Epilepsy Treatment Market was valued at USD 4.30 Billion in 2023, and it is expected to reach USD 7.04 Billion by 2030, exhibiting a CAGR of 7.3% during the forecast period (2024-2030). Epilepsy is a neurological disorder characterised by spontaneous, repeated seizures. Epilepsy is a chronic, non-communicable central nervous system illness characterised by abnormal activities, seizures, and involuntary moments and feelings. A seizure is an abnormal surge of electrical activity in your brain. Epilepsy is diagnosed when you have two or more seizures with no other known cause. It can be caused by congenital defects or genetic diseases, severe head injury, a brain tumour, and other factors during pregnancy and postnatal life. Patients with brain injuries have an increased incidence of accidents, brain injuries, and a greater prevalence of post-traumatic seizures. Medicines, surgeries, and other therapy are used to treat epilepsy. According to the World Health Organization (WHO), epilepsy affects 50 million people worldwide and about 3.5 million individuals in the United States, according to the Centers for Disease Control and Prevention (CDC). Almost 80% of epileptics reside in low- and middle-income nations. It is expected that if epilepsy is properly identified and treated, up to 70% of those living with it might live seizure-free. People with epilepsy are up to three times more likely to die prematurely than the general population. Three-quarters of patients with epilepsy in low-income nations do not receive the necessary therapy. People with epilepsy and their families face stigma and prejudice in many areas of the world. Epilepsy may affect anybody, however it most typically affects youngsters and the elderly. According to study released in 2023, men are more likely than women to acquire epilepsy, presumably due to greater exposure to risk factors such as alcohol usage and head trauma.Research Methodology

The research report relies heavily on both primary and secondary data sources. The research process entails the investigation of various factors affecting the industry, such as government policy, market environment, competitive landscape, historical data, current market trends, technological innovation, upcoming technologies, and technical progress in related industries, as well as market risks, opportunities, market barriers, and challenges. All conceivable elements influencing the markets included in this research study have been considered, examined in depth, validated through primary research, and evaluated to provide the final quantitative and qualitative data. The market size for top-level markets and sub-segments is normalised, and the impact of inflation, economic downturns, regulatory & policy changes, and other variables is factored into the market forecast. This data is combined and added with detailed inputs and analysis, and presented in the report.To know about the Research Methodology :- Request Free Sample Report

Epilepsy Treatment Market Dynamics

Developments in Anti-Epileptic Drugs: Although surgery, vagal nerve stimulation, and dietary modifications have all been used to treat epilepsy, antiepileptic medications (AEDs) are still the most often used treatment technique. Over twenty marketed AEDs are currently classed as first-line treatments. The primary objective of AED therapy is to allow patients to continue a normal lifestyle by controlling seizures completely and with minimum adverse effects. Ideally, this would be accomplished through the use of a comfortable dosage regimen with few restrictions on concomitant drugs. There is little question that enormous progress toward this aim has been achieved since the accidental discovery of phenobarbital, the first extensively used anticonvulsant, in 1912. If a single AED fails to control seizures, a mixture of AEDs, known as polytherapy, is frequently prescribed. An important trend in contemporary anti-epileptic medication research is the use of novel pharmacology to target medicines for specific subpopulations of people with drug-resistant epilepsy. According to the Journal of Drug Delivery and Therapeutics, new anti-epileptic medicines with fewer side effects and higher efficacy than those now available have been created. Reduced Side-Effects and Low Cost of Monotherapy: When opposed to polytherapy, monotherapy has been touted as the ideal in epilepsy treatment due to lesser side effects, the absence of medication interactions, greater compliance, cheaper cost, and, in many situations, enhanced seizure control. With the emergence of several novel antiepileptic medicines (AEDs), first studied as add-on agents, the debate over monotherapy vs. polytherapy has grown in relevance. Clobazam, lamotrigine, vigabatrin, gabapentin, and topiramate, all novel medications, have also been demonstrated to be effective as monotherapy. However, a large proportion of patients with refractory epilepsy are treated with polytherapy, which likely aids just a small fraction of them. The availability of various medications with diverse modes of action encourages the idea of "rational polytherapy," which takes advantage of potential synergism, a concept that has yet to be verified. Active epilepsy affects around 1.2% of the US population, including 3 million adults and 470,000 children. With optimal treatment, up to 70% of people with epilepsy will achieve remission, the majority with antiepileptic medication monotherapy. Increase in Number of Seizures among Patients: Seizures are caused by abnormal electrical discharges in a group of brain cells. Such discharges can occur in many areas of the brain. Seizures can range from momentary attention lapses or muscular jerks to severe and sustained convulsions. The frequency of seizures can also vary, from fewer than one per year to many per day. One seizure does not indicate epilepsy (up to 10% of persons in the globe have one seizure in their lifetime). Two or more unprovoked seizures are considered epilepsy. At any one time, the estimated proportion of the general population with active epilepsy (continuous seizures or the need for medication) is between 4 and 10 per 1000 persons. Epilepsy is estimated to affect 49 persons out of every 100,000 in high-income nations each year. This rate can reach 139 per 100 000 in low- and middle-income nations. Seizures can be managed. With proper antiseizure medication use, up to 70% of persons with epilepsy might achieve seizure-free status. After two years without seizures, discontinuing anti-seizure medication should be considered, taking into account pertinent clinical, social, and personal aspects. The two most reliable indicators of seizure recurrence are a confirmed aetiology of the seizure and an abnormal electroencephalography (EEG) pattern. Seizures are prevalent in people with human immunodeficiency virus (HIV) infection, and the rise in HIV infection may be a contributing factor to the rise in acute symptomatic seizures. Neurological diseases are the presenting sign in 5-10% of AIDS patients, and CNS involvement is seen in 90% of cases at autopsy. Acute seizures occur in around 50% of children and 5% of adults with tuberculosis. Seizures occur in around 10% of rabies patients. Seizures are caused by a variety of illnesses, including Japanese B encephalitis and malaria. Rising Number of Accidents & Injuries: Increasing the number of accidents and injuries and a higher rate of post-traumatic occurrence inpatient with brain injuries and the highest rate of post traumatic seizure occurrence in patients are the main driving factors. Government funding has been rising for the development of new and effective drugs for the treatment of seizures is a high-impact rendering driver for the epilepsy drugs market growth. Post-traumatic epilepsy and post-traumatic seizure can fuel the demand for epilepsy treatment by brain damage and high sensitivity risk of elderly epilepsy. The increasing geriatric population is also the second-largest factor for the increasing market growth. The growing adoption of rational polytherapy and advanced imaging technology for early diagnosis also contribute to the market growth. Brain tumours are the second most prevalent cause of epilepsy in the elderly, accounting for 10% to 30% of all geriatric epilepsy causes. Epilepsy is a frequent symptom of brain tumour patients. Seizures are the first symptom in 20% to 40% of brain tumour patients; around 20% to 45% of patients may experience epileptic seizures over the course of the disease. Meningitis, encephalitis, and neurocysticercosis are all examples of central nervous system infections that can cause both acute symptomatic seizures and epilepsy. In those who are prone to seizures, alcohol or drug addiction, as well as refusal to take prescribed anticonvulsant medicine, are major variables that are likely to enhance the risk of seizures. R&D, M&A are Creating Opportunities for Companies: Epilepsy therapeutics firms are benefiting from R&D, product launches, acquisitions, and collaborations. Extensive R&D operations serve as the foundation for novel and enhanced epilepsy therapies, boosting their effectiveness, efficacy, and pharmacokinetics in comparison to presently existing market goods. Companies producing epilepsy therapies are working on developing antiepileptic medications that are more tolerable, effective, and have fewer adverse effects. To enhance their position in the epilepsy therapeutics market, several market participants develop innovative medicines, gain regulatory approvals, launch new products, cooperate and build partnerships, participate in acquisitions and mergers, and generate profit-making possibilities. Furthermore, the market is being driven by ongoing discoveries and improvements in the epilepsy treatments industry. Art therapy for epilepsy, for example, which helps patients to examine their thoughts and feelings via the act of creating, painting, or sketching, is gaining popularity across the world. Treatment Gap in Epilepsy Patients: In low-income nations, almost three-quarters of patients with epilepsy may not obtain the necessary therapy. This is referred to as the "treatment gap." Antiseizure medicine is in short supply in many low- and middle-income nations. According to a recent study, the average availability of generic antiseizure medications in low- and middle-income nations' public sectors is less than 50%. This might be a barrier to receiving therapy. Most persons with epilepsy may be diagnosed and treated at the primary care level without the use of specialised technology. These factors may limit the growth of the Epilepsy Treatment market over the forecast period. Epilepsy does not spread. Although various underlying disease pathways can cause epilepsy, the origin of the condition remains unclear in around 50% of cases worldwide. The causes of epilepsy are classified into structural, genetic, infectious, metabolic, immunological, and unknown factors. Brain damage from prenatal or perinatal causes (e.g., loss of oxygen or trauma during birth, low birth weight); congenital abnormalities or genetic conditions with associated brain malformations; a severe head injury; a stroke that restricts the amount of oxygen to the brain; an infection of the brain such as meningitis, encephalitis, or neurocysticercosis, certain genetic syndromes; and a brain tumour are a few examples.Epilepsy Treatment Market Segment Analysis

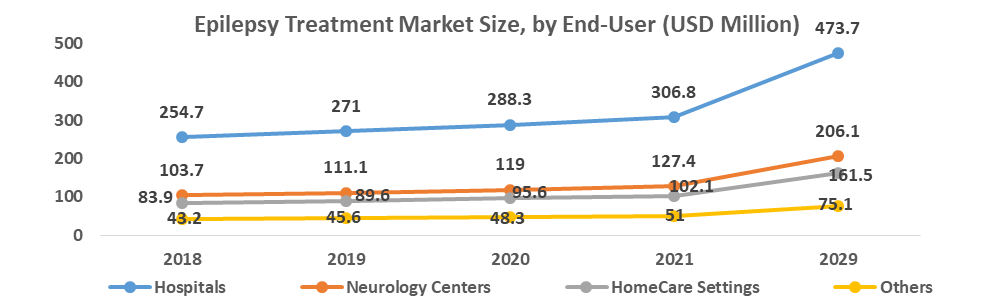

Based on the Product type, The Epilepsy Treatment Market is segmented into the First Generation Anti-epileptic drug, Second Generation Anti-epileptic drug, Third Generation Anti-epileptic drug. The second Generation Anti-epileptic drug segment held the largest market share of 45% in the year 2023. Owing to the high proscription rate, tolerability, and high efficacy thanks to its novel mechanism of action of this drug. Third Generation Anti-epileptic drug is expected to witness the fastest growth with a CAGR of over 4% during the forecast period. The major factor responsible for this growth of this segment is the launch of high new efficacy drugs with the improved mechanism of action of this drug. Based on the Condition, The Epilepsy Treatment Market is segmented into Epilepsy Drug-resistant, Intractable Drug Epilepsy, Other. The Epilepsy Drug-resistant segment is expected to hit a value of USD 2.93 Bn. during the forecast period. The advent of rational polytherapy for treating disease with minimal side effects is expected to produce the high revenue of the epilepsy market. Based on the End User, The Epilepsy Treatment Market is segmented into Hospitals, clinics, Diagnostic Centers, Other. The hospital segment held the largest market share of xx% in the year 2023. This segment is expected to remain dominant even during the forecasting period. Because of rising in the healthcare infrastructure and development in the drug development technology. This factors are attributed to the growth of the Epilepsy Treatment Market.

Epilepsy Treatment Market Regional Insights

North America dominated the Epilepsy Treatment Market with the largest market share of 53 % in 2023. It is also expected to register a CAGR of 4.1% during the forecast period. Increase in prevalence of neurological disease and increasing geriatric population, because this disease mostly occurs in the old age people. Presence of well-established healthcare infrastructure and favorable government initiatives for the healthcare system. The presence of high drug development technology and skilled professionals has been increased the Epilepsy treatment market in this region. The United States has the region's largest epileptic medicine market, owing to increased healthcare infrastructure and an increase in epilepsy patients. In 2023, around 470,000 children and 3 million adults in the United States had active epilepsy, according to the Centers for Disease Control and Prevention. Epilepsy affects more people in the United States than multiple sclerosis, Parkinson's disease, and cerebral palsy combined. As a result, the region's future for epilepsy treatment choices is bright. In addition, numerous groups in the United States are promoting awareness of epilepsy. For example, Epilepsy Awareness Day, also known as Purple Day, is held on March 26 to promote public knowledge of the brain illness and to reduce the stigma and fear associated with it.Asia Pacific is expected to grow the market with a CAGR of 4.5% during the forecast period. As rising disposable income level and the favorable healthcare government initiative in emerging economies such as India, China, and Japan. Rising government funding and support to improve drug development and innovative technology in it are also increasing the market revenue in this region. In India, over 10 million people suffer from epilepsy. It affects roughly 1% of the Indian population. The rural population (1.9%) has a larger prevalence than the urban population (0.6%). With less than 2000 neurologists and an estimated 5-6 million people with active epilepsy in India, there is a significant need to expand epilepsy services, particularly in rural and neglected regions, where the prevalence is significantly greater. Many persons with active epilepsy do not obtain proper therapy, resulting in a significant treatment gap. The treatment gap is exacerbated by a lack of awareness about antiepileptic medications, poverty, cultural beliefs, stigma, poor health infrastructure, and a paucity of skilled clinicians. Infectious disorders have a significant influence in the long-term burden of seizures, generating both new-onset epilepsy and status epilepticus. In a nation like India, proper education and health care services may make a huge difference. Scope of the Report The Epilepsy Treatment Market research report covers product classification, product application, development trend, product technology, competitive landscape, industrial chain structure, industry overview, national policy and planning analysis of the industry, and the most recent dynamic analysis, among other things. The report discusses the global market's drivers, opportunities, and limitations. It discusses the influence of various drivers, trends, and restraints on market demand during the forecast period. The research also outlines market potential on a global scale. The research includes the production time, base distribution, technical characteristics, research and development trends, technology sources, and raw material sources of main Epilepsy Treatment Market firms in terms of production bases and technologies. The more precise study also contains the primary market and consumer application sectors, significant regions and consumption, major producers, distributors, raw material suppliers, equipment providers, and their contact information, as well as an industry chain relationship analysis. This report's study also contains product specifications, manufacturing processes, cost structure, and data information organised by area, technology, and application.

Epilepsy Treatment Market: Inquire before buying

Global Epilepsy Treatment Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.30 Bn. Forecast Period 2024 to 2030 CAGR: 7.3 % Market Size in 2030: US $ 7.04 Bn. Segments Covered: by Product Type First Generation Anti-epileptic drug Second Generation Anti-epileptic drug Third Generation Anti-epileptic drug by Condition Epilepsy Drug resistant Intractable Drug Epilepsy Other by End-User Hospital Clinics Other Epilepsy Treatment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Epilepsy Treatment Market, Key Players

1. LivaNova PLC 2. GlaxoSmithKline PLC 3. Eisai Co. Ltd. 4. Pfizer Inc. 5. Medtronic PLC 6. UCB SA 7. NeuroPace Inc. 8. GW Pharmaceuticals PLC 9. Novartis AG 10.Johnson & Johnson Services Inc. 11.Abbott Laboratories 12.DiaGenic ASA 13.Quanterix 14.Merck KGaA 15.Neurelis 16.Teva Pharmaceutical Industries Ltd. 17.Sumitomo Dainippon Pharma Co. Ltd 18.Bausch Health 19.Sanofi 20.Takeda Pharmaceutical Company Limited 21.Marinus Pharmaceuticals Inc. 22.Upsher-Smith Laboratories LLC 23.SK BIOPHARMACEUTICALS 24.Vertex Pharmaceuticals Incorporated 25.ESTEVE 26.Zogenix Inc. 27.Lundbeck 28.Supernus Pharmaceuticals Inc 29.DAIICHI SANKYO COMPANY LIMITED Frequently Asked Questions: 1] What segments are covered in the Global Epilepsy Treatment Market report? Ans. The segments covered in the Epilepsy Treatment Market report are based on Product Type, Condition, and End-User. 2] Which region is expected to hold the highest share in the Global Epilepsy Treatment Market? Ans. The North America region is expected to hold the highest share in the Epilepsy Treatment Market. 3] What is the market size of the Global Epilepsy Treatment Market by 2030? Ans. The market size of the Epilepsy Treatment Market by 2030 is expected to reach USD 7.04 Bn. 4] What is the forecast period for the Global Epilepsy Treatment Market? Ans. The forecast period for the Epilepsy Treatment Market is 2024-2030. 5] What was the market size of the Global Epilepsy Treatment Market in 2023? Ans. The market size of the Epilepsy Treatment Market in 2023 was valued at USD 4.30 Bn.

1. Epilepsy Treatment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Epilepsy Treatment Market: Dynamics 2.1. Epilepsy Treatment Market Trends by Region 2.1.1. North America Epilepsy Treatment Market Trends 2.1.2. Europe Epilepsy Treatment Market Trends 2.1.3. Asia Pacific Epilepsy Treatment Market Trends 2.1.4. Middle East and Africa Epilepsy Treatment Market Trends 2.1.5. South America Epilepsy Treatment Market Trends 2.2. Epilepsy Treatment Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Epilepsy Treatment Market Drivers 2.2.1.2. North America Epilepsy Treatment Market Restraints 2.2.1.3. North America Epilepsy Treatment Market Opportunities 2.2.1.4. North America Epilepsy Treatment Market Challenges 2.2.2. Europe 2.2.2.1. Europe Epilepsy Treatment Market Drivers 2.2.2.2. Europe Epilepsy Treatment Market Restraints 2.2.2.3. Europe Epilepsy Treatment Market Opportunities 2.2.2.4. Europe Epilepsy Treatment Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Epilepsy Treatment Market Drivers 2.2.3.2. Asia Pacific Epilepsy Treatment Market Restraints 2.2.3.3. Asia Pacific Epilepsy Treatment Market Opportunities 2.2.3.4. Asia Pacific Epilepsy Treatment Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Epilepsy Treatment Market Drivers 2.2.4.2. Middle East and Africa Epilepsy Treatment Market Restraints 2.2.4.3. Middle East and Africa Epilepsy Treatment Market Opportunities 2.2.4.4. Middle East and Africa Epilepsy Treatment Market Challenges 2.2.5. South America 2.2.5.1. South America Epilepsy Treatment Market Drivers 2.2.5.2. South America Epilepsy Treatment Market Restraints 2.2.5.3. South America Epilepsy Treatment Market Opportunities 2.2.5.4. South America Epilepsy Treatment Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Epilepsy Treatment Industry 2.8. Analysis of Government Schemes and Initiatives For Epilepsy Treatment Industry 2.9. Epilepsy Treatment Market Trade Analysis 2.10. The Global Pandemic Impact on Epilepsy Treatment Market 3. Epilepsy Treatment Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 3.1.1. First Generation Anti-epileptic drug 3.1.2. Second Generation Anti-epileptic drug 3.1.3. Third Generation Anti-epileptic drug 3.2. Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 3.2.1. Epilepsy Drug resistant 3.2.2. Intractable Drug Epilepsy 3.2.3. Other 3.3. Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 3.3.1. Hospital 3.3.2. Clinics 3.3.3. Other 3.4. Epilepsy Treatment Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Epilepsy Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 4.1.1. First Generation Anti-epileptic drug 4.1.2. Second Generation Anti-epileptic drug 4.1.3. Third Generation Anti-epileptic drug 4.2. North America Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 4.2.1. Epilepsy Drug resistant 4.2.2. Intractable Drug Epilepsy 4.2.3. Other 4.3. North America Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 4.3.1. Hospital 4.3.2. Clinics 4.3.3. Other 4.4. North America Epilepsy Treatment Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. First Generation Anti-epileptic drug 4.4.1.1.2. Second Generation Anti-epileptic drug 4.4.1.1.3. Third Generation Anti-epileptic drug 4.4.1.2. United States Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 4.4.1.2.1. Epilepsy Drug resistant 4.4.1.2.2. Intractable Drug Epilepsy 4.4.1.2.3. Other 4.4.1.3. United States Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 4.4.1.3.1. Hospital 4.4.1.3.2. Clinics 4.4.1.3.3. Other 4.4.2. Canada 4.4.2.1. Canada Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. First Generation Anti-epileptic drug 4.4.2.1.2. Second Generation Anti-epileptic drug 4.4.2.1.3. Third Generation Anti-epileptic drug 4.4.2.2. Canada Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 4.4.2.2.1. Epilepsy Drug resistant 4.4.2.2.2. Intractable Drug Epilepsy 4.4.2.2.3. Other 4.4.2.3. Canada Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 4.4.2.3.1. Hospital 4.4.2.3.2. Clinics 4.4.2.3.3. Other 4.4.3. Mexico 4.4.3.1. Mexico Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. First Generation Anti-epileptic drug 4.4.3.1.2. Second Generation Anti-epileptic drug 4.4.3.1.3. Third Generation Anti-epileptic drug 4.4.3.2. Mexico Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 4.4.3.2.1. Epilepsy Drug resistant 4.4.3.2.2. Intractable Drug Epilepsy 4.4.3.2.3. Other 4.4.3.3. Mexico Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 4.4.3.3.1. Hospital 4.4.3.3.2. Clinics 4.4.3.3.3. Other 5. Europe Epilepsy Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 5.3. Europe Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 5.4. Europe Epilepsy Treatment Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 5.4.1.3. United Kingdom Epilepsy Treatment Market Size and Forecast, by End-User(2023-2030) 5.4.2. France 5.4.2.1. France Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 5.4.2.3. France Epilepsy Treatment Market Size and Forecast, by End-User(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 5.4.3.3. Germany Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 5.4.4.3. Italy Epilepsy Treatment Market Size and Forecast, by End-User(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 5.4.5.3. Spain Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 5.4.6.3. Sweden Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 5.4.7.3. Austria Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 5.4.8.3. Rest of Europe Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Epilepsy Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.3. Asia Pacific Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 6.4. Asia Pacific Epilepsy Treatment Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.4.1.3. China Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.4.2.3. S Korea Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.4.3.3. Japan Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 6.4.4. India 6.4.4.1. India Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.4.4.3. India Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.4.5.3. Australia Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.4.6.3. Indonesia Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.4.7.3. Malaysia Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.4.8.3. Vietnam Epilepsy Treatment Market Size and Forecast, by End-User(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.4.9.3. Taiwan Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 6.4.10.3. Rest of Asia Pacific Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Epilepsy Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 7.3. Middle East and Africa Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 7.4. Middle East and Africa Epilepsy Treatment Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 7.4.1.3. South Africa Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 7.4.2.3. GCC Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 7.4.3.3. Nigeria Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 7.4.4.3. Rest of ME&A Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 8. South America Epilepsy Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 8.3. South America Epilepsy Treatment Market Size and Forecast, by End-User(2023-2030) 8.4. South America Epilepsy Treatment Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 8.4.1.3. Brazil Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 8.4.2.3. Argentina Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Epilepsy Treatment Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Epilepsy Treatment Market Size and Forecast, by Condition (2023-2030) 8.4.3.3. Rest Of South America Epilepsy Treatment Market Size and Forecast, by End-User (2023-2030) 9. Global Epilepsy Treatment Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Epilepsy Treatment Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. LivaNova PLC 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. GlaxoSmithKline PLC 10.3. Eisai Co. Ltd. 10.4. Pfizer Inc. 10.5. Medtronic PLC 10.6. UCB SA 10.7. NeuroPace Inc. 10.8. GW Pharmaceuticals PLC 10.9. Novartis AG 10.10. Johnson & Johnson Services Inc. 10.11. Abbott Laboratories 10.12. DiaGenic ASA 10.13. Quanterix 10.14. Merck KGaA 10.15. Neurelis 10.16. Teva Pharmaceutical Industries Ltd. 10.17. Sumitomo Dainippon Pharma Co. Ltd 10.18. Bausch Health 10.19. Sanofi 10.20. Takeda Pharmaceutical Company Limited 10.21. Marinus Pharmaceuticals Inc. 10.22. Upsher-Smith Laboratories LLC 10.23. SK BIOPHARMACEUTICALS 10.24. Vertex Pharmaceuticals Incorporated 10.25. ESTEVE 10.26. Zogenix Inc. 10.27. Lundbeck 10.28. Supernus Pharmaceuticals Inc 10.29. DAIICHI SANKYO COMPANY LIMITED 11. Key Findings 12. Industry Recommendations 13. Epilepsy Treatment Market: Research Methodology 14. Terms and Glossary