EMC Shielding and Test Equipment Market was valued at US$ 7.16 Bn. in 2022. Global EMC Shielding and Test Equipment Market size is estimated to grow at a CAGR of 4.57% over the forecast period.EMC Shielding and Test Equipment Market Definition:

The rise of the EMC shielding and test equipment market is primarily driven by the increasing demand for consumer electronics, the increasing electromagnetic pollution, and the continuous demonstration of field tests and driver tests to demonstrate the efficiency of 5G technology. COVID-19 has affected almost every industry globally by disrupting the supply chain and preventing various industrial activities. Many companies have suspended or reduced their production capacity. The lockdown in all over the world because of COVID-19 had led to environmental closure and social reduction, which led to the closure of productive crops in the first phase of the epidemic. As allowed to operate in a few industries, consumer electronics and automotive industries are experiencing declining demand for products. The above factors have affected the EMC shielding and test equipment market as there are very few new EMC shielding solutions and testing equipment which are expected to be used by these industries during the ongoing crisis.To know about the Research Methodology :- Request Free Sample Report

EMC Shielding and Test Equipment Market Dynamics:

Driver: Growing demand for consumer electronics: Computers, smartphones, tablets, and laptops are among the most popular electronic devices used by ordinary people for various purposes, including communication, entertainment, and legal work. Factors such as voice-assisted infotainment systems, the increasing adoption of electronic devices in cars, the increase in the number of smartphones, the impact of smart devices, and the upcoming distribution of 5G mobile networks greatly support the global consumer electronics growth. Consumer electronics generate EMI. With the advancement of electronic devices such as computers, cell phones, and roaming systems around the world, EMC shielding has become a significant concern. High gas emissions also fuel the need for EMC shielding due to fluctuations in power supply, increased clock frequency, rapid kill rates, increased packing capacity, and greater demand for smaller, lighter, cheaper, and less expensive materials such as power devices. This has led to the emergence of a number of directives and regulations in favour of EMC shielding and test equipment from their suppliers. Reliable EMI shielding contributes significantly to the machine's reliability, thus providing a useful marketing proposition for manufacturers of system systems and equipment. Restrain: Increase in cost of EMC shielding and test equipment EMC shielding safeguards electronic devices from corrosion and oxidation. At the same time, materials such as metals, plastics, and active polymers can be used to control electromagnetic radiation. Steel is usually the best way to protect EMC; however, due to its heavyweight and high cost and being vulnerable to environmental degradation, it is not selected as the EMC shielding agent in current electrical equipment. While polymeric composite materials are light in weight and cheap to make, they do not have the protective power of EMC. The cost of EMC shielding solutions usually includes compliance testing costs in accordance with defined standards for a number of procedures such as cleaning, loading and unloading, and face masking. These additional costs increase the total cost of the final product. Many manufacturers of electronic types consider EMC shielding in the design phase and design type that is expected to meet the target market's needs. If manufacturers fail to achieve the EMC shielding, they desire, they need to find different shielding solutions to keep their product in the target market without interfering with product design. This is also expected to increase the product's final cost and increase its marketing time. Therefore, the high cost of EMC shielding hinders the market growth. Opportunity: Increased adoption of electric vehicles Electric vehicles are of 3 main types — battery-powered vehicles (BEV), Hybrid Electric vehicles (HEV), and plug-in hybrid electric vehicles (PHEV). Asia, Europe, and the US are some of the largest markets for electric vehicles, showing significant sales growth. Though the backdrop of growing environmental concerns and political support is there yet, the two-wheeled, three-wheeled electric bikes and buses are seeing a significant trend these days. Power converters, electric motors, secure and uninterrupted cables, wireless chargers, and batteries are essential components of a standard operating system and are subject to EMI and electromagnetic radiation. Wireless charging of electric vehicles has become very popular in the past. Unlike engines based on a combustion engine, some electric vehicles emit more electric waves in the charging mode than in driving mode. The power required for an electric drive system is much higher than the power required for an entire electrical system in conventional vehicles. Other factors such as weight, size, and emissions of an electric vehicle require special EMI shielding features. Therefore, the growth of the electric car market is expected to create a way for the growth of EMC market shielding and testing equipment. Challenge: Trade between miniaturization and EMC shielding of electrical equipment Advances in integrated circuits and energy systems have significantly reduced the size of various electronic devices, such as smartphones, cameras, TVs, and computers. The minimal performance of such devices leads to concerns related to signal interference within the device as technology integrates various components (transmitters, sensors, receivers, etc.) into a single enclosed enclosure. The small size of the parts and their proximity significantly increase the chances of exposure to EMC from nearby components within the same device. Small size and lowers the available space for EMC shielding solutions. It is complicated to pinpoint EMI in such a small cycle. Although simple boxes outside the shelf were previously used for security, their inability to fit into existing designs limits their use on these small devices. This necessitates the use of customized security solutions, which adds to the overall cost of the product.EMC Shielding and Test Equipment Market Segment Analysis:

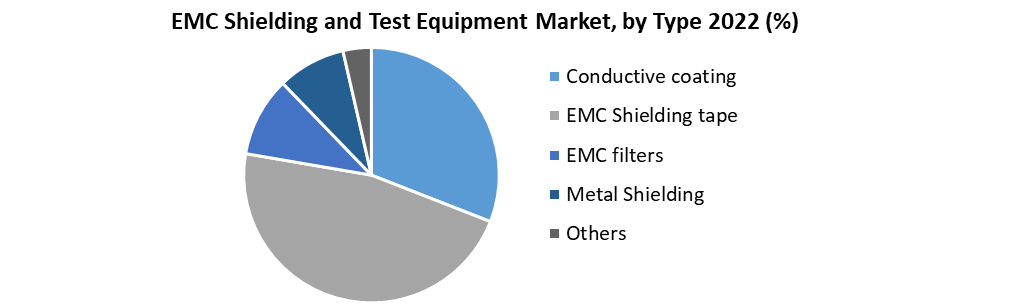

By Type, EMC shielding techniques such as conductive coatings, paints, EMC shielding tapes & laminates, filters, and metal shielding are significantly used for protecting many devices in various sectors such as healthcare, consumer electronics, and automotive. The rising demand for consumer electronics and the latest trends in electric vehicles create many opportunities for the acceptance of EMC shielding solutions in several application areas. Owing to such rapidly increasing requirements for EMC shielding, EMC shielding is predicted to hold the top position in the EMC shielding and test equipment market during the forecast period. By Application, The consumer electronics vertical's EMC shielding and test equipment market is expected to account for the largest share in the forecast period. Aerospace and defence, IT and Communication, and others accept the EMC Shielding and test equipment market. At the same time, the advancement in the consumer electronic devices and the availability of high-tech products, such as wearable gadgets, and the need to adjust to EMC shielding guidelines are expected to be the significant factors contributing to the growth of the EMC shielding and test equipment market in consumer electronics.

EMC Shielding and Test Equipment Market Regional Insights:

The global EMC Shielding and Test Equipment Market covers North America, South America, Europe, the Middle East, Africa, and the Asia Pacific. The Asia Pacific region is expected to grow during the forecasting period among all these regions. This is because of the increasing requirements for EMC shielding and test equipment in the region's manufacturing industries, especially in China, Japan, and India. This region is expected to grow exponentially and gain a superior position in the international market in the upcoming years. Moreover, the broad range of acceptance of EMC shielding and test equipment in the enhancement of the IT and telecommunications industry is expected to raise the EMC shielding and test equipment market in North America as well. It is expected that North America is expected to reach a market value of 477.0 Mn. USD in the upcoming forecasting period of 2023-2029. The objective of the report is to present a comprehensive analysis of the global EMC Shielding and Test Equipment Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the EMC Shielding and Test Equipment Market dynamic, structure by analyzing the market segments and projecting the EMC Shielding and Test Equipment Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the EMC Shielding and Test Equipment Market make the report investor’s guide.EMC Shielding and Test Equipment Market Scope: Inquire before buying

EMC Shielding and Test Equipment Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 7.16 Bn. Forecast Period 2023 to 2029 CAGR: 4.57 % Market Size in 2029: US $ 9.79 Bn. Segments Covered: by Type •Conductive coating • EMC Shielding tape • EMC filters • Metal Shielding • Others by Application •Consumer Electronics • IT and telecommunication • Aerospace and Defense • Others EMC Shielding and Test Equipment Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)EMC Shielding and Test Equipment Market Key Players

• PPG Industries (US) • Parker-Hannifin (US) • 3M (US) • Henkel (Germany) • RTP Company (US) • Schaffner (Switzerland) • Tech-Etch (US) • Keysight Technologies (US) • Teseq (Switzerland) • EM Test (Switzerland) • Johnson Bros. (US) • Spira Manufacturing Corporation (US) • ACS Industries Inc. (US) • Dali Electronics (India) • Omega Shielding (US) Frequently Asked Questions: 1] What segments are covered in the Global EMC Shielding and Test Equipment Market report? Ans. The segments covered in the EMC Shielding and Test Equipment Market report are based on Type, Application and Region. 2] Which region is expected to hold the highest share in the Global EMC Shielding and Test Equipment Market? Ans. The Asia Pacific region is expected to hold the highest share in the EMC Shielding and Test Equipment Market. 3] What is the market size of the Global EMC Shielding and Test Equipment Market by 2029? Ans. The market size of the EMC Shielding and Test Equipment Market by 2029 is expected to reach US$ 9.79 Bn. 4] What is the forecast period for the Global EMC Shielding and Test Equipment Market? Ans. The forecast period for the EMC Shielding and Test Equipment Market is 2023-2029. 5] What was the market size of the Global EMC Shielding and Test Equipment Market in 2022? Ans. The market size of the EMC Shielding and Test Equipment Market in 2022 was valued at US$ 7.16 Bn.

1. Global EMC Shielding and Test Equipment Market Size: Research Methodology 2. Global EMC Shielding and Test Equipment Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global EMC Shielding and Test Equipment Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global EMC Shielding and Test Equipment Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global EMC Shielding and Test Equipment Market Size Segmentation 4.1. Global EMC Shielding and Test Equipment Market Size, by Type (2022-2029) • Conductive coating • EMC Shielding tape • Metal Shielding • EMC Filters • Others 4.2. Global EMC Shielding and Test Equipment Market Size, by Application (2022-2029) • Consumer Electronics • Aerospace and Defence • IT and telecommunication • Others 5. North America EMC Shielding and Test Equipment Market (2022-2029) 5.1. North America EMC Shielding and Test Equipment Market Size, by Type (2022-2029) 5.1.1. Conductive coating 5.1.2. EMC Shielding tape 5.1.3. Metal Shielding 5.1.4. EMC Filters 5.1.5. Others 5.2. North America EMC Shielding and Test Equipment Market Size, by Application (2022-2029) 5.2.1. Consumer Electronics 5.2.2. Aerospace and Defence 5.2.3. IT and telecommunication 5.2.4. Others 5.3. North America EMC Shielding and Test Equipment Market, by Country (2022-2029) • United States • Canada • Mexico 6. European EMC Shielding and Test Equipment Market (2022-2029) 6.1. European EMC Shielding and Test Equipment Market Size, by Type (2022-2029) 6.2. European EMC Shielding and Test Equipment Market Size, by Application (2022-2029) 6.3. European EMC Shielding and Test Equipment Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific EMC Shielding and Test Equipment Market (2022-2029) 7.1. Asia Pacific EMC Shielding and Test Equipment Market Size, by Type (2022-2029) 7.2. Asia Pacific EMC Shielding and Test Equipment Market Size, by Application (2022-2029) 7.3. Asia Pacific EMC Shielding and Test Equipment Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa EMC Shielding and Test Equipment Market (2022-2029) 8.1. The Middle East and Africa EMC Shielding and Test Equipment Market Size, by Type (2022-2029) 8.2. The Middle East and Africa EMC Shielding and Test Equipment Market Size, by Application (2022-2029) 8.3. The Middle East and Africa EMC Shielding and Test Equipment Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America EMC Shielding and Test Equipment Market (2022-2029) 9.1. South America EMC Shielding and Test Equipment Market Size, by Type (2022-2029) 9.2. South America EMC Shielding and Test Equipment Market, by Application (2022-2029) 9.3. South America EMC Shielding and Test Equipment Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. PPG Industries (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Development 10.2. Parker-Hannifin (US) 10.3. 3M (US) 10.4. Henkel (Germany) 10.5. RTP Company (US) 10.6. Schaffner (Switzerland) 10.7. Tech-Etch (US) 10.8. Keysight Technologies (US) 10.9. Teseq (Switzerland) 10.10. EM Test (Switzerland) 10.11. Johnson Bros. (US) 10.12. Spira Manufacturing Corporation (US) 10.13. ACS Industries Inc. (US) 10.14. Dali Electronics (India) 10.15. Omega Shielding (US)