need for slightly invasive solutions & imaging systems is estimated to drive the demand in medical applications. CMOS has opened new viewpoints to negligibly invasive medical devices like wireless capsules which are used for the observation of the gastrointestinal area. The Europe Image Sensor Market report covers 2D Sensors, 3D Image Sensors with detailed analysis Europe Image Sensor Market with the classifications of the market on the Converter Spectrum, Processing Type, Spectrum, Vertical & region. Analysis of past market dynamics from 2016 to 2019 is given in the Europe Image Sensor Market report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The Europe Image Sensor Market report has profiled key players in the market from different regions. However, the Europe Image Sensor Market report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Types, labor cost, availability of advanced Plastic Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on demand side are covered in the Europe Image Sensor Market report.Europe Image Sensor Market Scope: Inquire before buying

Europe Image Sensor Market, by Country

• U.K • France • Germany • Italy • Spain • Sweden • CIS Countries • Rest of EuropeEurope Image Sensor Market, Key Players:

• STMicroelectronics • Espros Photonics Corporation • Imasenic • Andanta • BAE Systems Inc. • Insightness • Integrated Detector Electronics AS • Multix • ON Semiconductor • IR Nova • Emberion • E2V • Omnivision • Samsung • Canon • Aptina Imaging • Nikon • Toshiba • EM Microelectronics • Melexis • SK Hynix.

Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Europe Image Sensor Market Size, by Market Value (US$ Mn) 3.1. Europe Market Segmentation 3.2. Europe Market Segmentation Share Analysis, 2019 3.2.1. Europe 3.2.2. By Country 3.3. Geographical Snapshot of the Europe Image Sensor Market 3.4. Geographical Snapshot of the Europe Image Sensor Market, By Manufacturer share 4. Europe Image Sensor Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Types 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Europe Image Sensor Market 5. Supply Side and Demand Side Indicators 6. Europe Image Sensor Market Analysis and Forecast, 2019-2026 6.1. Europe Image Sensor Market Size & Y-o-Y Growth Analysis. 7. Europe Image Sensor Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 7.1.1. Complementary Metal-Oxide-Semiconductor (CMOS) 7.1.2. Charge-Coupled Device (CCD) 7.1.3. Others 7.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 7.2.1. 2D Sensors 7.2.2. 3D Image Sensors 7.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 7.3.1. Visible 7.3.2. Non-visible. 7.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 7.4.1. Consumer Electronics 7.4.2. Automotive 7.4.3. Medical and Life Sciences 7.4.4. Industrial 7.4.5. Commercial 7.4.6. Aerospace, Defense, and Homeland Security 8. Europe Image Sensor Market Analysis and Forecasts, By Country 8.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 8.1.1. U.K 8.1.2. France 8.1.3. Germany 8.1.4. Italy 8.1.5. Spain 8.1.6. Sweden 8.1.7. CIS Countries 8.1.8. Rest of Europe 9. U.K. Image Sensor Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 9.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 9.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 9.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 10. France Image Sensor Market Analysis and Forecasts, 2019-2026 10.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 10.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 10.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 10.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 11. Germany Image Sensor Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 11.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 11.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 12. Italy Image Sensor Market Analysis and Forecasts, 2019-2026 12.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 12.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 12.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 12.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 13. Spain Image Sensor Market Analysis and Forecasts, 2019-2026 13.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 13.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 13.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 13.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 14. Sweden Image Sensor Market Analysis and Forecasts, 2019-2026 14.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 14.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 14.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 14.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 15. CIS Countries Image Sensor Market Analysis and Forecasts, 2019-2026 15.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 15.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 15.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 15.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 16. Rest of Europe Image Sensor Market Analysis and Forecasts, 2019-2026 16.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 16.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 16.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 16.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 17. Competitive Landscape 17.1. Geographic Footprint of Major Players in the Europe Image Sensor Market 17.2. Competition Matrix 17.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Services and R&D Investment 17.2.2. New Type Launches and Type Enhancements 17.2.3. Market Consolidation 17.2.3.1. M&A by Regions, Investment and Verticals 17.2.3.2. M&A, Forward Integration and Backward Integration 17.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 17.3. Company Profile : Key Players 17.3.1. PSC Group 17.3.1.1. Company Overview 17.3.1.2. Financial Overview 17.3.1.3. Geographic Footprint 17.3.1.4. Type Portfolio 17.3.1.5. Business Strategy 17.3.1.6. Recent Developments 17.3.2. STMicroelectronics 17.3.3. Espros Photonics Corporation 17.3.4. Imasenic 17.3.5. Andanta 17.3.6. BAE Systems Inc. 17.3.7. Insightness 17.3.8. Integrated Detector Electronics AS 17.3.9. Multix 17.3.10. ON Semiconductor 17.3.11. IR Nova 17.3.12. Emberion 17.3.13. E2V 17.3.14. Omnivision 17.3.15. Samsung 17.3.16. Canon 17.3.17. Aptina Imaging 17.3.18. Nikon 17.3.19. Toshiba 17.3.20. EM Microelectronics 17.3.21. Melexis 17.3.22. SK Hynix 18. Primary Key Insights.