Electric Two-Wheeler Lithium-Ion Battery Management System Market size was valued at USD 1.22 Bn. in 2022 and the total Graphene Battery revenue is expected to grow by 20.1% from 2023 to 2029, reaching nearly USD 4.42 Bn.Electric Two-Wheeler Lithium-Ion Battery Management System Market Overview:

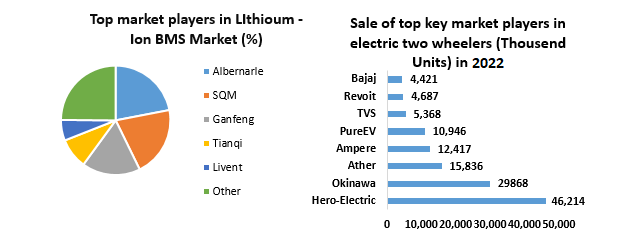

A Battery Management System (BMS) is an intelligent component of a battery pack that is in charge of advanced monitoring and management. It is the battery's brain, and it is important to its safety, performance, charge rates, and lifespan. Lithium-ion battery packs are the most common type of energy storage system in airplanes, electric cars, portable gadgets, and other equipment that requires a dependable, high-energy-density, lightweight power source. The battery management system (BMS) is in charge of ensuring the safe operation, performance, and lifespan of the battery under a variety of charge-discharge and environmental conditions.To know about the Research Methodology :- Request Free Sample Report The sales data for small-format EVs may appear low at first. The market for two-wheel EVs (E2Ws) and three-wheel EVs (E3Ws) was estimated to be worth $97 billion, accounting for 4% of global car sales. However, the industry is gaining traction, with global sales of E2Ws and E3Ws increasing by more than 14% year on year. (This statistic excludes sales in China, which was an early user of small-format EVs and hence has a slower growth rate.) Global E2W and E3W sales might exceed $150 billion in 2022. Most E2Ws and E3Ws now use relatively inexpensive lead-acid batteries, but regulatory changes may force a shift to lighter lithium-ion power packs, which give higher energy density and hence longer range. Replacement demand for vehicles with lithium-ion power packs might be considerable in China, where customers have long possessed electric two-wheelers with lead-acid batteries. This, change will provide global competitors with an opportunity to acquire market share, as demand for electric tow wheelers with lithium-ion batteries grows as their range extends, and this is expected to drive the demand for Electric Two-Wheeler Lithium-Ion Battery Management System Market There are several competitors in the E2W and E3W sectors, all of which are aggressively competing for market share. New entrants dominate in several regions, challenging OEMs' ability to maintain their dominance in ICE vehicles. Technological advancements are also bringing about significant changes that are affecting the traditional value pool. Vehicle automation, electrification, consumer-facing products, and data-enabled services are expected to contribute to around 20% of automotive sales by 2030, which creates high competition in the electric two-wheeler lithium-ion battery management system market. Competitive Landscape OMEs are pursuing strategies and investing opportunities for an electric two-wheel lithium-ion battery management system. Some of the major OMEs for electric two-wheelers include Niu International, Yadea Technology Group Co., Ltd., Jiangsu Xinri E-Vehicle Co.,Ltd., Viar Motor Indonesia, Zero Motorcycles, Inc., Honda Motor Company, Ltd., Deco Green Energy CO., LTD., Hero Electric Vehicles Pvt. Ltd., Okinawa Autotech Pvt. Ltd., and Ampere Vehicles More than 70% of the lithium supply in the world is under the hands of companies like Ganfeng Lithium, Albemarle, SQM, Tianqi Lithium, and Livent. The third-largest producer of lithium compounds globally and the top manufacture in China is Ganfeng, which was founded in 2000. The business stands out due to its comprehensive coverage of the lithium-ion battery supply chain, which includes the development, refining, and processing of lithium resources (which accounts for 75% of total revenue), battery manufacturing (17% of total revenue), and battery recycling & other (which accounts for 8% of total revenue). With major battery manufacturers and OEMs including Tesla, Panasonic, LG Chem, Volkswagen, Samsung, and most recently, BMW, the company states long-term supply agreements. There are several competitors in the E2W market, all of which are intensely competing for market share. New entrants dominate in several regions, threatening OEMs' ability to maintain their dominance in ICE vehicles. Technological advancements are also bringing about significant changes that are affecting the traditional value pool. Vehicle automation, electrification, consumer-facing products, and data-enabled services are expected to contribute for around 20% of automotive sales by 2030. Collaboration is more vital now than ever before. Strategic alliances and technical collaborations can assist OEMs in securing key EV components. Partnerships with e-commerce powerhouses, delivery companies, dealer networks, fleet companies, and ride-sharing groups may also be important for constructing demand centers. To establish the ecosystem, OEMs might collaborate with battery-swapping companies, charging solution suppliers, and others. Because they provide so many benefits, open company models that incorporate partners are becoming increasingly popular. The report is not only a representation of global players but also covers the market holding of local players in each country. Market structure by country with market holding by market leaders, market followers, and local players make this report a comprehensive and insightful industry outlook. The report has covered the mergers and acquisitions, strategic alliances, joint ventures, and partnerships happening in the market by region, by investment, and their strategic intent

Electric Two-Wheeler Lithium-Ion Battery Management System Market Dynamics:

The BMS is in charge of optimizing the battery pack's performance in electric two-wheelers Lithium-ion batteries function best when their State of Charge (SoC) is kept between the battery profile's minimum and maximum charge limitations. Overcharging and severe draining can reduce battery capacity, and reduce battery life. During charging, the BMS evaluates how much current may be safely injected and transmits this to the EVSE (Electric Vehicle Supply Equipment or the Charger). During battery discharge, the BMS would interact with the motor controller to prevent cell voltages from falling too low. The electric two-wheeler can display a warning to the user to charge the battery pack. The BMS also regulates the charge of the battery pack using the energy generated through regenerative braking, which drives the electric two-wheeler lithium-ion battery management system market. Individual cells in a battery pack can acquire capacity variations over time, which grow with each charge/discharge cycle. This imbalance restricts the amount of energy that can be extracted from the battery as well as the amount that the battery pack can be charged. Cell balancing is required to keep the cells at similar voltage levels and maximize battery pack capacity use, which creates demand for BMS in the electric two-wheeler lithium-ion battery management system market. Individual cell voltages measured by BMS reveal their relative balance and serve as a guide to how much charge equalization is necessary. The BMS balances cells by removing surplus energy from cells that are more charged than others, either actively or passively. State of health (SoH) creates an Opportunity for new EV two-wheelers market players Battery optimization is assisted by a BMS. The chemistry of the battery cells changes as they age over time and experience variable rates of charge and discharge. A succession of imbalanced cells with various capabilities to receive current during a charge cycle are produced as a result. Additionally, the controller must cut off the power supply after the healthy cells, which tolerate greater voltage, have finished charging entirely in order to prevent heating problems. As a result, the battery won't be fully charged since the cells with lower voltage capacities charge more slowly and don't reach their full potential, which drives the demand for BMS in the electric two-wheeler lithium-ion battery management system market. It avoids overheating difficulties and also balances the cells by diverting surplus current from a fully charged cell to one that hasn't reached that point. Because of this, Li-ion batteries frequently charge fast during the first 80% of the cycle before slowing down to a trickle until they are fully charged. The battery pack's lifespan is determined by its State of Health, which the BMS also assures to be improved. The BMS also controls the energy gathered for the TVS iQube's functions, such as regenerative braking for the battery during deceleration. BMS also displays statistics that enhance the connected experience of an electric scooter. The BMS is used to supply the rider with all the information that shows on the app for the battery charge state and use also, it helps to solve the problem of battery pakes in the electric two-wheeler lithium-ion battery management system market.Electric Two-Wheeler Lithium-Ion Battery Management System Market Segment Analysis:

Based on Topology, the Electric Two-Wheeler Lithium-Ion Battery Management System Market is segmented into Centralized, Distributed, and Modular. The modular lithium-ion battery is expected to dominate the market during the forecast period. A modular lithium-ion battery is a type of battery that highly uses in cells. This means that the battery is divided into multiple sections, or modules, that can be easily replaced if one fails. these modular batteries are more common than traditional lithium-ion batteries thanks to being easy to maintain and easy to repair. each module in modular lithium-ion batteries contains a few hundred cells. these cells are arranged in racks and connected with interconnecting wires. when batteries get charged, the cells become energized and start to release electrons. these electrons flow through the wires and are connected with other cells, which creates an electric current. this current gives power to the device, which is connected to batteries. the demand for modular lithium-ion batteries is high thanks to these batteries being more popular in two-wheelers due to their driving factors. First, it has high power density, which creates a lot of energy in small specs. this makes it great for applications where space is an issue. the modularity of the batteries allows for easy upgrades and modifications, which means that they can be tailored to specific needs. also, the battery is relatively safe and has low toxicity levels which drive the demand for the modular Electric Two-Wheeler Lithium-Ion Battery Management System Market. Long life scape and cost-effectiveness make it a good investment for OMEs. Based on the Vehicle Type, the Electric Two-Wheeler Lithium-Ion Battery Management System Market is segmented into Pedelecs, Scooters, and Motorcycles. Scooters held the largest market share in 2022 Electric scooters has a significant need for lithium-ion batteries. Due to the benefit of rechargeable models, manufacturers in the electric scooter battery industry are constantly experimenting with these batteries. High-capacity needs are suitable for lithium-ion batteries because of their high density. Lithium-ion batteries have been proven to have a slower rate of self-discharge than SLA and NiMH batteries.E-scooter owners like lithium-ion batteries because of their low maintenance requirements. Both scooter manufacturers and bike owners are going to be aware of the longer life of these batteries compared to SLA batteries. Manufacturers are stepping up R&D in less expensive metals to create these batteries since the high production costs of lithium-ion batteries are hampering the market's growth. In order to provide power or voltage to the scooter's accessories, such as the DC motor, lights, controller, and other elements, electric scooter batteries are known as power packs or energy storage units. Since the scooter battery is constructed of electronics and individual cells, it is lighter and hence considered a workable option for supplying electricity to an electric scooter. Additionally, there are several types of electric scooter batteries available, including lead acid, lithium, nickel metal hydride, and fuel cells. Just a few different internationally known companies manufacture the individual Li-ion cells that make up an e-scooter battery pack. Manufacturers of the highest caliber batteries include LG, Samsung, Panasonic, and Sanyo. These cells are often only found in the battery packs of more expensive scooters. The majority of cheap and commuter electric scooters use battery packs with generic Chinese-made cells, whose quality varies widely. Scooters with branded cells vary from generic Chinese ones in that there is a higher assurance of quality control with well-known brands.

Regional Insights:

Asia Pacific is expected to dominate the market during the forecast period. The regional market's major economies, China, India, and Japan, are expected to have an impact on the global market. In these countries, an increasing number of startups, as well as well-established and conventional manufacturers, are entering the market. Taiwan began offering a subsidy of up to USD 900-1000 for the purchase of new electric motorcycles/scooters in 2022. As a result of the implementation of such initiatives, local startup Gogoro sold a record-breaking 22,500 units in December 2019. It also has 145,000 sales in Taiwan by the end of 2019. Lithium-ion batteries were used to power the bulk of electric two-wheeler sales in 2022 in APAC, Europe, and North America. Over the next five years, almost all of the two-wheelers sold globally will be powered by Li-ion batteries. Government assistance for Li-ion battery-powered low-speed electric vehicles is also expected to assist the spread of this division over the next years in important countries like China and India. The cost has fallen due to advances in battery technology, but there is still room for improvement. Batteries for electric vehicles (EVs) today are heavy, costly, and challenging to charge. Research is being conducted as a result to improve current technologies and increase the usage of EVs. Data show that the number of electrical two-wheelers sold in China in 2022 was 53.375 million, up 16.5% from the previous year. As a result, the number of lithium two-wheelers sold was 9.287 million, up 22.6% from the previous year and with a penetration rate of 17.4%. Although the market for battery swapping and other two-wheelers is growing quickly in 2022, the rate at which lithium two-wheelers are growing is slower than expected. This is primarily because lead-acid batteries' competitive advantage has been weakened as the market for shared bikes has expanded, which has led to the primary increase in lithium-electric two-wheelers in the country.Electric Two-Wheeler Lithium-Ion Battery Management System Market Scope: Inquiry Before Buying

Electric Two-Wheeler Lithium-Ion Battery Management System Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US$ 1.22 Bn. Forecast Period 2023 to 2029 CAGR: 20.1% Market Size in 2029: US$ 4.42 Bn. Segments Covered: by Topology Centralized Distributed Modular by Vehicle Type Pedelecs Scooters Motorcycles Electric Two-Wheeler Lithium-Ion Battery Management System Market by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Elithion Inc, Leclanché SA 2. Sensata Technologies, Inc. 3. Nuvation Energy 4. NXP Semiconductors N.V. 5. Navitas System LLC 6. Renesas Electronics Corporation, 7. Shenzhen Litongwei Electronics Technology Co., Ltd. 8. Jiangsu Xinri E-Vehicle Co., Ltd. 9. Mahindra & Mahindra Ltd. 10. Yamaha Motor Co., Ltd 11. Texas Instruments Incorporated. 12. NIU International 13. AIMA Technology Group Co. Ltd 14. Zhejiang Yadea Motorcycle Co. Ltd 15. Dongguan Tailing Electric Vehicle Co. Ltd 16. Zhejiang Luyuan Electric Vehicle Co.,Ltd 17. Leclanche (Switzerland) 18. Lithium Balance (Denmark) 19. Nuvation Engineering (US) 20. Eberspaecher Vecture (Canada) 21. Storage Battery Systems (US) 22. Johnson Matthey (UK) Frequently Asked Questions: 1] What segments are covered in the Electric Two-Wheeler Lithium-Ion Battery Management System Market report? Ans. The segments covered in the Telepsychiatry Market report are based on Product, Age group, End-use, and Region. 2] Which region is expected to hold the highest share in the Electric Two-Wheeler Lithium-Ion Battery Management System Market? Ans. The Asia Pasific region is expected to hold the highest share in the Telepsychiatry Market. 3] What is the market size of the Electric Two-Wheeler Lithium-Ion Battery Management System Market by 2029? Ans. The market size of the Telepsychiatry Market by 2029 is expected to reach US$ 4.42 Bn. 4] What is the forecast period for the Electric Two-Wheeler Lithium-Ion Battery Management System Market? Ans. The forecast period for the Telepsychiatry Market is 2023-2029. 5] What was the market size of the Electric Two-Wheeler Lithium-Ion Battery Management System Market in 2022? Ans. The market size of the Telepsychiatry Market in 2022 was valued at US$ 1.22 Bn.

1. Electric Two-Wheeler Lithium-Ion Battery Management System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Electric Two-Wheeler Lithium-Ion Battery Management System Market: Dynamics 2.1. Electric Two-Wheeler Lithium-Ion Battery Management System Market Trends by Region 2.1.1. North America Electric Two-Wheeler Lithium-Ion Battery Management System Market Trends 2.1.2. Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Trends 2.1.3. Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Trends 2.1.4. Middle East and Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Trends 2.1.5. South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Trends 2.2. Electric Two-Wheeler Lithium-Ion Battery Management System Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Electric Two-Wheeler Lithium-Ion Battery Management System Market Drivers 2.2.1.2. North America Electric Two-Wheeler Lithium-Ion Battery Management System Market Restraints 2.2.1.3. North America Electric Two-Wheeler Lithium-Ion Battery Management System Market Opportunities 2.2.1.4. North America Electric Two-Wheeler Lithium-Ion Battery Management System Market Challenges 2.2.2. Europe 2.2.2.1. Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Drivers 2.2.2.2. Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Restraints 2.2.2.3. Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Opportunities 2.2.2.4. Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Drivers 2.2.3.2. Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Restraints 2.2.3.3. Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Opportunities 2.2.3.4. Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Drivers 2.2.4.2. Middle East and Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Restraints 2.2.4.3. Middle East and Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Opportunities 2.2.4.4. Middle East and Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Challenges 2.2.5. South America 2.2.5.1. South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Drivers 2.2.5.2. South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Restraints 2.2.5.3. South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Opportunities 2.2.5.4. South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Electric Two-Wheeler Lithium-Ion Battery Management System Industry 2.8. Analysis of Government Schemes and Initiatives For Electric Two-Wheeler Lithium-Ion Battery Management System Industry 2.9. Electric Two-Wheeler Lithium-Ion Battery Management System Market Trade Analysis 2.10. The Global Pandemic Impact on Electric Two-Wheeler Lithium-Ion Battery Management System Market 3. Electric Two-Wheeler Lithium-Ion Battery Management System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 3.1.1. Centralized 3.1.2. Distributed 3.1.3. Modular 3.2. Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 3.2.1. Pedelecs 3.2.2. Scooters 3.2.3. Motorcycles 3.3. Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 4.1.1. Centralized 4.1.2. Distributed 4.1.3. Modular 4.2. North America Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 4.2.1. Pedelecs 4.2.2. Scooters 4.2.3. Motorcycles 4.3. North America Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 4.3.1.1.1. Centralized 4.3.1.1.2. Distributed 4.3.1.1.3. Modular 4.3.1.2. United States Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 4.3.1.2.1. Pedelecs 4.3.1.2.2. Scooters 4.3.1.2.3. Motorcycles 4.7.2. Canada 4.3.2.1. Canada Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 4.3.2.1.1. Centralized 4.3.2.1.2. Distributed 4.3.2.1.3. Modular 4.3.2.2. Canada Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 4.3.2.2.1. Pedelecs 4.3.2.2.2. Scooters 4.3.2.2.3. Motorcycles 4.7.3. Mexico 4.3.3.1. Mexico Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 4.3.3.1.1. Centralized 4.3.3.1.2. Distributed 4.3.3.1.3. Modular 4.3.3.2. Mexico Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 4.3.3.2.1. Pedelecs 4.3.3.2.2. Scooters 4.3.3.2.3. Motorcycles 5. Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 5.2. Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 5.3. Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 5.3.1.2. United Kingdom Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 5.3.2. France 5.3.2.1. France Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 5.3.2.2. France Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 5.3.3.2. Germany Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 5.3.4.2. Italy Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 5.3.5.2. Spain Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 5.3.6.2. Sweden Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 5.3.7.2. Austria Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 5.3.8.2. Rest of Europe Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6. Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.2. Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6.7. Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.3.1.2. China Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.3.2.2. S Korea Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.3.3.2. Japan Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6.3.4. India 6.3.4.1. India Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.3.4.2. India Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.3.5.2. Australia Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.3.6.2. Indonesia Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.3.7.2. Malaysia Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.3.8.2. Vietnam Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.3.9.2. Taiwan Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 6.3.10.2. Rest of Asia Pacific Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 7. Middle East and Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 7.2. Middle East and Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 7.7. Middle East and Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Country (2022-2029) 7.7.1. South Africa 7.3.1.1. South Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 7.3.1.2. South Africa Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 7.7.2. GCC 7.3.2.1. GCC Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 7.3.2.2. GCC Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 7.7.3. Nigeria 7.3.3.1. Nigeria Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 7.3.3.2. Nigeria Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 7.3.4.2. Rest of ME&A Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 8. South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 8.2. South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 8.7. South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 8.3.1.2. Brazil Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 8.3.2.2. Argentina Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Topology (2022-2029) 8.3.3.2. Rest Of South America Electric Two-Wheeler Lithium-Ion Battery Management System Market Size and Forecast, by Vehicle Type (2022-2029) 9. Global Electric Two-Wheeler Lithium-Ion Battery Management System Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Electric Two-Wheeler Lithium-Ion Battery Management System Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Elithion Inc, Leclanché SA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sensata Technologies, Inc. 10.3. Nuvation Energy 10.4. NXP Semiconductors N.V. 10.5. Navitas System LLC 10.6. Renesas Electronics Corporation, 10.7. Shenzhen Litongwei Electronics Technology Co., Ltd. 10.8. Jiangsu Xinri E-Vehicle Co., Ltd. 10.9. Mahindra & Mahindra Ltd. 10.10. Yamaha Motor Co., Ltd 10.11. Texas Instruments Incorporated. 10.12. NIU International 10.13. AIMA Technology Group Co. Ltd 10.14. Zhejiang Yadea Motorcycle Co. Ltd 10.15. Dongguan Tailing Electric Vehicle Co. Ltd 10.16. Zhejiang Luyuan Electric Vehicle Co.,Ltd 10.17. Leclanche (Switzerland) 10.18. Lithium Balance (Denmark) 10.19. Nuvation Engineering (US) 10.20. Eberspaecher Vecture (Canada) 10.21. Storage Battery Systems (US) 10.22. Johnson Matthey (UK) 11. Key Findings 12. Industry Recommendations 13. Electric Two-Wheeler Lithium-Ion Battery Management System Market: Research Methodology 14. Terms and Glossary