Global Enhanced Geothermal System Market size was valued at USD 2.9 billion in 2022 and expected to reach USD 3.82 billion by 2029, at CAGR of 4%.Enhanced Geothermal System Market Overview

Geothermal energy comes from the Earth’s core. It’s created by the decay of radioactive elements and the heat that’s created when the Earth was formed. The rocks and fluids that make up our planet’s core contain this heat. In many parts of the world, we’ve been using geothermal energy to cook and heat food for thousands of years. The hot water that’s stored underground in geothermal reservoirs provides electricity for heating and cooling. Governments and organizations all over the world are focusing on implementing renewable energy sources. Furthermore, of all the renewable energy generation technologies available worldwide, solar and wind technologies have shown the most potential for development, attracting significant government funding. On the other hand, geothermal energy represents a massive market opportunities, with promising results from research. The resources has not been used extensively in recent years, but several locations around the world are expected to maximize the market’s potential in the coming years. An increasing focus on meeting high energy demand through sustainable sources such as geothermal, consistent base load power production technology, growing need for energy security and emission reduction, and a stable and controllable source of power are expected to drive the Global Enhanced Geothermal System (EGS) Market at a significant growth rate between 2022 and 2029.To know about the Research Methodology :- Request Free Sample Report

Enhanced Geothermal System Market Scope and Research Methodology

The report highlights the competitive market view, segment analysis based on the Type, Technology, End-User and Region. First, the market overview describes the market trends, key market drivers, market restraints, opportunities, and challenges for the Enhanced Geothermal System Market. The Market is segmented by the station type such as Dry steam power stations, Flash steam power stations, and Binary cycle power stations. It is segmented by Technology such as Hydraulic fracturing, Chemical stimulation, Thermal stimulation, and Explosive stimulation. Market also segmented by end-user including Commercial and Industrial sector. The market size and trends for the Enhanced Geothermal System Market were analysed by using both primary and secondary data. Top down approach is used to estimate market size of the Enhanced Geothermal System Market. Market projections were based on historical data, present sector developments, and future market opportunities and challenges. The SWOT analysis of the major market players, which included their strengths, weaknesses, opportunities, and threats, was also included in the research to provide a thorough knowledge of the market dynamics. By employing the PESTLE analysis, the operating environment of an organization can be assessed. Porter's analysis were used to identify crucial factors that directly affect market profitability.Enhanced Geothermal System Market Dynamics

Market Drivers Increasing Demand Power Consumption and Growing Prices of Fossil Fuels The global market for geothermal systems is expected to increase significantly due to the increasing use of electricity and electronic gadgets in households and businesses. The internet is also becoming more popular, with digitalization and internet networks popping up everywhere. This is making it easier for people to get heat from underground sources without damaging the environment. Geothermal systems heat and cool buildings in one go, without having to use multiple machines and power sources, which is helping the market grow. Increasing demand for renewable energy The Enhanced Geothermal Systems (EGS) Market is growing as the world looks for cleaner and more sustainable ways to tackle climate change. Enhanced Geothermal System technology extracts heat from the Earth’s crust, making it a dependable and stable source of clean energy even in areas where natural geothermal resources are limited. This reliability combined with EGS’s low environmental impact make it an attractive option for governments, businesses and investors looking to increase renewable energy capacity. Enhanced Geothermal system research and development efforts continue to improve system’s efficiency and cost effectiveness, further increasing its potential as a renewable energy solution. Government support for EGS development Government Support for enhanced geothermal system development can significantly increase demand for EGS technology by removing key barriers and creating an environment conductive to its growth. For example, the financial incentives such as grants, subsidies and tax credits can lower the initial cost of EGS projects, making them more appealing to investors and project developers. Supportive policies and regulations can help to streamline the permitting process, lowering bureaucratic barriers and shortening project timelines. Government-supported R&D initiatives can also drive innovation, improving EGS efficiency and cost-effectiveness. Furthermore, public awareness campaigns and education programs can educate communities about the advantages of EGS, thereby increasing demand. Current Market Trends in Enhanced Geothermal System (EGS) Horizontally Layered EGS The EGS concept involves extracting heat through a sub-surface fracture system to be injected through injection wells. An enhanced geothermal system will expand more quickly if the underlying rock permeability is higher. Rocks are permeable due to small cracks and pores between mineral grains. The injected water warms up by interacting with the underlying rock in naturally occurring hydrothermal systems. The injected water then returns to the ground through production reservoirs. Reservoirs designed to improve economics of resources with insufficient water and/or rock permeability are called EGS. Conventional EGS consists of an easy-to-build, twin vertical well for geothermal extraction. In recent years, however, more and more geothermal systems have been horizontally stratified. When it comes to overall heat recovery efficiencies, a horizontally stacked improved EGS exceeds that of a twin vertical well EGS. On top of that, the EGS that is horizontally stacked has a higher rate of heat recovery and is more economical than twin vertical wells EGS. Prominence of Closed-Loop EGS The term "deep closed-loop geothermal system" has recently received a lot of press attention. A closed-loop geothermal system circulates fluid hundreds or even tens of thousands of feet underground before returning to the surface. At no time does any liquid escape from the borehole. Fluids move beneath the surface in pipelines and boreholes, collecting heat by conducting it and transporting it to the surface, where it can be used for a customized mix of heat and power. Closed-loop geothermal systems have been around for a while, but a few companies have recently enhanced them with oil and gas industry technology. Closed-loop Enhanced geothermal systems can be applied in many geological conditions as they are flexible to implement in different geothermal reservoirs making them more suited for open loop, which requires specific condition in location. This adaptability opens up wider geographic area’s that can be used in geothermal energy production as it makes it possible in regions where other conventional geothermal sources may not exist. Closed-loop EGS systems have gained popularity because of their low environmental impact, which aligns with the global push for cleaner, more sustainable energy sources. As governments and industries work to reduce carbon emissions and promote renewable energy, the closed-loop EGS trend in the enhanced geothermal system market is expected to continue.Market Restraints

Enhanced Geothermal System projects can be very expensive due to the need to drill deep wells and inject water or various fluids into the ground. EGS initiatives may not be attractive to investors due to high initial costs. Enhanced Geothermal System is a relatively new technology, and there are still a number of technical issues to be resolved. For example, finding and characterizing suitable EGS reservoirs can be difficult, as can maintaining the integrity of EGS wells and infrastructure. Some communities have expressed concern about the potential environmental effects of EGS projects, such as earthquake risk and water contamination. This public opposition may cause EGS projects to be delayed or even halted.Market Opportunities

The generation of clean and sustainable energy is one of the primary opportunities in the enhanced geothermal system (EGS) market. EGS technology uses the Earth's natural heat to generate power that is reliable and consistent while emitting no greenhouse gases. As the world turns to renewable energy sources to combat climate change, EGS stands out as a promising solution, providing a consistent and environmentally friendly energy supply. Enhanced Geothermal System (EGS) technology makes it possible to produce geothermal energy in geothermal pools that do not occur in nature. It offers new geographic opportunities for clean energy generation, reducing dependence on fossil fuels in areas that may not have access that may not have access to renewable energy sources such as wind or solar. EGS technology can be applied to a wide range of geological conditions, providing a wide range of energy production options. Continuous R&D in enhance geothermal system technology provides opportunities for innovation and efficiency improvements. EGS systems can become more cost-effective and productive as technology advances, making them more appealing to investors and project developers. Innovations in drilling techniques, materials, and reservoir engineering can boost EGS's competitiveness in the energy market even further. EGS systems have the potential to provide the base load energy required for a stable and reliable power supply. Unlike wind and solar, EGS geothermal energy has no intermittency, unlike some other renewable energy sources. This makes it ideal to supplement the energy needs of industry and even communities to reduce dependence on fossil fuels to ensure energy stability.Market Challenges

EGS projects are costly to develop because it needs to drill deep wells and inject water or other fluids into the ground. For example, a single EGS well can cost between USD 10 million and USD 20 million to drill. So for few investors, the upfront cost of an enhanced geothermal system project can be a major challenge to make entry in market. Enhanced Geothermal system is relatively a new technology, and there are still number of technical challenges over there need to be resolved. For example, finding and characterizing suitable EGS reservoirs can be difficult, as can maintaining the integrity of EGS wells and infrastructure. Furthermore, EGS projects can be complex and necessitate a high level of expertise. Enhanced geothermal system faces competition from other renewable source of strength which includes sun and wind which can be becoming extra aggressive in terms of price. In reality, solar and wind are presently the cheapest new varieties of electricity generation in most of the arena, this means that the EGS faces competition only in terms of price. There is a lack of expertise and knowledge in EGS development, which makes finding qualified personnel and contractors challenging. This lack of experience can result in EGS project delays and cost overruns.Enhanced Geothermal System Market segment Analysis

On the basis of station type enhanced geothermal system market is segmented into Dry steam power stations, Flash steam power stations, and Binary cycle power stations. Binary Cycle Power Stations segment dominates the market with 60% of market share and expected to maintain its dominance during the forecasted period. Binary Cycle Power Station is different from dry steam power station and flash steam power station because the geothermal reservoir fluid never reaches the power plant’s turbine units. Binary cycle systems are also environmentally friendly due to their closed-loop operation, which follows to strict environmental laws. Their high energy conversion efficiency and ongoing technological advancements have made them a preferred choice for investors and developers, strengthening their position as the market's dominant segment. The second-largest segment of the enhanced geothermal system (EGS) market is typically flash steam power stations. Flash steam power plants are preferred because they can use moderately high-temperature geothermal reservoirs, which are more common than the extremely high-temperature resources required for dry steam systems. Because of this broader applicability, flash steam power stations can be deployed in a wide range of geothermal regions. While not as efficient or environmentally friendly as binary cycle systems, flash steam power stations are still a popular choice due to their ability to tap into readily available geothermal resources and produce electricity efficiently, making them the second-largest segment in the EGS market. On the basis of technology the enhanced geothermal system market is segmented into Hydraulic fracturing, Chemical stimulation, Thermal stimulation, and Explosive stimulation. The hydraulic segment accounted for a significant market share and is expected to grow significantly over the forecast period. This technology has gained popularity due to its ability to increase geothermal reservoir productivity. It can form a network of fractures, increasing reservoir permeability and allowing for a more efficient heat exchange process. While other stimulation methods have their uses, hydraulic fracturing has become the dominant technology in the EGS market due to its widespread use and success in improving geothermal resource accessibility and energy output.On the basis of end-user enhanced geothermal system market is segmented into Commercial and Industrial sector. The commercial segment of enhanced geothermal system dominating the market with 65% of market share. And expected to experience significant growth over the forecasted period due to the increasing prevalence of enhanced geothermal system applications in various commercial industries. The rate of consumption of end-users in the healthcare, government, educational, transportation, storage, IT, banking, supermarket, department store, and other sectors is increasing day by day due to the growth of digitalization transformation, which is impacting the market demand in the period from 2023 to 2029. As a result, all these sectors have adopted net zero energy buildings by installing geothermal systems, which have a lower surface footprint and lower infrastructure and transmission costs, in order to reduce their gas and energy price expenditure.

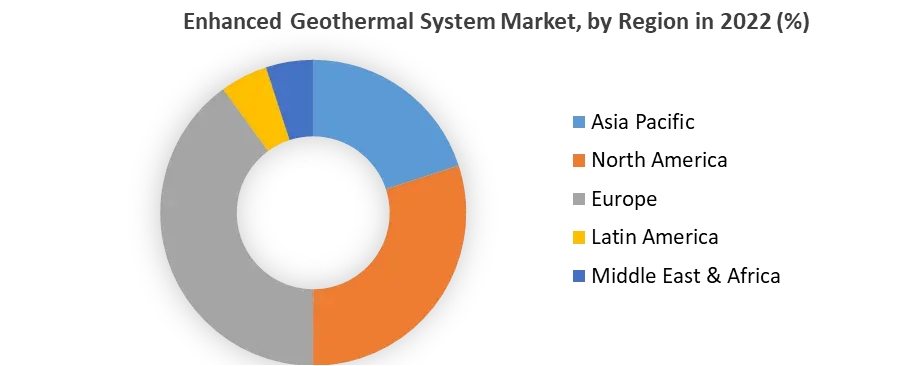

Enhanced Geothermal System Market Regional Insights

Europe has held largest market share is enhanced geothermal system market and is expected to have the highest growth during the forecast period due to aggressive investments in the energy sector achieve the net zero emission goal of 2050. Europe has made significant investments in renewable energy, including geothermal energy and countries such as Germany, France, and the United Kingdom are focusing on geothermal energy, with Germany taking the lead. The growth of European enhanced geothermal system market is driven by European green deal and Horizon Europe mission. The growing emission to reduce carbon emission by replacing geothermal energy with fossil fuels, which reduces carbon emission generated by 25% of the European population’s energy consumption and expenditure. Germany is expected to spend more than 1 billion dollar on geothermal projects by the end of 2029 in order to recover from the sudden withdrawal of Russian gas. The North American region is the second largest region in enhanced geothermal system market. And expected to have a significant market share over the forecast period. Due to the extreme temperature variations in the region, the demand for geothermal systems to process food, melt and deice snow, bathe, and cure concrete block is on the rise. The growing demand for energy efficient solutions to improve performance, lower functional costs, and minimize environmental impacts is driving market growth. The increasing government funding to improve sustainable measures and solutions is also driving market growth.

Enhanced Geothermal System Market Competitive Landscape

The market for enhanced geothermal systems is highly competitive. Some of the leading players in this market are Enel SpA, Ormat Technologies, Inc., AltaRock Energy, Inc., BESTEC GmbH, SA Geothermie Bouillante, Fuji Electric Co., Ltd., Calpine Corporation, Energy Development Corporation, Ansaldo Energia S.p.A., Mitsubishi Heavy Industries, Ltd, Toshiba Corporation, Siemens AG and joint ventures Key strategies used by market leaders to increase their market share are Product and service launches Mergers and acquisitions Partnerships and collaborations. Enhanced geothermal system market leaders are Eavor Technologies (Canada), Quaise Energy (USA), Geodynamics Limited (Australia), Greenfire Energy (USA), AltGeo (USA), Ormat Technologies (Israel), Mitsubishi Heavy Industries (Japan), Baker Hughes (USA), NIBE Group (Sweden) and Schlumberger (USA). All of these companies are working on a variety of technologies and EGS development approaches. Eavor Technologies, for instance, is working on an EGS closed-loop system that utilizes a fluid that flows between two wells to generate new fractures. Quaise Energy, on the other hand, is working on a high-pressure hydraulic fracturing (HPP) system. Apart from these businesses, there are many other enterprises that participate in the advanced geothermal market such as oil and gas companies, engineering firms, and construction firms. These companies provide services to enhance geothermal system developers such as drilling wells, building infrastructure and project management. The market is expected to become more competitive in the coming years as more companies enter the market and technology advances. This competition is likely to drive down EGS development costs and make EGS more competition with other energy sources.Enhanced Geothermal System Market Scope: Inquiry Before Buying

Enhanced Geothermal System Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2.9 Bn. Forecast Period 2023 to 2029 CAGR: 4% Market Size in 2029: US $ 3.82 Bn. Segments Covered: by Station Type Dry steam power stations Flash steam power stations Binary cycle power stations by Technology Hydraulic fracturing Chemical stimulation Thermal stimulation Explosive stimulation by End-User Commercial Sector Industrial Sector Enhanced Geothermal System Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Enhanced Geothermal System Key Players

1. Enel SpA 2. Ormat Technologies Inc. 3. AltaRock Energy, Inc. 4. BESTEC GmbH 5. SA Geothermie Bouillante 6. Fuji Electric Co., Ltd. 7. Calpine Corporation 8. Energy Development Corporation 9. Ansaldo Energia S.p.A. 10. Mitsubishi Heavy Industries Ltd 11. Toshiba Corporation 12. Siemens AG 13. Eavor Technologies, 14. Quaise Energy 15. Geodynamics Limited 16. Greenfire Energy 17. AltGeo 18. Ormat Technologies 19. Mitsubishi Heavy Industries 20. Baker Hughes 21. NIBE Group 22. SchlumbergerFrequently Asked Questions:

1] What segments are covered in the Global Enhanced Geothermal System Market report? Ans. The segments covered in the Enhanced Geothermal System Market report are based on Station Type, Technology, End-User and Region. 2] Which region held the largest share of the Global Enhanced Geothermal System Market in 2022? Ans. The Europe held the largest share of the Enhanced Geothermal System Market in 2022. 3] What is the market size of the Global Enhanced Geothermal System Market by 2029? Ans. The market size of the Enhanced Geothermal System Market by 2029 is expected to reach USD 3.82 Billion. 4] What is the forecast period for the Global Enhanced Geothermal System Market? Ans. The forecast period for the Enhanced Geothermal System Market is 2023-2029. 5] What was the market size of the Global Enhanced Geothermal System Market in 2022? Ans. The market size of the Enhanced Geothermal System Market in 2022 was valued at USD 2.9 Billion.

1. Enhanced Geothermal System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Enhanced Geothermal System Market: Dynamics 2.1. Enhanced Geothermal System Market Trends by Region 2.1.1. Global Enhanced Geothermal System Market Trends 2.1.2. North America Enhanced Geothermal System Market Trends 2.1.3. Europe Enhanced Geothermal System Market Trends 2.1.4. Asia Pacific Enhanced Geothermal System Market Trends 2.1.5. Middle East and Africa Enhanced Geothermal System Market Trends 2.1.6. South America Enhanced Geothermal System Market Trends 2.2. Enhanced Geothermal System Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Enhanced Geothermal System Market Drivers 2.2.1.2. North America Enhanced Geothermal System Market Restraints 2.2.1.3. North America Enhanced Geothermal System Market Opportunities 2.2.1.4. North America Enhanced Geothermal System Market Challenges 2.2.2. Europe 2.2.2.1. Europe Enhanced Geothermal System Market Drivers 2.2.2.2. Europe Enhanced Geothermal System Market Restraints 2.2.2.3. Europe Enhanced Geothermal System Market Opportunities 2.2.2.4. Europe Enhanced Geothermal System Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Enhanced Geothermal System Market Drivers 2.2.3.2. Asia Pacific Enhanced Geothermal System Market Restraints 2.2.3.3. Asia Pacific Enhanced Geothermal System Market Opportunities 2.2.3.4. Asia Pacific Enhanced Geothermal System Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Enhanced Geothermal System Market Drivers 2.2.4.2. Middle East and Africa Enhanced Geothermal System Market Restraints 2.2.4.3. Middle East and Africa Enhanced Geothermal System Market Opportunities 2.2.4.4. Middle East and Africa Enhanced Geothermal System Market Challenges 2.2.5. South America 2.2.5.1. South America Enhanced Geothermal System Market Drivers 2.2.5.2. South America Enhanced Geothermal System Market Restraints 2.2.5.3. South America Enhanced Geothermal System Market Opportunities 2.2.5.4. South America Enhanced Geothermal System Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Key Opinion Leader Analysis For Allogeneic Cell Therapy Industry 2.8. Analysis of Government Schemes and Initiatives For Enhanced Geothermal System Industry 2.9. The Global Pandemic Impact on Enhanced Geothermal System Market 2.10. Enhanced Geothermal System Price Trend Analysis (2021-22) 2.11. Global Enhanced Geothermal System Market Trade Analysis (2017-2022) 2.11.1. Global Import of Fixed Switch Cabinet 2.11.1.1. Ten Largest Importer 2.11.2. Global Export of Fixed Switch Cabinet 2.11.3. Ten Largest Exporter 2.12. Production Capacity Analysis 2.12.1. Chapter Overview 2.12.2. Key Assumptions and Methodology 2.12.3. Enhanced Geothermal System Manufacturers: Global Installed Capacity 3. Enhanced Geothermal System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 3.1. Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 3.1.1. Dry steam power stations 3.1.2. Flash steam power stations 3.1.3. Binary cycle power stations 3.2. Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 3.2.1. Hydraulic fracturing 3.2.2. Chemical stimulation 3.2.3. Thermal stimulation 3.2.4. Explosive stimulation 3.3. Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 3.3.1. Commercial Sector 3.3.2. Industrial Sector 3.4. Enhanced Geothermal System Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Enhanced Geothermal System Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. North America Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 4.1.1. Dry steam power stations 4.1.2. Flash steam power stations 4.1.3. Binary cycle power stations 4.2. North America Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 4.2.1. Hydraulic fracturing 4.2.2. Chemical stimulation 4.2.3. Thermal stimulation 4.2.4. Explosive stimulation 4.3. North American Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 4.3.1. Commercial Sector 4.3.2. Industrial Sector 4.4. North America Cabinet Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 4.4.1.1.1. Dry steam power stations 4.4.1.1.2. Flash steam power stations 4.4.1.1.3. Binary cycle power stations 4.4.1.2. United States Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 4.4.1.2.1. Hydraulic fracturing 4.4.1.2.2. Chemical stimulation 4.4.1.2.3. Thermal stimulation 4.4.1.2.4. Explosive stimulation 4.4.1.3. United States Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 4.4.1.4. Commercial Sector 4.4.1.5. Industrial Sector 4.4.2. Canada 4.4.2.1. Canada Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 4.4.2.1.1. Dry steam power stations 4.4.2.1.2. Flash steam power stations 4.4.2.1.3. Binary cycle power stations 4.4.2.2. Canada Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 4.4.2.2.1. Hydraulic fracturing 4.4.2.2.2. Chemical stimulation 4.4.2.2.3. Thermal stimulation 4.4.2.2.4. Explosive stimulation 4.4.2.3. Canada Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 4.4.2.3.1. Commercial Sector 4.4.2.3.2. Industrial Sector 4.4.3. Mexico 4.4.3.1. Mexico Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 4.4.3.1.1. Dry steam power stations 4.4.3.1.2. Flash steam power stations 4.4.3.1.3. Binary cycle power stations 4.4.3.2. Mexico Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 4.4.3.2.1. Hydraulic fracturing 4.4.3.2.2. Chemical stimulation 4.4.3.2.3. Thermal stimulation 4.4.3.2.4. Explosive stimulation 4.4.3.3. Mexico Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 4.4.3.3.1. Commercial Sector 4.4.3.3.2. Industrial Sector 5. Europe Enhanced Geothermal System Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. Europe Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 5.2. Europe Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 5.3. Europe Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 5.4. Europe Enhanced Geothermal System Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 5.4.1.2. United Kingdom Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 5.4.1.3. United States Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 5.4.2. France 5.4.2.1. France Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 5.4.2.2. France Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 5.4.2.3. France Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 5.4.3.2. Germany Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 5.4.3.3. Germany Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 5.4.4.2. Italy Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 5.4.4.3. Italy Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 5.4.5.2. Spain Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 5.4.5.3. Spain Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 5.4.6.2. Sweden Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 5.4.6.3. Sweden Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 5.4.7.2. Austria Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 5.4.7.3. Austria Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 5.4.8.2. Rest of Europe Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 5.4.8.3. Rest of Europe Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 6. Asia Pacific Enhanced Geothermal System Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.2. Asia Pacific Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.3. Asia-Pacific Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 6.4. Asia Pacific Enhanced Geothermal System Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.4.1.2. China Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.4.1.3. China Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.4.2.2. S Korea Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.4.2.3. S Korea Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029 6.4.3. Japan 6.4.3.1. Japan Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.4.3.2. Japan Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.4.3.3. Japan Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 6.4.4. India 6.4.4.1. India Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.4.4.2. India Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.4.4.3. India Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.4.5.2. Australia Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.4.5.3. Australia Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.4.6.2. Indonesia Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.4.6.3. Indonesia Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.4.7.2. Malaysia Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.4.7.3. Malaysia Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.4.8.2. Vietnam Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.4.8.3. Vietnam Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.4.9.2. Taiwan Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.4.9.3. Taiwan Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 6.4.10.3. Rest Asia-Pacific Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 7. Middle East and Africa Enhanced Geothermal System Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 7.2. Middle East and Africa Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 7.3. Middle East and Africa Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 7.4. Middle East and Africa Enhanced Geothermal System Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 7.4.1.2. South Africa Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 7.4.1.3. South Africa Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 7.4.2.2. GCC Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 7.4.2.3. GCC Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 7.4.3.2. Nigeria Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 7.4.3.3. Nigeria Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 7.4.4.2. Rest of ME&A Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 7.4.4.3. Rest of ME&A Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 8. South America Enhanced Geothermal System Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. South America Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 8.2. South America Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 8.3. South American Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 8.4. South America Enhanced Geothermal System Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 8.4.1.2. Brazil Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 8.4.1.3. Brazil Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 8.4.2.2. Argentina Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 8.4.2.3. Argentina Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Enhanced Geothermal System Market Size and Forecast, by Station Type (2022-2029) 8.4.3.2. Rest Of South America Enhanced Geothermal System Market Size and Forecast, by Technology (2022-2029) 8.4.3.3. Rest Of South America Enhanced Geothermal System Market Size and Forecast, by End-User (2022-2029) 9. Global Enhanced Geothermal System Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Station Type Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Enhanced Geothermal System Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Enel SpA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ormat Technologies Inc. 10.3. AltaRock Energy, Inc. 10.4. BESTEC GmbH 10.5. SA Geothermie Bouillante 10.6. Fuji Electric Co., Ltd. 10.7. Calpine Corporation 10.8. Energy Development Corporation 10.9. Ansaldo Energia S.p.A. 10.10. Mitsubishi Heavy Industries Ltd 10.11. Toshiba Corporation 10.12. Siemens AG 10.13. Eavor Technologies, 10.14. Quaise Energy 10.15. Geodynamics Limited 10.16. Greenfire Energy 10.17. AltGeo 10.18. Ormat Technologies 10.19. Mitsubishi Heavy Industries 10.20. Baker Hughes 10.21. NIBE Group 10.22. Schlumberger 11. Key Findings 12. Industry Recommendations 13. Enhanced Geothermal System Market: Research Methodology 14. Terms and Glossary