The Global Electronic Soap Dispenser Market size was valued at USD 1.07 Billion in 2022 and the total Electronic Soap Dispenser Market revenue is expected to grow at a CAGR of 6.7% from 2023 to 2029, reaching nearly USD 1.68 Billion. The increasing emphasis on hand hygiene is expected to drive demand for electronic soap dispensers. These products automatically release liquid and foam soap through sensor technology, which detects external objects, making them particularly popular in commercial and institutional settings. They are sought after for their Touch-Free Hand Hygiene Solutions, germ-free benefits, and skin-friendly features. By providing precise soap quantities, this technology enhances dispenser efficiency while reducing unnecessary soap consumption. The market has benefited from ongoing technological advancements, especially in Sensor-Activated Soap Dispensers technology and Battery-Powered Soap Dispensers efficiency, which have improved the reliability and performance of electronic soap dispensers. Some models now offer Smart Soap Dispenser Features like connectivity to mobile apps for monitoring soap levels and usage. Additionally, the rapid expansion of the hospitality sector is expected to contribute to market growth. Increasing awareness about hygiene and the rise in disposable income in emerging economies, including developing countries, are further boosting market prospects. A key driver for market expansion is the growing trend of handwashing to prevent diseases caused by air and water pollution. The heightened awareness of personal hygiene due to events like the COVID-19 pandemic has led to an increased demand for Automatic Soap Dispensers. However, it's worth noting that a significant portion of the population, especially in underdeveloped and developing nations, still prefers traditional soap over electronic dispensers, which hinders market growth. Additionally, the availability of traditional liquid soap dispensers at a lower cost poses a challenge to the growth of the electronic soap dispensers market. The rapid pace of commercial construction, particularly in the hospitality sector, fuels demand for bathroom fixtures, including Automatic Soap Dispensers. The hotel industry plays a substantial role in the hospitality sector of developing countries and the overall economy, which further stimulates hotel construction, creating opportunities for soap dispenser demand. The market is expanding as smart bathrooms with automatic taps gain popularity in urban settings. Increased public hygiene awareness in emerging countries, higher disposable incomes, and the growing use of smart kitchens are expected to drive market demand. The ongoing expansion of the hotel industry is likely to fuel market growth, supported by design and technological Foam Soap Dispenser Innovations.To know about the Research Methodology :- Request Free Sample Report

Electronic Soap Dispenser Market Scope and Research Methodology:

To comprehensively analyze the Electronic Soap Dispenser Market, a multi-faceted research methodology is employed. The research process involves data collection, analysis, and interpretation to provide valuable insights and forecasts. Information is gathered from various primary and secondary sources. Primary research involves interviews with industry experts, manufacturers, suppliers, and consumers to acquire first-hand insights. Secondary research comprises the examination of existing market reports, scholarly articles, company websites, and industry publications to gather historical data and market trends. The data is organized by segmenting the market into categories based on product types, applications, and geographical regions. This segmentation helps in understanding specific market dynamics and consumer preferences. Collected data is analyzed using statistical and analytical tools to identify market trends, growth drivers, restraints, and opportunities. Market size, market share, and growth rates are calculated to provide a quantitative understanding of the market. A detailed examination of key market players is conducted to evaluate their strategies, product offerings, and market positioning. This analysis helps in understanding the competitive landscape and emerging trends in the industry. Based on historical data and current trends, future market forecasts and growth predictions are made. These forecasts consider factors like technological advancements, consumer preferences, and economic conditions. The research findings are compiled into a comprehensive report, highlighting the market's scope, segmentation, and key insights.Electronic Soap Dispenser Market Dynamics:

Smart Features and Connectivity Drive Demand for Electronic Soap Dispensers: Growing awareness of the importance of hand hygiene, particularly in the wake of the COVID-19 pandemic, is driving the Electronic Soap Dispenser Market. For instance, the surge in global demand for touchless soap dispensers like those in airports and healthcare facilities showcases this trend. Continuous improvements in Sensor-Activated Soap Dispensers technology and Battery-Powered Soap Dispensers efficiency have enhanced the reliability and performance of electronic soap dispensers. As an example, companies like Dyson have introduced sensor-driven, touchless soap dispensers that offer a superior user experience. Automatic Soap Dispensers with Smart Soap Dispenser Features, such as connectivity to mobile apps for monitoring soap levels and usage, are gaining popularity. A prime illustration is the market success of IoT-enabled dispensers, which allow facility managers to optimize soap supply and maintenance. The rapid expansion of the hospitality sector, including hotels and restaurants, is a major growth driver. As an example, luxury hotels are increasingly adopting touchless electronic soap dispensers to enhance the guest experience and promote hygiene. The increasing focus on disease prevention, especially water and air pollution-related illnesses, encourages the use of electronic soap dispensers. The healthcare industry's adoption of these dispensers, for instance, demonstrates their role in preventing cross-contamination. Increasing disposable income in emerging economies is fueling the demand for electronic soap dispensers. For example, a rising middle class in countries like India is driving sales of these products. The rapid pace of commercial construction, particularly in the hospitality sector, is driving the need for bathroom fixtures, including Touchless Soap Dispensing Technology. This is evident in the surge in construction projects across major cities globally. As urbanization continues, the trend for smart bathrooms with automatic fixtures like Touchless Soap Dispensing Technology is gaining traction. Many residential and commercial buildings now incorporate these Foam Soap Dispenser Innovations as part of their modern amenities. The increase in public awareness of hygiene and cleanliness in emerging countries further fuels market demand. Government initiatives, such as promoting handwashing in public restrooms, underline this trend. Ongoing design and technological Foam Soap Dispenser Innovations in Touchless Soap Dispensing Technology is creating fresh market opportunities. For instance, companies are developing more aesthetically pleasing and eco-friendly designs to attract environmentally conscious consumers. These market growth drivers underscore the expanding adoption of electronic Touchless Soap Dispensing Technology across various sectors, driven by evolving consumer preferences and global health concerns.Soap Dispenser Functions and their Alternatives

Traditional Soap Preference Hinders Electronic Dispenser Adoption in Developing Regions: A significant challenge is the enduring preference for traditional bar soap or manual dispensers, especially in underdeveloped and developing nations. For instance, rural areas with limited access to electricity may rely on traditional soap due to its simplicity. Electronic soap dispensers are relatively expensive, limiting their adoption in cost-sensitive markets. In these cases, manual dispensers or traditional soap options may be chosen to cut costs, particularly in public facilities. Electronic Hand Sanitizer Dispensers require regular maintenance, and repairs are costly. Facilities with limited budgets may opt for manual dispensers, which have lower maintenance requirements, to avoid ongoing expenses. In some regions, there is limited awareness of the benefits of electronic soap dispensers, which hinders their adoption. Educational campaigns are necessary to promote their advantages. While electronic dispensers are eco-friendly, the disposal of electronic components and batteries poses environmental challenges. This deters environmentally conscious consumers from choosing Electronic Hand Sanitizer Dispensers options. In areas with an unreliable or inadequate power supply, electronic dispensers may not function effectively. This limits their suitability in regions with frequent power outages. The elderly and those unfamiliar with technology may find electronic soap dispensers complex to use. This is a restraint in public facilities where a broad range of users is present. Smart Soap Dispenser Features in some electronic dispensers may require connectivity to mobile apps, which may not be practical or accessible for all users, potentially limiting their usability. The presence of competing technologies, such as foam-based soap dispensers, may divert attention and investment away from Touchless Soap Dispensing Technology dispensers, affecting their market share. Adherence to local regulations and standards, especially in healthcare facilities, is complex for electronic soap dispensers. Complying with these regulations is a challenge for manufacturers. These challenges underline the need for market players to address affordability, awareness, and environmental concerns while ensuring the adaptability of electronic soap dispensers to diverse user needs and preferences.

Functio

n

Alternatives Touchless Passive infrared sensor Photo sensor Radar-based sensor Material ADS Plastic Thermo-steel Power supply Battery- powered Rechargeable Capacity 600ml 450ml 700ml Placement Wall- mounted Stand Portable Versatility Liquid Soap Sanitizer Lotion Settings Public Hospitals Homes Capacity 600ML 400 MI 300 MI Filling Top Middle Dispense 0.8ml 1.2ml 1.5ml Smart Homes and Healthcare Sector expansion creates an opportunity for Electronic Soap Dispensers Markets: The healthcare industry presents a significant growth opportunity due to its stringent hygiene requirements. Hospitals and clinics are increasingly adopting electronic soap dispensers to reduce the risk of cross-contamination, as seen in the widespread use of touchless dispensers in healthcare settings. With growing environmental awareness, there's an opportunity to develop eco-friendly electronic soap dispensers that use biodegradable soaps or reduce energy consumption. For instance, brands like Method have introduced eco-friendly soap and dispenser combinations, catering to environmentally conscious consumers. As smart home technology gains popularity, integrating electronic soap dispensers into the Internet of Things (IoT) ecosystem provides a new avenue for growth. Companies like Kohler have introduced touchless soap dispensers that can be controlled via smartphone apps. The expanding hospitality sector, including hotels and restaurants, offers opportunities for Electronic Hand Sanitizer Dispensers manufacturers. High-end hotels are increasingly opting for Touch-Free Hand Hygiene Solutions to enhance the guest experience, setting a trend for other establishments. Developing customizable electronic soap dispensers that cater to specific industries or branding requirements can lead to niche market opportunities. For example, a dispenser tailored to the food industry with anti-corrosion features. Combining electronic and manual Smart Soap Dispenser Features in a single dispenser allows users the flexibility to choose, appealing to a broader audience. For example, hybrid models are used electronically or manually in areas with varying preferences. Promoting the benefits of electronic soap dispensers through educational campaigns can expand market awareness and adoption. Government initiatives in public restrooms with informative posters and demonstrations can encourage usage. Emerging economies with increasing disposable incomes, like those in Southeast Asia and Africa, represent untapped markets with potential for rapid growth. Companies that establish a presence early can capture these opportunities. Creating compact and portable electronic soap dispensers suited to travel, offices, or small living spaces can open up new markets. These dispensers can also be promoted as a solution for personal hygiene on the go. Partnering with sustainability-focused organizations and certifications can boost the market. For example, offering Cradle to Cradle (C2C) certified products to meet the demands of eco-conscious consumers and organizations. These opportunities underscore the versatility and adaptability of the electronic soap dispenser market to evolving consumer needs, industry trends, and sustainability goals.

Electronic Soap Dispenser Market Segment Analysis:

Based on Product, The Electronic Soap Dispenser Market is segmented into various product categories, each catering to specific applications and adoption preferences. Touchless Electronic Soap Dispensers, equipped with infrared sensors for hands-free operation, have gained substantial popularity in public spaces, healthcare facilities, and commercial establishments due to their hygienic advantages. They significantly reduce the risk of cross-contamination and offer a variety of styles and sizes to suit different settings. Manual Electronic Soap Dispensers, although electronically operated, require user interaction through button or lever presses. This category strikes a balance between hygiene and user control, commonly found in homes and select commercial settings where user preference for Hygienic Soap Dispensing Systems is paramount. Foam Electronic Soap Dispensers transform liquid soap into foam, delivering enhanced coverage and environmental benefits. They are widely used in healthcare facilities, public restrooms, and commercial spaces for their economical soap consumption. Liquid Electronic Soap Dispensers, a traditional choice, accommodate various liquid soap formulations and are versatile, serving applications from residential bathrooms to commercial kitchens. Gel Electronic Soap Dispensers are designed to handle thicker gel-based soap formulations, making them ideal for healthcare facilities that prefer gel soap for its antimicrobial properties. Each type of dispenser serves specific needs, and manufacturers like Dolphy offer a range of options tailored for various settings, from homes to high-traffic industries and malls, ensuring precise and convenient Hygienic Soap Dispensing Systems to match specific requirements.Electronic Soap Dispenser Market Regional Insights:

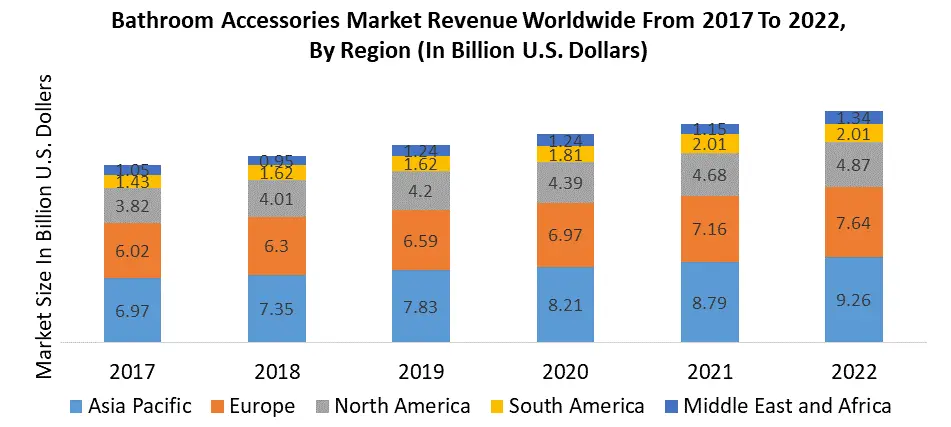

The Electronic Soap Dispenser Market exhibits diverse regional dynamics, with certain areas emerging as key production hubs and others serving as major consumer markets. The Asia-Pacific region, led by China, remains dominant in production, while North America and Europe are key consumer markets, dictating the growth trajectory of the Electronic Soap Dispenser Market. China's manufacturing capabilities, robust supply chains, and technological advancements have positioned it as a major producer of electronic soap dispensers. Also, countries like Thailand and Vietnam have seen a surge in production activities, further bolstering the region's production capabilities. North America and Europe lead in consumption, with the United States and several European countries demonstrating a strong affinity for advanced hygiene solutions, propelling significant demand for electronic soap dispensers. The Middle East and Africa are also noteworthy consumers, primarily driven by the flourishing hospitality sector in the region, emphasizing the importance of hygiene in hotels and public facilities. Latin America is steadily increasing its adoption of electronic soap dispensers, especially in commercial establishments and healthcare facilities.

Competitive Landscape

Key Players of the Electronic Soap Dispenser Market profiled in the report are American Specialties, Inc., Bobrick Washroom Equipment, Inc., Bradley Corporation, Dudley Industries Ltd., Duravit AG, Frost Products Ltd., Georgia-Pacific LLC, GOJO Industries, Inc., Kohler Co., Lovair, Orchids International, Shenzhen City Svavo Bathroom Products Co., Ltd., Simplehuman, Sloan Valve Company, Stern Engineering Ltd., Toshi Automatic Systems Pvt. Ltd., Toto Ltd., Umbra, ZAF Enterprises. This provides huge opportunities to serve many End-users and customers and expand the Electronic Soap Dispenser Market.In September 2021, Amazon, a prominent online shopping platform, introduced an Alexa-enabled automatic soap dispenser. This innovative device leverages Alexa's visual timer to guide users in proper handwashing, encouraging a 20-second duration for improved hygiene. In March 2022, Euronics Industries Pvt Ltd, a leading brand in public washroom automation accessories in India, unveiled automatic soap dispensers. These touchless devices dispense a predetermined amount of liquid soap when users place their hands beneath them. The main focus of this product is to deliver hands-free, germ-free hygiene solutions. In March 2019, Shenzhen SVAVO Intelligent Technology Co. Ltd. launched the V-370 tabletop touchless foaming soap dispenser. Designed for use in bathrooms, kitchens, and laundry rooms, it's available in three stylish colors: black, white, and nickel, offering a modern touch to hand hygiene. In April 2016, Cannon Hygiene Limited introduced the Imagine Range of washroom dispensers, setting a new standard for cleanliness. These products are known for being VOC-free and equipped with automatic antibacterial soap dispensers, promoting a healthy and eco-friendly approach to hand hygiene.

Electronic Soap Dispenser Market Scope: Inquiry Before Buying

Electronic Soap Dispenser Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.07 Bn. Forecast Period 2023 to 2029 CAGR: 6.7% Market Size in 2029: US $ 1.68 Bn. Segments Covered: by Product Touchless Manual Foam Liquid Gel by Type Plastic Steel Others by Application Commercial Residential Institutional by Sales Channel Direct Sales Indirect Sales Electronic Soap Dispenser Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Electronic Soap Dispenser Market Key Players:

1. American Specialties, Inc. 2. Bobrick Washroom Equipment, Inc. 3. Bradley Corporation 4. Dudley Industries Ltd. 5. Duravit AG 6. Frost Products Ltd. 7. Georgia-Pacific LLC 8. GOJO Industries, Inc. 9. Kohler Co. 10. Lovair 11. Orchids International 12. Shenzhen City Svavo Bathroom Products Co., Ltd. 13. Simplehuman 14. Sloan Valve Company 15. Stern Engineering Ltd. 16. Toshi Automatic Systems Pvt. Ltd. 17. Toto Ltd. 18. Umbra 19. ZAF EnterprisesFAQs:

1. What are the growth drivers for the Electronic Soap Dispenser Market? Ans. Smart Features and Connectivity Drive Demand for Electronic Soap Dispensers and is expected to be the major driver for the Electronic Soap Dispenser Market. 2. What is the major Restraints for the Electronic Soap Dispenser Market growth? Ans. Traditional Soap Preference Hinders Electronic Dispenser Adoption in Developing Regions and is expected to be a major restraints in the Electronic Soap Dispenser Market. 3. Which country is expected to lead the global Electronic Soap Dispenser Market during the forecast period? Ans. Asia Pacific is expected to lead the Electronic Soap Dispenser Market during the forecast period. 4. What is the projected market size and growth rate of the Electronic Soap Dispenser Market? Ans. The Electronic Soap Dispenser Market size was valued at USD 1.07 Billion in 2022 and the total Electronic Soap Dispenser Market revenue is expected to grow at a CAGR of 6.7% from 2023 to 2029, reaching nearly USD 1.68 Billion. 5. What segments are covered in the Electronic Soap Dispenser Market report? Ans. The segments covered in the Electronic Soap Dispenser Market report are by Product, Type, Application, Sales Channel, and Region.

1. Electronic Soap Dispenser Market: Research Methodology 2. Electronic Soap Dispenser Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Electronic Soap Dispenser Market: Dynamics 3.1 Electronic Soap Dispenser Market Trends by Region 3.1.1 North America Electronic Soap Dispenser Market Trends 3.1.2 Europe Electronic Soap Dispenser Market Trends 3.1.3 Asia Pacific Electronic Soap Dispenser Market Trends 3.1.4 Middle East and Africa Electronic Soap Dispenser Market Trends 3.1.5 South America Electronic Soap Dispenser Market Trends 3.2 Electronic Soap Dispenser Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Electronic Soap Dispenser Market Drivers 3.2.1.2 North America Electronic Soap Dispenser Market Restraints 3.2.1.3 North America Electronic Soap Dispenser Market Opportunities 3.2.1.4 North America Electronic Soap Dispenser Market Challenges 3.2.2 Europe 3.2.2.1 Europe Electronic Soap Dispenser Market Drivers 3.2.2.2 Europe Electronic Soap Dispenser Market Restraints 3.2.2.3 Europe Electronic Soap Dispenser Market Opportunities 3.2.2.4 Europe Electronic Soap Dispenser Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Electronic Soap Dispenser Market Drivers 3.2.3.2 Asia Pacific Electronic Soap Dispenser Market Restraints 3.2.3.3 Asia Pacific Electronic Soap Dispenser Market Opportunities 3.2.3.4 Asia Pacific Electronic Soap Dispenser Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Electronic Soap Dispenser Market Drivers 3.2.4.2 Middle East and Africa Electronic Soap Dispenser Market Restraints 3.2.4.3 Middle East and Africa Electronic Soap Dispenser Market Opportunities 3.2.4.4 Middle East and Africa Electronic Soap Dispenser Market Challenges 3.2.5 South America 3.2.5.1 South America Electronic Soap Dispenser Market Drivers 3.2.5.2 South America Electronic Soap Dispenser Market Restraints 3.2.5.3 South America Electronic Soap Dispenser Market Opportunities 3.2.5.4 South America Electronic Soap Dispenser Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Electronic Soap Dispenser Industry 3.8 The Global Pandemic and Redefining of The Electronic Soap Dispenser Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Electronic Soap Dispenser Trade Analysis (2017-2022) 3.11.1 Global Import of Electronic Soap Dispenser 3.11.2 Global Export of Electronic Soap Dispenser 4. Global Electronic Soap Dispenser Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 4.1 Global Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 4.1.1 Touchless 4.1.2 Manual 4.1.3 Foam 4.1.4 Liquid 4.1.5 Gel 4.2 Global Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 4.2.1 Plastic 4.2.2 Steel 4.2.3 Others 4.3 Global Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 4.3.1 Commercial 4.3.2 Residential 4.3.3 Institutional 4.4 Global Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 4.4.1 Direct Sales 4.4.2 Indirect Sales 4.5 Global Electronic Soap Dispenser Market Size and Forecast, by Region (2022-2029) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Electronic Soap Dispenser Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 5.1 North America Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 5.1.1 Touchless 5.1.2 Manual 5.1.3 Foam 5.1.4 Liquid 5.1.5 Gel 5.2 North America Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 5.2.1 Plastic 5.2.2 Steel 5.2.3 Others 5.3 North America Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 5.3.1 Commercial 5.3.2 Residential 5.3.3 Institutional 5.4 North America Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 5.4.1 Direct Sales 5.4.2 Indirect Sales 5.5 North America Electronic Soap Dispenser Market Size and Forecast, by Country (2022-2029) 5.5.1 United States 5.5.1.1 United States Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 5.5.1.1.1 Touchless 5.5.1.1.2 Manual 5.5.1.1.3 Foam 5.5.1.1.4 Liquid 5.5.1.1.5 Gel 5.5.1.2 United States Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 5.5.1.2.1 Plastic 5.5.1.2.2 Steel 5.5.1.2.3 Others 5.5.1.3 United States Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 5.5.1.3.1 Commercial 5.5.1.3.2 Residential 5.5.1.3.3 Institutional 5.5.1.4 United States Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 5.5.1.4.1 Direct Sales 5.5.1.4.2 Indirect Sales 5.5.2 Canada 5.5.2.1 Canada Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 5.5.2.1.1 Touchless 5.5.2.1.2 Manual 5.5.2.1.3 Foam 5.5.2.1.4 Liquid 5.5.2.1.5 Gel 5.5.2.2 Canada Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 5.5.2.2.1 Plastic 5.5.2.2.2 Steel 5.5.2.2.3 Others 5.5.2.3 Canada Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 5.5.2.3.1 Commercial 5.5.2.3.2 Residential 5.5.2.3.3 Institutional 5.5.2.4 Canada Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 5.5.2.4.1 Direct Sales 5.5.2.4.2 Indirect Sales 5.5.3 Mexico 5.5.3.1 Mexico Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 5.5.3.1.1 Touchless 5.5.3.1.2 Manual 5.5.3.1.3 Foam 5.5.3.1.4 Liquid 5.5.3.1.5 Gel 5.5.3.2 Mexico Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 5.5.3.2.1 Plastic 5.5.3.2.2 Steel 5.5.3.2.3 Others 5.5.3.3 Mexico Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 5.5.3.3.1 Commercial 5.5.3.3.2 Residential 5.5.3.3.3 Institutional 5.5.3.4 Mexico Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 5.5.3.4.1 Direct Sales 5.5.3.4.2 Indirect Sales 6. Europe Electronic Soap Dispenser Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 6.1 Europe Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 6.2 Europe Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 6.3 Europe Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 6.4 Europe Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 6.5 Europe Electronic Soap Dispenser Market Size and Forecast, by Country (2022-2029) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 6.5.1.2 United Kingdom Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 6.5.1.3 United Kingdom Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 6.5.1.4 United Kingdom Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 6.5.2 France 6.5.2.1 France Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 6.5.2.2 France Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 6.5.2.3 France Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 6.5.2.4 France Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 6.5.3 Germany 6.5.3.1 Germany Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 6.5.3.2 Germany Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 6.5.3.3 Germany Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 6.5.3.4 Germany Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 6.5.4 Italy 6.5.4.1 Italy Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 6.5.4.2 Italy Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 6.5.4.3 Italy Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 6.5.4.4 Italy Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 6.5.5 Spain 6.5.5.1 Spain Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 6.5.5.2 Spain Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 6.5.5.3 Spain Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 6.5.5.4 Spain Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 6.5.6 Sweden 6.5.6.1 Sweden Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 6.5.6.2 Sweden Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 6.5.6.3 Sweden Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 6.5.6.4 Sweden Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 6.5.7 Austria 6.5.7.1 Austria Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 6.5.7.2 Austria Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 6.5.7.3 Austria Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 6.5.7.4 Austria Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 6.5.8.2 Rest of Europe Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029). 6.5.8.3 Rest of Europe Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 6.5.8.4 Rest of Europe Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7. Asia Pacific Electronic Soap Dispenser Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 7.1 Asia Pacific Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.2 Asia Pacific Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.3 Asia Pacific Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.4 Asia Pacific Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5 Asia Pacific Electronic Soap Dispenser Market Size and Forecast, by Country (2022-2029) 7.5.1 China 7.5.1.1 China Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.1.2 China Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.1.3 China Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.1.4 China Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.2 South Korea 7.5.2.1 S Korea Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.2.2 S Korea Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.2.3 S Korea Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.2.4 S Korea Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.3 Japan 7.5.3.1 Japan Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.3.2 Japan Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.3.3 Japan Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.3.4 Japan Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.4 India 7.5.4.1 India Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.4.2 India Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.4.3 India Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.4.4 India Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.5 Australia 7.5.5.1 Australia Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.5.2 Australia Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.5.3 Australia Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.5.4 Australia Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.6 Indonesia 7.5.6.1 Indonesia Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.6.2 Indonesia Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.6.3 Indonesia Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.6.4 Indonesia Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.7 Malaysia 7.5.7.1 Malaysia Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.7.2 Malaysia Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.7.3 Malaysia Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.7.4 Malaysia Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.8 Vietnam 7.5.8.1 Vietnam Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.8.2 Vietnam Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.8.3 Vietnam Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.8.4 Vietnam Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.9 Taiwan 7.5.9.1 Taiwan Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.9.2 Taiwan Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.9.3 Taiwan Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.9.4 Taiwan Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.10.2 Bangladesh Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.10.3 Bangladesh Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.10.4 Bangladesh Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.11 Pakistan 7.5.11.1 Pakistan Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.11.2 Pakistan Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.11.3 Pakistan Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.11.4 Pakistan Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 7.5.12.2 Rest of Asia Pacific Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 7.5.12.3 Rest of Asia Pacific Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 7.5.12.4 Rest of Asia Pacific Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 8. Middle East and Africa Electronic Soap Dispenser Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 8.1 Middle East and Africa Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 8.2 Middle East and Africa Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 8.3 Middle East and Africa Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 8.4 Middle East and Africa Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 8.5 Middle East and Africa Electronic Soap Dispenser Market Size and Forecast, by Country (2022-2029) 8.5.1 South Africa 8.5.1.1 South Africa Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 8.5.1.2 South Africa Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 8.5.1.3 South Africa Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 8.5.1.4 South Africa Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 8.5.2 GCC 8.5.2.1 GCC Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 8.5.2.2 GCC Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 8.5.2.3 GCC Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 8.5.2.4 GCC Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 8.5.3 Egypt 8.5.3.1 Egypt Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 8.5.3.2 Egypt Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 8.5.3.3 Egypt Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 8.5.3.4 Egypt Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 8.5.4 Nigeria 8.5.4.1 Nigeria Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 8.5.4.2 Nigeria Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 8.5.4.3 Nigeria Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 8.5.4.4 Nigeria Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 8.5.5.2 Rest of ME&A Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 8.5.5.3 Rest of ME&A Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 8.5.5.4 Rest of ME&A Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 9. South America Electronic Soap Dispenser Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 9.1 South America Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 9.2 South America Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 9.3 South America Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 9.4 South America Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 9.5 South America Electronic Soap Dispenser Market Size and Forecast, by Country (2022-2029) 9.5.1 Brazil 9.5.1.1 Brazil Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 9.5.1.2 Brazil Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 9.5.1.3 Brazil Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 9.5.1.4 Brazil Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 9.5.2 Argentina 9.5.2.1 Argentina Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 9.5.2.2 Argentina Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 9.5.2.3 Argentina Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 9.5.2.4 Argentina Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Electronic Soap Dispenser Market Size and Forecast, By Product (2022-2029) 9.5.3.2 Rest Of South America Electronic Soap Dispenser Market Size and Forecast, By Type (2022-2029) 9.5.3.3 Rest Of South America Electronic Soap Dispenser Market Size and Forecast, By Application (2022-2029) 9.5.3.4 Rest Of South America Electronic Soap Dispenser Market Size and Forecast, By Sales Channel (2022-2029) 10. Global Electronic Soap Dispenser Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2022 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Electronic Soap Dispenser Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 American Specialties, Inc. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Bobrick Washroom Equipment, Inc. 11.3 Bradley Corporation 11.4 Dudley Industries Ltd. 11.5 Duravit AG 11.6 Frost Products Ltd. 11.7 Georgia-Pacific LLC 11.8 GOJO Industries, Inc. 11.9 Kohler Co. 11.10 Lovair 11.11 Orchids International 11.12 Shenzhen City Svavo Bathroom Products Co., Ltd. 11.13 Simplehuman 11.14 Sloan Valve Company 11.15 Stern Engineering Ltd. 11.16 Toshi Automatic Systems Pvt. Ltd. 11.17 Toto Ltd. 11.18 Umbra 11.19 ZAF Enterprises 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary