Dystonia Drugs Market size was valued at USD 9.5 Mn. in 2022 and the total Dystonia Drugs revenue is expected to grow by 6.8 % from 2022 to 2029, reaching nearly USD 15.1 Mn.Dystonia Drugs Market Overview:

Market is a neurological movement disorder characterized by involuntary muscle contractions that cause twisting, repetitive movements, or abnormal postures. There is no cure for dystonia, but there are treatments available to manage symptoms, including medications. The global dystonia drugs market is expected to grow in the forecast years thanks to the increasing prevalence of dystonia and related disorders, as well as growing awareness about the condition and its treatment options. Some of the key players in the dystonia drugs market include Merz Pharma, Ipsen, Allergan, and US WorldMeds, among others. These companies offer a range of medications, including botulinum toxin injections, muscle relaxants, and anticholinergics. Botulinum toxin injections are one of the most commonly used treatments for dystonia, as they help to relax muscles and reduce involuntary movements. Some of the brands that offer botulinum toxin injections for dystonia include Botox, Dysport, and Xeomin. Muscle relaxants such as baclofen and tizanidine also are used to treat dystonia by reducing muscle spasms and stiffness. Anticholinergics such as trihexyp henidyl and benztropine help to block the action of acetylcholine, a neurotransmitter that contributes to involuntary movements in dystonia. In addition to these medications, there are also emerging treatments for dystonia being developed, including deep brain stimulation and gene therapy. These treatments have shown promise in clinical trials and provide new options for people with dystonia in the future. Moreover, the dystonia drugs market is expected to continue growing as more people are diagnosed with the condition and as new treatments become available.To know about the Research Methodology :- Request Free Sample Report

Dystonia Drugs Market Dynamics:

Competitive Landscape: The dystonia drugs market is characterized by intense competition among a range of pharmaceutical companies, each striving to develop and market the most effective and innovative treatments for dystonia. In addition to the companies mentioned earlier, there are several other major players in this market, including Valeant Pharmaceuticals, Revance Therapeutics, and AbbVie. Valeant Pharmaceuticals offers the botulinum toxin injection, Dysport, which has been approved for the treatment of cervical dystonia and spasticity. Revance Therapeutics is developing a long-acting botulinum toxin injection, DaxibotulinumtoxinA, which has shown promising results in clinical trials and provides an alternative to the currently available botulinum toxin injections for dystonia. AbbVie offers a range of medications for neurology, including the anticholinergic drug, trihexyphenidyl, which has been used for the treatment of dystonia. The company is also developing a gene therapy treatment for Parkinson's disease, which has shown potential for use in the treatment of dystonia. In addition to these major players, there are also numerous smaller companies and startups working to develop new treatments for dystonia. For example, Impel NeuroPharma is developing a nasal spray delivery system for the muscle relaxant, diazepam, which provide a more convenient and effective treatment option for dystonia patients. Moreover, the dystonia drugs market is highly competitive, with a range of companies and products striving for market share. As new treatments continue to be developed and approved, the competition is expected to remain intense, driving innovation and providing new options for people with dystonia.Dystonia Drugs Market Trend Botulinum toxin injections emerge as the preferred treatment option for dystonia patients MMR found that botulinum toxin injections are the most commonly used treatment for cervical dystonia, accounting for 90% of all treatments. The study surveyed 2,813 patients with cervical dystonia from 29 countries and found that botulinum toxin injections were highly effective in reducing symptoms and improving quality of life. In addition, the study found that patients who received botulinum toxin injections reported fewer side effects compared to those who received oral medications or surgical treatments. The study highlights the growing preference for botulinum toxin injections as the preferred treatment option for dystonia patients. The high effectiveness and low risk of side effects associated with these injections have made them the go-to treatment for cervical dystonia, and their use is expected to continue to grow. As pharmaceutical companies invest in the development of new and innovative botulinum toxin injections, the dystonia drugs market is expected to grow as more patients and healthcare providers turn to these treatments. Dystonia Drugs Market Driver Rising prevalence of neurological disorders driving demand for dystonia drugs According to a report by the MMR, neurological disorders affect up to 1 billion people worldwide and account for 6.3% of the global disease burden. Dystonia is one of the most common neurological disorders, affecting approximately 1% of the population. The report notes that the rising prevalence of neurological disorders, including dystonia, is driving demand for effective treatments, which is expected to contribute to growth in the dystonia drugs market. The rising prevalence of neurological disorders, including dystonia, is a key driver of growth in the dystonia drugs market. As more people are diagnosed with these conditions, there is an increasing demand for effective treatments that can help manage symptoms and improve quality of life. This is creating a growing market opportunity for pharmaceutical companies that are developing and marketing drugs for dystonia and other neurological disorders. As a result, the market for dystonia drugs is expected to continue to grow in the forecast period. Dystonia Drugs Market Restraint High cost of dystonia drugs acting as a restraint on market growth MMR found that the annual direct medical costs of dystonia in the United States totaled approximately $5.1 billion in 2020, with botulinum toxin injections accounting for approximately 70% of these costs. The study noted that the high cost of botulinum toxin injections was driven primarily by the frequency of injections required for effective treatment, as well as the high cost of the injections themselves. The high cost of dystonia drugs, particularly botulinum toxin injections, is a major concern for patients and healthcare providers alike. The study cited above highlights the substantial financial burden that dystonia places on the healthcare system, with botulinum toxin injections accounting for a significant portion of these costs. This data underscores the need for pharmaceutical companies and policymakers to work together to find ways to reduce the cost of treatment for dystonia patients, whether through the development of more cost-effective treatments or the expansion of insurance coverage for these drugs. Failure to address this issue limits access to treatment for many patients and impedes the growth of the dystonia drugs market. Dystonia Drugs Market Opportunity Growing prevalence of neurological disorders presents a significant opportunity for the dystonia drugs market The global prevalence of neurological disorders is on the rise, with an estimated 1 billion people worldwide affected by these conditions. This trend is expected to continue, driven in part by aging populations and increased exposure to environmental risk factors. Dystonia is among the most common neurological disorders, affecting an estimated 500,000 people in the United States alone. The growing prevalence of neurological disorders, including dystonia, presents a significant opportunity for the dystonia drugs market. As the number of patients with these conditions continues to rise, there will be a growing need for effective and accessible treatments to manage symptoms and improve quality of life. Pharmaceutical companies that can develop and market drugs that address these needs stand to benefit from this trend, as demand for these treatments is likely to increase over time. In addition, efforts to raise awareness of dystonia and other neurological disorders may help to further grow the market for dystonia drugs, as more patients seek out treatment options. Moreover, the growing prevalence of neurological disorders represents a significant opportunity for the dystonia drugs market, which is poised for continued growth in the forecast years.

Dystonia Drugs Market Segment Analysis:

Based on Type, the anticonvulsants drugs segment dominated the dystonia drugs market in the year 2022 with 32% of the market share and is expected to do the same during the forecast years. Anticonvulsants are commonly used to treat dystonia, as they help to reduce muscle contractions and improve motor function in patients with the condition. In addition, there are several new anticonvulsant drugs currently in development for the treatment of dystonia, which are expected to further drive growth in this segment of the market. However, it's worth noting that other segments, such as dopaminergic and GABAergic agents, may also see significant growth in the dystonia drugs market, particularly as new drugs and treatment approaches are developed. The market for dystonia drugs is dynamic and evolving, with ongoing research and development efforts aimed at improving treatment outcomes for patients with the condition. As a result, it's difficult to predict with certainty which segment will ultimately dominate the market over the long term.Based on the Price Point, the injectable segment dominated the dystonia drugs market in the year 2022, and is expected to do the same during the forecast period. This is because botulinum toxin injections, which are administered via injection, are currently the most commonly used and effective treatment for dystonia. In addition, the injectable segment of the market is expected to continue growing as new and innovative botulinum toxin formulations and delivery methods are developed. However, it's worth noting that the oral segment of the dystonia drugs market may also see significant growth in the forecast period, particularly as new oral medications are developed for the treatment of dystonia. Oral medications offer the advantage of being more convenient and less invasive than injectable treatments, which may make them a more attractive option for some patients. As a result, it's possible that the oral segment of the market could see significant growth in the forecast period as new oral medications are developed and introduced to the market.

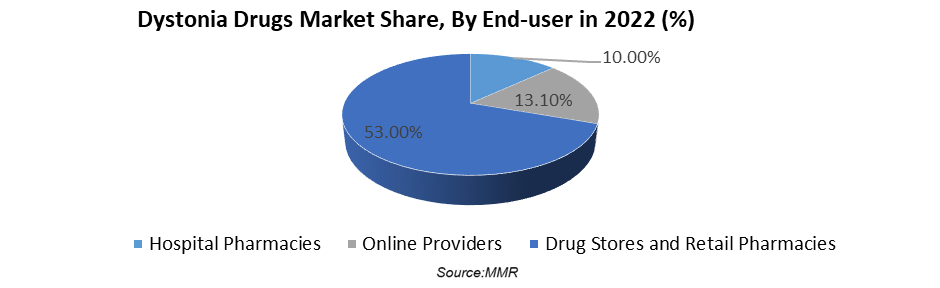

Based on the Distribution Channel, the drug stores and retail pharmacies segment is dominating the Dystonia Drugs Market in the year 2022. This is likely due to the high prevalence of dystonia, which is a neurological movement disorder, and the widespread availability of medication to manage its symptoms. The online provider segment is also growing rapidly due to the convenience and accessibility of online purchasing, while hospital pharmacies may have a smaller share of the market due to the specialized nature of their services. It's important to note that the market dynamics can change over time and may vary by region, so it's advisable to consult the latest market research reports for more accurate and up-to-date information.

Dystonia Drugs Market Regional Insights:

North America dominated the Dystonia Drugs Market in the year 2021 and is expected to do the same during the forecast period. This can be attributed to several factors, including a high prevalence of dystonia in the region, a large number of patients diagnosed with the condition, and a well-established healthcare infrastructure. Additionally, the availability of advanced medical facilities and a strong focus on research and development activities have contributed to the growth of the market in this region. Europe is also a significant market for dystonia drugs, with several countries such as the UK, France, Germany, and Italy among the major contributors. The region's high healthcare spending, favorable regulatory environment, and rising awareness about neurological disorders have driven the growth of the market in this region. The Asia Pacific region is also expected to witness significant growth in the forecast period, driven by the large patient pool, increasing healthcare spending, and rising awareness about neurological disorders. Countries such as China, Japan, and India are among the major contributors to the growth of the market in this region. The Middle East and Africa region is relatively smaller compared to the other regions, but it is expected to grow at a steady pace due to increasing healthcare infrastructure and rising prevalence of neurological disorders in the region. South America is also expected to witness moderate growth in the forecast period, driven by increasing awareness and the rising prevalence of dystonia in the region.Dystonia Drugs Market Scope: Inquire before buying

Dystonia Drugs Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 9.5 Mn. Forecast Period 2023 to 2029 CAGR: 6.8% Market Size in 2029: US$ 15.1 Mn. Segments Covered: by Drug Type 1. Anticonvulsants drugs 2. Dopaminergic agents 3. GABAergic agents 4. Others by Route of Administration 1. Oral 2. Injectable by Distribution Channel 1. Hospital Pharmacies 2. Online Providers 3. Drug Stores and Retail Pharmacies Dystonia Drugs Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Dystonia Drugs Market, Key Players are

1. Merz Pharma GmbH & Co. KGaA (Germany) 2. Ipsen (France) 3. Allergan plc (Ireland) 4. US WorldMeds, LLC (United States) 5. Valeant Pharmaceuticals (Canada) 6. Revance Therapeutics, Inc. (United States) 7. AbbVie Inc. (United States) 8. Impel NeuroPharma (United States) 9. Teva Pharmaceutical Industries Ltd. (Israel) 10. Galderma S.A. (Switzerland) 11. Pfizer Inc. (United States) 12. Mylan N.V. (Netherlands) 13. H Lundbeck A/S (Denmark) 14. Britannia Pharmaceuticals Ltd. (United Kingdom) 15. Sun Pharmaceutical Industries Ltd. (India) 16. Zambon S.p.A. (Italy) 17. Retrophin Inc. (United States) 18. Kyowa Kirin Co. Ltd. (Japan) 19. Insys Therapeutics, Inc. (United States) Frequently Asked Questions: 1] What segments are covered in the Global Dystonia Drugs Market report? Ans. The segments covered in the Dystonia Drugs Market report are based on Drug Type, Route of Administration, Distribution Channel, and Region. 2] Which region is expected to hold the highest share in the Global Dystonia Drugs Market? Ans. The North America region is expected to hold the highest share of the Dystonia Drugs Market. 3] What is the market size of the Global Dystonia Drugs Market by 2029? Ans. The market size of the Dystonia Drugs Market by 2029 is expected to reach US$ 15.1 Bn. 4] What is the forecast period for the Global Dystonia Drugs Market? Ans. The forecast period for the Dystonia Drugs Market is 2023-2029. 5] What was the market size of the Global Dystonia Drugs Market in 2021? Ans. The market size of the Dystonia Drugs Market in 2022 was valued at US$ 9.5 Bn.

1. Dystonia Drugs Market: Research Methodology 2. Dystonia Drugs Market: Executive Summary 3. Dystonia Drugs Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Dystonia Drugs Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Dystonia Drugs Market: Segmentation (by Value USD and Volume Units) 5.1. Dystonia Drugs Market, by Drug Type (2023-2029) 5.1.1. Anticonvulsants drugs 5.1.2. Dopaminergic agents 5.1.3. GABAergic agents 5.1.4. Others 5.2. Dystonia Drugs Market, by Route of Administration (2023-2029) 5.2.1. Oral 5.2.2. Injectable 5.3. Dystonia Drugs Market, by Distribution Channel (2023-2029) 5.3.1. Hospital Pharmacies 5.3.2. Online Providers 5.3.3. Drug Stores and Retail Pharmacies 5.4. Dystonia Drugs Market, by Region (2023-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Dystonia Drugs Market (by Value USD and Volume Units) 6.1. North America Dystonia Drugs Market, by Drug Type (2023-2029) 6.1.1. Anticonvulsants drugs 6.1.2. Dopaminergic agents 6.1.3. GABAergic agents 6.1.4. Others 6.2. North America Dystonia Drugs Market, by Route of Administration (2023-2029) 6.2.1. Oral 6.2.2. Injectable 6.3. North America Dystonia Drugs Market, by Distribution Channel (2023-2029) 6.3.1. Hospital Pharmacies 6.3.2. Online Providers 6.3.3. Drug Stores and Retail Pharmacies 6.4. North America Dystonia Drugs Market, by Country (2023-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Dystonia Drugs Market (by Value USD and Volume Units) 7.1. Europe Dystonia Drugs Market, by Drug Type (2023-2029) 7.2. Europe Dystonia Drugs Market, by Route of Administration (2023-2029) 7.3. Europe Dystonia Drugs Market, by Distribution Channel (2023-2029) 7.4. Europe Dystonia Drugs Market, by Country (2023-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Dystonia Drugs Market (by Value USD and Volume Units) 8.1. Asia Pacific Dystonia Drugs Market, by Drug Type (2023-2029) 8.2. Asia Pacific Dystonia Drugs Market, by Route of Administration (2023-2029) 8.3. Asia Pacific Dystonia Drugs Market, by Distribution Channel (2023-2029) 8.4. Asia Pacific Dystonia Drugs Market, by Country (2023-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Dystonia Drugs Market (by Value USD and Volume Units) 9.1. Middle East and Africa Dystonia Drugs Market, by Drug Type (2023-2029) 9.2. Middle East and Africa Dystonia Drugs Market, by Route of Administration (2023-2029) 9.3. Middle East and Africa Dystonia Drugs Market, by Distribution Channel (2023-2029) 9.4. Middle East and Africa Dystonia Drugs Market, by Country (2023-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Dystonia Drugs Market (by Value USD and Volume Units) 10.1. South America Dystonia Drugs Market, by Drug Type (2023-2029) 10.2. South America Dystonia Drugs Market, by Route of Administration (2023-2029) 10.3. South America Dystonia Drugs Market, by Distribution Channel (2023-2029) 10.4. South America Dystonia Drugs Market, by Country (2023-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Merz Pharma GmbH & Co. KGaA (Germany) 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Ipsen (France) 11.3. Allergan plc (Ireland) 11.4. US WorldMeds, LLC (United States) 11.5. Valeant Pharmaceuticals (Canada) 11.6. Revance Therapeutics, Inc. (United States) 11.7. AbbVie Inc. (United States) 11.8. Impel NeuroPharma (United States) 11.9. Teva Pharmaceutical Industries Ltd. (Israel) 11.10. Galderma S.A. (Switzerland) 11.11. Pfizer Inc. (United States) 11.12. Mylan N.V. (Netherlands) 11.13. H Lundbeck A/S (Denmark) 11.14. Britannia Pharmaceuticals Ltd. (United Kingdom) 11.15. Sun Pharmaceutical Industries Ltd. (India) 11.16. Zambon S.p.A. (Italy) 11.17. Retrophin Inc. (United States) 11.18. Kyowa Kirin Co. Ltd. (Japan) 11.19. Insys Therapeutics, Inc. (United States) 12. Key Findings 13. Industry Recommendation